NGS-based RNA-sequencing Market Size and Trends

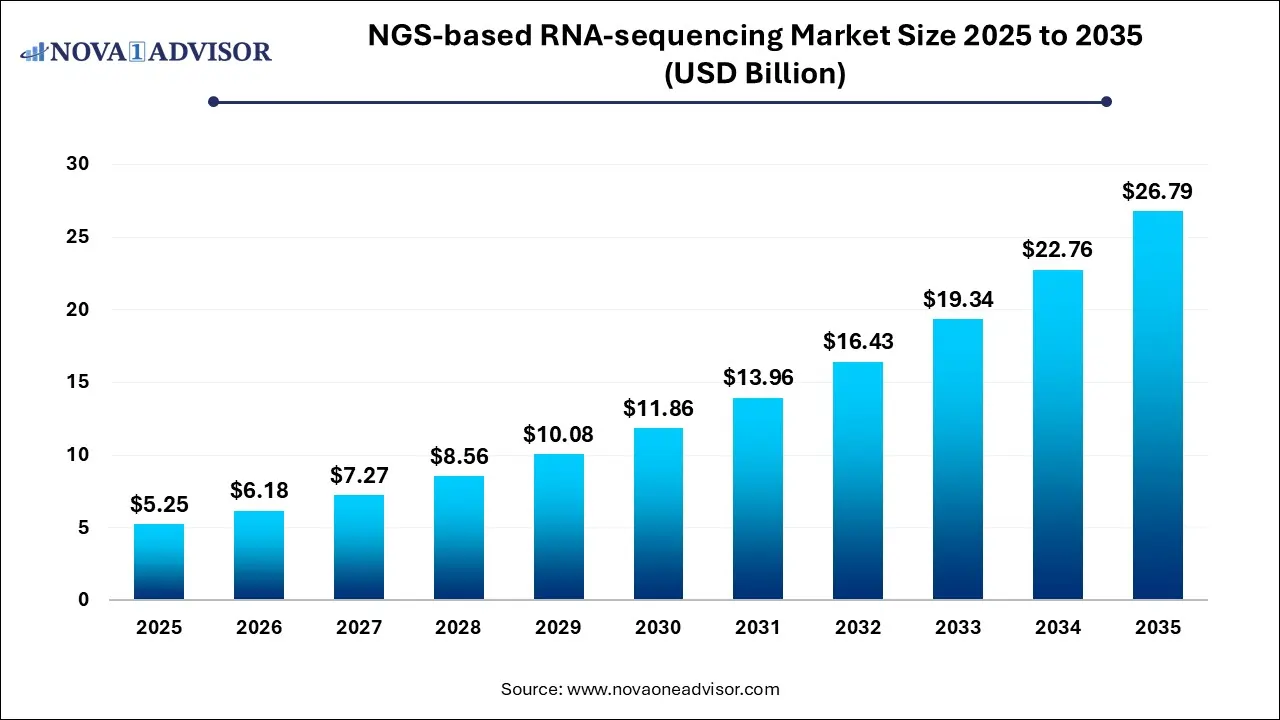

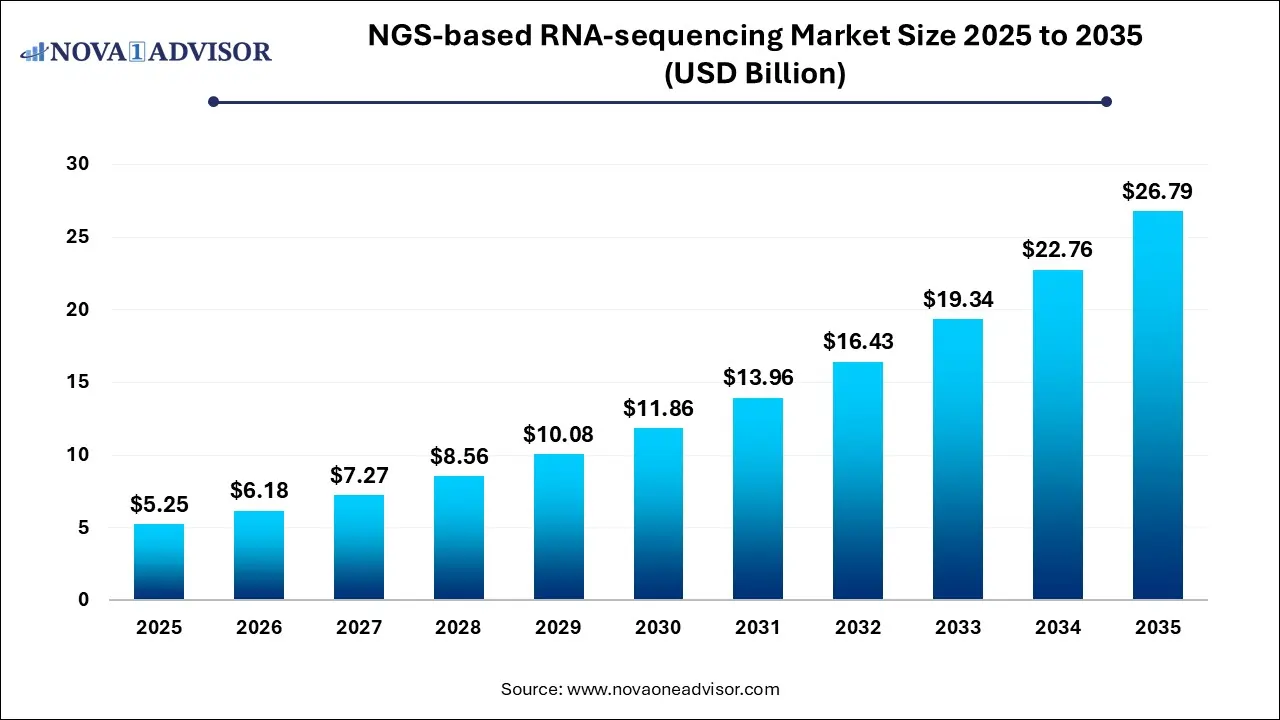

The NGS-based RNA-sequencing market size was exhibited at USD 5.25 billion in 2025 and is projected to hit around USD 26.79 billion by 2035, growing at a CAGR of 17.7% during the forecast period 2026 to 2035.

Key Takeaways:

- The consumables segment dominated the market with a revenue share of 59% in 2025.

- In 2025, the sequencing segment dominated the industry share.

- In 2025, drug discovery and development dominated the NGS-based RNA-sequencing market with a revenue share of 62%.

- In 2025, pharmaceutical & biotechnology companies held the largest market share of 38%.

- North America led the NGS-based RNA-sequencing industry with a revenue share of 49% in 2025

Market Overview

Next-generation sequencing (NGS)-based RNA sequencing (RNA-seq) has revolutionized transcriptomic research by enabling researchers to analyze the entire transcriptome with unparalleled accuracy and depth. This powerful technology goes beyond gene expression measurement, offering insights into transcript structure, alternative splicing, gene fusions, mutations, and non-coding RNA species. The ability to quantify both known and novel transcripts in a high-throughput manner has made NGS-based RNA-seq a cornerstone in biomedical research, drug development, disease diagnostics, and precision medicine.

The market for NGS-based RNA-sequencing has witnessed robust growth over the last decade, driven by technological advancements, increasing research funding, and the growing application of transcriptomics in oncology, infectious disease research, and personalized medicine. Additionally, the COVID-19 pandemic highlighted the utility of RNA-sequencing in virology and vaccine development, spurring demand across academic, clinical, and industrial settings.

