The global paracetamol IV market size was exhibited at USD 700.27 million in 2023 and is projected to hit around USD 1,035.57 million by 2033, growing at a CAGR of 3.99% during the forecast period of 2024 to 2033.

Key Takeaways:

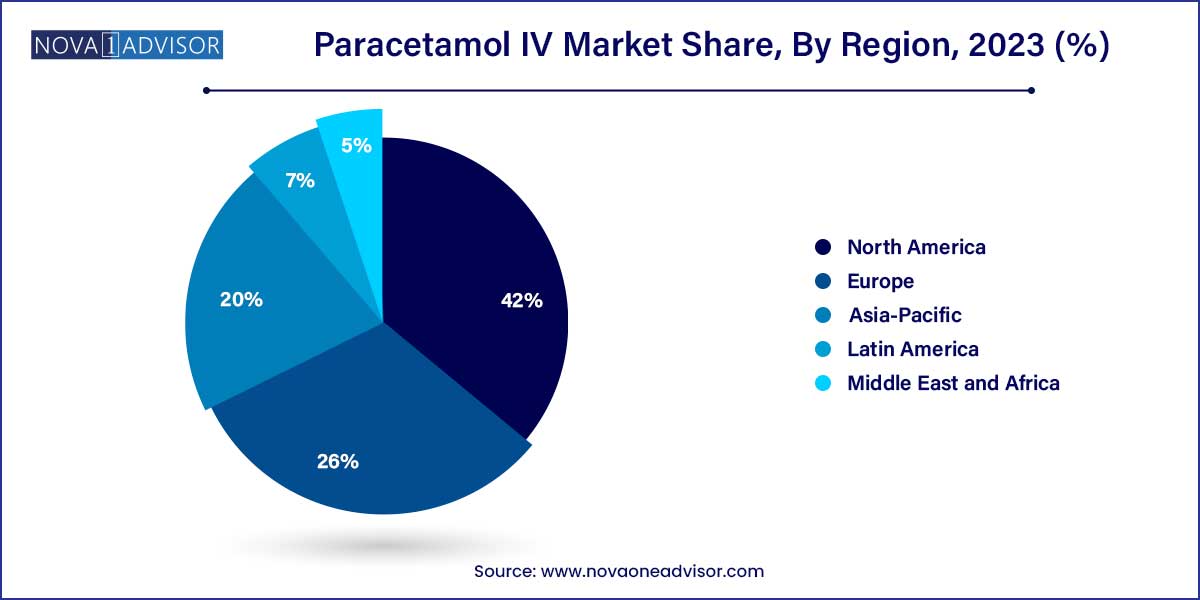

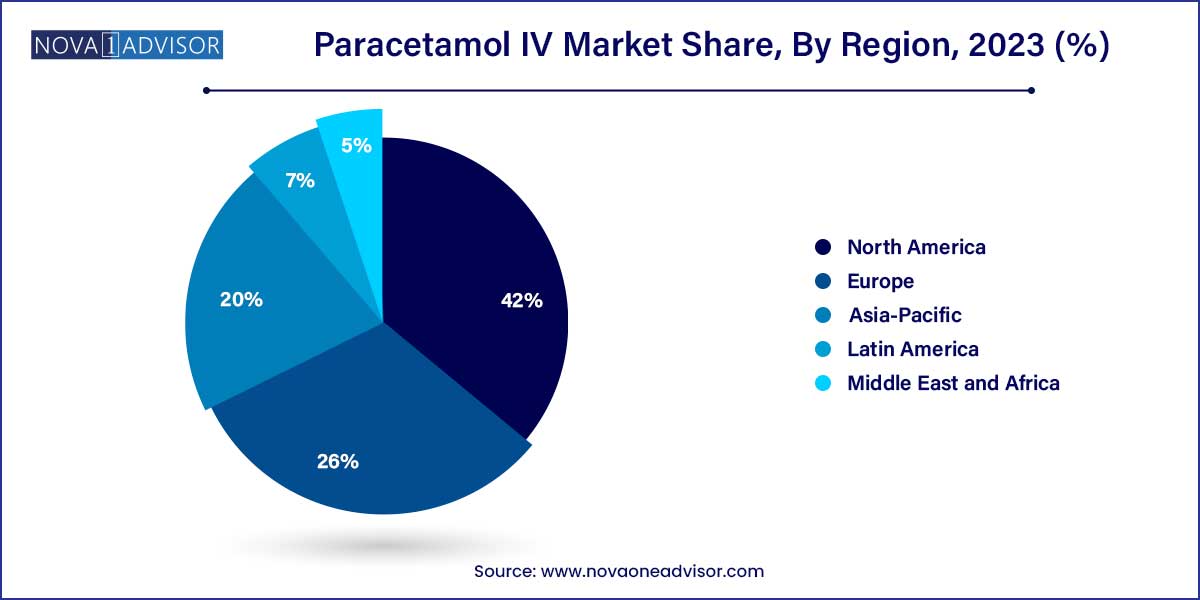

- North America dominated the global sector in 2023 and accounted for the maximum share of more than 42.0% of the overall revenue.

- The pain indication segment dominated the global industry in 2023 and accounted for the maximum share of more than 66.95% of the overall revenue.

- The surgical application segment dominated the global industry in 2023 and accounted for the maximum share of more than 63.45% of the overall revenue.

