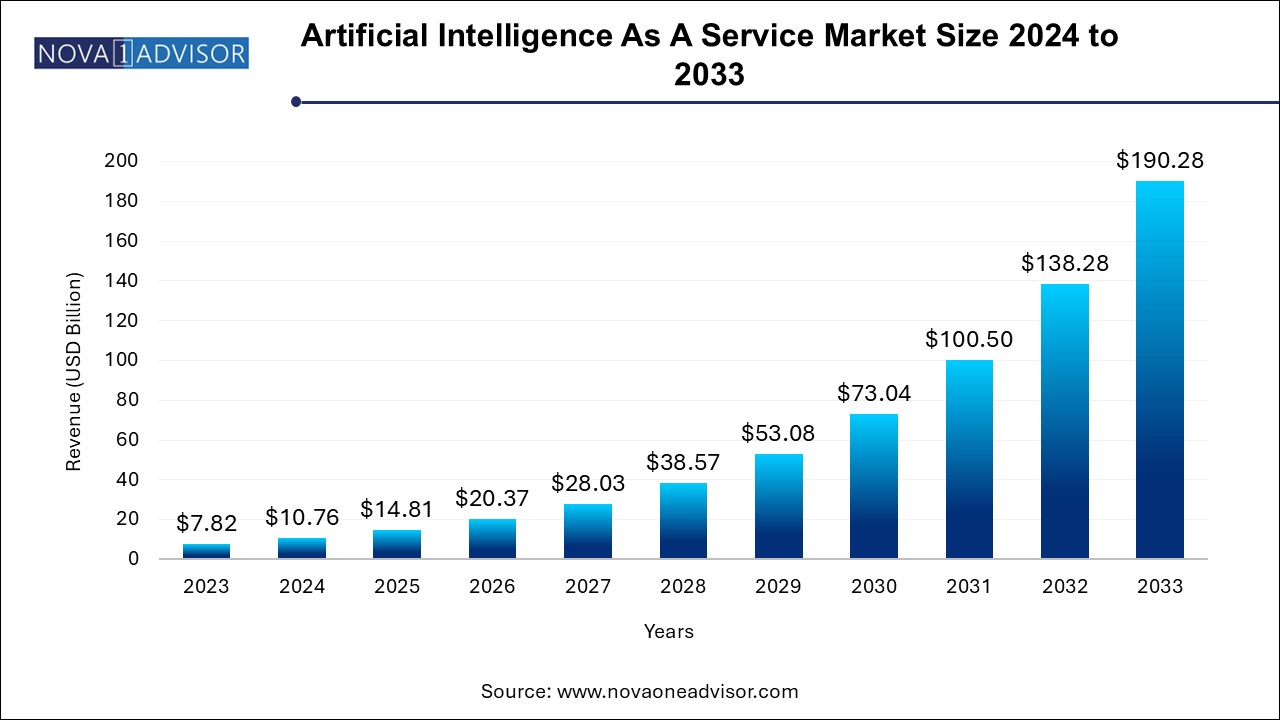

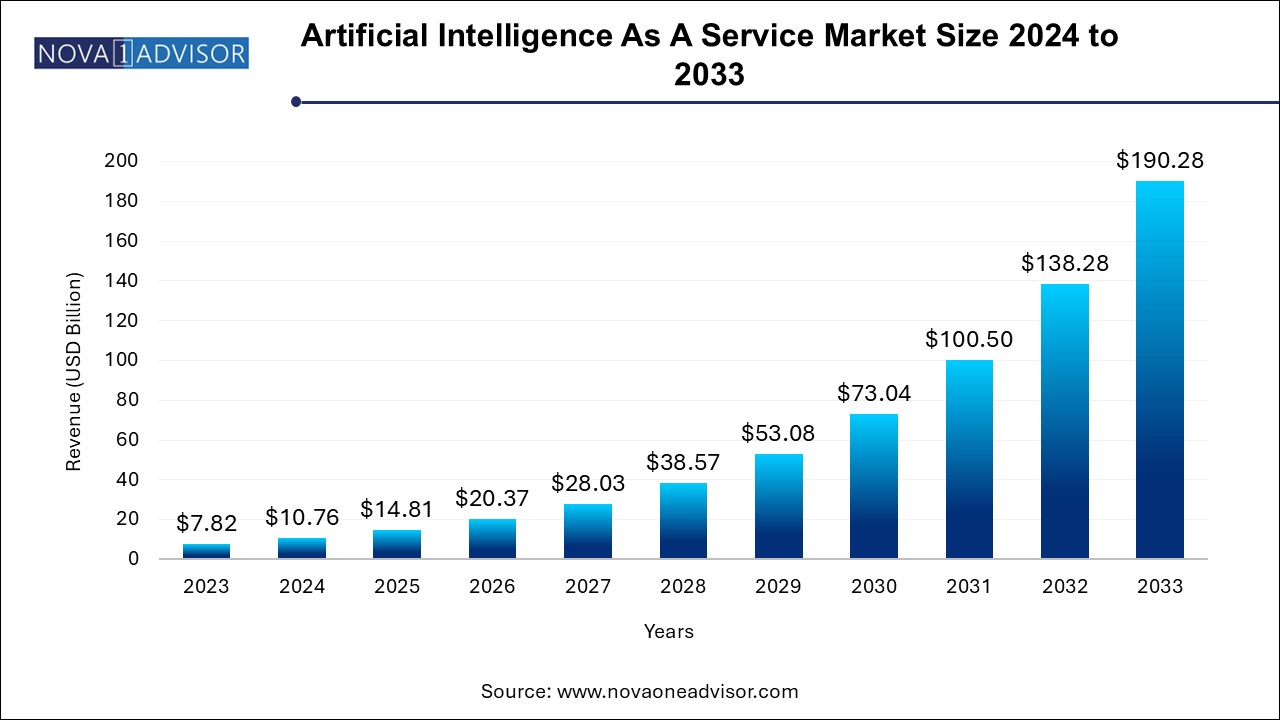

The global artificial intelligence as a service market size was exhibited at USD 7.82 billion in 2023 and is projected to hit around USD 190.28 billion by 2033, growing at a CAGR of 37.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America dominated the market in 2023 with a revenue share of over 47% of the global revenue.

- The large enterprises segment dominated the market in 2023 with a revenue share of more than 75%.

- The machine learning (ML) segment led the market in 2023 with a revenue share of over 40%.

- The software segment dominated the market in 2023 with a revenue share of more than 77%.

- The public cloud segment dominated the market in 2023 with a revenue share of over 55%.

- The BFSI segment led the market in 2023 with the largest revenue share of over 19% of global revenue.

- The software as a service (SaaS) segment dominated the market in 2023 with the largest revenue share exceeding 63% in 2023.

Market Overview

The Artificial Intelligence as a Service (AIaaS) market is experiencing explosive growth as businesses across industries race to integrate AI-driven capabilities without the need for extensive in-house infrastructure or technical expertise. AIaaS refers to the third-party provisioning of artificial intelligence solutions over the cloud, allowing organizations to access machine learning models, natural language processing tools, computer vision frameworks, and other AI functionalities via subscription or pay-as-you-go models. This democratized access is revolutionizing decision-making, operational efficiency, and customer engagement across small startups and multinational enterprises alike.

