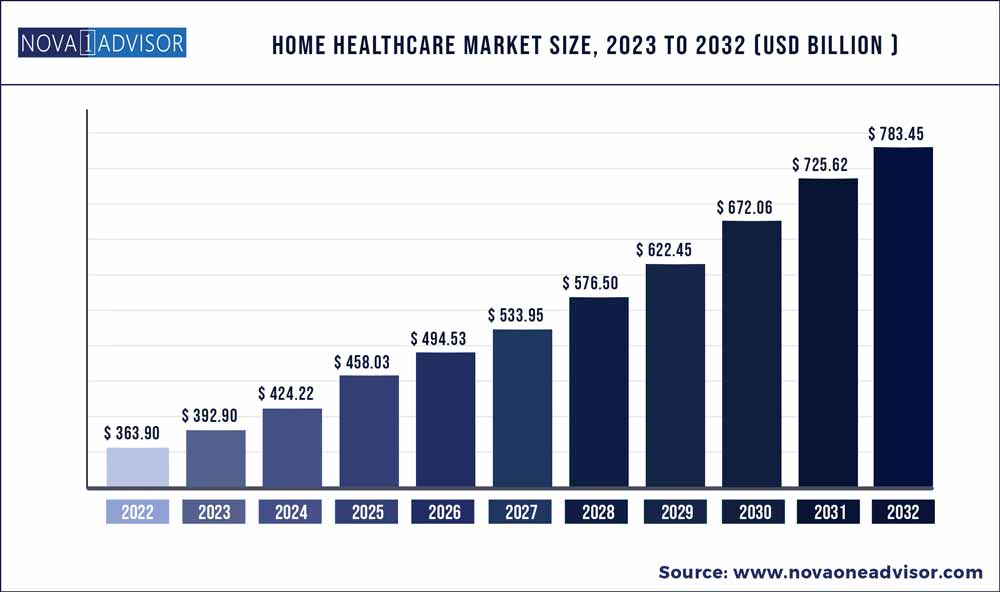

The global home healthcare market size was estimated at USD 363.90 billion in 2022 and is expected to surpass around USD 783.45 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 7.97% during the forecast period 2023 to 2032.

Key Takeaways:

Home Healthcare Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 392.90 Billion |

| Market Size by 2032 | USD 783.45 Billion |

| Growth Rate From 2023 to 2032 | CAGR of 7.97% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Component, Indication, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | B. Braun Melsungen AG; Abbott; Sunrise Medical; 3M Healthcare; Baxter International Inc.; Medtronic PLC; Cardinal Health Inc; F. Hoffmann-La Roche AG; Air Liquide; Amedisys, Inc; NxStage Medical, Inc. (Fresenius Medical Care); Arkray, Inc.; Becton, Dickinson and Company; Omron Healthcare, Inc; Drive DeVilbiss Healthcare; GE Healthcare; Medline Industries, Inc; Koninklijke Philips N.V; Johnson & Johnson Services, Inc.; Linde Healthcare; Acelity (3M); Vygon; Teleflex, Inc; Moog Inc.; Intersurgical Ltd.; Fresenius Kabi AG; GF Health Products, Inc. |

This growth can be attributed to cost-efficiency, improved patient outcomes, and convenience offered by home healthcare agencies. In addition, the rising geriatric population and the growing prevalence of chronic diseases such as Alzheimer’s, dementia, and orthopedic conditions, are expected to drive market growth. As per the Population Reference Bureau data updated in June 2019, the number of people aged 65 years and above was 52 million in 2018 and is projected to double by 2060 to reach 95 million. The World Health Organization (WHO) statistics state that there are around 50 million dementia patients in the world with 10 million new cases getting added every year. This number is expected to reach 85 million by 2032.

The establishment and maintenance of hospitals and other healthcare establishments are capital-intensive efforts. Hence, healthcare solution providers are now entering the rapidly growing market in an attempt to capitalize on the available opportunities and contain costs. Although hospital-at-home models are less prevalent in the U.S. than they are in other countries, several noteworthy initiatives have been undertaken in the past decade. These include programs at Johns Hopkins, Marshfield Clinic Health System, and Mount Sinai, which partnered with PE-backed Contessa in 2016. Moreover, these organizations engage extensively in mergers and acquisitions to expand their regional presence. Hospitals such as Apollo (Apollo Homecare) and Max (Max@Home) have entered the Indian homecare industry. Some have also established joint ventures, including the Burman family (promoters of Dabur) and UK-based Healthcare at Home, as well as India Home Healthcare and Bayada Home Healthcare, based in the U.S.

