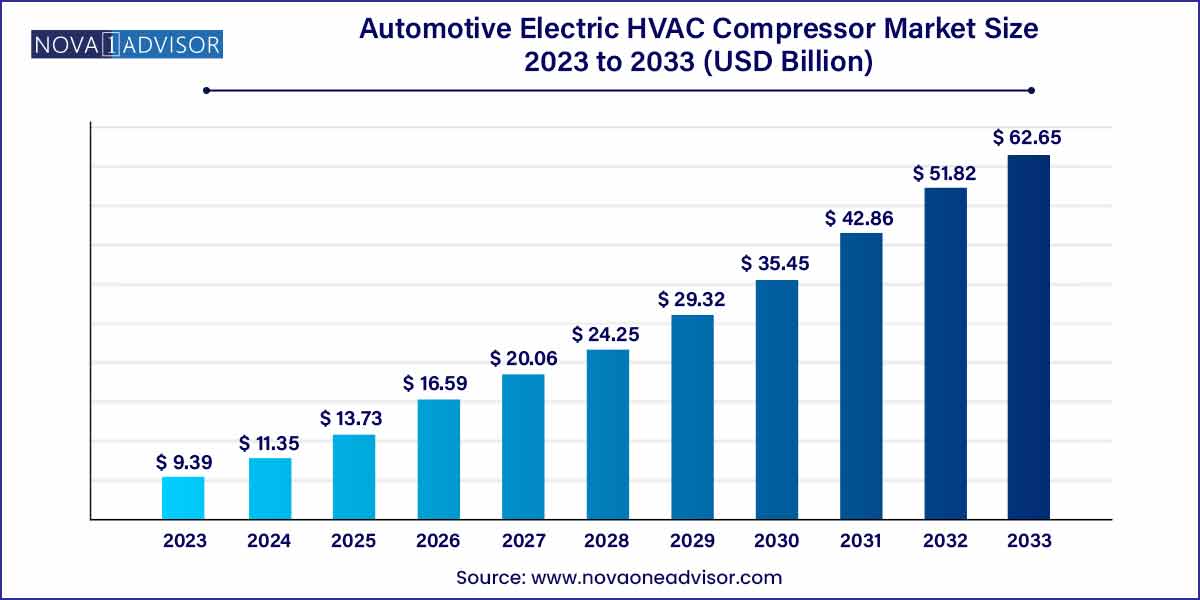

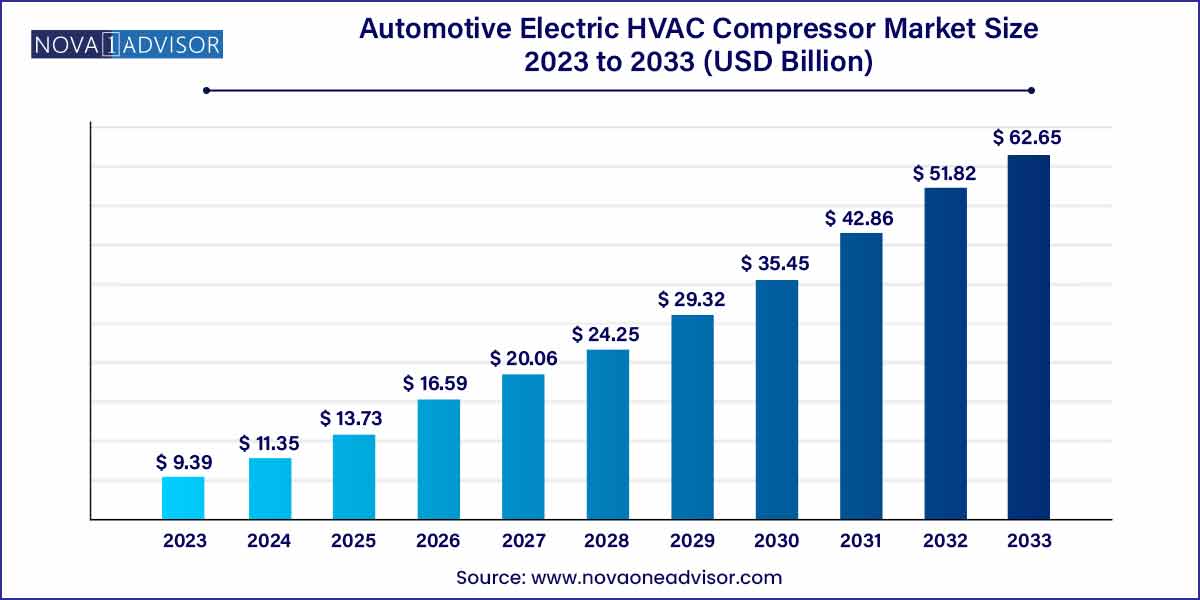

The global automotive electric HVAC compressor market size was estimated at USD 9.39 billion in 2023, is expected to surpass around USD 62.65 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 20.9% during the forecast period of 2024 to 2033.

