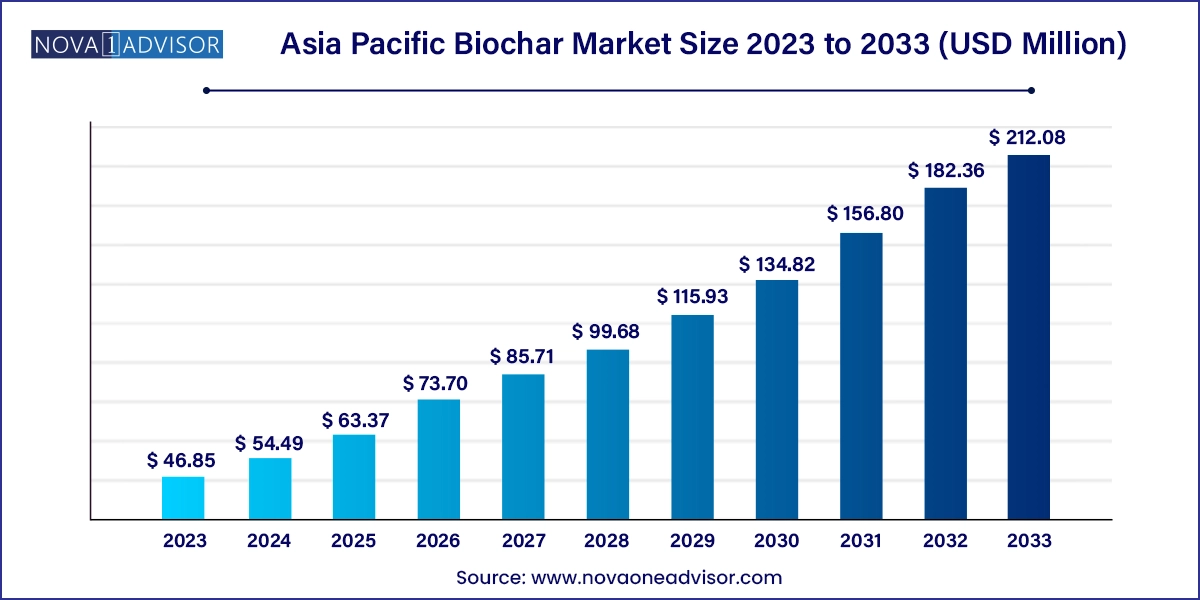

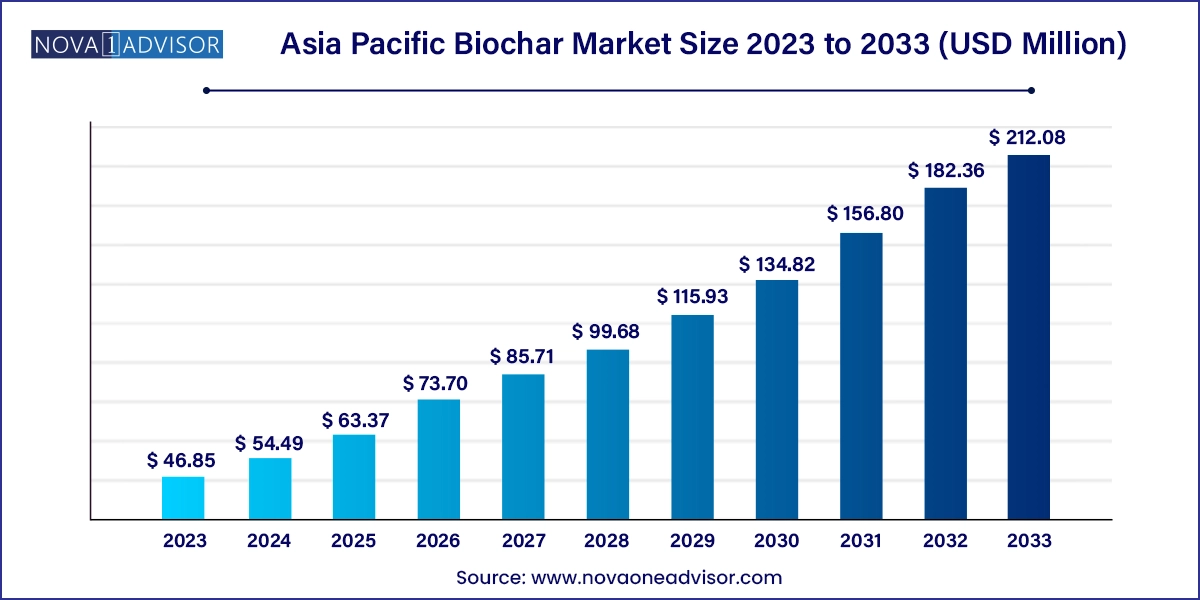

Asia Pacific Biochar Market Size and Growth

The Asia Pacific biochar market size was exhibited at USD 46.85 million in 2023 and is projected to hit around USD 212.08 million by 2033, growing at a CAGR of 16.3% during the forecast period 2024 to 2033.

Asia Pacific Biochar Market Key Takeaways:

- Based on technology, the pyrolysis segment dominated the market with the largest revenue share of 30.60% in 2023 and is expected to retain its dominance over the forecast period.

- The agriculture segment dominated the market with the largest revenue share in 2023.

Market Overview

The Asia Pacific Biochar Market is experiencing robust growth as regional governments, agricultural communities, and climate-focused businesses increasingly explore biochar’s potential to enhance soil health, sequester carbon, and improve waste management efficiency. Biochar, a charcoal-like substance derived from the thermal decomposition of organic biomass in an oxygen-limited environment, is emerging as a powerful tool in both climate change mitigation and sustainable agriculture.

This market is being shaped by the convergence of environmental imperatives, such as reducing greenhouse gas emissions and enhancing soil fertility, along with growing support for bio-based circular economies. In Asia Pacific, which encompasses a diverse mix of agrarian economies and industrial powerhouses, biochar is being adopted for various applications, including soil amendment, livestock feed, odor control, water filtration, and industrial carbon capture.