The integration of bioinformatics tools has further enhanced the analytical capabilities of RNA-seq platforms, making data interpretation faster and more accessible. Major biotechnology firms, research institutions, and clinical laboratories are increasingly adopting this technology to unravel complex biological mechanisms. As the costs associated with sequencing continue to decline, the market is anticipated to expand further, both in mature markets like North America and emerging regions such as Asia Pacific.

Major Trends in the Market

-

Rise of Single-Cell RNA-Sequencing (scRNA-seq): The market is witnessing a surge in demand for single-cell RNA sequencing techniques, which allow transcriptomic analysis at the individual cell level, revealing cellular heterogeneity critical in cancer and immunology research.

-

Integration with AI and Machine Learning: NGS data is increasingly being paired with AI-driven tools for faster, more precise data analysis, aiding in biomarker discovery and patient stratification.

-

Growing Use in Clinical Diagnostics: RNA-seq is transitioning from research labs to clinical settings, especially for oncology and rare disease diagnostics.

-

Development of Cloud-Based Bioinformatics Platforms: Cloud infrastructure is enabling the storage, sharing, and interpretation of large RNA-seq datasets, improving collaboration across labs and institutions.

-

Expansion in Companion Diagnostics: Pharma companies are utilizing RNA-seq in the development of companion diagnostics to predict patient responses to targeted therapies.

-

Customized Library Prep Kits: Companies are launching highly specific, customizable library preparation kits that streamline workflows and enhance accuracy.

-

Emergence of Portable Sequencing Devices: Miniaturized RNA-seq instruments like Oxford Nanopore’s MinION are making field-based sequencing viable.

