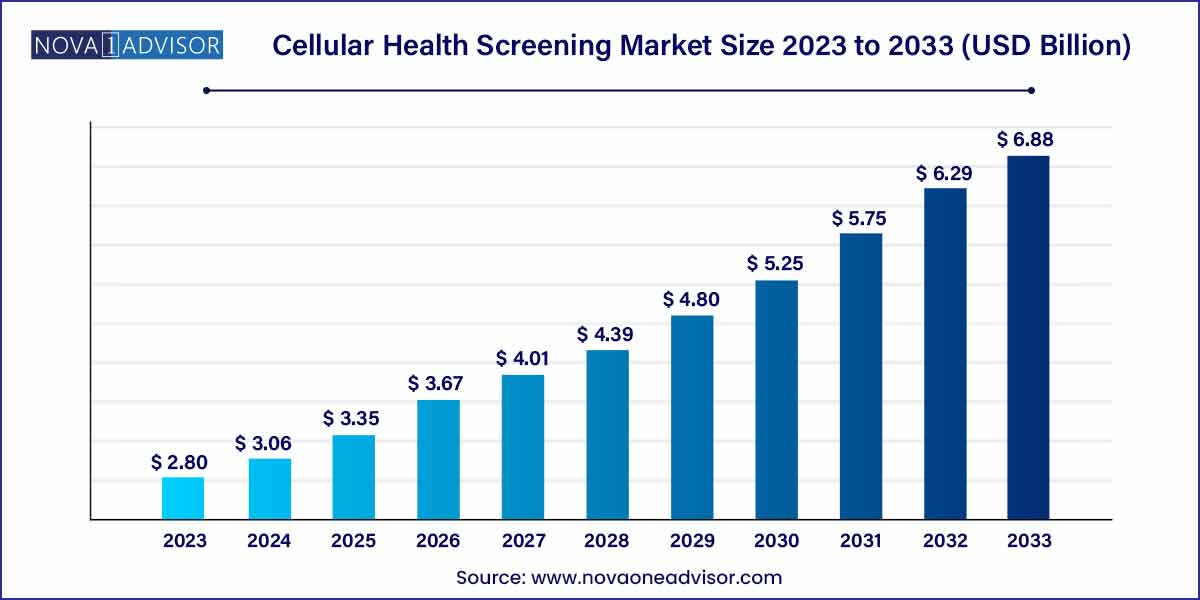

The global cellular health screening market size was exhibited at USD 2.80 billion in 2023 and is projected to hit around USD 6.88 billion by 2033, growing at a CAGR of 9.4% during the forecast period of 2024 to 2033.

Key Takeaways:

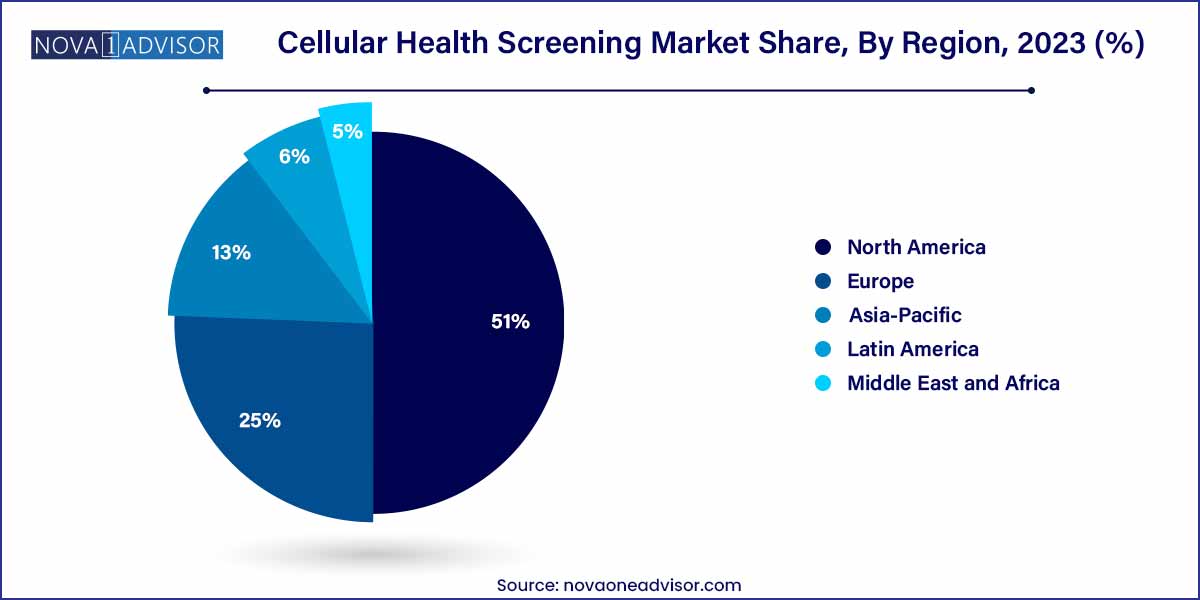

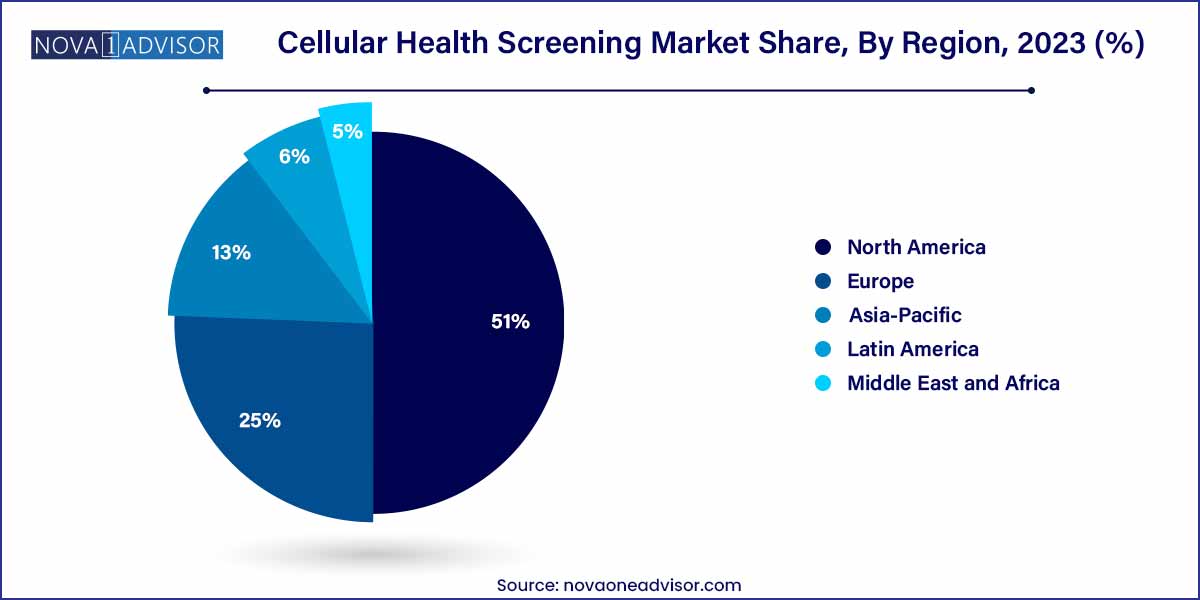

- North America accounted for the largest share (51.0%) of the cellular health screening market in 2023.

- The single test panel segment held the largest share of 79.08% in 2023.

- Blood samples dominated the market with a share of 47.41% in 2023.

