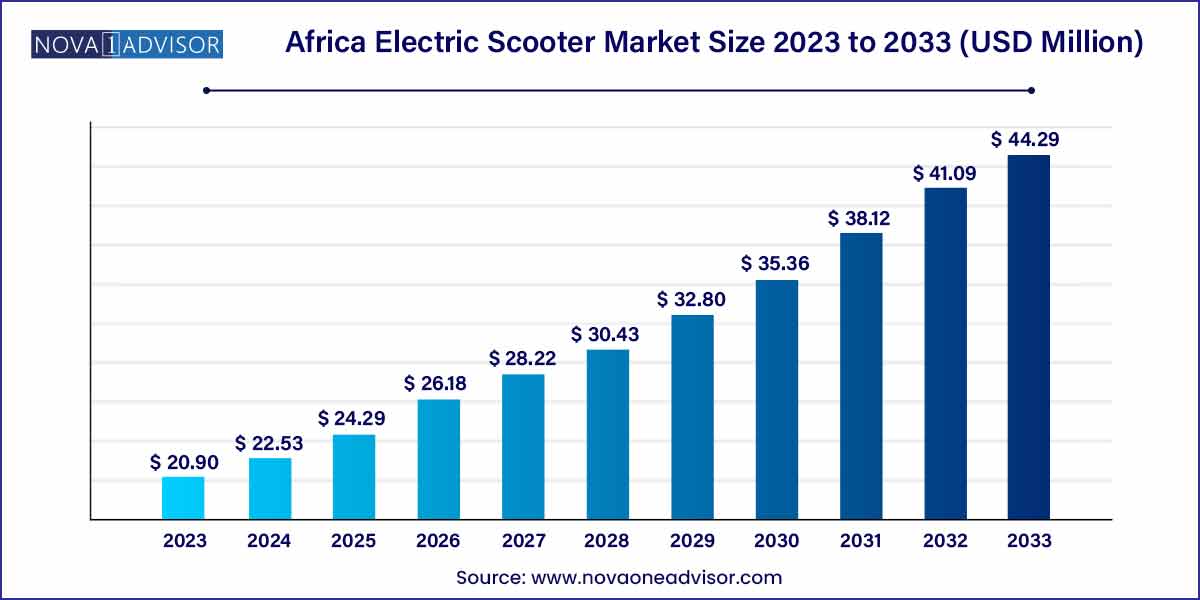

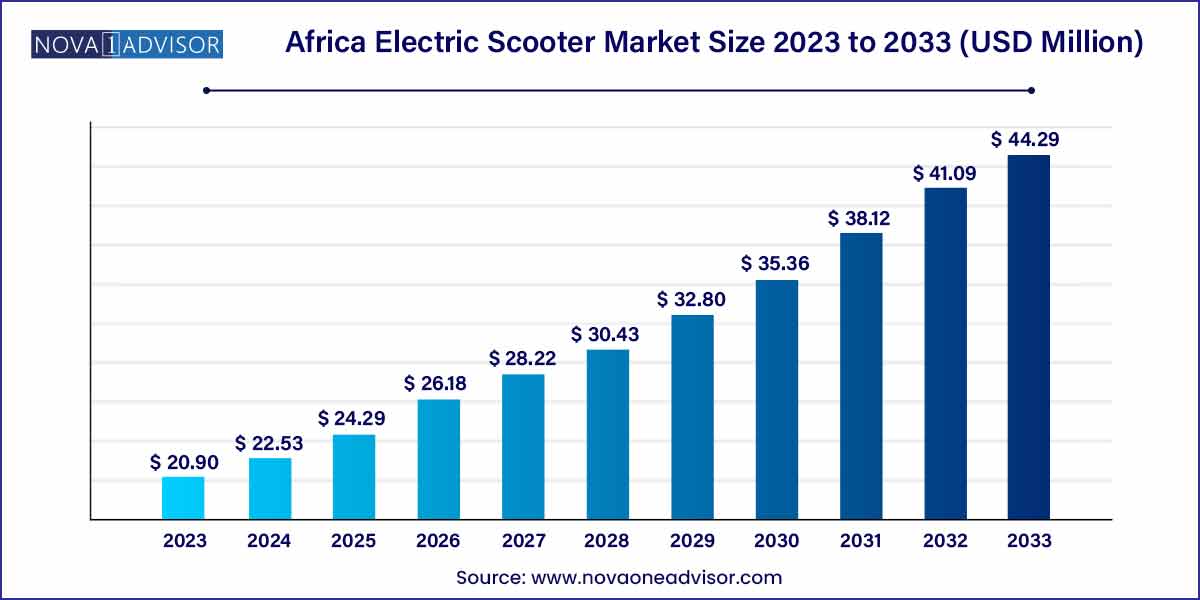

The global Africa electric scooter market size was exhibited at USD 20.90 million in 2023 and is projected to hit around USD 44.29 million by 2033, growing at a CAGR of 7.8% during the forecast period of 2024 to 2033.

Key Takeaways:

- The retro/self-start segment accounted for a revenue share of 58.7% in 2023.

