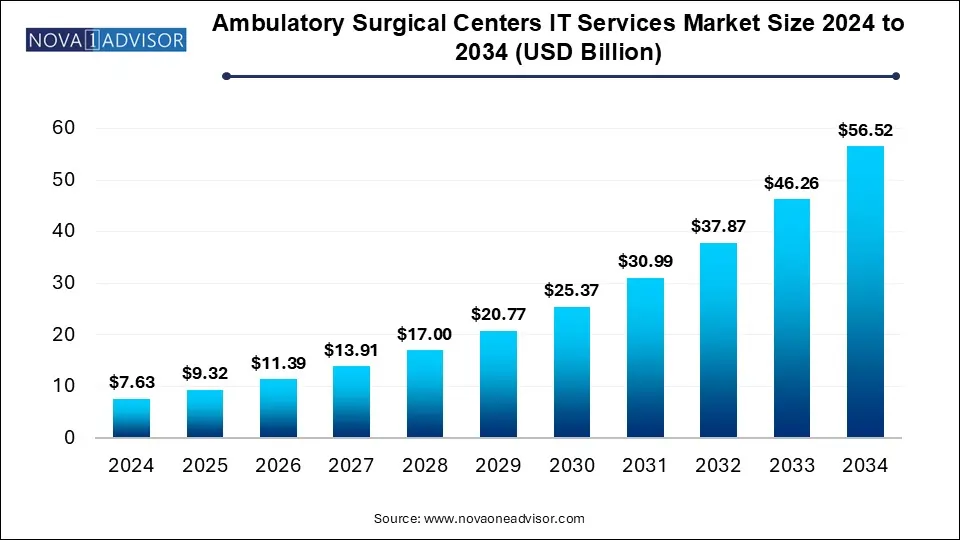

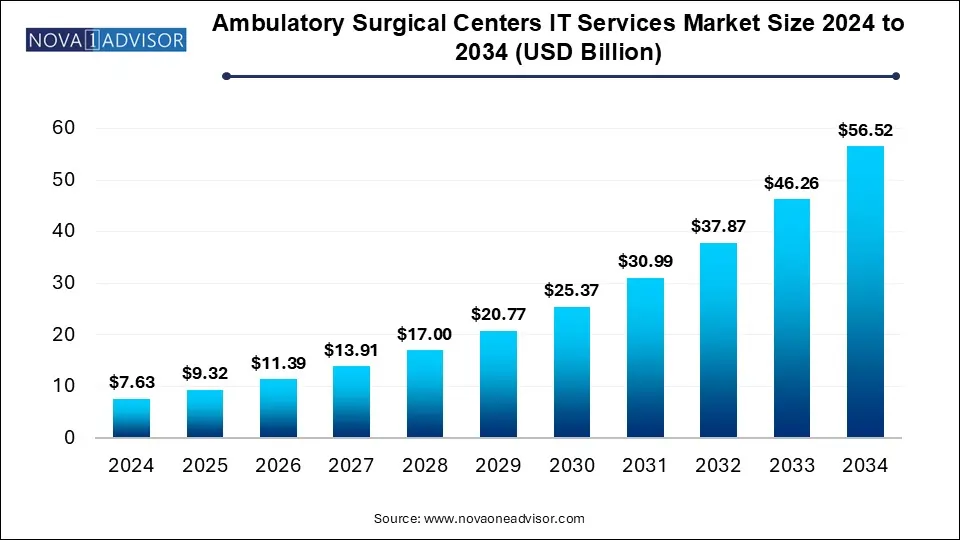

Ambulatory Surgical Centers IT Services Market Size and Growth

The ambulatory surgical centers it services market size was exhibited at USD 7.63 billion in 2024 and is projected to reach around USD 56.52 billion by 2034, growing at a CAGR of 22.17% during the forecast period 2025 to 2034.

Ambulatory Surgical Centers IT Services Market Key Takeaways:

- North America has held the largest revenue share of 59% in 2024.

- Asia Pacific is expected to grow at a significant rate in the global market.

