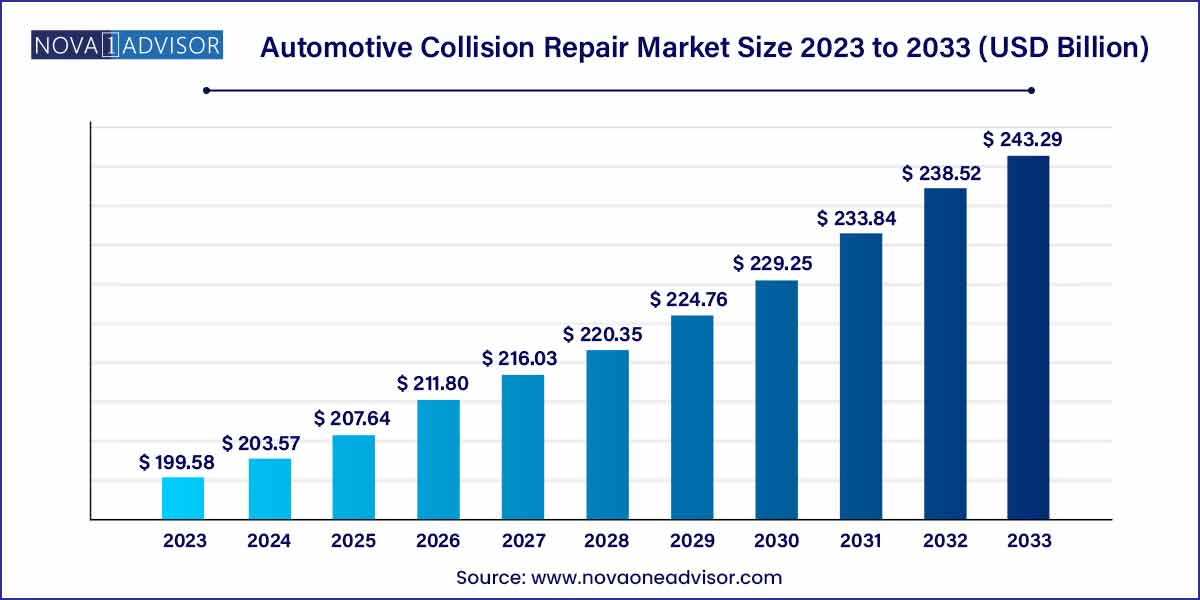

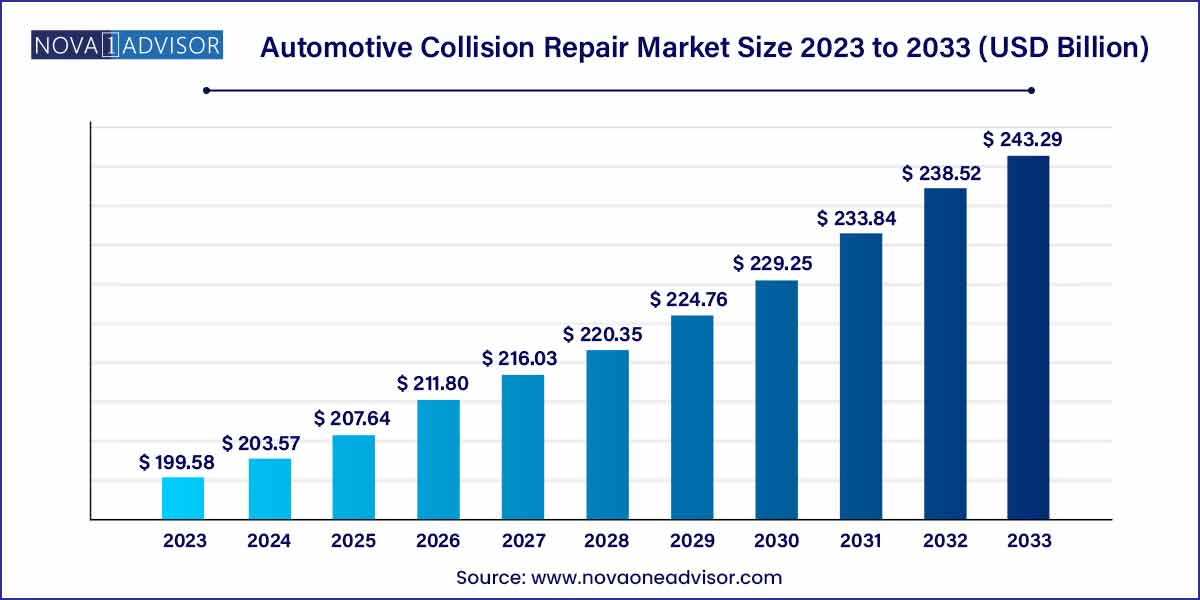

The global automotive collision repair market size was exhibited at USD 199.58 billion in 2023 and is projected to hit around USD 243.29 billion by 2033, growing at a CAGR of 2.0% during the forecast period of 2024 to 2033.

Key Takeaways:

- In Europe, automotive collision repair dominated the global market with a market share of 43.0% in 2023.

- The spare parts segment dominates the market, with a revenue share of 64.2% in 2023.

- The light-duty segment dominates the market, with a revenue share of 71.6% in 2023.

- The OE (handled by OEM's) segment dominates the market, with a revenue share of 58.0% in 2023.

Automotive Collision Repair Market: Overview

In the intricate ecosystem of the automotive industry, collision repair stands out as a critical segment, playing a pivotal role in restoring vehicles to their former glory after accidents. This overview delves into the dynamics, trends, and key factors shaping the automotive collision repair market.

Automotive Collision Repair Market Growth

The automotive collision repair market is experiencing robust growth, driven by several key factors. Firstly, the increasing number of vehicles on the road contributes to a steady demand for collision repair services, fueled by both minor accidents and major collisions. Additionally, technological advancements in repair techniques and tools are enhancing efficiency and quality, attracting customers seeking modern solutions. Moreover, stringent safety and environmental regulations are driving the adoption of compliant repair practices, ensuring both customer satisfaction and environmental responsibility. Furthermore, evolving consumer preferences, including a demand for convenience, transparency, and warranty assurances, are shaping the market landscape. Overall, these growth factors underscore a promising trajectory for the automotive collision repair market, highlighting opportunities for stakeholders to capitalize on emerging trends and meet evolving consumer needs.

Automotive Collision Repair Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 199.58 Billion |

