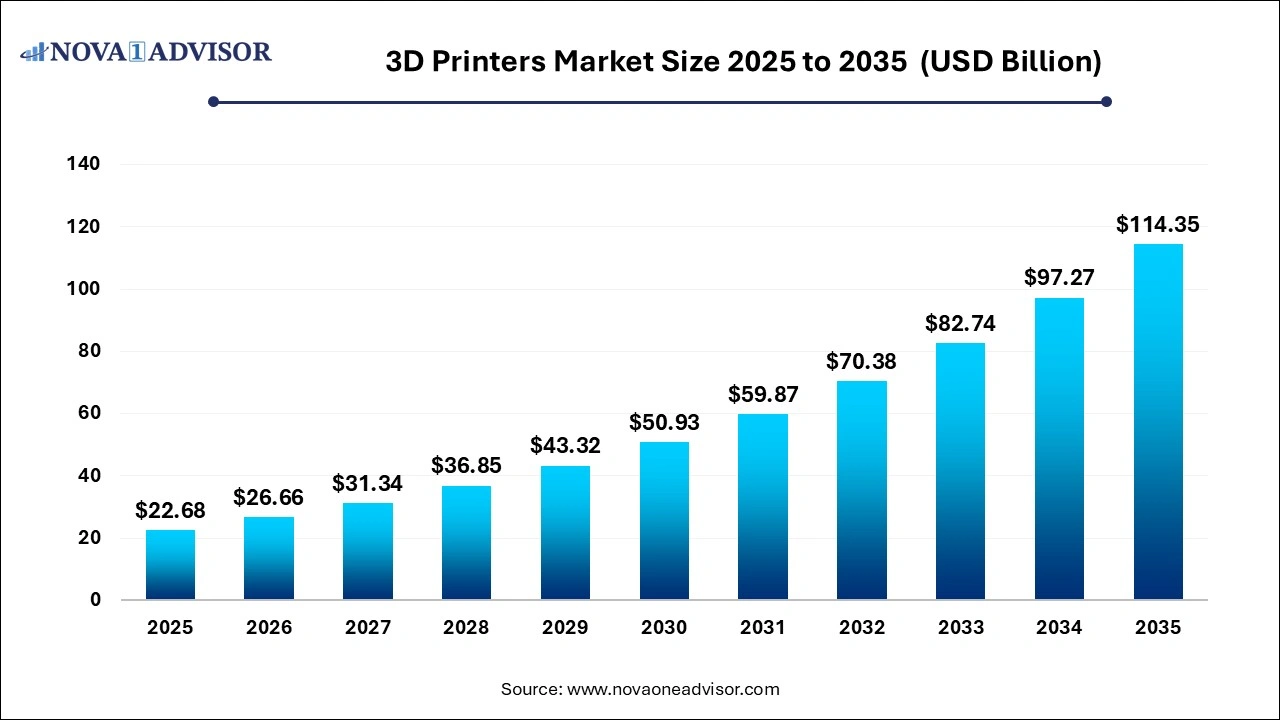

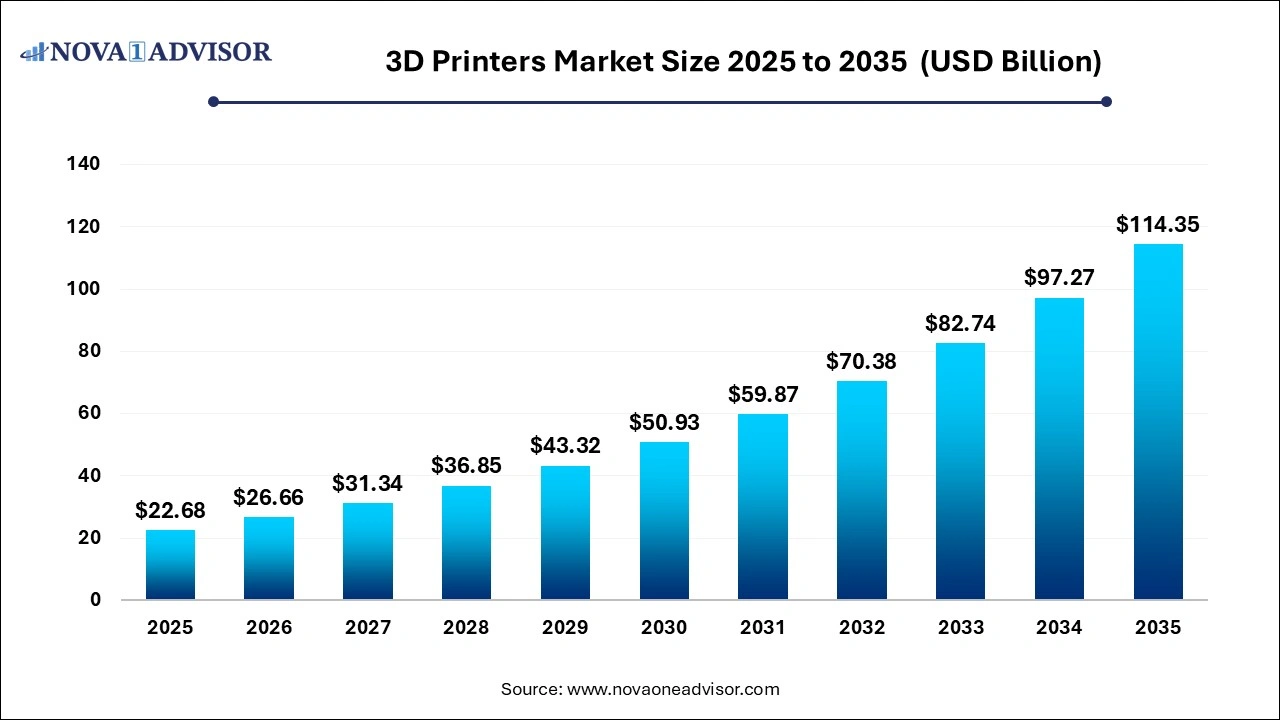

3D Printers Market Size, Growth, Trends 2026 to 2035

The global 3D printers market size was exhibited at USD 22.68 billion in 2025 and is projected to hit around USD 88.61 billion by 2035, growing at a CAGR of 17.54% during the forecast period 2026 to 2035.

Key Pointers:

- By component, the hardware segment dominates the market and captured more than 62% of revenue share in 2025.

- By printer type, the industrial 3D printers’ segment generated largest revenue share of around 72% in 2025.

- By technology, the stereolithography segment generated for the highest revenue share in 2025.

- By software, the design software segment captured for the highest revenue share of around 32% in 2025.

- By application, the prototyping segment generated the highest revenue share of around 57% in 2025.

- By vertical, the automotive segment dominates the market.

- By material, the metal material segment captured for the largest revenue share of around 52% in 2025.

- By geography, The North America dominates the market with the highest revenue share of around 33% in 2025.

Effortlessness in development of tailored products, reduction in manufacturing cost and process downtime, government investment in additive manufacturing-based projects globally, and availability of wide variety of industrial-grade 3D printing materials are the few driving factors for the growth of 3D printing industry.

3D Printers Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 26.66 Billion |

| Market Size by 2035 |

USD 114.35 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 17.56% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Component, By Component, By Technology, By Software, By Application, By Vertical and By Material |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

HP Inc., 3D Systems Inc., Envision Tec Inc., Autodesk Inc., Canon Inc., Stratasys Ltd. and Others. |

3D Printing Market Dynamics

Driver

Global government investment in 3D printing projects

Globally, governments are undertaking initiatives and funding educational institutions, research centers, and research and technology organizations to explore further the opportunities provided by 3D printing technology and encourage its development. The US, the UK, and Canada have implemented national programs for promoting university-level 3D printing research, driving technology advancement and the establishment of start-ups. The emergence of new applications for 3D printing has attracted industrialists and governments worldwide toward the technology. For instance, the UK National Strategy for Additive Manufacturing 2018–2025 aims to achieve EUR 3,500 million gross value added (GVA) per year by 2025 and 60,000 jobs across sectors. The strategy depicts a full set of recommendations developed by workgroups responsible for certain themes.