Key Takeaways:

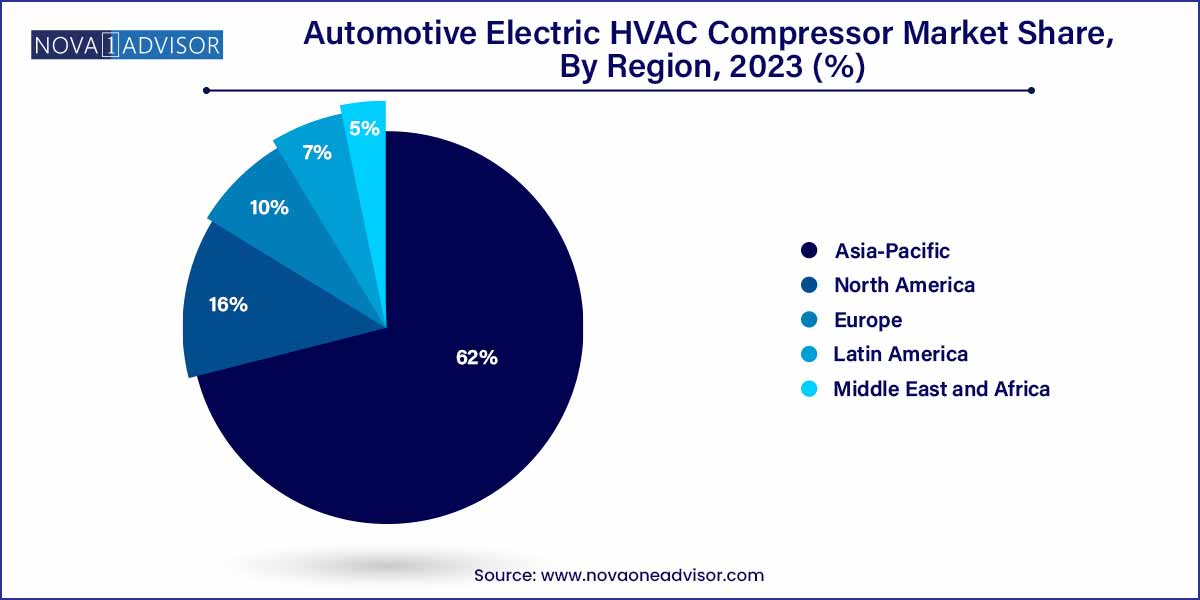

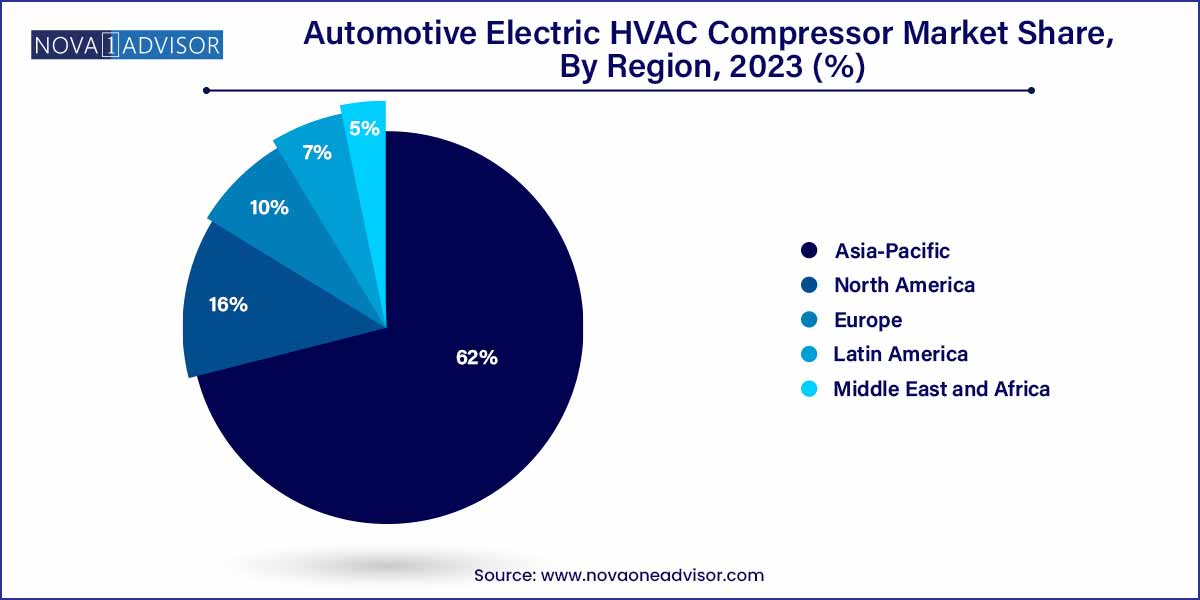

- The Asia Pacific regional market accounted for a significant share of over 62% in 2023 as a result of the high rate of EV adoption in China.

