Advanced Therapy Medicinal Products Market Size and Trends

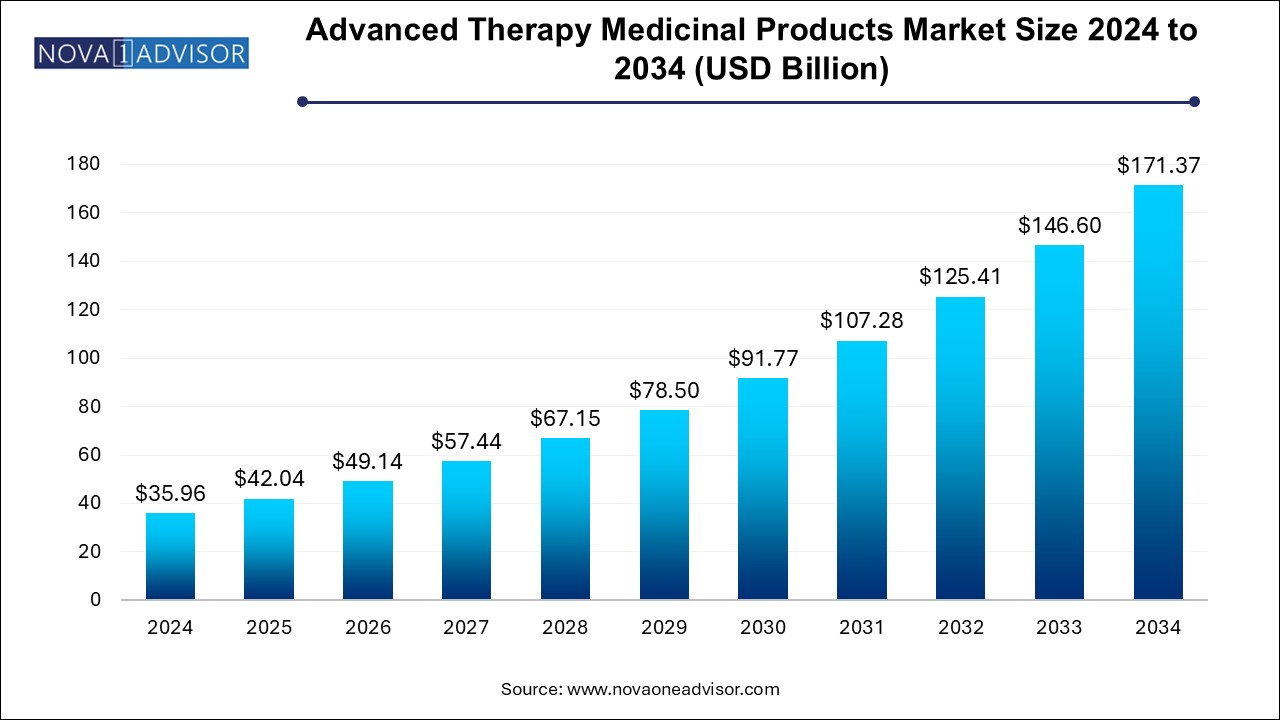

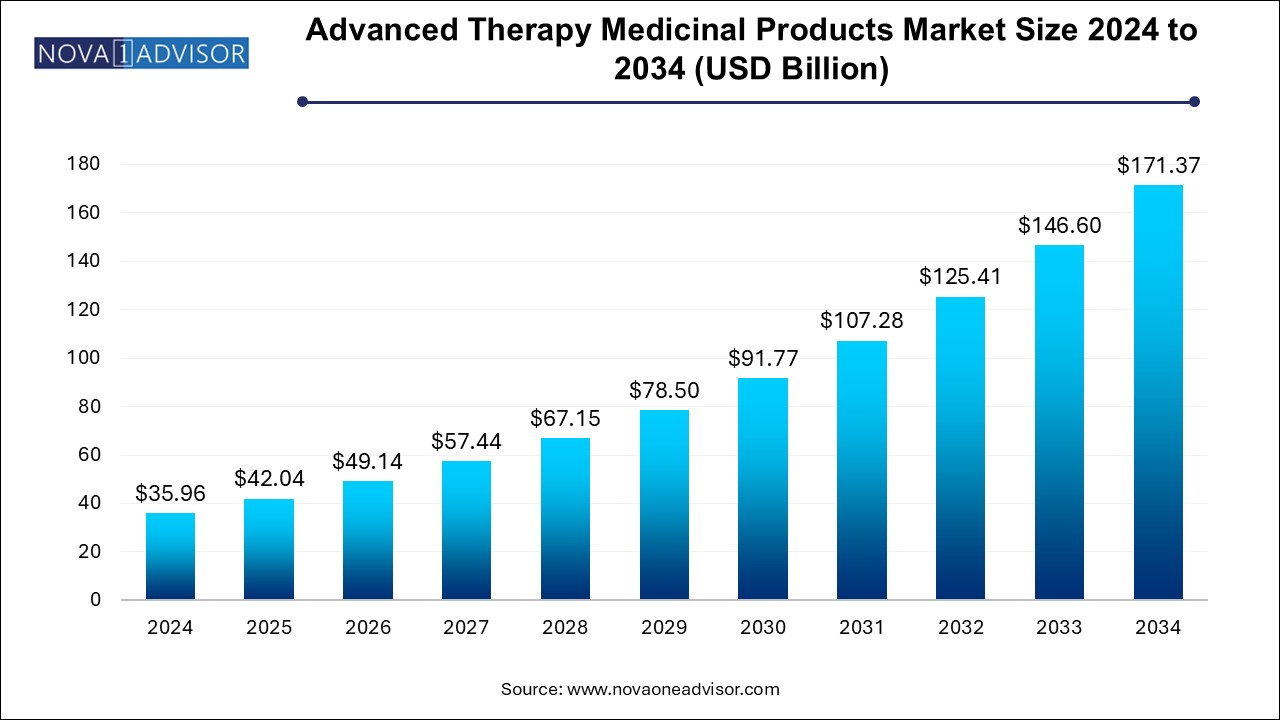

The advanced therapy medicinal products market size was exhibited at USD 35.96 billion in 2024 and is projected to hit around USD 171.37 billion by 2034, growing at a CAGR of 16.9% during the forecast period 2024 to 2034.

Advanced Therapy Medicinal Products Market Key Takeaways:

- North America dominated the advanced therapy medicinal products industry and accounted for the largest revenue share of 45.0% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 21.4%during the forecast period.

Market Overview

The advanced therapy medicinal products (ATMP) market represents a revolutionary frontier in the global healthcare industry, merging biotechnology, regenerative medicine, and personalized therapies. ATMPs encompass cell therapies, gene therapies, and tissue-engineered products, offering curative potential for previously intractable diseases such as rare genetic disorders, certain cancers, and degenerative conditions.

Unlike conventional pharmaceuticals that primarily manage symptoms, ATMPs aim to repair, replace, or regenerate diseased tissues or genetic anomalies at a fundamental level. Landmark approvals of products like CAR-T cell therapies, gene replacement therapies (e.g., Luxturna, Zolgensma), and bioengineered skin grafts have validated ATMPs’ clinical promise.

Rising incidences of genetic disorders, cancers, and chronic diseases, coupled with breakthroughs in stem cell research, CRISPR gene-editing technologies, and biomaterials science, have created an unprecedented innovation ecosystem. Regulatory agencies such as the FDA (U.S.) and EMA (Europe) have established specialized pathways (e.g., Regenerative Medicine Advanced Therapy – RMAT designation) to accelerate the clinical development and commercialization of ATMPs.

Despite technical and regulatory challenges, massive investments by biopharmaceutical giants, venture capitalists, and government bodies are fueling rapid market expansion. ATMPs are poised not just to transform therapeutic paradigms but also to reshape the economics of healthcare in the coming decades.

Major Trends in the Market

-

Increased Approvals of Gene and Cell Therapies: Momentum gaining with a growing number of ATMPs securing regulatory green lights.

-

