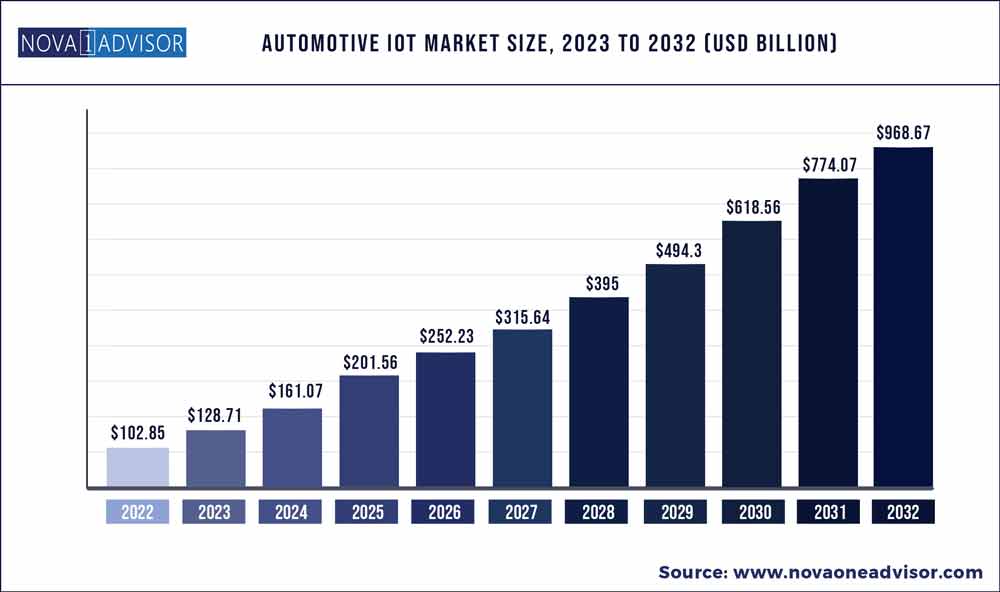

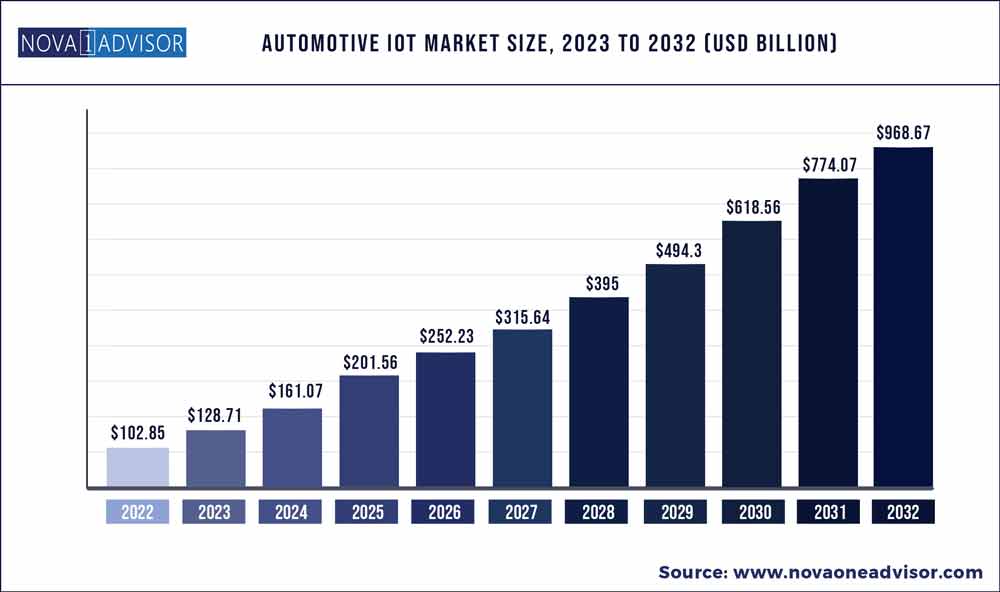

The global automotive IoT market size was exhibited at USD 102.85 billion in 2022 and is projected to hit around USD 968.67 billion by 2032, growing at a CAGR of 25.14% during the forecast period 2023 to 2032.

Key Pointers:

- Automotive IoT market in Asia Pacific estimated to grow at the fastest rate during the forecast period

- On the basis of the type of communication, the vehicle-to-vehicle segment is expected to dominate the market in the coming years period.

