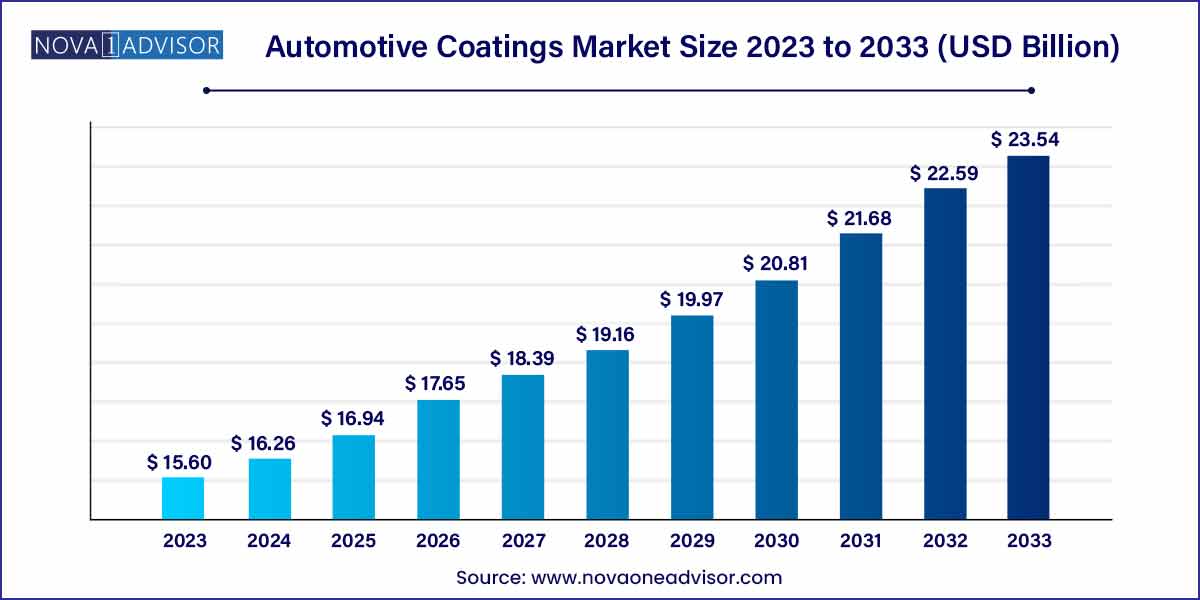

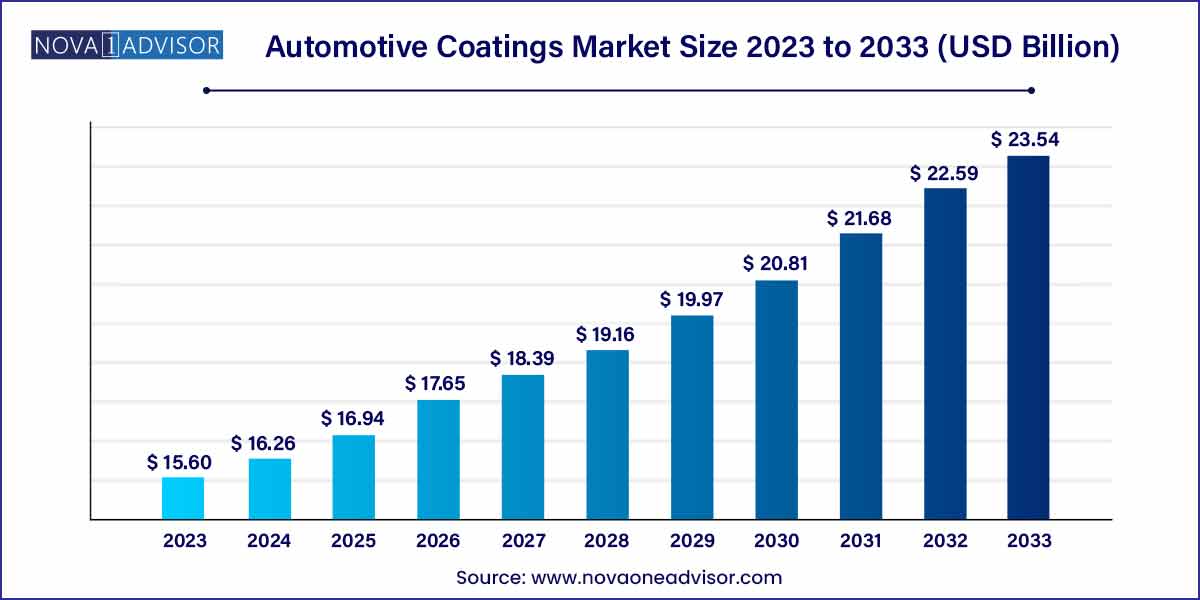

The global automotive coatings market size was exhibited at USD 15.60 billion in 2023 and is projected to hit around USD 23.54 billion by 2033, growing at a CAGR of 4.2% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific was the largest market, with 60% of the volume share in 2023

- Basecoats dominated the overall industry and accounted for 42.9% of the global revenue share in 2023.