Expansion of Allogeneic ("Off-the-Shelf") Therapies: Addressing manufacturing and scalability challenges of autologous therapies.

-

Advances in CRISPR and Gene-editing Technologies: Facilitating the development of next-generation gene therapies.

-

Adoption of Innovative Manufacturing Techniques: Automation, closed-system processing, and modular manufacturing platforms scaling ATMP production.

-

Emergence of Personalized Regenerative Medicine: Tailoring ATMPs to individual genetic or molecular profiles.

-

Strategic Partnerships and M&A Activity: Biopharma consolidations aimed at building robust ATMP pipelines.

-

Increased Investment in Supply Chain Infrastructure: Cold chain logistics and GMP-compliant facilities expanding globally.

-

Focus on Rare and Orphan Diseases: ATMP developers increasingly targeting smaller patient populations with high unmet needs.

Report Scope of Advanced Therapy Medicinal Products Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 42.04 Billion |

| Market Size by 2034 |

USD 171.37 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 16.9% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Therapy Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Spark Therapeutics, Inc.; Bluebird Bio, Inc.; Novartis AG; UniQure N.V.; Celgene Corporation; Gilead Lifesciences, Inc.; Kolon TissueGene, Inc.; JCR Pharmaceuticals Co., Ltd.; MEDIPOST; Vericel Corporation; PHARMICELL Co., Ltd; Organogenesis Inc. |

Key Market Driver: Rising Demand for Curative Therapies for Rare Diseases and Cancers

The primary driver accelerating the ATMP market is the growing demand for curative therapies addressing rare diseases and oncology indications.

Rare genetic disorders and aggressive cancers often have limited or no treatment options, leaving patients with unmet medical needs. ATMPs such as gene replacement therapies for spinal muscular atrophy (SMA) or CAR-T therapies for refractory leukemias offer durable or even curative outcomes by addressing root causes rather than merely controlling symptoms.

Patient advocacy, regulatory incentives like orphan drug designation, and high reimbursement rates for successful ATMPs are creating strong commercial incentives. Consequently, the ATMP pipeline is expanding rapidly, with hundreds of clinical trials underway globally, spanning indications such as hemophilia, retinal dystrophy, glioblastoma, and Duchenne muscular dystrophy.

