APAC Micro LED Market Size and Research

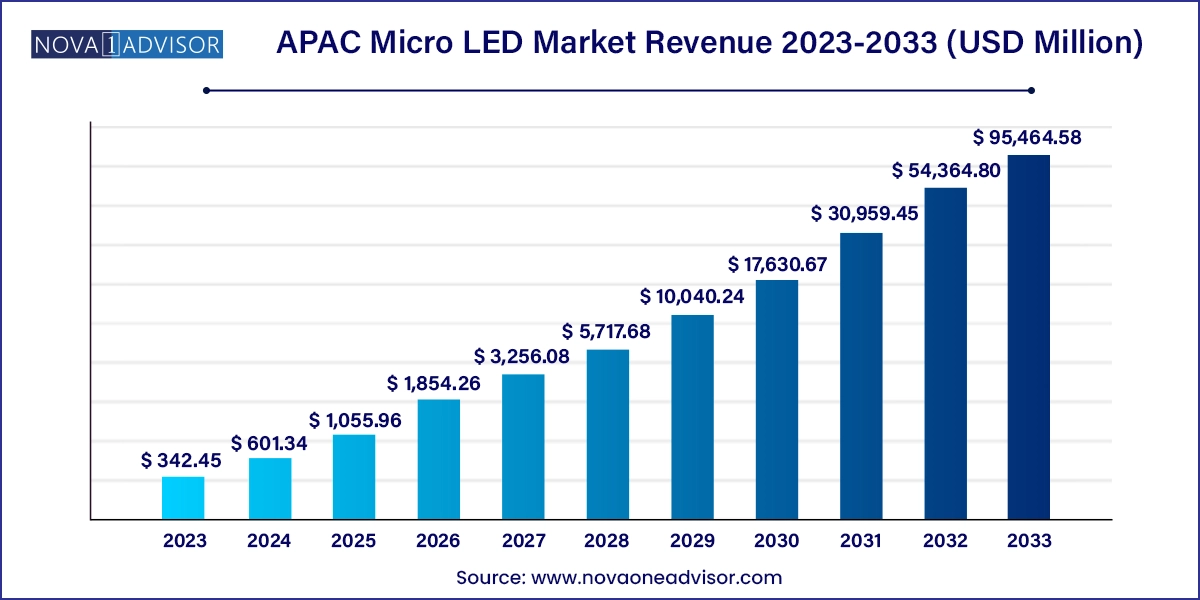

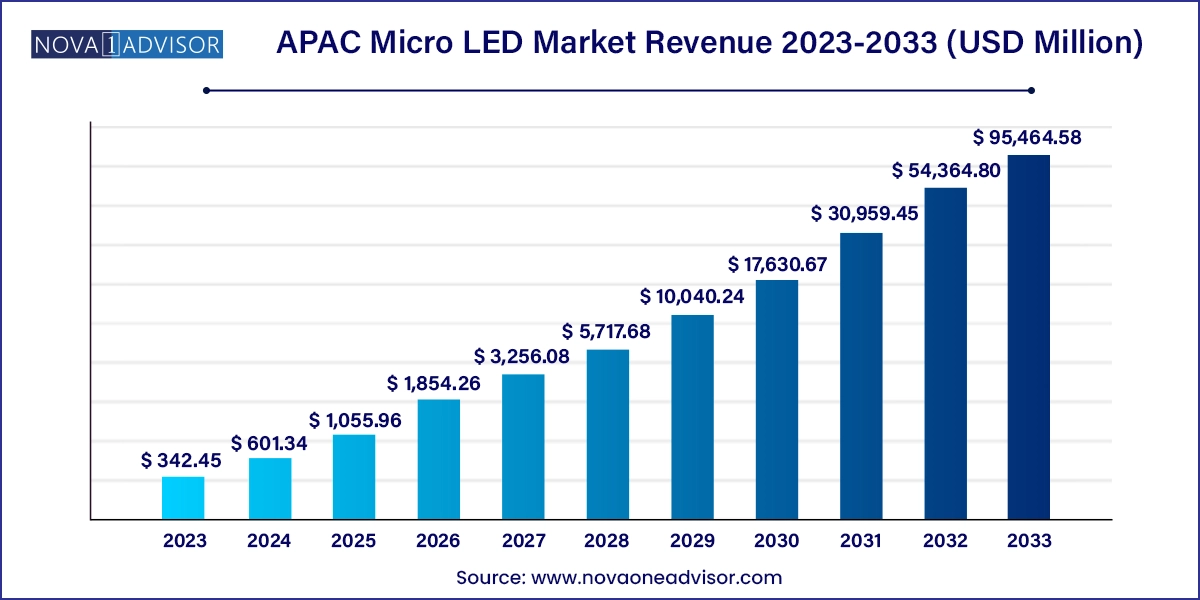

The APAC micro LED market size was exhibited at USD 342.45 million in 2023 and is projected to hit around USD 95,464.58 million by 2033, growing at a CAGR of 75.6% during the forecast period 2024 to 2033.

APAC Micro LED Market Key Takeaways:

