Ankylosing Spondylitis Market Size and Research

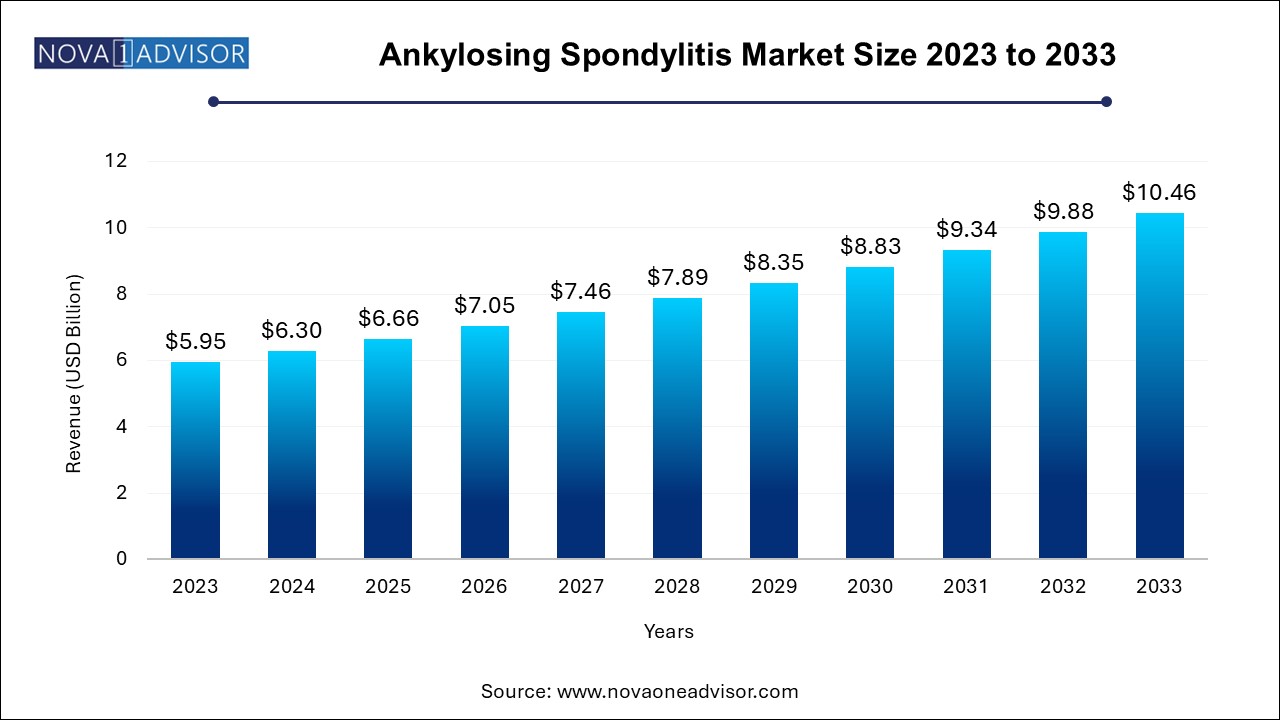

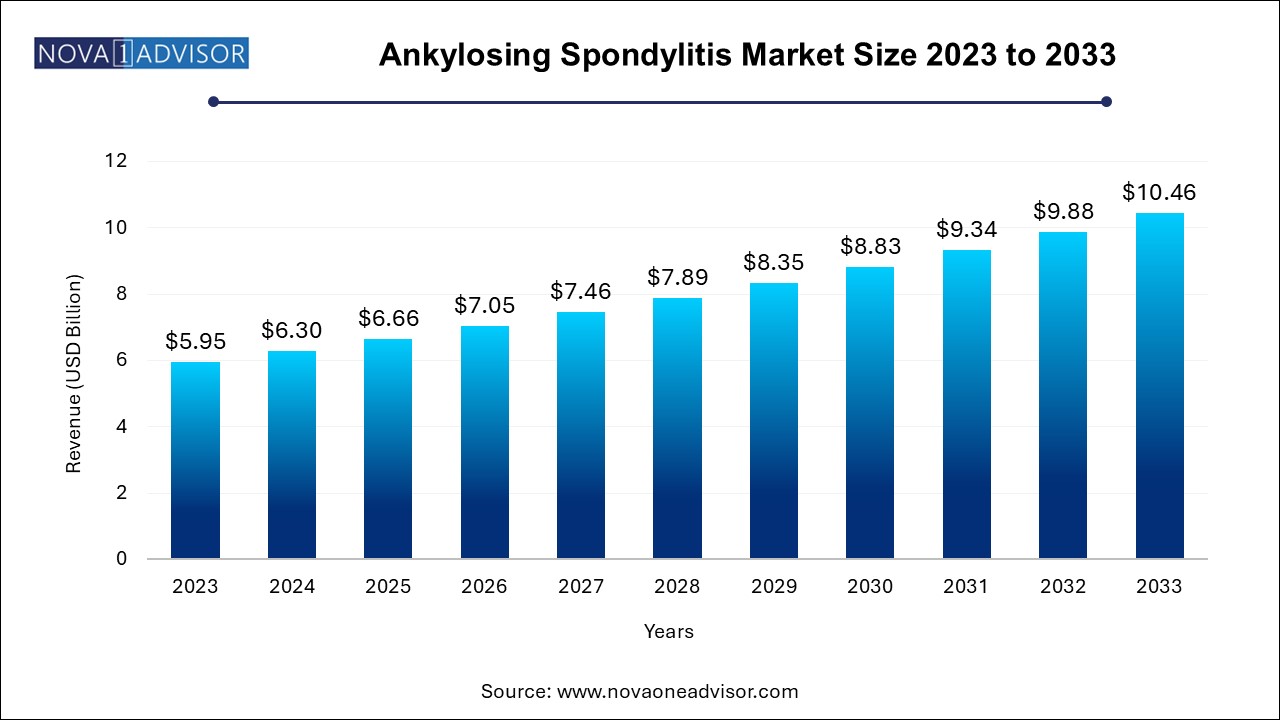

The global ankylosing spondylitis market size was exhibited at USD 5.95 billion in 2023 and is projected to hit around USD 10.46 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2024 to 2033.

Ankylosing Spondylitis Market Key Takeaways:

- The TNF (Tumor Necrosis Factor) segment dominated the market and accounted for a revenue share of 59.4% in 2023.

- The Non-steroidal Anti-Inflammatory Drug (NSAID) market is expected to grow at a CAGR of 8.8% over the forecast years.

- Humira is a leading TNF inhibitor, accounting for the largest market revenue share of 26.9% in 2023.

- The hospital pharmacy led the market and accounted for the largest revenue share of 48.3% in 2023.

- Retail pharmacies are expected to grow at a CAGR of 8.0% over the forecast period.

- The North America ankylosing spondylitis market accounted for the largest revenue share of 57.9% in 2023.

Market Overview

Ankylosing spondylitis (AS) is a chronic inflammatory disease primarily affecting the axial skeleton, leading to severe back pain, stiffness, and over time, spinal fusion. Belonging to the group of conditions known as spondyloarthropathies, AS is an autoimmune disorder closely associated with the HLA-B27 genetic marker, and its onset typically occurs in late adolescence or early adulthood. With a global prevalence estimated between 0.1% and 1.4%, depending on the region and population, AS poses a substantial burden on quality of life, productivity, and healthcare systems.