Key Market Restraint: High Costs and Complex Manufacturing Processes

Despite the promise of ATMPs, high treatment costs and complex manufacturing processes remain significant barriers to widespread adoption.

Manufacturing ATMPs, especially autologous cell therapies, involves individualized, labor-intensive procedures requiring stringent GMP compliance, cold chain management, and high process variability. The cost of production often translates into extraordinarily high list prices—upwards of USD 500,000 to USD 2 million per treatment creating affordability and reimbursement challenges even in high-income markets.

Additionally, scaling up manufacturing while ensuring product consistency and regulatory compliance is a significant hurdle, particularly for early-stage biotech companies. Solving these challenges through technological innovations, centralized production hubs, or allogeneic therapy platforms will be crucial for sustainable market growth.

Key Market Opportunity: Expansion of Allogeneic and Off-the-Shelf ATMPs

A transformative opportunity lies in the expansion of allogeneic (“off-the-shelf”) ATMPs, which can be manufactured in large batches and stored until needed, overcoming many limitations of autologous (patient-specific) therapies.

Allogeneic stem cells, T-cells, and engineered tissues derived from healthy donors offer scalability, cost reduction, and broader patient access. Companies are increasingly investing in genome editing technologies to reduce immunogenicity and graft-versus-host risks in allogeneic therapies.

For example, the approval of allogeneic CAR-T therapies under investigation by companies like Allogene Therapeutics and Celyad Oncology indicates a shift towards more commercially viable ATMP models. Allogeneic approaches will likely dominate future pipelines in oncology, regenerative orthopedics, and rare disease therapeutics.

Advanced Therapy Medicinal Products Market By Therapy Type Insights

Cell therapy dominates the therapy type segment, holding the largest share owing to the early clinical success and commercial approvals of therapies like Novartis' Kymriah and Gilead’s Yescarta. Cell therapies involve modifying or transplanting live cells to replace damaged tissues or reprogram immune responses, particularly in cancer treatment (CAR-T), orthopedic applications, and cardiovascular regeneration.

Gene therapy is growing fastest, fueled by breakthroughs in delivery vectors (AAVs, lentivirus), gene-editing platforms (CRISPR/Cas9), and regulatory approvals such as Zolgensma (SMA) and Luxturna (retinal dystrophy). Gene therapies promise single-administration cures, transforming patient outcomes and drawing substantial investment attention, particularly for monogenic disorders and inherited blindness.

Advanced Therapy Medicinal Products Market By Regional Insights

Europe currently leads the ATMP market, supported by a strong regulatory framework under the European Medicines Agency (EMA) and the Committee for Advanced Therapies (CAT), which specifically addresses ATMP evaluation and approval.

Countries like Germany, the UK, Spain, and France have active clinical trial ecosystems, sophisticated healthcare infrastructures, and favorable reimbursement policies for ATMPs, especially under health technology assessment (HTA) frameworks for rare diseases. Initiatives like the European Advanced Therapies Investor Day and Horizon Europe funding further boost Europe's leadership.

Europe’s experience in early approvals (e.g., Holoclar, an autologous stem cell therapy for corneal burns) and collaborative regulatory models (e.g., PRIME designation) continue to make it a preferred region for ATMP development and commercialization.

Asia-Pacific is witnessing the fastest growth, driven by increasing investments in regenerative medicine, expanding healthcare infrastructure, and rising demand for innovative therapeutics.

China, Japan, South Korea, and Australia are investing heavily in stem cell research, gene editing technologies, and ATMP manufacturing capabilities. Regulatory agencies like Japan's Pharmaceuticals and Medical Devices Agency (PMDA) have introduced expedited pathways for regenerative medicine products, accelerating market entry.

Moreover, the rising prevalence of genetic diseases, coupled with growing affordability and government support, positions Asia-Pacific as a key ATMP growth engine for the coming decade.

Some of the prominent players in the advanced therapy medicinal products market include:

Recent Developments

-

March 2025: Novartis announced plans to expand its manufacturing capacity for Kymriah CAR-T therapy with a new facility in Spain, boosting European supply chain resilience.

-

February 2025: Bluebird Bio received FDA approval for Skysona, a gene therapy for cerebral adrenoleukodystrophy, marking a major milestone in rare neurogenetic disorders.

-

January 2025: CRISPR Therapeutics and Vertex Pharmaceuticals initiated Phase 3 trials of their CRISPR-based gene therapy CTX001 for sickle cell disease and beta-thalassemia.

-

December 2024: Orchard Therapeutics launched Libmeldy commercially in Europe, the first ex vivo gene therapy for metachromatic leukodystrophy (MLD).

-

November 2024: Celyad Oncology received fast-track designation from the FDA for CYAD-211, an allogeneic CAR-T therapy for multiple myeloma.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the advanced therapy medicinal products market

By Therapy Type

-

- Stem Cell Therapy

- Non-stem Cell Therapy

- Gene Therapy

- Tissue Engineered Product

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)