Artificial Intelligence in Precision Medicine Market Size and Trends 2026 to 2035

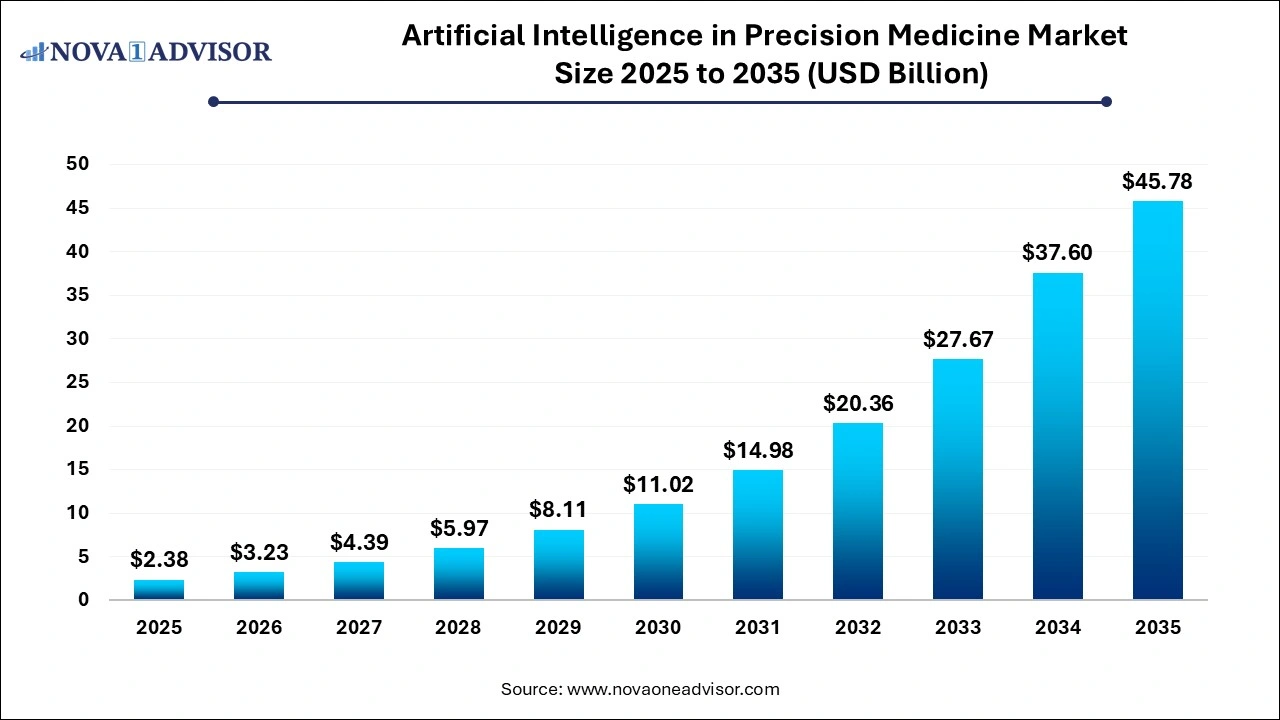

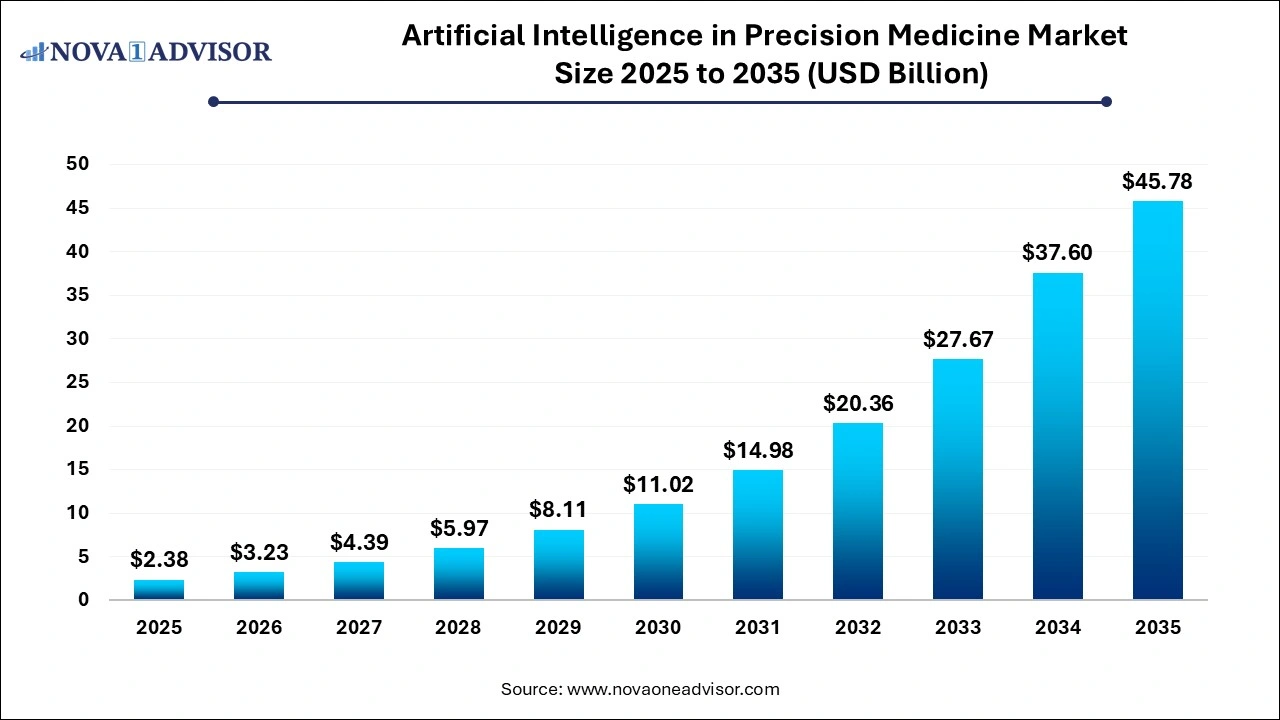

The artificial intelligence in precision medicine market size was exhibited at USD 2.38 billion in 2025 and is projected to hit around USD 45.78 billion by 2035, growing at a CAGR of 34.4% during the forecast period 2026 to 2035.

Artificial Intelligence in Precision Medicine Market Key Takeaways:

- The deep learning segment dominated the market with a share of 33.7% in 2025.

- The software segment held the largest share of 41.6% in 2025.

- Furthermore, the software segment is projected to grow at the fastest CAGR of 36.2% during the estimated period.