The demand for home care services is expected to increase in the immediate future, owing to the ongoing COVID-19 pandemic. These services are safer and cost-effective alternatives to hospital services. External substitutes, including hospitals, informal care, and other healthcare establishments, pose a limited threat, mostly due to their high costs. Thus, the threat of substitutes in the market is expected to be moderate during the forecast period.

Component Insights

The services segment dominated the market and held the largest revenue share of 85.3% in 2022. The market by services is segmented into skilled home healthcare and unskilled home healthcare. Skilled services are provided by healthcare professionals. Unskilled services are provided for daily living aid to home-bound patients and are categorized as basic assistance care/personal care service. Rising medical expenditure associated with hospital stays is expected to boost the demand for skilled care.

Under skilled nursing services, medical professionals such as physicians, registered nurses, physiotherapists, and specialty care providers aid patients at home or home care centers. The aging population suffering from diseases, such as diabetes and cardiac disorders, require medical assistance services such as medication management and continuous monitoring. With advancements in medical technology, many procedures can be performed at home in a more comfortable and convenient environment, which can be attributed to the growth of skilled home care services in the market for home healthcare.

Equipment is segmented as therapeutic, diagnostic, and mobility assistance. Diagnostics accounted for 40% of the overall home healthcare equipment market share in 2022 and is expected to gain a lucrative share over the forecast period. Technologically advanced products that enable accurate and timely diagnosis, such as strapless heart rate monitor, iPhone heart-rate monitor, and TQR heart rate watches are likely to propel the diagnostic equipment segment growth. Further, increasing patient awareness and health consciousness is also likely to boost segment growth.

Indication Insights

The neurological & mental disorder segment accounted for the largest revenue share of 17.6% in 2022 owing to increasing disease prevalence. Neurological disorders, including epilepsy, Alzheimer's & other dementias, stroke, migraine & other headaches, multiple sclerosis, & Parkinson's disease, can affect the functioning of the brain, spine, and nerves. Home healthcare services, such as physical therapy, occupational therapy, speech therapy, and mental health services, can help those with such disorders manage symptoms. According to the NCBI, in 2022, an estimated 6.5 million people aged 65 and over in the US were suffering from Alzheimer's disease, which is expected to rise to 13.8 million by 2060. In addition, women are more likely to be diagnosed with Alzheimer’s than men due to their longer life expectancy, and it is becoming the most common cause of death in neurodegenerative diseases, as well as a common cause of physical disability that requires urgent treatment.

Mobility disorders have been estimated to be the fastest growing segment. According to the CDC, 11.1% of U.S. adults have a mobility-related disability with serious difficulty walking or climbing stairs. Mobility disorders are conditions that limit movement due to physical, psychological, or neurological impairment, and treatment may include physical therapy, assistive devices, and medications. Home healthcare services can provide numerous benefits to individuals with mobility disorders, such as assistance with daily tasks & activities to help maintain independence and physiotherapists to help regain mobility, functionality, & strength & reduce pain through exercise, movements, & massage. The increasing prevalence of mobility disorders is expected to drive the growth of this segment over the forecast period.

Diabetes is one of the leading causes of disability & death worldwide, and the number of people living with diabetes is expected to grow in the coming years. This growing prevalence of diabetes is expected to have a significant impact on the growth of the home healthcare services market. For instance, according to the International Diabetes Federation estimates, in 2021, approximately 536 million adults were living with diabetes, and this number is expected to increase to 783 million by 2045. Home healthcare services can enable people with diabetes to manage their conditions in the comfort of their homes, thereby reducing the need for hospital visits and the overall cost of care. Such services can involve care planning, monitoring, and education, as well as providing diabetes-related equipment & supplies.

Regional Insights

North America accounted for the largest market share of 43.7% in the market. The large geriatric population in this region, coupled with sophisticated healthcare infrastructure and relatively high disposable incomes, are some key drivers of this market. Moreover, an increasing number of government initiatives that aim to curb healthcare expenditure levels, by promoting home healthcare is expected to serve as a vital impact-rendering driver.

