Neurovascular Catheters Market Size and Growth

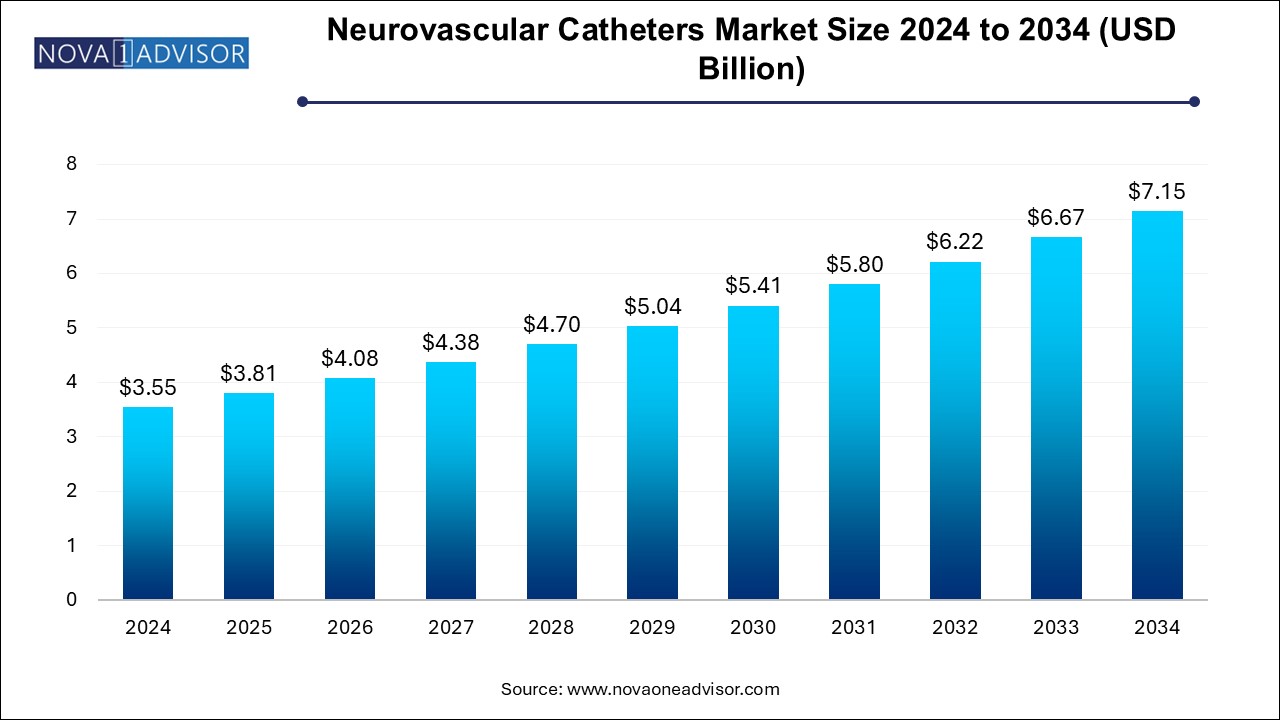

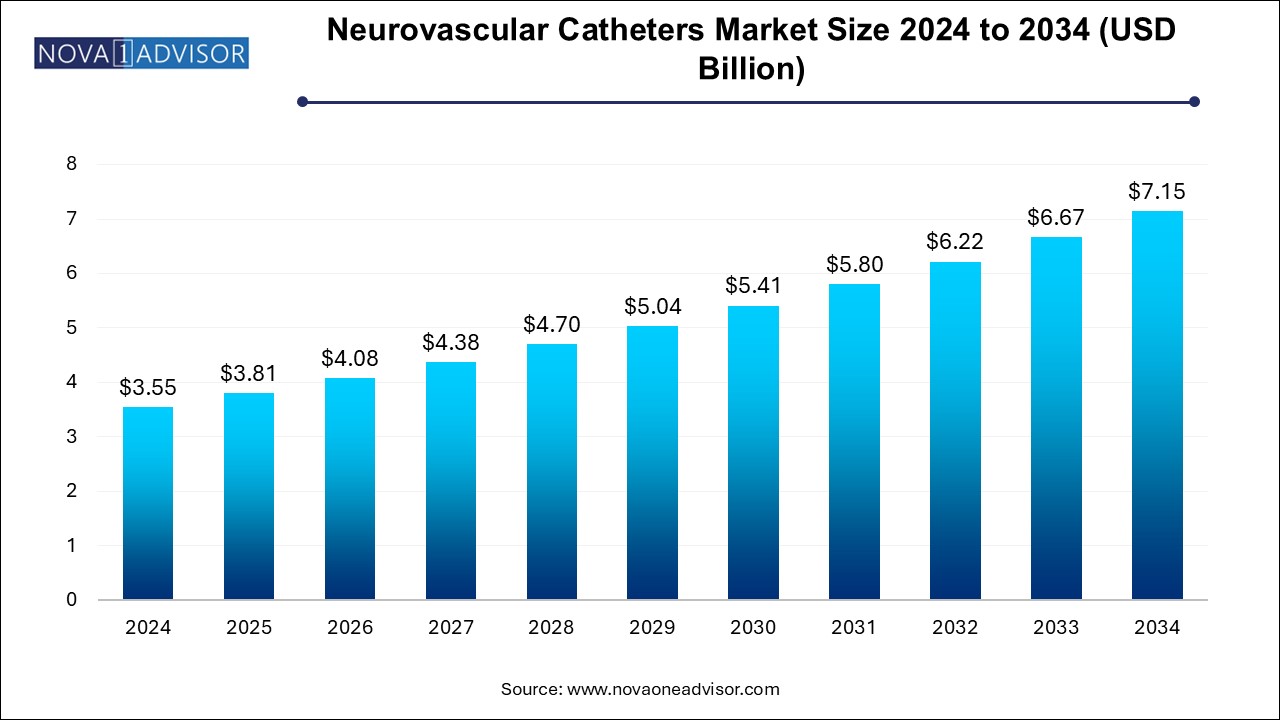

The neurovascular catheters market size was exhibited at USD 3.81 billion in 2024 and is projected to hit around USD 7.15 billion by 2034, growing at a CAGR of 7.26% during the forecast period 2024 to 2034.

Neurovascular Catheters Market Key Takeaways:

- In terms of type, the embolization catheters segment dominated the market in 2024 with the largest revenue share of 27.48%.

- In terms of components, the nylon tubing/pebax segment dominated the market in 2024 with the largest revenue share of 38.98%.

- In terms of application, the brain aneurysms segment dominated the market in 2024 with the largest revenue share of 32.79%.

