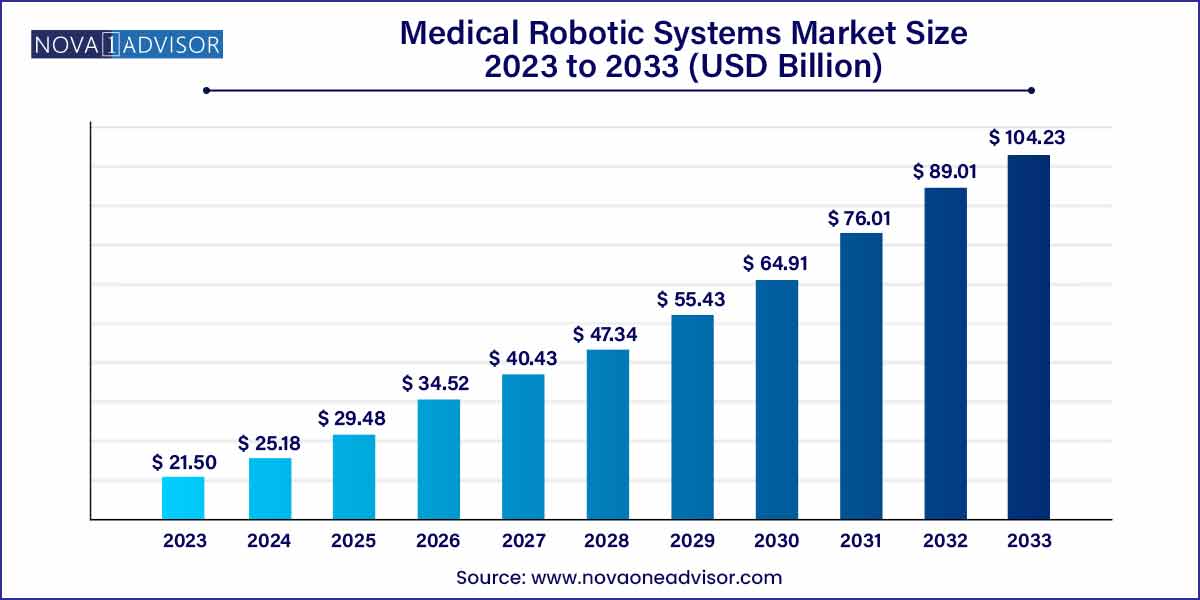

The global medical robotic systems market size was exhibited at USD 21.50 billion in 2023 and is projected to hit around USD 104.23 billion by 2033, growing at a CAGR of 17.1% during the forecast period of 2024 to 2033.

Key Takeaways:

