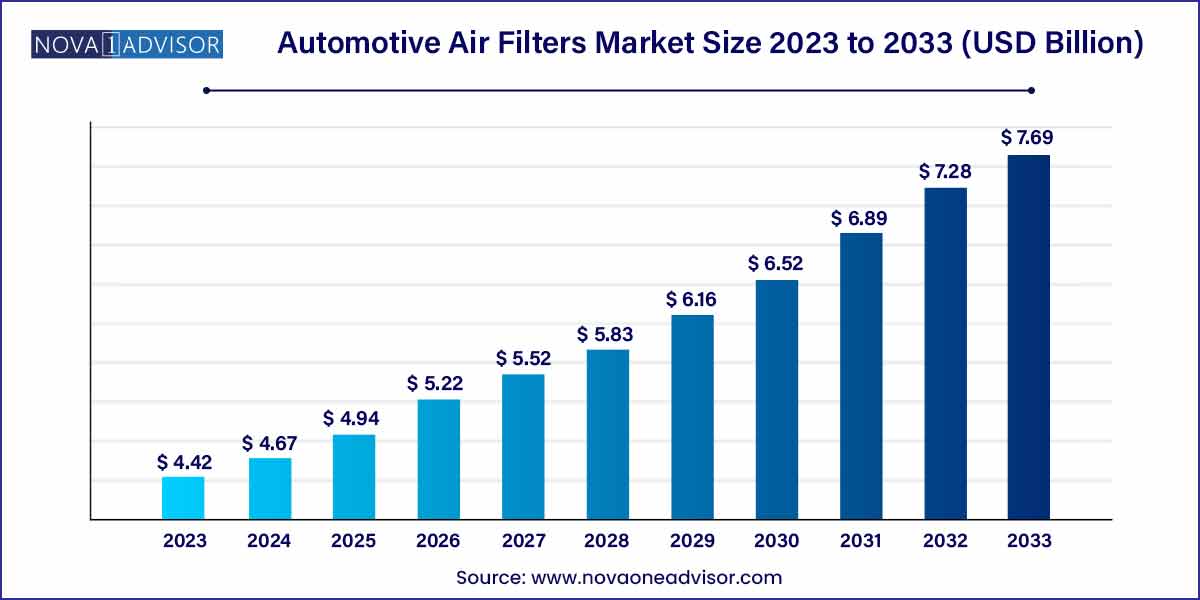

The global automotive air filters market size was exhibited at USD 4.42 billion in 2023 and is projected to hit around USD 7.69 billion by 2033, growing at a CAGR of 5.7% during the forecast period of 2024 to 2033.

Key Takeaways:

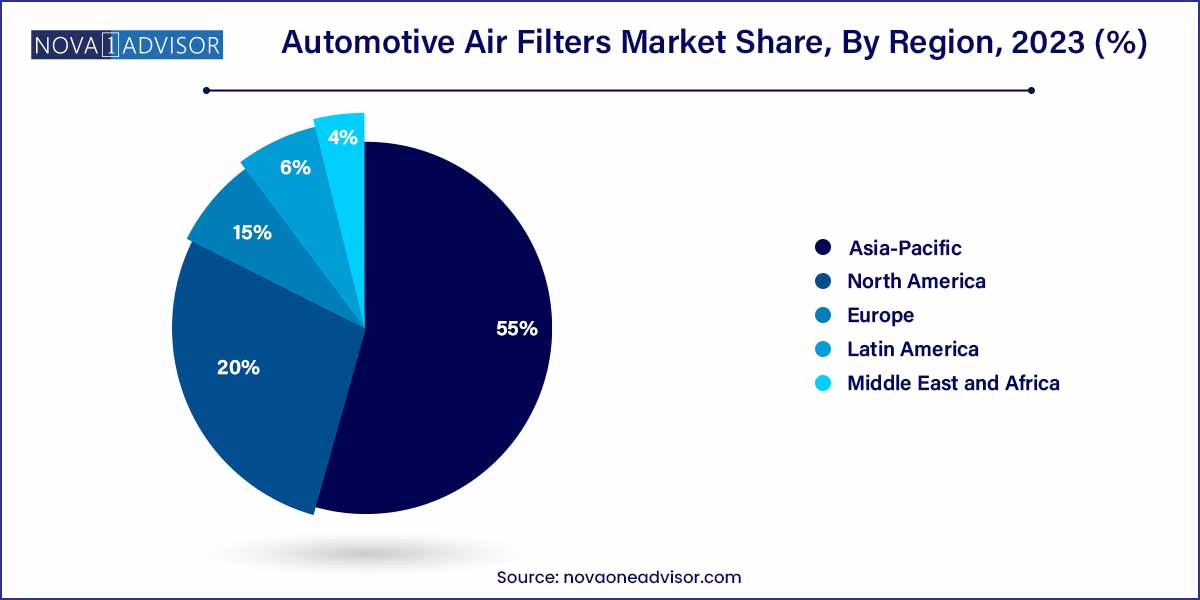

- Asia Pacific dominated the market and accounted for a 55.0% share of global revenue in 2023 owing to high automotive production witnessed by the region.

- The passenger cars segment led the market and accounted for more than 53.4% share of the global revenue in 2023.

- The OEM segment led the market and accounted for USD 1,022.5 million of the global revenue in 2023.

Automotive Air Filters Market by Overview

The automotive air filters market has evolved as a crucial component of the global automotive ecosystem, supporting both vehicle performance and passenger health. Air filters in vehicles serve the primary purpose of preventing dust, dirt, and other airborne particles from entering the engine and cabin spaces, ensuring efficient engine operation and maintaining clean interior air quality. In modern vehicles, where environmental regulations are becoming increasingly stringent and consumer demand for comfort is rising, automotive air filters play an indispensable role.

The growing adoption of automobiles worldwide, coupled with escalating concerns regarding vehicular emissions, has led to a heightened focus on the quality and effectiveness of air filtration systems. Moreover, with increasing urbanization and worsening air quality in many parts of the world, the need for efficient cabin air filters has soared. Regulatory mandates such as Euro 6 and China's National VI standards push manufacturers towards equipping vehicles with high-efficiency air filtration systems. Simultaneously, advancements in filtration technologies, including HEPA (High-Efficiency Particulate Air) and activated carbon filters, are revolutionizing the market landscape.

Market dynamics are also shaped by consumer preferences for electric vehicles (EVs), wherein maintaining internal air quality becomes even more critical due to minimal external ventilation needs. The aftermarket for air filters continues to thrive as vehicle owners become increasingly conscious of maintenance for optimal performance and health reasons.

Automotive Air Filters Market Growth

The growth of the automotive air filters market is fueled by various factors. Stringent emission regulations mandated by governments worldwide are compelling vehicle manufacturers to adopt advanced air filtration technologies to reduce pollutants emitted by automobiles. Additionally, the increasing number of vehicles on roads globally is driving the demand for replacement air filters, thereby bolstering market growth. Technological advancements, such as the development of high-efficiency particulate air (HEPA) filters and active carbon filters, are further enhancing filtration efficiency and expanding the market. Moreover, growing awareness about air pollution and its adverse health effects is prompting consumers to prioritize vehicles equipped with efficient air filtration systems, thus contributing to market expansion.