- By service type, the electronic health record segment has contributed more than 33%of revenue share in 2024.

- By service type, the clinical documentation segment is expected to grow the fastest in the market.

- By solution, the service segment has held the biggest revenue share of 59% in 2024.

- By solution, the software segment is expected to show the fastest growth in the market over the forecast period.

- By deployment mode, the cloud-based segment dominated the market with the highest revenue share of 86% in 2024.

- By deployment mode, the on-premise is expected to grow rapidly in the market in the upcoming years.

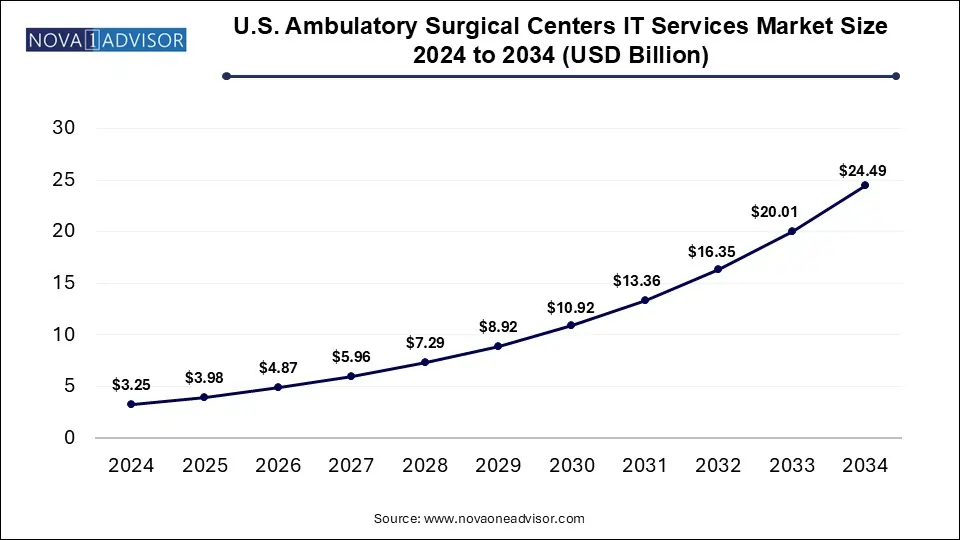

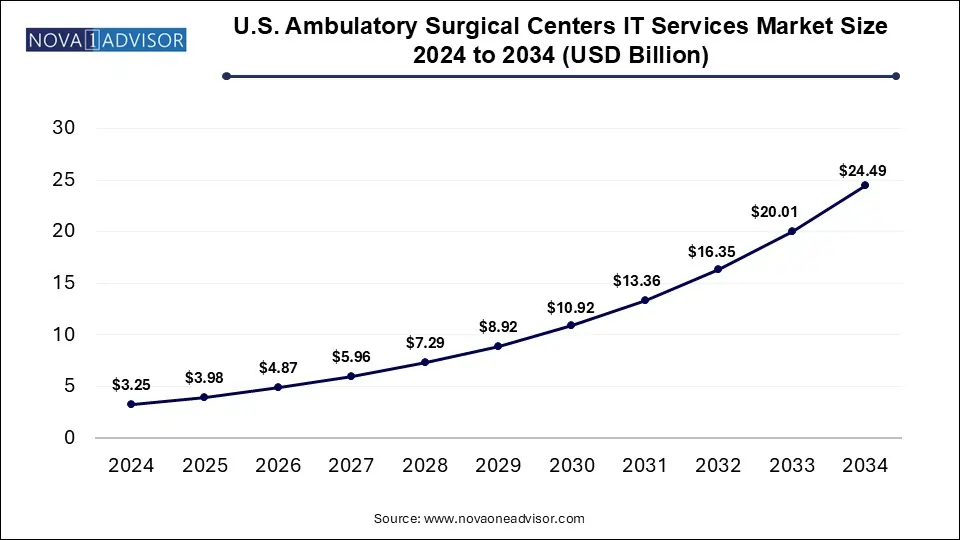

U.S. Ambulatory Surgical Centers IT Services Market Size and Growth 2025 to 2034

The U.S. ambulatory surgical centers it services market size was valued at USD 3.25 billion in 2024 and is expected to reach around USD 24.49 billion by 2034, growing at a CAGR of 22.38% from 2025 to 2034.

