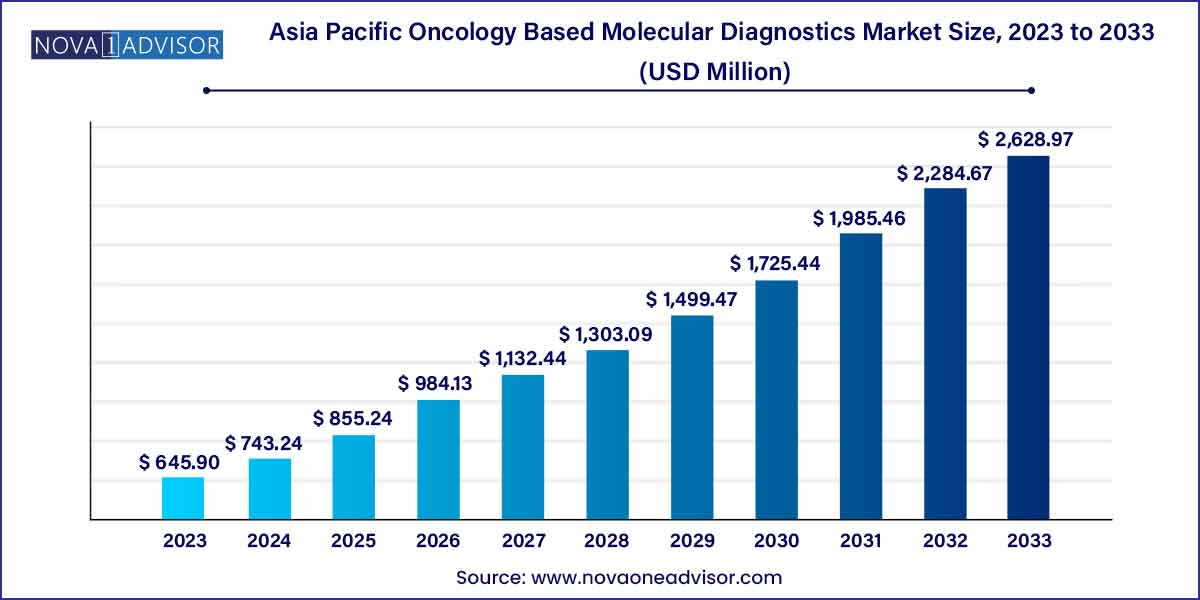

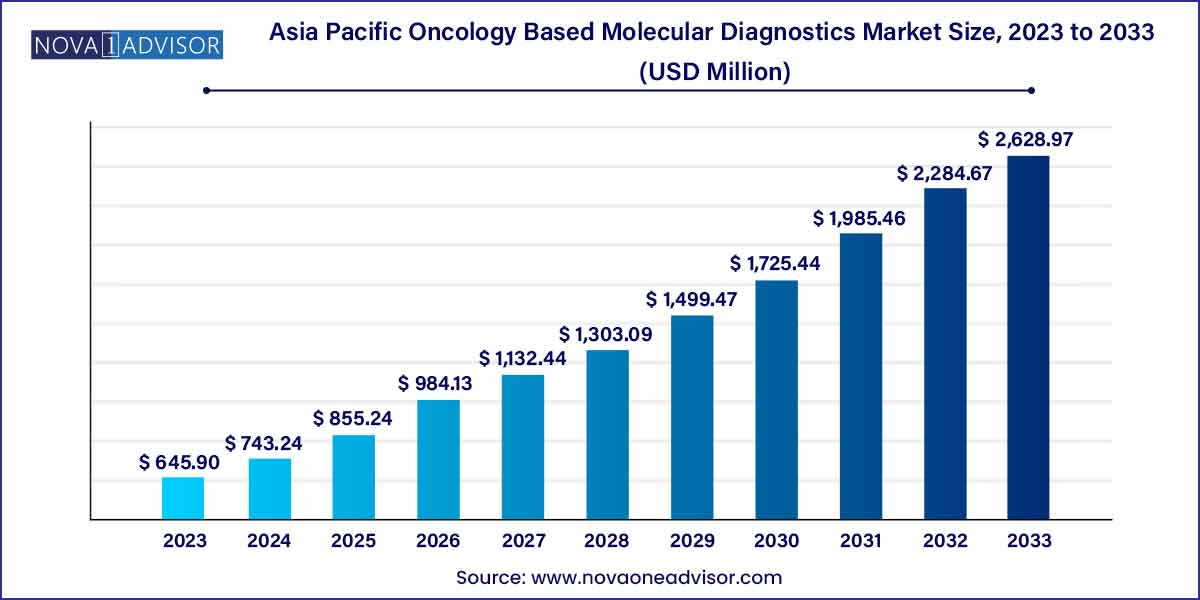

The Asia Pacific oncology based molecular diagnostics market size was estimated at USD 645.90 million in 2023 and is projected to hit around USD 2,628.97 million by 2033, growing at a CAGR of 15.07% during the forecast period from 2024 to 2033.

Key Takeaways:

- Japan oncology based molecular diagnostics market accounted for the largest revenue share of 40.59% in 2023.

- breast cancer dominated the overall market in 2023 in terms of revenue share due to large test volumes

- The polymerase chain reaction (PCR) technology segment held the highest revenue share of 31.15% in 2023.

- The sequencing segment is anticipated to witness a significant growth rate of YY.Y% during the forecast period.

- The reagents segment held the highest share of 58.59% of the overall revenue in 2023

- The reagents segment is also anticipated to expand at a significant CAGR over the forecast period.

Market Overview

The Asia Pacific oncology-based molecular diagnostics market has witnessed significant growth in recent years, fueled by advancements in genomics, increased awareness of early cancer detection, and the rising incidence of cancer across the region. Molecular diagnostics in oncology play a critical role in identifying specific genetic mutations, expressions, and markers that help guide personalized treatment options and improve clinical outcomes.

This market includes tools and techniques used to analyze biological markers in DNA, RNA, or proteins at the molecular level. It supports oncologists in detecting cancer types, understanding tumor biology, predicting disease progression, and selecting the most effective targeted therapies. As a result, molecular diagnostics have become central to modern cancer care, transitioning from traditional symptom-based diagnosis to precision medicine.

