U.S. Group 2 Powered Mobility Devices Market Size and Research

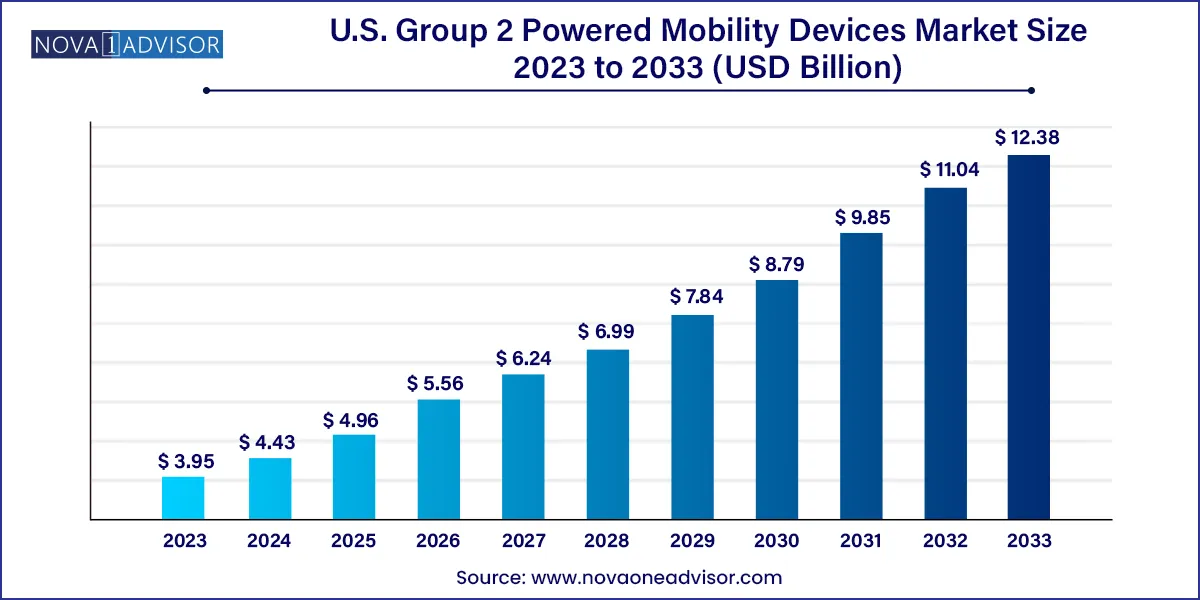

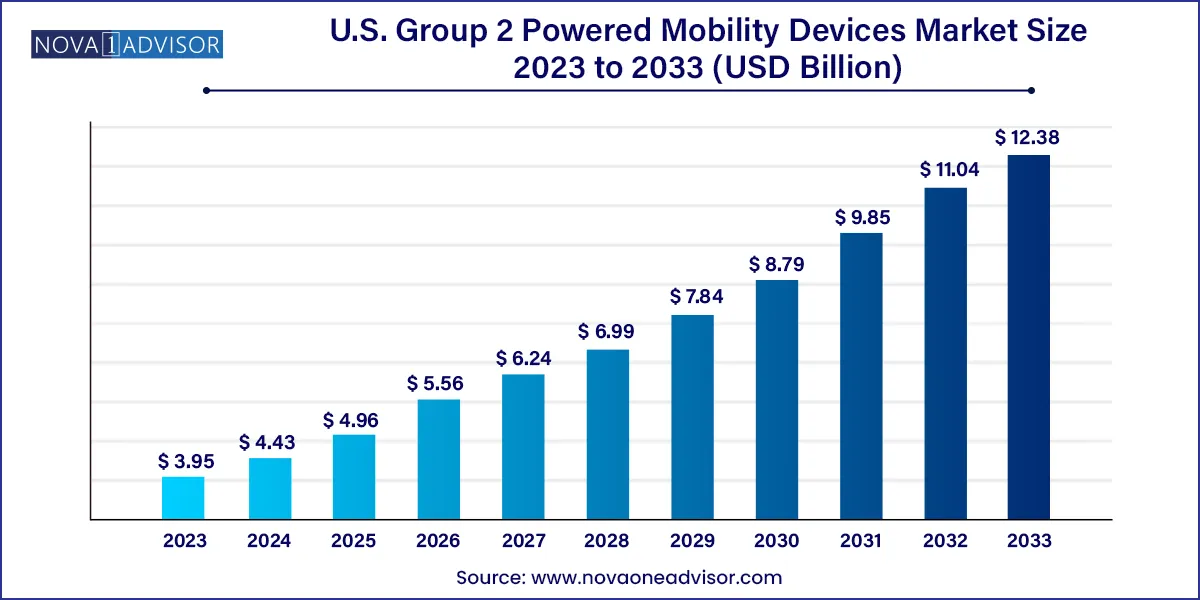

The U.S. group 2 powered mobility devices market size was exhibited at USD 3.95 billion in 2023 and is projected to hit around USD 12.38 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2024 to 2033.

Key Takeaways:

- The powered wheelchairs segment accounted for the leading share of more than 65.5% of the U.S. market in 2023.

- The out-of-pocket payment type segment dominated the U.S. group 2 powered mobility devices market with a share of 83.2% in 2023

- The segment will also exhibit the highest CAGR during the forecast period and will, therefore, retain its position through 2033.

- The general population segment dominated the U.S. group 2 powered mobility devices market with a share of 98.0% in 2023.

- The VA segment is also expected to witness a lucrative growth rate of 8.8% during the forecast period.

- In 2023, the USD 5,000-9,000 segment was the highest revenue generator and accounted for 76.3% of the market share.

Market Overview

The U.S. Group 2 Powered Mobility Devices (PMDs) market is witnessing a transformative shift driven by an aging population, evolving healthcare policies, and advances in assistive technology. Group 2 PMDs, which include power wheelchairs and power-operated vehicles (POVs), are intended for individuals with mobility limitations who can still operate the device independently but require powered support for daily movement. Unlike Group 1 PMDs, Group 2 devices offer superior maneuverability, adaptability for home and outdoor use, and enhanced features like adjustable seating, joystick control, and multiple drive settings.