North America led the global ambulatory surgical centers (ASC) IT services market in 2024. The increasing need for efficient patient data management and streamlined healthcare operations, along with the rising demand for outpatient procedures, has driven the growth of the ASC IT services sector in the region. North America's ASC IT services industry is highly competitive, with numerous established companies offering a wide array of solutions tailored to meet the specific needs of ambulatory surgery centers. Additionally, a surge of innovative startups and digital firms has entered the market, introducing specialized solutions to address emerging challenges in the healthcare industry.

Meanwhile, the Asia Pacific region is anticipated to witness substantial growth in the global ASC IT services market. Several factors, including rising healthcare expenditures, technological advancements, and an increasing preference for outpatient surgical procedures, are contributing to the region’s rapid market evolution. ASCs are becoming more popular due to their cost-effectiveness, convenience, and efficiency in delivering surgical care. These centers are increasingly investing in practice management software to enhance administrative, billing, and scheduling processes. Such software seamlessly integrates with electronic health record (EHR) systems, ensuring efficient workflow management. Given the importance of data security and regulatory compliance—such as adherence to the Health Insurance Portability and Accountability Act (HIPAA)—ASCs are also focusing on compliance and cybersecurity solutions to safeguard patient data and maintain regulatory standards.

Ambulatory Surgical Centers IT Services Market Overview

IT services are being used by ASCs more frequently in order to improve patient care, streamline operations, and adhere to legal regulations. This trend is being driven by technological advancements like telemedicine, cloud computing, electronic health records (EHR), and mobile health applications. ASCs can enhance staff communication, automate administrative duties, and allocate resources optimally with the use of IT services. Because ASCs are able to function more efficiently with fewer resources, this ultimately results in enhanced efficiency and cost savings. The telehealth services industry, especially ASCs, has benefited from the COVID-19 epidemic by growing in popularity. ASCs can provide patients with remote consultations, pre-operative evaluations, and post-operative care thanks to IT technologies that make it easier to integrate telehealth systems.

The ambulatory surgical centers IT services market is getting more and more competitive as more vendors provide customized products made to meet the particular requirements of ASCs. Larger healthcare IT companies are acquiring smaller businesses to increase their services and market share, which is another factor contributing to market consolidation. There is an increasing tendency toward outpatient operations, which are usually less expensive than those carried out in traditional hospital settings, as healthcare prices continue to climb. This rise is largely driven by ASCs, and IT services are critical to handling the rising number of patients and procedures. ASCs must adhere to a number of regulations, such as Meaningful Use standards and HIPAA (Health Insurance Portability and Accountability Act).

Ambulatory Surgical Centers IT Services Market Growth Factors

- The ambulatory surgical centers IT services market is becoming more and more common as healthcare systems throughout the world move toward outpatient services in an effort to cut costs and boost efficiency. The demand for effective IT systems to handle patient records, scheduling, billing, and compliance is being driven by the increase in outpatient treatment.

- The ambulatory surgical centers IT services market is required to comply with multiple standards, including Meaningful Use and HIPAA (Health Insurance Portability and Accountability Act), which require the use of electronic health records (EHR) and other IT solutions. The need for IT services that guarantee data security, privacy, and interoperability is driven by compliance.

- The ambulatory surgical centers IT services market strives to keep patients happy and safe while streamlining processes and cutting expenses. IT services provide ways to save costs and increase operational efficiency by automating administrative chores, maximizing resource use, and enhancing staff communication.

- The move towards patient-centric care emphasizes improving patient outcomes and experiences. The ambulatory surgical centers IT services market can provide better patient satisfaction and engagement when they use IT services that facilitate personalized care through patient portals, remote monitoring tools, and telehealth services.

