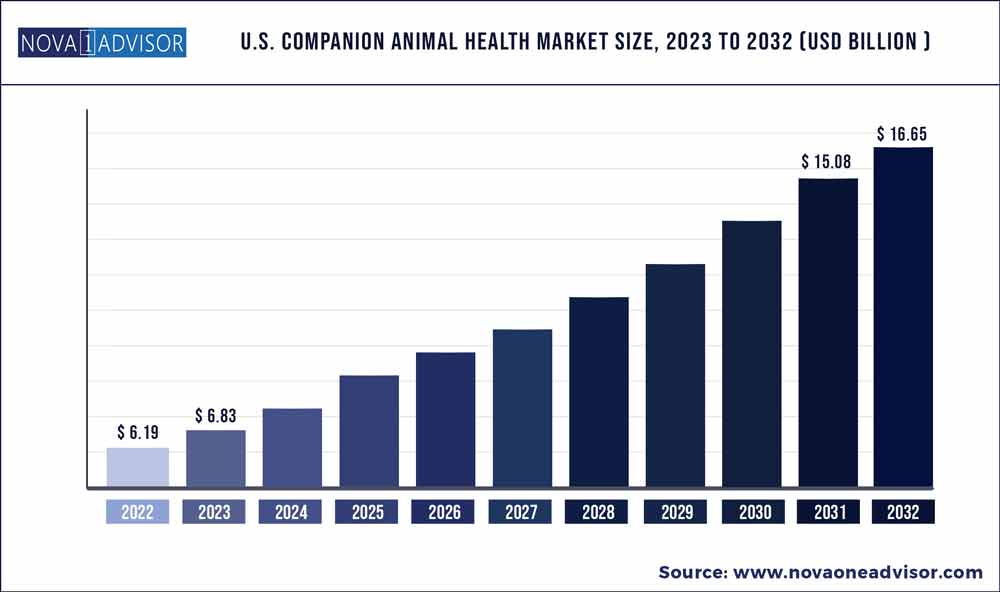

The U.S. companion animal health market size was exhibited at USD 6.19 billion in 2022 and is projected to hit around USD 16.65 billion by 2032, growing at a CAGR of 10.4% during the forecast period 2023 to 2032.

Key Takeaways:

U.S. Companion Animal Health Market Report Scope

| Report Attribute | Details |

| Market Size in 2023 | USD 6.83 Billion |

| Market Size by 2032 | USD 16.65 Billion |

| Growth Rate From 2023 to 2032 | CAGR of 10.4% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Animal type, Distribution channel, End use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Zoetis; Ceva Santé Animale; Merck & Co., Inc.; Vetoquinol S.A.; Boehringer Ingelheim Gmbh; Elanco; Virbac; Heska; Dechra Pharmaceuticals Plc; Idexx Laboratories, Inc.; Norbrook Inc. |

The rising number of pet owners seeking better healthcare services, healthier quality foods, and high-end grooming and training services for their companion animals is a major driver for this market. According to theNational Pet Owners Survey, 90.5 million families in the U.S. own a pet, out of which 69.0 million own a dog. Moreover, high-income families amounted to approximately 60% of the total spending. In recent years, pet adoption has shown immense growth. This is primarily attributed to the fact that people are healthier and happier in the presence of pets, as found by the Human-Animal Bond Research Initiative Foundation (HABRI).

With the rising adoption of companion animals and growing concerns over their health, there comes a direct association with pet insurance. Presently, pet insurance accounts for a small segment in the insurance industry. The Covid-19 pandemic positively impacted the market growth in the U.S. Key players such as Boehringer Ingelheim Animal Health, Chewy, Elanco, MWI Animal Health, Covetrus, and PetIQ focused on expanding their telemedicine solutions into the market as governments relaxed governance to enable more flexible veterinary examinations during the coronavirus pandemic.

Approval of novel therapeutics and companion animal vaccines continues to present this market with lucrative growth opportunities. Ongoing trends for the adoption of e-commerce, pet insurance, veterinary telemedicine, point of care diagnostic testing, and digitalization of veterinary practices are further accelerated by the crisis of COVID-19.

Groundbreaking technological advances are rapidly transforming the pet health industry. These expansions are maximizing the potential for growth. Companies are taking strategic initiatives in pet health, such as the adoption of big data, wearable technologies to monitor pet health, and the inclusion of stem cell therapy. Moreover, established players are focusing on expanding their portfolios. For instance, Elanco acquired Bayer AG’s animal health business unit in August 2019.

The U.S. captured a substantial share of the market. The share attained by this country is primarily a consequence of the presence of prominent market players undertaking extensive expansion strategies. Moreover, the increasing number of R&D investments initiated by the companies is one of the key potential growth factors presumed to be responsible for the sizeable share garnered by the U.S.

