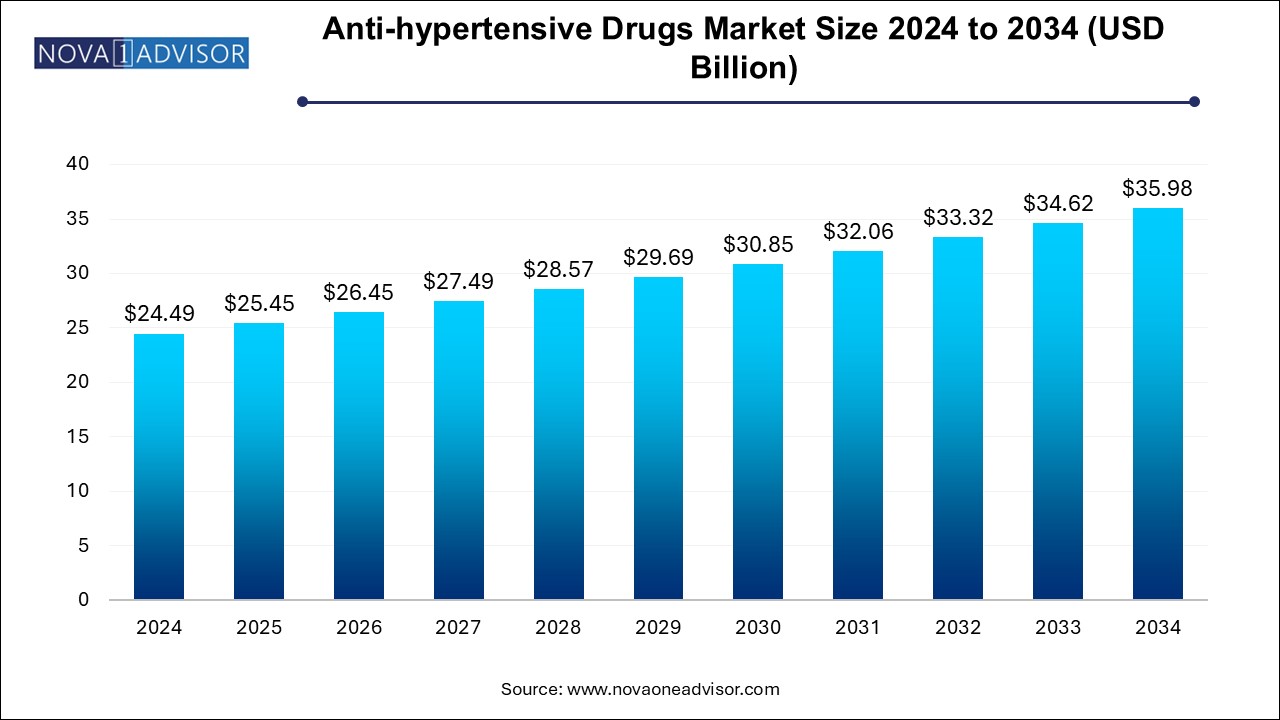

Anti-hypertensive Drugs Market Size and Growth

The anti-hypertensive-drugs-market size was exhibited at USD 24.49 billion in 2024 and is projected to hit around USD 35.98 billion by 2034, growing at a CAGR of 3.92% during the forecast period 2025 to 2034.

