Annuloplasty System Market Size and Research

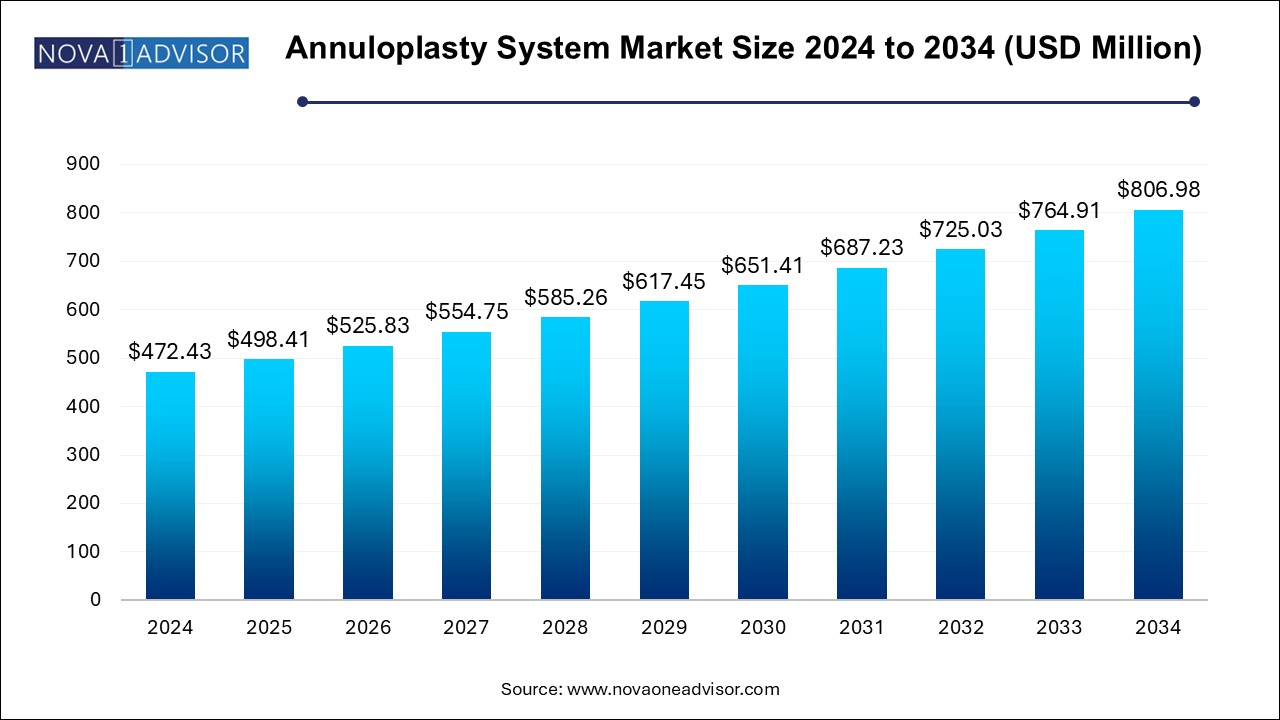

The annuloplasty system market size was exhibited at USD 472.43 million in 2024 and is projected to hit around USD 806.98 million by 2034, growing at a CAGR of 5.5% during the forecast period 2025 to 2034.

