Asia Pacific Meal Kit Delivery Services Market Size and Trends

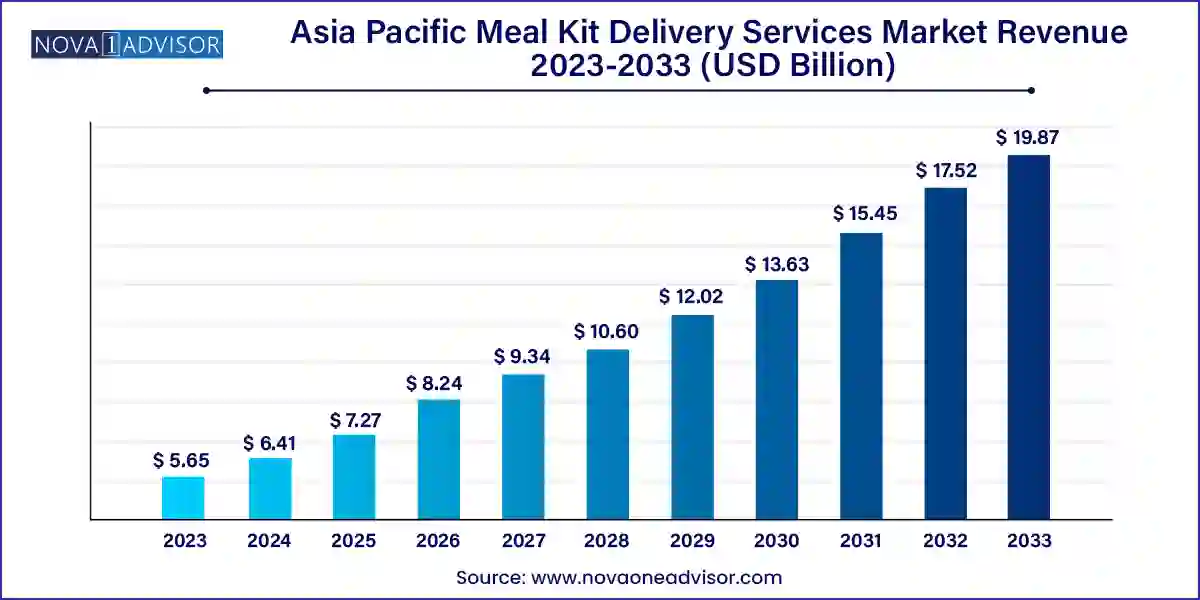

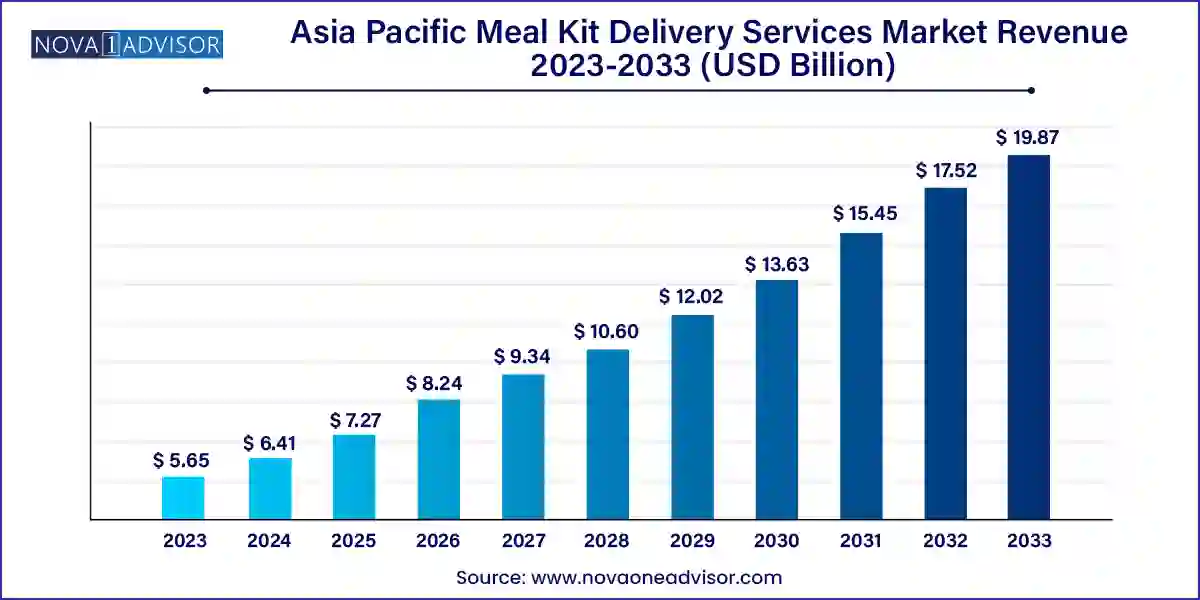

The Asia Pacific meal kit delivery services market size was exhibited at USD 5.65 billion in 2023 and is projected to hit around USD 19.87 billion by 2033, growing at a CAGR of 13.4% during the forecast period 2024 to 2033.

Asia Pacific Meal Kit Delivery Services Market Key Takeaways:

- The cook & eat segment held a market share of 60.8% in 2023.

- The heat & eat segment is projected to grow at a CAGR of 13.4% over the forecast period.

- The single-delivery service segment accounted for a revenue share of 54.3% in 2023.

- The multiple-delivery service segment is expected to grow at a CAGR of 13.6% over the forecast period.

- The non-vegetarian meal kit delivery services segment accounted for a revenue share of 64.5% in 2023.