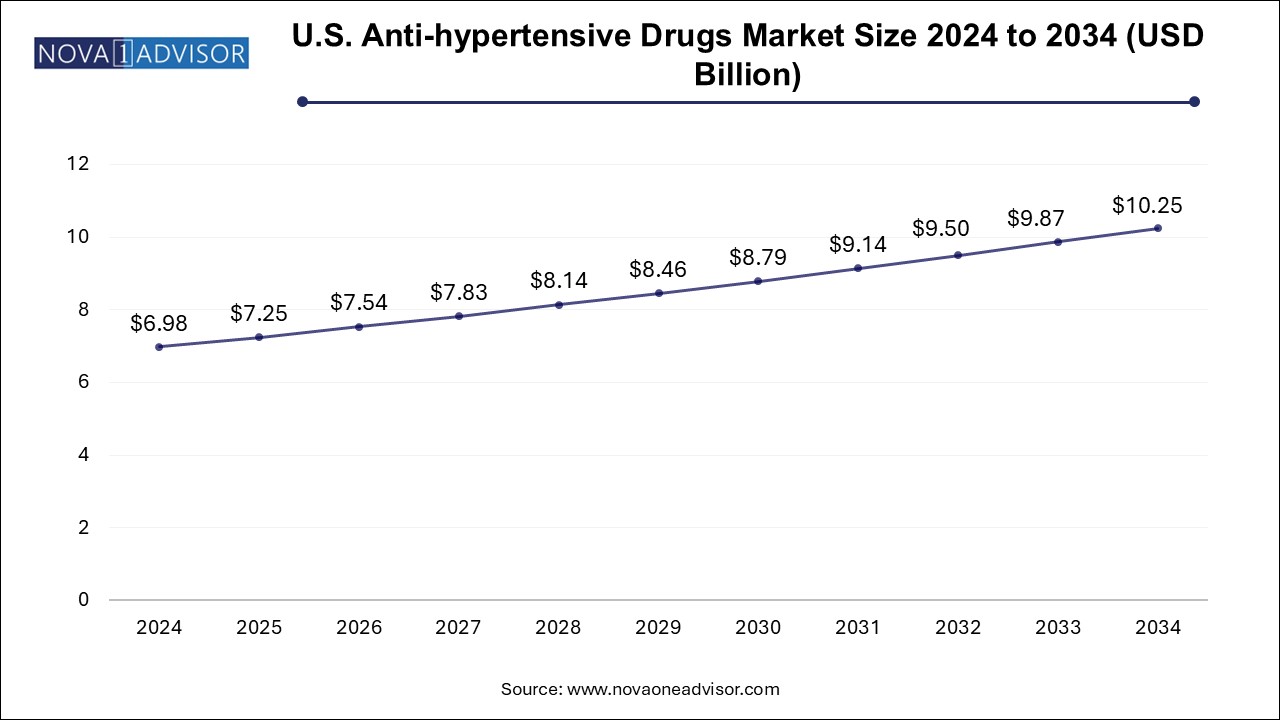

U.S. Anti-Hypertensive Drugs Market Size and Growth 2025 to 2034

The U.S. anti-hypertensive drugs market size is evaluated at USD 6.98 billion in 2024 and is projected to be worth around USD 10.25 billion by 2034, growing at a CAGR of 3.55% from 2025 to 2034.

North America dominates the anti-hypertensive drugs market, primarily driven by a high prevalence of hypertension, a strong healthcare infrastructure, and well-established pharmaceutical supply chains. The U.S. leads in terms of drug consumption, influenced by favorable reimbursement policies and clinical guidelines encouraging early diagnosis and treatment. Additionally, the region is home to major pharmaceutical companies such as Pfizer and Johnson & Johnson, further reinforcing its leadership position. Public health initiatives such as the CDC’s “Million Hearts” campaign have also successfully raised awareness and improved medication adherence, helping maintain North America's market dominance.

Asia Pacific is the fastest-growing region in the market. This growth is fueled by rapidly urbanizing populations, increasing incidences of obesity and diabetes, and improved healthcare access in countries like India and China. Government initiatives promoting primary care and essential drug availability, along with foreign direct investment in pharmaceutical manufacturing, are further propelling market growth. Countries like Japan and South Korea are also advancing in precision medicine and digital therapeutics, which may contribute to increased demand for newer anti-hypertensive formulations and delivery systems.

Market Overview

The global anti-hypertensive drugs market is a critical segment of the pharmaceutical industry, addressing one of the most prevalent chronic conditions worldwide—hypertension, also known as high blood pressure. According to the World Health Organization (WHO), over 1.28 billion adults aged 30–79 globally are estimated to have hypertension, with the majority living in low- and middle-income countries. This underscores the sustained and growing demand for effective blood pressure management solutions.

Anti-hypertensive drugs are prescribed to reduce high blood pressure and prevent complications such as stroke, heart attacks, and kidney damage. These medications are commonly used for both primary hypertension (with no identifiable cause) and secondary hypertension (caused by underlying conditions). The market comprises various drug classes, including diuretics, ACE inhibitors, calcium channel blockers, beta-blockers, and vasodilators. It serves a broad patient base across retail, hospital, and online pharmacies, with oral medications being the most commonly prescribed route of administration.

In recent years, the market has experienced steady growth driven by a combination of aging populations, sedentary lifestyles, and rising obesity rates—major contributors to hypertension. Furthermore, increased awareness campaigns, expanded healthcare access, and innovations in fixed-dose combination drugs are contributing to market growth. However, the landscape is not without challenges, including patent expirations, side effect profiles, and the growing preference for non-pharmacological treatments in some regions.

Major Trends in the Market

-

Shift Toward Combination Therapy: Fixed-dose combination drugs are increasingly being adopted due to improved patient adherence and convenience, particularly in treating complex or resistant hypertension cases.