Automotive Air Filters Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.42 Billion |

| Market Size by 2033 |

USD 7.69 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Mann+Hummel GmbH; Clarcor, Inc.; K&N Engineering, Inc.; Donaldson Company, Inc; Cummins Inc.; Parker Hannifin Corporation; SOGEFI Group; Hengst SE; Mahle GmbH; Robert Bosch GmbH; Ahlstrom Corporation; Freudenberg & Co.KG; ACDelco Inc.; Denso Corporation; Hollingsworth & Vose Co. Inc.; Lydall Inc.; Neenah Paper Inc.; Toyota Boshoku Corporation; Valeo SA; Roki Co.; Ltd. |

Automotive Air Filters Market Dynamics

The dynamics of the automotive air filters market are shaped by two primary factors. Firstly, stringent regulatory standards imposed by governments globally are driving the adoption of advanced air filtration technologies in vehicles. These regulations aim to reduce harmful emissions, compelling automotive manufacturers to integrate more efficient air filter systems into their vehicles to comply with environmental mandates. Secondly, the increasing vehicle parc worldwide is fueling the demand for replacement air filters. As the number of vehicles on the roads continues to rise, the need for regular maintenance and replacement of air filters becomes more pronounced, contributing significantly to market growth.

Automotive Air Filters Market Restraint

Two notable restraints impacting the automotive air filters market include technological complexity and market saturation. Firstly, the complexity of emerging air filtration technologies poses a challenge for both manufacturers and consumers. Advanced filtration systems, such as electrostatic filters and HEPA filters, require specialized manufacturing processes and expertise, leading to higher production costs and potential implementation challenges for automotive manufacturers. Additionally, consumer education and awareness regarding the benefits of these advanced technologies may lag behind, hindering widespread adoption.

Secondly, market saturation presents a significant restraint to the automotive air filters market. As the market becomes increasingly competitive, with numerous manufacturers vying for market share, the saturation of product offerings can lead to pricing pressures and reduced profit margins. Moreover, the presence of established players with strong brand recognition and customer loyalty further intensifies competition for newer entrants. Addressing these restraints requires strategic planning and innovation to overcome technological barriers and differentiate products in a crowded market landscape.

Automotive Air Filters Market Opportunity

Two prominent opportunities within the automotive air filters market include the rise of electric vehicles (EVs) and the growing emphasis on air quality.

Firstly, the increasing adoption of electric vehicles presents a significant opportunity for the automotive air filters market. As the EV market continues to expand, there is a growing need for specialized air filtration systems tailored to electric drivetrains. These systems play a crucial role in maintaining battery health and enhancing the overall performance of electric vehicles. As a result, manufacturers of automotive air filters can capitalize on this trend by developing innovative filtration solutions specifically designed for electric vehicles, thus tapping into a rapidly growing market segment.

Automotive Air Filters Market Challenges

Two significant challenges facing the automotive air filters market include increasing competition and material sustainability concerns.

Firstly, escalating competition within the automotive air filters market poses a significant challenge for manufacturers. With numerous players vying for market share, both domestically and internationally, competition intensifies, leading to pricing pressures and reduced profit margins. Established manufacturers with strong brand recognition and extensive distribution networks further compound the challenge for newer entrants. To thrive in this competitive landscape, manufacturers must differentiate their products through innovation, quality, and value-added services while effectively managing costs and maintaining customer satisfaction.

Secondly, material sustainability concerns present a pressing challenge for the automotive air filters market. Traditional filter materials, such as cellulose and synthetic fibers, raise environmental sustainability issues due to their non-biodegradable nature and reliance on fossil fuels in production. As consumers and regulators increasingly prioritize sustainability, there is growing demand for eco-friendly alternatives that minimize environmental impact throughout the product lifecycle. Manufacturers face the challenge of developing sustainable filter materials without compromising filtration efficiency, durability, or cost-effectiveness.

Segments Insights:

Product Insights

Intake Air Filters dominated the product segment. Intake air filters are critical for engine performance, preventing dust, pollen, and other particulates from entering the engine and ensuring optimal combustion. Clean intake air translates to better fuel efficiency, reduced emissions, and prolonged engine life. Automakers continue to prioritize high-performance intake filters, integrating multi-stage filtration mechanisms to comply with tightening environmental regulations. Furthermore, rising vehicle production globally bolsters the demand for reliable and efficient intake air filtration systems.

