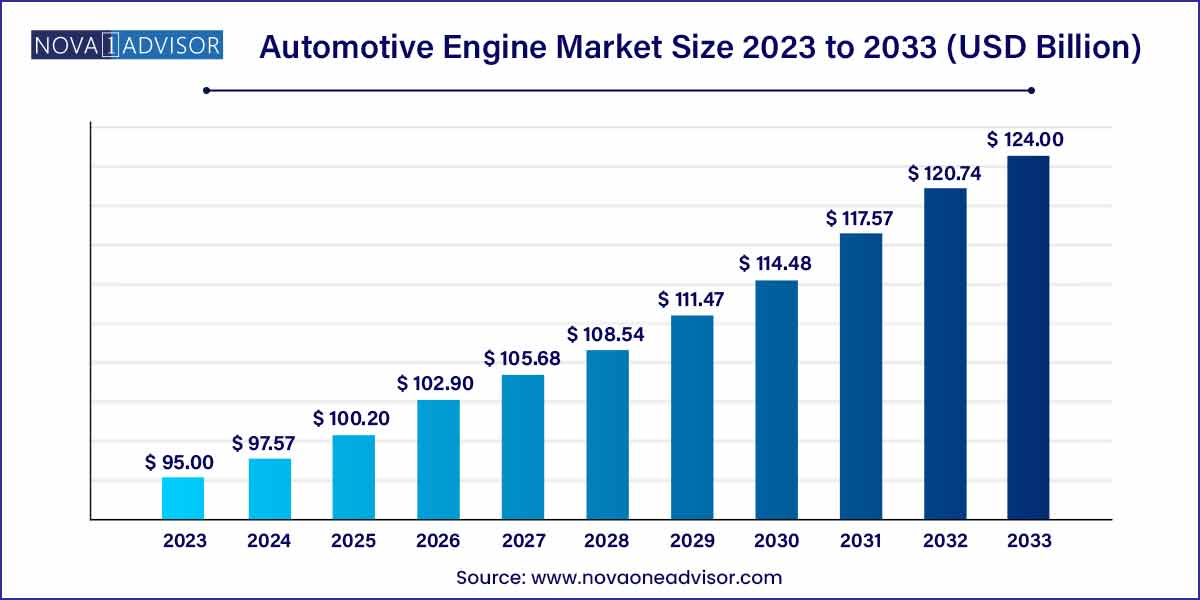

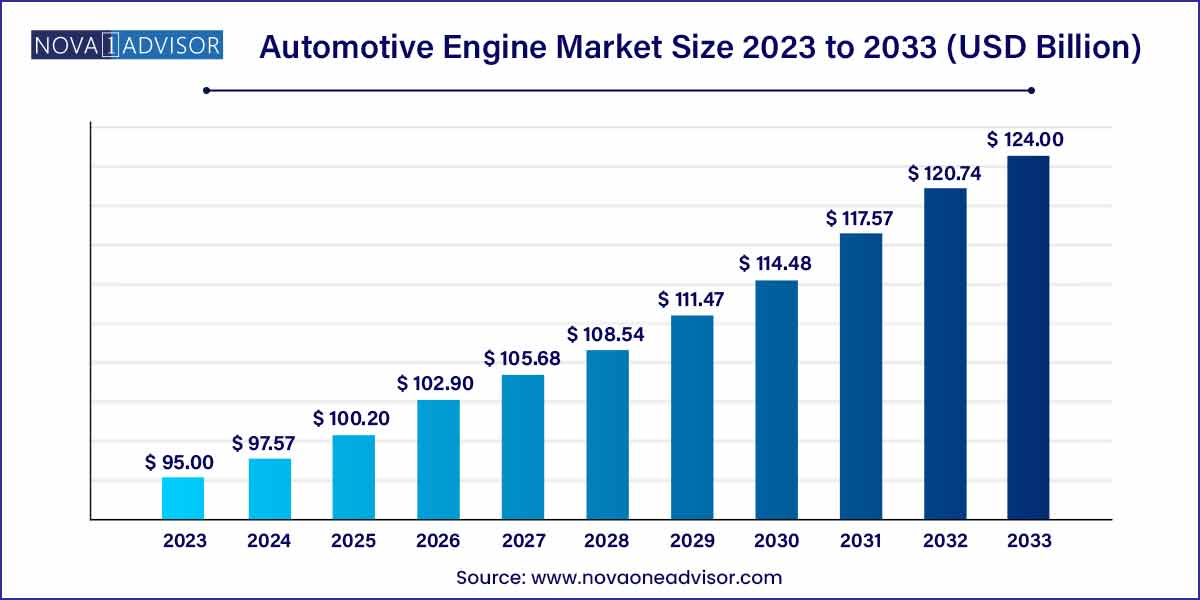

The global automotive engine market size was exhibited at USD 95.00 billion in 2023 and is projected to hit around USD 124.00 billion by 2033, growing at a CAGR of 2.7% during the forecast period of 2024 to 2033.

Key Takeaways:

