Asia Pacific Veterinary Equipment And Disposables Market Size and Research

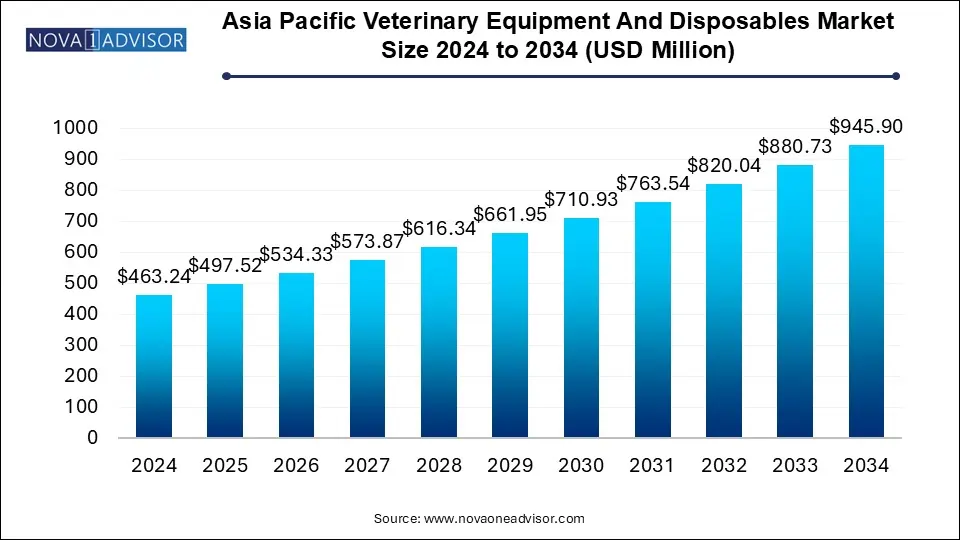

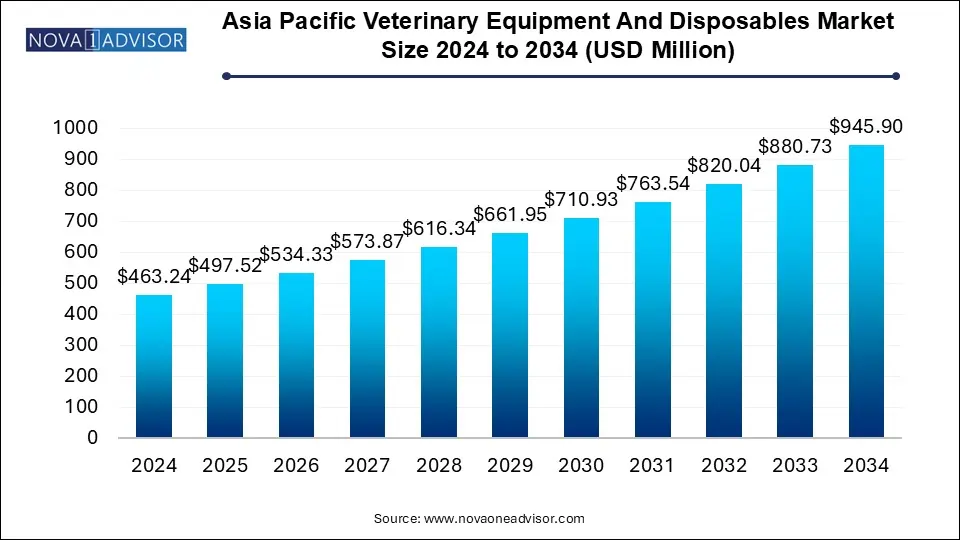

The Asia Pacific veterinary equipment and disposables market size was exhibited at USD 463.24 million in 2024 and is projected to hit around USD 945.9 million by 2034, growing at a CAGR of 7.4% during the forecast period 2025 to 2034.

Asia Pacific Veterinary Equipment And Disposables Market Key Takeaways:

- Based on animal type, the market is segmented into companion animal and livestock animal segments.

- In 2024, the companion animal segment held the largest revenue share of more than 50.0% and is expected to grow at a rapid CAGR over the forecast period.

- In terms of end-use, the veterinary hospitals/ clinics held the largest revenue share of more than 80.0% in 2024.

- In terms of product, the critical care consumables segment dominated the market in 2024 with a revenue share of 40.0%.

- The research equipment segment is expected to witness the fastest CAGR of 8.7% over the forecast period.

- The China, Hong Kong, and Taiwan segment held the largest revenue share of 30.10% in 2024

Market Overview

The Asia Pacific Veterinary Equipment and Disposables Market is undergoing a transformative phase, driven by increasing pet ownership, expanding livestock farming, rising awareness of animal health, and growing investments in veterinary infrastructure across the region. Veterinary equipment and disposables form the backbone of modern veterinary care, encompassing a wide array of tools, instruments, and consumables used in diagnosis, treatment, monitoring, and surgical procedures for both companion and livestock animals.

As economies across Asia Pacific—especially China, India, Japan, and Australia—grow in wealth and urbanization, animal healthcare is becoming a priority for both governments and private sectors. Companion animals, particularly dogs and cats, are seen increasingly as part of the family, with pet owners willing to invest heavily in their pets' health and well-being. Similarly, the need to maintain healthy livestock is critical for food safety, public health, and economic productivity, prompting farmers to adopt modern veterinary practices.

Veterinary hospitals and clinics are upgrading their facilities with advanced anesthesia machines, monitoring systems, temperature control devices, and a variety of critical care consumables. Technological advancements, the rising incidence of zoonotic diseases, and policy support for animal welfare are further fueling the market's momentum. With regional manufacturing hubs, a large veterinary population, and expanding distribution networks, Asia Pacific is poised to become one of the most dynamic markets for veterinary equipment and disposables globally.

Major Trends in the Market

-

Rise in Pet Adoption and Humanization of Pets: Urban households are increasingly treating pets like family members, boosting demand for advanced diagnostics and treatment equipment.

-

Shift Toward Preventive Veterinary Care: There is growing focus on wellness check-ups, early disease detection, and surgical interventions using modern equipment.

-

Government Initiatives for Livestock Health: Programs in India, China, and Australia to enhance livestock productivity are boosting demand for critical care and monitoring devices.

-

Technological Integration in Equipment: Devices with IoT features, digital monitors, and automated systems are gaining traction, especially in urban veterinary hospitals.

-

Growth of Veterinary Infrastructure: Investment in veterinary hospitals, mobile vet clinics, and research institutes is creating new equipment procurement opportunities.

-

Expansion of Domestic Manufacturing: Countries like China and India are ramping up local production of veterinary equipment to reduce reliance on imports and lower costs.

-

Emphasis on Temperature Management Equipment: Rising awareness about anesthesia-induced hypothermia and post-surgical care is driving demand for warming systems and fluid warmers.

Report Scope of Asia Pacific Veterinary Equipment And Disposables Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 497.52 Million |

| Market Size by 2034 |

USD 945.9 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 7.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Animal type, End-use, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Asia Pacific |

| Key Companies Profiled |

Smiths Medical; Nonin; B. Braun Melsungen AG; Kshama Equipments; Vetland Medical Sales & Services; Midmark Corporation; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Dispomed Ltd.; Zoetis |

Key Market Driver: Increasing Pet Ownership and Animal Health Awareness

A major catalyst for the Asia Pacific Veterinary Equipment and Disposables Market is the rise in pet ownership coupled with increasing awareness of animal health and welfare. In countries such as China, India, and Australia, rapid urbanization and changing lifestyles have led to a boom in pet adoption. According to the China Pet Industry White Paper, pet ownership in urban China reached over 100 million dogs and cats in recent years, with annual pet healthcare spending rising by double digits.

As owners become more attuned to their pets’ health needs, there is a growing demand for professional veterinary care services equipped with modern technology. Diagnostic equipment, monitoring systems, anesthesia machines, and critical care consumables are now commonplace in urban vet clinics. Similarly, rural animal owners are increasingly aware of the economic implications of livestock illness, resulting in greater demand for veterinary intervention. These trends, coupled with public education campaigns, are reshaping the perception of animal care across Asia Pacific and underpinning a steady demand for veterinary equipment and disposables.

Key Market Restraint: High Cost of Advanced Veterinary Equipment

Despite strong growth drivers, the market is constrained by the high cost of advanced veterinary equipment, particularly in developing nations. Veterinary hospitals and clinics in India, Indonesia, and Vietnam often operate on limited budgets, making it difficult to invest in cutting-edge devices such as complete anesthesia systems, automated syringe pumps, and temperature regulation devices. Moreover, imported equipment often comes with high tariffs, complex maintenance requirements, and a lack of trained personnel for operation.

This economic barrier leads to uneven access to quality veterinary care, especially in rural and semi-urban regions. Smaller clinics may rely on basic tools or older models, thereby restricting the adoption of more efficient and safer technologies. Unless addressed through subsidies, public-private partnerships, or localized production, this cost constraint could slow down the market’s full potential in certain segments and countries.

Key Opportunity: Rise of Veterinary Telemedicine and Remote Monitoring

An emerging opportunity lies in the convergence of veterinary care with digital health technologies, particularly in the area of remote patient monitoring and telemedicine. While still nascent in Asia Pacific, the potential for digital veterinary tools is immense, especially in vast rural regions where veterinary professionals are scarce. Wearable sensors, mobile diagnostic units, and IoT-enabled monitoring devices are beginning to change how veterinary services are delivered.

Countries like India and China are seeing a surge in digital platforms offering veterinary consultations, prescription delivery, and remote diagnostics. These services require a suite of compatible monitoring and fluid management equipment, creating a lucrative market for connected veterinary tools. Additionally, as younger veterinarians enter the workforce with strong digital proficiency, the demand for smart, user-friendly, and remotely accessible devices is expected to grow rapidly.

Asia Pacific Veterinary Equipment And Disposables Market By Animal Type Insights

Companion animals accounted for the largest market share, driven by urban pet ownership trends and growing expenditures on pet health. Dogs and cats remain the most commonly treated animals, requiring a broad range of equipment from anesthesia machines to patient monitors and fluid therapy devices. Urban vet clinics in countries like Japan, China, and Australia cater extensively to companion animals and are often equipped with advanced diagnostic and surgical tools. The emphasis on elective surgeries, dental care, and chronic disease management also fuels demand for disposables and monitoring systems.

Livestock animals are the fastest-growing segment, supported by government-backed health programs and rising export demand for safe, high-quality animal products. In India, Thailand, and Vietnam, large-scale dairy and poultry farms are investing in veterinary equipment to reduce mortality rates and enhance productivity. The use of resuscitation bags, oxygen masks, and gastroenterology consumables is rising in livestock facilities. Fluid management and temperature control systems are also being adopted in veterinary interventions aimed at improving reproductive health, especially in cattle and pigs.

Asia Pacific Veterinary Equipment And Disposables Market By End-use Insights

Veterinary hospitals and clinics emerged as the dominant end-use segment, as they form the primary access point for animal care in both urban and semi-urban areas. These facilities require a full range of equipment and disposables, including monitoring devices, anesthesia systems, resuscitation equipment, and lab testing tools. The proliferation of chain veterinary hospitals in China and Australia has further standardized the use of advanced equipment across multiple outlets. Investment in infrastructure and skilled personnel in these facilities ensures sustained demand for high-value equipment.

Research institutes are expected to be the fastest-growing end-use segment, driven by increased funding for veterinary research and growing interest in animal models for biomedical studies. Countries like Japan, South Korea, and Singapore are home to advanced research centers that utilize sophisticated veterinary equipment for laboratory animal welfare, toxicology studies, and vaccine trials. Equipment such as lab evacuation systems, induction chambers, and specialized warming systems are routinely used in these settings. Rising interest in One Health initiatives and zoonotic disease research further supports growth in this segment.