In addition, by 2032, one in five Americans will be above 65 years of age. Around 90% of the population aged above 65 in the U.S. is expected to have one or more chronic diseases requiring long-term care. Home healthcare services are very useful for the geriatric population, as they enable elderly people to manage chronic conditions at home, thereby reducing hospital visits and the cost of treatment.

Asia Pacific has been estimated to be the fastest-growing segment. Factors such as underdeveloped healthcare infrastructure, expensive in-hospital healthcare facilities, and chronic diseases that require long-term care are resulting in an increase in home healthcare products and services. Thailand, Australia, South Korea, and New Zealand are some of the emerging countries in the region. Technological advancements in patient monitoring devices and an increasing geriatric population coupled with the growing prevalence of lifestyle diseases, such as obesity & diabetes, are anticipated to drive the growth of the market.

Recent Developments

Key Companies & Market Share Insights

The market is highly fragmented due to the presence of a large number of multinational as well as local market players. Moreover, the consolidation activities undertaken by multinational companies are estimated to increase competition amongst new and local market players. Players in the market undertake the strategy to strengthen their product portfolios and offer diverse technologically advanced & innovative products to their customers. The strategies such as product launch is being widely adopted by companies to attract more customers in the market.

Key market players following this strategy include Roche; Medline Industries, Inc.; B. Braun Melsungen AG; and GF Health Products, Inc. For instance, in April 2022, Abbott launched an updated digital health app, NeuroSphere myPath, to assist medical professionals in tracking and managing chronic pain in patients. This upgraded version helps doctors monitor patients’ progress and provide more tailored treatments. To improve the quality of care, service providers are entering into partnerships. For instance, in February 2023, 3M launched a new medical adhesive designed for use with a range of sensors, health trackers, and long-term medical wearables. Some of the prominent players in the home healthcare market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Home Healthcare market.

By Component

By Indication

By Region

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Nova one advisor Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.3.5. Details of Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.5.1. Commodity Flow Analysis

1.5.1.1. Approach 1: Commodity flow approach

1.5.1.2. Approach 2: Country wise market estimation using bottom up approach

1.6. Data Validation & Publishing

1.7. Global Market: CAGR Calculation

1.8. List of Secondary Sources

1.9. List of Primary Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segmental Snapshot

2.3. Competitive Insights Snapshot

Chapter 3. Market Variables, Trends, and Scope

3.1. Market Lineage

3.1.1. Parent Market Analysis

3.1.2. Ancillary Market Analysis

3.2. Home Healthcare Market - Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Home healthcare as a cost-effective alternative

