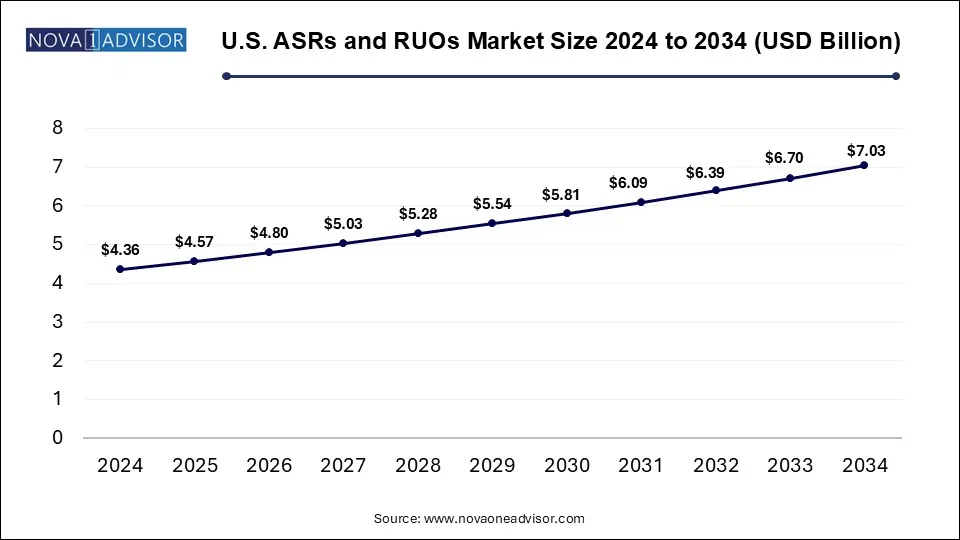

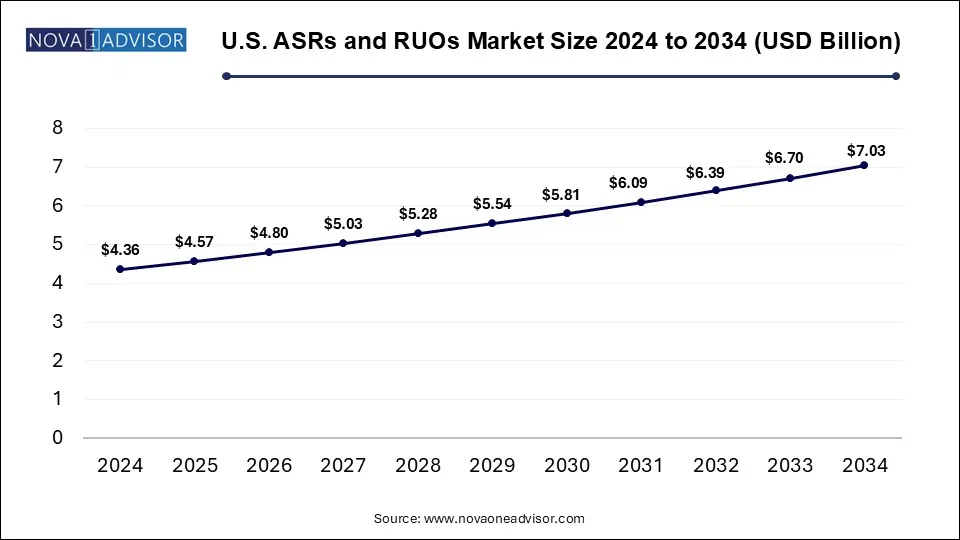

U.S. ASRs and RUOs Market Size and Trends

The U.S. ASRs and RUOs market size was valued at USD 4.36 billion in 2024 and is expected to be worth around USD 7.03 billion by 2034, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. The U.S. ASRs and RUOs market is thriving due to technological advancements, rising disease prevalence, personalized medicine, R&D, and AI integration, enhancing diagnostic accuracy and innovation.

U.S. ASRs and RUOs Market Overview

Analyte-Specific Reagents (ASRs) and Research Use Only (RUO) products are very much needed for diagnostic and research situations. The term ASRs relates to a class of specialized biological components such as an antibody, receptor protein, ligand, or nucleic acid sequence, which allow very specific identification and quantification of a chemical component within a biological sample. They are essentially the tools of the clinical diagnostics armamentarium by which one can develop methods of precision testing. RUO products are noncommercially intended for purposes of academic investigation, internal research, or the evaluation of products but are excluded from any activity for profit or clinical use. This is expected to push the U.S. market for ASRs and RUOs further since technological advances boost biotechnology, molecular diagnostics, and data analytics. Indeed, as research finds itself becoming ever more data-driven and precise, very sophisticated kinds of technologies will amplify the usefulness and effectiveness of ASRs and RUOs, thereby cementing their utility concerning new diagnostic development and exploratory research across the healthcare and life sciences sectors.

U.S. ASRs and RUOs Market Growth Factors

- Growing Demand for Precision Medicine: ASRs and RUOs are key components in developing laboratory-developed tests (LDTs) assisting in patient-specific treatment decisions.

- Growth of Molecular Diagnostics and Genomic Research: In genomics, transcriptomics, and proteomics developments, flexible reagents requiring custom design are ever more necessary.

- Increased Role of Academic and Clinical Research Institutions: Larger funding sources and collaborations are bottling increased research activity. RUOs are heavily relied upon for exploring disease mechanisms and biomarker development.