U.S. Annuloplasty System Market Size and Growth 2025 to 2034

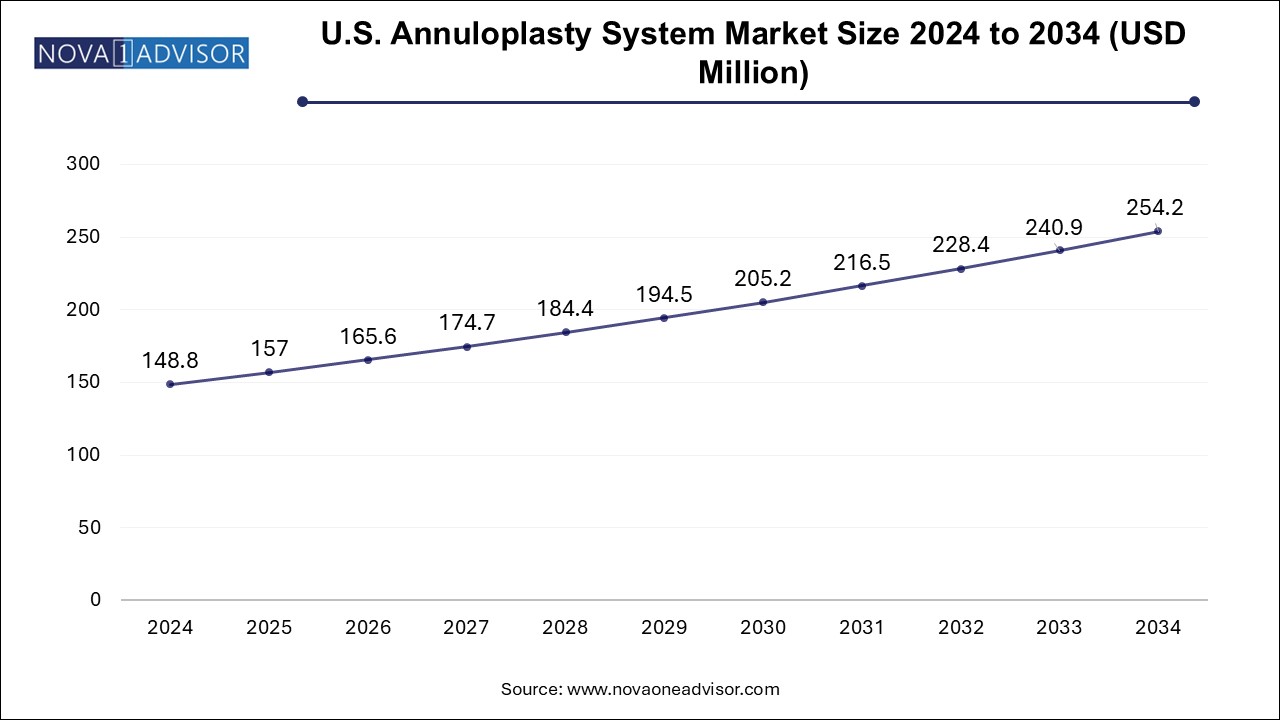

The U.S. annuloplasty system market size is evaluated at USD 148.8 million in 2024 and is projected to be worth around USD 254.2 million by 2034, growing at a CAGR of 4.98% from 2025 to 2034.

North America emerged as the dominant regional market in 2024, led by the United States. This leadership is underpinned by the region’s well-established cardiac care infrastructure, early adoption of medical innovations, and strong presence of leading medical device manufacturers such as Edwards Lifesciences and Medtronic. In addition, favorable reimbursement frameworks, high awareness among patients and clinicians, and a significant number of skilled cardiovascular surgeons contribute to the region’s stronghold. The U.S. also sees a high volume of both open-heart and transcatheter surgeries, ensuring consistent demand for annuloplasty systems.

Asia Pacific is expected to register the fastest growth during the forecast period, supported by rapid improvements in healthcare access and infrastructure. Countries like China, India, and South Korea are witnessing a rise in the prevalence of cardiovascular diseases, coupled with a growing emphasis on surgical intervention. Government investments in tertiary care hospitals and training programs for cardiac surgeons are improving procedural capabilities. Moreover, regional partnerships between local healthcare providers and international device companies are accelerating the introduction and approval of cutting-edge annuloplasty systems.

Market Overview

The annuloplasty system market is gaining significant momentum as the global prevalence of valvular heart diseases continues to rise. Annuloplasty is a surgical technique used to repair a valve by implanting a device (annuloplasty ring or band) that reinforces the valve’s annulus (the ring-like part of the valve). These systems are critical components in heart valve repair procedures, especially for conditions such as mitral regurgitation, tricuspid regurgitation, and other degenerative or functional valve abnormalities. With increasing awareness and adoption of minimally invasive surgeries, the market has witnessed robust growth in the past decade.

