Animal Wound Care Market Size and Research

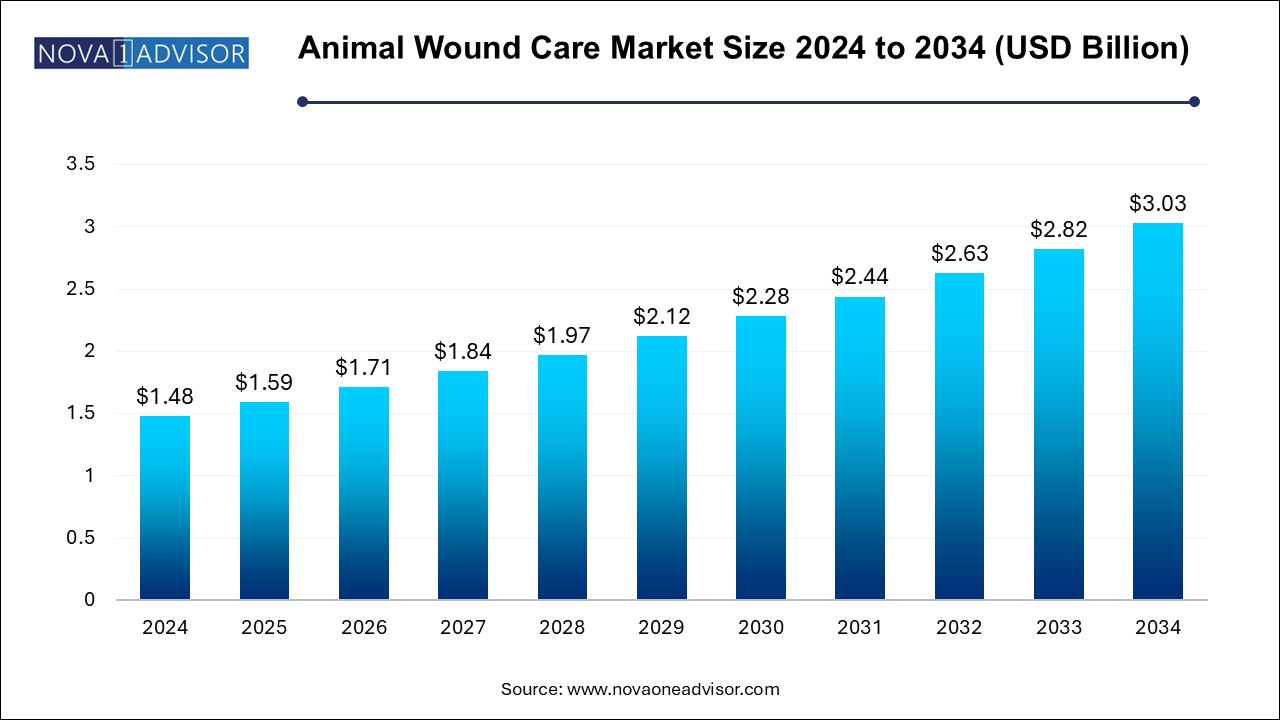

The animal wound care market size was exhibited at USD 1.48 billion in 2024 and is projected to hit around USD 3.03 billion by 2034, growing at a CAGR of 7.41% during the forecast period 2025 to 2034.