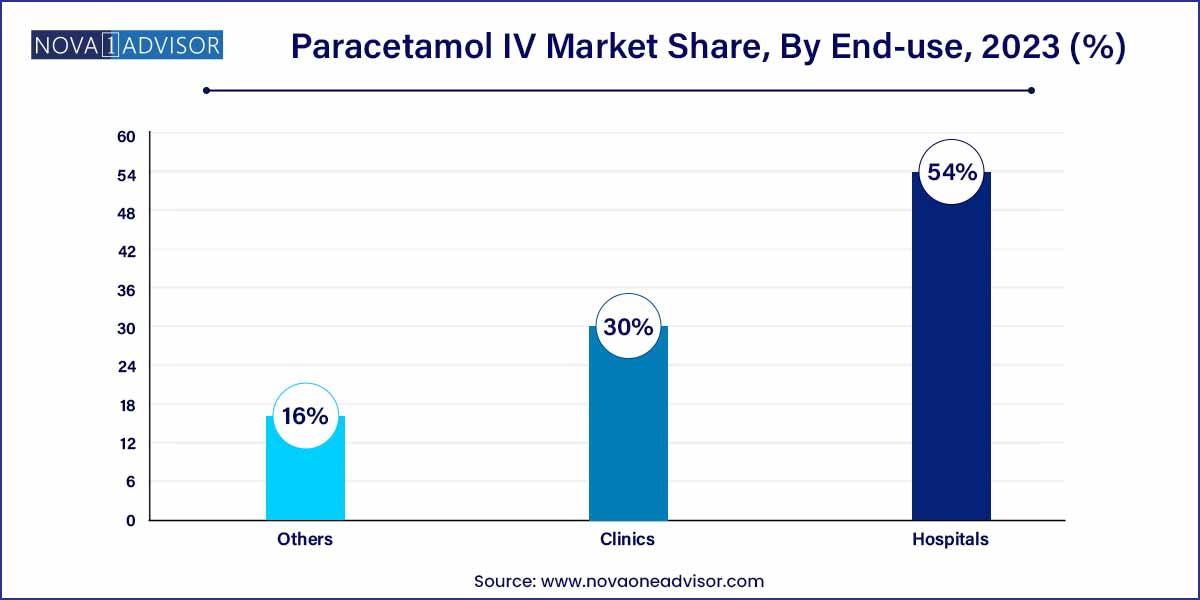

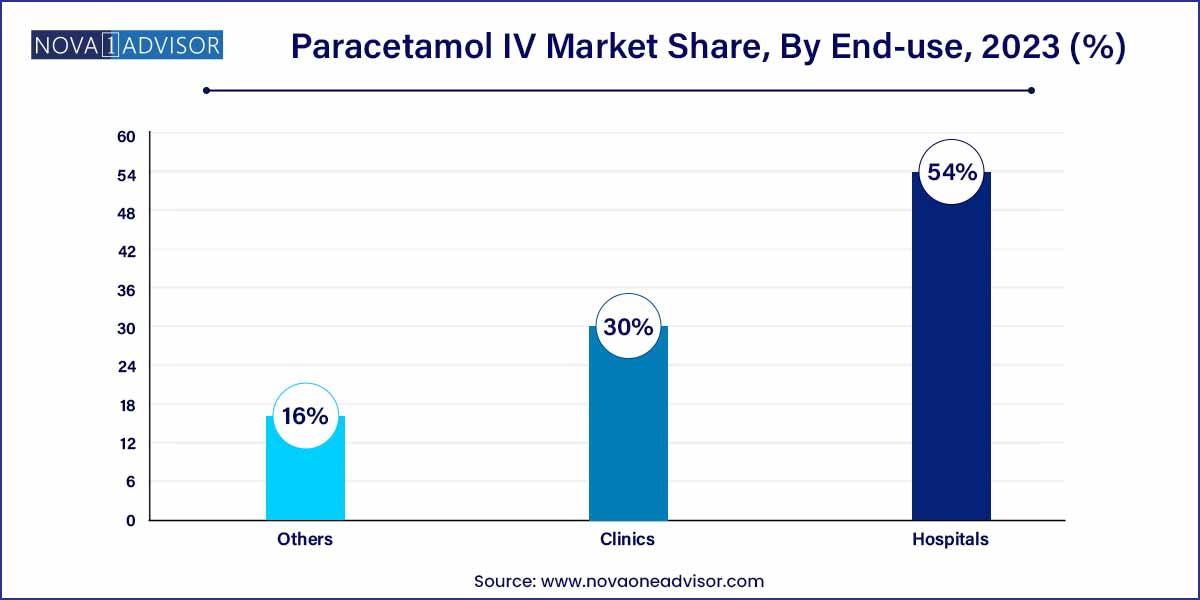

- The segment accounted for the maximum share of more than 54.0% of the global revenue in the same year.

Market Overview

The Paracetamol IV (Intravenous) Market represents a critical and expanding segment within the global analgesics and antipyretics industry. Paracetamol, widely known as acetaminophen, is among the most frequently used medications for pain relief and fever reduction. While oral forms of paracetamol dominate outpatient care, intravenous formulations are indispensable in inpatient settings, especially for patients who cannot take medications orally due to surgical procedures, gastrointestinal issues, or impaired consciousness.

The global demand for Paracetamol IV has surged in recent years, driven by a growing number of surgical procedures, a rise in hospital admissions, and an increasing preference for non-opioid analgesics in the wake of the opioid crisis. Unlike opioids, paracetamol IV offers an effective alternative for managing moderate to severe pain without the associated risks of addiction and respiratory depression. It is also frequently used in combination with opioids to reduce opioid dosage, thereby improving safety profiles for post-operative pain management.