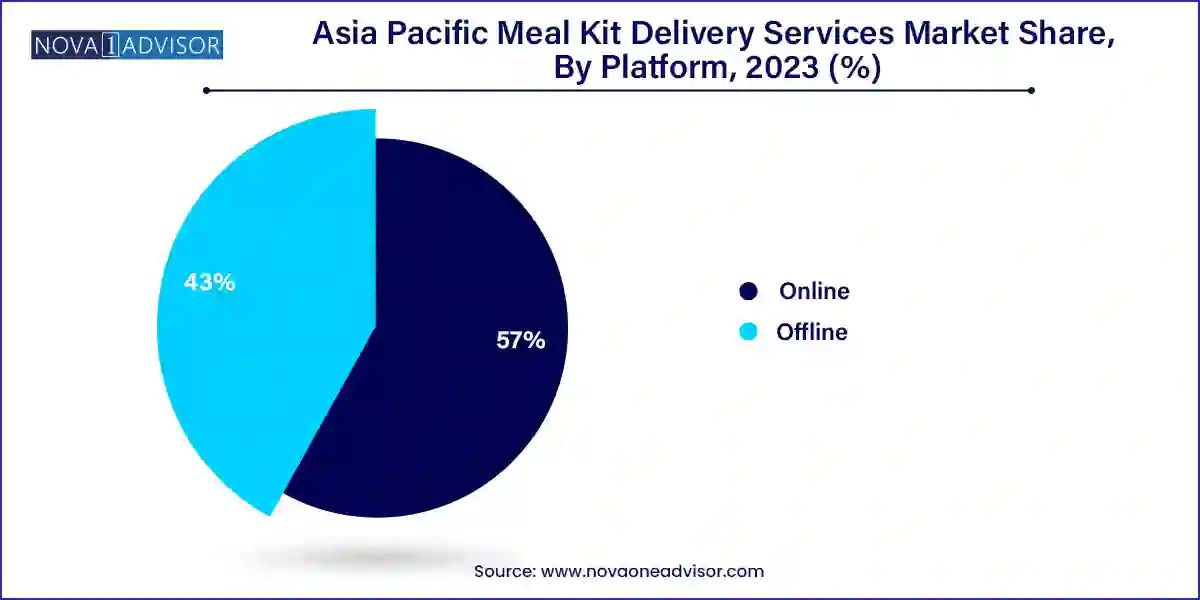

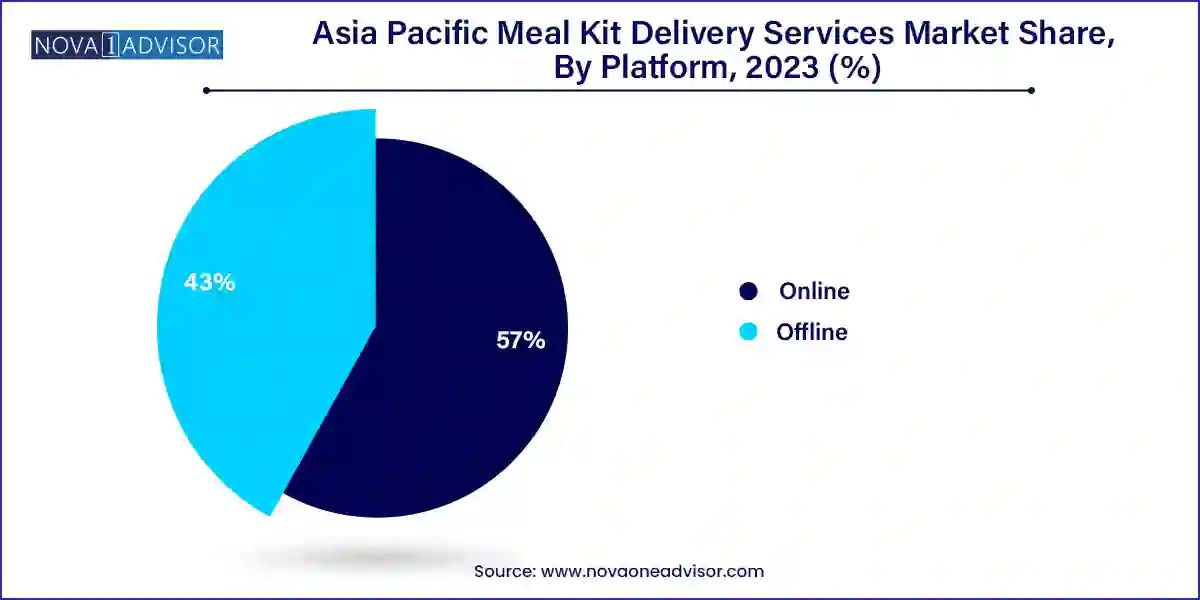

- The online platform segment accounted for a revenue share of 57.0% in 2023.

- The offline segment is expected to grow at a CAGR of 13.5% over the forecast period.

Market Overview

The Asia Pacific meal kit delivery services market is undergoing a paradigm shift, propelled by a convergence of evolving consumer lifestyles, growing demand for convenience, rising health consciousness, and the digitalization of food retail. Across urban and suburban households in key economies such as China, India, Japan, and Australia, the appeal of meal kits lies in their hybrid offering—convenient access to curated, fresh, pre-portioned ingredients that allow consumers to prepare restaurant-quality meals at home with minimal hassle.

Meal kit delivery services cater to a spectrum of needs ranging from time-pressed professionals and health-oriented individuals to families seeking variety and affordability. The concept bridges the gap between grocery shopping and dining out, delivering not just food but a culinary experience. Especially post-pandemic, these services have emerged as a vital solution for people avoiding public spaces while wanting nutritious, diverse, and personalized meals.

What sets the Asia Pacific market apart is its cultural and culinary diversity. Providers are actively tailoring kits to regional tastes—from Japanese miso soups and Indian curries to Australian steak dinners—while also offering international cuisines such as Mediterranean, Mexican, and Thai. The market is not just about convenience—it reflects a broader socio-economic shift toward smarter consumption, sustainability, and digitized lifestyles.

Backed by venture capital and tech-driven logistics, startups and established food brands alike are capitalizing on the growing appetite for subscription-based, chef-designed meal kits. With improved cold chain infrastructure, e-commerce proliferation, and an emphasis on fresh ingredients, the Asia Pacific meal kit market is expected to expand at a significant CAGR through 2034.

Major Trends in the Market

-

Rise of Health-Focused and Diet-Specific Meal Kits: Gluten-free, keto, diabetic-friendly, and low-calorie meal kits are gaining traction among health-conscious consumers in urban centers.

-

Growing Popularity of ‘Cook & Eat’ Among Young Adults: Millennials and Gen Z are driving demand for immersive cooking experiences where they can learn new recipes while preparing meals.

-

Expansion of Subscription-Based Models: Weekly or bi-weekly subscriptions offer variety, personalized plans, and discounted pricing, which are increasingly popular in India, China, and Australia.

-

Integration with Smart Kitchens and Apps: Leading platforms are incorporating recipe tutorials via mobile apps, voice assistants, and IoT-enabled devices for enhanced convenience and engagement.

-

Sustainability as a Differentiator: Eco-friendly packaging, ethically sourced ingredients, and carbon-neutral deliveries are emerging as key factors influencing consumer loyalty.

