The global aluminum die casting market size was exhibited at USD 69.37 billion in 2023 and is projected to hit around USD 118.49 billion by 2033, growing at a CAGR of 5.5% during the forecast period of 2024 to 2033.

Key Takeaways:

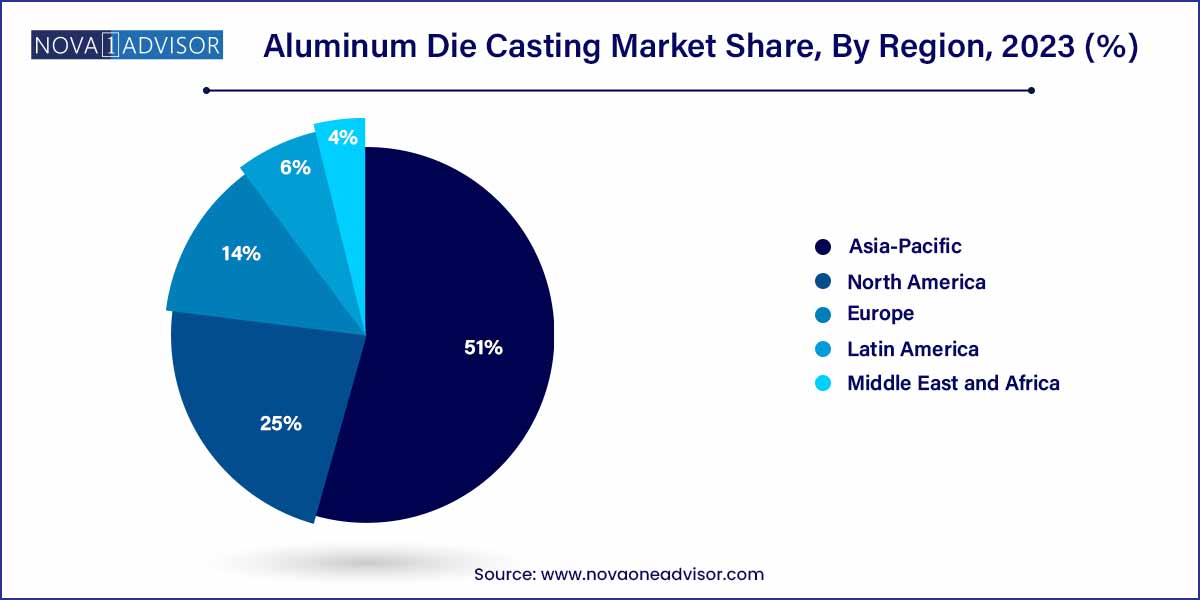

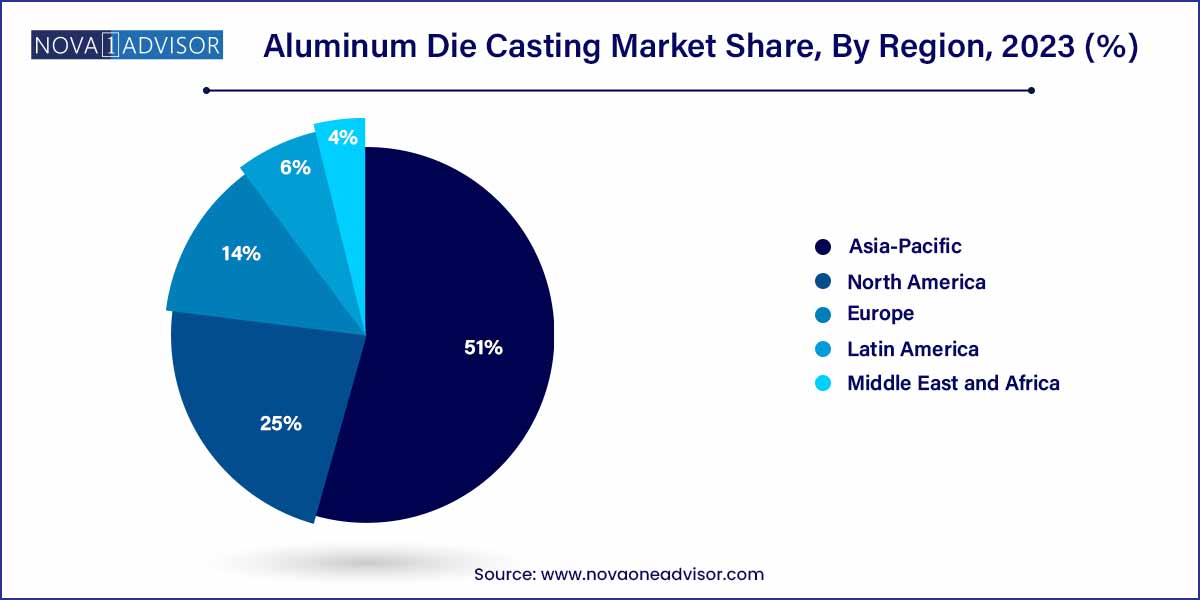

- Asia Pacific dominated the market and accounted for over 51.0% of the global revenue in 2023.

- Based on production process, pressure die casting held the largest revenue share of more than 80.0% in 2023.

- Based on application, the transportation segment held the largest revenue share of over 64.0% in 2023.

Aluminum Die Casting Market: Overview

The aluminum die casting market has evolved as a crucial segment within the global manufacturing and metalworking industries. Aluminum die casting involves the injection of molten aluminum into molds under high pressure to produce intricate, lightweight, and durable components. These characteristics make it an indispensable method for manufacturing complex automotive parts, industrial machinery components, and consumer electronics casings. With growing demand across transportation, industrial, and consumer sectors, aluminum die casting has witnessed significant expansion. The market's growth is underpinned by the rising need for lightweight materials to enhance fuel efficiency, the robust expansion of electric vehicle production, and the surging demand for sustainable and recyclable materials.

In addition to being a cost-effective solution for large-scale production, aluminum die casting offers exceptional mechanical properties such as corrosion resistance, thermal conductivity, and high strength-to-weight ratio. These attributes position aluminum as a preferred choice over other metals such as steel and plastic composites. With increasing focus on circular economy practices, aluminum's recyclability has further enhanced its appeal across diverse industries. Technological advancements such as simulation-based designing, automation in casting processes, and enhanced material grades are reshaping the competitive landscape.

Aluminum Die Casting Market Growth

