Automated NGS Library Preparation Market Size and Research

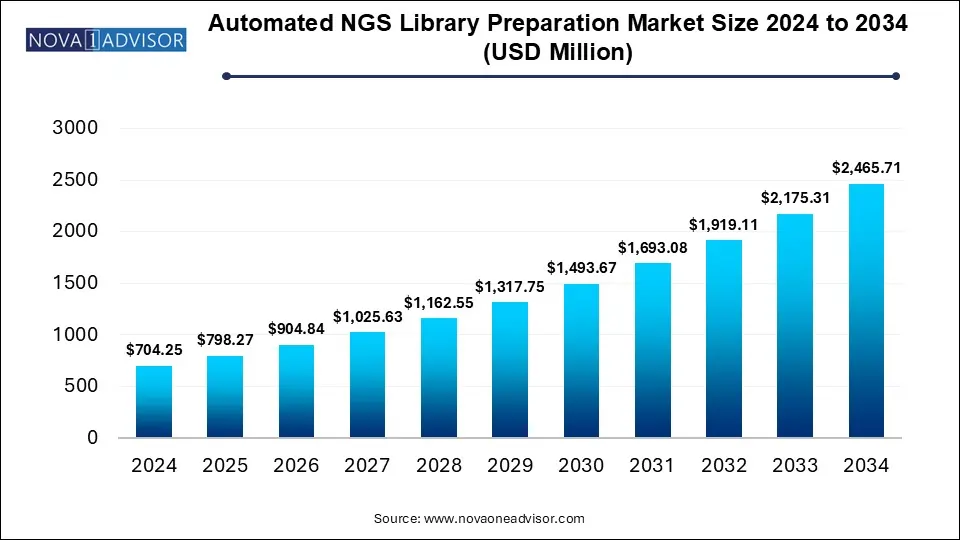

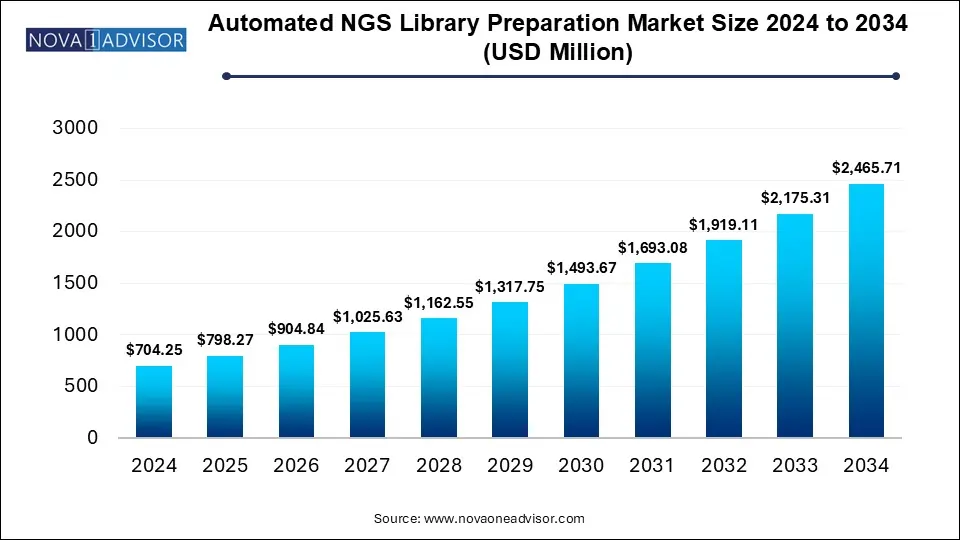

The automated NGS library preparation market size was exhibited at USD 704.25 million in 2024 and is projected to hit around USD 2465.71 million by 2034, growing at a CAGR of 13.35% during the forecast period 2025 to 2034.

