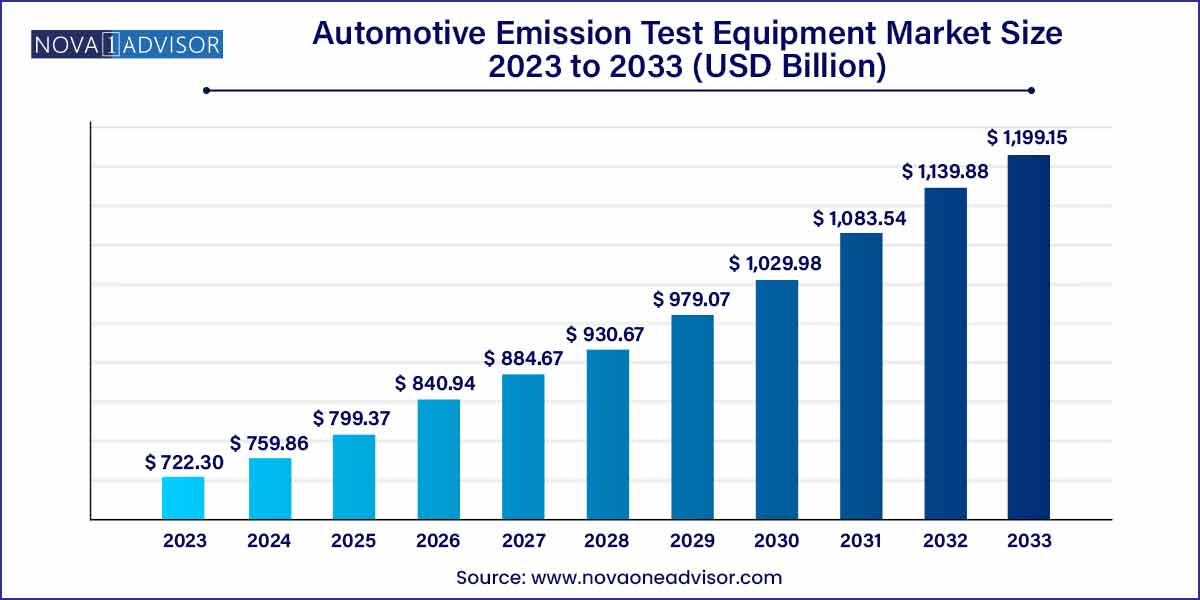

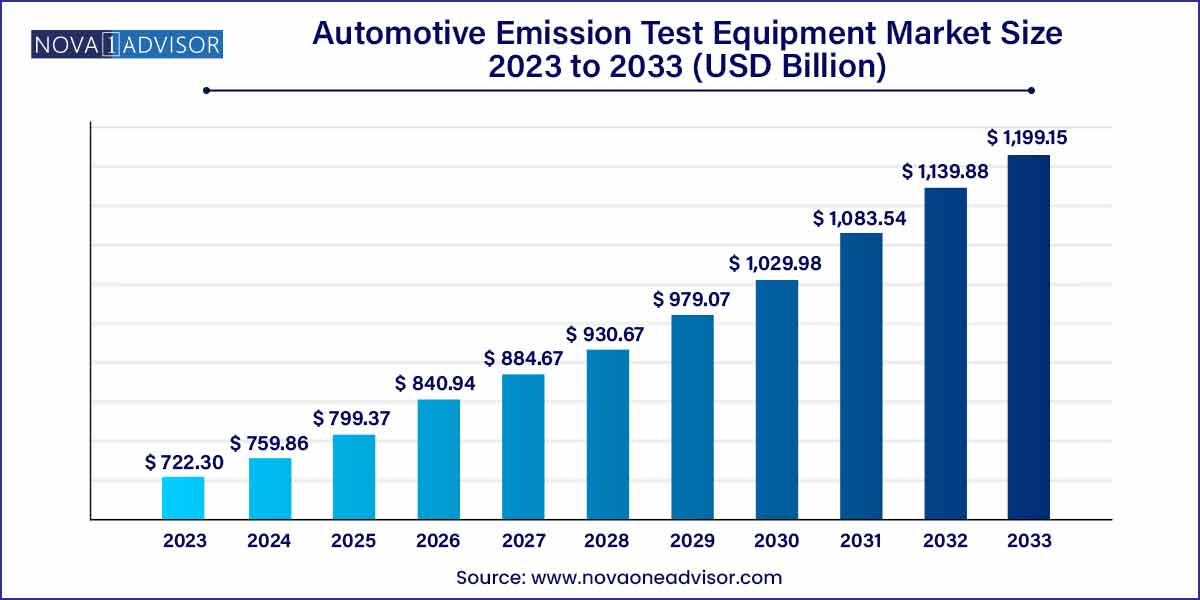

The global automotive emission test equipment market size was exhibited at USD 722.30 million in 2023 and is projected to hit around USD 1,199.15 million by 2033, growing at a CAGR of 5.2% during the forecast period of 2024 to 2033.

Key Takeaways:

- Europe dominated the market for automotive emission test equipment, accounting for 35.0% of the global revenue share in 2023.

- The emission test equipment segment held the largest share in the market for automotive emission test equipment and accounted for 47.1% of the global revenue in 2023.

- The other vehicle emission test equipment/components segment dominated the market with 86.0% of the global revenue share in 2023.

Automotive Emission Test Equipment Market by Overview

The automotive emission test equipment market plays a pivotal role in ensuring vehicles comply with stringent environmental regulations, reduce carbon footprints, and meet customer expectations for sustainable transportation. Governments worldwide are aggressively promoting cleaner air initiatives, compelling vehicle manufacturers and service centers to integrate emission test equipment into their processes. The rising concerns over global warming, public health hazards caused by vehicular pollution, and a surge in automotive production globally have amplified the significance of emission testing. Notably, traditional fuel vehicles, hybrid systems, and electric vehicles (for verifying auxiliary emissions) contribute to the expanding scope of this market.

Emerging economies, particularly in Asia-Pacific, are witnessing significant infrastructure development related to automotive services, offering a broader platform for emission testing adoption. On the other hand, developed markets like North America and Europe are continually tightening regulations, thereby necessitating technological advancements in emission test equipment. Increasing investments in R&D for sophisticated, real-time emission monitoring systems further bolster the market. Additionally, the automotive aftermarket and periodic inspection programs serve as consistent demand drivers.

