Asia Pacific Active Pharmaceutical Ingredients Market Size and Growth

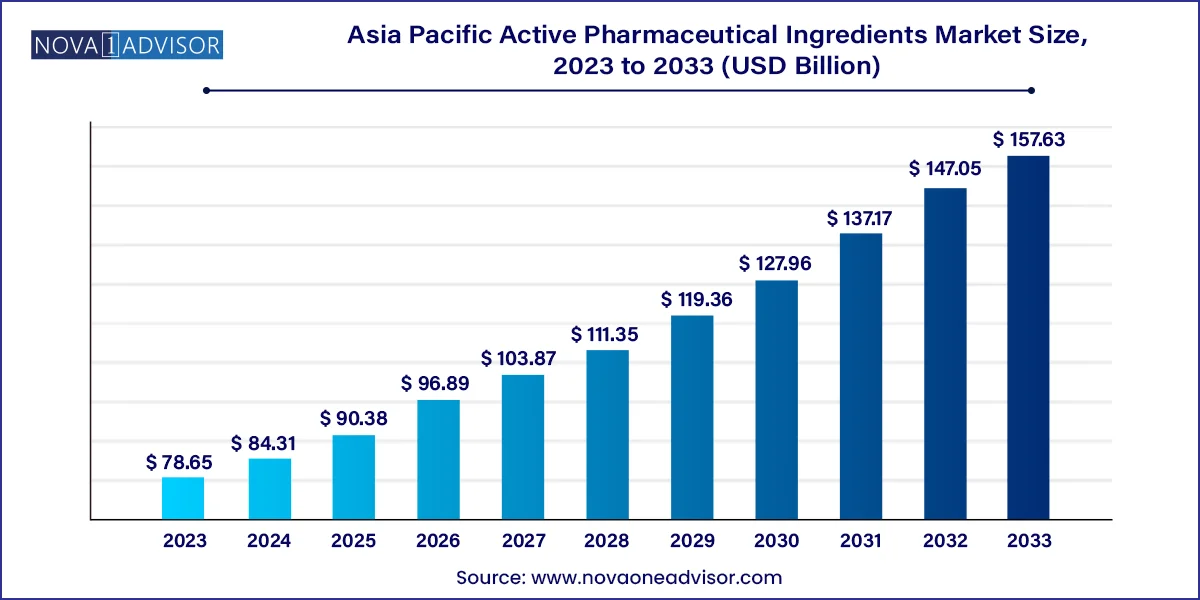

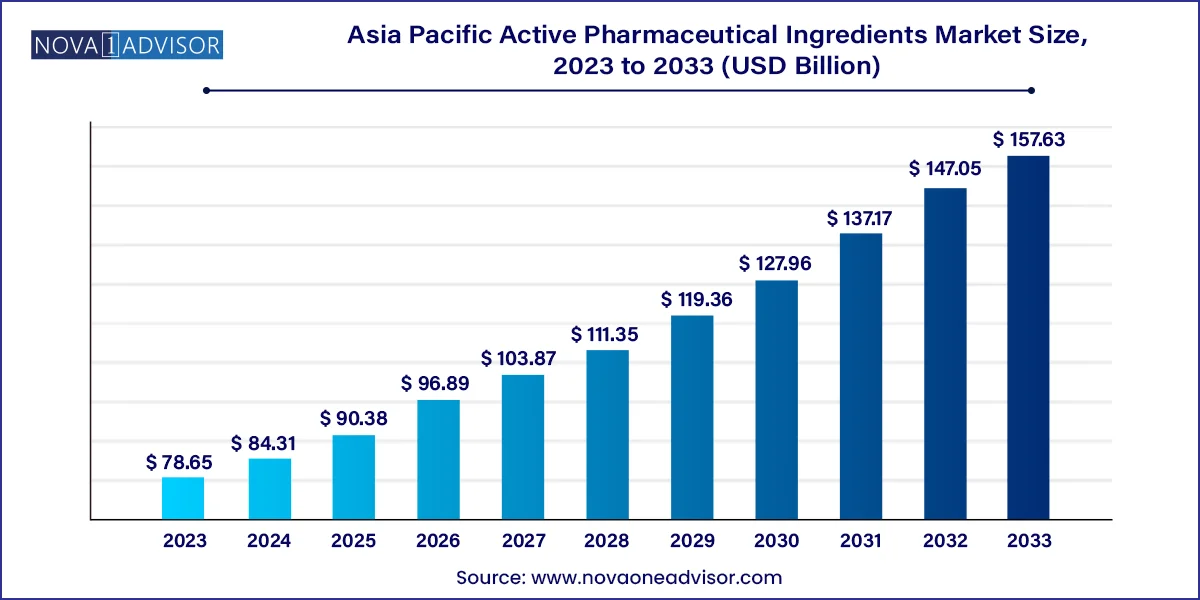

The Asia Pacific active pharmaceutical ingredients market size was exhibited at USD 78.65 billion in 2023 and is projected to hit around USD 157.63 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2024 to 2033.

Asia Pacific Active Pharmaceuticals Ingredients Market Key Takeaways:

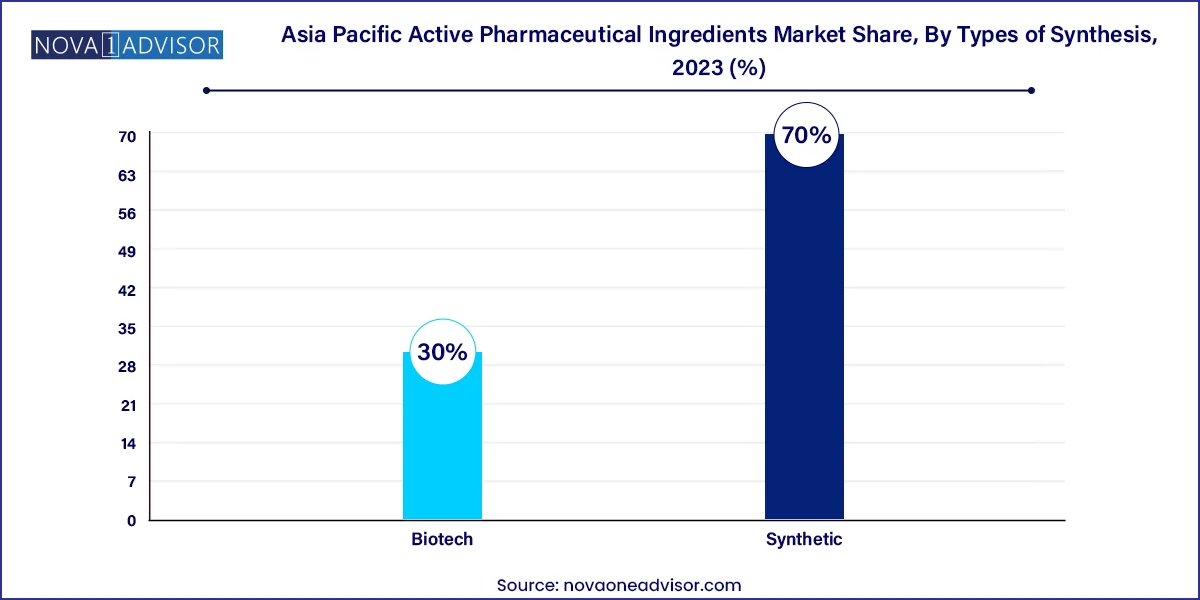

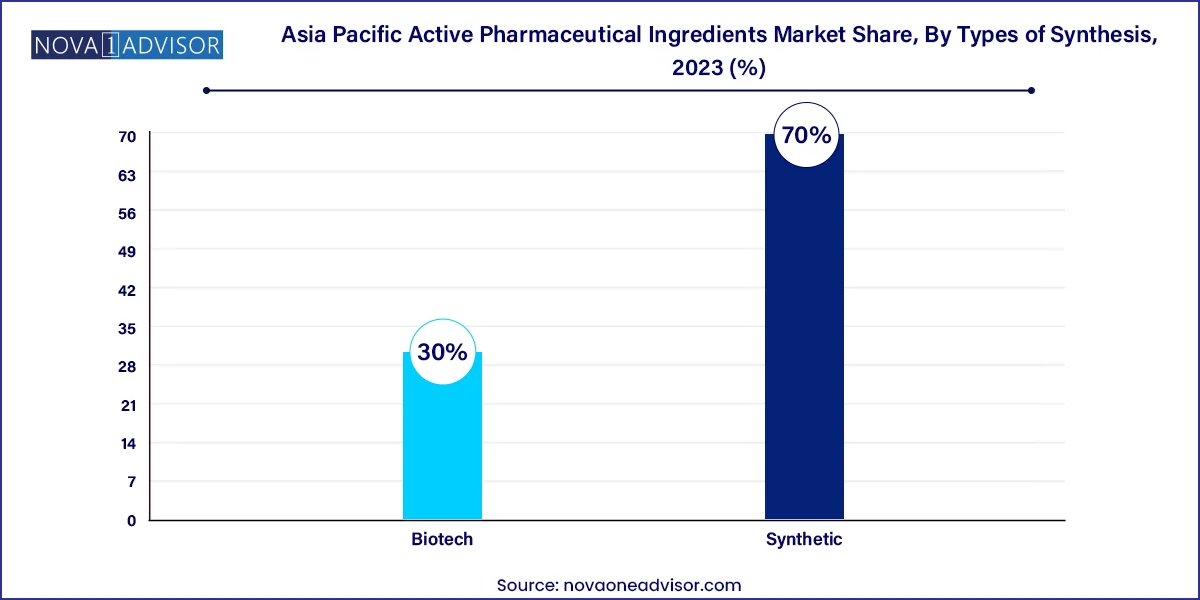

- The synthetic active pharmaceutical ingredients led the market and accounted for the largest market share of 70.0% in 2023.

- The captive API dominated the market and accounted for the largest revenue share of 50.0% in 2023.

- The innovative APIs segment dominated the market with a substantial revenue share in 2023.

- The cardiovascular diseases segment accounted for the largest market share of 21.2% in 2023.

- The endocrinology segment registered a substantial revenue share in 2023

Market Overview

The Asia Pacific Active Pharmaceutical Ingredients (API) market is one of the most dynamic and integral components of the global pharmaceutical supply chain. APIs are the biologically active components of drug products that produce the intended therapeutic effects. In recent decades, Asia Pacific has evolved from a peripheral supplier to a global powerhouse in API manufacturing, driven by technological advancements, robust chemical engineering capabilities, government incentives, and increasingly sophisticated manufacturing ecosystems.

China and India dominate the region’s API landscape, accounting for a large share of global API production. Both countries offer cost advantages, skilled labor, and increasingly high-quality facilities that meet international regulatory standards. Japan and South Korea, although smaller in volume, contribute significantly to high-end API manufacturing, particularly in specialty drugs and biologics. The emergence of biotech clusters in countries like Australia, Taiwan, and Singapore has further diversified the region's API capabilities, with increasing emphasis on high-potency and innovative APIs.

