Asia Pacific Paint Protection Film Market Size and Trends

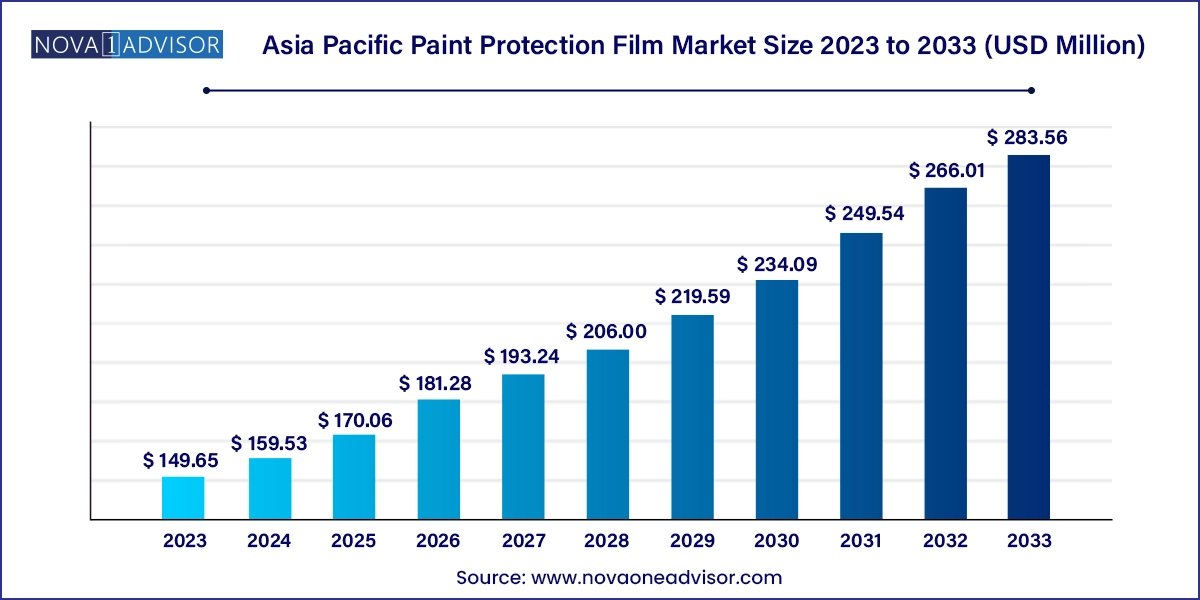

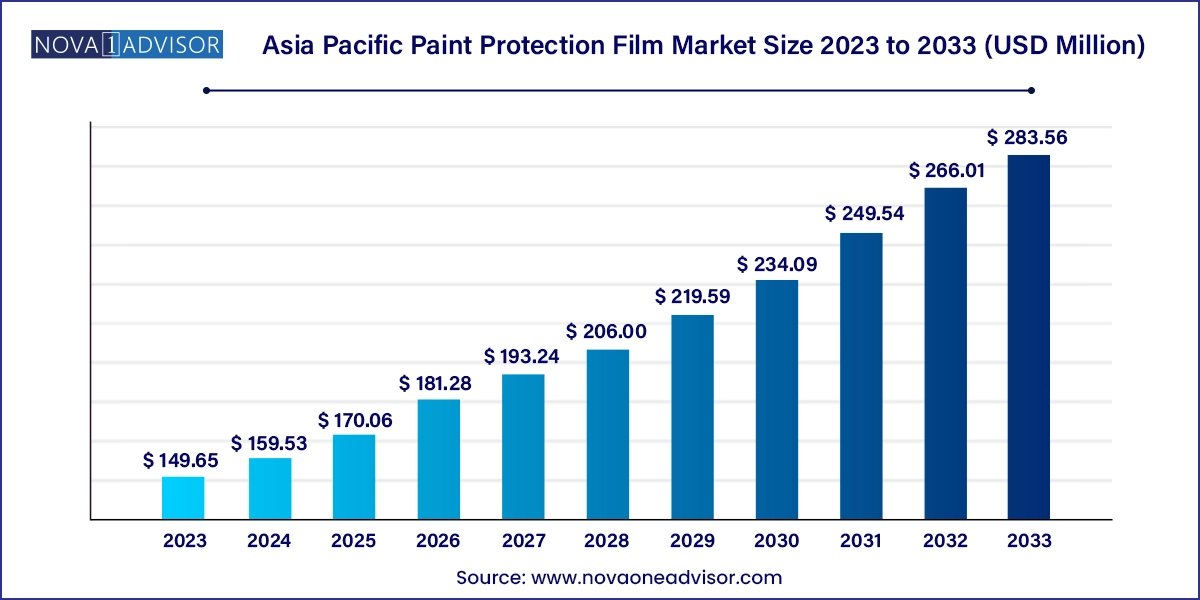

The Asia Pacific paint protection film market size was exhibited at USD 149.65 million in 2023 and is projected to hit around USD 283.56 million by 2033, growing at a CAGR of 6.6% during the forecast period 2024 to 2033.

Asia Pacific Paint Protection Film Market Key Takeaways:

- The Thermoplastic Polyurethane (TPU) segment held the largest revenue share of 81.2% in 2023.

- The Polyvinyl Chloride (PVC) segment is projected to witness a CAGR of 6.0% from 2024 to 2033.