- Regulatory Flexibility Promoting Innovation: Compared to other tests, RUOs, and ASRs usually undergo a limited regulatory burden, allowing innovation and testing in truncated timelines.

- Increase in LDT Applications: ASRs used in LDTs for a few rare conditions create increasing demand for ASRs.

Report Scope of U.S. ASRs and RUOs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.57 Billion |

| Market Size by 2034 |

USD 7.03 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 4.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By End-user |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

BioLegend, Inc., ELITechGroup, BD, BioMerieux, Inc., Genetic Signatures, Thermo Fisher Scientific, Inc., Danaher Corporation

, DiaSorin Molecular LLC, LGC Biosearch Technologies, Altona Diagnostics GmbH, QIAGEN |

Driver

Innovative biotechnology as a catalyst for the market

Biotechnology and life sciences are rapidly expanding Analyte-Specific Reagent (ASR) and Research Use Only (RUO) markets. Advanced biotechnology imparts more functions into diagnostic tools to have multiple applications in diverse research and clinic areas. Advances in diagnostic techniques such as molecular assay and immunological testing have increased the demand for accurate and efficient reagents to obtain precise and timely results in disease detection. Advancements in cell and tissue culture techniques have also increased the value of ASRs and RUOs in microbiology research, antibiotic discovery, and diagnostic testing. The fusing of biotechnology with personalized medicine, and targeted diagnostics underscores the clear relevance of these reagents to 21st-century healthcare and research. As such, ASRs and RUOs become core elements of scientific accuracy, efficiency, and flexibility fueling the long-term growth and future breakthroughs in the market as laboratories and medical institutions adopt new tools.

Opportunity

AI integration boosts market growth

Artificial intelligence incorporation into analyte-specific reagents and research-use-only products revolutionizes medical diagnostics and research. In the ASR software that surrounds RUO applications, integrative AI researchers process and analyze such data much faster and with greater accuracy, leading to improved outcomes in experimental and diagnostic predicaments. AI-enhanced experimenting tools can detect hidden patterns and similarities among heterogeneous biological data that can be utilized to produce more effective diagnostic tools and streamline the research workflow. AI’s speed and consistency with which it interprets data reduce research timelines for obtaining results and boost confidence in the results obtained. This evolution of AI with ASR and RUO is creating a vibrant environment where innovation thrives that will make laboratories and biotechs operate more efficiently whilst speeding up the process of making informed decisions about experimentation to be able to delve into new realms of personalized medicine and understanding of disease.

Restraint

Regulatory challenges in the ASRs and RUOs

Regulatory issues abound for the ASRs and RUO market present in the U.S., especially regarding fulfilling FDA dictates. ASRs are put to the rigors in proving safety, efficacy, and intended use in diagnostics. But ASRs and RUOs are rarely ever differentiated, and RUO-labeled products have started being used in the clinical realm. This should be viewed as a violation of compliance. RUO products are not meant for diagnostic or therapeutic purposes, but practical governance over their use remains ambiguous. Also, the manufacturers are limited in marketing RUO-labeled products, and any suggestion of clinical implications may be regarded by authorities as triggering a regulatory event. The situation gets even more complicated with multiple interpretations of these regulations, thus getting even more complex and exacerbated for different stakeholders, including laboratory manufacturers and regulators. Solving these issues is a prerequisite for a transparent and growth-oriented regulatory environment.

Segment Analysis

U.S. ASRs and RUOs Market By End User

Human healthcare dominated the market. This segment is exploiting the full potential of ASRs and RUOs to maximize testing performance and ultimately deliver quality patient outcomes. Likewise, this sector is getting fast-tracked owing to the hike in the salt and pepper research and development activity in the market, leading to the introduction of some fresh products and newest technologies. Healthcare establishments and diagnostic facilities are integrating advanced reagents into their work processes to benefit early disease detection and therapeutic monitoring of complex conditions such as cancers, infectious diseases, and genetic disorders. In the human life sciences stream, benefits accrued with continuous developments in biotechnology and diagnostics are likely to keep this sector on an extremely positive growth trajectory in terms of market revenue and investor interest.

Some of The Prominent Players in The U.S. ASRs and RUOs Market Include:

- BioLegend, Inc.

- ELITechGroup

- BD

- BioMerieux, Inc.

- Genetic Signatures

- Thermo Fisher Scientific, Inc.

- Danaher Corporation

- DiaSorin Molecular LLC

- LGC Biosearch Technologies

- Altona Diagnostics GmbH

- QIAGEN

U.S. ASRs and RUOs Market Recent developments

- In March 2025, Biocartis NV launched the Idylla™ POLE-POLD1 Mutation Assay (RUO1), a fully automated real-time PCR assay for detecting hypermutated phenotypes associated with POLE and POLD1 mutations, a groundbreaking molecular diagnostics tool.

- In January 2025, Beckman Coulter Diagnostics introduced new Research Use Only (RUO) blood-based biomarker immunoassays to advance neurodegenerative disease research. These assays assess p-Tau217, GFAP, NfL, and APOE ε4 biomarkers, which are emerging as crucial biomarkers in neurodegenerative diseases research and interventional clinical trials.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. ASRs and RUOs Market

By End-user

- Human Healthcare

- Veterinary

- Environmental

- Food Industry

- Academic & Research Institutes

- Others