3.2.1.2. Growing geriatric population

3.2.1.3. Hospital solution providers penetrating the home healthcare market

3.2.1.4. Growing prevalence of target diseases, especially Alzheimer’s and dementia

3.2.1.5. Geographical expansion of services by providers

3.2.1.6. Advancement in technology

3.2.2. Market Restraint Analysis

3.2.2.1. Lower remunerations

3.2.2.2. Shortage of skilled healthcare staff

3.2.2.3. Complicated reimbursement framework and reimbursement cuts

3.3. Business Environmental Tools Analysis: Home Healthcare Market

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTLE Analysis

Chapter 4. Home Healthcare Market: Component Estimates & Trend Analysis

4.1. Home Healthcare Market, By Component Key Takeaways

4.2. Home Healthcare Market: Component Movement & Market Share Analysis, 2023 - 2032

4.3. Services

4.3.1. Global Home Healthcare Services Market Estimates And Forecasts, 2020 - 2032

4.3.2. Skilled home healthcare

4.3.2.1. Global skilled home healthcare services market estimates and forecasts, 2020 - 2032

4.3.2.2. Nursing care

4.3.2.2.1. Global nursing care market estimates and forecasts, 2020 - 2032

4.3.2.3. Physician primary care

4.3.2.3.1. Global physician primary care market estimates and forecasts, 2020 - 2032

4.3.2.4. Physical/occupational/speech therapy

4.3.2.4.1. Global physical/occupational/speech therapy market estimates and forecasts, 2020 - 2032

4.3.2.5. Hospice & palliative

4.3.2.5.1. Global hospice & palliative market estimates and forecasts, 2020 - 2032

4.3.2.6. Nutritional support

4.3.2.6.1. Global nutritional support market estimates and forecasts, 2020 - 2032

4.3.2.7. Other skilled home healthcare

4.3.2.7.1. Global other skilled home healthcare services market estimates and forecasts, 2020 - 2032

4.3.3. Unskilled Home Healthcare

4.3.3.1. Global unskilled home healthcare services market estimates and forecasts, 2020 - 2032

4.4. Equipment

4.4.1. Global Home Healthcare Equipment Market Estimates And Forecasts, 2020 - 2032

4.4.2. Therapeutic

4.4.2.1. Global therapeutic home healthcare equipment market estimates and forecasts, 2020 - 2032

4.4.2.2. Home respiratory therapy

4.4.2.2.1. Global home respiratory therapy market estimates and forecasts, 2020 - 2032

4.4.2.3. Home intravenous pumps

4.4.2.3.1. Global home IV pumps market estimates and forecasts, 2020 - 2032

4.4.2.4. Home dialysis equipment

4.4.2.4.1. Global home dialysis equipment market estimates and forecasts, 2020 - 2032

4.4.2.5. Insulin delivery

4.4.2.5.1. Global insulin delivery market estimates and forecasts, 2020 - 2032

4.4.2.6. Other therapeutic equipment

4.4.2.6.1. Global other therapeutic equipment market estimates and forecasts, 2020 - 2032

4.4.3. Diagnostic

4.4.3.1. Global diagnostic home healthcare equipment market estimates and forecasts, 2020 - 2032

4.4.3.2. Diabetic care unit

4.4.3.2.1. Global diabetic care unit market estimates and forecasts, 2020 - 2032

4.4.3.3. Blood pressure monitoring

4.4.3.3.1. Global blood pressure monitoring market estimates and forecasts, 2020 - 2032

4.4.3.4. Multi parameter diagnostics monitors

4.4.3.4.1. Global multi parameter diagnostics market estimates and forecasts, 2020 - 2032

4.4.3.5. Apnea and sleep monitors

4.4.3.5.1. Global apnea and sleep monitors market estimates and forecasts, 2020 - 2032

4.4.3.6. Home pregnancy and fertility kits

4.4.3.6.1. Global home pregnancy and fertility kits market estimates and forecasts, 2020 - 2032

4.4.3.7. Holter monitors

4.4.3.7.1. Global holter monitors market estimates and forecasts, 2020 - 2032

4.4.3.8. Heart rate meters

4.4.3.8.1. Global heart rate meter market estimates and forecasts, 2020 - 2032

4.4.3.9. Other diagnostic equipment

4.4.3.9.1. Global other diagnostic equipment market estimates and forecasts, 2020 - 2032

4.4.4. Mobility Assist Equipment

4.4.4.1. Global mobility assist equipment market estimates and forecasts, 2018 - 2030 (USD Million

4.4.4.2. Wheelchair

4.4.4.2.1. Global wheelchair market estimates and forecasts, 2020 - 2032

4.4.4.3. Home medical furniture

4.4.4.3.1. Global home medical furniture market estimates and forecasts, 2020 - 2032

4.4.4.4. Walking assist devices

4.4.4.4.1. Global walking assist devices market estimates and forecasts, 2020 - 2032

Chapter 5. Home Healthcare Market: Indication Estimates & Trend Analysis

