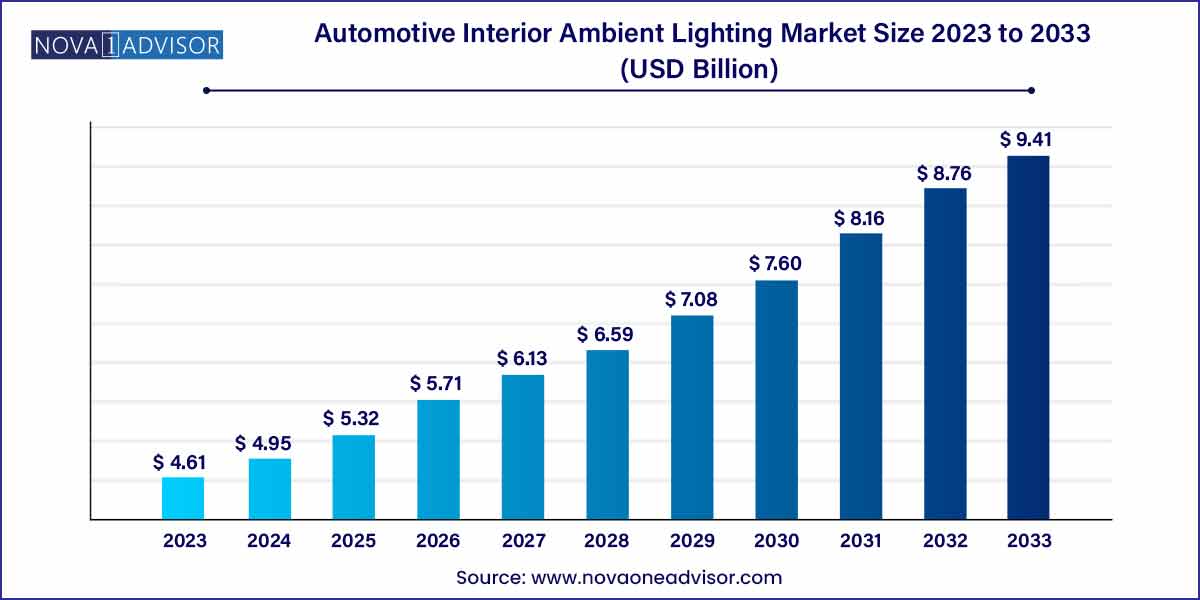

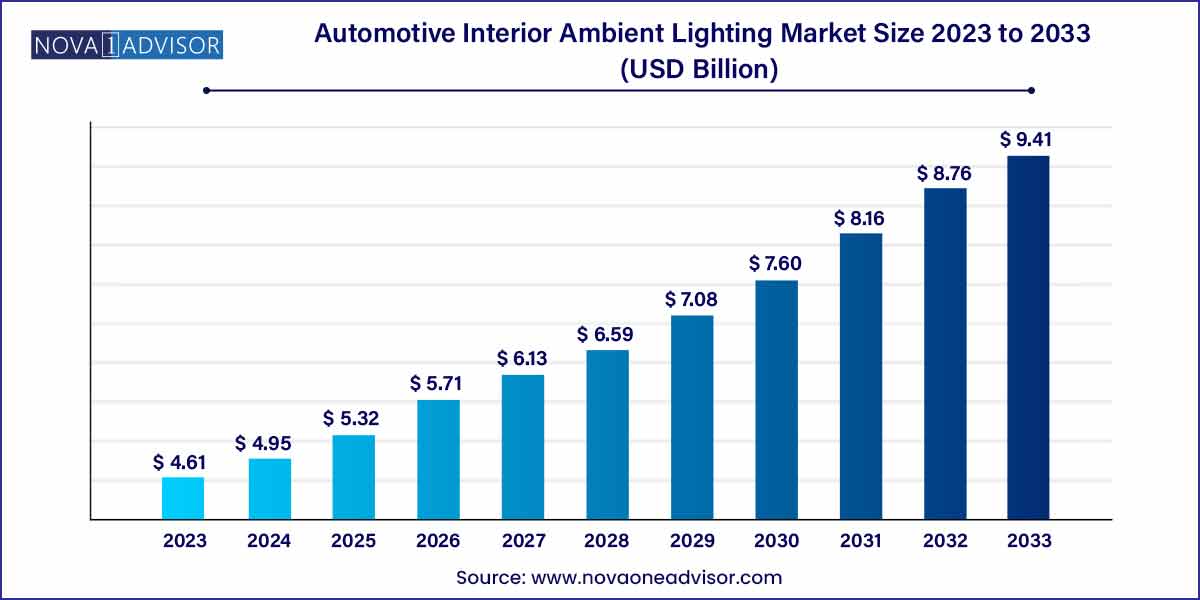

The global automotive interior ambient lighting market was estimated at USD 4.61 billion in 2023, is expected to surpass around USD 9.41 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 7.4% during the forecast period of 2024 to 2033.