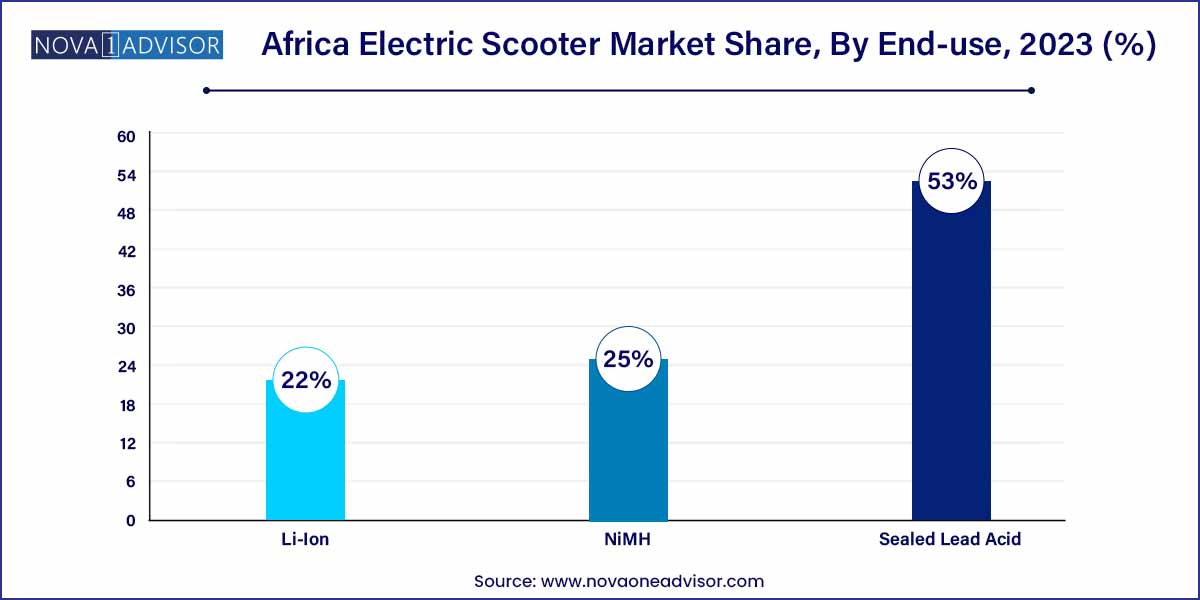

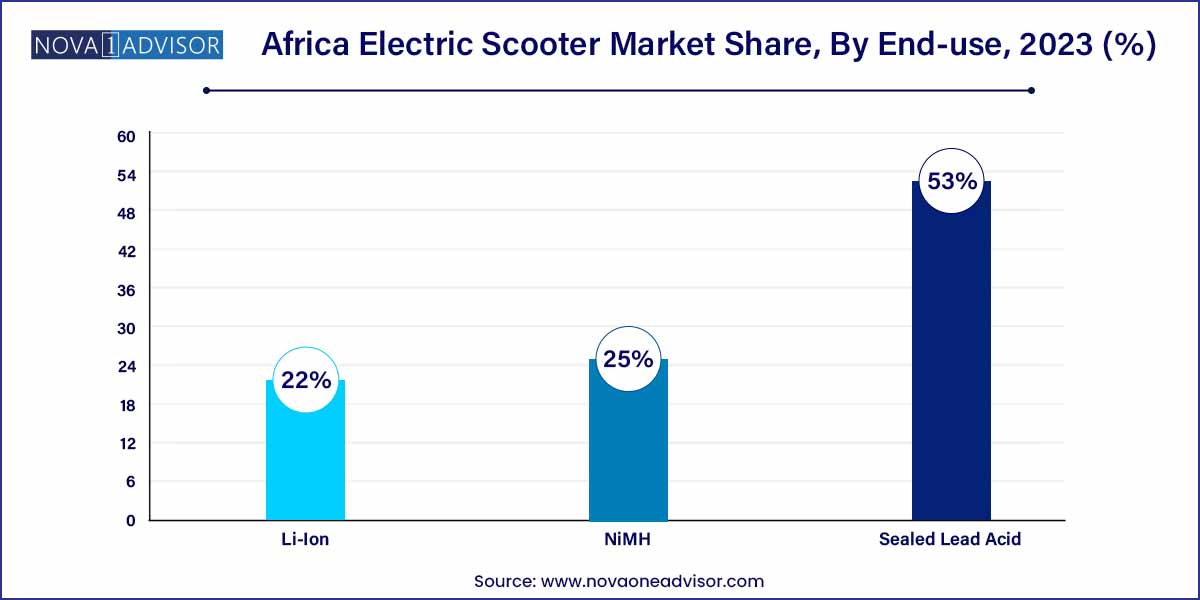

- The sealed lead-acid segment holds a market share of more than 53% in 2023 and is expected to remain dominant during the forecast period.

- The 36V segment will hold a market share of 55.1% in 2023.

Africa Electric Scooter Market: Overview

The Africa electric scooter market is gradually emerging as a dynamic and transformative segment within the broader mobility and transportation landscape of the continent. With growing urbanization, increasing awareness around sustainability, and the urgent need for cost-effective transportation alternatives, electric scooters are gaining traction as a promising solution to address Africa’s unique mobility challenges. As cities across the continent become more congested and pollution levels rise, electric scooters offer an appealing alternative due to their low carbon footprint, affordability, and convenience.

While adoption rates are currently lower than in Asia or Europe, a notable shift is occurring. Several startups and international companies are targeting African markets with tailored offerings such as battery-swappable scooters, pay-as-you-go leasing models, and mobile app-enabled rentals. Governments in countries such as South Africa, Egypt, and Morocco are also beginning to consider electric mobility frameworks, signaling long-term support for the sector.

Electric scooters are particularly well-suited for Africa’s dense urban areas, where traffic congestion, lack of public transportation infrastructure, and increasing fuel prices are constant challenges. Furthermore, with over 60% of Africa’s population under the age of 25, the continent has a tech-savvy, youth-dominated demographic that is open to adopting shared and electric mobility services.