5.1. Home Healthcare Market, By Indication: Key Takeaways

5.2. Home Healthcare Market: Indication Movement & Market Share Analysis, 2023 - 2032

5.3. Neurological & Mental Disorders

5.3.1. Global Neurological & Mental Disorders Market Estimates And Forecasts, 2020 - 2032

5.4. Diabetes & Kidney Disorders

5.4.1. Global Diabetes & Kidney Disorders Market Estimates And Forecasts, 2020 - 2032

5.5. Cancer

5.5.1. Global Cancer Market Estimates And Forecasts, 2020 - 2032

5.6. Respiratory Disease & COPD

5.6.1. Global Respiratory Disease & COPD Market Estimates And Forecasts, 2020 - 2032

5.7. Mobility Disorders

5.7.1. Global Mobility Disorders Market Estimates And Forecasts, 2020 - 2032

5.8. Cardiovascular Disorder & Hypertension

5.8.1. Global Cardiovascular Disorder & Hypertension Market Estimates And Forecasts, 2020 - 2032

5.9. Wound Care

5.9.1. Global Wound Care Market Estimates And Forecasts, 2020 - 2032

5.10. Maternal Disorders

5.10.1. Global Maternal Disorders Market Estimates And Forecasts, 2020 - 2032

5.11. Other Indications

5.11.1. Global Other Indications Market Estimates And Forecasts, 2020 - 2032

Chapter 6. Home Healthcare Market: Regional Estimates & Trend Analysis

6.1. Regional Outlook

6.2. Home Healthcare Market by Region: Key Marketplace Takeaway

6.3. North America

6.3.1. North America Home Healthcare Market Estimates And Forecasts, 2020 - 2032

6.3.2. U.S.

6.3.2.1. U.S. estimated disease burden by indication, 2018 -2022

6.3.2.2. Regulatory framework & reimbursement structure

6.3.2.3. Competitive scenario

6.3.2.4. U.S. home healthcare market estimates and forecasts, 2020 - 2032

6.3.3. Canada

6.3.3.1. Canada estimated disease burden by indication, 2018 -2022

6.3.3.2. Regulatory framework & reimbursement structure

6.3.3.3. Competitive scenario

6.3.3.4. Canada home healthcare market estimates and forecasts, 2020 - 2032

6.4. Europe

6.4.1. Europe Home Healthcare Market Estimates And Forecasts, 2020 - 2032

6.4.2. UK

6.4.2.1. UK estimated disease burden by indication, 2018 -2022

6.4.2.2. Regulatory framework & reimbursement structure

6.4.2.3. Competitive scenario

6.4.2.4. UK home healthcare market estimates and forecasts, 2020 - 2032

6.4.3. Germany

6.4.3.1. Germany estimated disease burden by indication, 2018 -2022

6.4.3.2. Regulatory framework & reimbursement structure

6.4.3.3. Competitive scenario

6.4.3.4. Germany home healthcare market estimates and forecasts, 2020 - 2032

6.4.4. France

6.4.4.1. France estimated disease burden by indication, 2018 -2022

6.4.4.2. Regulatory framework & reimbursement structure

6.4.4.3. Competitive scenario

6.4.4.4. France home healthcare market estimates and forecasts, 2020 - 2032

6.4.5. Italy

6.4.5.1. Italy estimated disease burden by indication, 2018 -2022

6.4.5.2. Regulatory framework & reimbursement structure

6.4.5.3. Competitive scenario

6.4.5.4. Italy Home healthcare market estimates and forecasts, 2020 - 2032

6.4.6. Spain

6.4.6.1. Spain estimated disease burden by indication, 2018 -2022

6.4.6.2. Regulatory framework & reimbursement structure

6.4.6.3. Competitive scenario

6.4.6.4. Spain home healthcare market estimates and forecasts, 2020 - 2032

6.4.7. Netherlands

6.4.7.1. Netherlands estimated disease burden by indication, 2018 -2022

6.4.7.2. Regulatory framework & reimbursement structure

6.4.7.3. Competitive scenario

6.4.7.4. Denmark home healthcare market estimates and forecasts, 2020 - 2032

6.4.8. Sweden

6.4.8.1. Sweden estimated disease burden by indication, 2018 -2022

6.4.8.2. Regulatory framework & reimbursement structure

6.4.8.3. Competitive scenario

6.4.8.4. Sweden home healthcare market estimates and forecasts, 2020 - 2032

6.4.9. Russia

6.4.9.1. Russia estimated disease burden by indication, 2018 -2022

6.4.9.2. Regulatory framework & reimbursement structure

6.4.9.3. Competitive scenario

6.4.9.4. Norway home healthcare market estimates and forecasts, 2020 - 2032

6.5. Asia Pacific

6.5.1. Asia Pacific Home Healthcare Market Estimates And Forecasts, 2020 - 2032

6.5.2. Japan

6.5.2.1. Japan estimated disease burden by indication, 2018 -2022

6.5.2.2. Regulatory framework & reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. Japan home healthcare market estimates and forecasts, 2020 - 2032