In the United States, the demand for these mobility solutions is rising in tandem with the increasing prevalence of mobility-impairing conditions such as multiple sclerosis, spinal cord injuries, and severe arthritis. Moreover, initiatives from Medicare and other insurance providers to reimburse qualified devices under certain clinical guidelines have further accelerated market growth. Technological innovation has also played a pivotal role in increasing product accessibility and improving user satisfaction. Integration of IoT and AI in mobility devices is pushing boundaries, enabling smart navigation, remote monitoring, and predictive maintenance.

With numerous product offerings available across various price points and sales channels, the U.S. market is not only competitive but also primed for innovation. Key market stakeholders include medical device manufacturers, rehabilitation service providers, healthcare institutions, and government agencies such as the Department of Veterans Affairs (VA).

Major Trends in the Market

-

Rising Adoption of Smart Features: Integration of AI and IoT in powered mobility devices for real-time navigation assistance, diagnostics, and safety monitoring.

-

Growth of E-commerce Sales Channels: Increasing number of elderly consumers turning to online platforms for the purchase of mobility devices, especially post-COVID-19.

-

VA-driven Procurement Programs: Expanding support from the Department of Veterans Affairs in providing high-quality powered mobility devices to eligible veterans.

-

Focus on Customization: Surge in demand for personalized features such as adjustable armrests, programmable control systems, and postural support options.

-

Emergence of Lightweight and Foldable Devices: Market shift toward easy-to-transport powered wheelchairs catering to active and semi-independent users.

-

Payment Flexibility and Financing Options: Rise in vendors offering EMI, lease-to-own, and insurance-covered payment solutions.