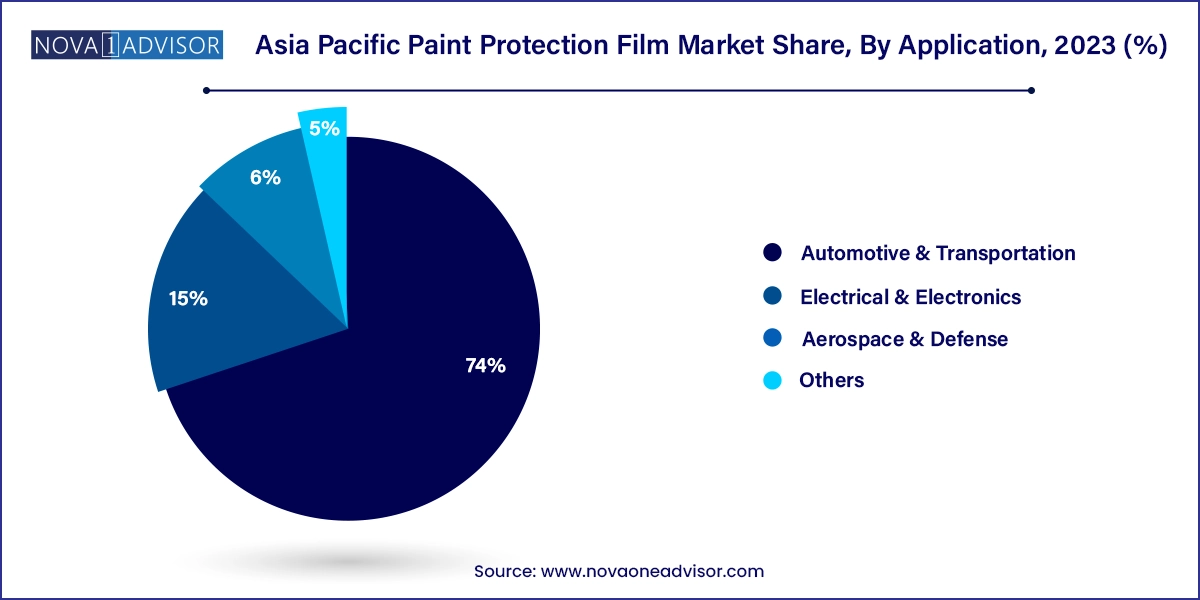

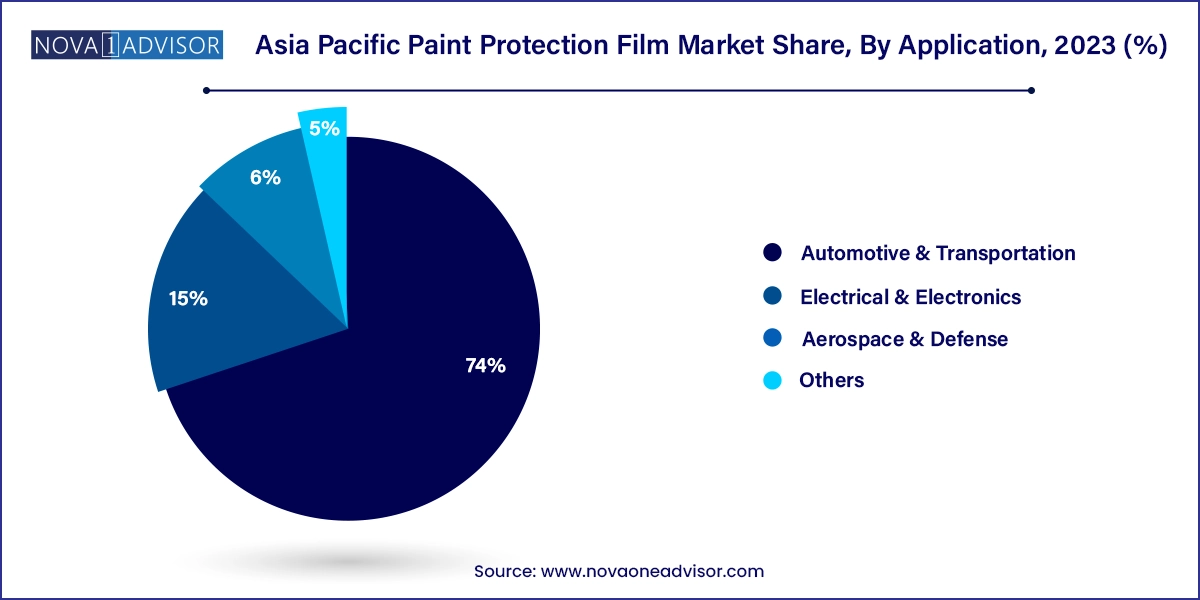

- The automotive & transportation segment accounted for a share of 74.0% in 2023.

- The electrical & electronics segment is expected to grow at a CAGR of 6.1% from 2023 to 2033.

Market Overview

The Asia Pacific Paint Protection Film (PPF) Market is rapidly evolving, fueled by increasing vehicle ownership, heightened consumer focus on preserving asset value, and the rise of automotive aesthetics and aftercare services. Paint protection films are transparent, thermoplastic urethane films applied to painted surfaces to protect against scratches, chips, abrasions, corrosion, and weather-induced damage. Their adoption is prominent in the automotive industry, but is also growing across electronics, aerospace, and defense sectors.

In Asia Pacific, countries like China, Japan, South Korea, and India are at the forefront of this growth, owing to their strong automotive manufacturing base, a booming middle class, and expanding luxury vehicle segment. The market is also seeing increased participation from aftermarket players, detailing centers, and OEMs, with many premium brands offering PPF as a value-added option.

As consumer awareness around vehicle care rises and preference for customization and long-term resale value increases, PPF adoption is spreading beyond luxury cars to mass-market vehicles, two-wheelers, and commercial fleets. Simultaneously, industries such as electronics (for screen protection) and aerospace (for surface integrity and anti-corrosion coatings) are exploring PPF for niche applications.

Major Trends in the Market

-

Rising Demand for Matte and Satin Finish Films: Consumers are seeking visual customization along with protection, driving demand for colored and textured PPFs.

-

Growth of Self-Healing and Hydrophobic Films: Technological advances have introduced films that can self-repair minor scratches under heat and repel water or stains.

-

Increased OEM Adoption: Automotive manufacturers in China, Japan, and South Korea are offering PPF installation at the factory or dealership level as part of premium packages.