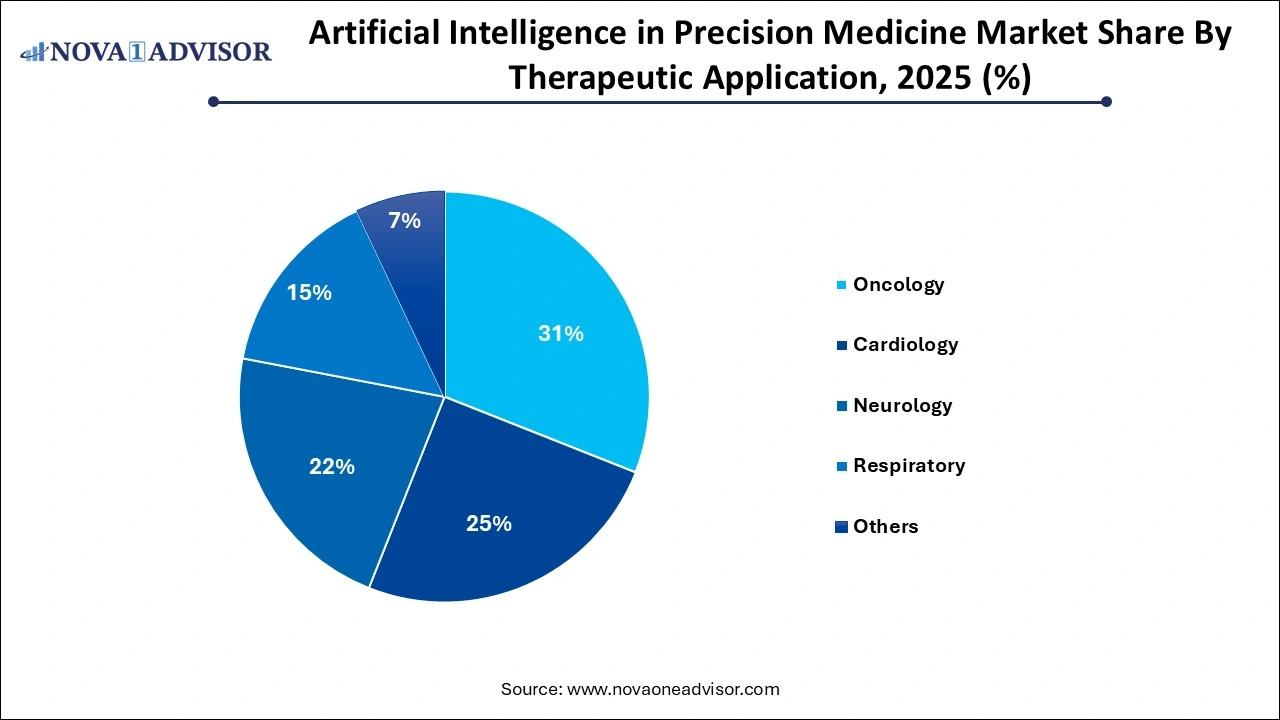

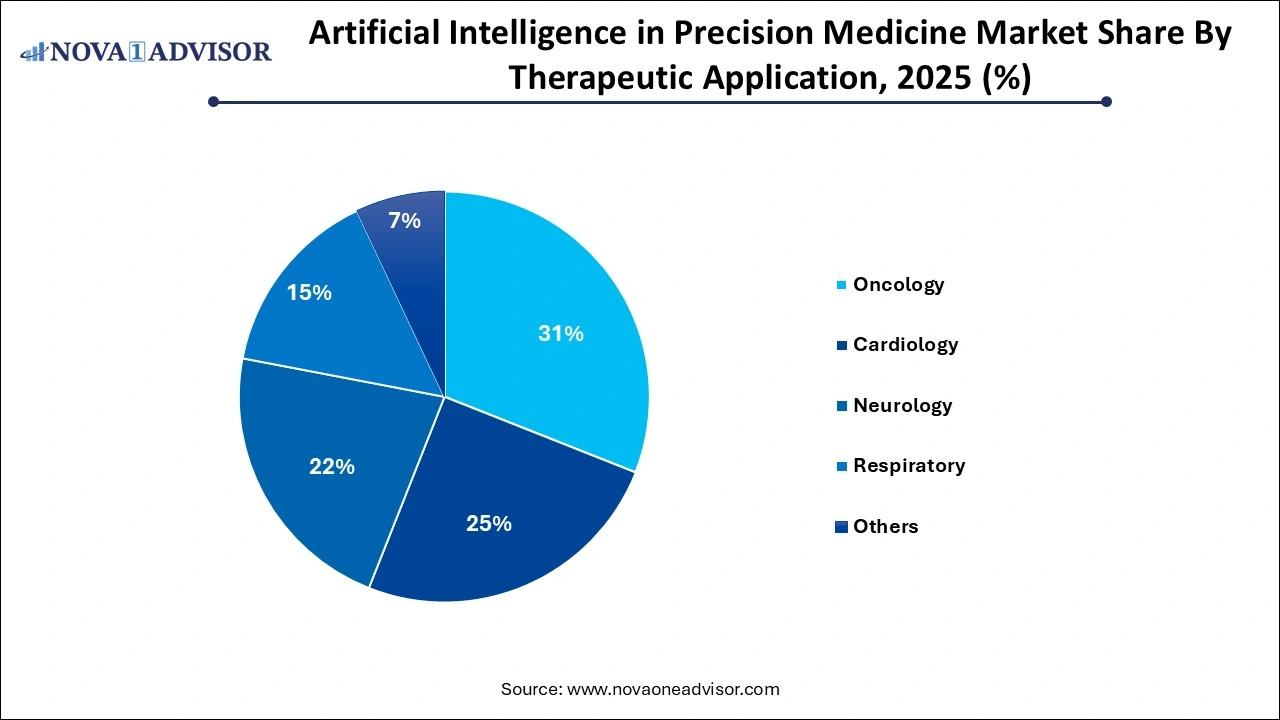

- Oncology emerged as the dominant segment and accounted for a revenue share of 31.0% in 2025.

- The neurology segment is anticipated to register the fastest CAGR of 36.8% over the forecast period.

- North America dominated the market with a revenue share of 29.6% in 2025.

- This is expected to drive the market growth in the country. Europe is anticipated to witness substantial growth at a CAGR of 36.3% over the forecast period.

Artificial Intelligence in Precision Medicine Market Overview

The artificial intelligence (AI) in precision medicine market represents a transformative convergence of advanced computing technologies with individualized healthcare. Precision medicine, which seeks to tailor medical treatment to individual characteristics such as genetics, environment, and lifestyle, is greatly empowered by AI's ability to rapidly process vast and complex datasets. The integration of machine learning, deep learning, natural language processing, and context-aware processing in biomedical and clinical workflows is redefining how diseases are diagnosed, treated, and prevented.

AI's role in precision medicine extends across the entire care continuum from predictive modeling and early diagnostics to personalized drug discovery and patient-specific therapeutic interventions. Real-world examples include AI tools that identify cancer subtypes using genomic profiles, predict cardiovascular risks through imaging biomarkers, and guide neurologists in designing optimized care plans for Alzheimer's patients based on multimodal data analysis.

The growing availability of electronic health records, wearable devices, genomic data, and biobanks has created a rich data ecosystem that AI can leverage for precision healthcare. Additionally, pharmaceutical companies are increasingly integrating AI to identify promising molecular targets and streamline clinical trial design. As the healthcare industry pivots towards more personalized and data-driven care models, AI's importance in precision medicine will continue to accelerate.