Furthermore, rising healthcare awareness, improving access to critical care services in emerging economies, and advancements in IV drug delivery technology are collectively fueling market expansion. The COVID-19 pandemic further underscored the importance of antipyretic and analgesic treatments administered intravenously, particularly in intensive care settings, where fever and pain management were integral to patient recovery.

Major Trends in the Market

-

Shift Toward Multimodal Pain Management Approaches: IV paracetamol is increasingly being used alongside opioids, NSAIDs, and local anesthetics to optimize pain relief while minimizing adverse effects.

-

Rising Number of Surgical Procedures Globally: With the growing elderly population and chronic diseases, surgeries are increasing, driving the demand for intravenous analgesics in post-operative care.

-

Opioid-Sparing Strategies in Hospitals: The ongoing opioid crisis is pushing healthcare providers to use IV paracetamol as a safer and effective pain management alternative.

-

Expansion of ICU and Emergency Care Infrastructure in Developing Countries: New healthcare facilities are increasing the adoption of injectable formulations like IV paracetamol.

-

Development of Generic and Biosimilar IV Paracetamol Formulations: Patent expirations are allowing more pharmaceutical players to enter the market with cost-effective versions.

-

Enhanced Drug Delivery Technologies: New IV administration systems that reduce infection risks and improve dosing precision are supporting market growth.