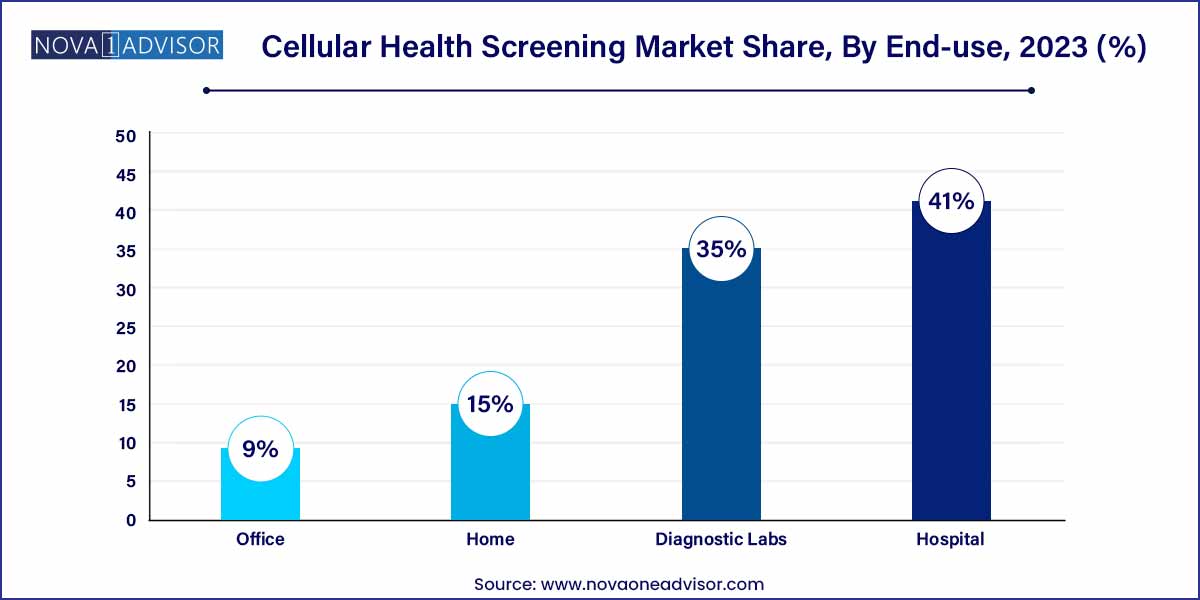

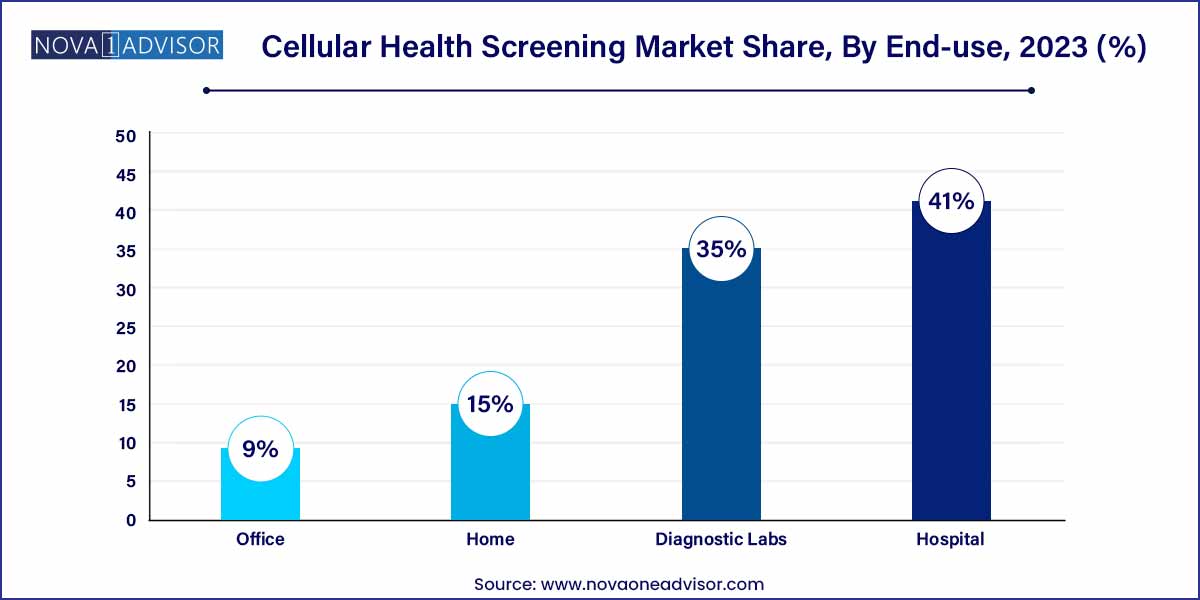

- In 2023, the hospital segment accounted for the largest revenue share at 41.0%.