The market for ankylosing spondylitis therapeutics is primarily driven by the growing adoption of biologic drugs, especially tumor necrosis factor (TNF) inhibitors and interleukin (IL) inhibitors, which have revolutionized disease management over the past two decades. While NSAIDs remain the initial treatment of choice for mild to moderate cases, biologics are preferred in patients with persistent inflammation and structural progression, as they offer both symptom relief and disease-modifying potential.

Furthermore, advancements in diagnostic imaging (e.g., MRI) and increased awareness among rheumatologists and general practitioners have contributed to early diagnosis and timely intervention, expanding the pool of treated patients. The emergence of oral small molecule therapies, such as Janus kinase (JAK) inhibitors, has further diversified the treatment landscape, offering new options for patients unresponsive to TNF inhibitors.

Biopharmaceutical companies are heavily investing in AS-focused R&D, aiming to develop safer, more effective, and more convenient drugs. The combination of unmet medical need, pipeline richness, and technological innovation is expected to drive sustained growth in the ankylosing spondylitis market in the years ahead.

Major Trends in the Market

-

Shift Toward Oral Therapies: JAK inhibitors such as upadacitinib and tofacitinib are gaining traction due to their oral administration and favorable efficacy profiles in AS.

-

Biosimilar Expansion: As patents expire for major biologics like Humira and Enbrel, biosimilar versions are entering the market, increasing competition and improving affordability.