- Metal surfaces were the largest segment and accounted for 69.5% of global revenue share in 2023.

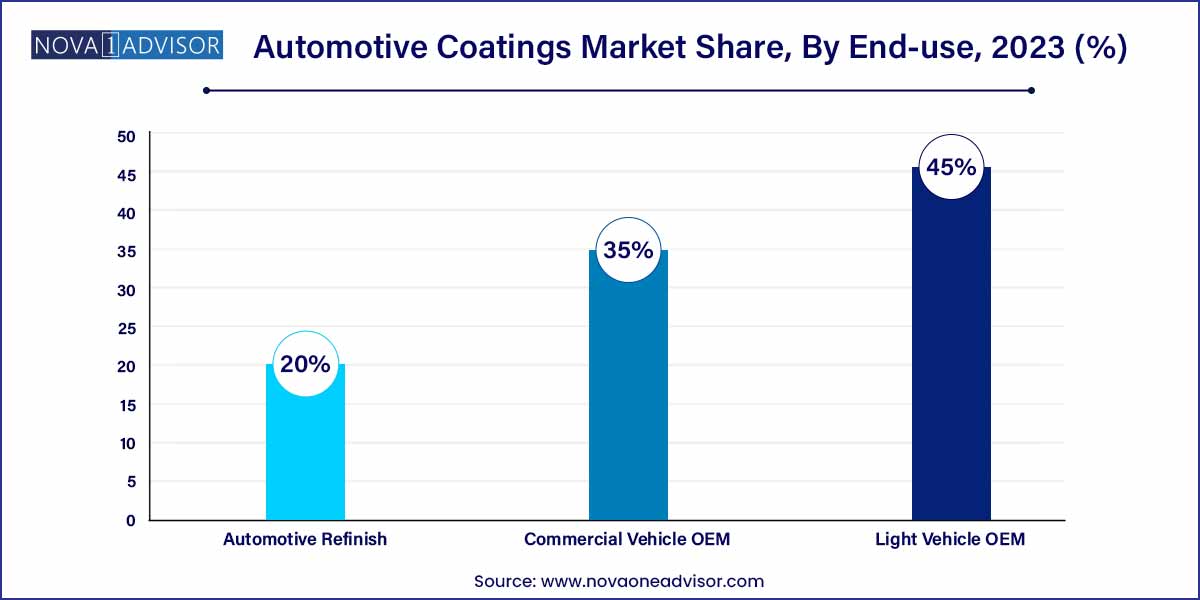

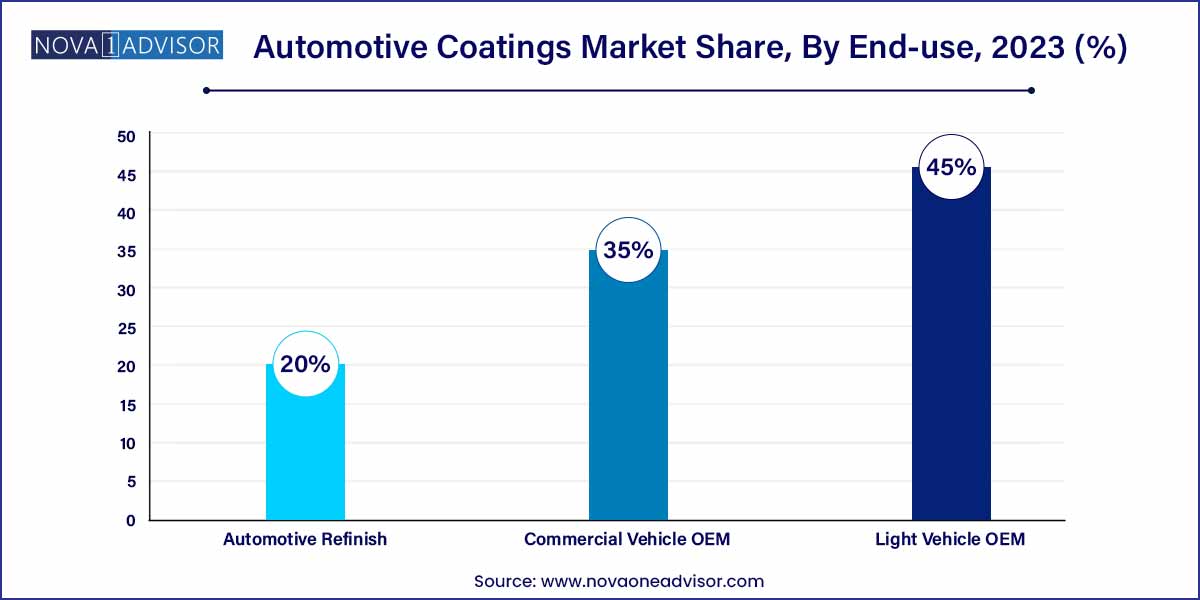

- Light vehicle OEM was the largest end-use segment of the market and was valued at USD 9.4 billion in 2023.

Automotive Coatings Market: Overview

The Automotive Coatings Market plays a pivotal role in enhancing not only the aesthetic appeal but also the durability and overall performance of vehicles. Automotive coatings provide critical protection against environmental hazards such as UV radiation, corrosion, abrasion, and chemical exposure, while also contributing to brand differentiation through customized finishes. Coatings comprise multiple layers including primer, electrocoat, basecoat, and clearcoat, each offering unique functional and visual attributes.

The surging global automotive production, particularly in emerging economies, coupled with the rising demand for premium vehicles with superior finishes, has fueled market growth. Innovations such as eco-friendly waterborne coatings, UV-cured coatings, and powder coatings are gaining prominence, driven by stringent environmental regulations and sustainability goals. Furthermore, the rise of electric vehicles (EVs) and smart vehicles has introduced new coating requirements for lightweight materials and battery components, creating additional opportunities for coatings manufacturers.

The competitive landscape is highly dynamic, with major players such as PPG Industries, Axalta Coating Systems, and BASF SE leading technological innovations, sustainability initiatives, and strategic expansions to consolidate their market positions.

Automotive Coatings Market Growth

The growth of the automotive coatings market is propelled by several key factors. Firstly, the increasing production of vehicles worldwide, driven by urbanization and rising disposable incomes, contributes to the expanding demand for automotive coatings. Additionally, stringent environmental regulations are driving the shift towards eco-friendly coatings, such as waterborne formulations, which offer lower VOC emissions. Technological advancements, including developments in nanotechnology and self-healing coatings, enhance durability and aesthetics, further stimulating market growth. Moreover, the growing popularity of electric vehicles necessitates specialized coatings to meet their unique requirements, presenting new opportunities for market expansion. Lastly, consumer preferences for customized colors and finishes underscore the importance of innovative solutions in driving growth within the automotive coatings industry.