- On the basis of the offerings, the software segment is expected to dominate the market in the coming years period.

- Depending upon the application, the navigation segment has dominated largest market share in 2022.

Automotive IoT Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 128.71 Billion

|

|

Market Size by 2032

|

USD 968.67 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 25.14%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Communication, Offering, Connectivity Form, Application, End User

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Texas Instruments (US), Intel (US), NXP Semiconductors (Netherlands), TOMTOM (Netherlands), Robert Bosch (Germany), Google (US), Apple (US), General Motors (US), Audi (Germany), Ford Motor (US), IBM (US), Cisco (US), Microsoft (US), Thales SA (France), AT&T (US), Vodafone (UK)

|

Automotive IoT Market Dynamics

Drivers: Rising adoption of electric and hybrid vehicles to reduce CO2 emissions

Motor vehicles not running on fossil fuels, such as electric vehicles, hybrid electric vehicles, and solar-powered vehicles, are the primary choice for alternate technologies of powering engines that do not involve petroleum. The increasing use of electric and hybrid vehicles will help consumers reduce fuel costs, minimize air pollution due to the reduction in greenhouse gases (GHGs), improve air quality in urban areas, and reduce dependence on fossil fuels.

Environmental problems and the need to conserve energy are powerful factors that have advanced the development of HEVs and EVs. Along with an engine, hybrid vehicles are equipped with a motor and a high-voltage, high-power battery to drive that motor. Hybrid vehicles fulfil the need for high power require The stringency of emission norms across the world has resulted in technological advancements in the automotive sector to reduce the harmful exhaust emissions from vehicles. The advent of EVs is one of the most important steps in the automotive industry for environmental protection. These vehicles do not use any conventional fuel, thereby not producing any harmful gases. All these factors have accelerated the demand for electric cars, especially in developed regions such as North America and Europe. As these vehicles completely rely on an electrical power supply, the use of electronic devices is much more in these vehicles. Power electronics is a key technology for hybrids and represents 20% of the total cost of a vehicle, giving a significant amount of scope for semiconductor technology. These new technologies are in the introduction phase and are poised to impact the automotive semiconductor market in the coming years. The rising adoption of HEVs and EVs drives the requirement for automotive semiconductors. Governments of several countries, such as Germany, the US, Denmark, China, France, Sweden, the UK, and India, offer several incentives to promote the use of electric and hybrid cars within the country. Hence, advanced technologies and new vehicle features have increased the scope for electrification. As a result, original equipment manufacturers (OEMs) are installing a greater number of ICs, microprocessors, and sensors in high-end electric vehicles.ments and environmental benefits whenever necessary.

Restraint: Lack of infrastructure for proper functioning of connected vehicles

High-speed connectivity, telematics devices, and sensor-equipped fleets are vital for the smooth functioning of connected cars. Applications such as real-time monitoring and geo-fencing gather data using telematics devices, sensors, and software. On highways, information such as lane change, object detection, the distance between vehicles, and traffic statuses, and services such as navigation and connectivity are very important for connected cars. However, vehicles are not connected to each other and the cloud due to limited network connectivity on highways. In developing countries such as Mexico, Brazil, and India, IT infrastructure development on highways is slower than in developed economies. 3G and 4G-LTE communication networks required for connectivity are offered only in urban and semi-urban areas. While several third-party logistics companies operate in semi-urban and rural areas, there are low connectivity issues. Therefore, the lack of IT and communication infrastructure in developing regions can hamper the growth of the connected car market in these countries.

Opportunity: Integration of predictive maintenance platform with vehicles

Predictive maintenance (PdM) is one of the key growth areas for the automotive IoT market. It helps in lowering the operating and capital costs by facilitating proactive servicing and repair of assets while allowing more efficient use of maintenance personnel and replacement components. PdM enables companies to accurately diagnose and prevent failures in real-time, which is vital in critical infrastructure applications.

When technological advancementstechnologies such as the Over the Air (OTA) update are integrated with vehicles, car owners do not have to perform routine car maintenance activities at a service station. They need to visit the service centrescenters only for crucial or emergency servicing activities. Predictive maintenance is highly successful in assuring these comforts to vehicle owners.