Africa Electric Scooter Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 20.90 Million |

| Market Size by 2033 |

USD 44.29 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 7.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Battery, Voltage Type, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Honda Motor Co Ltd , KTM AG, Mahindra GenZe, Peugeot Scooters, Ninebot Limited, Suzuki Motor Corporation, Terra Motors Corporation, Vmoto Limited, Yadea Technology Group Co., Ltd., Yamaha Motor Company Limited |

Africa Electric Scooter Market Dynamics

- Government Support and Incentives:

The dynamics of the Africa Electric Scooter Market are significantly influenced by government support and incentives. Recognizing the pivotal role of electric scooters in fostering sustainable transportation, governments across the continent are implementing policies to encourage their adoption. Incentive programs, tax credits, and subsidies for both manufacturers and consumers serve as catalysts for market growth. These strategic measures not only make electric scooters more financially accessible but also contribute to building a favorable ecosystem for sustainable mobility.

- Technological Advancements and Battery Innovation:

The rapid evolution of technology, particularly in battery innovation, stands as a key dynamic propelling the Africa Electric Scooter Market forward. Advancements in battery technology have addressed critical concerns related to range, charging times, and overall performance. Lithium-ion batteries, coupled with ongoing research and development efforts, have significantly enhanced the efficiency and viability of electric scooters. The increased energy density and prolonged battery life contribute to alleviating range anxiety, a common deterrent for potential buyers.