Patients want easy access to treatments, clear pricing, and easy communication with healthcare professionals as they become more involved in managing their own healthcare. IT services are essential in fulfilling these demands by providing digital communication channels, smartphone health apps, and online appointment booking.

- To increase their reach and service offerings, the ambulatory surgical centers IT services market is increasingly partnering with physician groups, healthcare systems, and other stakeholders. IT services that enable collaboration, interoperability, and data sharing amongst vario healthcare companies become crucial for successful alliances and attempts at industry consolidation.

Report Scope of Ambulatory Surgical Centers IT Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 9.32 Billion |

| Market Size by 2034 |

USD 56.52 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 22.17% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Service, By Solution, and By Deployment Mode |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Cerner Corporation, Allscripts Healthcare Solutions Inc, McKesson Corporation, Medical Information Technology Inc, Advanced Data Systems Corporation, Surgical Information Systems, NextGen Healthcare, Philips Healthcare and Others. |

Market Dynamics

Driver

Remote Monitoring and Telehealth

Advancements in technology, particularly in data analytics, wearable devices, and telecommunications, have enabled the development of sophisticated remote monitoring and telehealth solutions. Ambulatory surgical centers (ASCs) are increasingly becoming the preferred choice for various surgical procedures due to their affordability, convenience, and ability to provide specialized care. Remote monitoring allows healthcare providers to track patients’ vital signs, medication adherence, and post-operative recovery, enabling early detection of complications, reducing unnecessary hospital readmissions, and improving resource utilization. However, regulatory challenges such as licensing requirements, reimbursement policies, and data privacy concerns continue to impact the widespread adoption of these services in ASCs.

Restraint

Interoperability Challenges

The ASC IT services market faces significant hurdles in achieving interoperability due to the intricate structure of healthcare systems and the diverse range of technologies used by different providers. The IT systems in ASCs often lack standardized data formats, communication protocols, and interfaces, making seamless data exchange difficult. ASCs typically rely on multiple software solutions for various functions such as practice management, electronic health records (EHR), scheduling, and billing. Poor integration between these systems can lead to fragmented data, inefficiencies, and operational bottlenecks.

Opportunity

Data Analytics and Business Intelligence

Business intelligence (BI) and data analytics tools allow ASCs to analyze operational data related to patient flow, resource utilization, and inventory management. By identifying inefficiencies and bottlenecks, ASCs can improve patient throughput, reduce costs, and streamline their processes. Data analytics also plays a crucial role in revenue cycle management by helping ASCs identify coding errors, track reimbursement patterns, and optimize revenue collection. Additionally, by analyzing historical data and forecasting future demand, ASCs can ensure optimal resource allocation while minimizing waste. Furthermore, BI tools support compliance by enabling ASCs to monitor adherence to regulatory standards and accreditation requirements, detect non-compliance issues, and implement corrective measures to mitigate risks.

Ambulatory Surgical Centers IT Services Market By Service Type Insights

The electronic health record (EHR) segment holds the largest share of the global ambulatory surgical centers (ASC) IT services market due to several factors, including the increasing demand for enhanced patient care, operational efficiency, regulatory requirements, and technological advancements. EHR systems play a crucial role in optimizing clinical workflows, streamlining documentation processes, and improving communication among healthcare providers in ASCs. These systems automate and enhance various clinical operations, such as patient registration, pre-operative evaluations, intraoperative documentation, post-operative care, and billing. Additionally, EHR systems generate extensive data that can be utilized for quality improvement initiatives, performance tracking, and clinical decision-making.

The clinical documentation segment is projected to experience the highest growth in the ASC IT services market. Accurate and efficient clinical documentation is vital for ensuring timely patient care, regulatory compliance, and seamless provider communication in ASCs. The adoption and customization of EHR systems to meet the specific needs of ASCs have become a priority. These systems typically offer tools for recording treatment plans, demographic details, medical histories, prescriptions, and progress notes for each patient. Custom templates and forms in EHR/EMR systems facilitate the documentation of critical data elements required by ASCs, such as anesthesia records, surgical notes, post-operative instructions, and pre-operative assessments.