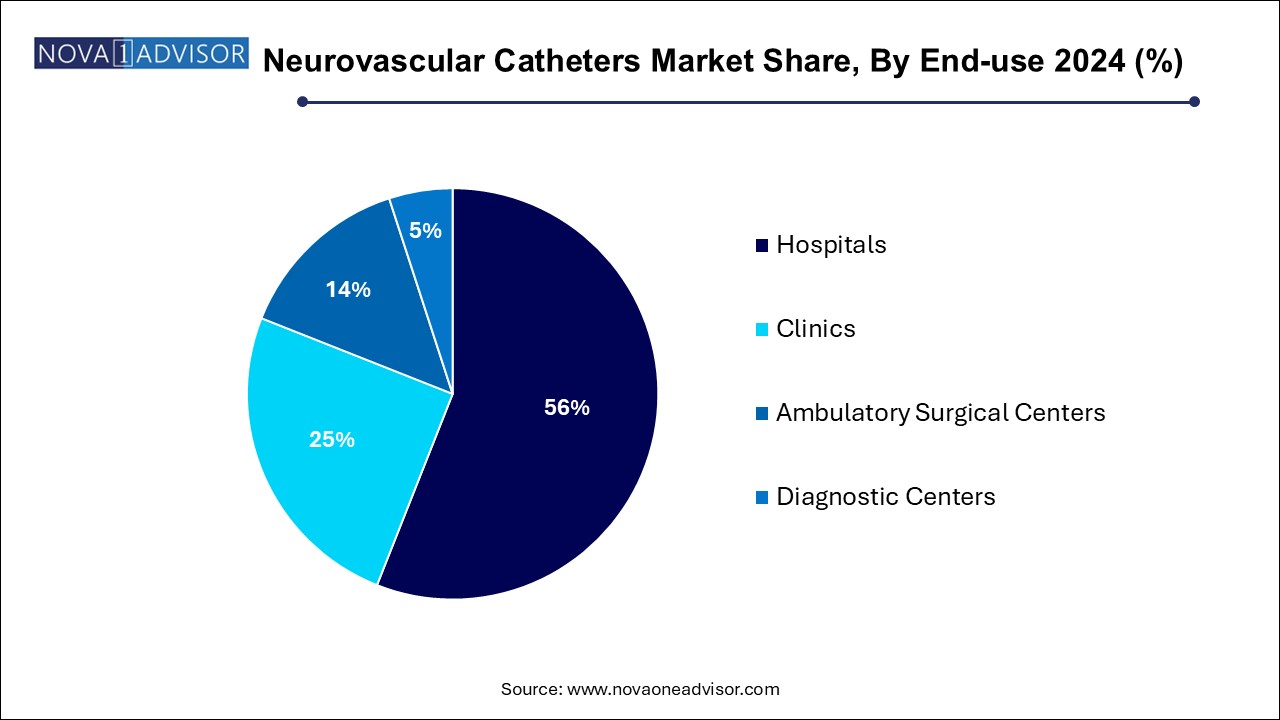

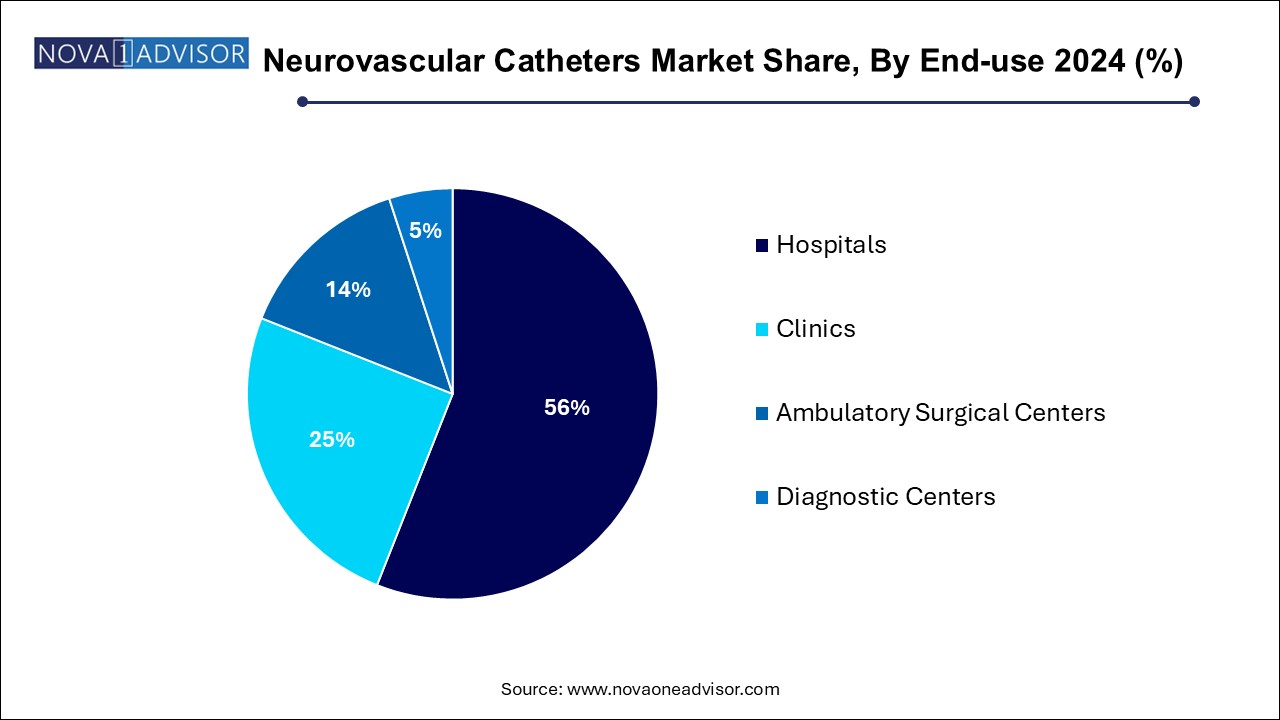

- In terms of end use, the hospital segment dominated the market in 2024 with the largest revenue share of 56.0%.

- North America neurovascular catheters market held the largest share and accounted for 35.29% of global revenue in 2024.

Market Overview

The neurovascular catheters market is a crucial segment within the broader neurointerventional and neurological medical devices industry. These specialized catheters are used for the diagnosis and treatment of neurovascular disorders, such as ischemic and hemorrhagic strokes, brain aneurysms, and arteriovenous malformations (AVMs). With a growing global burden of neurological diseases and increasing awareness of minimally invasive treatments, the demand for neurovascular catheters has been on a robust growth trajectory.

Advancements in catheter design, materials science, and navigation technologies have led to the development of more precise and flexible devices capable of accessing complex vasculature within the brain. The aging global population, combined with increasing rates of lifestyle-related risk factors such as hypertension, diabetes, and obesity, has driven the incidence of stroke and aneurysms. This, in turn, directly fuels the demand for neurovascular interventions and the associated devices.

Health systems worldwide are emphasizing early diagnosis and intervention to minimize the long-term consequences of neurological disorders. This shift has led to higher adoption rates of diagnostic and therapeutic catheterization procedures, thereby expanding the scope of the neurovascular catheters market. Moreover, the rising healthcare expenditure, growing number of neuro-specialty centers, and broader accessibility to advanced neurosurgical tools in emerging economies have contributed significantly to market expansion.

Major Trends in the Market

-

Integration of AI in catheter navigation systems: AI-based imaging and real-time catheter navigation systems are being integrated for enhanced precision during procedures.

-

Shift toward minimally invasive techniques: There is a clear trend of preference among physicians and patients for less invasive procedures that offer quicker recovery times and reduced risk.