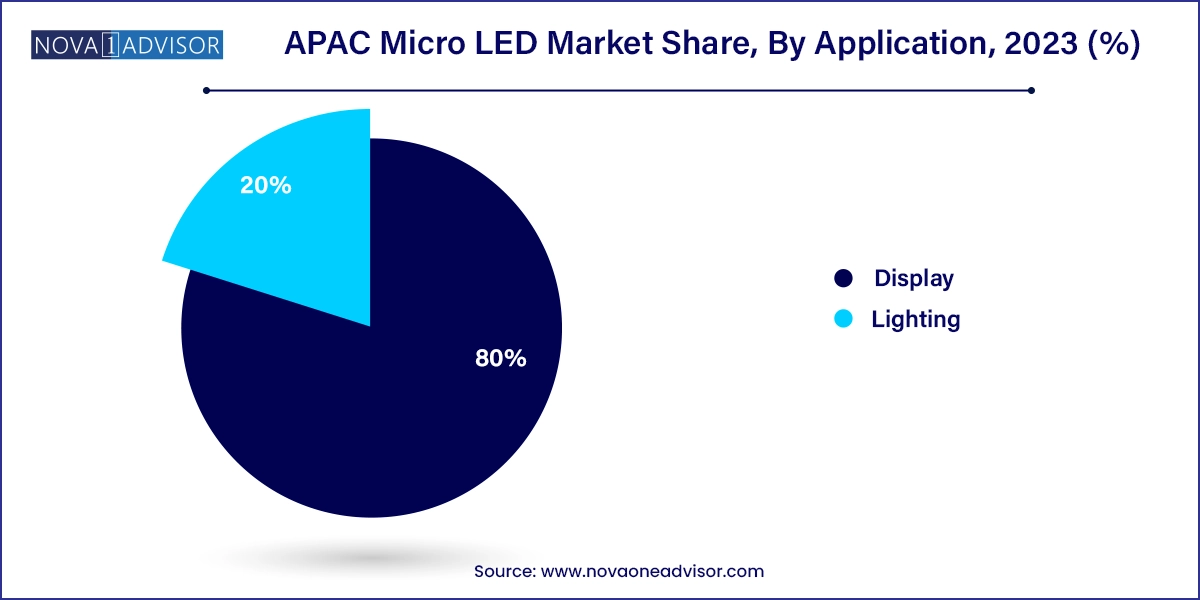

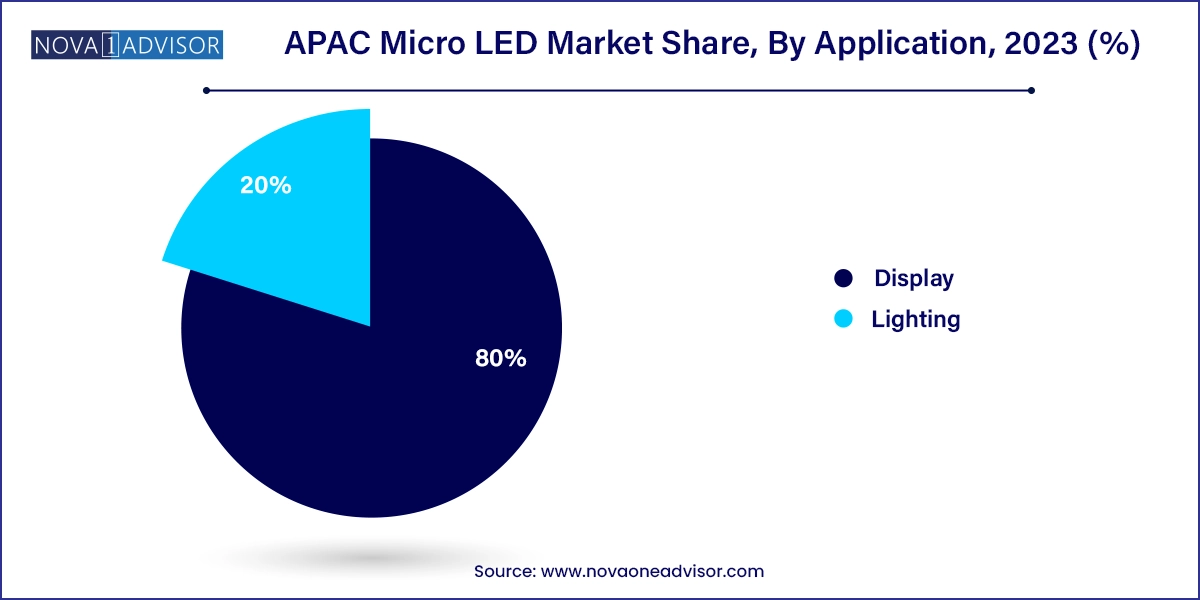

- Display segment dominates the market and accounted for the highest revenue of USD 280.8 million in 2023.

- The services segment is anticipated to witness a significant CAGR of 74.6% from 2024 to 2033 in the APAC Micro LED Market.

- Television segment led the market and accounted highest revenue share of 85.7% in 2023.

- Smartwatch segment is anticipated to witness CAGR of 141.8% from 2024 to 2033 in the APAC Micro LED Market.

- General lighting segment led the market and accounted highest revenue share of 72.1% in 2023.

- Automotive lighting segment is anticipated to witness CAGR of 76.7% from 2024 to 2033 in the APAC Micro LED Market.

- Greater than 5000ppi segment led the market and accounted highest revenue of USD 123.7 million in 2023.

- 3000ppi to 5000ppi segment is anticipated to witness CAGR of 75.8% from 2024 to 2033 in the APAC Micro LED Market.

- Customer electronics segment accounted for the largest market revenue share of 50.1% in 2023.

- Healthcare segment is expected to register the fastest CAGR of 77.3% during the forecast period.

Market Overview

The Asia-Pacific (APAC) micro LED market is emerging as a dynamic and technologically advanced frontier within the global display and lighting industry. Micro light-emitting diode (micro LED) technology, characterized by ultra-small LEDs (typically smaller than 100 micrometers), offers revolutionary improvements over existing display technologies such as OLED and LCD. It combines the advantages of high brightness, energy efficiency, faster response time, superior contrast, and longevity while being immune to burn-in issues that plague OLEDs.

With countries like China, South Korea, Taiwan, and Japan leading in semiconductor and display innovations, the APAC region is playing a central role in the development, manufacturing, and commercialization of micro LED technology. Large conglomerates such as Samsung, LG Display, BOE Technology, and AU Optronics, along with specialized manufacturers like PlayNitride and Epistar, are actively investing in R&D, partnerships, and pilot production lines to address the technical challenges of micro LED mass transfer, uniformity, and yield optimization.

The APAC market is witnessing increasing demand across consumer electronics, automotive displays, smart wearables, augmented/virtual reality (AR/VR), healthcare imaging, and high-end televisions. Additionally, the integration of micro LEDs in general and automotive lighting applications is gaining momentum. With extensive semiconductor fabrication infrastructure, skilled labor, and a robust supply chain ecosystem, APAC is poised to dominate the global micro LED market, both in volume and technological advancement.