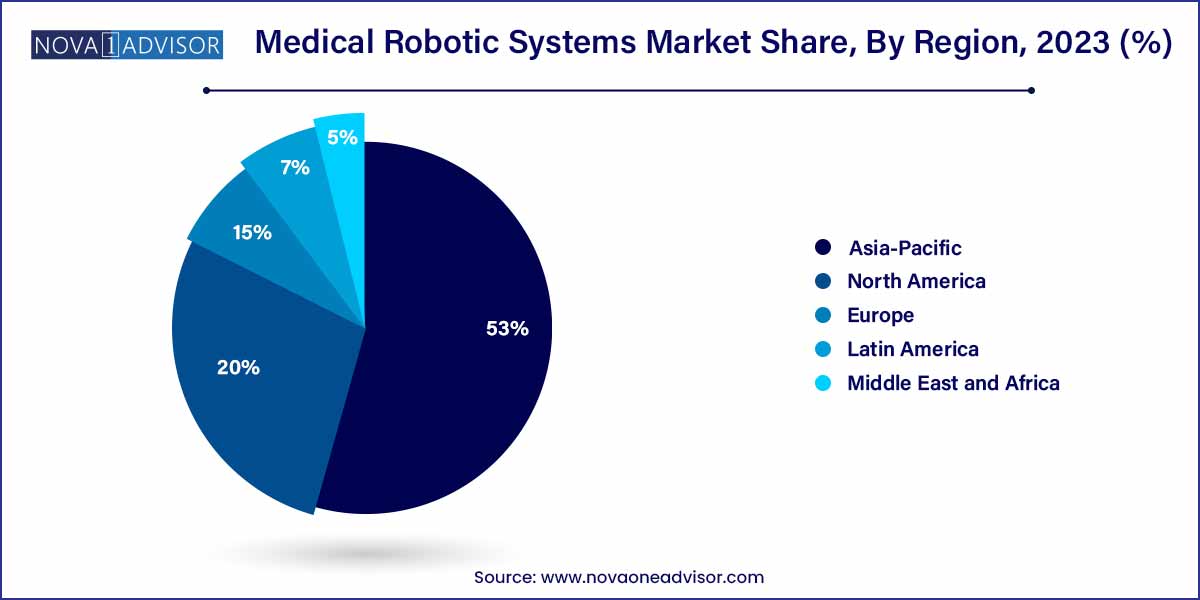

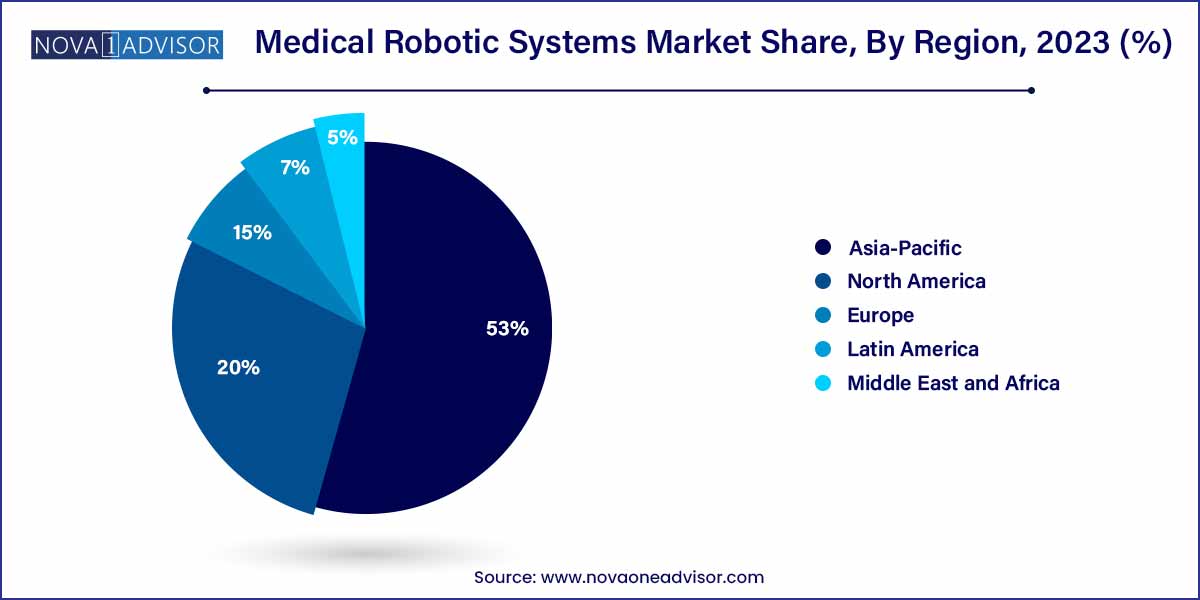

- Asia Pacific held the largest revenue share of over 53.0% in 2023.