-

Growing usage of 3D printing in prototyping catheters: Companies are employing 3D printing to speed up development cycles and test new designs efficiently.

-

Material innovation: Advancements in materials like Pebax and Nylon tubing with reinforced properties are leading to stronger, more flexible catheters.

-

Rising demand for disposable and single-use neurovascular catheters: To reduce infection risks and hospital-acquired complications, the industry is leaning toward disposables.

-

Expansion of neuro-interventional services in developing economies: More healthcare providers in Asia, Latin America, and parts of Africa are offering advanced neurovascular procedures, driving localized demand.

-

Cross-industry collaborations and M&As: Major medtech firms are partnering with startups or acquiring them to diversify and deepen their neurovascular device portfolios.

-

Growing investment in stroke prevention and management programs: Public and private initiatives globally are promoting awareness and access to stroke treatments.

Report Scope of Neurovascular Catheters Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.81 Billion |

| Market Size by 2034 |

USD 7.15 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 7.26% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Medtronic; Nordson Corporation; Stryker Corporation; Terumo Corporation; Integer Holdings Corporation; Penumbra, Inc.; Johnson & Johnson Services, Inc.; Integra LifeSciences Corporation |

Key Market Driver: Rising Incidence of Neurological Disorders

One of the most significant drivers propelling the neurovascular catheters market forward is the increasing incidence of neurovascular diseases, particularly strokes and brain aneurysms. According to the World Health Organization (WHO), stroke remains the second leading cause of death globally, with ischemic strokes accounting for the majority of cases. Neurovascular catheters play an essential role in both diagnosing and treating these events. The rising global geriatric population, which is more prone to such conditions due to age-related vascular fragility, further intensifies the demand for these devices.