Enterprises no longer need to invest heavily in data science teams, hardware, or model development from scratch. Instead, AIaaS enables them to leverage cutting-edge models hosted on scalable cloud infrastructure. Providers like Amazon Web Services (AWS), Google Cloud, Microsoft Azure, IBM, and startups such as DataRobot, C3.ai, and H2O.ai are continuously innovating to meet rising demand for customized, flexible AI solutions. Whether it's predictive analytics in retail, fraud detection in BFSI, or image classification in healthcare, AIaaS is turning artificial intelligence into a utility-like service.

Increased data generation, IoT integration, digitization across sectors, and a shortage of AI talent are further propelling this market. As organizations seek to become more agile and data-driven, AIaaS is becoming indispensable for enabling quick implementation, cost-efficiency, and innovation acceleration.

Major Trends in the Market

-

Proliferation of Vertical-Specific AI Solutions: AIaaS offerings are increasingly tailored for specific industries such as healthcare diagnostics, legal compliance, and retail forecasting.

-

Rise of Low-Code/No-Code AI Platforms: These platforms are enabling business users to create AI workflows with minimal coding, expanding adoption among non-technical users.

-

Integration of Generative AI in Services: AIaaS platforms are embedding large language models (LLMs) like GPT, Claude, and LLaMA into enterprise software for content creation, summarization, and interaction.

-

Edge AI and Hybrid Deployments: Combining cloud-based AI with edge computing for real-time, low-latency use cases, especially in IoT and manufacturing.

-

Growing Use of AI in Cybersecurity and Risk Management: AIaaS is being leveraged for threat detection, behavioral analysis, and autonomous incident response.

-

Increased Focus on Explainable AI (XAI): Enterprises are demanding transparency in AI decision-making, prompting AIaaS vendors to offer interpretability features and audit trails.

-

Sustainability and Green AI Initiatives: AIaaS providers are adopting carbon-aware workload management and investing in energy-efficient data centers.