Cabin Air Filters are the fastest-growing product segment. Growing health consciousness among consumers and the alarming deterioration of ambient air quality in urban regions have fueled the rapid adoption of cabin air filters. These filters not only remove particulates but also neutralize odors and allergens, providing a healthier in-cabin environment. The COVID-19 pandemic further amplified this trend, as automakers introduced cabin filters capable of trapping viruses and bacteria. Luxury brands are setting the trend by offering advanced cabin filtration as a standard feature, influencing mass-market players to follow suit.

Application Insights

Passenger Cars dominated the application segment. With the highest production volumes and consumer focus on comfort, passenger cars account for the largest share in the automotive air filters market. Features like multi-layered cabin filters, HEPA filters, and activated carbon layers are becoming standard even in mid-range vehicles. Increased car ownership in emerging markets and demand for personalized, health-conscious vehicle interiors are key drivers for this dominance.

Two Wheelers are the fastest-growing application segment. The expanding two-wheeler market in countries like India, China, and several Southeast Asian nations is creating significant demand for air filters tailored for motorcycles and scooters. Two-wheeler air filters ensure optimal engine performance and are increasingly being designed to be more durable and dust-resistant, particularly for off-road and urban commuting applications. As two-wheelers become a primary mode of transportation in densely populated regions, the segment’s growth trajectory continues to steepen.

End-use Insights

Aftermarket dominated the end-use segment. With vehicle lifespans extending beyond a decade, replacement cycles for air filters create sustained aftermarket demand. Consumers are becoming increasingly aware of the benefits of timely air filter replacements for maintaining vehicle performance and health standards. Aftermarket suppliers offer a wide range of products, including enhanced versions like HEPA filters, catering to DIY car enthusiasts and service centers.

Original Equipment Manufacturers (OEMs) are the fastest-growing end-use segment. OEMs are increasingly integrating advanced filtration systems during vehicle manufacturing to differentiate their offerings and meet regulatory standards. Manufacturers are partnering with filtration specialists to develop custom solutions that enhance overall vehicle value. As demand for factory-fitted premium air filters grows, the OEM segment's contribution to market revenue is expanding swiftly.

Regional Insights

Asia-Pacific dominated the automotive air filters market. The region’s dominance is attributed to massive vehicle production volumes, rapid urbanization, and growing awareness about air quality. China, India, and Japan are leading markets within the region, where increased environmental regulations and the rise of middle-class consumers support demand for better in-vehicle air quality. Automakers in Asia-Pacific are rapidly integrating high-efficiency filtration systems, both for engines and cabin spaces, to meet both consumer expectations and government mandates.

Latin America is the fastest-growing region. Countries like Brazil and Mexico are experiencing a resurgence in automotive manufacturing and sales post-pandemic. Improved economic stability, coupled with rising consumer awareness regarding health and vehicle maintenance, is fueling the adoption of advanced air filters. Additionally, government efforts to curb vehicular emissions through stricter regulations are creating favorable conditions for market expansion in the region.

Some of the prominent players in the automotive air filters market include:

- Mann+Hummel GmbH

- Clarcor, Inc.

- K&N Engineering, Inc.

- Donaldson Company, Inc

- Cummins Inc.

- Parker Hannifin Corporation

- SOGEFI Group

- Hengst SE

- Mahle GmbH

- Robert Bosch GmbH

- Ahlstrom Corporation

- Freudenberg & Co.KG

- ACDelco Inc.

- Denso Corporation

- Hollingsworth & Vose Co. Inc.

- Lydall Inc.

- Neenah Paper Inc.

- Toyota Boshoku Corporation

- Valeo SA

- Roki Co., Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive air filters market.

Product

- Intake Air Filters

- Cabin Air Filters

Application

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

End-use

- Original Equipment Manufacturers (OEMs)

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)