Automotive Emission Test Equipment Market Growth

The growth of the automotive emission test equipment market is propelled by several key factors. Firstly, stringent emission regulations imposed by governments worldwide necessitate the adoption of advanced testing equipment to ensure compliance. Secondly, continuous technological advancements in emission testing technologies, such as portable emissions measurement systems (PEMS) and remote sensing devices, drive market expansion by offering improved accuracy and efficiency. Thirdly, the rising production of vehicles, particularly in emerging economies, amplifies the demand for reliable emission testing solutions to meet regulatory standards and ensure environmental sustainability. These growth factors collectively underscore the significance of automotive emission test equipment in addressing environmental concerns and advancing the automotive industry towards a cleaner and greener future.

Automotive Emission Test Equipment Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 722.30 Million |

| Market Size by 2033 |

USD 1,199.15 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Solution, Emission Equipment, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Opus Inspection; GEMCO Equipment Ltd.; TÜV Nord Group; CAPELEC; HORIBA, Ltd.; Applus+; SGS SA; AVL List GmbH; TEXA S.p.A. |

Automotive Emission Test Equipment Market Dynamics

The automotive industry is subject to stringent emission regulations imposed by governments worldwide to mitigate air pollution and address climate change concerns. Compliance with these regulations necessitates the use of sophisticated emission test equipment capable of accurately measuring pollutants emitted by vehicles. As regulatory standards continue to evolve and become more stringent, the demand for advanced testing solutions is expected to increase, driving market growth. Manufacturers and service providers must continually innovate to develop cutting-edge emission test equipment that meets regulatory requirements and ensures environmental sustainability.