Africa Electric Scooter Market Restraint

- Charging Infrastructure Challenges:

A prominent restraint in the Africa Electric Scooter Market pertains to the inadequate and underdeveloped charging infrastructure across the continent. The success of electric scooters hinges on a robust network of charging stations, yet many regions face a scarcity of accessible and convenient charging points. The absence of a comprehensive charging infrastructure poses a significant hurdle, as potential electric scooter buyers are deterred by concerns related to charging accessibility and convenience.

- Consumer Awareness and Perception:

Another key restraint impacting the Africa Electric Scooter Market is the lack of widespread consumer awareness and misconceptions surrounding electric scooters. In many instances, potential buyers may not fully comprehend the benefits of electric mobility or may hold misconceptions about factors such as battery life, maintenance costs, and overall performance. Overcoming these challenges requires targeted educational campaigns and marketing initiatives aimed at dispelling myths, providing accurate information, and fostering a positive perception of electric scooters.

Africa Electric Scooter Market Opportunity

- Rising Urbanization and Last-Mile Connectivity:

An opportune factor in the Africa Electric Scooter Market lies in the continent's accelerating urbanization trends. As urban areas expand and traffic congestion becomes a prevalent issue, there is a growing need for efficient last-mile connectivity solutions. Electric scooters, with their compact design and agility, present a compelling opportunity to address this demand. Offering a convenient and eco-friendly alternative for short-distance commuting, electric scooters can play a pivotal role in enhancing urban mobility.

- Youthful Demographics and Changing Consumer Preferences:

The youthful demographics prevalent across many African countries present a significant opportunity for the Africa Electric Scooter Market. As younger consumers increasingly prioritize sustainability and adopt eco-conscious lifestyles, electric scooters align with their values. The shift in consumer preferences towards environmentally friendly transportation options positions electric scooters as a trendy and attractive choice. Manufacturers have the opportunity to tap into this demographic by designing stylish and technologically advanced electric scooters that resonate with the preferences of the younger generation.

Africa Electric Scooter Market Challenges

- Infrastructure Bottlenecks and Charging Accessibility:

A primary challenge confronting the Africa Electric Scooter Market revolves around the inadequate charging infrastructure and accessibility issues. The success of electric scooters heavily relies on a robust and widespread charging network, yet many regions in Africa face a shortage of well-distributed charging stations. This poses a significant challenge as potential buyers are deterred by concerns about the availability and accessibility of charging points. Addressing this challenge requires substantial investments in charging infrastructure development, with collaboration between public and private entities essential to overcoming the bottleneck and creating a conducive environment for electric scooter adoption.

- Affordability and Initial Investment Barriers:

Affordability remains a notable challenge in the Africa Electric Scooter Market, where the upfront cost of electric scooters can be a deterrent for many consumers. The initial investment in electric scooters, including the cost of the vehicle and associated charging infrastructure, can be relatively high compared to traditional alternatives. Despite potential long-term savings on operational costs, the higher upfront expenses can discourage widespread adoption, particularly in regions with lower purchasing power. To mitigate this challenge, manufacturers and policymakers need to explore innovative financing models, subsidies, and incentives that make electric scooters more economically accessible to a broader consumer base, fostering greater market penetration.

Segments Insights:

Product Insights

Retro electric scooters currently dominate the market in Africa due to their versatile usage across both personal and light commercial applications. These scooters resemble traditional petrol-powered mopeds and are increasingly adopted by small businesses, delivery services, and independent commuters. Their larger frames, greater battery capacity, and longer range make them suitable for day-long operation in congested cities where long travel times are the norm. For example, in cities like Nairobi and Accra, retro-style electric scooters are being used for food delivery services and courier operations, helping businesses reduce fuel costs and emissions.

On the other hand, folding electric scooters are the fastest-growing segment, driven by their convenience, portability, and appeal to tech-savvy urban youth. Ideal for first- and last-mile connectivity, folding scooters can be easily carried into offices, buses, or apartments, making them practical for users navigating congested cityscapes. Startups in cities like Cape Town and Lagos are integrating folding scooters into urban rental platforms, promoting them as alternatives to walking or using short-distance taxis. As infrastructure and consumer awareness evolve, this segment is expected to see rapid adoption, particularly in metro areas.

