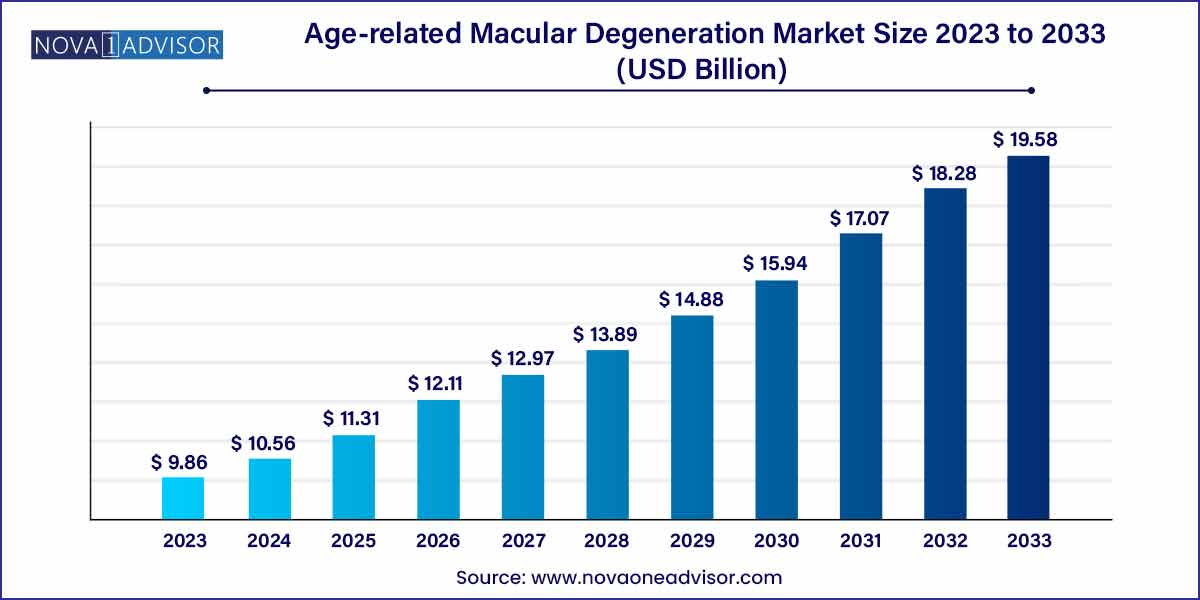

The global age-related macular degeneration market size was exhibited at USD 9.86 billion in 2023 and is projected to hit around USD 19.58 billion by 2033, growing at a CAGR of 7.1% during the forecast period of 2024 to 2033.

Key Takeaways:

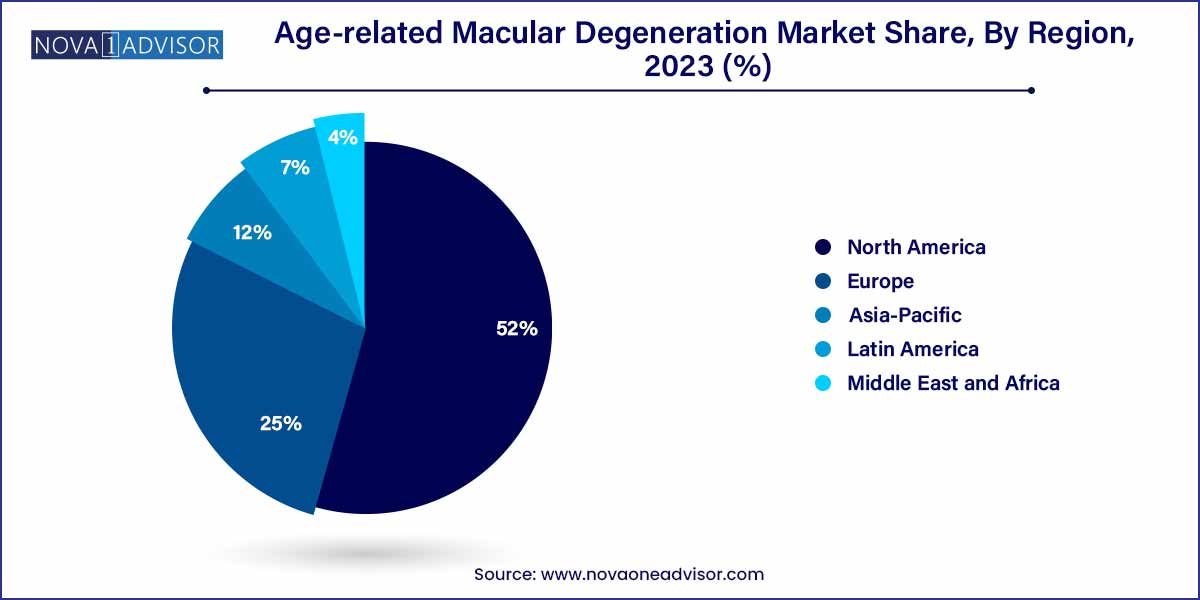

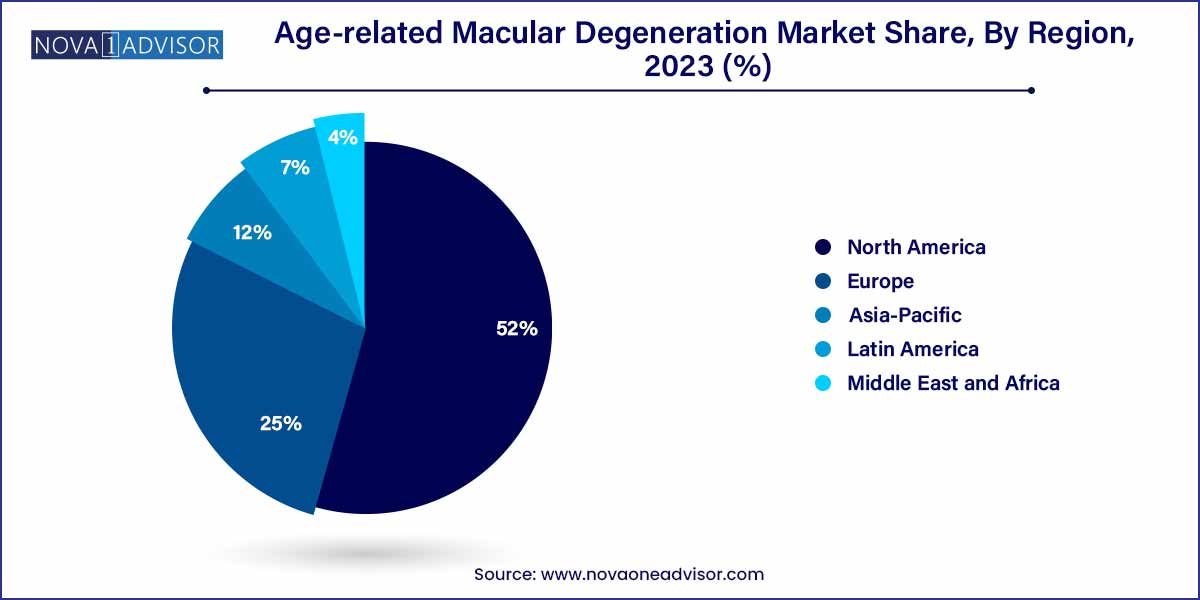

- North America dominated the market in 2023 with a revenue share of over 52.0%.

- The eylea segment dominated the market in 2023 with a revenue share of over 50.0%.