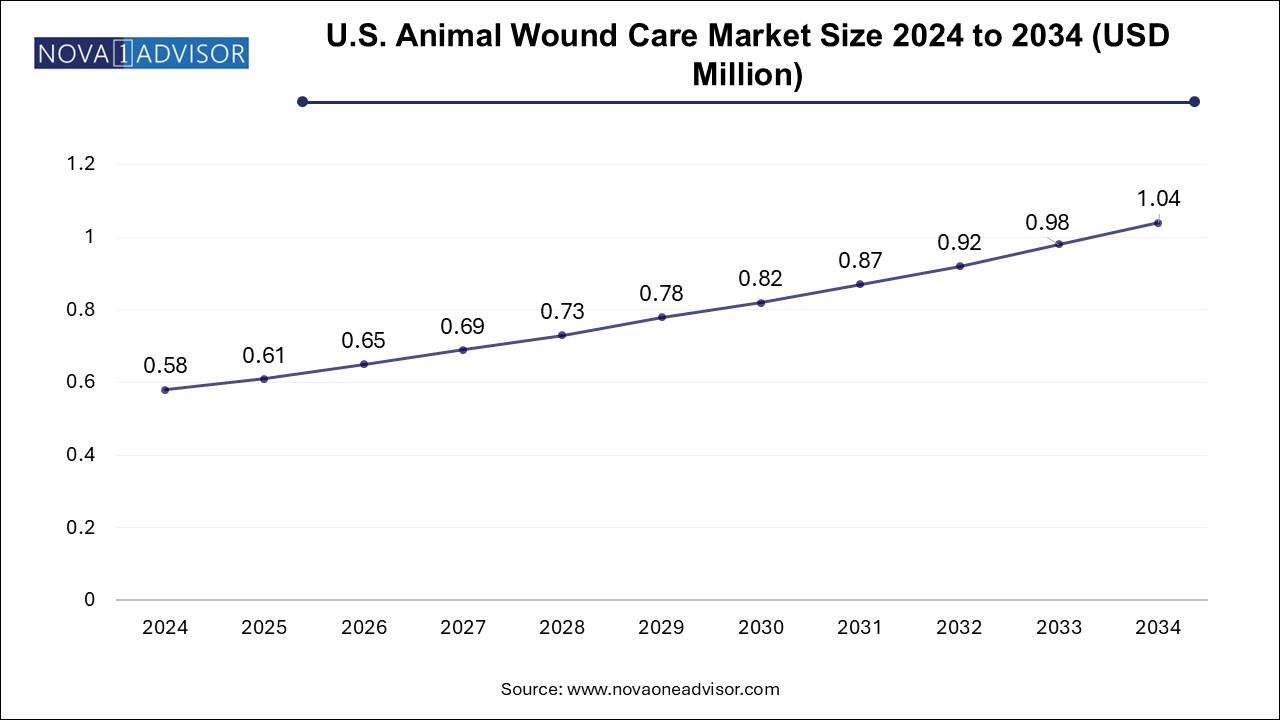

U.S. Animal Wound Care Market Size and Growth 2025 to 2034

The U.S. animal wound care market size is evaluated at USD 0.580 million in 2024 and is projected to be worth around USD 1.04 million by 2034, growing at a CAGR of 5.45% from 2025 to 2034.

North America dominated the animal wound care market in 2024, owing to high pet ownership rates, advanced veterinary infrastructure, and the widespread adoption of premium wound care solutions. The U.S. veterinary market is one of the most mature globally, with a well-established network of hospitals, specialist clinics, and mobile veterinary services. Key industry drivers include favorable insurance policies, strong public awareness, and the presence of leading companies offering a wide array of wound care products.

The region also leads in veterinary innovation and regulatory support. FDA approvals and the American Veterinary Medical Association (AVMA) guidelines have encouraged the development and standardization of advanced wound care protocols. Moreover, equine care in North America represents a significant subsegment, contributing to specialized demand for high-performance dressings, wraps, and therapy devices.

Asia Pacific is projected to register the highest CAGR, supported by increasing pet adoption, expansion of veterinary services, and modernization of livestock farming. Countries like China, India, Japan, and South Korea are witnessing rising demand for both companion animal and livestock wound care solutions. In India and China, government initiatives to improve farm productivity and animal welfare are boosting veterinary product adoption.

Urbanization and income growth have led to rising pet ownership in Southeast Asia and East Asia, which in turn is driving demand for quality pet care, including post-surgical recovery and dermatological treatment. Local manufacturers are beginning to introduce cost-effective wound care products, and global brands are entering partnerships to distribute advanced materials in this high-potential region.

Market Overview

The animal wound care market is expanding rapidly as global pet ownership rises, livestock productivity becomes more intensive, and veterinary care standards continue to evolve. Wound care products are essential for managing injuries, surgical incisions, chronic wounds, and infections in animals, ensuring their recovery and preventing complications such as sepsis, lameness, or loss of productivity. The market includes a wide range of products, from basic bandages and antiseptics to advanced dressings, tissue adhesives, and therapeutic devices, each tailored for specific use cases and species.

Companion animals—such as dogs, cats, and horses—are increasingly treated like family members in many regions, and pet owners are willing to invest in premium healthcare services. This cultural shift, particularly in urban centers of North America, Europe, and parts of Asia Pacific, is driving demand for high-performance wound care products, especially those used post-surgery, in dermatological cases, or for injuries caused by trauma and bites. Simultaneously, the livestock segment, which includes cattle, pigs, poultry, and other production animals, also requires efficient wound care solutions to prevent disease outbreaks, ensure animal welfare, and maintain the commercial viability of farming operations.

Wound care in veterinary practice has advanced significantly over the past decade. Traditional wound management approaches, while still relevant, are now complemented by new-generation products such as hydrocolloid and hydrogel dressings, antimicrobial films, negative pressure wound therapy (NPWT), and bioactive wound healing agents. Veterinary hospitals and clinics, along with research institutes, play a pivotal role in promoting the adoption of such technologies, supported by growing investments from government bodies and animal healthcare companies.

As awareness of animal health continues to increase globally and regulatory support strengthens, the market is poised for sustained growth. E-commerce and retail expansion, along with product innovations designed for homecare use, are opening up new avenues for market players. Moreover, the COVID-19 pandemic’s impact on animal-human interaction and a growing focus on zoonotic disease control have further elevated the profile of veterinary healthcare infrastructure, including wound care products and services.