Battery Insights

Lithium-ion (Li-ion) batteries dominate the African electric scooter market owing to their higher energy density, lighter weight, and longer lifecycle compared to alternatives. These batteries are increasingly preferred for both premium and mid-range electric scooters due to their ability to support long-range travel and faster charging. Moreover, the decline in global Li-ion battery prices, combined with technological improvements, is making them more accessible to African consumers. Major players in South Africa and Egypt have started offering scooters with removable Li-ion battery packs, allowing users to charge batteries at home or offices.

Sealed Lead Acid (SLA) batteries, while historically popular due to low cost, are losing ground. However, SLA batteries remain relevant in rural or semi-urban areas where upfront affordability is a key consideration. Despite being heavier and having a shorter lifespan, they are used in basic scooter models aimed at low-income populations. Meanwhile, NiMH batteries are being phased out gradually due to their inferior performance metrics and higher production costs compared to Li-ion technology.

Voltage Type Insights

48V electric scooters dominate the market as they strike an optimal balance between performance and affordability. These scooters offer better torque, range, and durability compared to 24V and 36V models, making them suitable for longer urban commutes and light delivery purposes. Cities like Casablanca and Johannesburg are seeing increased adoption of 48V models for fleet operations and personal use. Additionally, most models in the affordable mid-range category utilize 48V systems, enhancing their appeal among price-sensitive African consumers.

The "greater than 48V" segment is growing rapidly, especially among commercial delivery operators and shared mobility service providers that require extended range and robust performance. These high-voltage scooters are also used in niche applications such as tourism and inter-urban commuting. As infrastructure improves and battery prices continue to fall, adoption of high-voltage electric scooters is expected to grow significantly in North African and Southern African urban centers.

Regional Analysis

South Africa Dominates the Market

South Africa is the dominant country in the Africa electric scooter market. The nation’s relatively advanced urban infrastructure, access to capital, and openness to innovation have made it a fertile ground for electric mobility pilots and startups. Cities like Cape Town, Johannesburg, and Pretoria are hubs for micro-mobility innovation, supported by startup accelerators and university-led innovation labs. Companies like Green Scooter and e-Movement have launched electric scooter programs for both ride-sharing and delivery logistics.

South Africa's favorable demographics, with a growing middle class and widespread smartphone usage, make it an ideal testing ground for digitally integrated electric scooter services. Moreover, government initiatives to curb vehicle emissions and reduce urban congestion align with electric scooter market growth. The country’s relatively stable electricity infrastructure also supports wider adoption, especially in metro areas.

Egypt is the Fastest Growing Market

Egypt is emerging as the fastest-growing market for electric scooters in Africa. With Cairo’s severe traffic congestion, rising fuel prices, and increasing awareness around environmental sustainability, the country presents a strong case for electric micro-mobility solutions. The Egyptian government has recently introduced policies to promote electric vehicle adoption, and startups such as Scooter Egypt and eBike have launched rental and purchase models tailored to local urban challenges.

In addition to Cairo, cities like Alexandria and Giza are also witnessing micro-mobility expansion. Egypt’s youthful population, growing tech ecosystem, and strategic positioning as a gateway between Africa and the Middle East further accelerate its market potential. As urban infrastructure evolves and public-private partnerships emerge, Egypt is poised to become a central hub for electric scooter innovation in North

Some of the prominent players in the Africa electric scooter market include:

- Honda Motor Co Ltd

- KTM AG

- Mahindra GenZe

- Peugeot Scooters

- Ninebot Limited

- Suzuki Motor Corporation

- Terra Motors Corporation

- Vmoto Limited

- Yadea Technology Group Co., Ltd.

- Yamaha Motor Company Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global African electric scooter market.

Product Type

- Retro Electric Scooter

- Standing or self-balancing Electric Scooters

- Folding Electric Scooters

Battery Type

- Sealed Lead Acid

- NiMH

- Li-Ion

Voltage Type

- 24V

- 36V

- 48V

- Greater than 48V

Country

- South Africa

- Morocco

- Algeria

- Egypt

- Rest of Africa

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)