Report Scope of The U.S. Group 2 Powered Mobility Devices Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.43 Billion |

| Market Size by 2033 |

USD 12.38 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Payment Type, Sales Channel, End-use, Price-range |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Golden Technologies; Pride Mobility Products Corporation; Invacare Corporation; National Seating & Mobility; Numotion; 1800wheelchair.com; EZ Lite Cruiser; Shoprider Mobility Products, Inc.; Medical Depot, Inc. (Drive DeVilbiss Healthcare) |

Market Driver: Growing Aging Population

A significant driver propelling the U.S. Group 2 PMDs market is the increasing elderly population. According to the U.S. Census Bureau, over 54 million Americans were aged 65 and older as of 2021, a figure projected to reach over 70 million by 2030. This demographic shift directly correlates with a rise in age-associated mobility impairments such as osteoarthritis, Parkinson's disease, and post-stroke disabilities. Group 2 PMDs offer a practical and dignified solution for older adults to maintain independence and improve their quality of life. Additionally, as seniors increasingly prefer aging in place over institutional care, the demand for reliable and user-friendly mobility solutions has surged. This trend has prompted manufacturers to develop more ergonomically designed and smart-enabled devices tailored to senior users.

Market Restraint: Reimbursement Challenges

Despite increasing demand, reimbursement policies remain a major bottleneck in the U.S. Group 2 PMDs market. Stringent qualification criteria established by Medicare and private insurers often delay or prevent access to mobility devices. For instance, patients must demonstrate an "in-home need" under Medicare coverage, limiting usage outside the home setting. Furthermore, the documentation and approval process can be lengthy and cumbersome, deterring both healthcare providers and patients. As a result, many potential users are either forced to pay out-of-pocket or settle for inferior solutions, stalling overall market growth. These constraints highlight the need for policy reforms and a more inclusive reimbursement ecosystem that acknowledges the changing lifestyles and needs of mobility-impaired individuals.

Market Opportunity: Technological Advancements in PMDs

Technological innovation presents a significant growth opportunity in the U.S. Group 2 PMDs market. Advances in motor technology, lithium-ion battery systems, and control interfaces have revolutionized the user experience. For example, devices with gyroscopic balancing systems allow smoother navigation through uneven terrains, while joystick-controlled systems with Bluetooth capabilities offer greater control and ease of use. Some manufacturers are also introducing voice-activated controls and integration with smart home systems to enable seamless interaction. These advancements not only appeal to younger mobility device users but also attract tech-savvy older adults seeking greater independence. As innovation continues to evolve, companies that invest in R&D for smarter, lighter, and more adaptive PMDs are expected to capture significant market share.

U.S. Group 2 Powered Mobility Devices Market By Product Type Insights

Powered wheelchairs dominated the product type segment due to their versatility, ease of indoor and outdoor use, and enhanced maneuverability. These devices are particularly preferred for patients with higher mobility impairments who require features such as tilt-in-space or recline functions for comfort and pressure relief. Unlike POVs, powered wheelchairs are better suited for navigating confined spaces such as homes and healthcare facilities. Additionally, innovations in compact frame designs and joystick precision have made powered wheelchairs more desirable.

On the other hand, Power Operated Vehicles (POVs) are expected to be the fastest-growing segment. These devices offer a more rugged and aesthetically pleasing alternative for mobile users who are more active and often travel longer distances. Many POVs resemble scooters, appealing to users who prefer a less clinical look. The growing demand from semi-independent elderly individuals and those with mild impairments supports the accelerated growth of this segment. The market is also benefitting from the inclusion of features like all-terrain wheels, high-back seating, and extended battery ranges.

U.S. Group 2 Powered Mobility Devices Market By Payment Type Insights

Reimbursement is the leading segment under payment types, primarily because of the availability of federal programs like Medicare and VA benefits, which significantly reduce the cost burden for eligible individuals. Healthcare providers often prioritize reimbursed solutions due to their perceived quality assurance and safety standards. Additionally, awareness initiatives by mobility device vendors and insurance consultants have improved public understanding of how to qualify for reimbursement, further driving segment growth.

Conversely, out-of-pocket payment is seeing the fastest growth, particularly among individuals who do not meet insurance criteria but still require mobility assistance. This segment includes both the elderly who prefer premium models with added comfort and younger users with temporary injuries or disabilities. The growth of e-commerce platforms and availability of flexible financing options are also propelling this segment, as users increasingly seek immediate and convenient purchasing solutions.

U.S. Group 2 Powered Mobility Devices Market By Sales Channel Insights

Veteran Affairs (VA) remains the dominant sales channel, given its expansive reach, robust funding, and long-standing partnerships with top mobility device manufacturers. The VA ensures that veterans with service-connected disabilities receive high-quality PMDs that are tailored to their specific clinical needs. Their rigorous selection process also assures product reliability, making this channel highly preferred among manufacturers.