Asia Pacific, with its diverse healthcare systems, is at a transformative phase in cancer diagnostics. Emerging economies like India, China, and Southeast Asian nations are increasing their healthcare investments, while developed countries such as Japan and Australia are integrating next-generation technologies like liquid biopsy and sequencing into routine care. Governments and private sectors are collaborating to enhance diagnostic infrastructure and make these technologies more accessible.

Major Trends in the Market

-

Surge in Personalized Medicine Adoption: Oncology diagnostics are increasingly tied to patient-specific genetic profiling, particularly in breast, lung, and blood cancers.

-

Integration of Liquid Biopsy: Non-invasive testing methods such as liquid biopsies are being introduced in hospitals and specialty clinics to detect early-stage cancers.

-

Growth in Companion Diagnostics (CDx): Pharma-diagnostics partnerships are enabling simultaneous drug development and test approvals, especially for targeted cancer therapies.

-

Local Manufacturing and Reagent Customization: Domestic production of diagnostic reagents and platforms is gaining momentum in countries like China and India.

-

Expansion of Screening Programs: National cancer screening programs in Japan and Australia are increasing the demand for high-throughput molecular tests.

-

Digital Pathology and AI-Enabled Diagnostics: Use of AI to interpret molecular diagnostic outputs is improving accuracy and reducing time-to-diagnosis.

-

Decentralization of Testing: Shift from central labs to hospital-based and point-of-care diagnostics is improving rural and remote access in Asia Pacific.

