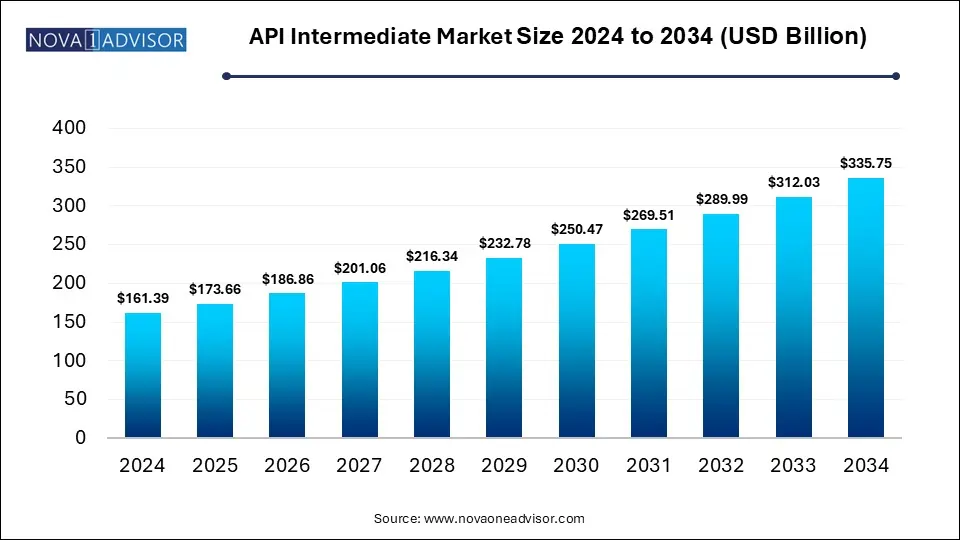

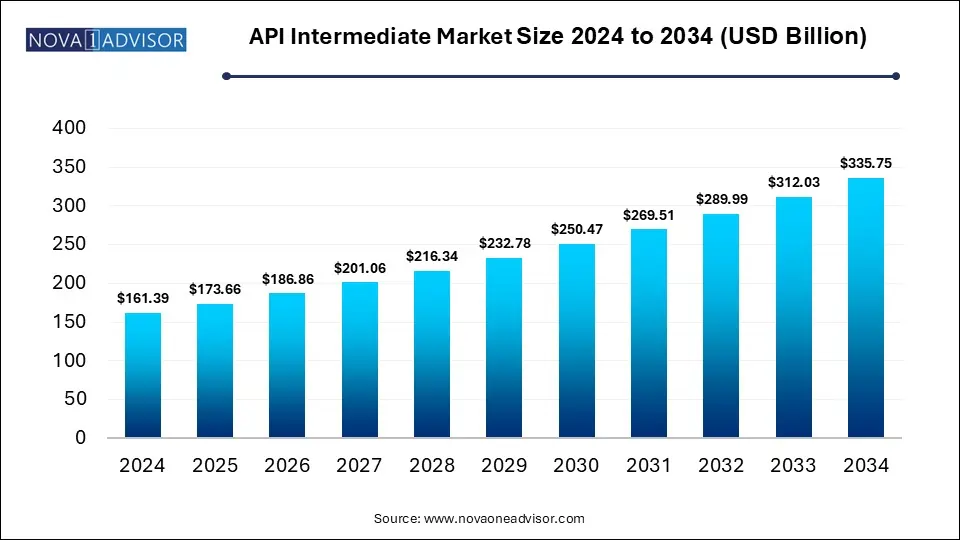

The global API Intermediate market size is calculated at USD 161.39 billion in 2024, grow to USD 173.66 billion in 2025, and is projected to reach around USD 335.75 billion by 2034, growing at a CAGR of 7.6% from 2025 to 2034. The market is growing due to rising pharmaceutical production and increased demand for cost-effective, high-quality components. Additionally, outsourcing trends and the global expansion of generic drug manufacturing are fueling market growth.

- Asia-Pacific dominated the API Intermediate market in 2024.

- North America is expected to grow at a notable rate in the market during the forecast period.

- By type, the bulk drug intermediates segment dominated the market in 2024.

- By type, the chemical intermediates segment is expected to grow at the fastest CAGR in the market during the studied years.

- By application, the anti-infective drugs segment held the largest market share.

- By application, the antidiabetic drugs segment is expected to grow at the fastest CAGR in the market during the studied years.

- By end-user, the biotech and pharmaceutical companies segment led the market in 2024.

- By end-user, the CMO segment is expected to grow at the fastest CAGR in the market during the studied years.

