U.S. Dialysis Centers Market Size and Trends

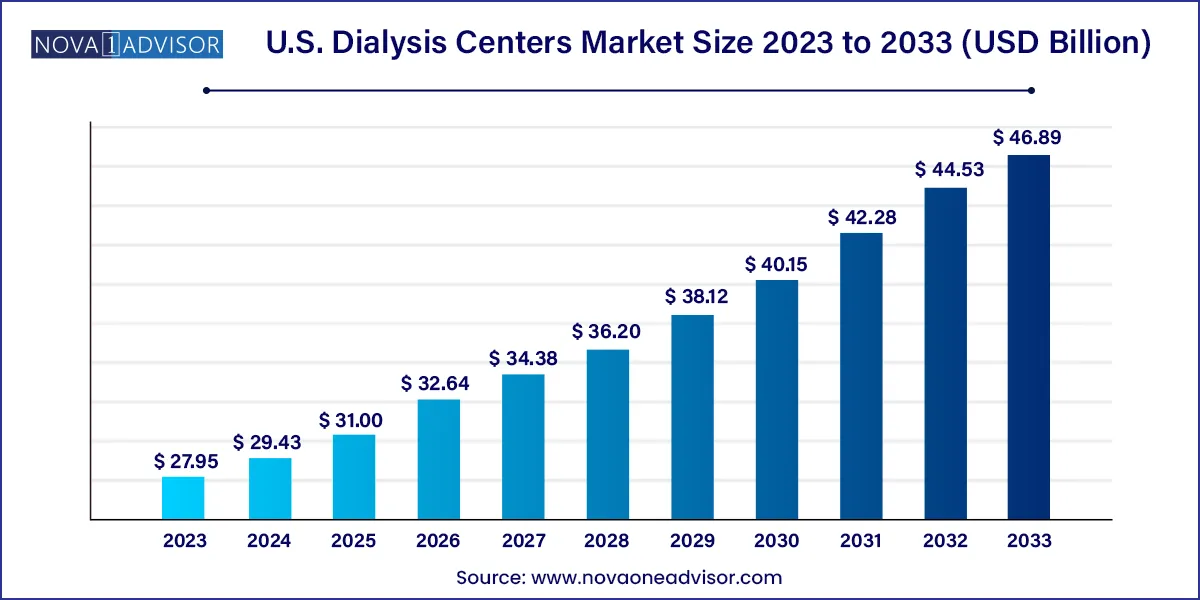

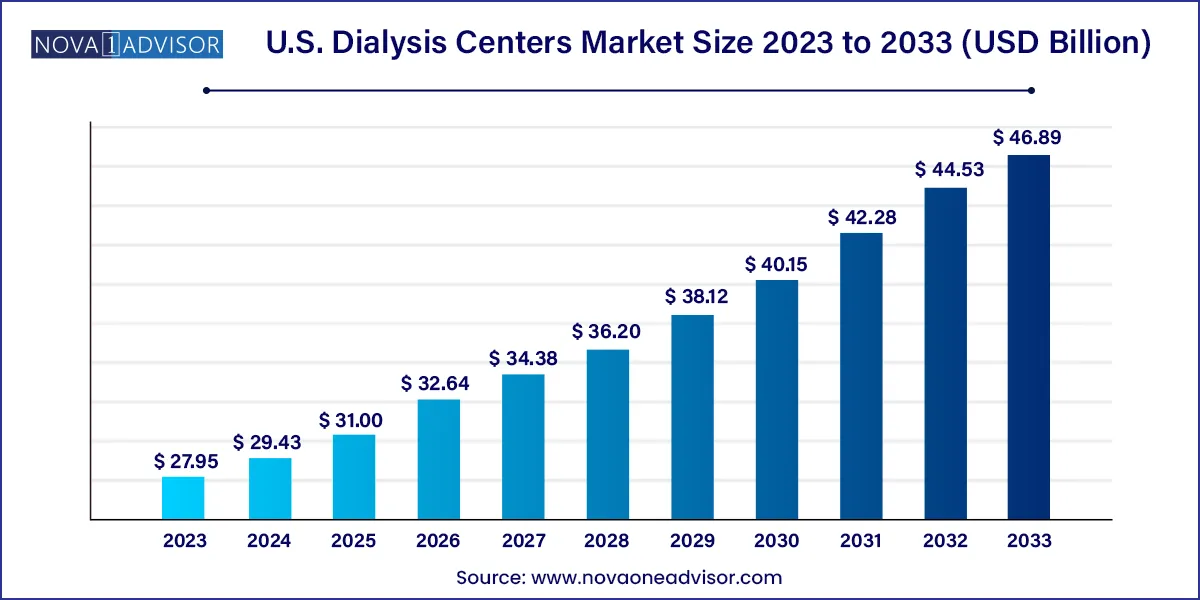

The U.S. dialysis centers market size was exhibited at USD 27.95 billion in 2023 and is projected to hit around USD 46.89 billion by 2033, growing at a CAGR of 5.31% during the forecast period 2024 to 2033.

Key Takeaways:

- In 2023, the in-center segment had the highest revenue share owing to the high adoption of the service.

- SNF-based modality is expected to have lucrative growth during the forecast period.

- In 2023, hemodialysis dominated the market.