Asia Pacific Oncology Based Molecular Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 743.24 million |

| Market Size by 2033 |

USD 2,628.97 million |

| Growth Rate From 2024 to 2033 |

CAGR of 15.07% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, technology, product, country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott Laboratories; Agilent Technologies Inc; bioMerieuz SA; Danaher; F. Hoffmann-La Roche Ltd.; Illumina Inc; Novartis AG; Qiagen NV; Siemens Healthineers AG; TBG Diagnostics Limited; Thermo Fisher Scientific Inc; Sysmex |

Market Driver: Increasing Cancer Incidence and Demand for Early Detection

A central driver of the Asia Pacific oncology-based molecular diagnostics market is the escalating cancer burden, driven by aging populations, lifestyle changes, and environmental factors. According to the International Agency for Research on Cancer (IARC), Asia accounts for over 50% of new global cancer cases annually, with countries like China and India leading in numbers due to their large populations.

In this landscape, molecular diagnostics have emerged as indispensable tools for early detection and disease stratification. Governments and private healthcare providers are investing in genetic screening programs to catch cancers at an early, treatable stage. For instance, India’s National Cancer Control Programme has expanded its scope to include molecular diagnostics for breast and cervical cancer screening.

Moreover, the growing middle-class population in Asia Pacific is becoming more proactive about health, demanding accurate and quick diagnostic solutions. This consumer awareness, combined with government backing, is propelling the adoption of advanced oncology testing.

Market Restraint: High Costs and Limited Access in Rural Areas

A major restraint in the region is the high cost of molecular diagnostic tests and the lack of testing infrastructure in rural or underserved areas. Advanced molecular technologies like sequencing, PCR, and hybridization-based tests often require expensive instruments, reagents, and skilled personnel, making them financially unviable for low-income healthcare settings.

In nations like India, Indonesia, and Vietnam, the disparity between urban and rural healthcare access limits the spread of advanced diagnostics. While Tier-1 cities may offer cutting-edge genetic tests, patients in Tier-2 or Tier-3 cities often face delays or must travel long distances for diagnosis.

Additionally, reimbursement policies for molecular diagnostics remain fragmented. While Japan and Australia have incorporated such diagnostics into their insurance frameworks, other countries lack comprehensive reimbursement models, which discourages widespread adoption.

Market Opportunity: Rising Investment in Genomic Medicine and Diagnostic Innovation

The most promising opportunity lies in the rising investments in genomics and diagnostic research across the region, led by both governments and private healthcare institutions. Precision oncology is becoming a focal point in healthcare policy, as seen in China's “Healthy China 2030” initiative and India’s Genome India Project, both of which promote genomic research and localized test development.

In addition, global diagnostic companies are partnering with local players to introduce region-specific panels and biomarker tests. For instance, Thermo Fisher Scientific and Illumina have launched Asia-focused sequencing assays tailored to regional cancer prevalence and genetic diversity.

Academic institutions and startups are also playing a vital role, particularly in Singapore, South Korea, and Taiwan, where biotechnology innovation is supported through tax incentives and research grants. These collaborative ecosystems are set to fuel innovation and increase affordability, unlocking massive market potential.

Segments Insights:

By Type

Lung cancer diagnostics dominate the market in terms of revenue, driven by high smoking prevalence and industrial pollution in countries like China and India. Molecular testing for EGFR, ALK, and KRAS mutations has become standard practice in guiding targeted therapies for non-small cell lung cancer (NSCLC). Hospitals across Asia Pacific are adopting these tests to improve survival rates and reduce chemotherapy toxicity.

Breast cancer diagnostics are the fastest growing, driven by increased awareness campaigns, government screening initiatives, and the availability of tests like BRCA1/BRCA2 and HER2 expression profiling. In India and Japan, early diagnosis of breast cancer is now a major health priority, with both public and private players offering subsidized genetic tests. With breast cancer incidence rising among women under 50, demand for molecular diagnostics in this segment is expected to surge.

By Technology

PCR technology dominates the oncology diagnostics landscape, owing to its affordability, accuracy, and familiarity in clinical laboratories. Real-time PCR assays for detecting gene expressions or viral DNA in cancer patients are routinely used in hospital settings across the region. It is particularly prevalent in colorectal, cervical, and hematological cancers.