Animal Type Insights

The dog segment held the largest revenue share of over 42.0% in 2022 majorly owing to the rising adoption of dogs. Dogs are known to provide numerous health benefits to their owners such as combating depression, reducing stress, and lowering blood pressure. Furthermore, dogs are more prone to various forms of cancer compared to other companion animals such as cats. As per the Veterinary Cancer Society, cancer is the foremost reason for death in 47% of dogs, especially those aged below 10 years.

The cat segment emerged as the second-largest animal type segment in 2022 and is expected to register the fastest growth rate over the forecast period. Cats are highly prone to infections and chronic health issues, such as cardiovascular disorders, diabetes, and kidney problems. Companies are focusing on expanding their product portfolio in this segment, giving it a major boost. For instance, Ceva expanded its range of cardiology products with the launch of Amodip for the treatment of arterial hypertension in cats.

Product Insights

The pharmaceuticals segment held the largest revenue share of over 52.0% in 2022. The segment is driven by the increasing usage of pharmaceuticals to treat the burgeoning prevalence of foodborne diseases and zoonotic diseases. These diseases are potentially hazardous to animal health and require immediate medical attention.

The vaccines segment is anticipated to grow at a lucrative rate during the forecast period. Vaccination is important for companion animals as it not only safeguards them from epidemics but also protects owners in case of any animal bites. As per the Centers for Disease Control and Prevention (CDC), in 2017, rabies vaccination is prime for pet animals; the vaccination has resulted in a 5.7% decrease in rabies cases in domestic animals since 2016. Moreover, clinical trials for vaccines take less time compared to pharmaceutical medicines, resulting in the release of new vaccination products in the market at a rapid pace.

The diagnostics segment is expected to register the fastest growth rate during the forecast period. Technological advancements in the field of radiology diagnostics such as electronic data capture, the inclusion of AI, and cloud-based storage are anticipated to drive the segment. For instance, IBM is working on AI assistants for doctors that can promptly recognize species the moment a pet is brought into a clinic. These assistants can also quickly scan through a database of over 800 medical conditions to make a diagnosis. Artificial intelligence is also giving rise to ‘smart farms’, helping in the diagnosis of affected animals without any human involvement.

Distribution Channel Insights

Hospital pharmacy held the largest revenue share of over 57.0% in 2022 due to the high accessibility and affordability. The segment is expected to grow at a steady pace owing to the increasing prevalence of epidemics and chronic health ailments among companion animals. Furthermore, hospitals provide advanced treatment products, which is expected to contribute to the overall growth of the segment.

E-commerce is estimated to be the fastest-growing segment owing to the ease of availability, greater accessibility, and less time consumption. E-commerce or online pharmacies eliminate other market intermediaries of the delivery channel, thereby reducing overall costs. This has driven customer preference over other channels. Furthermore, the OTC drug segment has significantly benefited from the advent of e-commerce. Consumers are progressively moving toward the usage of digital platforms for speedy delivery and convenience. The availability of home delivery services has given pet owners the option of having drugs delivered to them within a delivery window of an hour in many areas in the U.S.

End-use Insights

Veterinary hospitals and clinics dominated the market with a revenue share of over 82.0% in 2022. The demand for fast, accurate, and cost-effective diagnosis and treatment in companion animals has driven this segment. Moreover, in recent years, veterinary hospitals and clinics, and pet insurance companies have been collaborating efforts for better and fast reimbursement options, leading to better treatment and increased footfall.

The point-of-care or in-house testing segment is anticipated to register the fastest growth rate over the forecast period owing to the improved access to healthcare services and the ability to provide quick and accurate results. Moreover, facilities like lab-quality testing outside hospital settings will boost its adoption in veterinary healthcare. Another factor propelling this segment growth is the increase in the incidence of animal diseases that may affect companion animals and infect humans, thus raising the need for point-of-care tests.

Key Companies & Market Share Insights

Extensive mergers and acquisitions, product portfolios, geographical expansions, and collaborative research initiatives are strategies undertaken by the leading players. For instance, in July 2019, Zoetis and Colorado State University entered into an agreement for establishing a research lab for the development of new immunotherapies for veterinary patients.

Established players, in an attempt to increase their market presence and strengthen their product offering, are entering into alliances. For example, in April 2019, Merck acquired Antelliq Corporation in order to increase its foothold in animal health monitoring and smart data management for both companion and livestock animals. The market is competitive and the rising penetration of advanced technologies in this space is further anticipated to present this market with promising growth opportunities in the near future. Some prominent players in the U.S. companion animal health market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Companion Animal Health market.