Moreover, urbanization and lifestyle changes have exacerbated risk factors such as high blood pressure, smoking, and sedentary behavior—all contributing to the surge in stroke cases. These conditions necessitate timely neuro-intervention, making neurovascular catheters indispensable tools in modern medical care. The growing awareness among both patients and healthcare providers regarding early diagnosis and intervention has spurred the adoption of catheter-based treatments, particularly in developed nations and increasingly in middle-income economies.

Key Market Restraint: High Cost and Limited Access in Low-income Regions

Despite the market’s growth potential, a significant restraint is the high cost of neurovascular catheterization procedures and associated equipment. Advanced neurovascular interventions require sophisticated infrastructure, including imaging systems, specialized catheters, trained personnel, and post-operative care. This creates a financial barrier for hospitals and clinics in low- and middle-income countries. Furthermore, reimbursement frameworks in many regions do not adequately cover such procedures, limiting patient access.

Additionally, there is a pronounced shortage of skilled neuro-interventional radiologists and neurosurgeons, particularly in rural and underserved areas. Even with device donations or aid programs, without trained personnel, the utilization of neurovascular catheters remains suboptimal. These factors can impede the widespread adoption of these life-saving devices, especially in regions with underfunded healthcare systems.

Key Opportunity: Technological Advancements in Catheter Design

The neurovascular catheters market is poised to benefit immensely from technological innovations in catheter design and materials. Next-generation catheters are being engineered with features like improved torque control, hydrophilic coatings for smoother navigation, enhanced radiopacity for better visibility under imaging, and more ergonomic handle designs. These enhancements make procedures safer, quicker, and more efficient.

There’s also a growing interest in robot-assisted catheter navigation, which holds the promise of reducing surgeon fatigue and improving precision in complex neurovascular procedures. Innovations in biodegradable and drug-eluting catheter coatings are opening new avenues for preventing post-procedure complications. Companies that invest in R&D to address unmet clinical needs, such as navigating extremely narrow or tortuous vessels, will likely capture significant market share. The convergence of digital imaging, AI, and robotics in neurovascular catheter procedures offers a fertile ground for innovation and disruption.

Neurovascular Catheters Market By Type Insights

Microcatheters dominated the neurovascular catheters market due to their precision, flexibility, and ability to access small, intricate blood vessels in the brain. These catheters are crucial in embolization procedures, such as the delivery of coils or liquid embolics for treating aneurysms and AVMs. Their usage is expanding not just in therapeutic interventions but also in diagnostics where high-definition access is required. The constant innovation in microcatheter design—such as ultra-thin walls, braided shafts for enhanced torque response, and multiple tip configurations—has cemented their place as an indispensable tool for neurointerventionalists.

On the other hand, balloon catheters are projected to be the fastest-growing type segment over the forecast period. Balloon-assisted coiling and angioplasty in neurovascular interventions are gaining traction, especially for wide-neck aneurysms and stenotic lesions. These catheters are vital in temporarily occluding blood flow to stabilize treatment zones or facilitate embolic delivery. Their ability to support stent deployment and enable flow arrest makes them versatile, thus attracting increasing attention from neurovascular surgeons.

Neurovascular Catheters Market By Component Insights

Catheter liners held the largest market share in terms of components, owing to their role in enhancing the maneuverability and biocompatibility of catheters. Liners reduce friction, which improves catheter performance and reduces vessel trauma. PTFE and other high-performance materials are commonly used to ensure strength and kink resistance. These liners contribute significantly to the safety and durability of the final device, thus driving their widespread adoption.

However, the reflow heat shrinks segment is experiencing the fastest growth, as manufacturers seek improved bonding and encapsulation solutions for multilayer catheter construction. These components are essential during manufacturing to fuse multiple layers of catheter tubing, thereby enhancing structural integrity. The increasing demand for custom-engineered catheters with multiple functionalities is boosting the relevance of reflow heat shrink solutions.