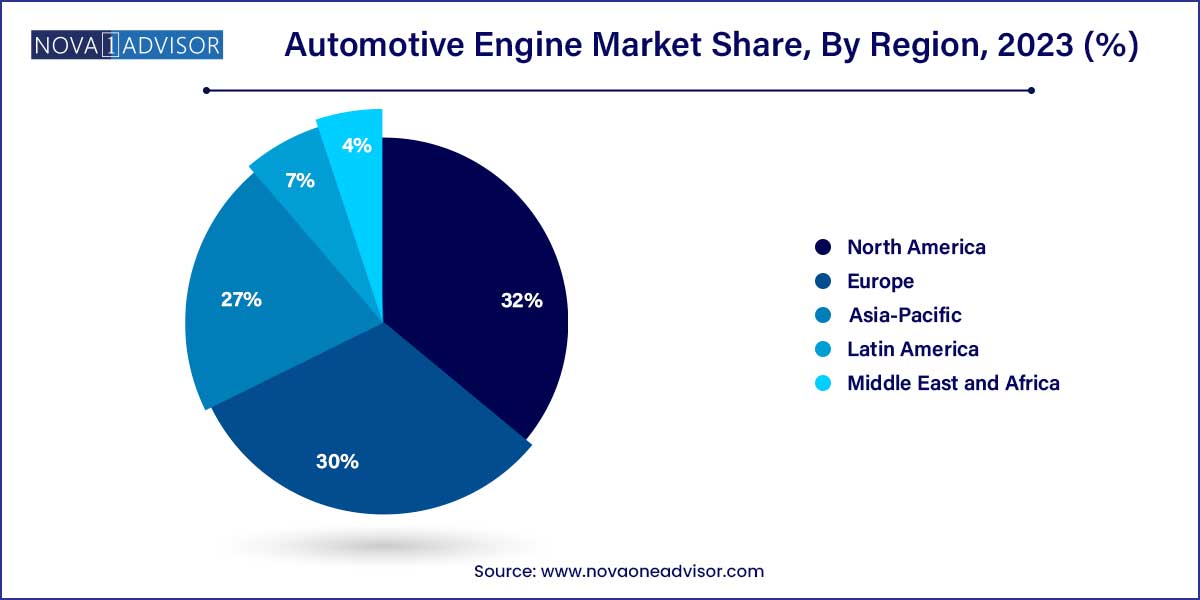

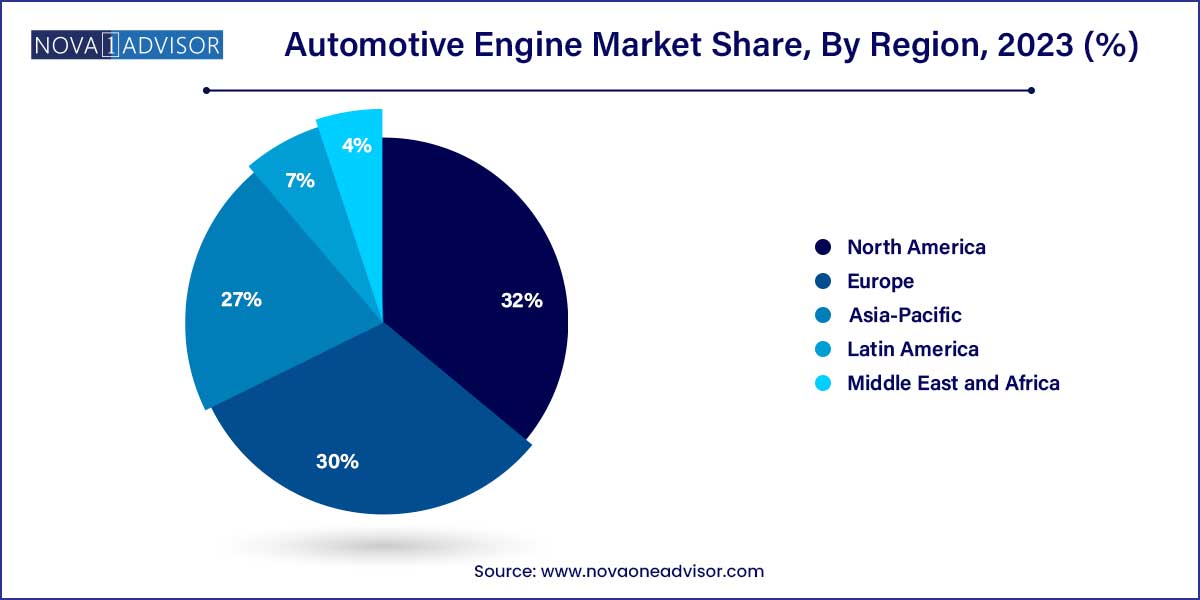

- North America accounted for a revenue share of more than 32% in 2023.

- The in-line segment held the highest market share of 45.04% in 2023.

- Gasoline held the highest market share of over 35% in 2023, attributed to the benefits offered by gasoline engines, such as less noise and vibration, as well as low fuel prices.