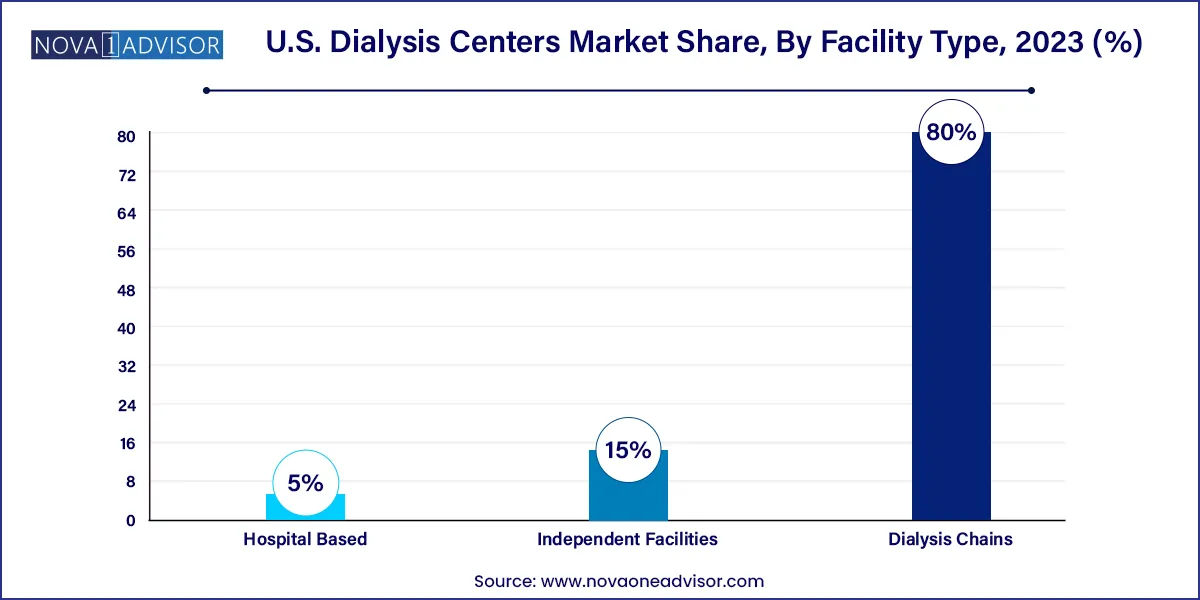

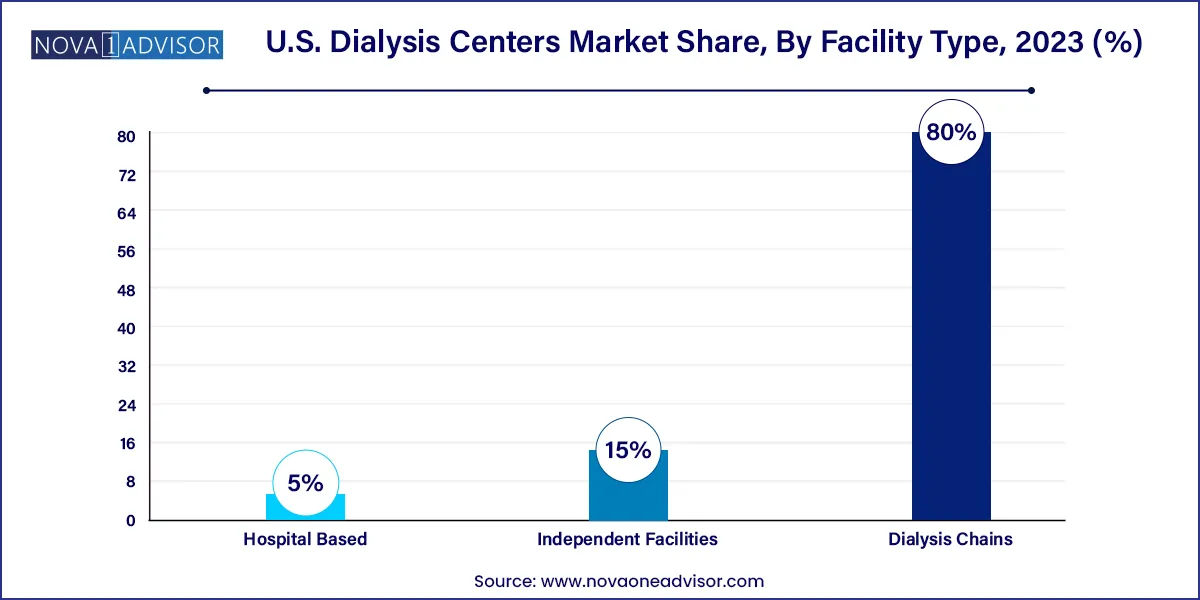

- In 2023, the dialysis chains dominated the industry owing to their presence across all states in the U.S. & better quality of the services offered by the chains at a national level.

- The Southeast region held a significant market share in 2023 owing to the high availability of facilities in the region.

- The Northeast region is expected to witness lucrative growth during the forecast period.

Market Overview

The U.S. dialysis centers market is a crucial segment of the nation’s healthcare infrastructure, designed to serve individuals suffering from chronic kidney diseases (CKD) and end-stage renal disease (ESRD). As of 2025, it continues to experience robust growth driven by the increasing prevalence of diabetes and hypertension—two of the leading causes of kidney failure. With over 37 million adults in the U.S. reportedly living with CKD, the demand for dialysis services has never been more pressing. Dialysis centers provide life-sustaining treatment to filter waste and toxins from the blood when the kidneys are no longer functioning adequately.

The market operates through a diverse array of service delivery models, including in-center, in-home, and skilled nursing facility (SNF)-based dialysis. Furthermore, technological advancements in dialysis equipment and a gradual shift toward home-based care are reshaping patient care strategies and accessibility. Despite ongoing challenges such as workforce shortages and high operational costs, the dialysis industry in the U.S. has proven to be resilient and adaptive, especially in the wake of the COVID-19 pandemic, which highlighted the need for remote and flexible treatment solutions.

The Centers for Medicare & Medicaid Services (CMS) play a pivotal role in the regulatory and reimbursement landscape of dialysis centers, directly influencing market dynamics. Public and private investments, along with supportive government policies such as the Advancing American Kidney Health Initiative, have set the tone for innovation, value-based care, and patient-centered outcomes in dialysis services.

Major Trends in the Market

-

Rise in home-based dialysis services, supported by telehealth advancements and improved patient training programs.

-

Integration of artificial intelligence (AI) and remote monitoring technologies to optimize treatment efficiency and patient safety.

-

Consolidation of independent facilities into large dialysis chains to improve service reach and reduce administrative costs.

-

Value-based care reimbursement models encouraging better health outcomes and cost-effectiveness.

-

Development of wearable and portable dialysis machines, especially for patients preferring mobility and independence.