The growth of the aluminum die casting market is propelled by several key factors. Firstly, the inherent properties of aluminum, including its lightweight nature, high strength-to-weight ratio, excellent thermal conductivity, and recyclability, make it an attractive choice for a wide range of applications across industries such as automotive, aerospace, electronics, and construction. Additionally, advancements in die casting technologies, such as computer-aided design (CAD), simulation software, and automated production systems, have significantly enhanced process efficiency, reduced lead times, and improved product quality. Furthermore, increasing environmental awareness and stringent regulatory standards are driving the adoption of lightweight materials like aluminum, particularly in the automotive sector, where lightweight components are crucial for achieving fuel efficiency and reducing emissions. These factors, coupled with rising demand from emerging economies and ongoing investments in research and development, are expected to fuel the growth of the aluminum die casting market in the coming years.

Aluminum Die Casting Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 69.37 Billion |

| Market Size by 2033 |

USD 118.49 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Production Process, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Alcast Technologies; BUVO Castings; Chongqing CHAL Precision Aluminium Co., Ltd.; Consolidated Metco, Inc.; Endurance Technologies Limited; FAIST Group; GF Casting Solutions; GIBBS; Martinrea Honsel Germany GmbH; Madison-Kipp Corporation; Ryobi Limited. |

Aluminum Die Casting Market Dynamics

- Technological Advancements:

Continuous innovations in die casting technologies play a pivotal role in driving market dynamics. Advancements such as computer-aided design (CAD), simulation software, and automated production systems have revolutionized the die casting process, enhancing efficiency, precision, and cost-effectiveness. CAD software enables engineers to design complex components with greater accuracy and detail, while simulation software allows for virtual testing and optimization of designs before physical production, reducing time and material waste. Moreover, the integration of automation and robotics in die casting operations streamlines production processes, minimizes errors, and increases throughput.

