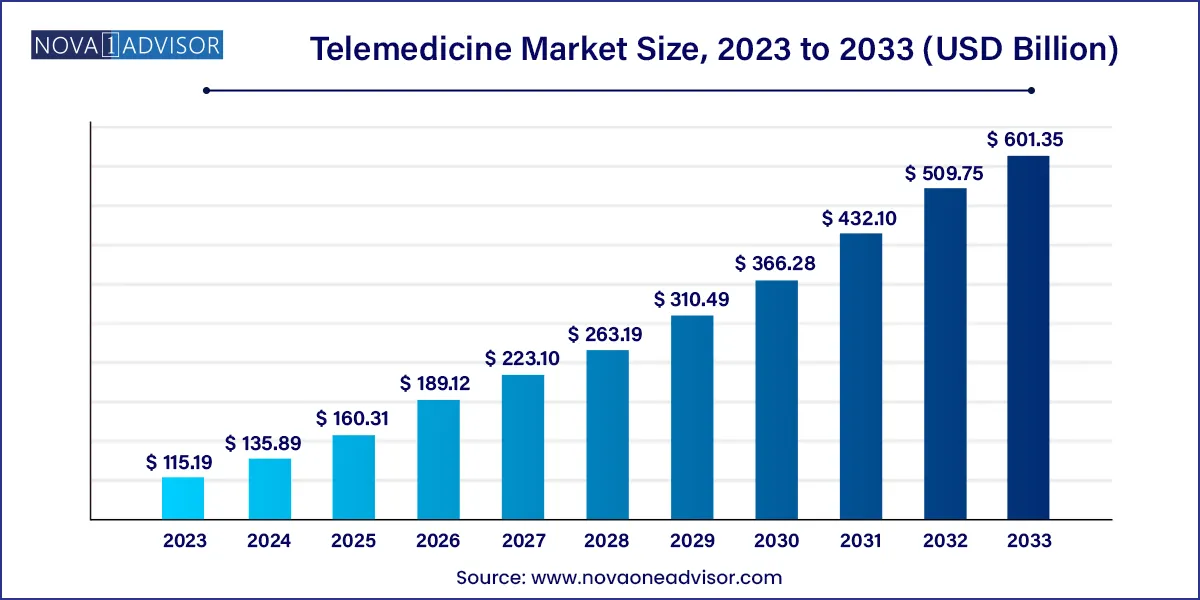

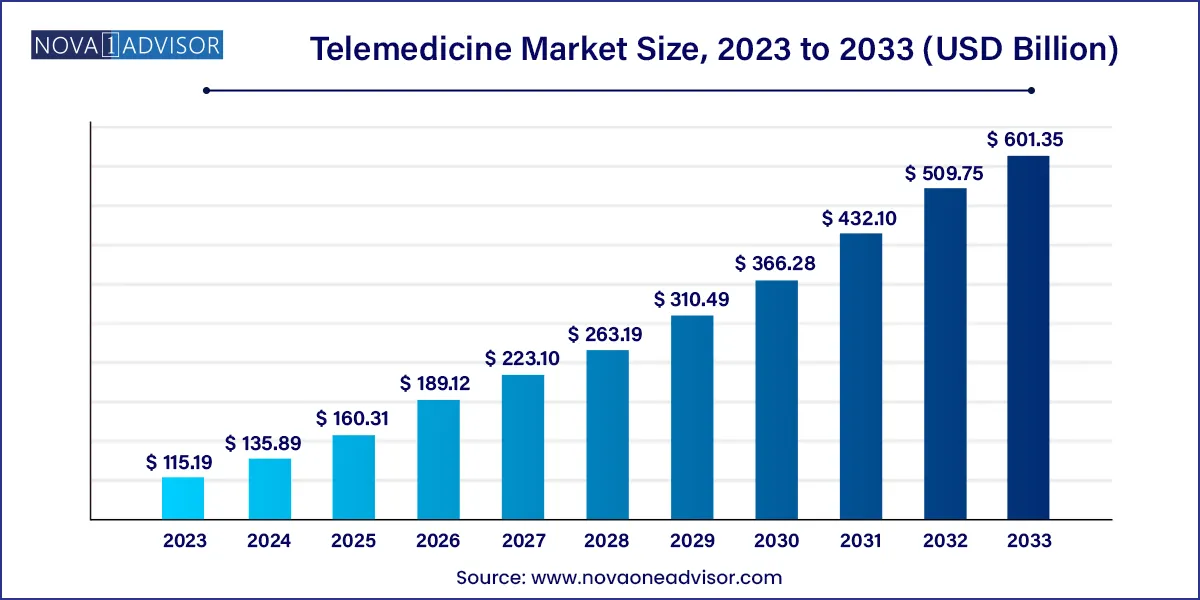

The global telemedicine market size was estimated at USD 115.19 billion in 2023 and is projected to hit around USD 601.35 billion by 2033, growing at a CAGR of 17.97% during the forecast period from 2024 to 2033.