| Market Size by 2033 |

USD 243.29 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 2.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Vehicle Type, Service Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

3M, Automotive Technology Products LLC, Continental AG, Denso Corporation, Faurecia, Federal-Mogul LLC, Honeywell International, Inc., International Automotive Components Group, Johnson Controls, Inc., Magna International Inc., Mann+Hummel Group, Martinrea International Inc., Mitsuba Corporation, Robert Bosch GmbH, Takata Corporation ODU GmbH & Co.KG, QPC FIBER OPTIC, LLC, Smiths Interconnect, Souriau, Stäubli International AG, Stran Technologies, TE Connectivity, Teledyne Defense Electronics, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, X-BEAM TECH CO, LTD. |

Automotive Collision Repair Market Dynamics

- Technological Advancements:

The collision repair industry is witnessing a significant transformation driven by technological advancements. Innovations such as computerized estimating systems, paintless dent repair, and laser measuring devices are revolutionizing repair processes, leading to faster turnaround times and higher quality outcomes. These technological developments not only improve efficiency but also enable repair professionals to tackle complex repairs with greater precision, ultimately enhancing customer satisfaction.

- Regulatory Compliance and Environmental Sustainability:

Compliance with stringent safety and environmental regulations is a key dynamic shaping the automotive collision repair market. Regulatory frameworks govern various aspects of repair practices, including repair standards, waste management, and emissions control. Collision repair facilities must adhere to these regulations to ensure the safety of repaired vehicles and minimize environmental impact. Additionally, there is a growing emphasis on environmental sustainability within the industry, with increasing adoption of eco-friendly repair methods and materials. This includes initiatives such as recycling of damaged parts and utilization of water-based paints, reflecting a broader commitment to sustainable business practices.

