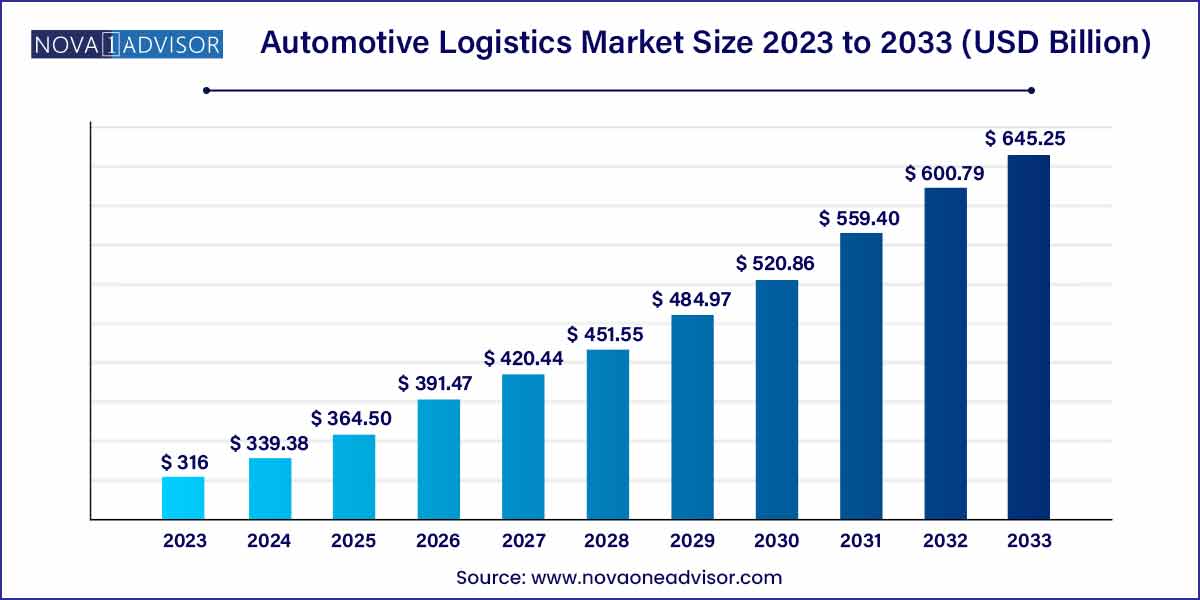

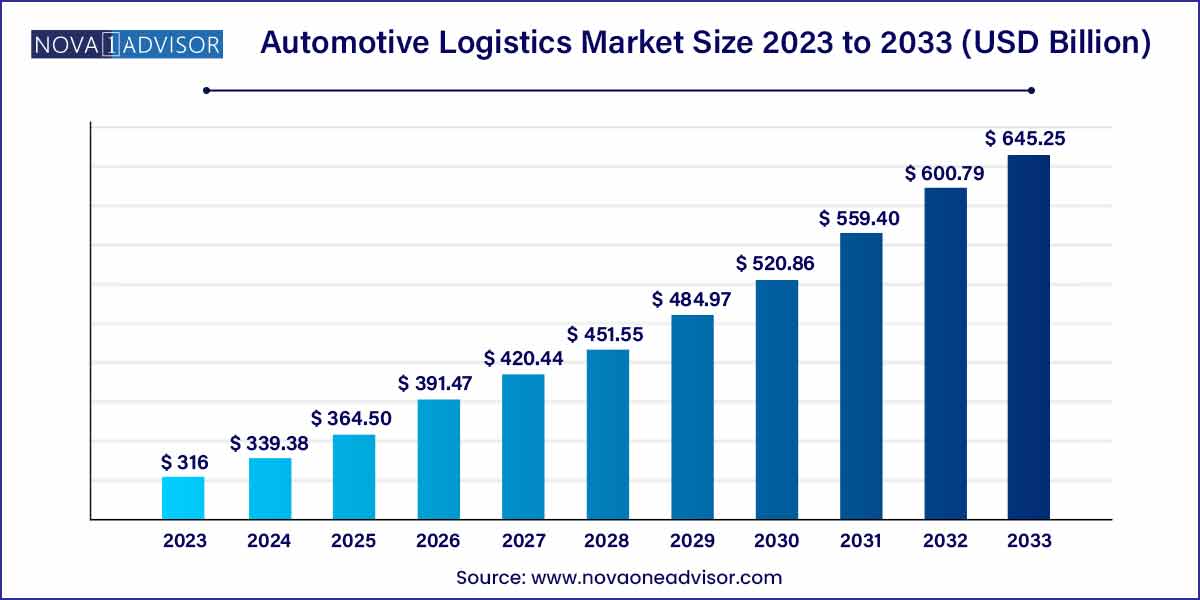

The global automotive logistics market size was exhibited at USD 316.00 billion in 2023 and is projected to hit around USD 645.25 billion by 2033, growing at a CAGR of 7.4% during the forecast period 2024 to 2033.