Automotive Coatings Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 15.60 Billion |

| Market Size by 2033 |

USD 23.54 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Insights,Technology Insights,Application Insights,End-Use Insights,Regional Insights |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BASF, PPG Industries, Nippon Paint, Kansai Paint, and AkzoNobel dominate the industry. Other players include Sherwin-Williams Company, KCC Paint, Bayer AG, Arkema SA, Beckers Group, Cabot Corporation, Berger Paints, Eastman Chemical Company, Valspar Corporation, Clariant AG, Deft, Inc., Jotun A/S, Royal DSM, Lord Corporation, and Solvay S.A. |

Automotive Coatings Market Dynamics

- Increasing Vehicle Production:

The automotive coatings market experiences significant growth due to the escalating production of vehicles globally. This surge is primarily fueled by urbanization, rising disposable incomes, and improving living standards in emerging economies. As more consumers gain access to automobiles, the demand for automotive coatings rises proportionally. Moreover, the expansion of manufacturing facilities by automotive OEMs to cater to growing market demand further stimulates the demand for coatings. This trend underscores the vital role of automotive coatings in protecting vehicles from environmental factors, enhancing aesthetics, and ensuring longevity, thus driving market growth.

- Shift towards Sustainable Coatings:

Environmental concerns and stringent regulations regarding volatile organic compound (VOC) emissions drive the automotive industry's transition towards sustainable coating solutions. Waterborne coatings, in particular, have gained traction due to their lower VOC content and reduced environmental impact compared to solvent-based alternatives. Additionally, advancements in eco-friendly formulations, such as powder coatings and UV-curable coatings, further support this shift towards sustainability. Manufacturers are increasingly investing in research and development to innovate greener coating technologies while maintaining performance standards.