-

Increased partnerships between hospitals and dialysis providers to expand reach into rural and underserved areas.

-

Focus on culturally competent care, especially in ethnically diverse regions of the U.S., to improve patient satisfaction and adherence.

Report Scope of The U.S. Dialysis Centers Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 29.43 Billion |

| Market Size by 2033 |

USD 46.89 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.31% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Modality, Dialysis Type, Facility Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Fresenius Medical Care AG & Co. KGaA; U.S. Renal Care, Inc.; DaVita Inc.; American Renal Associates; Dialysis Clinic, Inc.; Satellite Healthcare; Northwest Kidney Centers; Centers for Dialysis Care; Rogosin Institute; and Dialysis Care Center, USCF Health, Rhode Island Hospital, University of Iowa Hospital & Clinics; Saint Anthony Hospital, Rush Unit Children’s Hospital |

Key Market Driver: Rising Incidence of End-Stage Renal Disease (ESRD)

A critical driver of the U.S. dialysis centers market is the escalating number of ESRD cases, largely fueled by chronic illnesses like diabetes and hypertension. According to the United States Renal Data System (USRDS), approximately 800,000 people in the U.S. are living with ESRD, and over 60% of them undergo dialysis. The aging population particularly individuals above 65 years is significantly more prone to kidney-related complications, necessitating regular dialysis treatment. The increasing disease burden, paired with extended life expectancy due to advancements in healthcare, has led to a sustained surge in dialysis center visits. These facilities are vital in maintaining the quality of life for ESRD patients, and their continued expansion is a direct response to the ever-growing demand.

Key Market Restraint: Staffing Shortages and High Operational Costs

One of the most pressing restraints in the U.S. dialysis centers market is the shortage of skilled nephrology nurses and technicians, a challenge exacerbated by the high physical and emotional demands of the profession. Dialysis centers require highly trained personnel to operate complex equipment, monitor patients, and respond to emergencies, making staffing not just an operational necessity but also a compliance issue. This issue is compounded by rising costs associated with training, equipment procurement, utilities, and regulatory compliance. Smaller and independent facilities, in particular, struggle with sustainability, often leading to consolidation or closure—thereby impacting care access in rural or less economically viable regions.

Key Market Opportunity: Growth of In-home Dialysis with Telehealth Integration

The emergence of in-home dialysis, especially peritoneal dialysis (PD), coupled with telehealth-enabled remote monitoring, presents a substantial opportunity for growth. Patients and healthcare providers are increasingly favoring in-home dialysis due to its convenience, reduced infection risks, and lower cost implications. Companies are capitalizing on this trend by offering compact, easy-to-use devices with real-time connectivity to clinicians. For instance, platforms that alert caregivers in case of irregularities during a session are gaining momentum. This shift aligns with the broader healthcare industry’s movement toward decentralized, patient-centric care models, and opens up avenues for service innovation, particularly in tech-enabled patient education and support.

U.S. Dialysis Centers Market By Modality Insights

The in-center dialysis modality dominated the market in 2024, owing to its reliability, professional supervision, and insurance-friendly structure. These centers, often part of large dialysis chains, cater to patients who require frequent monitoring, complex vascular access, or are in early stages of treatment. With structured appointment systems and availability of emergency care, in-center dialysis remains the go-to option for the majority. Additionally, many elderly or comorbid patients prefer or are recommended for in-center care due to their physical limitations or lack of adequate home care infrastructure.

However, the in-home dialysis modality is the fastest-growing segment, driven by a rise in patient preference for flexibility, privacy, and reduced travel. Government support in the form of reimbursement models, especially under CMS’ ESRD Treatment Choices (ETC) Model, is pushing providers to expand home dialysis offerings. Moreover, companies are increasingly offering remote assistance, telemedicine consultations, and user-friendly devices to make in-home dialysis more accessible. This segment is expected to witness further acceleration with improvements in broadband penetration and digital literacy among patients.