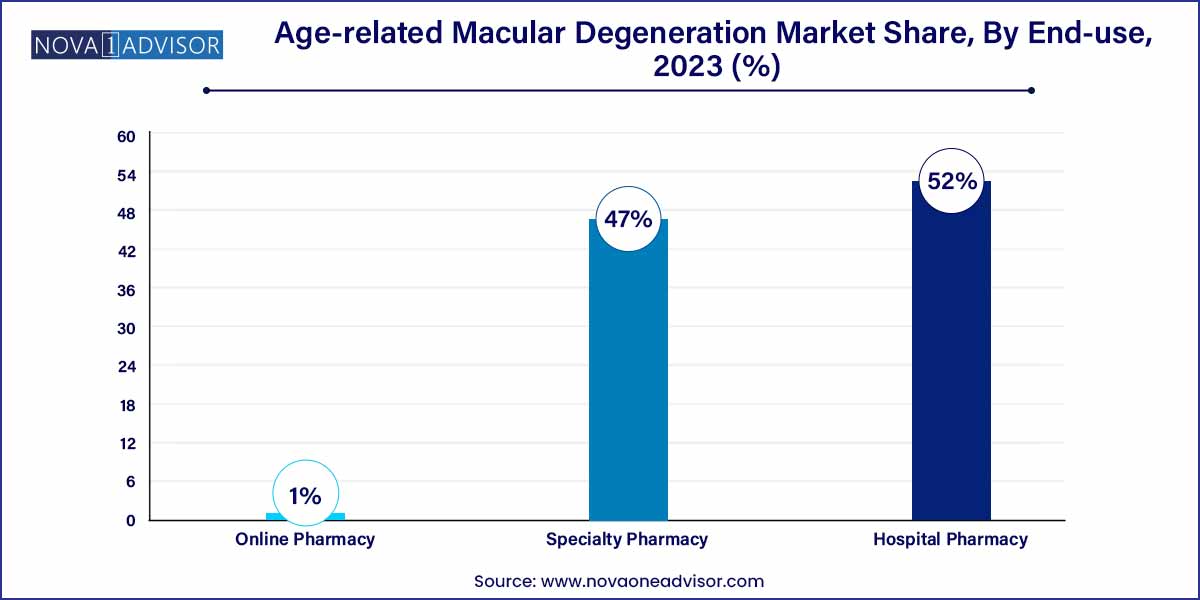

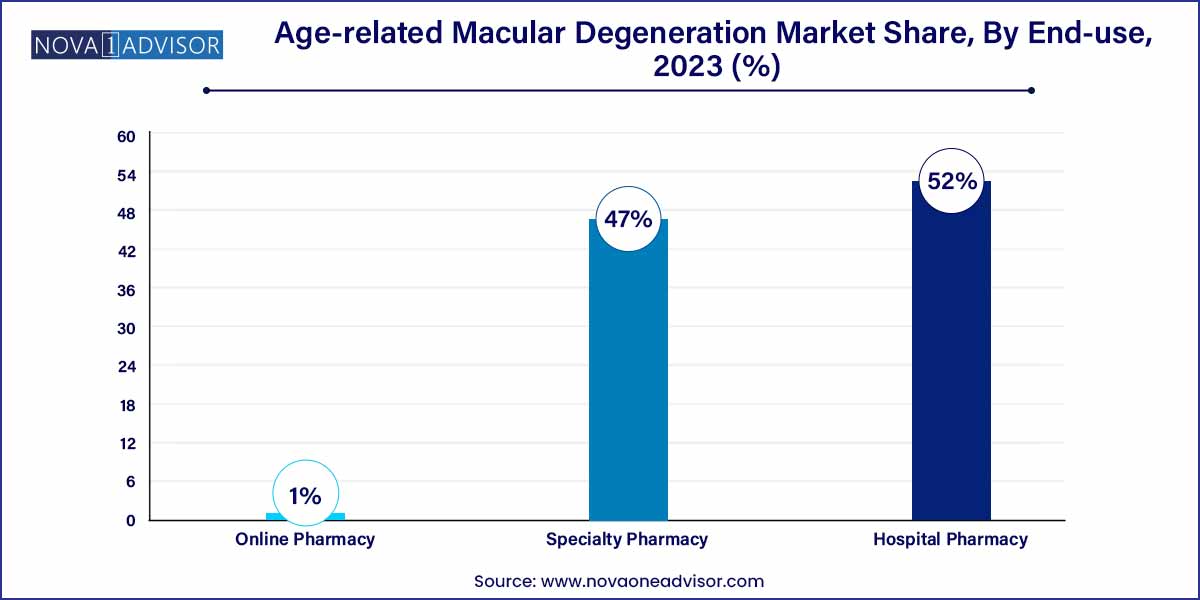

- The hospital pharmacy segment dominated the global market in 2023 with a revenue share of over 52.0%.

Market Overview

The Age-related Macular Degeneration (AMD) Market represents a critical segment within the global ophthalmology industry, addressing one of the most common causes of irreversible vision loss among the elderly population. AMD is a degenerative retinal disease that primarily affects the macula the central portion of the retina responsible for sharp, detailed vision. As the global population continues to age rapidly, the prevalence of AMD is escalating, making it a pressing public health challenge and a significant area of therapeutic innovation.

Broadly categorized into two types dry AMD and wet AMD this condition progresses differently across individuals. While dry AMD is more common and progresses slowly, wet AMD, though less prevalent, is more severe and can lead to sudden vision loss. The market has traditionally focused on wet AMD treatments, particularly anti-vascular endothelial growth factor (anti-VEGF) therapies that inhibit the abnormal blood vessel growth at the core of this condition.

Pharmaceutical and biotechnology companies have made substantial progress in AMD therapeutics, with drugs such as Eylea, Lucentis, and Beovu dominating the treatment landscape. These therapies, primarily administered through intravitreal injections, have revolutionized patient outcomes, turning a once-inevitable vision loss into a manageable condition. However, unmet needs remain—particularly for dry AMD and for long-acting or less invasive treatment modalities.