Key countries like China and India are leading the charge due to their large agricultural sectors and urgent need for sustainable land and waste management. Australia, with its emphasis on carbon-neutral farming practices, and Japan, known for its advanced waste-to-energy infrastructure, are also driving innovation in biochar production technologies.

Despite being a relatively nascent market, Asia Pacific is quickly becoming a global hub for biochar innovation, driven by government incentives, academic research collaborations, and entrepreneurial agritech ventures.

Major Trends in the Market

-

Growing Integration of Biochar in Sustainable Agriculture: Farmers are adopting biochar to boost soil productivity, retain moisture, and reduce reliance on chemical fertilizers.

-

Rising Interest in Carbon Credits and Carbon Farming: Countries like Australia and India are exploring biochar’s potential in carbon sequestration markets.

-

Expansion of Pyrolysis Facilities for Waste Management: Pyrolysis is being adopted to manage crop residues, forest waste, and organic municipal waste, especially in China and Japan.

-

Use of Biochar in Livestock and Animal Bedding: Biochar is increasingly used as a feed additive and bedding material to control odor and improve animal health.

-

Adoption of Small-Scale Biochar Units for Rural Electrification and Heating: Portable gasification systems are being used in off-grid rural areas of Southeast Asia and India.

-

Government Subsidies and R&D Funding: Supportive policy measures in China, Australia, and India are incentivizing R&D and commercialization of biochar.

-

Emergence of Premium Biochar Products: Companies are producing value-added products such as activated biochar, pelletized formulations, and blended soil conditioners.

Report Scope of Asia Pacific Biochar Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 54.49 Million |

| Market Size by 2033 |

USD 212.08 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 16.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

Australia, China, India, Japan, Malaysia and RoAPAC |

| Key Companies Profiled |

Pacific Biochar; Airex Energy; Arsta Eco; Carbon Gold; Biochar Products, Inc.; Carbofex; Biochar Supreme, LLC; Bio Energy Earth Systems; Farm2energy |

Key Market Driver: Agricultural Productivity and Soil Health Improvement

One of the most significant drivers in the Asia Pacific biochar market is the growing need for sustainable solutions to improve soil fertility and crop yields, especially in densely populated and agrarian economies like India, China, and Indonesia. With extensive degradation of arable land due to overuse of chemical fertilizers and monocropping, farmers are turning to biochar as a natural soil enhancer that can restore microbial balance, improve water retention, and increase nutrient availability.

Biochar acts as a long-term carbon sink in soil, enhancing cation exchange capacity (CEC) and reducing nutrient leaching, particularly in tropical and subtropical soils. Field trials across India have shown that biochar-amended soils improve yields of paddy, maize, and vegetables by up to 20–40%, while reducing input costs for fertilizers and irrigation.

Moreover, in Australia’s dry zones and Japan’s intensively cultivated areas, biochar is helping farmers adapt to climate variability and water scarcity, reinforcing its value as a climate-resilient soil amendment. As agricultural resilience becomes a national priority, biochar’s role is expanding across the region.

Key Market Restraint: Lack of Standardization and Commercial Scale Awareness

Despite growing interest, the Asia Pacific biochar market faces a significant restraint in the form of limited regulatory standardization, market awareness, and commercialization scalability. Many farmers and agribusinesses remain uncertain about optimal application rates, compatibility with crops, and long-term soil impacts, which inhibits widespread adoption.

Additionally, there is no uniform quality grading system for biochar, leading to variability in product efficacy across different batches and vendors. In markets like India and Southeast Asia, where informal biochar production using rudimentary kilns is common, issues like inconsistent carbon content, ash concentration, and contamination with tars or heavy metals undermine trust and hinder broader uptake.

Moreover, the lack of centralized support structures or subsidy programs in certain countries makes it financially unviable for smallholder farmers or cooperatives to invest in biochar production units. Without clear economic incentives or performance benchmarks, the market remains fragmented and regionally uneven.

Key Market Opportunity: Carbon Sequestration and Emerging Carbon Credit Markets

Biochar presents a transformative opportunity in carbon offsetting and emission reduction, with the potential to contribute significantly to national climate targets and voluntary carbon markets. As countries like Australia, Japan, and India introduce carbon pricing mechanisms and offset protocols, biochar is emerging as a permanent carbon sink technology that aligns with both climate mitigation and soil regeneration goals.

Each tonne of biochar applied to soil can sequester up to 2.5–3 tonnes of COâ‚‚ equivalent, making it a viable addition to carbon farming projects. In Australia, the Emissions Reduction Fund (ERF) already includes biochar-based methodologies for eligible carbon offset projects, while companies in India are developing blockchain-powered platforms to verify and trade biochar-based carbon credits.

This opens up a new revenue stream for farmers and biochar producers, incentivizing them to scale operations and adopt rigorous MRV (Monitoring, Reporting, and Verification) systems. As the price of voluntary carbon credits rises, particularly in Asia-Pacific-focused exchanges, biochar could become an essential tool for meeting net-zero pledges by corporates and governments alike.

Asia Pacific Biochar Market By Technology Insights

Pyrolysis dominated the biochar production technology segment, accounting for the majority of commercial and pilot-scale biochar facilities in the region. Pyrolysis, particularly slow pyrolysis, is preferred for its ability to produce high-carbon-content biochar while also generating bio-oil and syngas as valuable co-products. In countries like China and India, slow pyrolysis kilns are widely deployed to convert agricultural residues (e.g., rice husk, wheat straw, sugarcane bagasse) into soil-enhancing biochar. In Japan, advanced pyrolysis reactors are integrated with waste-to-energy plants to maximize biomass conversion efficiency.

Gasification is the fastest-growing technology, particularly in remote and off-grid regions of Southeast Asia and India. Gasification units offer dual benefits of decentralized power generation and biochar as a by-product, making them suitable for rural electrification schemes and small-scale community energy hubs. The syngas produced can be used for cooking, heating, or electricity, while the char residue is collected and used for soil application or briquetting.

Asia Pacific Biochar Market By Application Insights

Agriculture dominated the biochar application segment, as the majority of biochar produced in the Asia Pacific region is applied to croplands, orchards, greenhouses, and plantations. Countries like India and China are witnessing rapid integration of biochar in organic farming, regenerative agriculture, and drought mitigation programs. In Australia, biochar is used to improve degraded pastures, reduce soil erosion, and promote microbial diversity in arid zones.

Animal farming is the fastest-growing application, with rising use of biochar in livestock feed supplements, bedding materials, and manure management. Biochar is known to reduce methane emissions from cattle, enhance digestion, and control odors in poultry and pig farms. Trials in Japan and India have shown improved feed conversion ratios and reduced enteric fermentation, making biochar an emerging tool in sustainable animal husbandry.

Country Insights

China

China is the largest market for biochar in Asia Pacific, driven by its vast agricultural base, waste biomass availability, and government emphasis on rural revitalization and soil health restoration. The Ministry of Agriculture supports biochar research under the “Zero Growth of Fertilizer Use” initiative. Several universities, including China Agricultural University, are partnering with startups to scale biochar use in paddy fields and orchard systems. China is also investing in industrial-scale pyrolysis plants to manage urban organic waste and reduce landfilling.

India

India is rapidly emerging as a biochar adoption hub, with strong interest from state agricultural universities, rural development agencies, and climate NGOs. Biochar is being integrated into Farmer Producer Organizations (FPOs) and supported by CSR-funded sustainable farming programs. Rural entrepreneurs are setting up mobile pyrolysis units to process crop residues and combat stubble burning in Punjab and Haryana. Biochar also plays a role in India’s National Mission for Sustainable Agriculture, supporting soil conservation and nutrient cycling.

Japan

Japan’s focus on clean energy, waste valorization, and soil pollution mitigation positions it as a technology leader in advanced biochar systems. Municipal governments are funding projects that convert food waste and sewage sludge into biochar. Japanese companies like Mitsui Chemicals and Japan Biochar Association are leading R&D into activated carbon biochar for industrial filtration and water purification. Biochar is also being explored as a soil remediation tool for lands contaminated by heavy metals and salinity.

Australia

Australia has integrated biochar into its carbon farming initiative, with formal methodologies for earning carbon credits under the Emissions Reduction Fund (ERF). Farmers in Queensland and New South Wales are using biochar to improve drought resilience, reduce fertilizer use, and restore degraded grazing lands. Australian startups like Rainbow Bee Eater and Earth Systems are pioneering gasification-based biochar solutions, targeting both domestic agriculture and international carbon offset markets.

Malaysia

Malaysia is witnessing early-stage adoption of biochar, particularly in palm oil plantations, aquaculture, and composting systems. Research institutions such as Universiti Putra Malaysia (UPM) are developing cost-effective pyrolysis reactors and promoting biochar use to manage oil palm empty fruit bunches (EFB). Government initiatives under the Green Technology Master Plan are supporting biochar integration in organic farming and reforestation projects.

Some of the prominent players in the Asia Pacific biochar market include:

- Pacific Biochar

- Airex Energy

- Arsta Eco

- Carbon Gold

- Biochar Products, Inc.

- Carbofex

- Biochar Supreme, LLC

- Bio Energy Earth Systems

- Farm2energy

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific biochar market

Technology

- Pyrolysis

- Gasification

- Others

Asia Pacific Biochar Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Others

Asia Pacific Biochar Country

- China

- India

- Japan

- Malaysia

- Australia