Neurovascular Catheters Market By Application Insights

Brain aneurysm treatment applications dominate the neurovascular catheters market, attributed to the high global prevalence and the need for complex intervention techniques. Aneurysm coiling procedures often require multiple catheters, including access, embolization, and microcatheters, thereby increasing product utilization per case. The adoption of endovascular approaches has particularly risen in developed regions due to lower morbidity rates compared to open neurosurgery.

Meanwhile, the embolic stroke application segment is poised to witness the fastest growth over the coming years. With the global incidence of ischemic stroke rising and the need for rapid intervention to restore cerebral blood flow, thrombectomy procedures using aspiration or stent-retriever devices are gaining momentum. Catheters designed specifically for these interventions are in high demand, particularly in stroke-ready centers and tertiary hospitals.

Neurovascular Catheters Market By End-use Insights

Hospitals are the largest end-users of neurovascular catheters, driven by their comprehensive infrastructure, availability of trained personnel, and capacity to handle complex neurosurgical cases. Most neurointerventional procedures are performed in hospital settings due to the need for real-time imaging, specialized surgical teams, and intensive post-operative care.

However, ambulatory surgical centers (ASCs) are emerging as the fastest-growing segment. ASCs offer cost-effective and efficient alternatives for routine neurovascular diagnostic procedures or less invasive interventions. With the increasing focus on reducing hospital readmission rates and healthcare costs, ASCs are becoming popular among patients and providers, particularly in developed markets.

Neurovascular Catheters Market By Regional Insights

North America holds the dominant share of the global neurovascular catheters market. The United States, in particular, has a well-established neuro-interventional infrastructure, a high prevalence of stroke, and robust reimbursement frameworks. Leading hospitals and specialized stroke centers are increasingly adopting next-generation neurovascular devices, supported by active clinical research, favorable FDA approvals, and the presence of major market players. Public health initiatives, such as the American Heart Association’s programs on stroke awareness and management, have further facilitated early diagnosis and timely intervention.

Conversely, Asia Pacific is anticipated to be the fastest-growing region during the forecast period. Rapid urbanization, a growing aging population, and improving healthcare infrastructure in countries like China, India, and South Korea are driving market growth. Government investments in upgrading stroke care centers, expanding health insurance coverage, and improving neurovascular diagnostics are creating conducive environments for the adoption of neurovascular catheters. Multinational companies are also increasing their focus on these regions through strategic partnerships, training programs, and manufacturing expansions.

Some of the prominent players in the neurovascular catheters market include:

- Medtronic

- Nordson Corporation

- Stryker Corporation

- Terumo Corporation

- Integer Holdings Corporation

- Penumbra, Inc.

- Johnson & Johnson Services, Inc.

- Integra LifeSciences Corporation

Neurovascular Catheters Market Recent Developments

-

January 2025: Medtronic announced the global launch of its Catalyst Neurovascular Access System, designed to improve catheter control and reduce procedure time in ischemic stroke patients.

-

December 2024: Stryker received FDA approval for its NeuroElite Microcatheter, specifically engineered for enhanced navigability in tortuous vasculature during embolization procedures.

-

October 2024: Penumbra Inc. unveiled the RED Reperfusion Catheter Series, designed for improved clot retrieval and aspiration during mechanical thrombectomy.

-

September 2024: Terumo Corporation introduced the Sofia EX Catheter in the European market, featuring a new liner and distal shaft for improved access in distal neurovascular territories.

-

August 2024: Johnson & Johnson's Cerenovus division expanded its research partnership with leading U.S. stroke centers to co-develop next-generation balloon catheters with AI-guided navigation.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the neurovascular catheters market

Type

- Microcatheters

- Balloon Catheters

- Access Catheters

- Embolization Catheters

- Others

Component

- Catheter Mandrels

- Catheter Liners

- Reflow Heat Shrinks

- Nylon Tubing/Pebax

- Other Components

Application

- Embolic Stroke

- Brain Aneurysm

- Arteriovenous Malformations

- Others

End-use

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)