The AMD market is poised for strong growth over the next decade, driven by increasing disease prevalence, ongoing R&D in gene and stem cell therapy, innovations in sustained-release drug delivery, and expanding access to ophthalmologic care in emerging regions. The convergence of these factors is creating a dynamic market ecosystem that offers both established pharmaceutical giants and biotech startups abundant opportunities for innovation and expansion.

Major Trends in the Market

-

Rise of Long-acting and Sustained-release Therapies: Newer formulations are aiming to reduce the frequency of intravitreal injections, improving patient compliance.

-

Increasing Focus on Dry AMD Treatments: Research is accelerating in this underserved segment, with new drugs targeting geographic atrophy (GA) stages.

-

Gene Therapy and Cell-based Therapeutics: Biotech firms are investing heavily in gene-editing and regenerative approaches to address root causes of AMD.

-

Artificial Intelligence in Early Diagnosis: AI-driven retinal imaging tools are enhancing early detection, allowing intervention at less advanced stages.

-

Tele-ophthalmology Expansion: Post-COVID, virtual eye care platforms are helping extend reach, especially in rural and underserved populations.

-

Combination Therapies for Enhanced Efficacy: Combining anti-VEGF agents with anti-PDGF or anti-inflammatory drugs is a growing area of clinical trials.

-

Market Penetration in Emerging Economies: Increased healthcare access in countries like China, Brazil, and India is expanding the treatment base.

-

Biosimilars and Cost-competitive Alternatives: As original biologics face patent expiration, biosimilars are entering the market at lower costs, increasing access.

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.86 Billion |

| Market Size by 2033 |

USD 19.58 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Disease Type, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd.; Novartis AG; Bayer AG; Pfizer Inc.; Bausch Health Companies Inc.; Regeneron Pharmaceuticals Inc.; Amgen Inc.; Biogen; Samsung Bioepis. |

Key Market Driver: Increasing Global Geriatric Population

One of the most significant drivers fueling the AMD market is the rising global elderly population, particularly individuals over the age of 60, who are at the highest risk of developing AMD. According to the World Health Organization (WHO), by 2030, one in six people worldwide will be aged 60 years or older. This demographic shift is contributing to a sharp increase in the incidence of both dry and wet AMD globally.

With longevity improving due to better nutrition, healthcare access, and chronic disease management, age-related conditions like AMD are becoming more prevalent. Furthermore, the risk of AMD doubles every decade after the age of 50. In countries such as Japan, Germany, and Italy where the elderly already constitute over 20% of the population AMD has become one of the leading causes of disability and dependence in older adults. This demographic trend ensures a growing and sustained demand for innovative AMD diagnostics, therapeutics, and monitoring technologies.

Key Market Restraint: High Cost and Repeated Dosing of Anti-VEGF Therapies

Despite the revolutionary impact of anti-VEGF drugs in controlling wet AMD, the high cost and frequency of administration remain critical barriers to market expansion, particularly in low- and middle-income countries. Agents like Eylea and Lucentis are priced at several thousand dollars per year, and their treatment regimen often involves monthly or bimonthly intravitreal injections over extended periods.

For many patients especially those reliant on public healthcare systems or without comprehensive insurance coverage such regimens are financially unsustainable. Moreover, the burden of frequent hospital visits, injection-related anxiety, and potential adverse effects such as endophthalmitis deter adherence and long-term compliance. These factors limit the widespread adoption of current therapies and highlight the urgent need for cost-effective and long-acting alternatives.

Key Market Opportunity: Innovation in Dry AMD Therapeutics

A significant growth opportunity lies in the development of effective therapies for dry AMD, which accounts for 85-90% of all AMD cases but currently lacks approved treatment options especially for early and intermediate stages. The most advanced manifestation of dry AMD, known as geographic atrophy (GA), is characterized by the progressive loss of retinal cells and irreversible vision loss.

Recent advancements in understanding the inflammatory and genetic mechanisms involved in GA have spurred interest in targeting the complement cascade particularly complement factor inhibitors. Biopharmaceutical companies are investing in new modalities, including complement C3 and C5 inhibitors, neuroprotective agents, and stem cell-based therapies, to slow or halt GA progression. The recent FDA approval of Syfovre (pegcetacoplan) in 2023 for GA has marked a turning point in this space and opened the doors for further clinical innovation.

By Product

Eylea (aflibercept) dominated the product segment due to its broad adoption, demonstrated efficacy, and extended dosing intervals compared to first-generation anti-VEGF agents. Approved for wet AMD, diabetic macular edema, and other retinal vascular diseases, Eylea has become a market leader in ophthalmology. Its bi-monthly injection schedule—after an initial loading phase—offers better convenience and compliance than monthly therapies. Bayer and Regeneron have continuously expanded its clinical indications and are working on high-dose, long-acting versions to further solidify its market position.