- Technological Advancements:

Ongoing advancements in emission testing technologies play a pivotal role in shaping the automotive emission test equipment market. Innovations such as portable emissions measurement systems (PEMS), remote sensing devices, and real-time monitoring solutions have significantly enhanced the accuracy, efficiency, and effectiveness of emission testing procedures. These technological advancements enable automotive manufacturers, testing facilities, and regulatory bodies to obtain precise emission data, identify non-compliant vehicles, and enforce regulatory standards more effectively. Additionally, the integration of Internet of Things (IoT) and artificial intelligence (AI) technologies into emission test equipment enables predictive maintenance, remote monitoring, and data-driven insights, further driving market growth.

Automotive Emission Test Equipment Market Restraint

One of the primary restraints hindering the widespread adoption of automotive emission test equipment is the high initial cost associated with acquiring and deploying advanced testing solutions. The upfront investment required for purchasing sophisticated testing equipment, such as portable emissions measurement systems (PEMS) or remote sensing devices, can be substantial, particularly for small-scale automotive service providers and testing facilities. Additionally, the costs associated with installation, calibration, and training further contribute to the financial burden. As a result, budget constraints may deter some stakeholders from investing in state-of-the-art emission test equipment, limiting market penetration and adoption rates.

- Complexity of Calibration and Maintenance:

Another significant restraint facing the automotive emission test equipment market is the complexity of calibration and maintenance procedures. Ensuring the accuracy and reliability of emission test results necessitates regular calibration and maintenance of testing equipment, which can be time-consuming, labor-intensive, and resource-demanding. Calibration requires specialized knowledge, equipment, and expertise, often requiring the involvement of skilled technicians or third-party service providers. Moreover, the need for periodic maintenance to address wear and tear, component degradation, and software updates further adds to the operational challenges.

Automotive Emission Test Equipment Market Opportunity

- Growing Emphasis on Electric Vehicle (EV) Testing:

With the rapid electrification of the automotive industry, there is a burgeoning opportunity for emission test equipment tailored specifically to electric vehicles (EVs). As the adoption of EVs continues to rise, there is a growing need for testing solutions that can accurately assess battery performance, evaluate electric drivetrain efficiency, and measure overall environmental impact. Additionally, the development of emission testing protocols specific to EVs, including range testing and energy consumption assessments, presents a lucrative opportunity for manufacturers and service providers.

- Adoption of Green Testing Solutions:

There is an increasing emphasis on developing environmentally sustainable testing solutions within the automotive emission test equipment market. Stakeholders are exploring innovative approaches to minimize energy consumption, reduce waste generation, and mitigate environmental impact throughout the testing process. This includes the integration of renewable energy sources, such as solar or wind power, into testing facilities, as well as the implementation of eco-friendly materials and manufacturing practices. Moreover, the development of green testing technologies, such as low-emission testing equipment and energy-efficient testing methodologies, presents an opportunity for market differentiation and leadership.

Automotive Emission Test Equipment Market Challenges

One of the primary challenges hindering the widespread adoption of automotive emission test equipment is the high cost associated with acquiring and implementing advanced testing solutions. The initial investment required for purchasing sophisticated equipment, such as portable emissions measurement systems (PEMS) or remote sensing devices, can be substantial, particularly for small-scale automotive service providers and testing facilities. Additionally, the costs associated with installation, calibration, and training further contribute to the financial burden.

- Calibration and Maintenance Complexity:

Ensuring the accuracy and reliability of emission test results requires regular calibration and maintenance of testing equipment, which can be complex and resource-intensive. Calibration procedures demand specialized knowledge, equipment, and expertise, often necessitating the involvement of skilled technicians or third-party service providers. Moreover, the need for periodic maintenance to address wear and tear, component degradation, and software updates further adds to the operational challenges.

Segments Insights:

Solution Insights

Emission Test Equipment dominated the solution segment in the global market.

Emission test equipment forms the backbone of emission testing infrastructure. Devices such as gas analyzers, smoke meters, and particulate counters have witnessed rising demand globally due to the imposition of mandatory emission checks for new and old vehicles. Automotive manufacturers are investing heavily in laboratory setups with sophisticated chassis and engine dynamometers, supporting the expansion of the emission test equipment segment. Additionally, government-owned testing centers are procuring advanced instruments to enhance compliance with global emission standards.