Asia Pacific Veterinary Equipment And Disposables Market By Product Insights

Critical care consumables dominated the Asia Pacific market, reflecting the essential role of items like needles, fluid administration sets, wound dressings, and airway management devices in routine veterinary operations. These consumables are used extensively across both companion and livestock care, especially during surgeries, wound treatment, hydration therapy, and emergency interventions. Among subsegments, fluid therapy consumables and wound care items are particularly critical in veterinary settings, where trauma and infections are common. The affordability and recurring nature of these items contribute to their sustained demand. Furthermore, local manufacturers in India and China are producing affordable consumables, making them widely accessible.

Temperature management equipment is projected to be the fastest-growing product segment, owing to rising concerns around hypothermia in animals during and post-anesthesia. Veterinary hospitals in Australia, Singapore, and South Korea are increasingly investing in patient warming systems to reduce surgical risks and improve recovery outcomes. Both convection and conduction warming systems are gaining popularity, with convection systems being preferred due to better heat distribution. Fluid warmers, used in conjunction with IV therapy, are also witnessing demand in post-operative and emergency settings, particularly in high-end clinics and referral centers.

Asia Pacific Veterinary Equipment And Disposables Market By Country Insights

China is the largest and most influential market for veterinary equipment and disposables in the Asia Pacific region. With a massive pet population, extensive livestock industry, and expanding veterinary infrastructure, China presents a comprehensive demand profile spanning all product categories. Government regulations promoting animal welfare and public health have strengthened the role of veterinary services in both urban and rural settings.

The Chinese government has also emphasized the modernization of animal farming practices, particularly after past outbreaks of avian flu and African swine fever. This has led to increased adoption of monitoring equipment, infusion pumps, and resuscitation kits in livestock facilities. Meanwhile, urban veterinary clinics—especially in tier 1 and tier 2 cities—are investing in patient monitors, warming systems, and anesthesia devices to meet the rising expectations of pet owners. The presence of domestic manufacturers, such as Mindray and Sinovet, further accelerates local availability and affordability of equipment.

Some of the prominent players in the Asia Pacific veterinary equipment and disposables market include:

- Smiths Medical

- Nonin

- B. Braun Melsungen AG

- Kshama Equipments

- Vetland Medical Sales & Services

- Midmark Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Dispomed Ltd.

- Zoetis

Recent Developments

-

In March 2025, Mindray, a Chinese medical device manufacturer, announced the launch of its new veterinary-specific patient monitoring system, VetLife 300, designed for use in small animal practices across Asia Pacific.

-

Bionet, a South Korean company, introduced a new portable veterinary ECG and vital signs monitor in February 2025, targeting small and mid-sized clinics in Southeast Asia.

-

In April 2025, Smiths Medical Japan collaborated with a Tokyo-based veterinary chain to pilot its new syringe pump system adapted for small animal anesthesia and fluid therapy.

-

India's VetQuip announced in January 2025 its plan to expand its manufacturing base to meet increasing domestic demand for critical care consumables and warming systems.

-

Jorvet partnered with distributors in Australia and New Zealand in March 2025 to roll out its expanded range of airway and wound care consumables.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Asia Pacific veterinary equipment and disposables market

By Product

- Critical Care Consumables

-

- Wound Management Consumables

- Airway Management Consumables

- Gastroenterology Consumables

- Needles

- Fluid Administration and Therapy Consumables

- Accessories

- Others

-

- Complete Anesthesia Machines

- Ventilators

- Vaporizers

- Waste Gas Management Systems

- Gas Delivery Management Systems

- Accessories

- Fluid Management Equipment

-

- Large-volume Infusion Pumps

- Syringe Pumps

- Temperature Management Equipment

-

-

- Convection Warming Systems

- Conduction Warming Systems

- Rescue & Resuscitation Equipment

-

- Resuscitation Bags

- Oxygen Masks

-

- Lab Evacuation Systems

- Induction Chambers

- Patient Monitoring Equipment

By Animal Type

By End-use

- Veterinary Hospitals/Clinics

- Research Institutes

By Country

- China, Hong Kong, Taiwan

- Japan

- India

- Thailand

- Australia

- South Korea

- Singapore

- Vietnam

- New Zealand

- Malaysia

- Philippines

- Indonesia