Key Takeaways:

- Asia Pacific contributed more than 32.0% of revenue share in 2023.

- By Type, the automobile parts segment has held the largest market share of 75% in 2023.

- By Type, the finished vehicles segment is anticipated to grow at a remarkable CAGR between 2023 and 2033.

- By Activity, the transportation segment generated over 83% of revenue share in 2023.

- By Activity, the warehousing segment is expected to expand at the fastest CAGR over the projected period.

Automotive Logistics Market: Overview

The automotive logistics market plays a crucial role in facilitating the complex movement of parts, components, and finished vehicles across manufacturing plants, suppliers, distributors, and customers worldwide. As the global automotive sector evolves with the rise of electric vehicles (EVs), connected car technologies, and globalized supply chains, the importance of efficient, flexible, and resilient logistics solutions has never been greater. Automotive logistics not only ensures timely delivery but also supports production schedules, cost-efficiency, and customer satisfaction.

Rapid industrialization, global automotive trade, increasing vehicle production, and the expanding aftermarket sector have significantly amplified the demand for specialized logistics services. OEMs (Original Equipment Manufacturers) are increasingly outsourcing logistics operations to third-party logistics (3PL) providers to focus on their core competencies. Additionally, the growing emphasis on reducing carbon footprints and adopting sustainable practices is influencing the way automotive logistics is conducted globally.

Growth Factors

Increasing outsourcing of automotive components, emergence of logistics services, and technological advancement are some of the prime factors that drive the market growth. Requirement of an effective and customized logistic service have established a differentiating factor among various logistic service providers and plays a crucial role in maintaining competition in the market. Logistics service providers are also incorporating disruptive technologies such as Big Data, Internet of Things (IoT), and connected ship to enhance their supply chain management system. These technologies aid in reducing the labor cost and also eliminate the delay in shipments. The aforementioned factor propels the demand of automotive logistics significantly over the coming years. Further, increasing sale of automobiles across the globe along with a significant rise in the demand for automotive spare parts positively influence the market growth. Advancement in the distribution channel and rising trend for Do it yourself (DIY) has again prominently boosted the demand for automotive aftermarket, thereby triggers the market growth of automotive logistics.

Automotive Logistics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 316.00 Billion |

| Market Size by 2033 |

USD 645.25 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Logistics Solution, Distribution, Activity, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

CEVA Logistics, BLG LOGISTICS GROUP AG & Co. KG, Hellmann Worldwide Logistics, Ryder System, Inc., GEFCO, CFR Rinkens, Penske Automotive Group, Inc., Imperial Logistics, Expeditors International of Washington, Inc., Nippon Express Co. Ltd. |

Automotive Logistics Market Dynamics

- Technological Advancements Driving Efficiency:

In the automotive logistics landscape, technological advancements play a pivotal role in enhancing efficiency and streamlining operations. One significant trend is the adoption of advanced analytics and predictive modeling for demand forecasting. By leveraging big data analytics and machine learning algorithms, logistics providers can accurately predict demand patterns, optimize inventory management, and allocate resources more effectively. This proactive approach not only minimizes inventory holding costs but also ensures timely delivery of automotive components and vehicles, thus improving overall supply chain efficiency.

- Sustainability Initiatives Reshaping the Industry Landscape:

In recent years, there has been a growing emphasis on sustainability within the automotive logistics sector, driven by environmental concerns and regulatory pressure. As a result, logistics providers are increasingly adopting eco-friendly practices and investing in alternative fuels and energy-efficient transportation modes. One notable trend is the shift towards electric vehicle (EV) logistics, with an increasing number of companies incorporating electric trucks and vans into their fleets.

Automotive Logistics Market Restraint

- Regulatory Complexity and Trade Barriers:

One significant restraint in the automotive logistics market is the complex regulatory environment and the presence of trade barriers across global markets. As automotive manufacturers and logistics providers operate across borders, they must navigate a myriad of regulations, tariffs, and customs procedures, which can vary significantly from one country to another. These regulatory complexities not only increase administrative burdens but also add layers of uncertainty and risk to supply chain operations.

- Capacity Constraints and Infrastructure Challenges:

Another key restraint in the automotive logistics market is the presence of capacity constraints and infrastructure challenges, particularly in rapidly growing markets and regions with underdeveloped transportation networks. As global demand for automotive products continues to rise, logistics providers are faced with the challenge of meeting growing transportation needs while navigating limitations in infrastructure capacity.