Market Overview

The cellular health screening market represents an innovative and rapidly evolving area of preventive healthcare, which focuses on assessing the biological age, oxidative stress, inflammation levels, and exposure to environmental toxins at a cellular level. By measuring biomarkers such as telomere length, oxidative DNA damage, and heavy metal concentrations, cellular health tests provide insights into an individual's overall health status and potential risks for chronic diseases, including cardiovascular conditions, neurodegenerative disorders, and cancers.

With increasing awareness around personalized healthcare, wellness optimization, and early disease detection, the demand for cellular health screening is gaining traction among both medical practitioners and health-conscious consumers. Integrative medicine clinics, wellness centers, and specialized diagnostic laboratories are integrating cellular health tests into routine wellness checkups. Furthermore, technological advancements in biomarker analytics, miniaturized testing kits, and AI-enabled diagnostics are making these tests more accessible, accurate, and affordable.

The cellular health screening industry is also being propelled by the rising prevalence of lifestyle-related disorders, an aging population, and a growing interest in biohacking and longevity science. As more consumers seek holistic and preventative approaches to manage their health, cellular health screening is emerging as a cornerstone in the shift from reactive to proactive medicine.

Major Trends in the Market

-

Growing consumer demand for biohacking and longevity tools: Cellular health testing is becoming central to longevity enthusiasts and biohackers aiming to monitor biological age and cellular vitality.

-

Integration of AI and machine learning in test interpretation: AI tools are being used to analyze complex biomarker data and generate personalized wellness recommendations.

-

Rise in direct-to-consumer (D2C) test kits: Companies are offering at-home cellular health screening kits, making the process more convenient and private.

-

Shift toward multi-panel testing: Consumers prefer comprehensive panels that analyze multiple biomarkers in a single test session.

-

Strategic collaborations between biotech firms and wellness providers: Partnerships are expanding access to cellular tests across fitness centers, spas, and holistic wellness centers.

-

Expansion in corporate wellness programs: Employers are including cellular health screening as part of employee health benefits to promote longevity and productivity.

-

Increased usage in sports science and elite athlete monitoring: Cellular tests are being used to track recovery, oxidative stress, and inflammation in high-performance athletes.

-

Focus on biomarker discovery and validation: R&D investments are being funneled into discovering novel biomarkers for cellular health, enhancing diagnostic accuracy.

Cellular Health Screening Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.80 Billion |

| Market Size by 2033 |

USD 6.88 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Test Type, Sample Type, Collection Site, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Life Length, SpectraCell Laboratories, Inc., RepeatDx, Cell Science Systems, Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, OPKO Health, Inc., Genova Diagnostics (GDX), Immundiagnostik AG, DNA Labs India. |

Key Market Driver: Emphasis on Preventive Healthcare

The most influential driver of the cellular health screening market is the growing global emphasis on preventive healthcare and early detection. As chronic diseases continue to dominate global morbidity and mortality statistics, governments, health systems, and individuals are increasingly shifting focus toward early intervention strategies. Cellular health screening fits seamlessly into this model, enabling healthcare providers to detect imbalances and cellular damage before they manifest as symptomatic illnesses.

Preventive screenings, such as telomere testing or oxidative stress assessment, offer the ability to tailor lifestyle changes, nutritional interventions, and treatment plans specific to an individual’s cellular profile. For instance, identifying shortened telomeres can prompt early lifestyle interventions like improved diet, stress management, and exercise regimens. This proactive approach not only improves health outcomes but also reduces long-term healthcare costs, which is a strong incentive for payers and policymakers to support adoption.

Key Market Restraint: Limited Regulatory Standardization

One of the most notable challenges restraining the growth of the market is the lack of regulatory standardization and clinical validation. Despite the promise of cellular health screening, many of the biomarkers used in testing such as telomere length or oxidative stress markers still face scrutiny regarding their clinical relevance, reliability, and predictive power.

The absence of universally accepted testing protocols and quality control standards has resulted in variable results across different labs and test providers. This inconsistency can undermine physician and consumer confidence in the accuracy and utility of the tests. Furthermore, regulatory bodies in many regions have yet to establish clear guidelines for cellular health diagnostics, making market entry and reimbursement challenging for new players.