Artificial Intelligence As A Service Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 7.82 Billion |

| Market Size by 2033 |

USD 190.28 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 37.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Service Type, Organization Size, Deployment, Vertical, Offering, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Amazon Web Services, Inc.; Salesforce, Inc.; International Business Machines Corporation; Intel Corporation; Microsoft; BigML, Inc.; Google LLC; SAP SE; Fair Isaac Corporation; SAS Institute Inc. |

Market Driver: Explosion of Big Data and Real-Time Analytics

A powerful driver for the AIaaS market is the unprecedented volume of data generated across industries and the need for real-time analytics to remain competitive. From transactional data in banking to sensor data in industrial equipment and behavioral data from social platforms, enterprises are sitting on massive data lakes that require AI for actionable insights. Traditional analytics tools fall short in scalability, predictive power, and automation. AIaaS bridges this gap by enabling advanced analytics through machine learning, natural language processing, and cognitive computing, accessible via APIs or managed platforms. This is particularly critical in sectors like retail (dynamic pricing), healthcare (predictive diagnostics), and logistics (demand forecasting).

Market Restraint: Data Privacy and Compliance Challenges

Despite its benefits, the AIaaS market faces significant headwinds in the form of data privacy and regulatory compliance. Organizations must often transmit sensitive data such as financial records, medical histories, or personal identifiers to external cloud environments for processing. This raises concerns around data breaches, sovereignty, and compliance with stringent regulations such as GDPR (Europe), HIPAA (U.S.), and PIPL (China). Additionally, AI models often operate as “black boxes,” making it difficult to trace decisions in regulated environments. These concerns can delay adoption, limit use cases, or push companies to favor private or hybrid cloud models over public AIaaS offerings.

Market Opportunity: AIaaS for Small and Medium-sized Enterprises (SMEs)

One of the most promising opportunities in the AIaaS landscape is the untapped potential within the global SME sector. Traditionally, the cost, complexity, and talent requirements of AI kept it out of reach for smaller businesses. AIaaS breaks this barrier by offering modular, subscription-based access to AI capabilities such as chatbots, forecasting tools, image recognition, and sentiment analysis. SMEs in e-commerce, hospitality, education, and logistics are increasingly leveraging AIaaS to optimize operations, improve customer experience, and drive digital transformation. Cloud-native and no-code platforms are especially impactful, enabling business analysts and marketers to deploy AI without engineering support.

Segments Insights:

By Organization Size Insights

Large enterprises dominate this segment, owing to their greater budgetary flexibility, established digital ecosystems, and mature AI adoption strategies. These organizations use AIaaS to streamline operations, drive innovation, and create data-driven cultures. Sectors like BFSI, telecom, and manufacturing are major consumers of AIaaS at scale, integrating services across departments from supply chain to HR.

Small and Medium-sized Enterprises (SMEs) represent the fastest-growing market, fueled by cost-efficient, plug-and-play AI services. AIaaS empowers SMEs to compete with larger players through better demand forecasting, customer segmentation, fraud prevention, and intelligent automation. As no-code platforms and bundled AI packages become more intuitive, SMEs across Asia, Europe, and Latin America are adopting AI to leapfrog traditional digital transformation curves.

By Technology Insights

Machine Learning (ML) dominates the technology segment, as it underpins a broad spectrum of AI applications—from predictive maintenance and recommendation engines to fraud detection and demand forecasting. ML algorithms are easily integrated into enterprise workflows via cloud APIs or SDKs, and many AIaaS providers now offer AutoML platforms that automate model building, training, and tuning. Companies across BFSI, manufacturing, and retail rely heavily on ML-as-a-Service for scalable, continuous learning applications. ML’s adaptability and broad use cases make it a staple in nearly every AI adoption journey.

Natural Language Processing (NLP) is the fastest-growing segment, driven by the surge in generative AI, conversational agents, sentiment analysis tools, and document processing automation. The adoption of large language models (LLMs) such as OpenAI’s GPT, Anthropic’s Claude, and Meta’s LLaMA via cloud platforms is revolutionizing how enterprises handle text-based data. NLP is particularly vital in customer service, legal documentation, healthcare records, and knowledge management. With increasing demand for multilingual capabilities and regulatory document automation, this segment is set to expand rapidly.

By Service Type Insights

Software services dominate the service type segment, primarily because enterprises initially adopt AIaaS through cloud-based APIs, dashboards, and integrated tools. Software packages such as modelers, cloud-hosted inference engines, and storage-optimized AI workflows provide rapid prototyping and deployment. Google Cloud AI Platform, Azure AI, and AWS SageMaker are prominent examples where software services form the core offering. These platforms allow users to train, test, and deploy models in minutes, often bundled with data visualization and management tools.