-

Increased Use in Pediatric and Geriatric Care: IV paracetamol is often preferred for children and elderly patients due to ease of administration and controlled dosing.

Paracetamol IV Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 700.27 Million |

| Market Size by 2033 |

USD 1,035.57 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 3.99% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Indication, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Mallinckrodt (Mallinckrodt Pharmaceuticals); Cipla Inc.; Lupin; Dr. Reddy's Laboratories Ltd.; Aurobindo Pharma; Sun Pharmaceutical Industries Ltd.; Novartis AG; Pfizer Inc.; Abbott; Sanofi; Bristol-Myers Squibb Company. |

Key Market Driver: Rising Global Surgical Volume

One of the strongest drivers of the Paracetamol IV market is the significant increase in global surgical procedures. According to WHO statistics, over 300 million surgeries are performed annually worldwide a number that continues to rise due to the growing burden of chronic illnesses, trauma cases, and elective procedures in aging populations. Surgeries ranging from orthopedic and cardiovascular interventions to general and laparoscopic procedures require effective post-operative pain management.

IV paracetamol has emerged as a preferred option in these settings for its rapid onset, safety profile, and compatibility with multimodal analgesic protocols. Hospitals increasingly use IV paracetamol in surgical suites and post-anesthesia care units to enhance patient comfort and recovery outcomes. For example, in orthopedic surgeries like total knee replacement, IV paracetamol is often administered to minimize opioid use and shorten recovery time. This trend is especially evident in high-income countries but is also gaining traction in emerging economies with growing surgical capacities.

Key Market Restraint: High Cost Compared to Oral Alternatives

Despite its clinical advantages, the high cost of intravenous paracetamol compared to oral forms remains a major market restraint. IV formulations can be up to 10 times more expensive than oral tablets, posing a financial challenge, particularly in resource-limited settings and outpatient care. Even though the therapeutic value of IV paracetamol in critical care settings is undisputed, budget-constrained hospitals often have to balance efficacy with cost-effectiveness.

Moreover, reimbursement policies in several countries do not fully cover IV paracetamol unless strongly justified by patient condition, leading to inconsistent usage patterns. In developing regions where healthcare systems operate with limited budgets and where out-of-pocket spending is common, healthcare providers may lean toward more affordable oral or injectable NSAIDs, limiting IV paracetamol's penetration.

Key Market Opportunity: Expansion in Emergency and Critical Care Units

As healthcare infrastructure improves globally, especially in low- and middle-income countries, there is a substantial opportunity for the growth of IV paracetamol use in emergency departments and intensive care units. Paracetamol IV is particularly effective in managing acute pain and fever in critically ill patients, where rapid action and bypassing of gastrointestinal absorption are essential.

Governments and private sectors are investing heavily in expanding critical care and emergency facilities—especially in light of lessons learned from the COVID-19 pandemic. For example, India has doubled its ICU beds over the past five years, while countries across Africa and Southeast Asia have upgraded their emergency response systems. This infrastructure expansion is a fertile ground for IV paracetamol manufacturers to position their products as essential emergency drugs. Moreover, partnerships with public health systems for bulk supply and training programs for administration can further enhance market penetration.

By Indication Insights

Pain dominated the indication segment in the Paracetamol IV market, largely due to the increasing demand for effective analgesia in surgical, trauma, and critical care settings. Pain management remains a cornerstone of modern clinical practice, with IV paracetamol providing rapid relief in scenarios where oral medications are either ineffective or impractical. It is widely used in post-operative recovery to mitigate the need for opioids, particularly in orthopedic and gynecological surgeries. In trauma cases, such as road accidents, where the patient may be unconscious or in shock, IV paracetamol becomes the preferred choice for managing acute pain without respiratory depression.

Pyrexia is the fastest-growing indication, particularly in pediatric and intensive care settings where fever control is essential for patient stabilization. IV paracetamol is often used when oral administration is not feasible due to nausea, vomiting, or unconsciousness. In hospitals managing infectious diseases or viral outbreaks—such as dengue, influenza, or malaria—paracetamol IV is frequently administered for antipyresis. Additionally, its safety in children and elderly populations makes it a reliable option in sensitive healthcare environments, contributing to rapid market expansion in this sub-segment.