Report Scope of NGS-based RNA-sequencing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 6.18 Billion |

| Market Size by 2035 |

USD 26.79 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 17.7% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product & Service, Workflow, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Illumina, Inc.; Thermo Fisher Scientific Inc.; Merck KGaA; QIAGEN N.V.; Pacific Biosciences of California, Inc.; Oxford Nanopore Technologies Ltd.; Agilent Technologies, Inc.; BGI Group; Roche Holding AG; Revvity, Inc. |

Key Market Driver: Rising Demand for Personalized Medicine

The shift towards personalized medicine is a major driver of the NGS-based RNA-sequencing market. Personalized medicine involves tailoring medical treatment based on individual genetic profiles, lifestyle, and environmental factors. RNA-sequencing plays a pivotal role by offering detailed insights into gene expression patterns, which helps identify biomarkers and stratify patients for targeted therapies. For instance, in oncology, RNA-seq can detect specific gene fusions, aberrant transcripts, and expression profiles indicative of tumor subtypes. This precision enables clinicians to prescribe more effective and less toxic treatments. Governments and healthcare providers are increasingly investing in personalized medicine initiatives, which is expected to propel the adoption of RNA-seq across diagnostic labs and research centers globally.

Key Market Restraint: High Cost of Equipment and Data Analysis

Despite declining sequencing costs, the initial setup cost of high-throughput NGS platforms, along with associated consumables, reagents, and software, remains substantial. Instruments like Illumina's NovaSeq or Thermo Fisher’s Ion Proton require significant capital investment. Moreover, RNA-seq generates large datasets, necessitating high-performance computing infrastructure and skilled bioinformaticians to analyze the results. In many low- and middle-income countries, the lack of access to funding, technical expertise, and data interpretation tools limits the adoption of RNA-seq technologies. These cost-related barriers hinder widespread implementation, particularly in clinical settings and small academic institutions.

Key Market Opportunity: Expansion into Emerging Markets

Emerging economies in Asia Pacific and Latin America represent significant growth opportunities for the NGS-based RNA-sequencing market. Increasing government funding for genomics, growing awareness about precision medicine, and the rise of biotech startups are contributing to heightened interest in RNA-seq applications. Countries like China and India are investing in genomics initiatives such as the "Genome India Project" and expanding their healthcare infrastructure. Additionally, collaborations between local firms and global technology providers are bringing advanced sequencing platforms to these regions. Expanding into these markets not only opens new revenue streams but also diversifies patient genomic databases, enhancing the global applicability of RNA-seq insights.

Segmental Analysis

By Product & Service Outlook

Consumables dominated the product & service segment in terms of revenue share, and this trend is expected to continue throughout the forecast period. The recurrent nature of consumable usage—including library preparation kits, sequencing reagents, and purification kits drives consistent demand. In particular, sequencing reagents and flow cells are indispensable components that are consumed in every run, leading to high volume sales. The launch of proprietary kits with improved sensitivity and speed, such as Illumina’s TruSeq RNA Library Prep Kit, has enhanced market competitiveness. Furthermore, as the complexity of transcriptomic studies increases, so does the requirement for specialized, high-fidelity consumables that support diverse applications including low-input RNA samples, FFPE tissues, and non-coding RNA profiling.

The services segment is the fastest-growing, particularly RNA-sequencing and bioinformatics services. Many research institutions and biotech companies outsource their sequencing needs due to limited in-house capacity or lack of bioinformatics expertise. RNA-seq service providers offer end-to-end solutions, including sample preparation, sequencing, and data interpretation. This model is particularly attractive for pharmaceutical companies involved in clinical trials, as it reduces capital expenses and turnaround time. Additionally, the growth in cloud-based analytical platforms has made outsourcing even more viable, allowing researchers to access and interpret complex data remotely.

By Workflow Outlook

Sequencing led the workflow segment, attributed to its central role in the RNA-seq pipeline. With advancements in high-throughput technologies, sequencing processes have become faster and more accurate, thereby contributing significantly to market revenue. Companies continue to optimize sequencing chemistry, read lengths, and throughput to accommodate a broad range of applications from whole-transcriptome analysis to targeted sequencing. Notably, platforms like Illumina's NovaSeq 6000 offer scalability and cost efficiency, making them preferred choices for large-scale transcriptomic studies.