Key Takeaways:

- North America dominated the market with a revenue share of 33.59% in 2023.

- Asia Pacific is expected to experience fastest CAGR growth during the forecast period.

- Product segment dominated the market and is further divided into software, hardware, and others. Product segment accounted for the largest market share of 52.2% in 2023.

- Service segment is expected to witness fastest CAGR growth, over the forecast period.

- Real-time segment dominated the market in terms of revenue share in 2023.

- Others segments, including patient monitoring from remote locations such as homes or hospitals, are expected to experience significant growth over the forecast period.

- Teleradiology segment held largest revenue share of in 2023

- Teleradiology segment held largest revenue share of in 2023

- By delivery mode, market is segmented into web/mobile and call centers. Web/mobile segment accounted for largest revenue share in 2023

- By facility, market is divided into tele-hospitals and tele-home. Tele-hospitals segment accounted for largest revenue share in 2023.

- Telehome care solutions segment is anticipated to experience fastest growth rate as adoption of remote patient monitoring devices increases

- By end use, market is divided into patients,payers,providers and others. In 2023, patients segment held largest market share.

- Provider segment is expected to grow at fastest CAGR

Market Overview

The telemedicine market has evolved from a niche healthcare service to a cornerstone of global medical infrastructure. Once considered a convenience, it has become a necessity in modern healthcare, especially after the COVID-19 pandemic which disrupted traditional care delivery. Telemedicine refers to the remote delivery of clinical services via telecommunications and digital platforms, enabling patients and physicians to connect without physical contact. The market spans across various services such as tele-consultation, telemonitoring, diagnostics, mental health services, and chronic disease management.

Telemedicine plays a vital role in addressing the disparities of healthcare accessibility, especially for rural or underserved populations. As of 2024, the market is experiencing unprecedented growth driven by high-speed internet penetration, digital literacy, supportive policy frameworks, and increased acceptance of virtual care by patients and providers alike. Government healthcare programs like Medicare in the U.S., Ayushman Bharat in India, and NHS initiatives in the UK are progressively integrating telemedicine as part of reimbursable healthcare services.

Healthcare providers are embracing telemedicine not only to manage patient loads efficiently but also to reduce operational costs. Simultaneously, patients appreciate the convenience, reduced travel time, and flexible scheduling options offered by virtual healthcare platforms. Moreover, advancements in AI, wearable health devices, and secure cloud-based platforms have enhanced the quality, accuracy, and security of telemedicine solutions, further cementing their relevance in the future of healthcare delivery.

Major Trends in the Telemedicine Market

-

AI-augmented virtual care: Integration of artificial intelligence for predictive diagnostics, virtual triaging, and conversational bots is transforming telehealth consultations.

-

Mental health services surge: Growing demand for remote psychological counseling and psychiatry, especially among youth and working professionals.

-

Cross-border telemedicine platforms: International virtual consultations for second opinions and specialized treatments are rising.

-

Growth of direct-to-consumer (D2C) platforms: B2C telemedicine apps are thriving due to increasing user trust and subscription-based healthcare models.

-

Expansion of tele-home ICU care: Intensive care services are being extended to patient homes using real-time monitoring devices and virtual physician visits.

-

Hybrid care models: Combining in-person and remote services into unified platforms is becoming the new standard for clinics and hospitals.

-

Voice assistant integration: Use of smart speakers and voice interfaces (e.g., Alexa Health, Google Assistant) for elderly patient interaction and medication reminders.

-

Blockchain for health records: Emerging blockchain-based telehealth systems are enabling secure, immutable, and interoperable health data sharing.

-

Reimbursement and insurance alignment: Progressive insurance policies covering telehealth across more services are boosting its uptake.

Telemedicine Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 135.89 Billion |

| Market Size by 2033 |

USD 601.35 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.97%

|

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Component, Modality, Application, Delivery Model, Facility, and End User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

MDlive, Inc. (Evernorth); American Well Corporation; Twilio Inc.; Teladoc Health, Inc.; Doctor On Demand, Inc. (Included Health); Zoom Video Communications, Inc.; SOC Telemed, Inc.; NXGN Management, LLC; Plantronics, Inc.; Practo; VSee |

Key Market Driver: Rising Burden of Chronic Diseases

A leading driver of the telemedicine market is the increasing global burden of chronic diseases such as diabetes, hypertension, cardiovascular disorders, and respiratory conditions. According to WHO, chronic diseases account for approximately 71% of all global deaths. Managing these conditions requires ongoing medical supervision, frequent consultations, and consistent monitoring—areas where telemedicine offers a practical, cost-effective solution.