Ambulatory Surgical Centers IT Services Market By Solution Insights

The service segment accounted for the largest share of the ASC IT services market in 2024 and is expected to continue growing throughout the forecast period. The service sector in the ASC IT market encompasses a variety of offerings designed to meet the specific technical requirements of ASCs. These services focus on enhancing operational efficiency, streamlining workflows, ensuring regulatory compliance, and improving patient care. Key components include comprehensive training programs for ASC staff to ensure proficiency in IT solutions, which may involve instructional materials, online courses, and on-site training. Additionally, continuous technical support is provided to address concerns, troubleshoot issues, and maintain the smooth functioning of IT systems.

The software segment is anticipated to witness the fastest growth in the ASC IT services market over the coming years. This segment includes a diverse range of software solutions tailored to the specific operational needs of ASCs. These software tools play a vital role in improving workflow efficiency, increasing productivity, ensuring compliance with regulations, and enhancing patient care. EHR systems specifically designed for ASCs facilitate the maintenance of digital patient records, including medical histories, prescriptions, and treatment plans. Practice management software assists ASCs in handling administrative responsibilities such as appointment scheduling, billing, insurance claim processing, and inventory management. Additionally, surgical management systems streamline the planning, scheduling, and coordination of surgical procedures in ASCs.

Ambulatory Surgical Centers IT Services Market By Deployment Mode Insights

The cloud-based segment dominated the ASC IT services market in 2024. In this market, cloud-based solutions refer to IT services and applications that are hosted on cloud computing infrastructure and accessed remotely. Cloud-based IT services provide significant benefits for ASCs, which operate as outpatient surgical facilities. These solutions enable ASC staff to access essential data and applications from any location with an internet connection, enhancing flexibility and efficiency. Cloud-based systems are often offered through pay-per-use or subscription models, eliminating the need for large upfront infrastructure investments. This cost-effective approach is particularly beneficial for ASCs, which may have limited IT budgets.

The on-premise segment is expected to grow rapidly in the ASC IT services market in the coming years. On-premise deployment involves setting up and managing IT infrastructure and applications within the ASC’s physical premises. Under this model, ASCs purchase or license software, install it on their own servers or computers, and manage their IT infrastructure internally or with the assistance of third-party vendors. Unlike cloud-based solutions, which are hosted online and accessed via a web browser, on-premise solutions offer greater control and customization. However, they often require higher initial investments in software licenses, hardware, and dedicated IT personnel for maintenance and updates.

Some of The Prominent Players in The Ambulatory Surgical Centers IT Services Market Include:

- Cerner Corporation

- Allscripts Healthcare Solutions Inc

- McKesson Corporation

- Medical Information Technology Inc

- Advanced Data Systems Corporation

- Surgical Information Systems

- NextGen Healthcare

- Philips Healthcare

Ambulatory Surgical Centers IT Services Market Recent Developments

- In January 2024, Leading international alternative asset management company TPG (NASDAQ: TPG) today announced a sizable strategic investment in Compass Surgical Partners ("Compass" or the "Company"), a stand-alone full-service ASC development and management partner. The investment is being funded by TPG Growth, the company's middle market and growth equity vehicle, in collaboration with current partner Health Velocity Capital.

- In January 2024, The Center for Spine Economics, Outcomes & Research was established by Commons Clinic, a premier value-based physician group that is redefining musculoskeletal (MSK) care. This initiative will hasten the adoption of cutting-edge care models for the diagnosis, treatment, and management of spine problems. The center has committed to investing $100 million over the next ten years to improve the delivery of ambulatory spinal care.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Ambulatory Surgical Centers IT Services Market

By Service

- EHR

- Clinical Documentation

- Practice Management

- Revenue Cycle Management

- Supply Chain Management

- Patient Engagement

- Others

By Solution

By Deployment Mode

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)