Key Takeaways:

- The footwell application type segment in the automotive ambient lighting market is expected to expand at a CAGR of 6.8% over the forecast period.

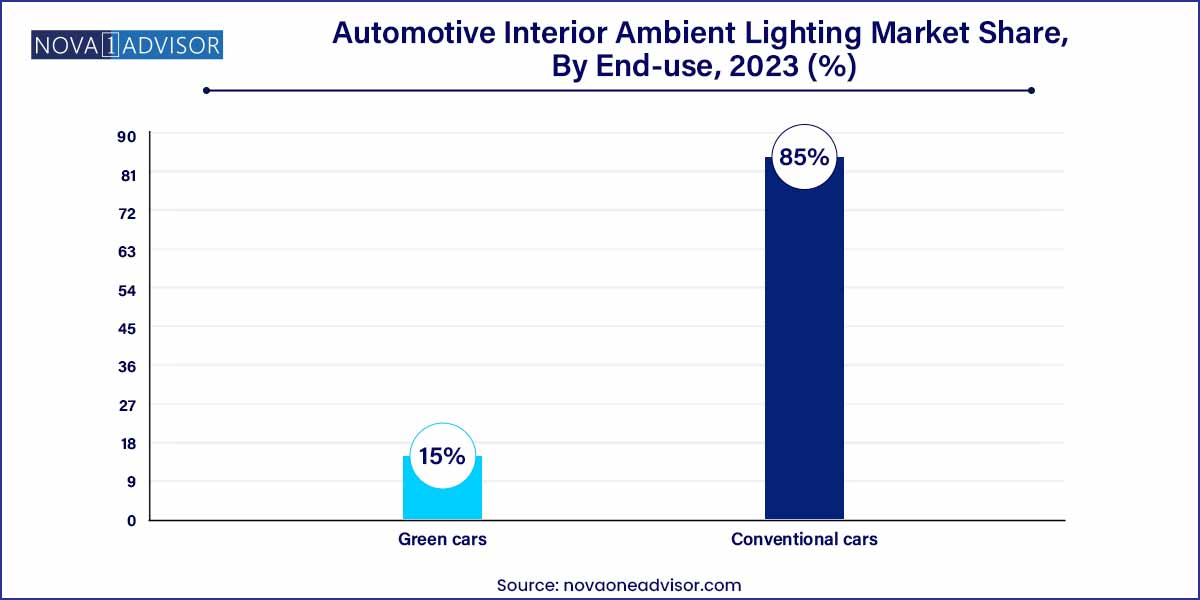

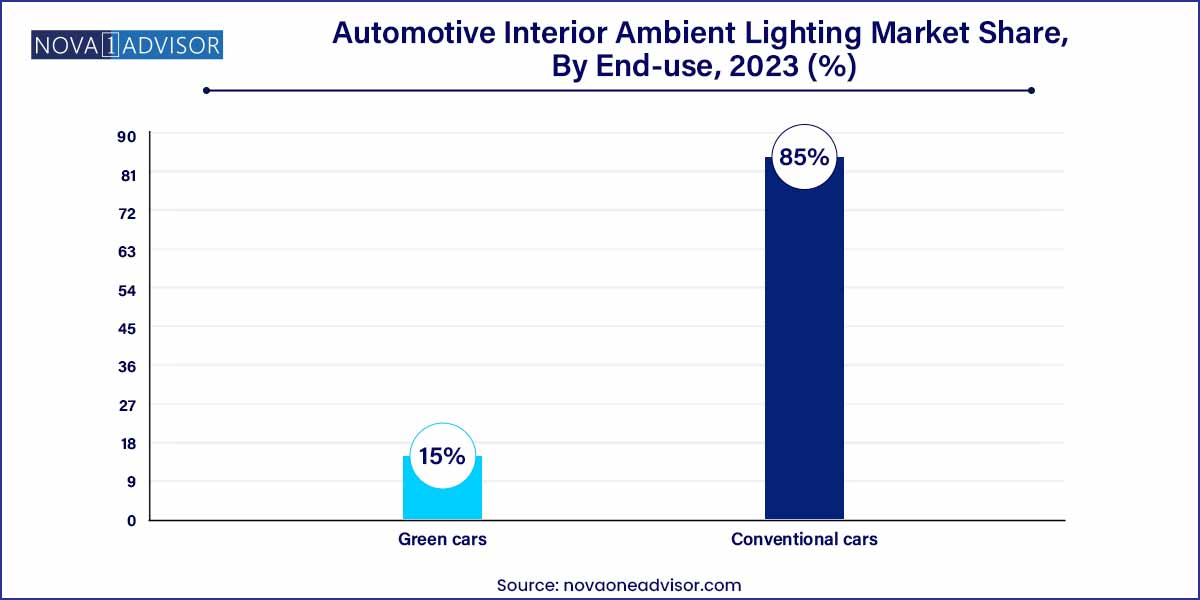

- The conventional car segment is expected to expand at a CAGR of nearly 7.0% over the forecast period and account for the majority of revenue share in 2023.

Automotive Interior Ambient Lighting Market by Overview

The automotive industry is witnessing a paradigm shift with an increasing focus on enhancing the overall driving experience. One pivotal element contributing to this transformation is the automotive interior ambient lighting market. This market overview delves into the key facets, trends, and drivers that shape the landscape of ambient lighting within vehicle interiors.

Automotive Interior Ambient Lighting Market Growth

In the realm of the automotive interior ambient lighting market, robust growth is propelled by several key factors. Primarily, the heightened emphasis on elevating the driving experience has transformed ambient lighting from a mere aesthetic feature to a pivotal element contributing to occupant comfort and luxury. The infusion of advanced LED technologies and smart lighting systems further fuels this growth, providing customizable color options and dynamic lighting scenarios that align with evolving consumer preferences. Moreover, the integration of ambient lighting with safety features enhances visibility and fosters a safer driving environment. The trend towards customization, where consumers seek personalized lighting options, is also a significant growth factor.

Automotive Interior Ambient Lighting Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.61 Billion |

| Market Size by 2033 |

USD 9.41 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Vehicle Type, And Region. |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

OSRAM GmbH; Hella KGaA Hueck & Co.; SCHOTT AG; DRÄXLMAIER Group; Grupo Antolin; Texas Instruments Incorporated; and Philips Lighting. |

Automotive Interior Ambient Lighting Market Dynamics

- Technological Advancements Driving Innovation:

The dynamics of the automotive interior ambient lighting market are significantly influenced by the continuous march of technological advancements. The integration of cutting-edge LED technologies has paved the way for sophisticated ambient lighting systems within vehicle interiors. Manufacturers are actively exploring smart lighting solutions that go beyond aesthetics, incorporating functionalities such as customizable color options, dynamic lighting scenarios, and synchronization with vehicle controls.

- Consumer-Centric Trends and Personalization:

The automotive interior ambient lighting market is experiencing a paradigm shift driven by consumer-centric trends, with a growing emphasis on personalization. Modern consumers seek more than just functional vehicles; they desire a driving environment that reflects their individual tastes and preferences. In response, manufacturers are offering a spectrum of customization options, allowing users to tailor ambient lighting to suit their moods and styles. From a diverse range of color choices to dynamic lighting scenarios, the market is witnessing a surge in demand for personalized lighting experiences.

Automotive Interior Ambient Lighting Market Restraint

- Cost Constraints and Affordability Challenges:

One of the prominent restraints impacting the automotive interior ambient lighting market is the challenge posed by cost constraints. The integration of advanced LED technologies, smart lighting systems, and customizable features often results in higher production costs. This creates a dilemma for manufacturers, particularly those catering to price-sensitive market segments. Balancing the incorporation of innovative lighting solutions with the need for affordability becomes a critical challenge.

- Regulatory Compliance and Safety Standards:

The automotive interior ambient lighting market faces restraints related to stringent regulatory compliance and safety standards. As ambient lighting systems become more intricate and integrated with vehicle functionalities, ensuring compliance with industry regulations becomes a complex task. Meeting safety standards while incorporating advanced lighting technologies requires meticulous engineering and testing processes. Navigating these regulatory landscapes can pose challenges for manufacturers, potentially leading to delays in product development and market entry.