- The 20-40 CC segment is expected to register the highest CAGR of more than 15% over the forecast period.

- The Battery Electric Vehicle (BEV) segment is expected to register a CAGR of 16.1% over the forecast period.

- The passenger vehicle segment accounted for the largest revenue share of more than 50% of the automotive electric HVAC compressor market in 2023.

Automotive Electric HVAC Compressor Market: Overview

The automotive industry is experiencing a significant shift towards electrification, driven by the growing demand for eco-friendly solutions and stringent emission regulations. Within this landscape, the Automotive Electric HVAC (Heating, Ventilation, and Air Conditioning) compressor market has emerged as a pivotal sector, offering innovative solutions to enhance vehicle comfort and efficiency. This overview delves into the dynamics, trends, and key players shaping the Automotive Electric HVAC Compressor market.

Automotive Electric HVAC Compressor Market Growth

The growth of the Automotive Electric HVAC Compressor market is propelled by several key factors. Firstly, the increasing demand for energy-efficient solutions in vehicles, driven by environmental concerns and regulatory pressures, has led to a surge in adoption of electric HVAC compressors. Additionally, the rapid advancements in electric vehicle technology, coupled with the rising popularity of electric vehicles, are fueling the demand for electric-driven HVAC systems. Furthermore, stringent emission regulations worldwide are compelling automakers to integrate eco-friendly HVAC solutions, further boosting the market growth. These factors collectively contribute to the expansion of the Automotive Electric HVAC Compressor market, with sustained growth projected in the foreseeable future.

Automotive Electric HVAC Compressor Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.39 Billion |

| Market Size by 2033 |

USD 62.65 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 20.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Cooling Capacity, Vehicle Type, Drivetrain, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Denso Corporation; Hanon Systems; MAHLE GmbH; Sanden Holdings Corporation; Toyota Industries Corporation; Highly Marelli Holdings Co., Ltd.; Valeo S.A |

Automotive Electric HVAC Compressor Market Dynamics

The Automotive Electric HVAC Compressor market dynamics are characterized by two primary factors driving its evolution. Firstly, the escalating demand for energy-efficient solutions within the automotive sector is a significant driver. With increasing environmental awareness and stringent emissions regulations, automakers are prioritizing electric HVAC compressors for their superior efficiency compared to traditional mechanical counterparts. This shift aligns with the industry's broader transition towards sustainability and reduced carbon footprint.

Secondly, the rapid advancements in electric vehicle (EV) technology play a pivotal role in shaping the Automotive Electric HVAC Compressor market. As the adoption of EVs continues to soar, the demand for electric-driven HVAC systems grows in tandem. Electric vehicles require efficient cabin temperature control without compromising driving range, making electric HVAC compressors indispensable components. Consequently, the market is witnessing heightened investments in research and development to innovate and optimize electric HVAC compressor designs tailored to the specific requirements of electric mobility.

Automotive Electric HVAC Compressor Market Restraint

Two significant restraints affecting the Automotive Electric HVAC Compressor market include infrastructure challenges and cost considerations. Firstly, infrastructure challenges, such as the availability of charging infrastructure for electric vehicles, pose a significant hurdle to market growth. While the demand for electric HVAC compressors rises with the increasing adoption of electric vehicles, the lack of adequate charging infrastructure could limit the widespread adoption of electric vehicles, thereby constraining the market for electric HVAC compressors.

Secondly, cost considerations play a crucial role in shaping market dynamics. Despite the benefits of electric HVAC compressors in terms of energy efficiency and environmental sustainability, their initial cost tends to be higher than that of traditional mechanical compressors. This upfront investment can deter cost-conscious consumers and automakers from adopting electric HVAC compressor technology, especially in price-sensitive market segments. As a result, addressing cost concerns through technological innovations and economies of scale will be essential to drive broader market acceptance and penetration of electric HVAC compressors.

Automotive Electric HVAC Compressor Market Opportunity

Two significant opportunities within the Automotive Electric HVAC Compressor market include technological advancements and the expanding electric vehicle (EV) market. Firstly, continuous technological advancements present significant opportunities for innovation within the Automotive Electric HVAC Compressor market. Advancements in materials, design, and manufacturing processes enable the development of more efficient, compact, and lightweight electric compressors. Additionally, the integration of smart technologies such as IoT sensors and predictive analytics offers opportunities to enhance the performance, reliability, and user experience of electric HVAC systems, further driving market growth.