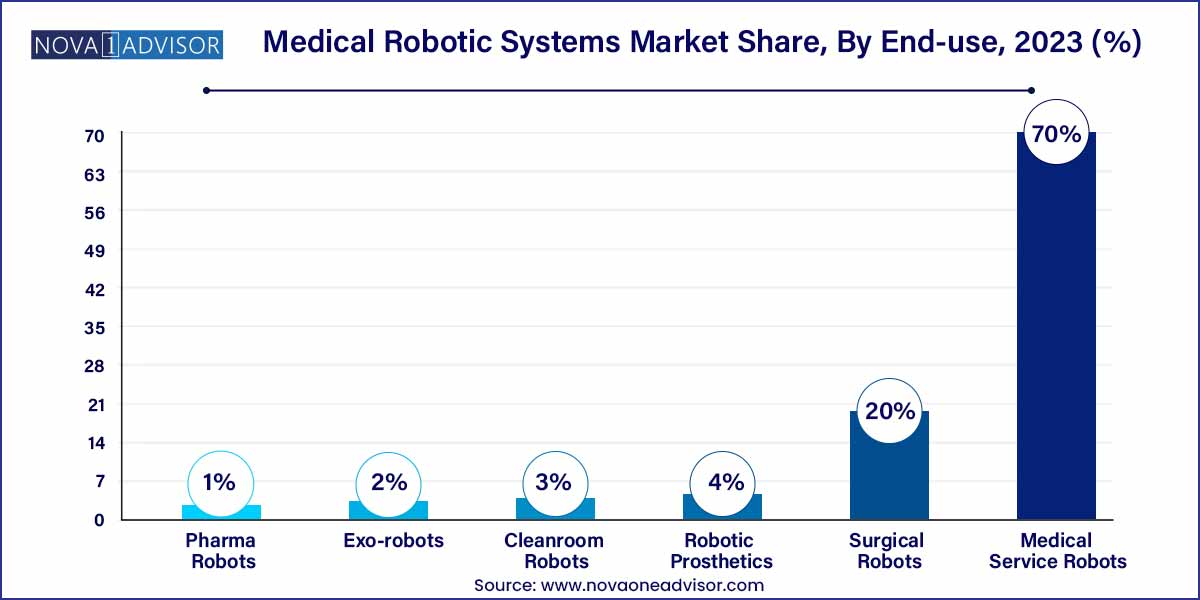

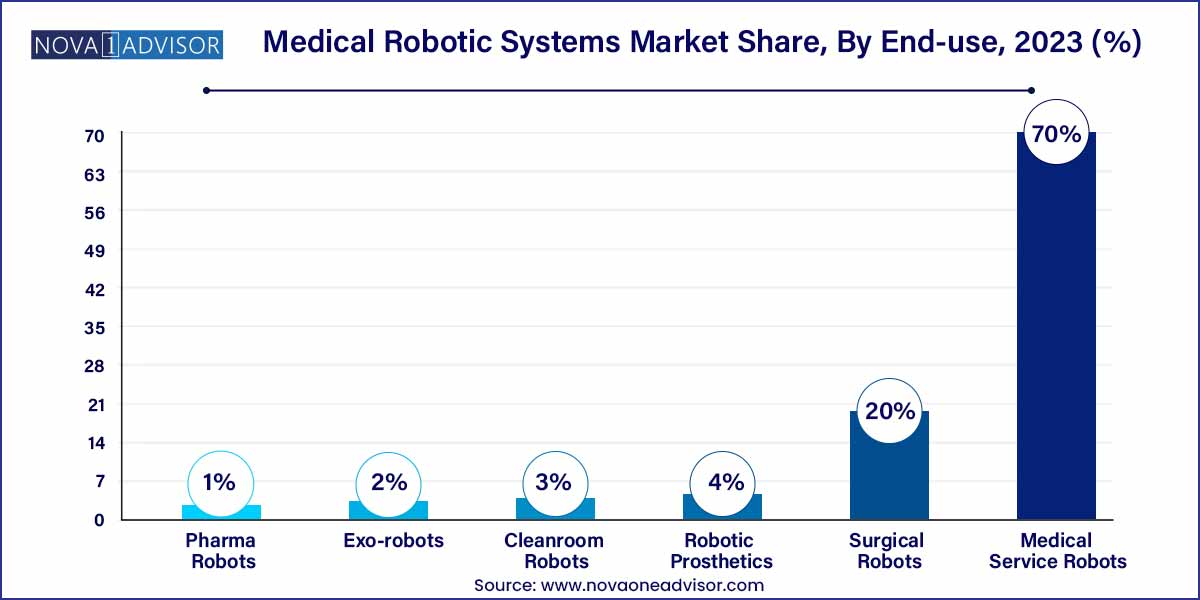

- The medical service robots segment dominated the market for medical robotic systems and accounted for a revenue share of over 70.0% in 2023.

Market Overview

The Medical Robotic Systems Market is transforming healthcare delivery by revolutionizing surgical precision, rehabilitation therapy, patient care, and pharmaceutical manufacturing. These robotic technologies extend beyond traditional surgical applications and now encompass service robots, prosthetics, exoskeletons, and cleanroom robots for pharmaceutical logistics. With the convergence of artificial intelligence (AI), sensor technology, machine learning, and cloud computing, the sector has entered a new era of intelligent, data-driven, and minimally invasive solutions.

The market has gained prominence due to its potential to overcome several human limitations in clinical and surgical practice. Robotic systems ensure greater accuracy, minimal invasiveness, reduced recovery times, and enhanced safety, making them ideal for complex procedures in orthopedics, neurology, urology, and gynecology. Additionally, robots in rehabilitation and prosthetics significantly improve patient outcomes by mimicking natural movement and adjusting in real-time to muscular or neurological changes.

The COVID-19 pandemic further accelerated the deployment of medical robots, particularly in settings like disinfection, remote patient interaction, and drug dispensing in infectious disease zones. Cleanroom robots gained popularity for automating tasks in vaccine manufacturing environments requiring sterile conditions. Similarly, collaborative robots (cobots) have been employed in labs and pharmacies to reduce human contact, improving efficiency and safety.

As the global healthcare landscape faces growing demand, staff shortages, and pressure to improve clinical outcomes, robotic automation has emerged as a strategic enabler. Governments, hospitals, and venture capitalists are making significant investments in robotic technologies, driving innovation and adoption across healthcare ecosystems.

Major Trends in the Market

-

Surge in minimally invasive robotic-assisted surgeries, particularly in urology, gynecology, and orthopedics.

-

Rise of collaborative robots (cobots) in pharmaceutical production and cleanroom environments to improve efficiency and reduce contamination risks.

-

Integration of AI, computer vision, and deep learning to enhance robot autonomy and clinical decision-making support.

-

Increased deployment of exoskeleton robots for neurorehabilitation and post-stroke therapy in rehabilitation centers.

-

Growing role of robotic prosthetics with myoelectric control systems, mimicking natural limb functions with higher precision.

-

Expansion of service robots in hospitals, including delivery robots, cleaning robots, and patient monitoring units.

-

Miniaturization of surgical robots to enable broader use in outpatient settings and ambulatory surgery centers.

-

Public-private partnerships to deploy robotic systems in underserved and rural healthcare systems for telepresence and surgical assistance.

Medical Robotic Systems Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 21.50 Billion |

| Market Size by 2033 |

USD 104.23 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, End-user And Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

iRobot Corporation; Medrobotics Corporation; Titan Medical Inc.; Hansen; Renishaw Plc; Intuitive Surgical; Health Robotics SLR; OR Productivity plc; Mazor Robotics; Accuray; Mako Surgical Corp.; Varian Medical Systems; Stereotaxis Inc., Medtronic, Stryker, Zimmer Biomet, Smith & Nephew. |

Medical robotic systems market Dynamics

The dynamics of the medical robotic systems market are shaped by various factors driving its growth and influencing its trajectory. One significant dynamic is the continuous advancements in robotic technologies, particularly in areas such as artificial intelligence (AI), machine learning, and 3D imaging. These technological innovations are revolutionizing the capabilities of medical robots, enabling more precise and efficient procedures across a wide range of medical specialties. As a result, healthcare providers are increasingly adopting robotic-assisted surgeries to improve patient outcomes, enhance surgical precision, and reduce the risks of complications.

Another key dynamic driving the medical robotic systems market is the increasing demand for minimally invasive surgeries. With growing awareness among patients and healthcare professionals about the benefits of minimally invasive procedures, such as reduced pain, shorter hospital stays, and faster recovery times, the demand for robotic-assisted surgeries is on the rise. Robotic systems offer greater dexterity and precision than traditional surgical methods, making them particularly well-suited for complex and delicate procedures. As a result, the market is witnessing a surge in the adoption of robotic-assisted surgeries across various medical specialties, further fueling its growth and expansion.

Medical robotic systems market Restraint

One significant restraint in the medical robotic systems market is the high cost associated with acquiring and implementing robotic systems. The initial investment required for purchasing robotic platforms, along with the ongoing maintenance and training costs, can be substantial, limiting the accessibility of these technologies to certain healthcare facilities and patients. Additionally, the high cost of robotic-assisted surgeries can pose financial challenges for both patients and healthcare providers, particularly in regions with limited healthcare resources and reimbursement policies. As a result, the affordability and cost-effectiveness of robotic systems remain a significant restraint in the widespread adoption of these technologies.

Another restraint impacting the medical robotic systems market is the regulatory hurdles and compliance requirements governing the development, approval, and deployment of medical robots. Regulatory agencies impose stringent standards and guidelines to ensure the safety, efficacy, and reliability of robotic-assisted procedures, which can significantly delay the market entry of new robotic platforms and technologies. Moreover, navigating the complex regulatory landscape requires significant investments in regulatory affairs and compliance, further adding to the time and cost involved in bringing robotic systems to market.

Medical robotic systems market Opportunity

One significant opportunity in the medical robotic systems market is the expansion of robotic applications beyond surgery into areas such as rehabilitation, diagnostics, and telemedicine. With continuous advancements in robotic technologies, there is growing potential to leverage robots for tasks such as physical therapy, patient monitoring, and remote consultations. By integrating robotic systems with digital health platforms and wearable devices, healthcare providers can enhance patient care, improve treatment outcomes, and enable greater accessibility to healthcare services, particularly in remote or underserved regions. This expansion of robotic applications presents new growth opportunities for manufacturers and providers in the medical robotic systems market.

Another notable opportunity in the medical robotic systems market is the development of cost-effective robotic solutions tailored to the needs of emerging markets and resource-constrained settings. While high costs have traditionally been a barrier to the adoption of robotic technologies, advancements in manufacturing processes, materials, and components are driving down the cost of robotic systems. By developing affordable and scalable robotic solutions, manufacturers can address the needs of healthcare facilities in emerging markets, where there is a growing demand for advanced medical technologies but limited financial resources.

Medical robotic systems market Challenges

One of the prominent challenges in the medical robotic systems market is the high cost associated with acquiring and implementing robotic technologies. The substantial initial investment required for purchasing robotic platforms, along with ongoing maintenance and training costs, can pose significant financial barriers for healthcare facilities and patients. Moreover, the cost of robotic-assisted surgeries can be prohibitive, limiting access to these advanced procedures for certain patient populations. Addressing the affordability of robotic systems remains a critical challenge in expanding their adoption and ensuring equitable access to advanced medical technologies.

Another significant challenge in the medical robotic systems market is the regulatory hurdles and compliance requirements governing the development, approval, and deployment of robotic technologies. Regulatory agencies impose stringent standards and guidelines to ensure the safety, efficacy, and reliability of robotic-assisted procedures, which can significantly impact the time and cost involved in bringing new robotic platforms to market. Moreover, navigating the complex regulatory landscape requires substantial investments in regulatory affairs and compliance, posing barriers to innovation and market entry for manufacturers.