-

Expansion of Film Applications Beyond Cars: PPF is now being applied to motorcycles, bicycles, marine vessels, smartphones, tablets, and industrial equipment.

-

Sustainability and Bio-Based Films: Innovations in eco-friendly TPU materials and solvent-free adhesives are gaining traction as sustainability becomes a purchase driver.

-

Franchise Growth of Auto Detailing Chains: Countries like India and Thailand are witnessing a boom in organized car detailing service providers, offering PPF and ceramic coatings.

-

Widespread Use of CAD and Pre-Cut Templates: Computer-aided design tools are allowing faster, precise installation through digitally pre-cut PPF kits, reducing labor costs and waste.

Report Scope of Asia Pacific Paint Protection Film Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 159.53 Million |

| Market Size by 2033 |

USD 283.56 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

Germany; UK; France |

| Key Companies Profiled |

3M; Saint-Gobain; Eastman Chemical Company; XPEL, Inc.; HEXIS S.A.S.; Avery Dennison Corp.; STEK India; Reflek Technologies Corp.; Kimoto; CPFilms; Hexis; Turtle Wax |

Key Market Driver: Automotive Sales and Premiumization in Asia Pacific

A pivotal driver for the Asia Pacific PPF market is the accelerated growth of the automotive sector and the consumer shift toward premium vehicle care. Countries like China and India are among the largest car markets in the world, with increasing disposable income leading to a surge in demand for luxury and performance vehicles.

Paint protection films are becoming standard accessories for new vehicle owners looking to preserve their cars’ aesthetic value and resale price. Premium car buyers are more likely to invest in invisible protection technologies, making PPF a default add-on for many sports cars, sedans, and SUVs.

Moreover, PPFs are finding favor among commercial fleet operators, ride-hailing services, and logistics firms that wish to maintain vehicle branding and appearance over time. As vehicles are seen more as lifestyle symbols than mere transportation, PPF adoption is steadily growing across consumer demographics.

Key Market Restraint: High Installation Costs and Awareness Gaps

One of the major restraints in the Asia Pacific PPF market is the high initial cost of both the film material and its professional installation. While PPF offers superior protection and longevity, it often comes at a premium that many price-sensitive consumers find prohibitive. The installation process requires trained professionals, clean room environments, and cutting tools, which further adds to the cost.

Additionally, there is still a significant lack of awareness among the middle-income population segments regarding the benefits of PPF. Many consumers in emerging Asian economies are unfamiliar with PPF, confusing it with lower-grade vinyl wraps or traditional wax coatings. The long-term ROI offered by PPF (in terms of reduced repainting or touch-ups) is not yet a universally understood value proposition. Overcoming these barriers requires investment in consumer education, localized marketing, and affordable entry-level film options.

Key Market Opportunity: Expansion in Two-Wheeler and E-Mobility Segments

A significant opportunity lies in the fast-growing two-wheeler and electric vehicle (EV) segments across the Asia Pacific region. Countries like India, Vietnam, Indonesia, and the Philippines have enormous two-wheeler populations, with increasing demand for PPF kits tailored for motorcycles and scooters.

Electric two-wheelers and entry-level EVs, which often use lightweight and fragile panels, are prime candidates for PPF adoption. Manufacturers and aftermarket players can target these segments with smaller, customized film kits that offer essential scratch and UV protection at lower prices.

In urban areas where EV charging infrastructure is expanding, vehicle owners are increasingly inclined to preserve the pristine condition of their technologically advanced vehicles, creating a new avenue for PPF manufacturers.

Asia Pacific Paint Protection Film Market By Material Insights

Thermoplastic Polyurethane (TPU) dominated the Asia Pacific paint protection film market, accounting for the largest revenue share due to its exceptional elasticity, clarity, chemical resistance, and self-healing capabilities. TPU-based PPF is highly preferred in the automotive and aerospace sectors because of its durability and resistance to environmental factors such as UV radiation, moisture, and bird droppings. TPU films maintain transparency over time and conform well to complex curves on vehicle bodies. OEMs and luxury car owners in countries like Japan, South Korea, and Australia rely heavily on TPU films for long-term value.