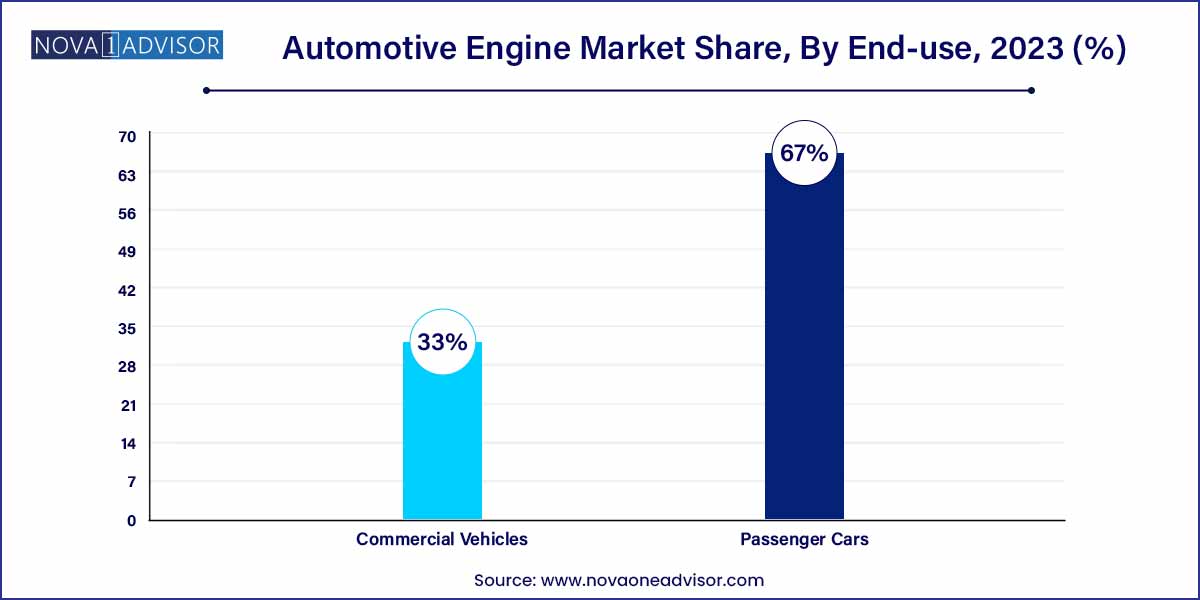

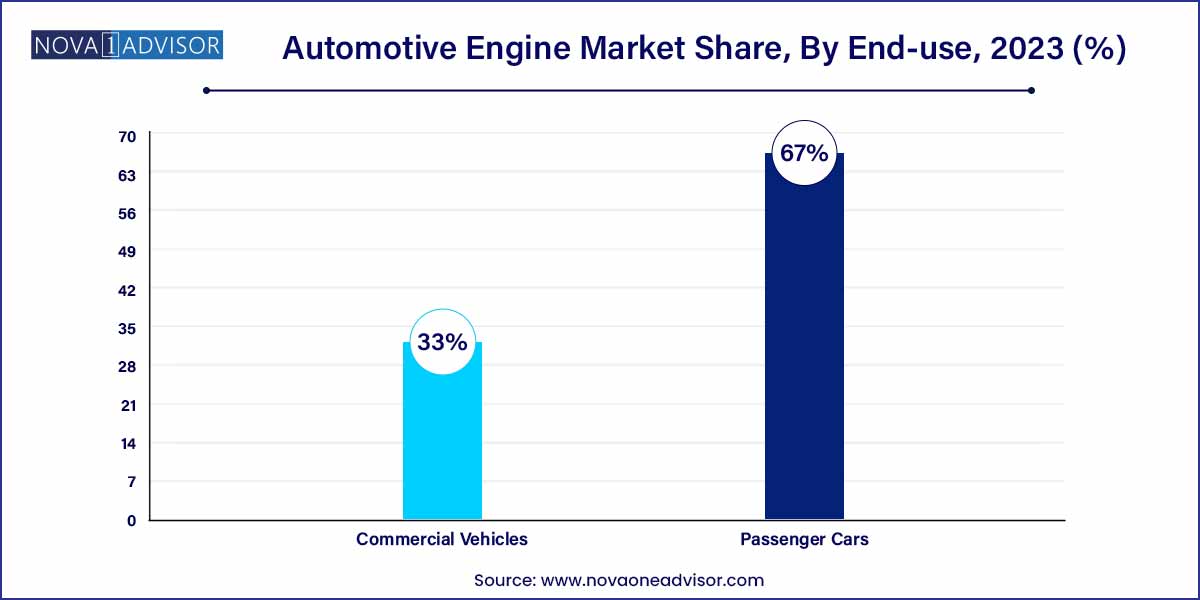

- Passenger cars held the highest market share of more than 67% in 2023.

Automotive Engine Market by Overview

The global automotive engine market is a dynamic and rapidly evolving industry that plays a pivotal role in the automotive sector. Automotive engines serve as the heart of vehicles, powering them with the necessary force to drive efficiently and effectively. This overview aims to provide a comprehensive understanding of the current state of the automotive engine market, highlighting key trends, challenges, and opportunities that shape its landscape.

Automotive Engine Market Growth

The growth of the automotive engine market is propelled by several key factors. Firstly, the continual rise in global vehicle production, fueled by increasing consumer demand and technological advancements, serves as a primary driver for the market. As automotive manufacturers strive to meet growing transportation needs, the demand for efficient and high-performance engines remains robust. Secondly, stringent emission regulations worldwide have spurred innovation in the sector, leading to the development of fuel-efficient and environmentally friendly engines. Adherence to these regulations has become a pivotal factor for market players, driving advancements in engine technology. Together, these factors contribute to a dynamic landscape in the automotive engine market, fostering growth, innovation, and sustainability within the industry.