Automotive Interior Ambient Lighting Market Opportunity

- Rising Demand for Connected Vehicles:

A significant opportunity within the Automotive Interior Ambient Lighting market stems from the growing demand for connected vehicles. As automotive interiors become increasingly digitized and interconnected, ambient lighting is positioned to play a pivotal role in enhancing the overall in-car experience. The integration of ambient lighting with smart technologies, such as voice control, gesture recognition, and connectivity features, presents a lucrative opportunity for market players.

- Eco-Friendly and Sustainable Solutions:

The emphasis on sustainability in the automotive industry opens up a significant opportunity for the Ambient Lighting market. With consumers becoming more environmentally conscious, there is a growing demand for eco-friendly and energy-efficient solutions. Manufacturers have the opportunity to innovate and offer ambient lighting systems that utilize sustainable materials, energy-efficient LED technologies, and adhere to eco-friendly practices. By aligning with the global shift towards greener technologies, the market can cater to a discerning consumer base while contributing to the broader goal of sustainable mobility.

Automotive Interior Ambient Lighting Market Challenges

- Integration Complexity and Technological Hurdles:

A primary challenge facing the Automotive Interior Ambient Lighting market is the complexity associated with the integration of advanced technologies. As manufacturers strive to incorporate cutting-edge LED systems, customizable features, and smart functionalities, the technical intricacies escalate. The seamless integration of these technologies requires sophisticated engineering and coordination with other in-car systems. Overcoming these technological hurdles while maintaining reliability and ensuring a smooth user experience presents a formidable challenge.

- Global Regulatory Compliance and Standardization:

The global nature of the automotive industry brings forth the challenge of navigating diverse regulatory landscapes and standardization requirements. As ambient lighting evolves and becomes more integrated with vehicle functionalities, adhering to stringent safety and regulatory standards becomes paramount. Manufacturers must grapple with varying standards across different regions, necessitating a meticulous approach to compliance. Achieving a balance between innovation and regulatory adherence, especially when standards continue to evolve, poses a persistent challenge.

Segments Insights:

The application of automotive ambient lighting is found majorly in luxury cars, as it positively influences the internal ambiance of the vehicle, space perception, and comfort of the customers. With changing lifestyles and income levels, the demand for advanced technologies based on luxury cars has increased, leading to market growth. The rise in adoption of LED lighting in the C&D segment cars owing to the huge shift in preferences towards customization with distinct features, has driven the demand for automotive interior ambient lighting.

Additionally, the growing awareness and trend to use energy-efficient lighting systems have also led to greater market prominence. This also facilitated the adoption of green cars by individuals in the economy, which is a key driver for boosting the industry growth. It also provides benefits in terms of reduced traffic accident rates, and safety for the driver and passengers, especially at night. This is another vital factor which is expected to fuel the growth of the market during the forecast period.

The adoption of advanced technologies in the automobile sector within developing regions such as India, China, and Japan provides growth opportunities for the market. The increased investments by the customers and R&D innovation is creating ample opportunities for this segment to grow during the forecast period.

The growth of automotive interior ambient lighting is impacted by certain factors which include the cost of the LED lights embedded in the cars, and the use of advanced technologies. In addition, the high cost of integration of the interior lighting system is also anticipated to cause hindrance to the market growth during the forecast period.

Higher occupancy for the space, and increased consumption of power or energy create a challenge for the manufacturers in the market. Also, increased prices of the raw materials and lack of availability of essential components or parts are other significant challenges reported by manufacturing firms in this industry.

Application Insights

Dashboard lighting dominated the application segment, being an integral part of virtually every vehicle sold. It serves both functional and aesthetic purposes—illuminating controls, dials, and instrument clusters while contributing to the overall visual theme. Dashboard lighting is also the first point of contact for users when interacting with the vehicle’s infotainment and climate control systems. Automakers use lighting to differentiate drive modes, highlight warning alerts, and improve night-time ergonomics. Brands like Audi and Lexus have made dashboard lighting a key part of their HMI strategy, offering ambient strips that extend from dash to door in a continuous flow.