-

Rise in Personalized Medicine: Advancements in genomics and biomarkers are paving the way for more tailored anti-hypertensive treatments, especially in secondary hypertension cases.

-

Technological Integration: Digital health monitoring tools, such as wearable blood pressure monitors and app-based medication tracking, are supporting therapy adherence.

-

Increased Use of Generic Drugs: With many blockbuster anti-hypertensive drugs losing patent protection, the use of generics is expanding rapidly, especially in emerging economies.

-

Focus on Minimizing Side Effects: Pharmaceutical companies are investing in research to reduce common adverse effects like dizziness, fatigue, and electrolyte imbalance, improving patient tolerance.

-

Growing Government and NGO Initiatives: Global health bodies are funding programs to ensure broader access to anti-hypertensive drugs, especially in underserved populations.

-

Regional Formulary Reforms: Some countries are revising their national drug formularies to incorporate newer or cost-effective anti-hypertensives, driving sales volumes.

Report Scope of Anti-hypertensive Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 25.45 Billion |

| Market Size by 2034 |

USD 35.98 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 3.92% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Drug Class, Type, Route of Administration, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Sanofi; Boehringer Ingelheim International GmbH; Novartis AG; Johnson & Johnson Services, Inc.; DAIICHI SANKYO COMPANY; LIMITED.; Merck & Co., Inc.; AstraZeneca; Pfizer Inc.; Lupin; Sun Pharmaceutical Industries Ltd. |

Key Market Driver: Growing Global Burden of Hypertension

One of the most potent drivers of the anti-hypertensive drugs market is the increasing global prevalence of hypertension. Modern sedentary lifestyles, unhealthy diets rich in sodium and fat, lack of physical activity, and increased stress levels have significantly contributed to the rise in hypertension cases, particularly among adults over the age of 40. In addition, aging populations in countries like Japan, the U.S., and Italy have contributed to a higher incidence of chronic diseases including hypertension.

Hypertension is a silent condition that often goes undetected until it results in severe complications, such as heart disease, stroke, or kidney failure. This has led to a push for early detection and long-term treatment. Public health awareness programs such as "Know Your Numbers" in the UK and blood pressure screening initiatives in U.S. pharmacies are expanding the diagnosed patient base, thereby boosting drug sales. Furthermore, many patients require lifelong treatment, translating into a consistent revenue stream for pharmaceutical manufacturers.

Key Market Restraint: Side Effects and Adherence Issues

Despite their effectiveness, anti-hypertensive drugs often come with side effects, which pose a significant barrier to long-term adherence. Common complaints include fatigue, dizziness, sexual dysfunction, and frequent urination (especially with diuretics). Such effects can lead to poor compliance, with patients discontinuing medication or not following dosage recommendations—especially when symptoms of hypertension are not overt.

For instance, elderly patients on beta-blockers may report feeling excessively tired or lightheaded, prompting them to skip doses. Similarly, young adults concerned about sexual side effects may resist long-term therapy. This hesitancy negatively impacts treatment outcomes and creates challenges for healthcare providers. To mitigate this, patient education and the development of drugs with improved safety profiles remain essential. Additionally, physicians are increasingly opting for personalized drug regimens to minimize side effects, though this often involves higher costs and complexity.

Key Market Opportunity: Penetration in Emerging Markets

The anti-hypertensive drugs market presents a significant growth opportunity in emerging economies, particularly in Asia Pacific and parts of Africa and Latin America. These regions are experiencing rapid urbanization and lifestyle changes that correlate with increased rates of hypertension. However, healthcare infrastructure and access to prescription drugs remain limited in many rural and peri-urban areas.

Governments and NGOs are actively working to bridge this gap. For example, India's "Ayushman Bharat" scheme aims to provide free medications, including anti-hypertensives, to millions of low-income citizens. The World Health Organization has also collaborated with pharmaceutical companies to reduce the prices of essential medications for low- and middle-income countries. This, combined with growing investments in healthcare and improved distribution networks, creates a fertile environment for market expansion.

Anti-hypertensive Drugs Market By Drug Class Insights

Calcium channel blockers dominated the drug class segment in 2024. These medications are preferred for their efficacy in both monotherapy and combination therapy, and are particularly useful for elderly patients and those with comorbid conditions such as angina or arrhythmias. Drugs like amlodipine and nifedipine are commonly prescribed due to their relatively favorable side effect profiles and once-daily dosing, which enhance adherence. Calcium channel blockers also tend to show superior outcomes in Black populations, making them a first-line option in diverse global markets. As per clinical guidelines, they are frequently recommended alongside diuretics for initial therapy in many hypertensive patients.