Automotive Collision Repair Market Restraint

One of the primary restraints facing the automotive collision repair market is the shortage of skilled labor. The industry requires highly trained technicians proficient in the latest repair techniques and technologies to deliver quality repairs efficiently. However, there is a growing scarcity of skilled professionals entering the field, exacerbated by factors such as an aging workforce, lack of vocational training opportunities, and competition from other industries. The shortage of skilled labor not only hampers the capacity of collision repair facilities to meet increasing demand but also leads to challenges in maintaining quality standards and turnaround times.

- Supply Chain Disruptions:

Another significant restraint impacting the automotive collision repair market is supply chain disruptions. The industry relies on a complex network of suppliers for various repair materials, parts, and equipment. However, disruptions in the supply chain, such as natural disasters, geopolitical tensions, or global pandemics, can lead to shortages, delays, and price fluctuations. These disruptions not only hinder the timely completion of repairs but also increase operational costs and erode profit margins for collision repair facilities. Additionally, the increasing complexity of vehicle designs and the proliferation of advanced materials pose challenges in sourcing compatible replacement parts, further exacerbating supply chain vulnerabilities.

Automotive Collision Repair Market Opportunity

- Rising Demand for Advanced Repair Technologies:

One key opportunity in the automotive collision repair market lies in the rising demand for advanced repair technologies. As vehicles become increasingly complex and incorporate advanced materials and technologies, such as aluminum bodies and ADAS (Advanced Driver Assistance Systems), there is a growing need for collision repair facilities equipped with specialized tools and expertise to handle these repairs. This presents an opportunity for collision repair businesses to invest in training and equipment for advanced repair techniques, positioning themselves as leaders in the field.

- Expansion of Value-Added Services:

Another significant opportunity within the automotive collision repair market lies in the expansion of value-added services. Beyond traditional repair services, there is a growing demand for additional offerings that enhance customer experience and convenience. This includes services such as mobile estimating, pickup and delivery, rental car coordination, and digital communication platforms for real-time updates on repair progress. By diversifying their service offerings and providing a seamless, customer-centric experience, collision repair businesses can not only attract and retain customers but also increase revenue streams and differentiate themselves from competitors. Additionally, value-added services contribute to higher customer satisfaction and loyalty, fostering long-term relationships and referrals within the community.

Automotive Collision Repair Market Challenges

- Rapid Technological Advancements:

One of the primary challenges confronting the automotive collision repair market is the rapid pace of technological advancements in vehicle design and repair techniques. Modern vehicles incorporate advanced materials, such as aluminum and carbon fiber, as well as sophisticated technologies like ADAS (Advanced Driver Assistance Systems) and autonomous driving features. Repairing these vehicles requires specialized knowledge, tools, and training, posing challenges for collision repair facilities to stay updated with evolving repair methodologies and equipment. Additionally, the complexity of modern vehicle systems increases the risk of errors during repairs, necessitating thorough training and quality control measures to ensure safety and compliance.

- Increasing Cost Pressures:

Another significant challenge facing the automotive collision repair market is the increasing cost pressures on repair facilities. Factors such as rising labor costs, inflation, and fluctuations in the price of repair materials and parts contribute to escalating operational expenses for collision repair businesses. Additionally, insurance companies exert pressure on repair facilities to minimize repair costs and cycle times, often leading to negotiations over pricing and reimbursement rates. Moreover, the introduction of advanced repair technologies and techniques, while beneficial in enhancing efficiency and quality, requires significant upfront investment, further adding to the financial burden on collision repair facilities.

Segments Insights:

Product Insights

Spare parts dominated the automotive collision repair market in 2024, largely due to the critical need for component replacements following accidents. Bumpers, headlights, radiators, grilles, and windshields are among the most commonly replaced parts. The shift towards complex and modular vehicle designs has further fueled demand for high-quality spare parts to maintain performance and safety standards. OEM parts, in particular, are preferred for their precise fit and compatibility with vehicle safety systems, contributing to their significant share in the market.