Major Trends in the Market

-

Rising Preference for Advanced Wound Care Products: Increasing demand for hydrogel, foam, and antimicrobial dressings for faster and more hygienic healing.

-

Growth of Companion Animal Expenditure: Pet owners are spending more on veterinary procedures, post-operative recovery, and at-home wound management.

-

Emergence of Tele-Veterinary Consultations: Virtual consultations are fueling e-commerce sales of wound care products for at-home use.

-

Expansion of Veterinary Clinics in Emerging Markets: Infrastructure development in Asia Pacific and Latin America is widening access to quality animal healthcare.

-

Increasing Focus on Zoonotic Disease Prevention: Enhanced biosecurity in livestock farms is encouraging proactive wound care.

-

Use of Natural and Bioactive Ingredients: Rising trend toward herbal and non-toxic wound care solutions for sensitive animals and long-term use.

-

Product Customization by Animal Type: Introduction of species-specific wound care kits, particularly for horses and exotic pets.

-

Adoption of Portable Therapy Devices: Wearable or battery-operated wound therapy systems for large animals and equine use cases are gaining traction.

Report Scope of Animal Wound Care Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.59 Billion |

| Market Size by 2034 |

USD 3.03 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.41% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Animal Type, End use, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

B. Braun Melsungen AG; Medtronic; 3M; Johnson & Johnson (Ethicon); Virbac; Advancis Veterinary Ltd.; INNOVACYN, Inc.; Vernacare (Robinson Healthcare); NEOGEN Corp.; KeriCure, Inc. |

Market Driver: Surge in Pet Ownership and Animal Healthcare Expenditure

A central driver of the animal wound care market is the rising global pet population and the parallel growth in veterinary healthcare expenditure, especially in developed and urbanizing regions. According to global pet industry estimates, over 60% of households in the U.S. and large portions of the European Union own at least one pet. As pets are increasingly considered family members, owners are more willing to spend on both preventive and emergency healthcare—including surgical interventions, injury recovery, and chronic wound care.

This shift is not just cultural but also structural. Veterinary service providers, pet insurance companies, and pharmaceutical firms are all aligning with this trend. As a result, the adoption of high-quality wound care products such as surgical adhesives, advanced dressings, and even portable therapy devices is growing. Post-surgical recovery, treatment of pressure sores in elderly pets, and care for skin disorders or lacerations are among the top drivers of product demand in the companion animal category.

Market Restraint: Cost Sensitivity in Livestock Sector and Rural Areas

Despite rising demand, the cost of wound care products and services remains a major barrier, particularly in the livestock segment and rural or low-income regions. Advanced wound care materials such as hydrogel dressings, tissue adhesives, or negative pressure wound therapy systems are often priced beyond the reach of small-scale farmers or pet owners in emerging markets. Additionally, these products may require trained personnel for application, limiting their utility in remote or under-resourced veterinary settings.

For livestock, producers often prioritize cost-effectiveness and herd-level health management, meaning high-end wound care is less accessible unless the animal’s productivity is significantly threatened. Traditional methods such as bandages, iodine solutions, and natural remedies continue to dominate rural veterinary practices. This cost-conscious approach can slow the overall market penetration of innovative wound care technologies and reduce revenue potential in these regions, especially where insurance coverage or government subsidy is lacking.

Market Opportunity: Growth of E-commerce and Direct-to-Consumer Distribution Channels

A significant opportunity lies in the expansion of e-commerce platforms and direct-to-consumer (DTC) models for animal wound care products. Pet owners, livestock handlers, and small-scale veterinarians are increasingly turning to online platforms to purchase veterinary supplies, including bandages, antiseptics, wound sprays, and advanced dressings. The rise of online veterinary consultations—especially during the COVID-19 pandemic—has accelerated this trend, with pet parents preferring doorstep delivery and home-friendly solutions for minor wounds or post-operative recovery.

Companies investing in user-friendly packaging, educational marketing, and remote consultation support can differentiate their offerings and reach underserved customers. Subscription models for routine care kits, homecare bundles, and first-aid packs tailored to specific animals (e.g., dogs, horses, or poultry) are becoming more popular. As logistics infrastructure improves and regulatory clarity around veterinary e-commerce emerges, especially in Asia and Latin America, this channel could significantly contribute to market growth.

Animal Wound Care Market By Product Insights

The Advanced wound care products dominated the animal wound care market in 2024, driven by their effectiveness in managing complex wounds and post-surgical recovery. Foam dressings, hydrocolloid dressings, hydrogel-based solutions, and film dressings are increasingly being used for deep wounds, infected injuries, and hard-to-heal surgical sites. These products provide moisture regulation, antimicrobial protection, and reduced need for frequent dressing changes—making them ideal for both clinical and at-home use. In high-income regions, pet clinics are shifting toward these products to ensure better clinical outcomes and pet owner satisfaction.