6.5.3. China

6.5.3.1. China estimated disease burden by indication, 2018 -2022

6.5.3.2. Regulatory framework & reimbursement structure

6.5.3.3. Competitive scenario

6.5.3.4. China home healthcare market estimates and forecasts, 2020 - 2032

6.5.4. India

6.5.4.1. India estimated disease burden by indication, 2018 -2022

6.5.4.2. Regulatory framework & reimbursement structure

6.5.4.3. Competitive scenario

6.5.4.4. India home healthcare market estimates and forecasts, 2020 - 2032

6.5.5. Australia

6.5.5.1. Australia estimated disease burden by indication, 2018 -2022

6.5.5.2. Regulatory framework & reimbursement structure

6.5.5.3. Competitive scenario

6.5.5.4. Australia home healthcare market estimates and forecasts, 2020 - 2032

6.5.6. South Korea

6.5.6.1. South Korea estimated disease burden by indication, 2018 -2022

6.5.6.2. Regulatory framework & reimbursement structure

6.5.6.3. Competitive scenario

6.5.6.4. South Korea home healthcare market estimates and forecasts, 2020 - 2032

6.5.7. Singapore

6.5.7.1. Singapore estimated disease burden by indication, 2018 -2022

6.5.7.2. Regulatory framework & reimbursement structure

6.5.7.3. Competitive scenario

6.5.7.4. Singapore home healthcare market estimates and forecasts, 2020 - 2032

6.5.8. Thailand

6.5.8.1. Thailand estimated disease burden by indication, 2018 -2022

6.5.8.2. Regulatory framework & reimbursement structure

6.5.8.3. Competitive scenario

6.5.8.4. Thailand home healthcare market estimates and forecasts, 2020 - 2032

6.5.9. Philippines

6.5.9.1. Philippines estimated disease burden by indication, 2018 -2022

6.5.9.2. Regulatory framework & reimbursement structure

6.5.9.3. Competitive scenario

6.5.9.4. Philippines home healthcare market estimates and forecasts, 2020 - 2032

6.5.10. Malaysia

6.5.10.1. Malaysia estimated disease burden by indication, 2018 -2022

6.5.10.2. Regulatory framework & reimbursement structure

6.5.10.3. Competitive scenario

6.5.10.4. Malaysia home healthcare market estimates and forecasts, 2020 - 2032

6.6. Latin America

6.6.1. Latin America Home Healthcare Market Estimates And Forecasts, 2020 - 2032

6.6.2. Brazil

6.6.2.1. Brazil estimated disease burden by indication, 2018 -2022

6.6.2.2. Regulatory framework & reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. Brazil home healthcare market estimates and forecasts, 2020 - 2032

6.6.3. Mexico

6.6.3.1. Mexico estimated disease burden by indication, 2018 -2022

6.6.3.2. Regulatory framework & reimbursement structure

6.6.3.3. Competitive scenario

6.6.3.4. Mexico home healthcare market estimates and forecasts, 2020 - 2032

6.6.4. Argentina

6.6.4.1. Argentina estimated disease burden by indication, 2018 -2022

6.6.4.2. Regulatory framework & reimbursement structure

6.6.4.3. Competitive scenario

6.6.4.4. Argentina home healthcare market estimates and forecasts, 2020 - 2032

6.7. Middle East & Africa

6.7.1. Middle East & Africa SWOT Analysis

6.7.2. Middle East & Africa Home Healthcare Market Estimates And Forecasts, 2020 - 2032

6.7.3. South Africa

6.7.3.1. South Africa estimated disease burden by indication, 2018 -2022

6.7.3.2. Regulatory framework & reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. South Africa home healthcare market estimates and forecasts, 2020 - 2032

6.7.4. Saudi Arabia

6.7.4.1. Saudi Arabia estimated disease burden by indication, 2018 -2022

6.7.4.2. Regulatory framework & reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. Saudi Arabia home healthcare market estimates and forecasts, 2020 - 2032

6.7.5. UAE

6.7.5.1. UAE estimated disease burden by indication, 2018 -2022

6.7.5.2. Regulatory framework & reimbursement structure

6.7.5.3. Competitive scenario

6.7.5.4. UAE home healthcare market estimates and forecasts, 2020 - 2032

6.7.6. Egypt

6.7.6.1. Egypt estimated disease burden by indication, 2018 -2022

6.7.6.2. Regulatory framework & reimbursement structure

6.7.6.3. Competitive scenario

6.7.6.4. Egypt home healthcare market estimates and forecasts, 2020 - 2032

6.7.7. Oman

6.7.7.1. Oman estimated disease burden by indication, 2018 -2022

6.7.7.2. Regulatory framework & reimbursement structure

6.7.7.3. Competitive scenario

6.7.7.4. Oman home healthcare market estimates and forecasts, 2020 - 2032

Chapter 7. Competitive Landscape

7.1. Company Categorization

7.2. Company Market Share Analysis, 2022

7.3. Strategy Mapping

7.4. Company Profiles: Suppliers

7.4.1. McKesson Medical-Surgical Inc.

7.4.1.1. Overview

7.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.1.3. Product Benchmarking