Meanwhile, paints and coatings are the fastest-growing product segment, driven by increasing consumer emphasis on vehicle aesthetics post-repair. Technological advancements have led to the development of eco-friendly, fast-curing, and high-durability coatings. Waterborne paints, for instance, are gaining traction due to their lower environmental impact compared to solvent-based alternatives. Innovations in color-matching technology ensure that post-repair vehicles maintain a seamless, factory-finish appearance, further driving this segment's growth.

Vehicle Type Insights

Light-duty vehicles dominated the collision repair market, reflecting their higher penetration rates globally among personal and fleet-owned vehicles. Sedans, SUVs, and compact cars constitute the majority of road traffic, resulting in a higher volume of collision repairs in this category. Furthermore, the proliferation of ride-sharing and rental services has expanded the need for quick and efficient repairs to maintain fleet operability and customer satisfaction.

However, heavy-duty vehicles are the fastest-growing segment, fueled by the expansion of the logistics, construction, and commercial transportation sectors. Accidents involving trucks and buses typically result in substantial damage requiring specialized repair expertise, including chassis alignment and structural repairs. As e-commerce drives the need for freight transport, the repair demand for heavy-duty vehicles is expected to increase steadily.

Service Channel Insights

DIFM (Do-it-for-me) services dominated the collision repair service channel, where professional technicians perform repairs on behalf of the vehicle owners. The rising complexity of vehicle structures and electronics discourages DIY repairs, making professional services the default choice for most collision repairs. Certified collision repair centers are particularly favored for their warranty-backed repairs, compliance with OEM standards, and ability to handle insurance claims directly.

Meanwhile, OE (Original Equipment) repair services are the fastest-growing channel, propelled by manufacturers establishing branded collision repair networks. Automakers like Tesla, BMW, and Ford are developing their certified repair programs to ensure quality control, brand consistency, and customer loyalty. OE-backed repair centers are trained specifically on each model’s repair standards, ensuring optimal safety and performance post-collision.

Region Insights

North America dominated the automotive collision repair market in 2024, driven by a high vehicle ownership rate, well-established insurance infrastructure, and a significant number of vehicle collisions annually. The United States, in particular, boasts a mature collision repair industry with widespread presence of multi-shop operators (MSOs) like Caliber Collision and Gerber Collision & Glass. Regulatory standards mandating safety inspections and repair quality further bolster the market.

Asia-Pacific is the fastest-growing region, fueled by the rapid expansion of vehicle fleets in emerging economies like China, India, and Southeast Asian nations. Rising disposable incomes, urbanization, and growing awareness of vehicle insurance have increased vehicle collision repairs. Moreover, local governments' focus on road safety and accident reduction programs, coupled with growing investments by international collision repair brands in the region, are accelerating market growth.

Recent Developments

-

March 2025: Caliber Collision announced its acquisition of 50 new service centers across the Midwest U.S., strengthening its national footprint and enhancing service availability.

-

February 2025: BASF launched a new range of eco-friendly automotive refinishing paints under the Glasurit brand, emphasizing sustainability in collision repair.

-

January 2025: LKQ Corporation introduced a new AI-powered parts sourcing and inventory management platform to optimize parts availability for collision repair centers.

-

December 2024: Service King partnered with Tesla to expand certified repair center locations, offering specialized collision repairs for Tesla vehicles.

-

November 2024: 3M unveiled an advanced line of sanding and finishing systems designed to improve the efficiency of bodywork repairs in professional workshops.

Some of the prominent players in the automotive collision repair market include:

- 3M

- Automotive Technology Products LLC (subsidiary of Lodi Group of Monterrey)

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International, Inc.

- International Automotive Components Group

- Johnson Controls, Inc.

- Magna International Inc.

- Mann+Hummel Group

- Martinrea International Inc.

- Mitsuba Corporation

- Robert Bosch GmbH

- Takata Corporation ODU GmbH & Co.KG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive collision repair market.

Product

- Paints & coatings

- Consumables

- Spare parts

Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

Service channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)