Beovu (brolucizumab) is emerging as the fastest-growing product, particularly for patients seeking longer treatment intervals. With its small molecular size and ability to penetrate retinal tissues more effectively, Beovu offers potential for quarterly dosing. Although safety concerns following its initial launch prompted a reevaluation of its risk profile, Novartis has continued to support it through additional trials and real-world safety studies. Its appeal lies in its promise of reduced injection frequency without compromising efficacy a major unmet need in current wet AMD therapy.

By Disease Type

Wet AMD remains the dominant disease type, mainly because it accounts for the majority of clinical interventions and treatment-related expenditures. Despite comprising only about 10-15% of total AMD cases, wet AMD is responsible for over 80% of severe vision loss associated with the disease. The rapid progression and immediate threat to sight compel patients and providers to pursue aggressive treatment, usually involving anti-VEGF therapies. As a result, the commercial landscape is highly focused on managing neovascular AMD.

Dry AMD is the fastest-growing segment, owing to its high prevalence and a growing pipeline of investigational therapies. The unmet need in early and intermediate dry AMD stages, especially in slowing progression toward GA, is prompting considerable R&D activity. Biotech firms are developing oral, injectable, and gene therapy-based solutions for this segment. As new treatments for dry AMD gain regulatory approval, market share is expected to shift toward more balanced management between the two disease types.

By Distribution Channel Insights

Hospital pharmacies dominated the distribution channel segment, particularly for wet AMD, where treatment is administered in specialized ophthalmology departments. Intravitreal injections must be performed in sterile, clinical environments by trained professionals, making hospitals the primary point of care. High-value drug inventory, storage requirements, and insurance processing are also streamlined in hospital settings, justifying their central role in distribution.

Online pharmacies are the fastest-growing channel, especially for dry AMD supplements, diagnostics, and follow-up therapies. As e-commerce penetration deepens in healthcare, patients are increasingly turning to digital platforms for prescription refills, vitamins like AREDS2, and tele-ophthalmology services. The convenience, cost savings, and expanding virtual consultation infrastructure are facilitating the growth of online channels, particularly in developed regions.

By Regional Insights

North America leads the global AMD market, owing to a high prevalence of AMD, advanced healthcare infrastructure, and rapid adoption of new therapies. The United States, in particular, accounts for a substantial share due to its aging population and favorable reimbursement policies. The presence of key pharmaceutical players like Regeneron and Genentech has ensured early market access to cutting-edge treatments. In addition, the robust ecosystem of academic medical centers and clinical trials makes North America a hub for AMD innovation and adoption.

Asia-Pacific is the fastest-growing region, driven by increasing elderly populations, greater awareness, and expanding access to retinal care. Countries like Japan, South Korea, and China are experiencing rapid epidemiological transitions, resulting in rising AMD prevalence. Governments are investing in primary eye care infrastructure, while private hospitals are adopting high-end diagnostic and treatment technologies. Moreover, rising disposable incomes and insurance penetration are improving patient access to therapies that were once limited to elite urban centers. With domestic companies entering the biosimilar and generic anti-VEGF space, the region is also witnessing cost-effective treatment options that are widening market reach.

- F. Hoffmann-La Roche Ltd.

- Novartis AG

- Bayer AG

- Pfizer Inc.

- Bausch Health Companies Inc.

- Regeneron Pharmaceuticals Inc.

- Amgen Inc.

- Biogen

- Samsung Bioepis

Recent Developments

-

March 2025: Apellis Pharmaceuticals announced extended clinical trial results for its dry AMD drug Syfovre, showing consistent geographic atrophy slowing over 24 months.

-

February 2025: Roche/Genentech launched Vabysmo (faricimab) in European markets, following its FDA approval for wet AMD and diabetic macular edema. The drug is the first to target both VEGF and Ang-2 pathways.

-

January 2025: Regeneron Pharmaceuticals initiated Phase III trials for its high-dose Eylea (aflibercept 8mg), aimed at achieving dosing intervals up to four months.

-

November 2024: Outlook Therapeutics submitted a Biologics License Application (BLA) to the FDA for ONS-5010, a biosimilar version of bevacizumab for ophthalmic use.

-

September 2024: Kodiak Sciences presented Phase IIb data for KSI-301, a novel anti-VEGF therapy with potential for extended dosing intervals up to six months.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global age-related macular degeneration market.

Product

- Eylea

- Lucentis

- Beovu

- Others

Disease Type

Distribution Channel

- Hospital Pharmacy

- Specialty Pharmacy

- Online Pharmacy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)