-

Personalized Medicine and Biomarker Development: Efforts are ongoing to identify predictive biomarkers for treatment response and disease progression, enabling more targeted therapies.

-

Combination Therapy Strategies: Clinical trials are exploring the benefits of combining biologics or combining biologics with NSAIDs to enhance treatment response.

-

Digital Health Integration: Mobile apps and remote monitoring tools are increasingly used to track disease activity, medication adherence, and patient-reported outcomes.

-

Focus on Non-radiographic Axial Spondyloarthritis: As understanding of the disease spectrum improves, early-stage and non-radiographic forms of AS are being recognized and treated proactively.

-

Increasing Awareness and Advocacy: Patient support organizations and awareness campaigns are helping reduce diagnostic delays, particularly in emerging markets.

-

Expanded Reimbursement for Biologics: Many countries are expanding insurance coverage and public healthcare support for high-cost AS therapies.

Report Scope of Ankylosing Spondylitis Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.95 Billion |

| Market Size by 2033 |

USD 10.46 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Drug class, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

AbbiVie, Inc; Amgen, Inc; Pfizer, Inc; UCB, Inc.; Novartis AG; Eli Lilly and Company; Johnson and Johnson Services, Inc; Merck and Co., Inc; Izana Biosciences; Zydus Lifescience ltd.; |

Market Driver: Increasing Diagnosis and Biologic Adoption

One of the major drivers propelling the ankylosing spondylitis market is the increased diagnosis rate and expanding utilization of biologic therapies. Historically, AS has suffered from delayed diagnosis, often taking up to 8–10 years due to its gradual onset and nonspecific symptoms. However, with greater clinician education and improved imaging technologies (especially MRI), earlier detection has become more common, enabling timely initiation of disease-modifying therapies.

Biologic drugs—especially TNF inhibitors like Humira, Enbrel, and Simponi—have transformed the treatment paradigm by targeting the inflammatory cascade responsible for joint damage. These drugs significantly reduce disease activity, improve function, and enhance quality of life. Their success has led to increased adoption in both developed and developing countries. Additionally, the introduction of biosimilars and newer IL-17A inhibitors has broadened access and reduced the financial burden, further expanding market potential.

Market Restraint: High Cost of Biologic and Advanced Therapies

A significant restraint in the ankylosing spondylitis market is the high cost of biologic therapies, which can limit patient access, especially in countries with underdeveloped insurance systems. First-line biologics such as TNF inhibitors can cost upwards of $20,000 to $40,000 annually per patient. Even with the introduction of biosimilars, the overall treatment cost remains high when considering administration, monitoring, and associated care.

In low- and middle-income countries, out-of-pocket payments for such medications are unsustainable for many families. Furthermore, treatment adherence can suffer due to the cost burden, leading to suboptimal disease control. Governments and healthcare providers are increasingly pressured to balance budget constraints with patient demands for effective treatment, which may slow market growth in some regions.

Market Opportunity: Expansion of JAK Inhibitors and Novel Oral Therapies

An exciting opportunity in the ankylosing spondylitis market is the emergence of JAK inhibitors and other novel oral therapies. These small-molecule drugs offer the convenience of oral administration, fewer injection-related complications, and promising results in controlling inflammation in AS patients.

In February 2024, AbbVie announced positive Phase 3 trial results for upadacitinib, a selective JAK1 inhibitor, in ankylosing spondylitis patients with inadequate response to biologics. The drug showed statistically significant improvements in disease activity and spinal mobility, potentially positioning it as a new standard of care. Other JAK inhibitors like tofacitinib are also being studied for AS indications.

These developments represent a paradigm shift, offering alternatives to injectable biologics and expanding the therapeutic arsenal. They also cater to patients who prefer oral medications or have needle phobia. Pharmaceutical companies entering this segment can tap into a growing population of AS patients looking for more convenient, personalized treatment options.

Ankylosing Spondylitis Market By Drug Class Insights

TNF inhibitors remain the dominant class of drugs in the ankylosing spondylitis market. Agents such as Humira (adalimumab), Enbrel (etanercept), Simponi (golimumab), Remicade (infliximab), and Cimzia (certolizumab) have become the backbone of AS treatment due to their strong anti-inflammatory effects and robust long-term efficacy data. TNF blockers not only improve spinal inflammation but also address extra-articular manifestations such as uveitis and inflammatory bowel disease. With years of use and well-established safety profiles, they continue to be the first-line biologics prescribed by rheumatologists globally.