API intermediate is a chemically processed substance formed during the synthesis of an active pharmaceutical ingredient. It is not the final product but a crucial step in the multi-stage process, undergoing further reactions to become the finished API used in pharmaceutical formulation. Innovation is driving significant growth in the API intermediate market by improving production efficiency, product quality, and environmental sustainability. Advanced manufacturing technologies such as continuous processing and flow chemistry streamline operations and reduce costs. The adoption of green chemistry minimizes ecological impact, while automation and AI enhance research, process optimization, and quality control. Additionally, novel synthetic routes and demand for high-purity, custom intermediates are enabling faster and more efficient development of complex pharmaceutical ingredients, boosting overall market competitiveness.

- In July 2023, Evonik Industries AG collaborated with Heraeus Precious Metals to strengthen its service offerings related to highly potent active pharmaceutical ingredients (HPAPIs). This partnership aims to boost Evonik’s capabilities in the HPAPI segment.

- In May 2023, Evonik Industries AG entered into a distribution agreement with IMCD, a leading distributor of specialty chemicals, to promote its pharmaceutical products across Europe. This collaboration is expected to support Evonik in expanding its market reach and driving business growth in the region.

AI is positively impacting the API intermediate market by enhancing efficiency, reducing costs, and improving quality. It enables faster and smarter research by predicting optimal synthesis routes and reaction outcomes. AI-driven tools support real-time quality monitoring and predictive maintenance, minimizing production downtime. Additionally, AI helps in data analysis to streamline manufacturing processes and ensure regulatory compliance. Overall, AI is accelerating innovation and productivity across the API intermediate value chain.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 173.66 Billion |

| Market Size by 2034 |

USD 335.75 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Application, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

HIKAL Ltd, Cambrex Corporation, Ganesh-Group, AlzChem Group AG, Vasudha Pharma, Pfizer CentreOne, Evonik Industries AG, Sun Pharmaceutical, Industries, Aurobindo Pharma, Cipla Limited |

Market Dynamics

Driver

Rising demand for Generic and Innovative Pharmaceuticals

The growing demand for both generic and innovative pharmaceuticals is a major driver in the API intermediate market. As healthcare needs expand globally, there is increased pressure to produce cost-effective and high-quality medications. This surge in demand encourages pharmaceutical companies to scale up production, directly boosting the need for API intermediates. Additionally, patient expectations and the push for affordable treatment in emerging markets further fuel the growth of API intermediates manufacturing worldwide.

For Instance, In July 2024, Glenmark Life Sciences reported a 6.2% year-over-year growth in its generic API business for Q1 FY25, reaching ₹5,354 million. This increase was driven by strong demand in regulated markets like Europe and Latin America. The company also expanded its portfolio by adding five new products, including three high-potency APIs in oncology and two synthetic small molecules, reflecting the rising global demand for generic and innovative pharmaceuticals.

Restraint

Stringent Regulatory Requirement

Strict regulatory requirements hinder the growth of the API intermediate market as companies must invest heavily in documentation, audits, and compliance systems. These regulations vary across regions, creating complexity in global operations. Smaller players often lack the resources to meet these standards, restricting their entry or expansion. Additionally, regulatory delays can slow production timelines and disrupt supply consistency, making it challenging for manufacturers to respond swiftly to market demand or develop new pharmaceutical ingredients efficiently.

Opportunity

Increasing Shift towards Specialty and High Potency Drugs

The increasing shift towards specialty and high-potency drugs offers a major opportunity in the API intermediate market, as these medications require advanced, high-purity intermediates for their formulation. With rising cases of cancer, autoimmune, and rare diseases, the demand for targeted and effective treatment is growing. This trend encourages manufacturers to invest in specialized facilities and technologies, allowing them to cater to the high-value segment and meet stringent quality standards, ultimately driving long-term growth and innovation in the market.

For Instance, In July 2024, Pfizer expanded its high-potency API (HPAPI) manufacturing capabilities by opening a new facility in Singapore. This strategic move was driven by the increasing demand for targeted oncology therapies, which require specialized and potent intermediates. The facility is designed to enhance Pfizer's capacity to produce complex HPAPIs, positioning the company to better meet the growing global need for advanced cancer treatments.

Segmental Insights

How will the Bulk Drug Intermediates Segment Dominate the API Intermediate Market in 2024?

In 2024, the bulk drug intermediate segment led the market due to its widespread use in the large-scale production of essential drugs across various therapeutic areas. The growing need for affordable generics and mass-manufactured medications increased demand for these intermediates. Additionally, rising investments in pharmaceutical infrastructure and support from government schemes to boost in-house manufacturing helped strengthen this segment's dominance, especially in emerging economies aiming to reduce reliance on imports.