Automotive Engine Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 95.00 Billion |

| Market Size by 2033 |

USD 124.00 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 2.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Placement Type, Fuel Type, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AB Volvo; Cummins Inc.; Fiat Automobiles S.p.A; Volkswagen AG; Ford Motor Company; Mitsubishi Heavy Industries, Ltd.; General Motors; Honda Motor Co., Ltd.; Mercedes-Benz; Renault Group. |

Automotive Engine Market Dynamics

The automotive engine industry is driven by a number of growth drivers, the most important of which is the continued expansion in worldwide vehicle production. Fueled by rising consumer demand and technical developments, this surge in production highlights the critical role engines play in servicing the world's growing transportation needs. Additionally, stringent emission regulations have emerged as a critical driver, necessitating the development of fuel-efficient and eco-friendly engines. Manufacturers are compelled to invest in research and innovation to ensure compliance, driving the overall growth of the automotive engine market.

Amidst the dynamic landscape of the automotive engine market, challenges arise prominently from the ongoing trends in vehicle electrification. The growing emphasis on electric vehicles poses a considerable challenge to traditional internal combustion engines, urging manufacturers to adapt and invest in alternative technologies. Additionally, supply chain disruptions, influenced by factors such as geopolitical events and the ongoing semiconductor shortage, present a significant hurdle.

Automotive Engine Market Restraint

One of the primary restraints in the automotive engine market stems from the accelerating shift towards vehicle electrification. The increasing popularity of electric vehicles (EVs) poses a significant challenge to traditional internal combustion engines. As governments and consumers prioritize sustainability, automotive manufacturers face the need to adapt their strategies, invest in electric propulsion technologies, and navigate the complexities associated with the transition.

- Supply chain disruptions:

The automotive engine market faces a notable restraint due to supply chain disruptions. Factors such as geopolitical events and the ongoing semiconductor shortage contribute to fluctuations in the supply chain, impacting the production and availability of automotive engines. Manufacturers grapple with uncertainties in sourcing essential components, leading to production delays and increased costs. To mitigate these challenges, industry stakeholders must implement robust supply chain management strategies, fostering resilience and adaptability to ensure a steady flow of components essential for engine production.

Automotive Engine Market Opportunity

- Alternative Fuels and Sustainable Technologies:

A notable opportunity in the automotive engine market lies in the exploration and development of alternative fuels and sustainable technologies. As the industry undergoes a paradigm shift towards environmental consciousness, there is a growing demand for engines that operate on cleaner fuels such as hydrogen, biofuels, and synthetic fuels. Manufacturers have the chance to capitalize on this trend by investing in research and development to create engines that not only meet emission standards but also contribute to a more sustainable and eco-friendly transportation ecosystem.

- Advanced Connectivity and Autonomous Driving:

The integration of advanced connectivity features and the rise of autonomous driving present a compelling opportunity for the automotive engine market. Modern engines are becoming integral components of intelligent, connected vehicles. As vehicles become more sophisticated and reliant on data-driven technologies, there is an increasing need for engines that can seamlessly integrate with advanced systems.

Automotive Engine Market Challenges

- Vehicle Electrification Challenges:

A prominent challenge facing the automotive engine market is the accelerating trend toward vehicle electrification. The increasing demand for electric vehicles (EVs) poses a significant hurdle for traditional internal combustion engines. Manufacturers must navigate the complexities associated with developing and integrating electric propulsion technologies. This transition requires substantial investments in research and development, retooling of production facilities, and addressing concerns related to charging infrastructure.

- Supply chain disruptions:

The automotive engine market is confronted with challenges arising from supply chain disruptions. Factors such as geopolitical events, natural disasters, and the ongoing semiconductor shortage contribute to significant fluctuations in the supply chain. These disruptions impact the timely sourcing of critical components, leading to production delays, increased costs, and potential supply shortages.

Segments Insights:

By Placement Type Insights

In-line engines dominated the placement segment due to their simplified architecture, lower manufacturing costs, and efficient space utilization. Commonly used in passenger cars and light-duty vehicles, in-line engines offer easier maintenance and better fuel economy. Their balanced performance-to-efficiency ratio makes them the engine of choice for compact and mid-sized cars. For instance, Toyota's 2.5-liter inline-4 engines are renowned for their reliability and performance in the Camry and RAV4 models. Automakers favor in-line configurations when aiming for reduced mechanical complexity and manufacturing overhead.