In contrast, JAK inhibitors represent the fastest growing segment in the drug class category. The appeal of oral administration, rapid onset of action, and their success in other autoimmune diseases have paved the way for their expansion into AS. AbbVie’s upadacitinib, in particular, has shown remarkable promise, especially for patients who have failed TNF inhibitors. As more real-world evidence accumulates and reimbursement pathways expand, JAK inhibitors are expected to rapidly gain market share over the next five years.

Ankylosing Spondylitis Market By Distribution Channel Insights

Hospital pharmacies currently lead the market distribution channel segment. Given the nature of biologic administration—often requiring subcutaneous or intravenous infusion—hospitals remain the central hub for drug dispensation and patient monitoring. These facilities also manage high-risk patients who require close supervision, particularly during therapy initiation or dosage escalation. Additionally, hospitals benefit from centralized procurement agreements with manufacturers, ensuring consistent supply and pricing.

Retail and online pharmacies are witnessing the fastest growth, driven by the increasing demand for home-based administration and oral medications like JAK inhibitors. With the expansion of e-prescriptions and digital health tools, patients are now more comfortable managing their treatment independently. This shift is particularly evident in high-income countries where home delivery of specialty medications is supported by robust logistics and cold-chain systems. As convenience becomes a major driver of adherence, this channel is expected to play a more prominent role in AS therapy distribution.

Ankylosing Spondylitis Market By Regional Insights

North America, particularly the United States, holds the largest share in the global ankylosing spondylitis market. This dominance is attributed to a combination of factors including high disease awareness, early diagnosis, a strong presence of rheumatologists, and broad insurance coverage for biologics. The U.S. FDA has been proactive in approving advanced therapies for AS, and most top-tier biologics have been integrated into clinical practice quickly after approval.

Moreover, major pharmaceutical players such as AbbVie, Pfizer, and Johnson & Johnson are based in North America, reinforcing product availability and clinical research. The presence of specialty pharmacy networks and patient support programs further facilitates widespread drug access, even for high-cost medications.

The Asia Pacific region is the fastest growing market for ankylosing spondylitis treatment, driven by rising disease awareness, improvements in diagnostic infrastructure, and expanding healthcare spending. Countries like India, China, South Korea, and Japan have seen an upsurge in rheumatology clinics and biologic adoption, particularly among urban populations.

As governments roll out universal healthcare programs and public-private partnerships, access to advanced therapies is improving. Biosimilars of major biologics are widely available in this region, offering cost-effective treatment options. For example, India and China have approved multiple adalimumab biosimilars that are used extensively for AS. The growing middle class, increasing physician training, and expansion of specialty pharmacies further position Asia Pacific as a high-potential market for AS therapeutics.

Ankylosing Spondylitis Market Recent Developments

-

February 2024 – AbbVie announced positive Phase 3 clinical trial results for upadacitinib (Rinvoq) in patients with active ankylosing spondylitis who had an inadequate response to TNF inhibitors. The study demonstrated significant improvements in ASAS40 scores, spinal mobility, and inflammatory markers, paving the way for potential regulatory approval. [Source: BusinessWire]

-

November 2023 – Biocon Biologics launched a biosimilar version of adalimumab in the Indian market, offering a cost-effective alternative for ankylosing spondylitis and rheumatoid arthritis patients.

-

September 2023 – Novartis continued to expand access to Cosentyx (secukinumab)—an IL-17A inhibitor—across Europe and Latin America, highlighting its efficacy in axial spondyloarthritis, including AS.

-

July 2023 – Pfizer initiated a global post-marketing surveillance study on Xeljanz (tofacitinib) to evaluate long-term outcomes in AS patients using JAK inhibitors in real-world settings.

-

May 2023 – Amgen began Phase 2 trials for a novel dual-cytokine inhibitor targeting IL-17 and IL-23 pathways, with early data showing promise in spondyloarthritis management.

Some of the prominent players in the global ankylosing spondylitis market include:

- AbbiVie, Inc.

- Amgen, Inc.

- Pfizer, Inc.

- Johnson & Johnson, Inc.

- Novartis AG

- UCB, Inc.

- Eli Lilly and Company

- Merck & Co., Inc.

- Zydus Lifescience ltd.

- Izana Bioscience

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global ankylosing spondylitis market

Drug Class

- Non-Steroidal Anti Inflammatory Drug(NSAID)

- TNF Inhibitors

-

- Humira

- Simponi

- Remicade

- Enbrel

- Cimzia

- Other TNF Inhibitors

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)