Telemedicine allows for remote monitoring of vitals, symptom tracking, medication adherence, and lifestyle management without the need for frequent hospital visits. Devices such as glucometers, blood pressure cuffs, and pulse oximeters connected to mobile apps help in real-time monitoring, allowing physicians to intervene early. For example, in the U.S., the Veterans Health Administration has integrated telehealth for chronic care, resulting in a 25% reduction in hospital admissions. This trend is mirrored globally, demonstrating that telemedicine can significantly alleviate the pressure on healthcare systems by reducing the need for in-person consultations while improving patient outcomes.

Key Market Restraint: Data Privacy and Security Concerns

Despite its promising potential, data security and patient privacy remain pressing concerns that restrain the growth of the telemedicine market. Health data is highly sensitive, and breaches can lead to identity theft, fraud, and loss of trust. With telemedicine platforms collecting vast amounts of data medical history, real-time vitals, prescriptions, and mental health records the need for robust cybersecurity frameworks is paramount.

Many telehealth providers still operate on insecure networks or do not comply fully with data protection laws such as HIPAA (U.S.), GDPR (Europe), or regional health data regulations. In 2023, a prominent telehealth provider in Asia reported a breach that compromised over 1 million patient records, highlighting the vulnerability of digital health ecosystems. Such incidents can deter both patients and providers from adopting telemedicine solutions, especially in countries where digital infrastructure and regulatory oversight are still evolving.

Key Market Opportunity: Expansion in Remote and Underserved Areas

One of the most impactful opportunities for the telemedicine market lies in expanding access to healthcare in remote, rural, and underserved regions. Millions globally lack access to basic healthcare facilities due to geographic barriers, insufficient infrastructure, or a shortage of trained medical professionals. Telemedicine can bridge this gap by connecting these populations with urban specialists, thereby democratizing access to quality care.

Government partnerships and NGO initiatives are increasingly deploying telemedicine kiosks and mobile vans equipped with digital diagnostic tools and internet connectivity. In India, projects like eSanjeevani and Apollo TeleHealth have brought healthcare to remote tribal belts and hilly terrains. Similarly, in sub-Saharan Africa, organizations like Babyl Rwanda are offering AI-powered telehealth consultations via basic mobile phones, proving that even minimal tech can make a difference. These models not only provide affordable care but also pave the way for future public-private partnerships and policy support for broader telehealth integration.

Segments Insights:

By Component Insights

Services dominate the telemedicine market by component, accounting for a significant share of overall revenue. Services such as tele-consulting, telemonitoring, and tele-education are the most consumed by both individual users and institutions. Tele-consulting has especially seen exponential adoption as patients look for instant medical guidance without the need for physical travel. Hospitals and clinics are increasingly outsourcing or co-developing service-based telemedicine platforms to scale operations rapidly. Additionally, governments are also investing in tele-education services to upskill healthcare workers in rural areas using remote training tools.

Meanwhile, software products are growing at the fastest rate, fueled by increasing demand for scalable, interoperable, and customizable telehealth platforms. Cloud-based software with AI-powered triaging, integration with EMRs (Electronic Medical Records), multilingual interfaces, and user-friendly UIs are enabling rapid adoption across hospitals and consumer apps. Companies like Teladoc and Amwell are continuously innovating with new platform updates that support patient-doctor messaging, prescription uploads, and AI-based symptom checkers—all of which are crucial for patient retention.

By Modality Insights

Real-time telemedicine dominates the market modality-wise, thanks to the high preference for synchronous consultations between doctors and patients. This method ensures immediate diagnosis, live interaction, and real-time symptom assessment. Especially in urgent care, mental health, and pediatrics, real-time consultations provide reassurance and reduce delays in treatment. Healthcare institutions are integrating video consultation modules with diagnostic tools for seamless virtual appointments, improving both patient satisfaction and clinical outcomes.

In contrast, store-and-forward telemedicine is the fastest-growing modality, particularly useful in specialties like dermatology, pathology, and radiology where asynchronous communication suffices. Physicians can assess images or data at their convenience and provide feedback without needing a live session. The asynchronous model is gaining traction in developing nations with limited bandwidth or time zone challenges, and also among specialists who manage large case loads.

By Application Insights

Teleradiology is the dominant application, largely due to the global shortage of radiologists and the need for 24/7 imaging services. Teleradiology solutions allow healthcare providers to outsource image interpretation to certified professionals across borders, reducing turnaround time and ensuring continuous service. Major hospitals often collaborate with external radiology hubs to handle complex imaging cases during off-hours or holidays. For instance, U.S.-based RadNet and India-based Teleradiology Solutions have created international networks of radiologists for seamless image interpretation.