The fastest-growing drug class is the ACE inhibitors segment. With the continued rise in patients suffering from both hypertension and diabetes or chronic kidney disease, ACE inhibitors such as lisinopril and enalapril are gaining traction due to their renal-protective benefits. These drugs are recommended by major clinical guidelines, including those from the American College of Cardiology (ACC), for patients at risk of cardiovascular and renal complications. Additionally, the introduction of newer ACE inhibitors with improved tolerability profiles is contributing to segment growth, particularly in developed regions where brand-name drug use remains high despite the availability of generics.

Anti-hypertensive Drugs Market By Type Insights

Primary hypertension was the dominating segment in terms of treatment volume and revenue. This condition, which accounts for over 90% of all hypertension cases, typically develops over years and has no identifiable cause. Lifestyle factors such as high salt intake, obesity, and stress contribute to its progression. Treatment primarily includes long-term pharmacological management and lifestyle modification, thus creating consistent demand for anti-hypertensive drugs. Given the sheer prevalence of primary hypertension, this segment naturally commands a larger share of the market.

Secondary hypertension is the fastest-growing segment. Although it accounts for a smaller portion of total cases, improved diagnostics and increased awareness are driving growth. This form of hypertension is caused by identifiable medical conditions such as kidney disease or hormonal disorders. As personalized medicine and precision diagnostics become more prevalent, especially in tertiary care hospitals, more cases of secondary hypertension are being detected and appropriately managed with targeted drug therapies.

Anti-hypertensive Drugs Market By Route of Administration Insights

Oral administration dominated the market due to ease of use and patient compliance. Most anti-hypertensive medications are formulated for oral delivery, allowing patients to self-administer their treatment without clinical supervision. Oral drugs also tend to be less expensive to produce and distribute, contributing to their dominance in both high-income and low-resource settings. The availability of oral fixed-dose combination therapies further enhances their utility in outpatient settings.

Injectables are the fastest-growing segment. While traditionally limited to hospital settings for managing hypertensive emergencies, injectable formulations are seeing increased usage in acute care environments. Drugs like labetalol and hydralazine are administered intravenously to provide rapid blood pressure control in critical care scenarios, such as stroke units and intensive care wards. Advances in formulation technologies may also lead to long-acting injectable anti-hypertensives in the future.

Anti-hypertensive Drugs Market By Distribution Channel Insights

Retail pharmacies held the largest market share. The accessibility and convenience of retail pharmacies make them the primary point of sale for chronic condition medications, including anti-hypertensive drugs. Patients on long-term therapy often refill prescriptions monthly or quarterly, and retail settings also offer basic patient education services, encouraging adherence.

Online pharmacies are the fastest-growing distribution channel. With the digital transformation of healthcare, more patients—especially younger, tech-savvy demographics—are choosing online platforms for prescription refills. The COVID-19 pandemic further accelerated this shift. Online pharmacies offer discounts, doorstep delivery, and automated refill options, making them a preferred channel for chronic medications like those for hypertension.

Some of the prominent players in the anti-hypertensive-drugs-market include:

-

Pfizer Inc.

-

Novartis AG

-

AstraZeneca PLC

-

Merck & Co., Inc.

-

Sanofi S.A.

-

Boehringer Ingelheim GmbH

-

Johnson & Johnson

-

Teva Pharmaceutical Industries Ltd.

-

Bayer AG

-

Cipla Ltd.

-

Takeda Pharmaceutical Company Limited

-

Glenmark Pharmaceuticals

Recent Developments

-

Pfizer Inc. (January 2025): Announced the development of a new fixed-dose combination anti-hypertensive pill that combines an ACE inhibitor and a calcium channel blocker, aimed at improving adherence among elderly patients.

-

Novartis AG (March 2024): Received FDA Fast Track designation for a novel angiotensin receptor neprilysin inhibitor (ARNI)-based therapy that targets both hypertension and early-stage heart failure.

-

Cipla Ltd. (December 2024): Expanded its generic anti-hypertensive portfolio in Africa by launching a new branded generic version of amlodipine in collaboration with local healthcare providers.

-

AstraZeneca (October 2024): Published Phase III clinical trial results for a next-gen beta-blocker with reduced side effect profile, showing promise for market entry by late 2025.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the anti-hypertensive-drugs-market

By Drug Class

- Diuretics

- ACE Inhibitors

- Calcium Channel Blockers

- Beta-adrenergic Blockers

- Vasodilators

- Others

By Type

- Primary Hypertension

- Secondary Hypertension

By Route of Administration

By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- Online Pharmacy

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)