7.4.1.4. Strategic Initiatives

7.4.2. Fresenius Medical Care

7.4.2.1. Overview

7.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.2.3. Product Benchmarking

7.4.2.4. Strategic Initiatives

7.4.3. Medline Industries, Inc.

7.4.3.1. Overview

7.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.3.3. Product Benchmarking

7.4.3.4. Strategic Initiatives

7.4.4. Medtronic PLC

7.4.4.1. Overview

7.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.4.3. Product Benchmarking

7.4.4.4. Strategic Initiatives

7.4.5. 3M Healthcare

7.4.5.1. Overview

7.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.5.3. Product Benchmarking

7.4.5.4. Strategic Initiatives

7.4.6. Baxter International Inc.

7.4.6.1. Overview

7.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.6.3. Product Benchmarking

7.4.6.4. Strategic Initiatives

7.4.7. B. Braun Melsungen AG

7.4.7.1. Overview

7.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.7.3. Product Benchmarking

7.4.7.4. Strategic Initiatives

7.4.8. Arkray, Inc.

7.4.8.1. Overview

7.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.8.3. Product Benchmarking

7.4.8.4. Strategic Initiatives

7.4.9. F. Hoffmann-La Roche AG

7.4.9.1. Overview

7.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.9.3. Product Benchmarking

7.4.9.4. Strategic Initiatives

7.4.10. Becton, Dickinson And Company

7.4.10.1. Overview

7.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.10.3. Product Benchmarking

7.4.10.4. Strategic Initiatives

7.4.11. Acelity L.P.

7.4.11.1. Overview

7.4.11.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.11.3. Product Benchmarking

7.4.11.4. Strategic Initiatives

7.4.12. Hollister Inc.

7.4.12.1. Overview

7.4.12.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.12.3. Product Benchmarking

7.4.12.4. Strategic Initiatives

7.4.13. ConvaTec Group PLC

7.4.13.1. Overview

7.4.13.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.13.3. Product Benchmarking

7.4.13.4. Strategic Initiatives

7.4.14. Molnlycke Health Care

7.4.14.1. Overview

7.4.14.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.14.3. Product Benchmarking

7.4.14.4. Strategic Initiatives

7.5. Company Profile: Service Providers

7.5.1. Brookdale Senior Living, Inc.

7.5.1.1. Overview

7.5.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.1.3. Service Benchmarking

7.5.1.4. Strategic Initiatives

7.5.2. Home Health Services Ltd.

7.5.2.1. Overview

7.5.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.2.3. Service Benchmarking

7.5.2.4. Strategic Initiatives

7.5.3. Sunrise Carlisle, LP

7.5.3.1. Overview

7.5.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.3.3. Service Benchmarking

7.5.3.4. Strategic Initiatives

7.5.4. Extendicare, Inc.

7.5.4.1. Overview

7.5.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.4.3. Service Benchmarking

7.5.4.4. Strategic Initiatives

7.5.5. Care UK Limited

7.5.5.1. Overview

7.5.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.5.3. Service Benchmarking

7.5.5.4. Strategic Initiatives

7.5.6. Senior Care Centers of America

7.5.6.1. Overview

7.5.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.6.3. Service Benchmarking

7.5.6.4. Strategic Initiatives

7.5.7. Genesis Healthcare Corp.

7.5.7.1. Overview

7.5.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.7.3. Service Benchmarking

7.5.7.4. Strategic Initiatives

7.5.8. Sompo Holdings, Inc.

7.5.8.1. Overview

7.5.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.8.3. Service Benchmarking

7.5.8.4. Strategic Initiatives

7.5.9. Kindred Healthcare, Inc.

7.5.9.1. Overview

7.5.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.9.3. Service Benchmarking

7.5.9.4. Strategic Initiatives

7.5.10. Home Instead Senior Care, Inc.

7.5.10.1. Overview

7.5.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.5.10.3. Service Benchmarking

7.5.10.4. Strategic Initiatives