Segments Insights:

Type Insights

Surgical robots dominated the market, primarily due to their extensive use in minimally invasive surgeries across a range of specialties. These systems offer greater dexterity, visualization, and control compared to conventional laparoscopic methods. Within surgical robots, orthopedics has gained substantial traction, with systems like Stryker’s Mako transforming joint replacement surgeries by enabling pre-surgical planning and real-time haptic feedback. In gynecology and urology, robotic platforms are widely used for hysterectomies and prostatectomies, respectively, given the anatomical precision required.

Exo-robots are the fastest-growing segment, reflecting their increasing deployment in rehabilitation centers for patients recovering from strokes, spinal cord injuries, or neurodegenerative diseases. These wearable devices support body-weight and limb movements, helping patients regain mobility and muscular strength. The full-body exo-robot subsegment is gaining popularity for military and spinal trauma recovery applications. For example, ReWalk Robotics and Ekso Bionics have developed FDA-approved devices for lower limb assistance that are seeing adoption in both clinical and home-use settings..

Regional Insights

North America dominates the global medical robotic systems market, supported by advanced healthcare infrastructure, significant R&D investment, favorable reimbursement policies, and early technology adoption. The U.S. is home to several pioneering companies like Intuitive Surgical, Stryker, Medtronic, and Zimmer Biomet, which continue to innovate and commercialize robotic systems. Hospitals across the U.S. have widely adopted robotic surgery and automation in logistics and pharmacy services. Furthermore, the FDA’s proactive regulatory support for robotic devices encourages innovation and clinical adoption.

Asia-Pacific is the fastest-growing region, fueled by a rising patient population, growing middle-class demand for advanced healthcare, and increasing government investment in healthcare technology. Countries like China, Japan, South Korea, and India are witnessing strong growth in robotic surgeries, cleanroom robots for pharmaceutical production, and rehabilitation robotics. For instance, Japan’s aging demographic is driving the deployment of robotic caregivers and mobility aids, while China’s national AI strategies are supporting robotic innovation in healthcare. Local companies are also entering the market with cost-effective robotic systems tailored for regional needs.

Some of the prominent players in the medical robotic systems market include:

- iRobot Corporation

- Medrobotics Corporation

- Titan Medical Inc.

- Renishaw Plc

- Health Robotics SLR

- OR Productivity plc

- Intuitive Surgical

- Mako Surgical Corp.

- Varian Medical Systems

- Stereotaxis Inc.

- Mazor Robotics

- Medtronic

- Stryker

- Zimmer Biomet

- Smith & Nephew

Recent Developments

-

In March 2025, Intuitive Surgical announced the launch of its next-generation da Vinci SP system, aimed at expanding single-port robotic surgery applications across thoracic and ENT procedures. The system includes enhanced wrist articulation and AI-assisted visualization.

-

In January 2025, Stryker Corporation revealed clinical trial results showing improved outcomes in total hip replacements using its Mako SmartRobotics platform, encouraging broader adoption across orthopedic networks in the U.S. and Europe.

-

In November 2024, Ekso Bionics received FDA clearance for its EksoNR neurorehabilitation exoskeleton, enabling wider use in post-stroke therapy and spinal cord rehabilitation in outpatient facilities.

-

In October 2024, Medtronic introduced a new version of its Hugo™ robotic-assisted surgery system in India and Brazil, marking its aggressive expansion into emerging markets with cost-sensitive solutions.

-

In September 2024, ABB Robotics launched collaborative cleanroom robots compliant with ISO 5 standards for vaccine manufacturing, targeting pharmaceutical companies in Asia and Europe.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical robotic systems market.

Type

-

- Surgical Robots, By Application

-

-

- Orthopedics

- Neurology

- Urology

- Gynecology

- Others

-

- Exo-robots, By Extremities

-

-

- Upper Body

- Lower Body

- Full Body

-

- Traditional Robots

- Collaborative Robots

-

- Traditional Robots

- Collaborative Robots

- Robotic Prosthetics

- MPC Prosthetics

- Myoelectrical Prosthetics

- Medical Service Robots

End User

- Hospitals

- Ambulatory Surgery Centers

- Rehabilitation Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)