The Asia Pacific region also plays a strategic role in the pharmaceutical value chain by providing not only raw materials but also contract manufacturing services. The expansion of generic drug production, rising chronic disease prevalence, and growing demand for cost-effective medications have bolstered the need for reliable API sources. Governments in countries such as India and China have also implemented production-linked incentives (PLI) and other schemes to encourage local API production, especially in response to global supply disruptions witnessed during the COVID-19 pandemic.

Major Trends in the Market

-

Rising Shift Toward Biotech APIs: Growing demand for biologics and biosimilars is accelerating biotech API manufacturing, especially in Japan, South Korea, and Australia.

-

Government Incentives for Local API Manufacturing: National programs in China, India, and Indonesia support domestic API production to reduce reliance on imports.

-

Emergence of High-Potency APIs (HPAPIs): Increasing investment in oncology and targeted therapy APIs is expanding the market for highly potent ingredients.

-

Sustainability and Green Chemistry Adoption: Regulatory pressures and ESG goals are pushing manufacturers to adopt eco-friendly synthesis processes.

-

Growth of Merchant APIs: The rise in outsourcing and contract manufacturing organizations (CMOs) is propelling merchant API production over captive production.

-

API Supply Chain Diversification: Countries like Vietnam, Malaysia, and Thailand are being explored as alternate manufacturing destinations post-pandemic.

-

Increased Investment in API R&D: API companies are focusing more on structural chemistry, process optimization, and scale-up technologies.