Major Trends in the Market

-

Proliferation of Micro LED in AR & VR Headsets: The ultra-small size, low power consumption, and high brightness of micro LEDs make them ideal for immersive displays in AR glasses and VR headsets.

-

Automotive Applications Gaining Momentum: OEMs are increasingly integrating micro LEDs into dashboards, head-up displays (HUDs), and external lighting systems for their compactness and high brightness.

-

Wearable Devices Fueling Volume Demand: Smartwatches and fitness bands are emerging as early commercial use cases for micro LED due to their need for compact, power-efficient, and sunlight-readable displays.

-

Miniaturization and Ultra-Fine Pixel Pitch Advancements: Companies are pushing micro LED manufacturing toward higher pixel density (greater than 5000ppi) for premium displays and medical imaging.

-

China’s Government-Led Push into Next-Gen Display Technology: Government incentives, smart city projects, and national goals are accelerating domestic innovation in micro LED R&D and manufacturing.

-

Collaborative Ecosystem Development: Partnerships among semiconductor players, display panel makers, and startups are enabling faster resolution of mass transfer and yield challenges.

-

High-End TV Commercialization: Despite premium pricing, luxury TV brands in South Korea and Japan have begun offering micro LED TVs as flagship products.

-

Transition Toward Backplane-agnostic Designs: Shift from rigid silicon backplanes to flexible alternatives is opening doors for flexible and curved micro LED displays.

Report Scope of APAC Micro LED Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 601.34 Million |

| Market Size by 2033 |

USD 95,464.58 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 75.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Display, Lighting, Display Pixel Density, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

APAC |

| Key Companies Profiled |

AUO Corporation; BOE Technology;Cincoze Co., Ltd.; Epistar; Foshan NationStar Optoelectronics Co.,Ltd; HC SemiTek; Innolux Corporation; Jade Bird Display; KYOCERA Corporation; Ledman Optoelectronic Co; LEYARD; LG Electronics; PlayNitride; Samsung Electronics Co., Ltd.; SANAN Optoelectronics; Seoul Semiconductor Co Ltd; Sony Corporation; Unilumin |

A key growth driver for the APAC micro LED market is the rapidly increasing demand for high-performance, power-efficient display technology in the consumer electronics sector. As consumers gravitate toward displays that offer enhanced visual quality, longer lifespans, and minimal power usage, micro LED emerges as a natural successor to OLED and LCD technologies.

Smartphones, tablets, laptops, and televisions are increasingly expected to deliver brighter images, wider color gamuts, and improved durability. Micro LEDs fulfill these requirements with exceptional pixel control, near-infinite contrast, and superior luminance, making them ideal for both indoor and outdoor environments. In particular, companies like Samsung and LG are leveraging micro LEDs in next-generation TVs, where image fidelity and size scalability matter most.

Furthermore, the miniaturization of components in wearables, AR/VR headsets, and smart devices fuels the adoption of micro LEDs due to their space-saving attributes and minimal heat dissipation. APAC’s stronghold in electronics manufacturing and consumer product innovation significantly bolsters this market trend.

Market Restraint: High Manufacturing Costs and Mass Production Complexity

Despite its potential, a key restraint limiting wider commercialization of micro LED displays is the high cost of production and the complexity involved in manufacturing processes, especially in mass transfer and defect control. Producing micro LEDs involves placing millions of microscopic LEDs on a backplane with extreme precision—a process that currently suffers from low yield rates and high equipment costs.

For example, assembling a 4K resolution display requires over 24 million micro LEDs to be accurately positioned and tested, which increases the chances of misalignment, pixel failure, and costly rework. Moreover, the scalability of this process across different panel sizes and applications remains a significant technological hurdle.

While large companies in APAC are investing in advanced tools and automation to overcome these limitations, the high barrier to entry for smaller firms and startups remains a challenge. These constraints affect pricing strategies and limit adoption to premium product categories, particularly in consumer electronics.