Key Takeaways:

- The kits & reagents segment accounted for the largest market revenue share in 2024

- Based on type, the targeted genome sequencing segment led the market with the largest revenue share of 46% in 2024

- Based on workflow, the nucleic acid extraction segment led the market with the largest revenue share of 35% in 2024

- Based on application, the drug & biomarker discovery segment led the market with the largest revenue share of 39% in 2024

- Based on end use, the pharmaceutical and biotechnology companies segment led the market with the largest revenue share of 44% in 2024

- North America dominates the automated NGS library preparation market with the largest revenue share of 40% in 2024

Market Overview

The Automated NGS Library Preparation Market has emerged as a vital component of the next-generation sequencing (NGS) industry, addressing the growing need for scalable, reproducible, and time-efficient sample preparation solutions. Library preparation the process of converting raw nucleic acid samples into a format suitable for sequencing is a critical, yet traditionally labor-intensive step in NGS workflows. Automation of this process not only reduces human error but also significantly improves throughput, making it indispensable for clinical diagnostics, genomics research, and biopharmaceutical development.

In recent years, the demand for high-throughput NGS has surged due to its applications in precision medicine, infectious disease surveillance, oncology, and genetic diagnostics. As the cost of sequencing continues to decline and data quality improves, NGS is transitioning from research labs to mainstream clinical practice. However, the complexity and variability of manual library preparation have long posed bottlenecks in scaling sequencing operations. Automated systems and kits now fill this gap by standardizing protocols, minimizing contamination risk, and enabling parallel processing of hundreds of samples.

Major companies are developing compact, user-friendly platforms that integrate with downstream sequencing systems. As of 2025, the market is witnessing heightened demand from academic institutions, hospitals, diagnostics labs, and biotech firms seeking to optimize workflows and accelerate turnaround times. With the proliferation of omics-based diagnostics, the global automated NGS library preparation market is poised for robust growth, supported by innovation, rising sequencing volume, and growing investment in genomics infrastructure.

Major Trends in the Market

-

Integration of AI and Machine Learning for Workflow Optimization

Intelligent automation platforms are being developed to improve process control, reduce reagent consumption, and enhance error detection in library prep.

-

Miniaturization and Portability of Library Prep Instruments

Compact, bench-top devices are gaining popularity among small-to-medium-sized labs for decentralized sequencing.

-

Rising Adoption of RNA and Exome Prep Kits

Increased focus on transcriptomics and targeted sequencing is boosting demand for RNA and exome library kits.

-

Workflow Consolidation in End-to-End Platforms

Vendors are offering integrated solutions that combine extraction, library prep, and sequencing in a single platform.

-

Customization of Kits for Specific Sequencing Platforms

Companies are tailoring reagent kits to optimize compatibility with Illumina, PacBio, Oxford Nanopore, and BGI sequencers.

-

Growing Use of Automation in Infectious Disease Testing and Surveillance

Automated prep systems played a critical role in high-throughput sequencing of pathogens like SARS-CoV-2, and continue to support epidemiological studies.

Report Scope of Automated NGS Library Preparation Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 798.27 Million |

| Market Size by 2034 |

USD 2465.71 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 13.35% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Type, Workflow, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Illumina, Inc.; Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; QIAGEN N.V.; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Revvity; Oxford Nanopore Technologies Ltd.; Pacific Biosciences of California, Inc.; Hamilton Company |

Market Driver: Surge in Genomic-Based Diagnostics and Precision Medicine

A key driver for the market is the rising adoption of genomics in diagnostics and precision medicine. The shift toward personalized healthcare is underpinned by the ability to sequence individual genomes rapidly and cost-effectively, enabling physicians to tailor treatments based on genetic profiles. However, for NGS to be reliably applied in clinical settings, sample processing must be highly standardized, scalable, and reproducible.