Data analysis is emerging as the fastest-growing workflow segment, reflecting the escalating volume of transcriptomic data and the need for advanced interpretation tools. The complexity of RNA-seq data including splicing variants, differential expression, and isoform detection necessitates robust computational resources. As a result, there is a surge in demand for automated pipelines, machine learning-based annotation tools, and user-friendly interfaces. Companies like Partek and QIAGEN Digital Insights are developing integrated solutions that simplify and accelerate data analysis, making RNA-seq more accessible to non-bioinformaticians.

By Application Outlook

Oncology remained the dominant application area, given RNA-seq’s critical role in cancer research, diagnostics, and therapy selection. RNA-seq enables the identification of fusion transcripts, alternative splicing events, and tumor microenvironment signatures, all of which are vital for understanding tumor biology. Research initiatives like The Cancer Genome Atlas (TCGA) heavily rely on RNA-seq to characterize various cancer types. Moreover, the development of RNA-based biomarkers is driving the use of transcriptomic profiling in companion diagnostics and immunotherapy response prediction.

Infectious diseases represent the fastest-growing application area, driven by the COVID-19 pandemic, antimicrobial resistance studies, and emerging pathogens. RNA-seq facilitates the identification of viral genomes, host-pathogen interactions, and immune response mechanisms. For example, researchers used RNA-seq extensively to understand SARS-CoV-2’s impact on host gene expression, guiding vaccine development and therapeutic strategies. With global health agencies increasingly prioritizing pandemic preparedness, RNA-seq is becoming an indispensable tool in infectious disease research.

By End Use Outlook

Academic & research institutes dominated the end-use segment, as they are the primary users of RNA-seq technology for basic and translational research. Universities, government labs, and non-profit organizations invest heavily in transcriptomic studies related to developmental biology, neurobiology, and plant genomics. Grant funding from agencies like the NIH, European Commission, and Chinese Academy of Sciences sustains continuous RNA-seq usage, often in collaboration with private firms.

Pharmaceutical and biotechnology companies are the fastest-growing end-users, utilizing RNA-seq in drug discovery, target validation, and clinical trial biomarker development. The need to understand disease mechanisms at the molecular level has led to the integration of RNA-seq into various phases of drug development. For instance, RNA-seq was used by Moderna during the early development phases of its mRNA COVID-19 vaccine. The increasing adoption of RNA-seq in precision medicine initiatives is expected to further boost its use in commercial settings.

By Regional Analysis

North America dominated the NGS-based RNA-sequencing market, accounting for the largest share in revenue terms. The region benefits from advanced healthcare infrastructure, a high concentration of genomic research institutions, and substantial funding from government and private bodies. The U.S. National Institutes of Health (NIH) continues to be a major patron of transcriptomics research. In addition, the presence of leading market players such as Illumina, Thermo Fisher Scientific, and Agilent Technologies ensures the continuous availability of cutting-edge technologies and support services. The region also has a higher rate of adoption of RNA-seq in clinical diagnostics, especially in oncology and rare disease settings.

Asia Pacific is the fastest-growing region, propelled by increasing investments in genomics, favorable government policies, and a rising number of collaborative research initiatives. China, India, and South Korea are leading the charge, establishing national genome sequencing programs and offering incentives for biotech innovations. For example, BGI Group in China has scaled up RNA-seq services in response to demand for infectious disease monitoring and personalized health solutions. Academic institutions in India, like the Indian Institute of Science (IISc), are also expanding transcriptomics research. As awareness and infrastructure continue to improve, Asia Pacific is expected to contribute significantly to the global expansion of the RNA-seq market.

Some of The Prominent Players in The NGS-based RNA-sequencing market Include:

Recent Developments

-

March 2025 – Illumina announced the launch of its latest NovaSeq X series flow cells that offer increased throughput and reduced cost per sample, targeting high-volume RNA-seq applications in cancer research and population genomics.

-

January 2025 – BGI Genomics partnered with multiple Southeast Asian governments to provide RNA-sequencing services for pathogen surveillance under their regional public health initiatives.

-

December 2024 – Thermo Fisher Scientific expanded its Ion Torrent Genexus System with new RNA-seq panels aimed at hematologic malignancies, enabling automated end-to-end sequencing in clinical settings.

-

October 2024 – Roche entered into a strategic collaboration with Genentech to integrate RNA-seq data with clinical trial results to accelerate biomarker discovery for oncology therapies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the NGS-based RNA-sequencing market

Product & Service

-

- Extraction & Purification Kits

- Library Preparation Kits

- Sequencing Reagents & Flow Cells

- Others

-

- RNA-sequencing

- Bioinformatics & Data Analysis

Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

Application

- Drug Discovery & Development

-

- Oncology

- Infectious Diseases

- Others

- Clinical Diagnostics

- Others

End Use

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinics

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)