Market Opportunity: Expanding Use of Micro LEDs in Automotive and Healthcare Displays

The expansion of micro LED applications in the automotive and healthcare industries presents a promising growth opportunity for the APAC market. In automotive systems, micro LEDs are being adopted in instrument clusters, infotainment displays, HUDs, and ambient lighting due to their resilience in high-temperature environments, energy efficiency, and high brightness.

APAC is home to several leading automotive OEMs and Tier-1 suppliers who are now exploring micro LEDs to meet demand for in-vehicle display innovation, particularly in electric and autonomous vehicles. Curved dashboards, customizable digital cockpits, and smart mirrors are use cases where micro LEDs outperform other technologies in form factor and visual performance.

In healthcare, micro LEDs offer potential in medical imaging and wearable health monitors. Their compactness and brightness are ideal for high-resolution diagnostic screens, surgical displays, and next-generation biosensors. The aging population in countries like Japan and the rising digital health trend across China and South Korea further amplify the relevance of this market opportunity.

APAC Micro LED Market By Application Insights

Display applications dominated the APAC micro LED market, accounting for the largest revenue share. Within this segment, televisions remain a key product category, where companies like Samsung (with “The Wall”) and Sony (with “Crystal LED”) have already commercialized large-scale micro LED displays for ultra-premium buyers. The scalability of micro LEDs—allowing custom screen sizes without degrading image quality—is a key factor behind their appeal in high-end home entertainment and commercial signage. Smartwatches and AR/VR headsets also represent volume-driven display segments with immediate market potential, particularly as their compact size and sunlight readability are critical design requirements.

Lighting applications are growing at a faster pace, especially in automotive lighting and architectural general lighting. Micro LED-based lighting solutions are being adopted in adaptive headlights, tail lights, and smart interior lighting systems due to their pixel-level controllability and energy efficiency. General lighting applications—like signage, ambient lighting in public spaces, and integrated architectural designs—are beginning to see micro LED adoption, particularly where design flexibility and visual aesthetics are prioritized.

APAC Micro LED Market By Display Insights

Television displays dominate the display sub-segment, as consumer interest in ultra-large screens, high brightness, and next-gen clarity drives investment from panel manufacturers. Samsung has led this effort with its micro LED TV lineup, initially introduced in luxury markets across South Korea and APAC. These TVs offer modularity and higher longevity compared to OLED, making them ideal for ultra-high-net-worth individuals and public venues.

AR & VR displays are the fastest-growing, driven by exponential growth in immersive technologies and metaverse platforms. Micro LEDs deliver low latency, high brightness, and a wide color gamut with minimal form factor—making them ideal for headsets where space is limited, and thermal efficiency is crucial. With Apple, Meta, and local players in China launching AR glasses and VR gear, micro LEDs are set to become the dominant display technology in this space over the next five years.

APAC Micro LED Market By Lighting Insights

Automotive lighting holds the dominant share, especially in Japan, South Korea, and increasingly in China, where electric vehicle manufacturing is accelerating. Micro LEDs are integrated into adaptive driving beams (ADB), tail lights, and cabin ambient lighting. OEMs are leveraging micro LED's fine-tuned pixel control to deliver precise beam shaping and intelligent lighting systems that improve driver safety.

General lighting is the fastest-growing segment, particularly in APAC’s urban design and infrastructure projects. Cities like Tokyo, Seoul, and Shanghai are implementing smart, energy-efficient lighting for pedestrian zones, transit terminals, and shopping complexes. Micro LED-based architectural and display lighting enables creative design with programmable luminance and dynamic visual experiences.

APAC Micro LED Market By Display Pixel Density Insights

Displays with less than 3000ppi currently dominate, especially for applications like TVs, smartphones, and digital signage, where ultra-high pixel density is not yet essential. Manufacturing costs are lower in this range, and the existing supply chain in APAC is optimized for large-format, lower-ppi micro LED displays.

The segment with greater than 5000ppi is growing fastest, particularly in AR/VR and medical displays. Such ultra-fine pixel density enables crystal-clear imagery even when viewed close to the eyes, a necessity in head-mounted displays and high-end diagnostic imaging. Taiwanese players like PlayNitride and Epistar are actively advancing technologies to achieve this level of miniaturization with high yields.