W engines are the fastest-growing in the placement segment, although they remain niche. Primarily used in high-performance and luxury vehicles, such as the Bugatti Chiron’s quad-turbocharged W16 engine, W configurations offer compact packaging for high cylinder counts. As performance brands like Bentley and Bugatti push engineering limits, innovations in W engine designs continue to emerge. Though the unit volume is low, the technological advancement and premium pricing contribute to robust segmental value growth.

Fuel Type Insights

Gasoline engines lead the fuel-type segment, primarily due to their widespread use in passenger vehicles and urban driving scenarios. These engines are typically more affordable and lighter than their diesel counterparts, producing less NOx and particulate matter. Leading automakers like Honda and Hyundai continue to offer gasoline variants in most models to cater to mainstream consumers. Gasoline engines are also easier to maintain, providing smoother performance, making them ideal for city usage and personal vehicles.

Other fuels, including hybrid and alternative biofuels, are the fastest-growing category. Flex-fuel engines that operate on ethanol blends and dual-fuel systems (CNG/LPG) are gaining traction in regions with fuel diversification policies. Furthermore, hybrid engines combining gasoline and electric powertrains are being increasingly adopted as transitional technologies. Countries such as Brazil, where ethanol is widely available, see a higher penetration of alternative fuel engines. Similarly, CNG engines are popular in India due to lower operating costs and cleaner combustion.

Vehicle Type Insights

Passenger cars dominate the market by vehicle type, driven by the rising global demand for personal mobility. Urbanization, income growth, and lifestyle changes have significantly contributed to passenger vehicle sales, particularly in densely populated countries such as China and India. These cars predominantly feature gasoline and hybrid engines, with OEMs enhancing engine efficiency to cater to environmentally conscious buyers. Additionally, sports and luxury car segments offer performance-oriented engines, elevating the technological scope within this category.

Commercial vehicles represent the fastest-growing segment, largely propelled by increasing demand in the logistics, construction, and public transportation sectors. The expansion of e-commerce and trade infrastructure has led to a surge in demand for light and heavy-duty trucks, vans, and buses. Diesel engines are preferred in this category for their torque efficiency, durability, and fuel economy. With governments investing in fleet modernization and cleaner engines for commercial use, innovations in commercial-grade ICEs continue to gain traction.

Regional Insights

Asia-Pacific is the largest regional market for automotive engines, accounting for a substantial share of global production and consumption. Countries such as China, India, Japan, and South Korea host leading automobile manufacturers and a vast supplier base. China alone manufactures over 20 million vehicles annually, serving as a global hub for automotive components, including engines. India’s robust growth in personal mobility and preference for fuel-efficient vehicles supports market expansion. Moreover, favorable government policies such as the “Make in India” initiative and rising investment in manufacturing facilities bolster regional demand for engines. Major OEMs, including Suzuki, Toyota, Hyundai, and Honda, have established production bases in this region.

The MEA region is emerging as a high-potential automotive engine market due to rising urbanization, infrastructure development, and growing automobile demand in countries like Saudi Arabia, UAE, Egypt, and South Africa. The demand for SUVs, pickup trucks, and commercial vehicles has been increasing, driven by the need for durable transportation over long distances and rough terrains. Governments are also investing in the diversification of fuel sources, promoting the development of natural gas-powered engines and hybrid variants. With local assembly plants expanding and used car imports still dominant, ICE engines continue to be the mainstay in this region.

Some of the prominent players in the automotive engine market include:

- AB Volvo

- Cummins Inc.

- Fiat Automobiles S.p.A

- Volkswagen AG

- Ford Motor Company

- Mitsubishi Heavy Industries, Ltd.

- General Motors

- Honda Motor Co., Ltd.

- Mercedes-Benz

- Renault Group

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive engine market.

Placement Type

- In-line Engine

- V-type Engine

- W Engine

Fuel Type

- Gasoline

- Diesel

- Other Fuel

Vehicle Type

- Passengers Car

- Commercial Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)