Conversely, Emission Test Software is expected to emerge as the fastest-growing solution segment. The need for digitalization, automation, and real-time data management is pushing software adoption. Cloud-based solutions, AI-enabled diagnostic systems, and real-time reporting software are increasingly favored by service centers and OEMs. Moreover, remote diagnostics and predictive maintenance capabilities powered by software platforms add value, making emission test software critical in the coming years.

Emission Equipment Insights

Opacity Meters/Smoke Meters dominated the emission equipment segment.

Smoke meters, especially opacity meters for diesel vehicles, remain the most widely used equipment, particularly in heavy-duty vehicle segments. Given diesel vehicles' significant contribution to particulate matter pollution, regulatory bodies have mandated rigorous opacity testing. Smoke meters' relatively low cost compared to gas analyzers also aids their widespread adoption, particularly across periodic vehicle inspection centers in developing and developed markets alike.

However, Other Vehicle Emission Test Equipment/Components are set to be the fastest-growing category. This includes exhaust gas analyzers, PEMS units, and mini-constant volume sampling systems. As testing requirements broaden beyond opacity alone to include NOx, CO2, and particle number measurements, the demand for a diversified range of emission testing tools is surging. Particularly, PEMS are becoming indispensable for real-driving emission tests, reflecting future market expansion trends.

Regional Insights

Europe emerged as the dominant region in the automotive emission test equipment market.

Europe has consistently led in adopting stringent automotive emission norms, notably Euro standards, which have evolved progressively from Euro 1 to the currently proposed Euro 7 norms. These regulatory milestones compel vehicle manufacturers and testing centers to invest in state-of-the-art emission testing solutions. Countries like Germany, France, and the United Kingdom showcase significant investments in automotive emission R&D. Moreover, Europe was the pioneer in implementing the Real Driving Emissions (RDE) test procedure, necessitating mobile and advanced emission measurement systems. Robust regulatory frameworks, public awareness, and technological advancements fortify Europe's dominant market position.

Asia-Pacific is projected to be the fastest-growing region.

Asia-Pacific, particularly China and India, is experiencing robust growth fueled by rapidly increasing vehicle ownership, deteriorating urban air quality, and heightened regulatory pressure. China's "Blue Sky Protection" initiative and India's Bharat Stage VI norms have intensified the need for widespread emission testing infrastructure. Southeast Asian nations like Thailand and Indonesia are following suit with policy revisions and incentives for emission control. The rapid industrialization, increasing governmental funding for pollution control measures, and evolving automotive manufacturing hubs make Asia-Pacific the most dynamic region for automotive emission test equipment growth.

Recent Developments

-

In December 2024, HORIBA Ltd. launched its advanced MEXA-ONE series portable emission measurement system, catering to upcoming Euro 7 and U.S. LEVIII standards.

-

In October 2024, AVL List GmbH collaborated with Ford Motors to integrate new RDE test facilities at Ford's research centers in the U.S. and Germany.

-

In August 2024, SGS SA expanded its automotive testing center in Shanghai, China, introducing advanced emission testing capabilities aimed at serving EV and hybrid vehicles.

-

In June 2024, Applus+ IDIADA announced a major investment in Spain, opening a new vehicle emission test facility to support automakers in meeting Euro 7 standards.

-

In March 2024, California Analytical Instruments, Inc. unveiled a new line of fast-response gas analyzers suitable for RDE and laboratory-based emissions research.

Some of the prominent players in the automotive emission test equipment market include:

- Opus Inspection

- GEMCO Equipment Ltd.

- TÜV Nord Group

- CAPELEC

- HORIBA, Ltd.

- Applus+

- SGS SA

- AVL List GmbH

- TEXA S.p.A.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive emission test equipment market.

Solution

- Emission Test Equipment

- Emission Test Software

- Emission Test Services

Emission Equipment

- Opacity Meters/Smoke Meters

- Other Vehicle Emission Test Equipment/Components

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)