-

Offline Retail Convergence: Some companies are entering physical retail through kiosk partnerships or in-store placements in premium grocery chains to boost visibility and reduce last-mile costs.

Report Scope of Asia Pacific Meal Kit Delivery Services Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.41 Billion |

| Market Size by 2033 |

USD 19.87 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 13.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Offering, Service, Platform, Meal Type, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

China; Japan; India; Australia; New Zealand |

| Key Companies Profiled |

Blue Apron, LLC; HelloFresh; Freshly Inc.; Sun Basket; Relish Labs LLC (Home Chef) |

The leading driver of the Asia Pacific meal kit delivery services market is rapid urbanization coupled with transformation in consumer lifestyles. With increasing work hours, long commute times, and dual-income households becoming the norm, particularly in metropolitan areas across China, India, and Australia, meal preparation has become both a time and mental bandwidth challenge. Consumers are seeking alternatives that combine the nourishment of home-cooked meals with the ease of delivery services.

Meal kits provide a structured, guided, and time-efficient way to cook meals at home without planning menus or shopping for ingredients. For example, in cities like Tokyo or Sydney, where working professionals have limited time for daily grocery runs, meal kits eliminate multiple steps from the cooking process. The convenience is further enhanced by digital ordering, scheduled deliveries, and customer-centric subscription models. This urban consumer behavior has created fertile ground for players offering innovative, locally-tailored, and lifestyle-compatible meal solutions.

Market Restraint: High Cost and Subscription Fatigue

Despite strong growth potential, one significant restraint facing the market is the perceived high cost of meal kits and growing subscription fatigue. Many consumers view meal kits as premium-priced offerings, especially when compared to traditional grocery shopping or cooking from scratch. This is particularly pronounced in price-sensitive markets like India, where middle-income households may find it difficult to justify the cost of a weekly subscription despite the convenience.

Additionally, subscription fatigue is a growing challenge. As consumers juggle subscriptions across streaming, fitness, and meal services, the recurring expense of meal kits may lead to cancellations, especially when consumer novelty fades. Some customers also experience menu repetition or difficulty customizing meals for changing dietary preferences. Unless platforms invest in ongoing personalization, flexible pricing, and transparent value propositions, they risk losing consumer retention despite initial acquisition.

Market Opportunity: Integration with Fitness and Wellness Ecosystems

An emerging opportunity in the Asia Pacific meal kit delivery space lies in strategic integration with fitness and wellness ecosystems. As consumers increasingly link their diets to health goals—whether it’s weight loss, muscle gain, diabetes control, or mental wellness—meal kit providers have the chance to co-create value with fitness centers, nutritionists, and health tech platforms.

For instance, a partnership between a meal kit company and a fitness app could allow users to receive personalized meal plans based on their BMI, caloric burn, or workout type. In Australia and Japan, there is growing interest in “performance nutrition,” where meals are designed to align with exercise regimens or health diagnostics. Similarly, wellness companies offering coaching and meditation tools could integrate meal kits tailored for cognitive health or anti-inflammatory benefits.

This convergence could elevate meal kit brands from mere delivery services to holistic wellness enablers, opening the door to premium pricing, brand loyalty, and differentiation in a competitive landscape.

Asia Pacific Meal Kit Delivery Services Market By Offering Insights

The Cook & Eat segment dominates the Asia Pacific meal kit delivery services market. This segment resonates strongly with consumers who value the experience of cooking and experimenting with new cuisines but seek support in the form of pre-portioned ingredients and recipe guides. In urban India and China, millennials and young professionals are particularly drawn to this format. They view cooking not just as a necessity, but as a creative and stress-relieving activity. Cook & Eat kits also appeal to families who use these meal kits to bond over food preparation, making dinner time more engaging.

Conversely, the Heat & Eat segment is emerging as the fastest-growing, especially among time-strapped single households and older demographics. This segment eliminates the cooking step entirely, offering microwavable or oven-ready meals that can be consumed instantly. In densely populated cities like Tokyo or Singapore, where kitchen space is limited and eating out is expensive, Heat & Eat kits offer a viable alternative. The growth of this segment is also supported by better food preservation technologies and improved taste profiles, dispelling earlier skepticism around freshness and quality.