PVC-based PPF is the fastest-growing segment, especially in the low-cost and commercial application segments. While it lacks the self-healing property and long-term clarity of TPU, it offers an economical solution for fleet vehicles and non-premium markets. In India and Southeast Asia, PVC films are used for motorcycles, delivery vans, and taxis, providing basic scratch and abrasion resistance. Continuous improvements in PVC formulations and coating technologies are making it more viable for broader adoption.

Asia Pacific Paint Protection Film Market By Application Insights

Automotive & Transportation emerged as the dominant application, capturing the majority of market share. Automobiles remain the primary canvas for PPF use, with installations on front bumpers, hoods, side mirrors, door handles, and rear fenders. Luxury vehicle owners opt for full-body PPF installations, while mass-market consumers choose panel-wise protection. In countries like China and South Korea, where automotive aesthetics and resale value are highly prioritized, the automotive application dominates the demand landscape.

Electrical & Electronics is the fastest-growing application, driven by the proliferation of smartphones, tablets, laptops, and wearable devices. Manufacturers are increasingly exploring PPF for display protection and casing durability, particularly for flexible screens and foldable electronics. OEMs and aftermarket accessory brands are launching transparent, anti-glare, and fingerprint-resistant PPF films tailored for tech devices. With Asia Pacific housing some of the largest electronics manufacturers (e.g., Samsung, Huawei, Xiaomi), this application segment is expected to grow rapidly.

Country Insights

China

China leads the Asia Pacific PPF market due to its massive automotive sector, extensive detailing infrastructure, and strong aftermarket customization culture. Cities like Shanghai, Guangzhou, and Shenzhen are hubs for PPF innovation, installation centers, and OEM partnerships. Domestic brands such as XPEL China and FlexiShield are expanding aggressively. Government incentives for EV adoption and rising premium car sales make China a hotbed for PPF consumption.

India

India is experiencing high growth potential in the PPF market, led by rising awareness among urban car buyers, detailing studio franchises, and premium two-wheeler owners. While PPF adoption is still nascent, cities like Delhi, Mumbai, and Bengaluru are seeing a boom in detailing businesses offering combo packages of ceramic coating and PPF. With over 20 million two-wheelers sold annually, there's a huge opportunity for entry-level PPF kits for scooters and bikes.

Japan

Japan’s PPF market is mature, driven by automotive technology innovation and precision engineering. Japanese consumers value long-term vehicle aesthetics, and detailing shops in Tokyo and Osaka often provide paint correction and PPF as bundled services. Brands like 3M Japan and SunTek maintain strong footholds. PPF is also used in aerospace and defense projects, supported by government research programs.

Australia

Australia’s harsh UV exposure and climate conditions create a strong demand for protective coatings. PPF adoption is particularly strong in the off-road vehicle and pickup truck segments, popular in rural and mining regions. Australian car owners are known for investing in vehicle protection upgrades, making PPF a mainstream offering across urban and regional car dealerships.

South Korea

South Korea, home to automotive giants like Hyundai and Kia, is integrating PPF in both OEM and aftermarket spaces. South Korean consumers are early adopters of self-healing and color-change films, and major detailing chains offer subscription-based vehicle appearance maintenance plans that include PPF.

Some of the prominent players in the Asia Pacific paint protection film market include:

- 3M

- Saint-Gobain

- Eastman Chemical Company

- XPEL, Inc.

- HEXIS S.A.S.

- Avery Dennison Corporation

- STEK India

- Reflek Technologies Corporation

- Kimoto

- CPFilms

- Hexis

- Turtle Wax

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific paint protection film market

Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

Application

- Automotive & Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

Country

- Japan

- China

- India

- Australia

- South Korea

- Indonesia

- Malaysia

- Thailand