Automated NGS library preparation addresses this need by minimizing human intervention and ensuring consistent quality across large sample batches. For example, in oncology, where sequencing is used to identify actionable mutations, automated prep systems ensure reproducibility essential for clinical decision-making. Similarly, in reproductive health diagnostics, rapid and reliable library prep enables timely analysis of fetal DNA for non-invasive prenatal testing (NIPT). As healthcare systems continue integrating genomics into mainstream care, the demand for automation in NGS workflows will intensify, driving market growth.

Market Restraint: High Capital Costs and Technical Barriers for Small Labs

One of the main restraints limiting broader adoption is the high upfront investment and operational complexity associated with automated systems. Instruments for automated library preparation can cost tens to hundreds of thousands of dollars, making them financially inaccessible for small laboratories, startups, and institutions in low-resource settings. In addition, the need for trained personnel to operate, calibrate, and troubleshoot these systems adds to implementation challenges.

While vendors have made strides in simplifying user interfaces and reducing footprint, many systems still require technical expertise, particularly for high-throughput or multi-omics applications. Moreover, the cost of proprietary reagents, maintenance, and software licensing can add to the long-term operational burden. Without affordable and modular options, smaller labs may continue to rely on manual preparation or semi-automated alternatives, limiting the market’s full potential.

Market Opportunity: Increasing Demand for RNA and Single-Cell Sequencing

An emerging opportunity in the automated NGS library preparation market lies in the growing interest in RNA sequencing and single-cell genomics. These applications require specialized and often complex library preparation protocols to capture dynamic expression profiles and transcript diversity. Manual preparation is not only labor-intensive but also prone to loss of rare transcripts, making automation essential for data fidelity.

As single-cell RNA sequencing gains momentum in cancer biology, immunology, and developmental research, demand for ultra-sensitive, low-input prep kits and instruments is rising. Vendors developing automation platforms compatible with low-volume and high-throughput single-cell protocols stand to gain significant market share. For instance, systems supporting combinatorial indexing or droplet-based library prep workflows are being widely adopted in both academic and commercial settings. This trend opens new revenue streams beyond traditional DNA library preparation, particularly in translational and personalized research applications.

Segmental Analysis

Product Outlook

Kits & Reagents dominated the product segment, generating the majority of revenue in 2024. This is due to the continuous and repeated use of reagents across all NGS workflows—ranging from DNA shearing and adapter ligation to barcoding and purification. Subcategories like RNA and exome/targeted capture library kits have witnessed a significant uptick, driven by growing applications in transcriptomics, liquid biopsies, and hereditary disease testing. For example, Illumina’s TruSeq kits and NEBNext kits from New England Biolabs are widely used for generating high-quality libraries across various sequencing platforms.

Instruments are expected to grow at the fastest rate, owing to increased demand for automation in both clinical and research environments. Next-gen automated systems such as the Illumina NovaPrep, Thermo Fisher's Ion Chef, and Agilent Bravo NGS workstation are enabling faster, hands-free library prep workflows. As labs scale up their sequencing operations, automated platforms that can handle 96 or more samples in a batch are gaining traction, particularly in national genomics programs and infectious disease surveillance.

Type Outlook

Targeted genome sequencing led the type segment, driven by its cost-efficiency, focused data output, and widespread clinical application. This approach is widely used for identifying mutations in known genes associated with diseases, especially in oncology and rare disease diagnostics. Targeted panels require fewer sequencing reads, enabling faster and more affordable library preparation, particularly when processed via automated workflows.

Whole genome sequencing (WGS) is the fastest growing segment, as falling costs and improvements in read length and depth have made WGS more accessible. WGS is increasingly adopted in large-scale population genomics studies, pathogen surveillance, and personalized medicine. Automation plays a critical role in handling the large data volumes and consistent prep required for these applications. High-throughput library prep systems compatible with long-read sequencing platforms are further accelerating WGS adoption.

Workflow Outlook

Adapter ligation dominated the workflow segment, as it is a core step in library construction where platform-specific sequencing adapters are attached to DNA or RNA fragments. This step is highly sensitive to enzymatic conditions and contamination, making it a prime candidate for automation. Vendors have introduced pre-optimized protocols that reduce ligation time and variability, particularly for high-throughput settings.