Asia Pacific Meal Kit Delivery Services Market By Service Insights

Multiple-meal subscriptions dominate the market, offering consumers a week’s worth of meals with convenience, cost savings, and menu variety. These plans cater to structured households and fitness enthusiasts who prefer meal planning. Brands like Marley Spoon in Australia and iChef in Taiwan offer curated bundles that reduce the daily decision-making burden and promote routine. Consumers who prioritize health, calorie tracking, and portion control benefit from structured subscription services that ensure nutritional consistency.

However, single-meal options are gaining momentum, especially among Gen Z and single urban dwellers who prioritize spontaneity and variety. This format is particularly popular in fast-paced urban centers in China and India where consumers enjoy mixing traditional takeout with occasional home-cooked meals. Single-meal options also offer a low-commitment trial experience for first-time users unsure about weekly subscriptions. Players who can seamlessly toggle between subscription and a la carte options are better positioned to capture diverse consumer behaviors.

Asia Pacific Meal Kit Delivery Services Market By Meal Type Insights

The non-vegetarian meal segment leads due to the wide variety of meat, poultry, and seafood dishes offered across Asian cuisines. Chicken teriyaki, lamb biryani, butter chicken, shrimp tempura, and grilled salmon are some of the popular inclusions in meal kits. High protein content, cultural preferences, and indulgent meal planning ensure steady demand for non-veg kits across Japan, China, and Australia. Most players offer non-vegetarian bundles as their core revenue segment, often with seasonal or festive offerings.

However, the vegan meal kit segment is growing rapidly, supported by rising environmental awareness, lactose intolerance, and ethical consumption choices. Consumers in metro areas of Australia and India are opting for plant-based proteins such as tofu, lentils, and mock meats. With brands offering oat milk sauces, vegan desserts, and soy-based proteins, the vegan segment is becoming more diverse and gourmet. Marketing strategies that link vegan diets to fitness, environmental impact, and animal welfare are helping to mainstream this once-niche offering.

Unsurprisingly, online platforms dominate the meal kit delivery space, fueled by robust mobile app ecosystems, e-commerce adoption, and logistics innovations. Online ordering, customization, and tracking options provide the convenience that modern consumers expect. In regions like Southeast Asia, integration with third-party platforms like Grab, Meituan, and Zomato has expanded the reach of meal kit brands beyond their proprietary platforms. Moreover, the use of data analytics enables real-time feedback and predictive ordering, improving user satisfaction and retention.

Interestingly, the offline channel is seeing a revival through physical pop-ups, retail tie-ups, and premium supermarket placements. Some brands are placing refrigerated meal kits in grocery chains such as Woolworths in Australia or Aeon in Japan, allowing impulse purchases and greater visibility. Offline channels are also helping companies build trust, attract first-time buyers, and experiment with meal demos and sampling campaigns. This omnichannel approach is vital in a market where consumer touchpoints are fragmented.

Country Insights

China represents the largest and most dynamic market for meal kit delivery services in the Asia Pacific region. With over 60% of urban consumers experiencing long work hours, limited kitchen space, and rising disposable incomes, the country provides an ideal landscape for meal kit growth. Chinese consumers are embracing both Western and local culinary formats, with increasing demand for hybrid meal kits that incorporate Sichuan, Cantonese, and international flavors.

Tech-savvy millennials are the primary audience, with mobile-first behavior and high adoption of food delivery apps. Companies like MissFresh and Meicai are leading the charge, leveraging AI for personalized recommendations and rapid fulfillment networks. In March 2024, MissFresh announced a new series of "five-minute gourmet" kits featuring traditional Chinese dishes adapted for busy professionals, further enhancing consumer appeal.

The government’s push toward food security, digitized agriculture, and domestic consumption is reinforcing investments in cold chain logistics and agri-tech innovations. This makes China not just a consumption hub, but also an operational benchmark for meal kit scalability in Asia.

Some of the prominent players in the Asia Pacific meal kit delivery services market include:

- Blue Apron, LLC

- HelloFresh

- Freshly Inc.

- Sun Basket

- Relish Labs LLC (Home Chef)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific meal kit delivery services market

Offering

Service

Platform

Meal Type

- Vegan

- Vegetarian

- Non-vegetarian

Country

-

- China

- Japan

- India

- Australia and New Zealand