Services are the fastest-growing category, reflecting the growing demand for consultation, custom model development, compliance support, and ongoing optimization. As organizations mature in their AI adoption journey, they seek tailored solutions, explainability services, domain-specific tuning, and governance support. Consulting services for AI ethics, change management, and workforce upskilling are also gaining traction, especially among large enterprises and regulated industries.

By Deployment Insights

Public cloud deployment dominates, given its affordability, scalability, and instant access to sophisticated AI capabilities. Leading platforms like AWS, Azure, and Google Cloud provide extensive ML libraries, compute power, and model marketplaces, enabling enterprises to get started without infrastructure investments. Public cloud is especially favored for customer-facing applications like chatbots, marketing analytics, and voice assistants.

Hybrid deployment is the fastest-growing segment, driven by data sovereignty concerns and the need for edge-AI solutions. Hybrid models allow sensitive data to remain on-premise or within private clouds, while leveraging public cloud AI capabilities for non-sensitive processing. This model is particularly valuable in healthcare, finance, and defense, where regulatory compliance intersects with innovation.

By Vertical Insights

BFSI leads the vertical segment, as banks and insurers use AIaaS for fraud detection, credit risk analysis, algorithmic trading, and robo-advisors. The sector’s massive data pools and need for real-time decision-making make it ideally suited for ML, NLP, and AI-powered automation.

Healthcare and Life Sciences is the fastest-growing vertical, propelled by the explosion of medical data, diagnostics automation, and precision medicine. AIaaS is used for medical imaging analysis, clinical trial optimization, drug discovery, and patient engagement. Cloud-native AI solutions are reducing diagnostic times, enhancing accuracy, and helping overburdened healthcare systems scale services with fewer resources.

By Offering Insights

Software-as-a-Service (SaaS) dominates, as it allows organizations to access AI applications on a subscription basis without needing to manage infrastructure or updates. Examples include Salesforce Einstein, IBM Watson Assistant, and Google’s Vertex AI, where AI is embedded within productivity or CRM suites.

Platform-as-a-Service (PaaS) is the fastest-growing, driven by developer interest in building, training, and deploying custom models with maximum control. PaaS providers offer end-to-end environments for coding, testing, model management, and deployment, serving as the backbone for AI-driven innovation in enterprises and startups alike.

By Regional Insights

North America leads the global AIaaS market, fueled by a concentration of cloud hyperscalers, technology innovators, and early enterprise adopters. The U.S. is home to Microsoft, Amazon, Google, IBM, and numerous startups pioneering AIaaS frameworks. High digital maturity, cloud penetration, R&D spending, and proactive AI policies have cemented the region’s dominance. Moreover, the rapid integration of AI in sectors like healthcare, defense, and finance supports strong multi-industry demand.

Asia-Pacific is the fastest-growing region, driven by government-backed AI initiatives, rising digital economies, and increasing AI adoption across e-commerce, fintech, and public services. Countries like China, India, South Korea, and Singapore are investing in AI infrastructure and policy frameworks to stimulate innovation. Cloud-native startups, large populations, and mobile-first behavior provide fertile ground for AIaaS adoption, particularly among SMEs and emerging tech hubs.

Some of the prominent players in the artificial intelligence as a service market include:

- Amazon Web Services, Inc.

- Salesforce, Inc.

- International Business Machines Corporation

- Intel Corporation

- Microsoft

- BigML, Inc.

- Google LLC

- SAP SE

- Siemens

- Fair Isaac Corporation

Recent Developments

-

Microsoft (April 2025): Launched Copilot Pro, an AIaaS enhancement across Office 365, embedding GPT-4-based AI in Word, Excel, and Outlook for enterprise users.

-

Google Cloud (March 2025): Partnered with Mayo Clinic to deploy Vertex AI in healthcare diagnostics, offering NLP-based patient record analysis and predictive analytics tools.

-

AWS (February 2025): Introduced Titan, a proprietary large language model integrated into SageMaker for regulated industries with explainability and compliance support.

-

IBM (January 2025): Released Watsonx, a generative AI platform for business workflows, emphasizing privacy-preserving AI and enterprise-grade transparency.

-

C3.ai (December 2024): Signed multi-million-dollar agreements with European energy firms for AIaaS solutions focused on predictive maintenance and carbon emissions analytics.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global artificial intelligence as a service market.

Technology

- Machine Learning (ML)

- Computer Vision

- Natural Language Processing (N

- Others

Service Type

-

- Data Storage and Archiving

- Modeler and Processing

- Cloud and Web-Based Application Programming Interface (APIs)

- Others

Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Deployment

Vertical

- Banking, Financial, and Insurance (BFSI)

- Healthcare and Life Sciences

- Retail

- IT & Telecommunication

- Government and defense

- Manufacturing

- Energy & Utility

- Others (Automotive, Education, Agriculture, Others)

Offering

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)