On the other hand, telepsychiatry is the fastest-growing application, owing to the mental health crisis exacerbated by the pandemic, economic uncertainty, and rising social isolation. Online therapy platforms such as BetterHelp, Talkspace, and Calmerry have seen explosive user growth, particularly among adolescents and working adults. Mental health professionals are embracing video and text-based therapies, making psychiatric consultations more accessible and less stigmatized.

By Delivery Model Insights

Web and mobile-based delivery dominates, especially through visualized platforms offering video conferencing. Patients increasingly prefer apps or web portals over traditional in-person visits. These platforms are integrated with features like appointment scheduling, payment processing, e-prescriptions, and follow-up tracking, offering a comprehensive digital healthcare experience. Companies like Practo, MDLIVE, and Doctor on Demand exemplify this segment's success.

In contrast, call centers are growing steadily in regions with limited digital access, particularly among older populations and in developing countries. Voice-based consultations over the phone remain relevant where patients lack smartphones or digital literacy. Several insurers also rely on call center-based nurse helplines for pre-authorizations and basic triage.

By Facility Insights

Tele-hospitals dominate the facility segment, driven by large-scale deployments in multi-specialty hospital chains and healthcare systems. These organizations often establish centralized telehealth departments to manage specialist consultations across locations. For example, the Mayo Clinic and Cleveland Clinic have advanced telehospital services that connect patients with world-class experts across specialties.

However, tele-homecare is the fastest-growing segment, empowered by wearable devices and home monitoring kits. Patients recovering from surgery, managing chronic conditions, or undergoing palliative care prefer being treated in the comfort of their homes. Tele-homecare services often include video consultations, daily vitals monitoring, and caregiver support. The rising elderly population and desire for aging in place further fuel this trend.

By End Use Insights

Healthcare providers dominate the end-use segment, as hospitals, clinics, and specialty centers constitute the primary implementers and consumers of telemedicine technologies. They use telehealth to expand patient outreach, reduce congestion in OPDs, and improve workflow efficiency. Provider-centric platforms are often deeply integrated with hospital IT systems, allowing seamless data exchange and appointment coordination.

Yet, patients are now the fastest-growing end-user group, with D2C apps gaining mainstream popularity. Tech-savvy individuals are turning to subscription-based services for everything from dermatology to endocrinology consultations. This trend is particularly visible among millennials and Gen Z who value convenience, privacy, and autonomy in managing their health.

By Regional Insights

North America leads the global telemedicine market, accounting for the largest share due to robust digital infrastructure, widespread health insurance, and favorable regulatory reforms. The U.S. government’s temporary expansion of telehealth reimbursement policies under Medicare and Medicaid during COVID-19 greatly accelerated adoption. Additionally, strong presence of market leaders like Teladoc, Amwell, and MDLIVE, coupled with ongoing innovation in AI and IoT healthcare tools, has made North America the hub of telemedicine excellence.

Conversely, Asia-Pacific is the fastest-growing region, buoyed by rapid digital transformation, increasing smartphone penetration, and rising healthcare demand in populous nations. Government initiatives like China’s Internet+Healthcare and India’s National Telemedicine Service have been pivotal in promoting adoption. Countries like Japan, South Korea, and Singapore are also leading in remote elderly care innovations. The region's vast rural population, coupled with public-private partnerships, continues to unlock new opportunities for telemedicine platforms.

Recent Developments

-

February 2025: Teladoc Health launched its next-gen AI-driven mental health platform, enabling adaptive care paths for patients with anxiety and depression.

-

January 2025: Practo Technologies rolled out multilingual AI chat support in India, targeting tier-2 and tier-3 cities with limited English fluency.

-

December 2024: Amwell partnered with Google Cloud to enhance its virtual care platform with advanced data analytics and speech recognition features.

-

November 2024: MDLIVE launched a chronic care management initiative using real-time wearable integration, initially targeting diabetic patients.

-

October 2024: Doctor Anywhere raised $50 million in Series C funding to expand telemedicine services across Southeast Asia and integrate digital pharmacies.

Key Telemedicine Companies:

- MDlive, Inc. (Evernorth)

- American Well Corporation

- Twilio Inc.

- Teladoc Health, Inc.

- Doctor On Demand, Inc. (Included Health)

- Zoom Video Communications, Inc.

- SOC Telemed, Inc.

- NXGN Management, LLC

- Plantronics, Inc.

- Practo

- VSee

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Telemedicine market.

By Component

- Product

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

By Modality

- Store and forward

- Real time

- Others

By Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

By Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

By Facility

By End-use

- Providers

- Payers

- Patients

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)