U.S. Dialysis Centers Market By Dialysis Type Insights

Hemodialysis held the largest market share in 2024 due to its widespread clinical adoption and well-established procedural protocols. Most dialysis centers are equipped to provide hemodialysis, making it the default option for many ESRD patients. It is particularly suited for patients requiring rapid and efficient toxin removal. Technological innovations in hemodialysis machines, such as automated fluid management and better dialyzer membranes, have further strengthened its dominance.

In contrast, peritoneal dialysis (PD) is the fastest-expanding sub-segment, particularly within the in-home care structure. PD is less invasive and does not require regular trips to dialysis centers, making it attractive for working-age patients and those living in remote areas. Its rise is also attributed to increasing efforts by providers to educate patients about PD’s long-term benefits. Fresenius Medical Care and DaVita have launched dedicated programs to increase PD adoption, which is expected to drive significant growth in this segment.

U.S. Dialysis Centers Market By Facility Type Insights

Dialysis chains dominated the U.S. market in 2024 due to their expansive geographic footprint, standardization of care, and operational efficiencies. Major players like DaVita Inc. and Fresenius Medical Care operate hundreds of centers across states, offering patients convenience, uniformity, and trust. Their ability to negotiate better reimbursement rates, invest in R&D, and provide telehealth integration gives them a competitive edge over standalone facilities.

However, the hospital-based segment is anticipated to grow at the fastest rate, supported by increasing integration of nephrology services within larger healthcare systems. Patients admitted for comorbid conditions often receive dialysis in hospitals, making this a vital growth segment. Hospitals are also investing in outpatient dialysis centers to streamline transitions in care, especially for recently discharged patients. With healthcare systems pushing toward comprehensive care networks, hospital-based dialysis centers are set to grow significantly.

Country-Level Analysis: United States

In the U.S., the dialysis centers market shows regional variability driven by healthcare infrastructure, demographic factors, and state-level regulations. For instance, the Southeast region, including states like Florida and Georgia, shows higher dialysis prevalence due to elevated rates of diabetes and hypertension. Urban areas such as New York City, Los Angeles, and Chicago host some of the most advanced dialysis facilities with high patient throughput and cutting-edge technology.

The Midwest and Southwest are experiencing a growing number of SNF-based and home dialysis programs, often tailored for rural patients. The West Coast leads in terms of innovation and implementation of AI-enabled monitoring systems in home dialysis, thanks to proximity to technology hubs and higher digital literacy. The Northeast, while saturated with in-center facilities, is seeing policy shifts aimed at encouraging home dialysis adoption, with pilot programs launched across states like Massachusetts and Pennsylvania.

Some of the prominent players in the U.S. dialysis centers market include:

- Fresenius Medical Care AG & Co. KGaA

- U.S. Renal Care, Inc.

- DaVita Inc.

- American Renal Associates

- Dialysis Clinic, Inc.

- Satellite Healthcare

- Northwest Kidney Centers

- Centers for Dialysis Care

- Rogosin Institute

- Dialysis Care Center

- USCF Health

- Rhode Island Hospital

- University of Iowa Hospital & Clinics

- Saint Anthony Hospital

- Rush Unit Children’s Hospital

Recent Developments

-

Fresenius Medical Care (January 2025) launched its new connected dialysis care platform, enabling real-time data sharing between home patients and nephrologists. This initiative aims to improve treatment adherence and early detection of complications.

-

DaVita Inc. (February 2025) announced the expansion of its Hospital Services Group, partnering with 50 new hospitals to provide inpatient dialysis, bolstering its hospital-based service offerings.

-

Satellite Healthcare (March 2025) introduced its “Home First” initiative, a patient education campaign and remote support program to drive awareness and adoption of peritoneal dialysis in underserved communities.

-

U.S. Renal Care (April 2025) opened 12 new dialysis centers across Texas and Arizona, focusing on improving access in rural and Hispanic-majority populations.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. dialysis centers market

Modality

- In-center

- In-home

- SNF-based

Dialysis Type

- Hemodialysis

- Peritoneal Dialysis

Facility Type

- Dialysis Chains

- Independent Facilities

- Hospital Based

Region

- Northeast

- Southeast

- Southwest

- Midwest

- West