Despite its numerous advantages, the aluminum die casting market faces several challenges that influence its dynamics. Fluctuations in raw material prices, particularly aluminum alloys, pose a significant challenge for manufacturers, impacting production costs and profit margins. Additionally, stringent regulatory standards related to environmental protection, occupational safety, and product quality impose compliance burdens on die casting operations, requiring investments in equipment upgrades, employee training, and environmental management systems. Moreover, competition from alternative manufacturing processes, such as injection molding and 3D printing, presents a challenge for traditional die casting companies, necessitating differentiation through innovation, specialization, or cost efficiency.

Aluminum Die Casting Market Restraint

- Environmental Regulations:

Stringent environmental regulations pose a significant restraint on the aluminum die casting market. Government bodies worldwide are increasingly implementing regulations aimed at reducing emissions, promoting energy efficiency, and minimizing waste generation. These regulations often impose strict limits on emissions of pollutants such as greenhouse gases, volatile organic compounds (VOCs), and particulate matter from manufacturing processes, including die casting operations. Compliance with these regulations requires significant investments in pollution control equipment, process optimization, and environmental monitoring systems, which can increase production costs and affect profitability. Moreover, the use of certain chemicals and materials in the die casting process, such as mold release agents and lubricants, may be subject to restrictions or bans due to their potential environmental and health impacts, further complicating compliance efforts.

- Market Saturation and Competition:

Market saturation and intensifying competition represent another significant restraint for the aluminum die casting industry. With numerous players operating in the market, both domestically and internationally, competition is fierce, leading to pricing pressures and shrinking profit margins. Moreover, the proliferation of alternative manufacturing processes, such as injection molding, 3D printing, and additive manufacturing, presents a formidable challenge to traditional die casting methods. These alternative processes offer advantages such as greater design flexibility, reduced lead times, and lower tooling costs, making them increasingly attractive to manufacturers seeking to differentiate their products or streamline production. Additionally, the commoditization of die casting services and the rise of low-cost manufacturing hubs in emerging economies further exacerbate competitive pressures, forcing companies to continually innovate, optimize operations, and differentiate their offerings to maintain market share and profitability.

Aluminum Die Casting Market Opportunity

- Growing Demand for Lightweight Components:

One of the key opportunities driving the aluminum die casting market is the growing demand for lightweight components across various industries, particularly automotive and aerospace. With increasing emphasis on fuel efficiency, emissions reduction, and vehicle electrification, manufacturers are seeking lightweight materials to replace traditional heavy metals such as steel and iron. Aluminum die casting offers a compelling solution, thanks to its excellent strength-to-weight ratio, which enables the production of lightweight yet durable components. In the automotive sector, lightweight aluminum components can help reduce vehicle weight, improve fuel efficiency, and enhance performance without compromising safety or structural integrity. Similarly, in the aerospace industry, aluminum die castings are widely used in aircraft structures, engine components, and interior fittings to reduce weight and enhance fuel economy.

- Expansion in Emerging Markets:

Another significant opportunity for the aluminum die casting market lies in the expansion of operations and investments in emerging markets. Rapid industrialization, urbanization, and infrastructure development in countries such as China, India, Brazil, and Mexico are driving robust demand for aluminum die castings across a wide range of end-use industries, including automotive, construction, electronics, and consumer goods. These emerging markets offer attractive growth prospects due to their large and growing populations, rising disposable incomes, and increasing consumption of manufactured goods. Moreover, favorable government policies, incentives for foreign investment, and improving business environments further enhance the attractiveness of these markets for die casting manufacturers seeking to expand their global footprint.

Aluminum Die Casting Market Challenges

- Fluctuating Raw Material Prices:

One of the primary challenges confronting the aluminum die casting market is the volatility of raw material prices, particularly aluminum alloys. The price of aluminum is subject to various factors, including global supply and demand dynamics, geopolitical tensions, currency fluctuations, and trade policies. Fluctuations in aluminum prices can have a significant impact on the cost structure of die casting manufacturers, affecting profitability and competitiveness. Moreover, sudden spikes or declines in aluminum prices can disrupt production planning, inventory management, and pricing strategies, making it challenging for manufacturers to maintain stable operations and meet customer demand. To mitigate the impact of fluctuating raw material prices, die casting companies often employ hedging strategies, long-term supply contracts, and inventory optimization techniques.