Footwell lighting is the fastest-growing application, especially in premium and mid-tier segments. It adds to the sense of spaciousness and comfort, particularly during night-time driving. New models like the Kia Seltos, BMW iX, and Genesis GV80 feature interactive footwell lighting that changes with door operations, climate settings, or driving behavior. Footwell lights are also seen as safety enablers, helping occupants locate pedals, floor mats, or belongings in dark conditions. As lighting zones proliferate within vehicle cabins, the demand for footwell illumination is expected to witness robust CAGR over the forecast period.

Vehicle Type Insights

Conventional cars currently dominate the market, as they account for the majority of vehicles on the road and encompass a wide range of sedans, hatchbacks, and SUVs. OEMs are adding ambient lighting to enhance the appeal of ICE-powered vehicles, especially as EVs introduce minimalist but high-tech interiors. In this segment, ambient lighting is often used to emulate premium experiences, even in compact models. For example, the Volkswagen Polo and Honda City both offer customizable ambient lighting packages that elevate their interior look and feel.

Green cars are the fastest-growing vehicle segment, including hybrid, plug-in hybrid (PHEV), and fully electric vehicles (EVs). With fewer moving parts, futuristic cabins, and a tech-savvy target audience, green cars provide an ideal platform for ambient lighting. Tesla, for example, integrates ambient lighting subtly into its Model S Plaid edition, while the BMW i4 uses ambient cues linked to battery performance and eco-driving scores. As EV adoption scales globally, especially in China, Europe, and the U.S., the ambient lighting market in this segment is set to boom, supported by integrated digital cockpits and immersive cabin design trends.

Regional Insights

Europe has emerged as the largest regional market, driven by the strong presence of luxury and premium automakers such as BMW, Mercedes-Benz, Audi, and Porsche. These brands have pioneered ambient lighting as a standard feature in high-end vehicles and are now pushing boundaries with dynamic lighting linked to biometric recognition, voice assistants, and vehicle modes. For instance, the 2024 Mercedes-Benz E-Class features ambient lights that pulse to music, change based on air conditioning temperature, and signal warnings via color changes setting global benchmarks.

European consumers also associate ambient lighting with safety and luxury, creating a high baseline expectation even in compact cars. Regulatory frameworks encouraging smart interiors, strong aftermarket channels, and a culture of premium car ownership further reinforce Europe’s leadership position.

Asia-Pacific, particularly China, India, Japan, and South Korea, is witnessing the fastest growth in ambient lighting adoption. Rising vehicle ownership, a booming middle class, and growing aspirations for premium features are fueling demand in this region. Chinese automakers such as NIO, BYD, and XPeng are equipping their EVs with highly customizable ambient lighting zones, sometimes extending to the roofline or rear cabin. In India, car models like the Hyundai Creta, Tata Harrier, and MG Hector now include ambient lighting even in mid-trims, signaling a shift in consumer expectations.

Moreover, regional startups and tier-1 suppliers are entering the ambient lighting market with cost-optimized solutions, further accelerating adoption. The trend of 'smart cabins' in Japanese kei cars and Korean electric SUVs is also driving investment in innovative lighting ecosystems across Asia-Pacific.

Recent Developments

-

February 2025 – Valeo unveiled its next-generation ambient lighting module designed for electric vehicles, featuring ultra-thin LED strips with adaptive light temperature settings.

-

December 2024 – Osram Continental expanded its partnership with BMW to supply dynamic ambient lighting for upcoming models in the i-Series, including integrated RGB mapping for wellness features.

-

October 2024 – HELLA launched a customizable rear-seat ambient lighting suite with AI-assisted mood recognition, targeting premium electric sedans and robo-taxis.

-

September 2024 – DRÄXLMAIER Group announced a strategic alliance with interior design startup Canatu to integrate flexible OLED lighting panels into dashboard and door trims.

-

July 2024 – Hyundai Mobis introduced a smart ambient lighting system that synchronizes with the driver’s heart rate and external weather data, enhancing occupant comfort and safety.

Some of the prominent players in the automotive interior ambient lighting market include:

- OSRAM GmBH

- Hella KGaA Hueck & Co.

- SCHOTT AG,

- DRÄXLMAIER Group

- Philips Lighting

- Grupo Antolin

- Texas Instruments Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive interior ambient lighting market.

Application

- Dashboard

- Footwell

- Doors

- Others

Vehicle Type

- Conventional cars

- Green cars

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)