Report Scope of Asia Pacific Active Pharmaceuticals Ingredients Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 84.31 Billion |

| Market Size by 2033 |

USD 157.63 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Types of Synthesis, Types of Manufacturers, Types, Application, and Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

Asia Pacific |

| Key Companies Profiled |

Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd.; Cipla Inc.; Aurobindo Pharma.; Asymchem Laboratories; Reyoung Pharmaceutical; CSPC Pharmaceutical Group Limited; Otsuka Pharmaceutical Australia Pty Ltd.; GC Biopharma Corp.; Chong Kun Dang Pharmaceutical Corp. |

Key Market Driver

Expansion of Generic Drug Manufacturing in the Region

A primary driver of the Asia Pacific API market is the rapid expansion of generic drug manufacturing, especially in India and China. As healthcare systems seek to reduce costs, the global pharmaceutical industry is placing greater reliance on generics—many of which are sourced from Asia. India alone supplies more than 20% of the global generic drugs by volume, and over 70% of the APIs used in these formulations are manufactured domestically or imported from China.

This environment creates consistent demand for APIs, particularly generic APIs, with manufacturers scaling up to meet the needs of both domestic and international markets. Additionally, partnerships between local API producers and Western pharmaceutical giants have helped bridge quality expectations, ensuring compliance with U.S. FDA and EMA standards. The growing acceptance and use of generics in countries like Indonesia, Malaysia, and Thailand further underscores this trend, driving steady growth across API categories.

Key Market Restraint

Quality Compliance and Regulatory Variability

Despite its strengths, the Asia Pacific API market faces a critical challenge in maintaining regulatory compliance and quality consistency. While many top-tier manufacturers have international GMP certifications, a large number of small and mid-sized API producers still struggle with quality management systems, particularly in developing economies.

Regulatory environments vary widely across the region. For example, while Japan and Australia have highly mature regulatory frameworks, countries like Indonesia and Vietnam are still developing consistent enforcement mechanisms. This disparity creates complexity for multinational companies sourcing APIs from Asia, often requiring additional audits and risk mitigation. Incidents of quality lapses or regulatory bans—such as import alerts from the U.S. FDA can severely impact business continuity and brand trust. Ensuring traceability, consistent documentation, and supply chain transparency remains a persistent bottleneck.

Key Market Opportunity

Biotech API Growth and Biologics Manufacturing

The most promising opportunity in the Asia Pacific API market lies in the rapidly growing biotech API segment, driven by rising demand for biologics, biosimilars, and personalized therapies. As global R&D pipelines increasingly feature monoclonal antibodies, recombinant proteins, and cell-based therapies, the need for biotech-based APIs has surged.

Countries like South Korea and Japan have made substantial investments in biopharmaceutical infrastructure. South Korea’s Incheon Biocluster and Japan’s Yokohama Bioindustry Center are prime examples of hubs dedicated to biotech innovation. Meanwhile, India and China are rapidly catching up, with Biocon, WuXi Biologics, and other companies expanding their biologics capabilities. The high margins, lower competition, and technological sophistication associated with biotech APIs make them an attractive growth frontier for both established and emerging players in Asia Pacific.

Asia Pacific Active Pharmaceuticals Ingredients Market By Types of Synthesis Insights

Synthetic APIs continue to dominate the Asia Pacific market due to their widespread application in generics and established manufacturing processes. These APIs are used extensively in therapeutic areas such as cardiovascular, gastrointestinal, and central nervous system disorders. India and China lead in synthetic API production, leveraging their large-scale chemical manufacturing ecosystems and raw material access. India’s stronghold in small-molecule generics further fuels demand for bulk synthesis of synthetic APIs. Regulatory harmonization with U.S. FDA, WHO GMP, and EU standards has strengthened export potential.

However, biotech APIs are the fastest-growing segment, gaining ground as biologics increasingly feature in new drug approvals. Countries such as South Korea, Japan, and Singapore have invested heavily in cell culture, fermentation, and purification technologies to support complex biologics development. With the increasing focus on chronic disease management and precision medicine, biotech APIs will see accelerated growth, particularly in oncology, immunology, and rare diseases.

Asia Pacific Active Pharmaceuticals Ingredients Market By Types of Manufacturers Insights

Captive API manufacturing where pharmaceutical companies produce APIs in-house for their own formulations remains dominant due to integrated supply chain advantages and quality control. This model is prevalent in Japan and South Korea, where vertically integrated pharma companies prefer tight control over production. It also exists in India and China among large firms like Sun Pharma, Aurobindo, and Dr. Reddy’s.