- Regulatory Compliance and Environmental Sustainability:

Regulatory compliance and environmental sustainability pose significant challenges for the aluminum die casting market. Government regulations pertaining to environmental protection, occupational health and safety, and product quality impose stringent requirements on die casting operations, necessitating compliance with a complex and evolving regulatory landscape. Compliance with regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) requires die casting manufacturers to adhere to strict limits on the use of hazardous substances and implement measures to minimize environmental impact and ensure worker safety. Moreover, increasing emphasis on sustainability and circular economy principles is driving demand for eco-friendly manufacturing practices, resource-efficient processes, and recyclable materials in the die casting industry.

Segments Insights:

Production Process Insights

High Pressure Die Casting dominated the production process segment in 2024. High Pressure Die Casting (HPDC) is the most widely adopted method owing to its capability to produce intricate designs with superior surface finishes at a rapid rate. Major automotive parts, such as engine blocks, transmission cases, and structural components, are often manufactured using HPDC. Companies like Ryobi Limited and Nemak have leveraged HPDC technology to cater to large OEM orders, supporting mass production while maintaining dimensional accuracy and strength.

Low Pressure Die Casting (LPDC) is projected to be the fastest-growing production process segment. LPDC is gaining popularity, especially in the manufacturing of premium automotive parts and aerospace components where higher material density and superior mechanical properties are prioritized. Unlike HPDC, LPDC provides better control over the filling process, minimizing porosity and producing stronger parts. With growing applications in electric vehicle battery housings and structural aerospace components, LPDC is expected to witness accelerated adoption.

Application Insights

Transportation application segment dominated the aluminum die casting market in 2024. Transportation sectors, encompassing automotive, aerospace, and heavy vehicles, collectively account for the largest share of aluminum die casting usage. The trend towards vehicle electrification and the lightweighting imperative has bolstered demand. OEMs and Tier 1 suppliers consistently integrate die-cast components to enhance fuel economy, reduce emissions, and improve safety features.

The energy sector is emerging as the fastest-growing application segment. As the world shifts towards renewable energy sources, aluminum die casting finds increasing application in the production of solar panel frames, battery enclosures, and wind turbine components. The need for lightweight, corrosion-resistant materials aligns well with the specific demands of the renewable energy sector. Companies specializing in green technologies are heavily investing in aluminum-based solutions, thereby driving the segment's growth trajectory.

Regional Insights

Asia-Pacific dominated the aluminum die casting market in 2024. This dominance stems from robust manufacturing bases, particularly in China, India, and Japan. China, being the largest automotive manufacturer globally, heavily drives aluminum die casting demand. Additionally, the presence of major industrial hubs, supportive government policies promoting lightweight materials, and rapid infrastructure development bolster market growth. In countries like India, the "Make in India" initiative has encouraged local automotive and industrial production, consequently enhancing the demand for die-cast components. Moreover, Asia-Pacific benefits from lower labor costs, advanced manufacturing technologies, and the rapid adoption of electric mobility solutions.

Latin America is anticipated to be the fastest-growing region for the aluminum die casting market. Countries such as Mexico and Brazil are witnessing rapid industrialization, expanding automotive manufacturing bases, and rising foreign direct investments. Mexico, in particular, has become a significant hub for automotive production with companies like General Motors, BMW, and Audi expanding their operations. Coupled with infrastructural developments and a push for sustainable energy solutions, the demand for lightweight, durable aluminum die-cast components is set to experience robust growth across Latin America.

Some of the prominent players in the aluminum die casting market include:

- Alcast Technologies

- BUVO Castings

- Chongqing CHAL Precision Aluminium Co., Ltd.

- Consolidated Metco, Inc.

- Endurance Technologies Limited

- FAIST Group

- GF Casting Solutions

- GIBBS

- Martinrea Honsel Germany GmbH

- Madison-Kipp Corporation

- Ryobi Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global aluminum die casting market.

Production Process

-

- High Pressure Die Casting

- Low Pressure Die Casting

Application

-

- General Road Transportation

- Sports Road Transportation

- Heavy Vehicles

- Aerospace & Aviation

-

- Agricultural Equipment

- Construction Equipment

- Others

- Building & Construction

- Telecommunication

- Consumer Durables

- Energy

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)