The chemical intermediates segment is expected to grow at the fastest CAGR in the API intermediates market due to its broad application across various drug formulations and its adaptability to diverse chemical processes. Ongoing innovations in synthetic chemistry, coupled with the rising focus on efficient and scalable drug manufacturing, are driving demand. Moreover, increased outsourcing by pharma companies and the push for high-purity intermediates in complex drug development are further accelerating the growth of the market.

Why Did the Anti-infective Drugs Segment Dominate the Market in 2024?

In 2024, the anti-infective drug segment led the market due to continuous demand for treatment against bacterial, viral, and fungal infections. Frequent outbreaks, along with the prevalence of chronic infection in both developed and developing regions, fueled large-scale production of anti-infective drugs. Moreover, increased government funding for infectious disease control and expanding antibiotic R&D pipelines further contributed to the segment’s dominance by driving consistent demand for relevant API intermediates.

The anti-diabetic drug segment is expected to witness the fastest CAGR in the API intermediate market due to the rapid rise in diabetes cases worldwide, especially in urban and middle-income populations. Increasing adoption of advanced treatment options and combination therapies has driven the need for specialized and high-quality intermediates. Moreover, expanding healthcare access, growing investment in metabolic disorder research, and lifestyle changes linked to poor diet and inactivity continue to boost demand for anti-diabetic drug production.

Why Did the Biotech and Pharmaceutical Companies Segment Dominate the API Intermediate Market in 2024?

In 2024, biotech and pharmaceutical companies dominated the market as they are the primary consumers of intermediates for drug formulation and scale-up. Their ongoing efforts in developing novel therapies and expanding production pipelines created continuous demand for a reliable intermediate supply. These companies also invest heavily in R&D and advanced processing technologies, allowing them to manage complex formulations and comply with global quality standards, which further strengthens their leadership in the API intermediate landscape.

The CMO segment is expected to grow at the fastest CAGR in the API intermediate market as pharma companies increasingly rely on third-party manufacturers to improve flexibility and speed up time-to-market. CMOs provide cost-efficient solutions, reduce in-house operational burdens, and offer access to specialized equipment and global supply networks. Their ability to quickly adapt to changing market needs and scale production according to demand makes them a preferred choice, especially for complex and high-volume intermediates manufacturing.

Regional Insights

How is Asia Pacific Contributing to the Expansion of the API Intermediate Market?

Asia Pacific led the API intermediate market in 2024 due to its strong presence of key raw material suppliers, expanding pharmaceutical manufacturing capacity, and favorable trade conditions. Countries like India and China benefited from growing export demand, backed by competitive pricing and skilled workforce availability. Moreover, increasing investment in R&D, rising healthcare needs, and local government efforts to boost self-reliance in drug production further reinforced the region's dominant position in the global API intermediate landscape.

How is North America Accelerating the API Intermediate Market?

North America is set to witness significant growth in the API intermediate market, fueled by expanding drug development activities and increased demand for innovative therapies. The region benefits from a well-established healthcare system, strong R&D infrastructure, and growing investment in pharmaceutical manufacturing. Rising health awareness and early adoption of advanced production technologies also contribute to market expansion. Moreover, efforts to localize supply chains and reduce dependence on imports are further accelerating growth across the region.

For Instance, In May 2024, Eli Lilly increased its investment to USD 9 billion at its Lebanon, Indiana, facility to expand API production for tripeptide-based drugs like Zepbound and Mounjaro. This marks the largest synthetic API investment in U.S. history and will generate 200 full-time jobs and 5,000 construction roles. Operations are set to begin by 2026.

- HIKAL Ltd

- Cambrex Corporation

- Ganesh-Group

- AlzChem Group AG

- Vasudha Pharma

- Pfizer CentreOne

- Evonik Industries AG

- Sun Pharmaceutical Industries

- Aurobindo Pharma

- Cipla Limited

- In November 2024, Boehringer Ingelheim selected Veeva Vault CRM as its primary commercial platform to support its future growth strategy, aiming to launch 25 new treatments by 2030. This move is intended to enhance customer interactions and streamline internal operations. Veeva acknowledged the continued partnership, emphasizing its role in advancing Boehringer’s digital transformation within the life sciences sector.

- In November 2024, Sanofi committed €40 million to upgrade its Lyon Gerland bioproduction site to enhance Thymoglobulin output and support local monoclonal antibody development for type 1 diabetes. The ongoing modernization aims to expand production capacity and ensure a stable supply by 2027. This initiative is part of Sanofi’s broader post-COVID investment strategy, with over €2.5 billion allocated to major biomanufacturing projects.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the API Intermediate Market.

By Type

- Bulk Drug Intermediates

- Chemical Intermediates

By Application

- Analgesics

- Anti-infective Drugs

- Antidiabetic Drugs

- Cardiovascular Drugs

- Anticancer Drugs

- Others

By End-User

- Biotech and Pharmaceutical Companies

- CMO

- Other

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)