Therapy devices are expected to be the fastest-growing segment, particularly due to their increasing use in equine care, chronic wound treatment, and large animal surgery recovery. Devices such as negative pressure wound therapy (NPWT), low-level laser therapy systems, and electromechanical stimulation tools are gaining recognition for improving healing time and reducing infection risk. These are commonly used in referral centers and specialized veterinary hospitals. As technology becomes more portable and affordable, their use in ambulatory practices and even homecare settings is expected to rise.

Animal Wound Care Market By Animal Type Insights

Based on Companion animals held the largest market share, especially dogs and horses, due to the frequency of veterinary visits, surgical interventions, and owner-driven care. Dogs, in particular, account for the majority of advanced wound care product use because of their active lifestyles, skin sensitivities, and common occurrences of lacerations, post-surgical wounds, and dermatological issues. Horses follow closely, especially in regions with strong equine sports industries, where performance animals receive premium care.

Livestock animals are projected to witness the fastest growth, fueled by increasing farm mechanization, injury management in high-density production systems, and a push toward improved animal welfare. As global meat and dairy demand grows, producers are under pressure to maintain the health and productivity of their herds. Even minor wounds can lead to infections, reduced output, or culling if left untreated. As a result, farm veterinarians and producers are adopting more effective, species-specific wound care protocols and products.

Animal Wound Care Market By End Use Insights

Based on Veterinary hospitals and clinics dominated the end-use segment, due to the comprehensive range of treatments offered and the presence of trained staff to apply advanced dressings and devices. These facilities also serve as key locations for surgical interventions, trauma care, and chronic wound management. Many clinics are integrating advanced wound care protocols into standard post-surgical recovery and dermatology services, thereby increasing recurring demand for high-quality materials.

Homecare is the fastest-growing end-use segment, particularly in the companion animal category. Increasing pet owner confidence, access to digital veterinary consultations, and the availability of easy-to-use wound care products are enabling at-home recovery management. From simple bandages to antimicrobial sprays and ready-to-use dressings, manufacturers are targeting the homecare market with user-centric innovations. This trend is particularly pronounced in North America and Europe, but is gaining traction in affluent urban centers across Asia Pacific and Latin America.

Animal Wound Care Market By Distribution Channel Insights

Veterinary hospitals and clinics led the distribution channel, as most wound care products are initially dispensed during or after treatment. Veterinarians typically recommend specific brands or products and often provide the first round of wound management, encouraging compliance and appropriate product usage. Clinics also stock common wound care items, especially for repeat injuries, post-operative care, and emergency walk-ins.

E-commerce is the fastest-growing distribution channel, boosted by convenience, competitive pricing, and increasing digitalization of veterinary retail. Pet supply websites, online pharmacies, and marketplaces like Amazon are offering a broader array of veterinary-grade wound care products. Many manufacturers are also launching direct-to-consumer online stores, providing tutorials, subscriptions, and bundled first-aid kits. The ease of reordering and availability of doorstep delivery are making this an attractive channel for time-pressed consumers and small-scale livestock handlers.

Some of the prominent players in the animal wound care market include:

Animal Wound Care Market Recent Developments

-

In February 2025, Elanco Animal Health announced the launch of a new bioactive hydrogel dressing for equine wound care, offering sustained antimicrobial protection and faster epithelialization.

-

In November 2024, Neogen Corporation expanded its product portfolio with a veterinary tissue adhesive line, targeting post-surgical wound management in small and large animals.

-

In September 2024, Dechra Pharmaceuticals partnered with a Japanese distributor to introduce advanced wound care kits for home-use in companion animals, including antiseptic sprays and hydrocolloid dressings.

-

In August 2024, Zoetis Inc. launched a regional awareness campaign in Latin America promoting preventive wound care in livestock, in collaboration with local veterinary schools.

-

In June 2024, Vetoquinol introduced a new foam dressing for surgical recovery in dogs and cats, designed for 3-day wear and easy removal without skin trauma.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the animal wound care market

By Product

- Surgical Wound Care Products

-

- Sutures & staplers

- Tissue Adhesive

- Advanced Wound Care Products

-

- Foam Dressings

- Hydrocolloid dressing

- Film Dressing

- Hydrogel Dressing

- Others

- Traditional Wound care Products

-

- Tapes

- Bandages

- Dressing

- Absorbants

- Others

By Animal Type

-

- Dogs

- Cats

- Horses

- Others (Small mammals, birds)

By End Use

- Veterinary Hospitals/Clinics

- Homecare

- Research Institutes

By Distribution Channel

- Retail

- E-commerce

- Veterinary Hospitals/Clinics

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)