Automotive Electric HVAC Compressor Market Challenges

Two significant challenges facing the Automotive Electric HVAC Compressor market include battery limitations and thermal management concerns. Firstly, battery limitations pose a challenge to the widespread adoption of electric HVAC compressors in electric vehicles (EVs). Electric HVAC systems draw power from the vehicle's battery, which can impact overall driving range and battery life. Balancing the energy requirements of HVAC systems with the driving range expectations of consumers remains a challenge for automakers and electric HVAC compressor manufacturers.

Secondly, thermal management concerns present challenges in maintaining optimal performance and efficiency of electric HVAC compressors. HVAC systems are subjected to varying ambient temperatures and operating conditions, which can affect compressor performance and reliability. Ensuring effective thermal management to prevent overheating and maintain consistent HVAC performance is crucial, particularly in extreme climates or high-demand driving scenarios. Addressing thermal management challenges requires innovative design solutions and advanced materials to enhance heat dissipation and system durability, thus ensuring reliable operation of electric HVAC compressors in diverse operating conditions.

Segments Insights:

Cooling Capacity Insights

The 20-40 CC cooling capacity segment dominated the market in 2024, primarily because it offers the ideal balance between cooling efficiency and energy consumption for mid-sized passenger vehicles. Compressors in this range are well-suited for compact cars, sedans, and small SUVs, which constitute the majority of global vehicle sales. Manufacturers prioritize 20-40 CC compressors to optimize vehicle cost, weight, and efficiency without compromising cabin comfort.

Meanwhile, the more than 60 CC segment is the fastest-growing, driven by the increasing adoption of electric buses, heavy trucks, and large SUVs. These vehicles require high-capacity compressors to efficiently manage the larger cabin space and thermal loads. As electrification expands in commercial transportation sectors, high-capacity compressors are becoming a necessity, fueling rapid growth in this segment.

Drivetrain Insights

Battery electric vehicles (BEVs) dominated the drivetrain segment, given the rising global emphasis on full electrification and the rapid expansion of BEV production lines by automakers such as Tesla, Volkswagen, and BYD. BEVs rely entirely on electric HVAC compressors since they lack traditional engines to drive mechanical compressors.

Simultaneously, plug-in hybrid electric vehicles (PHEVs) are the fastest-growing drivetrain segment. Offering a balance between electric-only operation and traditional fuel backup, PHEVs require dual-mode HVAC systems that operate efficiently in both electric and hybrid modes. As countries push for partial electrification with hybrid incentives, the demand for specialized electric compressors tailored for PHEVs is increasing swiftly.

Vehicle Type Insights

Passenger vehicles dominated the automotive electric HVAC compressor market, as they represent the bulk of global vehicle production and the primary focus of EV manufacturers. Passenger vehicles, including compact cars, sedans, and SUVs, require efficient HVAC solutions to ensure customer satisfaction and maintain competitive advantage in a crowded market.

However, buses and coaches are the fastest-growing vehicle segment. Electrification of public transportation fleets, supported by government incentives and urban sustainability programs, has accelerated demand for heavy-duty electric HVAC compressors. Comfort and air quality inside buses are crucial factors, and thus, robust and energy-efficient compressors are increasingly being integrated into electric buses and coaches worldwide.

Regional Insights

Asia-Pacific dominated the automotive electric HVAC compressor market in 2024, owing to its massive automotive production hubs, high EV adoption rates, and aggressive government initiatives promoting cleaner transportation. China, Japan, and South Korea are at the forefront, with companies like BYD, NIO, Toyota, and Hyundai leading the charge. China alone accounted for a significant share, propelled by incentives under its "New Energy Vehicle" (NEV) policies and the expansion of public EV infrastructure.

Europe is the fastest-growing region, fueled by stringent CO2 emission regulations, EV incentives, and major OEM investments in electric mobility. Countries like Germany, Norway, the Netherlands, and the UK are witnessing rapid adoption of EVs and plug-in hybrids, necessitating advanced electric HVAC compressor solutions. Furthermore, Europe's push for sustainable urban transport, including electric buses, amplifies compressor demand across various vehicle categories.

Some of the prominent players in the automotive electric HVAC compressor market include:

- Denso Corporation

- Hanon Systems

- MAHLE GmbH

- SANDEN Holdings Corporation

- Toyota Industries Corporation

- Highly Marelli Holdings Co., Ltd.

- Valeo S.A.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive electric HVAC compressor market.

Cooling Capacity

- Less Than 20 CC

- 20-40 CC

- 40-60 CC

- More Than 60 CC

Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Buses and Coaches

Drivetrain

- Plug-in Hybrid Electric Vehicles (PHEV)

- Battery Electric Vehicles (BEC)

- Hybrid Electric Vehicles (HEV)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)