Meanwhile, e-commerce is the fastest-growing sales channel. The COVID-19 pandemic accelerated digital transformation in healthcare retail, and mobility device vendors quickly adapted by enhancing online product catalogs, adding virtual consultations, and offering direct-to-home delivery. Customers now enjoy comparing features, reading reviews, and customizing products online, which has created a convenient alternative to in-person purchases.

U.S. Group 2 Powered Mobility Devices Market By End-use Insights

VA end-use leads the market owing to high penetration of powered mobility devices among U.S. military veterans. The Department of Veterans Affairs offers tailored services, rehabilitation programs, and financial support, making it easier for veterans to access advanced devices. The collaboration between VA hospitals, rehabilitation centers, and PMD manufacturers enhances service quality and customer satisfaction.

However, the general population end-use segment is expected to grow rapidly. As awareness of Group 2 PMDs expands beyond traditional users, more individuals with chronic illnesses, temporary disabilities, or post-surgical mobility limitations are opting for powered mobility solutions. Increased independence, comfort, and cost-effectiveness are among the key factors influencing this shift. Consumer-facing brands are also increasingly marketing their products directly to individuals and caregivers, further fueling this segment.

U.S. Group 2 Powered Mobility Devices Market By Price-range Insights

The $1,000-$4,999 price range dominates the market, largely because it includes a broad array of basic yet high-quality powered mobility devices covered under most insurance plans. These models typically include standard powered wheelchairs and POVs that meet clinical guidelines for Medicare and VA coverage. Vendors in this segment benefit from volume sales driven by affordability and coverage.

Devices priced between $9,000 and above are growing at the fastest pace, fueled by consumer interest in premium features and personalization. These high-end models often include customizable seating systems, advanced battery technologies, remote control features, and robust safety mechanisms. Wealthier individuals or those seeking top-tier solutions for long-term use are contributing significantly to this segment’s expansion.

Country-Level Analysis (United States)

The U.S. remains a fertile market for Group 2 powered mobility devices due to several socio-economic and policy factors. The healthcare ecosystem strongly supports mobility-impaired individuals through Medicare, Medicaid, and extensive VA services. Additionally, public and private healthcare providers frequently collaborate with device manufacturers to ensure patient-centered solutions. The country's emphasis on independent living, combined with robust technological infrastructure, makes it an ideal environment for adoption and innovation in PMDs.

Furthermore, urban infrastructure in most American cities is increasingly accommodating mobility devices through accessible transport systems, ramps, and pedestrian pathways. Regulatory oversight from bodies like the FDA ensures quality control, while non-profit advocacy groups actively promote accessibility and inclusion. The strong culture of digital adoption also allows e-commerce channels to thrive, creating a dynamic and multi-faceted marketplace for Group 2 PMDs.

Some of the prominent players in the U.S. group 2 powered mobility devices market include:

- Golden Technologies

- Pride Mobility Products Corporation

- Invacare Corporation

- National Seating & Mobility

- Numotion

- 1800wheelchair.com

- EZ Lite Cruiser

- Shoprider Mobility Products, Inc.

- Medical Depot, Inc. (Drive DeVilbiss Healthcare).

Recent Developments

-

February 2025: Pride Mobility Products announced the launch of its new AI-powered Jazzy Smart Chair, which includes voice-assist, terrain sensing, and automated maintenance alerts.

-

January 2025: Invacare Corporation reported its partnership with the VA for a pilot program supplying customized powered wheelchairs to veterans in remote areas via mobile service units.

-

December 2024: Golden Technologies introduced a foldable power scooter under $4,000, aiming at the budget-conscious e-commerce demographic.

-

November 2024: Drive DeVilbiss Healthcare expanded its e-commerce footprint by launching a direct-to-consumer portal with AR-based device simulations.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. group 2 powered mobility devices market

Product Type

- Powered Wheelchairs

- Power Operated Vehicle

Payment Type

- Reimbursement

- Out-of-Pocket

Sales Channel

- Retail

- E-commerce

- Direct Sales (excluding VA)

- Veteran Affairs

End-use

Price-range

- 1,000-4,999

- 5,000-9,000

- 9,000 and above