Restraint

Lack of standardized testing methods to verify mechanical properties of 3D printing materials and high cost of raw materials

More raw materials are available for traditional manufacturing than for 3D printing-based manufacturing processes. 3D printing of products with mixed materials and technology, such as circuit boards, is still under development. Though the technology is a major process breakthrough, the materials that can be used are still limited. Also, the accuracy and reproducibility of the products formed by 3D printing are hampered due to the lack of standardized tests to verify the mechanical properties (strength, toughness, stiffness, and hardness) of the materials used. Another concern is characterizing material properties depending on their suitability in 3D printing. Various available materials have characteristic mechanical properties, porosity, powder composition, particle homogeneity, size, and morphology. Therefore, material characterization and standardization for 3D printing are some of the important issues.

Opportunity

Emerging applications of 3D printing technology in automotive, printed electronics, jewelry, and education fields

3D printing technology is increasingly adopted in industrial manufacturing, especially in the automotive, aerospace, and defense industries. 3D printing has potential opportunities in tooling, jigs and fixtures, injection molding, and production parts manufacturing. 3D printing technology is in an early stage of development across several sectors, such as printed electronics, textiles, footwear, and food and culinary; however, it is experiencing significant adoption from the education, art and architecture, and jewellery industries. The market has been experiencing the advancement of printers and printing technologies, improvement in printing materials, and the development of a skilled workforce. The advancements in printing technology, design tools, software, materials, and printed electronics will allow electronics to be embedded within the structure of the products instead of mounting the printed circuit boards (PCBs) separately within the device. 3D printing finds potential opportunities to eliminate PCBs and produce hearing aids, structural electronics, print sensors, cell phone antennae, batteries, solar cells, light-emitting diodes, and other active and passive devices.

Challenge

Decline in sales of 3D printing devices due to recession impact

During a recession, companies and individuals may reduce their spending on non-essential items such as 3D printers, which could decrease the demand for 3D-printed products. Companies using 3D printers may delay their plans to adopt newer technologies due to financial uncertainty, which could slow down the growth of the 3D printing market. Established players in the 3D printing market may witness a decline in their annual revenues at the end of FY2023 due to the recession. Customers from emerging markets will be looking for low-cost 3D printers, which could increase the competition among established players.

3D printing market in Asia Pacific is expected to foresee the highest CAGR during the forecast period

The Asia Pacific region is expected to foresee the highest growth of 3D printing solutions during the forecast period. The region has witnessed a significant shift toward prototyping and advanced manufacturing using 3D printing. Government initiatives coupled with extensive research and development capabilities and foreign direct investment (FDI) have accelerated the growth of the market in this region. Technological advancements in China are another important driving factor for the market. China is one of the largest manufacturers of consumer devices and automotive vehicles.

Some of the prominent players in the 3D Printers Market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global 3D Printers market.

By Component

- Hardware

- Software

- Services

By Printer Type

- Industrial 3D Printer

- Desktop 3D Printer

By Technology

- Stereolithography

- Inkjet Printing

- Direct Metal Laser Sintering

- Fuse Deposition Modeling

- Selective Laser Sintering

- Poly Jet Printing

- Electron Beam Melting

- Laser Metal Deposition

- Digital Light Processing

- Laminated Object Manufacturing & Others

By Software

- Design Software

- Inspection Software

- Printer Software

- Scanning Software

By Application

- Prototyping

- Tooling

- Functional Parts

By Vertical

- Automotive

- Airospace& Defense

- Healthcare

- Consumer Electronics

- Industrial

- Power & Energy

- Education

- Fashion & Jewelry

- Food

- Object

- Dental

- Others

By Material

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)