APAC Micro LED Market By End-use Insights

Consumer electronics remains the dominant end-use sector, with companies like Samsung, Sony, LG, and TCL leading commercialization of micro LED-based displays in televisions, smartphones, tablets, and wearables. The APAC region's dominance in electronics manufacturing, coupled with rising consumer affluence, fuels demand for next-gen visual experiences.

The automotive sector is the fastest-growing, spurred by a surge in EV production and vehicle digitization. Automotive OEMs in Japan, China, and South Korea are rapidly adopting micro LED displays for smart dashboards, HUDs, and advanced lighting systems. Partnerships between panel makers and automotive suppliers are accelerating time-to-market for micro LED-integrated vehicles.

Country Insights

China

China is at the forefront of APAC’s micro LED expansion, supported by substantial government investment in semiconductor and display technologies. Companies such as BOE Technology and Konka Group have launched pilot lines for micro LED TV panels and wearable displays. Additionally, start-ups and universities are collaborating to solve mass transfer and quantum dot integration challenges. With the government designating display technology as a strategic priority under its "Made in China 2025" policy, the micro LED segment is seeing accelerated R&D and domestic commercialization.

South Korea

South Korea, led by Samsung and LG Display, continues to push boundaries in micro LED TV commercialization and micro-architectural design. Samsung's production facility in Suwon is one of the most advanced in micro LED R&D. Moreover, South Korean universities and public labs are heavily invested in improving micro LED yields and backplane integration, especially for transparent and foldable displays.

Japan

Japan’s emphasis on precision manufacturing and imaging quality supports its leadership in micro LED technology for professional and medical use cases. Sony’s Crystal LED display systems are widely adopted in control rooms, simulators, and entertainment venues. Japanese universities are also researching GaN-on-silicon and RGB micro LED stacking techniques, which promise to lower production costs.

Taiwan

Taiwan is home to key players such as AUO, Epistar, and PlayNitride, which are at the center of micro LED material innovation and packaging technologies. Taiwan’s integration of semiconductor and panel manufacturing ecosystems gives it a strategic edge in the mass production of micro LEDs for consumer electronics and automotive applications.

APAC Micro LED Market Recent Developments

-

April 2024 – Samsung Display announced the expansion of its micro LED pilot line in South Korea, targeting ultra-fine pixel pitch modules for transparent displays and digital signage.

-

February 2024 – AUO Corporation launched a new automotive-grade micro LED display for dashboards and HUDs, co-developed with leading EV manufacturers in Taiwan and Japan.

-

January 2024 – BOE Technology unveiled its 85-inch 8K micro LED TV prototype at the Display Week Asia, showcasing enhanced color rendering and energy efficiency.

-

December 2023 – PlayNitride began mass production of its micro LED smartwatch modules for a major Chinese wearable brand, marking the first high-volume deployment of wearable micro LED panels.

-

November 2023 – LG Display showcased its flexible micro LED technology at CEATEC Japan, targeting future rollable TVs and curved AR displays.

Some of the prominent players in the APAC micro LED market include:

- AUO Corporation

- BOE Technology

- Cincoze Co., Ltd.

- Epistar

- Foshan NationStar Optoelectronics Co.,Ltd

- HC SemiTek

- Innolux Corporation

- Jade Bird Display

- KYOCERA Corporation

- Ledman Optoelectronic Co

- LEYARD

- LG Electronics

- PlayNitride

- Samsung Electronics Co., Ltd.

- SANAN Optoelectronics

- Seoul Semiconductor Co Ltd

- Sony Corporation

- Unilumin

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the APAC micro LED market

Application

Display

- Television

- AR & VR

- Automotive

- Smartwatch

- Smartphone, Tablets, and Laptops

Lighting

- General Lighting

- Automotive Lighting

Display Pixel Density

- Less than 3000ppi

- 3000ppi to 5000ppi

- Greater than 5000ppi

End-use

- Automotive

- Consumer Electronics

- Healthcare

- BFSI

- Aerospace & Defence

- Others