Technological advancements in annuloplasty rings—including flexible, semi-rigid, and rigid models—have significantly improved patient outcomes. Companies are now developing next-generation rings that provide better physiological compatibility and adaptability during heart function. Additionally, the growing elderly population and the increasing burden of comorbidities such as hypertension and diabetes, which often lead to valvular issues, have created a compelling case for expansion.

Furthermore, rising investments in cardiovascular care, especially in emerging economies, and strategic collaborations between medtech companies and hospitals for product trials and training are propelling market development. While developed markets like North America and Europe are mature and infrastructure-rich, regions such as Asia Pacific are showing remarkable potential due to growing healthcare expenditure, increasing surgical capabilities, and an expanding patient base.

Major Trends in the Market

-

Adoption of Minimally Invasive Surgical Techniques: Surgeons increasingly prefer transcatheter annuloplasty systems, especially for high-risk elderly patients who are not candidates for open-heart surgery.

-

Technological Advancements in Annuloplasty Devices: Introduction of adjustable and 3D contoured rings to provide tailored valve repair solutions is a major trend.

-

Integration of Robotic-Assisted Surgery: Robotic and image-guided systems are being employed for precision in annuloplasty procedures, enhancing surgical outcomes.

-

Increased Clinical Trials and FDA Approvals: Companies are investing in regulatory trials to gain approvals for next-gen rings, especially in Europe and North America.

-

Focus on Biocompatibility and Durability: Enhanced material innovation aims to reduce long-term complications, including infection, thrombosis, and calcification.

-

Training Programs for Surgeons and Hospital Partnerships: Medtech firms are establishing training centers to familiarize surgeons with new annuloplasty systems.

-

Rising Incidence of Congenital Heart Defects: Increasing congenital cases requiring early valve repair is boosting the market.

-

Personalized Treatment Approaches: Surgeons now choose ring types based on individual patient anatomy and disease progression, signaling a shift toward personalized healthcare.

Report Scope of Annuloplasty System Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 498.41 Million |

| Market Size by 2034 |

USD 806.98 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 5.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Medtronic; Abbott; Edwards Lifesciences Corporation; Corcym; Labcor Laboratories Ltda; AFFLUENT MEDICAL; Valcare Medical; Braile Biomédica; Micro Interventional Devices, Incorporated |

Key Market Driver

Rising Prevalence of Valvular Heart Diseases

One of the most powerful drivers of the annuloplasty system market is the increasing global incidence of valvular heart diseases (VHDs), particularly mitral and tricuspid regurgitation. According to the American Heart Association, VHDs affect over 5 million people in the United States alone, with mitral valve regurgitation being among the most common. The elderly population is especially vulnerable, as degenerative changes in the valves become more common with age.

This demographic trend has accelerated demand for efficient, reliable surgical interventions. Unlike valve replacement, which involves removing the entire valve, annuloplasty offers a conservative approach with lower risks of complications and higher survival rates. With aging populations across Europe, Japan, and the U.S., demand for these repair systems continues to escalate, positioning them as essential components in cardiac surgical care.

Key Market Restraint

High Cost of Surgical Procedures and Devices

Despite the benefits, the high cost associated with annuloplasty surgeries and devices remains a significant barrier to market growth, particularly in low- and middle-income countries. The procedure, often requiring advanced imaging, surgical expertise, and post-operative care, can be prohibitively expensive. Moreover, premium annuloplasty systems incorporating flexible and 3D technologies carry a high price tag due to R&D investments, precision engineering, and regulatory approvals.

Hospitals in emerging regions may struggle with limited reimbursements or lack of government support, which reduces adoption. This disparity has created an uneven playing field, with significant accessibility gaps, limiting the potential for uniform global market penetration.