Automotive Coatings Market Restraint

- Regulatory Compliance Challenges:

The automotive coatings industry faces significant challenges due to stringent regulatory requirements imposed by governing bodies worldwide. Compliance with environmental regulations, such as restrictions on volatile organic compound (VOC) emissions and hazardous substances, presents a substantial hurdle for coatings manufacturers. Achieving and maintaining compliance often necessitates costly modifications to production processes, formulation adjustments, and investment in pollution control measures. Additionally, varying regulations across different regions and countries further compound the complexity of ensuring regulatory compliance. Failure to adhere to these regulations not only incurs hefty fines but also tarnishes the reputation of companies, leading to potential loss of market share and competitiveness.

- Fluctuating Raw Material Prices:

Another significant restraint impacting the automotive coatings market is the volatility of raw material prices. The prices of key raw materials, such as resins, pigments, and solvents, are subject to fluctuations influenced by factors like supply chain disruptions, geopolitical tensions, and changes in global demand. These fluctuations can significantly impact the production costs of coatings manufacturers, leading to margin compression and reduced profitability. Moreover, sudden spikes in raw material prices may necessitate adjustments in pricing strategies or compromise on product quality to maintain profitability, thereby eroding customer trust and loyalty.

Automotive Coatings Market Opportunity

- Growth in Electric Vehicle (EV) Segment:

The rapid expansion of the electric vehicle (EV) market presents a significant opportunity for the automotive coatings industry. As the automotive sector undergoes a profound shift towards electrification to reduce greenhouse gas emissions and combat climate change, there is a growing need for specialized coatings tailored to the unique requirements of electric vehicles. EV coatings must address challenges such as thermal management, battery protection, and lightweighting while maintaining durability and aesthetics. Manufacturers have the opportunity to develop innovative coatings solutions that enhance the performance, efficiency, and safety of electric vehicles, thereby catering to the evolving needs of this burgeoning market segment.

- Technological Advancements and Product Innovation:

The automotive coatings industry is ripe for technological advancements and product innovation, presenting abundant opportunities for coatings manufacturers to differentiate themselves in the market. Innovations in coating technologies, such as nanocoatings, self-healing coatings, and smart coatings, offer enhanced performance characteristics, durability, and functionality. By leveraging these advancements, coatings companies can develop next-generation coatings solutions that meet the evolving needs of automotive OEMs and end consumers. Furthermore, customization and personalization are becoming increasingly important in the automotive sector, with consumers seeking unique colors, finishes, and effects for their vehicles.

Automotive Coatings Market Challenges

- Environmental Concerns and Regulatory Pressures:

Environmental regulations and sustainability concerns pose significant challenges for the automotive coatings industry. Regulatory bodies worldwide are imposing stricter limits on volatile organic compound (VOC) emissions, hazardous air pollutants, and other harmful substances present in coatings formulations. Compliance with these regulations requires coatings manufacturers to invest in research and development to develop eco-friendly formulations that minimize environmental impact without compromising performance. Additionally, the complexity of navigating varying regulatory frameworks across different regions adds to the compliance burden for coatings companies, increasing operational costs and administrative challenges. Failure to comply with environmental regulations not only risks legal repercussions but also damages brand reputation and erodes consumer trust.

- Intense Competitive Landscape and Price Pressure:

The automotive coatings market is characterized by intense competition among coatings manufacturers, OEMs, and suppliers, leading to price pressures and margin erosion. Globalization and the proliferation of coatings suppliers have intensified competition, driving price competition and commoditization of certain coating products. Additionally, automotive OEMs increasingly seek to optimize costs throughout their supply chains, exerting pressure on coatings suppliers to reduce prices while maintaining quality and performance standards. This price pressure can squeeze profit margins for coatings manufacturers, limiting their ability to invest in research and development, innovation, and technological advancements. Moreover, the emergence of low-cost competitors in developing countries further exacerbates competitive pressures, challenging established coatings companies to differentiate themselves through product quality, service excellence, and value-added solutions.

Segments Insights:

Product Insights

Basecoat dominated the product segment within the automotive coatings market in 2024. Basecoats provide the primary color effect and aesthetics to vehicles, and their popularity stems from consumers’ growing demand for visual appeal and vehicle personalization. The increasing preference for vibrant colors, special effects like metallic and pearlescent finishes, and customizations drive the extensive use of basecoats. Automotive manufacturers are also investing heavily in developing new pigments and coating formulations to cater to evolving consumer tastes, further fueling basecoat dominance.