Key Market Opportunity: Growth in Personalized Wellness and Functional Medicine

A significant opportunity in the market lies in the intersection of cellular health screening with personalized wellness and functional medicine. These models of care emphasize a whole-body approach to health that is informed by individual biochemistry and lifestyle patterns. Cellular health testing provides a data-rich foundation for this approach, offering actionable insights into metabolic, inflammatory, and detoxification pathways.

As more consumers seek tailored nutrition plans, supplements, and fitness programs, cellular biomarker data offers a unique value proposition. For instance, athletes can use inflammation tests to adjust training loads, while wellness clients can monitor improvements in biological aging metrics after adopting new routines. Clinics practicing integrative and functional medicine are especially poised to adopt cellular screening as a cornerstone of personalized treatment planning.

By Test Type Insights

Multi-test panels dominate the cellular health screening market, as they offer a holistic overview of an individual’s cellular environment by assessing multiple biomarkers simultaneously. These panels typically include telomere length, oxidative stress, inflammation, and heavy metal exposure—providing a comprehensive picture of cellular vitality and risks. Multi-panel testing is particularly favored by healthcare practitioners aiming for systemic wellness assessments and by patients seeking thorough biohealth profiling in a single collection event.

Conversely, oxidative stress tests are among the fastest-growing individual test segments, given their relevance in chronic disease risk profiling and performance monitoring. These tests are widely adopted in anti-aging clinics, athletic performance labs, and wellness centers. With increased understanding of oxidative damage’s role in neurodegenerative and cardiovascular diseases, consumers and clinicians alike are turning to oxidative stress testing as an essential tool for early detection and intervention.

By Sample Type Insights

Blood samples are the dominant sample type in cellular health screening, owing to their ability to provide high-fidelity biomarker readings across multiple test types. Blood-based assays for telomeres, inflammatory cytokines, and heavy metal levels offer robust, clinically actionable data. These samples are routinely collected in clinical settings and offer a gold standard for many advanced diagnostics.

At the same time, saliva-based sampling is growing rapidly, especially in the D2C market. Saliva collection is non-invasive, simple, and ideal for home-based test kits. Recent advancements in saliva-based diagnostics have enabled accurate testing of hormone levels, oxidative stress markers, and even certain epigenetic signatures, making this sample type increasingly attractive for users seeking convenience without compromising accuracy.

By Collection Site Insights

Hospitals and diagnostic labs are currently the largest contributors to the collection site segment, largely due to their established infrastructure, access to trained phlebotomists, and ability to handle complex testing protocols. These institutions are often the first to adopt cellular health testing as part of extended diagnostic packages or wellness screening panels, especially in urban centers and premium care facilities.

On the other hand, home-based sample collection is the fastest growing segment, driven by the increasing demand for convenience, privacy, and accessibility. With the rise of mail-in test kits and telehealth integration, consumers can now collect samples at home and receive results digitally. This trend has been amplified by the COVID-19 pandemic, which encouraged remote testing and decentralized diagnostics across the board.

By Regional Insights

North America dominates the global cellular health screening market, led by the United States. This leadership stems from high consumer awareness of preventative health, advanced diagnostic infrastructure, and the presence of leading test providers. The U.S. also has a strong base of functional medicine practitioners and wellness clinics that actively incorporate cellular screening into their service offerings. Regulatory flexibility in the D2C testing space further supports innovation and rapid market penetration.

Asia-Pacific, however, is emerging as the fastest-growing region, fueled by growing disposable income, digital health adoption, and a rising interest in anti-aging and longevity. Countries like Japan, South Korea, and China are witnessing a surge in wellness tourism and health optimization services, with cellular diagnostics playing a central role. Government initiatives to promote preventive care and a booming personalized nutrition sector are also contributing to regional growth.

Some of the prominent players in the cellular health screening market include:

- Life Length

- SpectraCell Laboratories, Inc.

- RepeatDx

- Cell Science Systems

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- OPKO Health, Inc.

- Genova Diagnostics (GDX)

- Immundiagnostik AG

- DNA Labs India

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cellular health screening market.

Test Type

-

- Telomere Tests

- Oxidative Stress Tests

- Inflammation Tests

- Heavy Metals Tests

Sample Type

Collection Site

- Home

- Office

- Hospital

- Diagnostic Labs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)