By Application Insights

Surgical applications dominate the Paracetamol IV market, driven by its widespread use during and after surgical procedures to manage pain and reduce inflammation. The need for fast-acting, non-opioid analgesics in perioperative care has made IV paracetamol a mainstay in hospitals worldwide. In high-risk surgeries where opioids are contraindicated or limited, such as cardiovascular and neurosurgeries, paracetamol IV is often administered for pain control. Enhanced recovery after surgery (ERAS) protocols have further popularized its usage, reinforcing its place in multimodal pain management strategies.

Non-surgical applications are witnessing faster growth, especially in critical care units, emergency departments, and chronic disease management. In these contexts, IV paracetamol is used for controlling pain and fever resulting from conditions like cancer, severe infections, and inflammatory diseases. For example, in oncology, patients undergoing chemotherapy often develop febrile neutropenia a condition where IV paracetamol is favored for its quick onset and tolerability. This versatility outside the surgical domain is unlocking new market avenues for the drug in both public and private healthcare systems.

By End-use Insights

Hospitals account for the largest share in the end-use segment, reflecting their role as primary centers for surgical procedures, emergency care, and inpatient treatment. IV paracetamol is extensively stocked and used in operating rooms, ICUs, and post-operative care units across tertiary and secondary hospitals. Its inclusion in hospital formularies and clinical guidelines ensures consistent demand. Moreover, the ability of hospitals to justify the higher cost of IV paracetamol based on improved patient outcomes supports its continued use in large volumes.

Clinics are emerging as the fastest-growing end-use segment, especially in urban and semi-urban areas where short-stay surgeries and day-care procedures are becoming more common. Many specialty clinics, including dental and minor surgical centers, are adopting IV paracetamol for effective pain management and quick discharge. Additionally, urgent care clinics treating high fever and trauma cases also prefer IV paracetamol for its immediate therapeutic effect. The trend toward decentralization of healthcare services and increased outpatient visits is supporting this growth.

By Regional Insights

Europe dominates the Paracetamol IV market, owing to robust healthcare infrastructure, high surgical volumes, and a strong inclination toward non-opioid pain management. Countries like Germany, France, and the UK have well-established protocols integrating IV paracetamol into perioperative and critical care practices. The region’s early adoption of enhanced recovery protocols and patient safety initiatives has made paracetamol IV a staple in hospital settings. Moreover, strong regulatory frameworks and the availability of generics have stabilized pricing, making it accessible across public healthcare systems.

Asia-Pacific is the fastest-growing region, driven by rising healthcare investments, increasing surgical procedures, and greater awareness of post-operative care. Rapid urbanization and an expanding middle class in countries like India, China, and Indonesia are increasing demand for quality healthcare services, including advanced analgesics. Government initiatives to improve hospital infrastructure, especially in tier-2 and tier-3 cities, are boosting the availability and administration of IV medications. Additionally, local manufacturing by generic pharmaceutical firms is making IV paracetamol more affordable and widely distributed.

Some of the prominent players in the Paracetamol IV market include:

- Mallinckrodt (Mallinckrodt Pharmaceuticals)

- Cipla Inc.

- Lupin

- Dr. Reddy's Laboratories Ltd.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- Pfizer, Inc.

- Abbott

- Sanofi

- Bristol-Myers Squibb Company

Recent Developments

-

January 2025: Pfizer Inc. announced the expansion of its paracetamol IV product line in Southeast Asia, following regulatory approvals in Malaysia and Thailand.

-

December 2024: Fresenius Kabi launched a new prefilled IV paracetamol syringe designed to reduce administration time and minimize infection risks in surgical wards.

-

October 2024: Sandoz (a Novartis division) entered into a licensing agreement with an Indian pharmaceutical company to manufacture and distribute generic IV paracetamol in Latin America.

-

August 2024: B. Braun Melsungen AG initiated clinical trials in Europe for a new IV paracetamol formulation targeting pediatric use, aiming for enhanced safety and palatability.

-

June 2024: Cipla Ltd. began domestic production of IV paracetamol in its new facility in Maharashtra, India, to cater to rising demand in Asia and Africa.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global paracetamol IV market.

Indication

Application

End-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)