Clearcoat is projected to be the fastest-growing product segment. As the final protective layer, clearcoats safeguard underlying paint from UV radiation, moisture, chemical exposure, and scratches. The growing demand for durable and long-lasting finishes, coupled with consumer willingness to invest in vehicle appearance preservation, is accelerating clearcoat adoption. Technological innovations, such as self-healing and anti-scratch clearcoats, introduced by companies like PPG Industries in 2024, are enhancing the growth prospects of this segment.

Technology Insights

Solventborne coatings dominated the technology segment in 2024, owing to their superior application properties, including better adhesion, durability, and versatility across different climatic conditions. Solventborne technologies have been the industry standard for decades, and their widespread usage across OEM and refinish applications maintains their leading position despite environmental concerns.

Waterborne coatings are emerging as the fastest-growing technology. Driven by stringent environmental regulations limiting VOC emissions, especially in North America and Europe, waterborne coatings are increasingly preferred. These coatings offer comparable performance to solventborne alternatives while significantly reducing environmental impact. Major manufacturers, such as Axalta and BASF, are continuously investing in R&D to enhance the performance attributes of waterborne coatings, further propelling this segment's growth.

Application Insights

Metal parts dominated the application segment within the automotive coatings market in 2024. Traditionally, vehicles have been predominantly constructed from metal, necessitating robust coating solutions to protect against corrosion, environmental damage, and mechanical wear. Primers, electrocoats, and clearcoats are crucial in enhancing the lifespan and appearance of metal components, solidifying this segment's dominance.

Plastic parts are the fastest-growing application segment, primarily due to the increasing use of plastics and composites in modern vehicle manufacturing. Plastic parts, such as bumpers, spoilers, mirrors, and interior trims, require specialized coatings for proper adhesion, flexibility, and aesthetic consistency with metal parts. As OEMs continue to adopt plastics for lightweighting vehicles and improving fuel efficiency, the demand for plastic-compatible coatings is set to rise sharply.

End-Use Insights

Light Vehicle OEM dominated the end-use segment in 2024. The sheer volume of light vehicles produced globally, coupled with increasing consumer expectations for high-quality finishes and long-lasting exterior protection, drives this segment's preeminence. Light vehicles, including sedans, SUVs, and hatchbacks, require multilayered coating systems to meet aesthetic, safety, and environmental standards.

Automotive Refinish is anticipated to be the fastest-growing end-use segment. With the rising number of vehicles on the road and increasing frequency of vehicle repairs, the automotive refinish market is experiencing robust growth. The growth of the used vehicle market, vehicle leasing, and ride-sharing services also contribute to the demand for refinishing services. Companies such as AkzoNobel and Sherwin-Williams are actively developing fast-curing, eco-friendly refinishing solutions to meet this growing need.

Regional Insights

Asia-Pacific dominated the global automotive coatings market in 2024. The region’s dominance is driven by the massive automotive manufacturing bases in China, Japan, India, and South Korea. China, in particular, accounts for a significant portion of global vehicle production and consumption, creating enormous demand for automotive coatings. Rapid urbanization, rising disposable incomes, and shifting consumer preferences toward premium vehicles have further bolstered the region’s market position. Major manufacturers like Nippon Paint Holdings and Kansai Paint Co., Ltd. are deeply entrenched in the Asia-Pacific market, offering tailored solutions for regional needs.

Latin America is emerging as the fastest-growing region. Economic recovery post-pandemic, infrastructure development, and increasing automotive production in countries like Mexico and Brazil are fueling coatings demand. Mexico’s status as an automotive manufacturing hub for North American markets has made it a hotspot for coatings suppliers. In February 2024, PPG Industries announced the expansion of its automotive coatings manufacturing facility in San Luis Potosí, Mexico, reflecting the region's growing strategic importance.

Some of the prominent players in the automotive coatings market include:

- BASF, PPG Industries,

- Nippon Paint,

- Kansai Paint,

- KCC Paint,

- Bayer AG,

- Arkema SA,

- Beckers Group,

- Cabot Corporation,

- Berger Paints,

- Eastman Chemical Company,

- Valspar Corporation,

- Clariant AG, Deft, Inc.,

- Jotun A/S,

- Royal DSM,

- Lord Corporation, and Solvay S.A.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive coatings market.

Product

- Primer

- Electrocoat

- Basecoat

- Clearcoat

Technology

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV-cured Coatings

Application

- Metal Parts

- Plastic Parts

End-use

- Light Vehicle OEM

- Commercial Vehicle OEM

- Automotive Refinish

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)