Typically, technicians are sent to carry out routine diagnostic inspections and preventive maintenance according to fixed schedules, which can be a costly and labor-intensive process with little assurance that the failure would not occur between inspections. PdM is a more sophisticated technology for remotely monitoring the vehicle’s condition and identifying potential failures.

Challenge: Threats associated with cybersecurity

Despite major developments in connected vehicles technology, cybersecurity remains a major challenge to be tackled. IoT-enabled automobiles comprise hardware, software, mobile apps, and Bluetooth, and each of them is vulnerable to cyberattacks. There are various instances where cybersecurity has created a nuisance. In 2022, luxury brands Volkswagen and Audi were hit by a data breach that exposed the contact details and, in a few cases, personal information such as the driver’s license numbers in the US and Canada.

According to a white paper published by Accenture, data breaches have increased by 68%, with the US being the number one target of cyberattacks. Various stakeholders are working on cybersecurity systems to make connected cars safer by integrating cybersecurity and threat detection systems with data analytics and AI. In collaboration with a leading car manufacturer, Viasat developed the first-ever advanced, in-car connectivity system with military-grade security features.

There is an inherent risk due to the number of companies involved in handling data and the stakeholders present in the IoT value chain, along with observing the flow of data from end to end. From enterprises’ perspective, managing the security of data transferred from various devices at multiple locations is going to be a more complex task. To handle these flows, enterprises must adopt distributed data center management methods. The current model of centralized applications for reducing costs would not be applicable to IoT. Data management companies are expected to aggregate the data in multiple data centers for primary processing and then forward it to a central data center for further processing. In data center networking, the existing network links are not prepared to handle the data generated by IoT devices.

Automotive IoT market in Asia Pacific estimated to grow at the fastest rate during the forecast period

The automotive IoT market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. China, Japan, South Korea, and India are the major contributors to the market in the Asia Pacific region. China is the largest automobile market, making it attractive for automotive IoT. The market growth in Asia Pacific can be attributed to the changing government norms regarding the adoption of ADAS and connected services systems. Factors such as the high adoption rate of IoT in automotives due to their smart features, such as fleet management, better monitoring of fuel consumption and travel time, among others, coupled with the rising production of IoT-enabled automotive in the Asia Pacific region, have been instrumental in market growth. Moreover, government initiatives for collecting traffic data for proper monitoring of vehicles have also been beneficial for the adoption of automotive IoT technology in the Asia Pacific region.

Recent Developments

In January 2023 , VinFast and NXP Semiconductors announced their collaboration on VinFast’s next generation of automotive applications. The collaboration supports VinFast’s goal of developing smarter, cleaner, connected electric vehicles. Under the collaboration, VinFast seeks to leverage NXP’s processors, semiconductors, and sensors. VinFast and NXP will engage in the early development phases of new VinFast automotive projects, leveraging NXP’s rich portfolio of system solutions for innovative applications.

In January 2023, HARMAN unveiled HARMAN Ready on Demand, a software platform for delivering branded audio value, feature enhancement, upgrades, and monetization opportunities in an easy to-use app. An industry-first product, Ready on Demand is the foundation for providing expanded experiences and future upgrades that can be unlocked by the consumer at any time via in-app purchases throughout the life of the vehicle.

In November 2022, TomTom International, announced it will power PTV Truck Navigator G2, the next generation of PTV Group’s professional truck navigation app. In a move that expands the firms’ partnership, PTV Group will be using TomTom’s recently launched Navigation SDK (Mobile Software Development Kit) to power up-to-date maps, custom truck routing, and more in their app, now available globally for the first time

Some of the prominent players in the Automotive IoT Market include:

- Texas Instruments (US)

- Intel (US)

- NXP Semiconductors (Netherlands)

- TOMTOM (Netherlands)

- Robert Bosch (Germany)

- Google (US)

- Apple (US)

- General Motors (US)

- Audi (Germany)

- Ford Motor (US)

- IBM (US)

- Cisco (US)

- Microsoft (US)

- Thales SA (France)

- AT&T (US)

- Vodafone (UK)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Automotive IoT market.

By Communication

- Vehicle to Vehicle

- In vehicle communication

- Vehicle to infrastructure

By Offering

- Hardware

- Software

- Services

By Connectivity Form

- Embedded

- Tethered

- Integrated

By Application

- Navigation

- Infotainment

- Telematics

By End User

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)