Nucleic acid extraction is the fastest growing workflow, especially with the rise in liquid biopsy, metagenomics, and low-input applications. Automated extraction modules are now being bundled with library prep systems to offer seamless sample-to-sequencer workflows. For example, Thermo Fisher’s KingFisher Flex and Qiagen’s QIAcube are widely used in conjunction with downstream library automation platforms, driving growth in integrated solutions.

Application Outlook

Drug and biomarker discovery remained the leading application segment, with pharmaceutical companies relying on automated NGS workflows to accelerate early-stage research and target validation. Large compound libraries and diverse genomic datasets necessitate standardized and scalable library preparation for consistent and reproducible results. Automated systems reduce turnaround times and support parallel processing, making them ideal for drug screening pipelines.

Disease diagnostics is projected to grow fastest, particularly in subsegments like cancer, infectious disease, and reproductive health. Automated NGS library prep enables clinical labs to process large sample volumes with minimized risk of contamination or variability. For instance, NIPT, cancer panel testing, and COVID-19 genomic surveillance rely heavily on rapid and reliable library preparation. Automation ensures compliance with regulatory standards and laboratory accreditation requirements in diagnostic applications.

End-use Outlook

Academic and research institutions dominated end-use in 2024, as they remain the largest consumers of NGS technologies for hypothesis-driven research. These organizations require flexible and customizable prep workflows to explore a wide range of research topics from epigenetics to evolutionary biology. Institutions like Broad Institute and EMBL are leading adopters of high-throughput library automation platforms to support their massive sequencing infrastructure.

Hospitals and clinics are expected to be the fastest growing end-users, driven by the increasing integration of genomics in routine diagnostics and personalized treatment. Automated systems are being deployed in clinical genomics labs to process patient samples quickly and accurately. With the growth of precision oncology and hereditary disease screening programs, hospital labs are investing in in-house sequencing capabilities, including automated library prep to support real-time clinical decision-making.

Regional Analysis

North America leads the global automated NGS library preparation market, primarily due to the dominance of the U.S. in genomics research, biopharmaceutical R&D, and diagnostics. The region benefits from strong government funding (e.g., NIH), well-established infrastructure, and presence of major industry players like Illumina, Thermo Fisher, and Agilent. Academic institutions and commercial labs alike are investing heavily in automation to meet the increasing demand for sequencing in cancer, rare disease, and infectious disease research.

Asia Pacific is the fastest growing region, driven by rising investment in life sciences, genomics initiatives, and clinical research capabilities. Countries like China, Japan, and South Korea are building state-of-the-art sequencing centers and expanding national genomics programs. For example, China's Precision Medicine Initiative and Japan’s iPS Cell Research initiatives are creating significant demand for automated NGS workflows. Regional companies are also beginning to develop indigenous automation solutions, contributing to rapid market expansion.

Some of The Prominent Players in The Automated NGS library preparation market Include:

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- QIAGEN N.V.

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories, Inc.

- Revvity

- Oxford Nanopore Technologies Ltd.

- Pacific Biosciences of California, Inc.

- Hamilton Company

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Automated NGS library preparation market

Product

- Instruments

- Kits & Reagents

-

- DNA Library Preparation Kits

- RNA Library Preparation Kits

- Exome/Targeted Capture Library Preparation Kits

- Others

Type

- Targeted Genome Sequencing

- Whole Genome Sequencing

- Whole Exome Sequencing

- Other Sequencing Types

Workflow

- Nucleic Acid Extraction

- Fragmentation

- Adapter Ligation

- Purification & Quantification

Application

- Drug & Biomarker Discovery

- Disease Diagnostics

-

- Cancer Diagnostics

- Reproductive Health Diagnostics

- Infectious Disease Diagnostics

- Other Disease Diagnostic Applications

End-use

- Hospitals and Clinics

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)