Major Trends in the Artificial Intelligence in Precision Medicine Market

-

Widespread adoption of deep learning algorithms in clinical diagnostics and image interpretation

-

Expansion of AI-assisted drug discovery platforms and genomics-guided trials

-

Integration of natural language processing (NLP) to extract actionable insights from unstructured clinical notes

-

Rise of context-aware systems in remote and continuous patient monitoring

-

Growth in AI-powered decision support tools for oncology, cardiology, and neurology

-

Strategic collaborations between tech giants and healthcare providers for AI-enabled precision initiatives

-

Use of digital twin and AI to simulate individual treatment responses

-

Increasing regulatory validation and FDA approvals of AI algorithms for medical applications

Report Scope of Artificial Intelligence in Precision Medicine Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.23 Billion |

| Market Size by 2035 |

USD 45.78 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 34.4% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology, Component, Therapeutic Application, and Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

BioXcel Therapeutics, Inc.; Sanofi S.A.; NVIDIA Corp.; Alphabet Inc. (Google Inc.); IBM; Microsoft; Intel Corporation; AstraZeneca plc; GE HealthCare; Enlitic, Inc. |

Artificial Intelligence In Precision Medicine Market Segmental Insights

By Technology Insights

Deep learning dominates the AI technology segment in precision medicine, particularly in fields like medical imaging, pathology, and genomic analysis. Its ability to process unstructured data such as images, histopathological slides, and genomic sequences with minimal human intervention has led to breakthroughs in cancer detection, radiogenomics, and digital pathology. Deep learning models trained on large datasets can identify subtle disease patterns and improve diagnostic accuracy, often outperforming traditional statistical models.

Natural Language Processing (NLP) is the fastest-growing technology, driven by the urgent need to extract actionable insights from unstructured clinical documents, such as radiology reports, progress notes, and discharge summaries. NLP enables AI systems to contextualize patient history, medication lists, and lifestyle factors for more holistic and personalized care planning. Hospitals and research institutions are increasingly deploying NLP-based engines to enrich electronic health records and guide clinical decision-making.

By Component Insights

Software solutions dominate the component segment, forming the backbone of AI-driven precision medicine platforms. These include predictive analytics tools, machine learning frameworks, AI-integrated EHR systems, and clinical decision support applications. Software-based AI models are easier to scale, update, and integrate into existing healthcare IT systems, making them the primary revenue-generating component in the market.

Services are the fastest-growing component, particularly in consulting, training, and platform customization. As healthcare organizations and pharmaceutical firms adopt AI solutions, demand is rising for expert services that ensure smooth implementation, regulatory compliance, and operational optimization. Services also include cloud infrastructure support, data annotation, algorithm validation, and AI model maintenance, all of which are crucial for sustainable AI adoption.

By Therapeutic Application Insights

Oncology dominates the therapeutic application segment, owing to the high complexity and heterogeneity of cancers. AI is widely used to stratify cancer subtypes, identify actionable mutations, and design precision drug regimens. Liquid biopsies combined with AI analytics are transforming early detection, while radiomics and pathology-based AI tools are enhancing diagnostic precision. Personalized cancer vaccines and immunotherapies are also benefiting from AI-guided design and outcome modeling.

Neurology is the fastest-growing application, particularly in the context of Alzheimer’s disease, Parkinson’s, and multiple sclerosis. AI enables longitudinal tracking of neurodegenerative changes, risk prediction through genetic markers, and optimized intervention planning. The integration of brain imaging, wearable biosensor data, and cognitive assessments into AI platforms is paving the way for earlier diagnosis and disease-modifying therapies.

Artificial Intelligence In Precision Medicine Market By Regional Insights

North America dominates the AI in precision medicine market, led by the United States. The region benefits from an advanced digital health ecosystem, strong funding in biomedical research, and favorable regulatory frameworks. Initiatives such as the NIH’s All of Us Research Program and the Cancer Moonshot have provided robust support for precision medicine adoption. Furthermore, the presence of global tech leaders like IBM, Google, and Microsoft has accelerated innovation in AI-driven health applications.

Asia-Pacific is the fastest-growing region, driven by rapid digital transformation in healthcare, growing investments in genomics, and increasing adoption of AI by hospitals and pharma companies. Countries like China, Japan, and South Korea are actively pursuing AI strategies in precision medicine, with initiatives such as China’s Precision Medicine Plan and India’s Genomics for Public Health program. The region’s diverse population also presents a valuable data source for global precision medicine research.

Some of the prominent players in the artificial intelligence in precision medicine market include:

- BioXcel Therapeutics, Inc.

- Sanofi S.A.

- NVIDIA Corp.

- Alphabet Inc. (Google Inc.)

- IBM

- Microsoft

- Intel Corp.

- AstraZeneca plc

- GE HealthCare

- Enlitic, Inc.

Recent Developments

-

In April 2025, Tempus announced a new partnership with Pfizer to use AI for clinical trial patient matching in oncology.

-

In February 2025, IBM Watson Health expanded its collaboration with Mayo Clinic to develop AI models for individualized cardiovascular care planning.

-

In January 2025, Google Health launched a new AI-powered genomic variant interpretation tool in partnership with leading academic hospitals.

-

In December 2024, Freenome raised $400 million in funding to scale its AI-driven multi-cancer early detection platform.

-

In October 2024, PathAI received FDA breakthrough designation for its digital pathology AI tool used in prostate cancer diagnosis.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the artificial intelligence in precision medicine market

Technology

- Deep Learning

- Querying Method

- Natural Language Processing

- Context-Aware Processing

Component

- Hardware

- Software

- Service

Therapeutic Application

- Oncology

- Cardiology

- Neurology

- Respiratory

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)