By Animal Type

By Product

By Distribution Channel

By End-use

Chapter 1. Methodology and Scope

1.1. Market Segmentation And Scope

1.2. Research Methodology

1.3. Information Procurement

1.3.1 Purchased Database

1.3.2 Nova one advisor Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.4. Information/Data Analysis

1.5. Market Formulation & Visualization

1.6. Data Validation & Publishing

1.7. Model Details

1.8. List Of Secondary Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. U.S. Companion Animal Health Market Variables, Trends, and Scope

3.1. Market Lineage

3.1.1. Parent Market Analysis

3.1.2. Ancillary Market Analysis

3.2. U.S. Companion Animal Health Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Rising pet population

3.2.1.2. Increasing pet expenditure & pet humanization

3.2.1.3. Increasing adoption of pet insurance

3.2.2. Market Restraint Analysis

3.2.3. Market Opportunity Analysis

3.2.4. Market Challenges Analysis

3.3. U.S. Companion Animal Health Market: Porter’s 5 Forces Analysis

3.3.1.1. Threat of New Entrants

3.3.1.2. Threat of Substitutes

3.3.1.3. Bargaining Power of Buyers

3.3.1.4. Bargaining Power of Suppliers

3.3.1.5. Competitive Rivalry

3.4. U.S. Companion Animal Health Market: PESTLE Analysis

3.5. COVID-19 Impact Analysis

3.6. Estimated Pet Population by species, 2020 to 2023

3.7. Product Pipeline Analysis

3.8. User perspective analysis

3.9. Regulatory Framework

Chapter 4. Animal Type Estimates & Trend Analysis, 2020 - 2032

4.1. U.S. Companion Animal Health Market By Animal Type: Key Takeaways

4.2. Animal Type Movement Analysis & Market Share, 2023 & 2032

4.3. U.S. Companion Animal Health Market Estimates & Forecast, By Animal Type

4.4. Dogs

4.4.1. Dogs Market Estimates And Forecasts, 2020 - 2032

4.5. Horses

4.5.1. Horses Market Estimates And Forecasts, 2020 - 2032

4.6. Cats

4.6.1. Cats Market Estimates And Forecasts, 2020 - 2032

4.7. Others

4.7.1. Others Market Estimates And Forecasts, 2020 - 2032

Chapter 5. Product Estimates & Trend Analysis, 2020 - 2032

5.1. U.S. Companion Animal Health Market By Product: Key Takeaways

5.2. Product Movement Analysis & Market Share, 2023 & 2032

5.3. U.S. Companion Animal Health Market Estimates & Forecast, By Product

5.4. Vaccines

5.4.1. Vaccines Market Estimates And Forecasts, 2020 - 2032

5.5. Pharmaceuticals

5.5.1. Pharmaceuticals Market Estimates And Forecasts, 2020 - 2032

5.5.2. OTC

5.5.2.1. OTC Market Estimates And Forecasts, 2020 - 2032

5.5.3. Prescription

5.5.3.1. Prescription Market Estimates And Forecasts, 2020 - 2032

5.6. Feed Additives

5.6.1. Feed Additives Market Estimates And Forecasts, 2020 - 2032

5.7. Diagnostics

5.7.1. Diagnostics Market Estimates And Forecasts, 2020 - 2032

5.8. Others

5.8.1. Others Market Estimates And Forecasts, 2020 - 2032

Chapter 6. End Use Estimates & Trend Analysis, 2020 - 2032

6.1. U.S. Companion Animal Health Market By End Use: Key Takeaways

6.2. End Use Movement Analysis & Market Share, 2023 & 2032

6.3. U.S. Companion Animal Health Market Estimates & Forecast, By End Use

6.4. Point-of-care testing/In-house testing

6.4.1. Point-of-care testing/In-house testing Market Estimates And Forecasts, 2020 - 2032

6.5. Veterinary Hospitals & Clinics

6.5.1. Veterinary Hospitals & Clinics Market Estimates And Forecasts, 2020 - 2032

6.6. Others

6.6.1. Others Market Estimates And Forecasts, 2020 - 2032

Chapter 7. Distribution Channel Estimates & Trend Analysis, 2020 - 2032

7.1. U.S. Companion Animal Health Market By Distribution Channel: Key Takeaways

7.2. Distribution Channel Movement Analysis & Market Share, 2023 & 2032

7.3. U.S. Companion Animal Health Market Estimates & Forecast, By End Use

7.4. Retail

7.4.1. Retail Market Estimates And Forecasts, 2020 - 2032

7.5. E-commerce

7.5.1. E-commerce Market Estimates And Forecasts, 2020 - 2032

7.6. Hospital Pharmacy

7.6.1. Hospital Pharmacy Market Estimates And Forecasts, 2020 - 2032

Chapter 8. Competitive Landscape

8.1. Market Participant Categorization

8.2. Key Company Profiles

• Zoetis

• Ceva Santé Animale

• Merck & Co., Inc.

• Vetoquinol S.A.

• Boehringer Ingelheim Gmbh

• Elanco

• Virbac

• Heska

• Dechra Pharmaceuticals Plc

• Idexx Laboratories, Inc.

• Norbrook Inc.

8.2.1. Company Overview

8.2.2. Product Benchmarking

8.2.3. Financial Performance

8.2.4. Strategy Mapping

8.3. Company Market Position Analysis

8.4. Estimated Company Market Share Analysis, 2023

8.5. List of Other Key Market Players (Manufacturers & Distributors)