Key Market Opportunity

Emerging Demand in Asia Pacific Healthcare Markets

A substantial opportunity lies in expanding into emerging markets such as India, China, Indonesia, and Vietnam, where increasing investments in healthcare infrastructure are paving the way for advanced cardiovascular procedures. The growing middle class, coupled with rising insurance coverage, is making high-end treatments like annuloplasty more accessible.

Governments across Asia are prioritizing non-communicable diseases, especially cardiac care, in their national health agendas. For instance, China’s “Healthy China 2030” initiative includes measures to expand surgical capabilities across rural and urban hospitals. This shift opens up new avenues for international medtech players to collaborate with local distributors, establish production units, or engage in licensing partnerships—strategies that could enable substantial market penetration.

Annuloplasty System Market By Application Insights

The Mitral Valve Repair dominated the application segment of the annuloplasty system market in 2024, accounting for the highest market share. This dominance is attributed to the high incidence of mitral valve regurgitation, particularly in aging populations in North America and Europe. Surgical mitral valve repair using annuloplasty rings is a standard of care and often recommended before the onset of heart failure symptoms. Innovations such as adjustable rings have made these procedures even more effective and widely adopted. As a result, hospitals and cardiac centers are prioritizing mitral valve repairs over complete replacements due to better long-term patient outcomes and fewer complications.

Tricuspid Valve Repair is emerging as the fastest growing segment, supported by increasing recognition of tricuspid regurgitation’s impact on cardiac health. Historically considered secondary, tricuspid valve issues are now being addressed proactively, especially with the advent of specialized annuloplasty systems designed for this valve. The availability of novel minimally invasive tricuspid repair systems, combined with growing clinical evidence of their efficacy, is pushing this segment forward. Additionally, a growing number of patients undergoing multiple valve repairs has emphasized the importance of integrated tricuspid interventions during mitral surgeries, thus further boosting this category.

Annuloplasty System Market By End Use Insights

The Hospitals dominated the end-use segment in 2024, driven by their comprehensive cardiac care facilities, access to advanced imaging technologies, and the presence of trained cardiovascular surgeons. The availability of hybrid operating rooms, integration with transcatheter surgical systems, and multidisciplinary teams have made hospitals the preferred centers for performing annuloplasty procedures. Hospitals also benefit from partnerships with medical device companies, which often support them with training programs, trial equipment, and surgical support during complex interventions.

The Ambulatory Surgical Centers (ASCs) are projected to be the fastest-growing segment, owing to the trend of outpatient cardiac procedures facilitated by innovations in minimally invasive annuloplasty systems. These centers offer reduced hospital stays, lower costs, and faster recovery, which appeal to both patients and providers. In the U.S. and parts of Europe, policy support and payer reimbursement models are encouraging surgeries in outpatient settings, driving the adoption of advanced systems in ASCs. Additionally, the emergence of mobile cardiac units and satellite surgery centers is likely to enhance their role in the future market.

Some of the prominent players in the annuloplasty system market include:

Annuloplasty System Market Recent Developments

-

In March 2024, Edwards Lifesciences announced the successful European launch of its next-generation CardioBand Mitral System, a transcatheter-based annuloplasty solution that enhances precision during mitral valve repair.

-

In January 2024, Medtronic revealed expanded clinical trials for its Intrepid TMVR system, including a new focus on combining transcatheter mitral valve replacement with advanced annuloplasty support.

-

In November 2023, Abbott Laboratories reported positive results from its TRILUMINATE Pivotal Trial, validating the use of tricuspid valve repair devices in patients with severe tricuspid regurgitation—supporting market expansion for tricuspid annuloplasty.

-

In October 2023, LivaNova entered a strategic partnership with a leading Asian healthcare group to distribute and train surgeons on its semi-rigid annuloplasty rings across major Indian hospitals.

-

In September 2023, Boston Scientific completed a minority acquisition in a startup focused on developing robotically assisted annuloplasty systems, indicating growing interest in AI-guided heart surgeries.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the annuloplasty system market

By Application

- Mitral Valve Repair

- Tricuspid Valve Repair

- Aortic Valve Repair

By End Use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)