Automotive Logistics Market Opportunity

- Expansion into Emerging Markets:

One significant opportunity in the automotive logistics market lies in the expansion into emerging markets, where rapid urbanization, rising disposable incomes, and increasing demand for vehicles present lucrative growth prospects. Emerging economies in regions such as Asia-Pacific, Latin America, and Africa are experiencing a surge in automotive sales, driven by growing middle-class populations and infrastructure development initiatives.

- Embrace of E-commerce and Omnichannel Distribution:

Another significant opportunity in the automotive logistics market is the embrace of e-commerce and omnichannel distribution channels, driven by changing consumer preferences and digital transformation trends. With the proliferation of online retail platforms and the rise of digital purchasing behaviors, automotive companies are increasingly adopting e-commerce strategies to reach a wider customer base and enhance the shopping experience.

Automotive Logistics Market Challenges

- Balancing Cost-efficiency with Quality and Safety Standards:

One of the primary challenges in the automotive logistics market is the constant need to balance cost-efficiency with stringent quality and safety standards. While cost optimization is essential for maintaining competitiveness and profitability, it must not come at the expense of compromising product quality or jeopardizing the safety of automotive goods during transportation and storage.

- Navigating Regulatory Complexities and Trade Barriers:

Another significant challenge in the automotive logistics market is navigating the complex regulatory environment and overcoming trade barriers across global markets. As automotive manufacturers and logistics providers operate across borders, they must contend with a myriad of regulations, tariffs, customs procedures, and trade agreements, which can vary significantly from one country to another.

Segments Insights:

Type Insights

Automobile parts logistics dominated the market in 2024, primarily because of the sheer volume and frequency of component shipments required across manufacturing and aftermarket networks. Components ranging from small electronic chips to large engine parts are constantly moving across global supply chains to support JIT production models. As global vehicle production rebounds post-pandemic, ensuring uninterrupted parts supply chains has become paramount for OEMs and Tier 1 suppliers.

Meanwhile, finished vehicle logistics is the fastest-growing segment, fueled by increasing global trade of both new and used vehicles. Growing consumer demand for imported models and rising EV exports from regions like China to Europe and North America are propelling the need for specialized finished vehicle carriers. Innovations such as autonomous vehicle transporters and digital booking platforms are further enhancing the finished vehicle logistics segment.

Activity Insights

Transportation dominated the automotive logistics market, driven by the need to move parts and vehicles quickly across vast distances. Roadways, accounting for the largest share within transportation, remain critical due to their flexibility and extensive network reach. Companies like Ceva Logistics and DB Schenker are enhancing their road transport fleets with specialized carriers and connected vehicles to support this.

However, warehousing is the fastest-growing activity segment. The need for strategically located distribution hubs to manage inventory efficiently, enable faster deliveries, and support e-commerce channels has boosted demand for modern automotive warehouses. Smart warehousing with automation, robotics, and real-time inventory management is becoming a key differentiator among leading logistics providers.

Regional Insights

Europe dominated the automotive logistics market in 2024, fueled by its strong automotive manufacturing ecosystem comprising global leaders like Volkswagen, BMW, and Daimler. Countries like Germany, France, and Spain have extensive, sophisticated supply chain networks that support both parts and finished vehicle logistics. European logistics providers are investing heavily in digitalization, electrified fleets, and green logistics initiatives to comply with stringent EU environmental regulations.

Asia-Pacific is the fastest-growing region. Rapid urbanization, rising vehicle ownership rates, and government initiatives like India's "Make in India" and China's "Belt and Road Initiative" are propelling market growth. Additionally, the region's leadership in EV production and battery manufacturing demands specialized logistics solutions, creating lucrative opportunities for regional and global logistics companies.

Some of the prominent players in the Automotive logistics market include:

- CEVA Logistics

- BLG LOGISTICS GROUP AG & Co. KG

- Hellmann Worldwide Logistics

- Ryder System, Inc.

- GEFCO

- CFR Rinkens

- Penske Automotive Group, Inc.

- Imperial Logistics

- Expeditors International of Washington, Inc.

- Nippon Express Co. Ltd.

- Kerry Logistics Network

- Schnellecke group ag& co. Kg

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive logistics market.

By Type

- Automobile Parts

- Finished Vehicle

By Activity

-

- Airways

- Roadways

- Railways

- Maritime

By Logistics Solution

- Outbound

- Inbound

- Reverse Distribution (International and Domestic)

By Distribution

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)