In contrast, merchant API production is growing rapidly due to outsourcing trends and the rise of third-party contract manufacturers (CMOs and CDMOs). Startups, biotech firms, and even Big Pharma companies are increasingly outsourcing API synthesis to specialized players in India, China, and Vietnam. This trend offers scalability, flexibility, and cost efficiency particularly for companies with limited infrastructure or those entering new markets.

Asia Pacific Active Pharmaceuticals Ingredients Market By Types Insights

Generic APIs form the bulk of the Asia Pacific market due to the region’s massive role in global generic drug production. India, often called the “pharmacy of the world,” heavily relies on generic APIs for its exports to regulated and semi-regulated markets. China's massive volume output also caters to global generic manufacturers. These APIs are generally used in treating chronic and infectious diseases and form the backbone of essential drug programs across Asia.

However, innovative APIs are growing steadily, especially in countries with strong R&D ecosystems like Japan and South Korea. With increasing domestic drug innovation and rising investment in novel therapeutics, these countries are developing APIs for patent-protected drugs and complex therapies. Biocon, Daiichi Sankyo, and WuXi AppTec are examples of companies advancing the innovative API space in the region.

Asia Pacific Active Pharmaceuticals Ingredients Market By Application Insights

Cardiovascular diseases (CVD) remain the leading application area for APIs in Asia Pacific due to the high incidence of hypertension, stroke, and heart disease across both developed and developing countries. APIs for antihypertensives, statins, and anticoagulants form a significant portion of production, especially in India and China. The aging population and increasing sedentary lifestyles are further fueling demand for cardiovascular medications.

Oncology APIs are the fastest-growing, driven by rising cancer prevalence and the evolution of targeted therapies. High-potency APIs (HPAPIs) used in chemotherapy and immunotherapy are gaining momentum. Japan, South Korea, and Australia are leading in the development of APIs for innovative oncology therapies, while India and China are expanding contract development and manufacturing in this domain. The growth of biosimilars is also bolstering demand for APIs used in cancer biologics.

Country Insights

China

China is the largest producer and exporter of APIs in the region. It dominates synthetic API manufacturing for antibiotics, antivirals, and general medicine. The Chinese government has launched numerous reforms, such as environmental control regulations and the API cluster initiative, to modernize the industry. Leading players include Zhejiang Huahai, CSPC Pharmaceutical, and North China Pharmaceutical Group.

India

India ranks second in API production globally and is the largest exporter of generic APIs to the U.S. and Europe. The Indian government’s PLI scheme aims to reduce import dependency on China and boost domestic API manufacturing. Major players include Sun Pharma, Aurobindo, and Divi’s Laboratories.

Japan

Japan's API industry is centered around high-value and innovative APIs with a strong focus on quality. Local companies like Eisai and Daiichi Sankyo lead in proprietary APIs, particularly for CNS and oncology indications.

South Korea

South Korea focuses on biotech and innovative APIs. With government support and private investment, the country is rapidly building world-class biologics manufacturing infrastructure. Samsung Biologics and Celltrion are notable names.

Australia

Australia’s API market is smaller but highly regulated and focused on clinical-stage innovation. Companies like CSL Limited lead in plasma-derived APIs and specialty therapeutics.

Emerging Markets (Vietnam, Thailand, Malaysia, Indonesia)

These countries are being explored as alternative API manufacturing destinations due to lower labor costs, improving regulatory standards, and rising domestic pharma demand. Their role is expected to expand significantly over the next decade.

Some of the prominent players in the Asia Pacific active pharmaceutical ingredients market include:

- Dr. Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Cipla Inc.

- Aurobindo Pharma.

- Asymchem Laboratories

- Reyoung Pharmaceutical

- CSPC Pharmaceutical Group Limited

- Otsuka Pharmaceutical Australia Pty Ltd.

- GC Biopharma Corp.

- Chong Kun Dang Pharmaceutical Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific active pharmaceutical ingredients market

Type of Synthesis

Type of Manufacturers

- Captive APIs

- Merchant APIs

Type

- Innovative APIs

- Generic APIs

Application

- Cardiovascular Diseases

- Endocrinology

- CNS and Neurology

- Oncology

- Gastroenterology

- Orthopedic

- Pulmonology

- Nephrology

- Ophthalmology

- Others

Country

-

- China

- India

- South Korea

- Japan

- Australia

- Indonesia

- Taiwan

- Thailand

- Malaysia

- Vietnam