Sequencing-based diagnostics are the fastest-growing technology, especially next-generation sequencing (NGS). NGS enables multi-gene panel testing and tumor profiling in a single run, crucial for complex cancers. In countries like China and Singapore, NGS adoption is being boosted by both government support and private labs offering comprehensive cancer screening packages. The expansion of sequencing infrastructure in these countries will likely catalyze this segment’s future dominance.

By Product

Reagents represent the largest share of the product segment, as they are consumed in higher volumes across repeated diagnostic procedures. From sample preparation kits to probes and primers, reagents are a recurring expense in both PCR and sequencing workflows. Manufacturers like Roche, Bio-Rad, and Qiagen supply large quantities of oncology-specific reagents to hospitals and labs in Asia Pacific.

Instruments are the fastest-growing product type, as hospitals and diagnostic chains expand their in-house testing capabilities. With rising test volumes and demand for same-day reporting, labs are investing in compact, automated platforms for molecular oncology. Companies are also introducing entry-level sequencers and hybridization systems that cater specifically to resource-constrained environments.

Country-Level Analysis

China

China is the largest oncology-based molecular diagnostics market in Asia Pacific. Supported by policies like “Made in China 2025” and massive investment in biotech, China has become a hotspot for cancer genomics. Companies like BGI, Burning Rock, and WuXi Diagnostics are leading domestic innovation in NGS, liquid biopsy, and AI-based diagnostics. Additionally, collaborations between U.S. diagnostic giants and Chinese hospitals are bringing advanced solutions to urban and secondary cities.

India

India is one of the fastest-growing markets, with a rapidly increasing cancer burden and digital health expansion. Molecular diagnostic labs like MedGenome and Strand Life Sciences are making precision oncology tests more accessible. Government programs such as the Ayushman Bharat health insurance scheme and the National Digital Health Mission are expected to promote broader access to diagnostic tools.

Japan

Japan boasts a highly sophisticated molecular diagnostics ecosystem. With full reimbursement for certain cancer gene panels and strong public health policies, Japan leads in terms of technology adoption and clinical integration. Companies like Sysmex and Fujifilm are innovating domestic solutions, while global firms conduct clinical trials and pilot tests with Japanese hospitals.

Australia and New Zealand

Australia is a regional leader in cancer screening programs and clinical research. The government’s Medical Research Future Fund and initiatives like Genomics Australia are driving innovation in diagnostics. New Zealand, while smaller in scale, follows similar healthcare policies and is witnessing steady growth in breast and lung cancer molecular testing.

Recent Developments

-

April 2025 – Illumina launched a region-specific NGS assay in China and India focused on lung and colorectal cancer mutations, tailored to local genomic profiles.

-

March 2025 – BGI Genomics announced the opening of a new sequencing hub in Southeast Asia, targeting oncology research and diagnostics.

-

February 2025 – Roche Diagnostics partnered with a major Japanese cancer institute to pilot digital pathology integration with molecular testing platforms.

-

January 2025 – MedGenome launched its next-generation liquid biopsy test for breast and prostate cancers, expanding services to over 100 Indian cities.

-

December 2024 – Qiagen announced expansion of its PCR-based oncology diagnostics manufacturing facility in South Korea to serve Asia-Pacific markets.

Key Asia Pacific Oncology Based Molecular Diagnostics Companies:

The following are the leading companies in the Asia Pacific oncology based molecular diagnostics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Asia Pacific oncology based molecular diagnostics companies are analyzed to map the supply network.

- Abbott Laboratories

- Agilent Technologies, Inc

- bioMerieux SA

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Illumina

- Novartis AG

- Qiagen NV

- Siemens Healthineers AG

- TBG Diagnostics Limited

- Thermo Fisher Scientific Inc

- Sysmex Corporatio

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific Oncology Based Molecular Diagnostics market.

By Type

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Cervical Cancer

- Liver Cancer

- Lung Cancer

- Blood Cancer

- Kidney Cancer

- Other Cancer

By Technology

- PCR

- In Situ Hybridization

- INAAT

- Chips and Microarrays

- Mass Spectrometry

- Sequencing

- TMA

- Others

By Product

- Instruments

- Reagents

- Others

By Country

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand