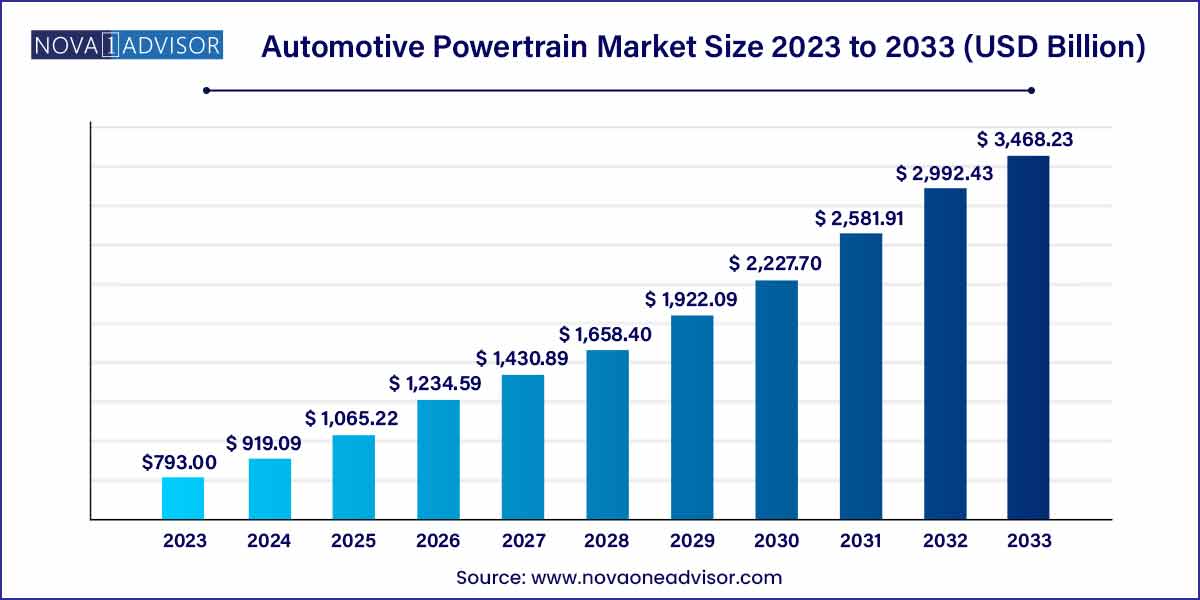

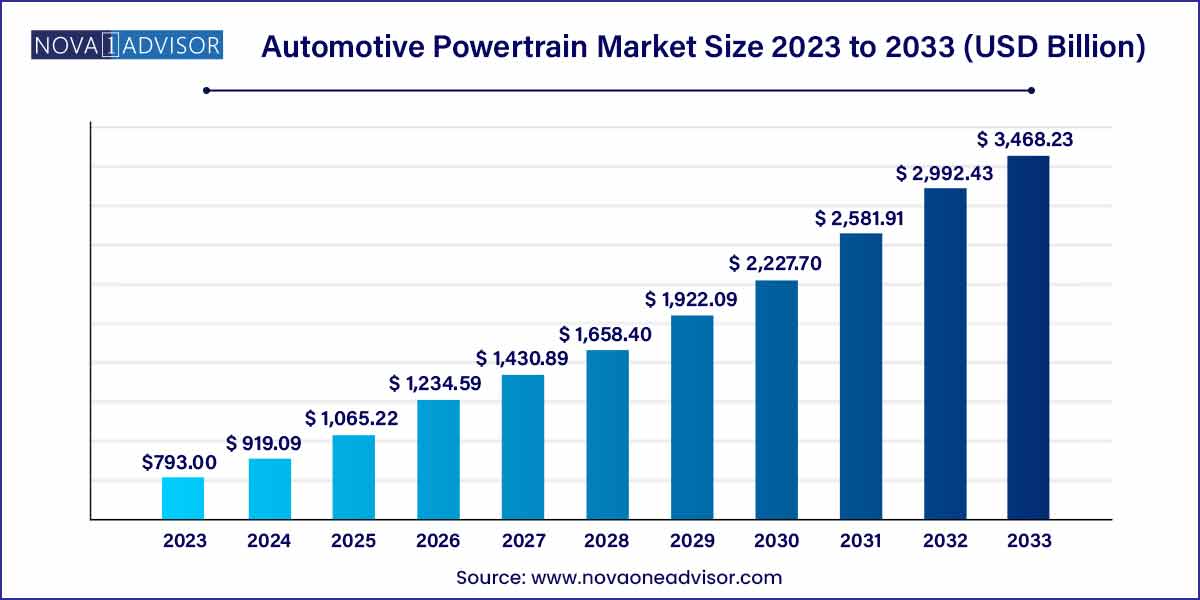

The global automotive powertrain market size was exhibited at USD 793.00 billion in 2023 and is projected to hit around USD 3,468.23 billion by 2033, growing at a CAGR of 15.9% during the forecast period of 2024 to 2033.

Key Takeaways:

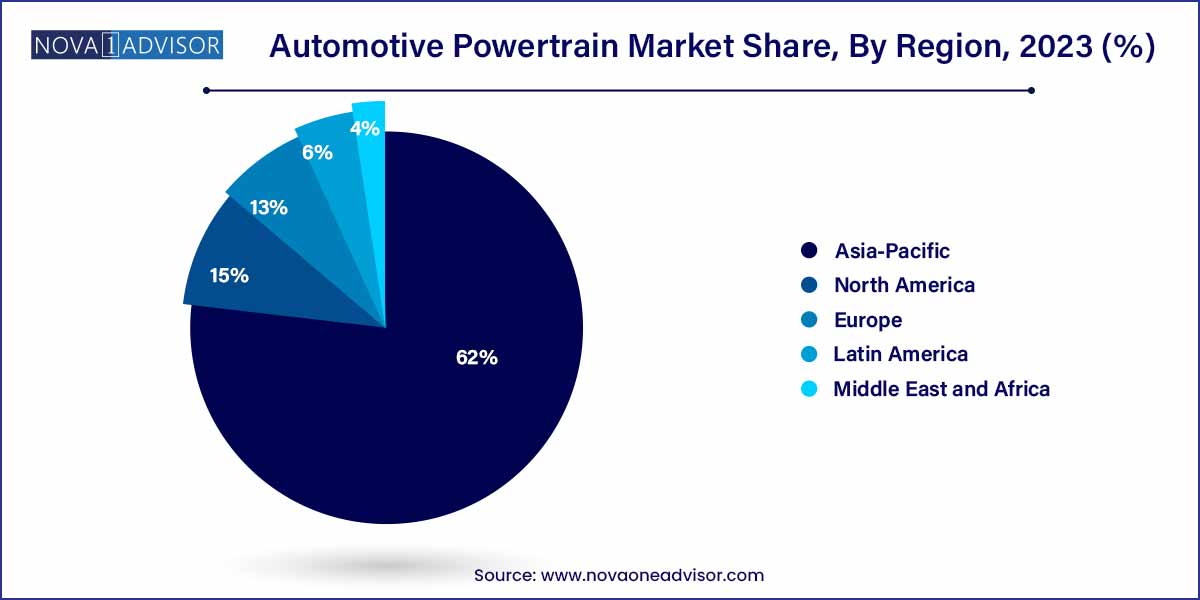

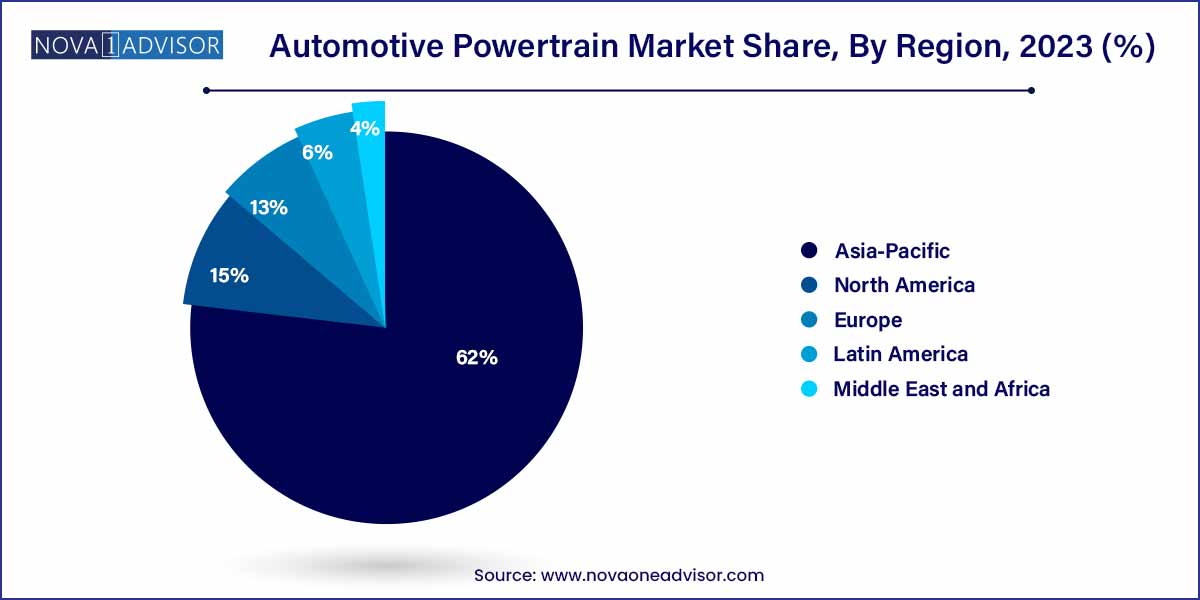

- Asia Pacific accounted for the largest market share of 62.0% in 2023.

- The Internal Combustion Engine (ICE) segment accounted for the largest share of 88.0% in 2023.

- The passenger vehicle segment dominated the market with a revenue share of 75.9% in 2023.

Automotive Powertrain Market: Overview

The Automotive Powertrain Market forms the core of the global automotive industry, comprising the components that generate power and deliver it to the road. Powertrains, including internal combustion engines (ICEs), transmissions, drive shafts, differentials, and final drives, are undergoing a significant evolution. Driven by a global push toward electrification, stricter emissions standards, and changing consumer preferences, the market is moving from traditional ICE vehicles toward electric powertrains, such as battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

The growing emphasis on sustainability, the rapid adoption of electric vehicles (EVs), and continuous technological advancements are reshaping the powertrain landscape. Innovations such as lightweight designs, hybridization, multi-speed electric drives, and next-generation battery systems are becoming key differentiators for OEMs and suppliers. The powertrain segment has emerged not just as a functional necessity but as a strategic area for achieving performance, efficiency, and regulatory compliance.

Leading players like Toyota, Volkswagen Group, and Tesla are investing massively in R&D to optimize powertrain efficiency while maintaining driving dynamics. Furthermore, collaborations between traditional automakers and tech firms are opening new opportunities for innovation, particularly in electric and autonomous vehicle powertrain architectures.

Automotive Powertrain Market Growth

The growth of the automotive powertrain market is propelled by several key factors. Firstly, the increasing adoption of electric powertrains, spurred by advancements in battery technology and supportive government policies promoting sustainability, is driving market expansion. Additionally, the demand for fuel-efficient vehicles is fueling innovation in powertrain design, with manufacturers focusing on lightweight materials and advanced technologies to enhance efficiency. Moreover, the integration of connectivity and artificial intelligence into powertrain systems is enabling optimized performance and diagnostics, further driving market growth. Lastly, the global push towards stricter emissions regulations is incentivizing automotive stakeholders to invest in cleaner and more sustainable powertrain solutions, driving innovation and market expansion in the process.

Automotive Powertrain Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 793.00 Billion |

| Market Size by 2033 |

USD 3,468.23 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Propulsion Type, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BorgWarner Inc.; Continental AG; Magna International Inc.; Marelli Holdings Co., Ltd.; Mitsubishi Electric Corporation; NIDEC CORPORATION; Robert Bosch GmbH; Schaeffler AG; ZF Friedrichshafen AG; VALEO. |

Automotive Powertrain Market Dynamics

- Electrification Dynamics:

The automotive powertrain market is undergoing a profound shift towards electrification, driven by various dynamics. Advancements in battery technology, coupled with declining costs and increasing energy density, are making electric powertrains increasingly viable alternatives to traditional internal combustion engines. Moreover, stringent emissions regulations and government incentives promoting electric vehicle adoption are accelerating the electrification trend. As a result, automakers are investing heavily in the development of electric powertrain technologies, including battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs).

- Integration of Advanced Technologies Dynamics:

The integration of advanced technologies into automotive powertrains is driving significant dynamics within the market. Artificial intelligence (AI), connectivity, and predictive analytics are being increasingly leveraged to optimize powertrain performance, enhance efficiency, and enable predictive maintenance. AI-powered algorithms are used to optimize engine operation, transmission shifting, and energy management in hybrid and electric vehicles, leading to improved fuel economy and driving dynamics. Additionally, connectivity enables real-time data exchange between vehicles and infrastructure, facilitating dynamic optimization of powertrain parameters based on driving conditions and environmental factors. Furthermore, predictive analytics algorithms analyze vast amounts of data generated by powertrain sensors to predict potential failures and optimize maintenance schedules, reducing downtime and enhancing reliability.

Automotive Powertrain Market Restraint

One of the significant restraints facing the automotive powertrain market is cost constraints associated with the adoption of advanced technologies, particularly in the realm of electrification. Electric powertrains, despite their environmental benefits and long-term cost savings on fuel, initially require substantial investment due to the high cost of components such as batteries and electric motors. This upfront cost can deter price-sensitive consumers from purchasing electric vehicles and hinder market penetration, particularly in emerging economies where affordability is a significant concern. Additionally, the high cost of research, development, and production of advanced powertrain technologies poses challenges for automotive manufacturers, especially smaller players with limited resources.

- Infrastructure Limitations:

Another restraint hampering the automotive powertrain market is infrastructure limitations, particularly concerning electric vehicle charging infrastructure. Despite the increasing adoption of electric vehicles, the availability of charging stations remains inadequate in many regions, limiting the practicality and convenience of electric vehicles for consumers. Insufficient charging infrastructure can lead to range anxiety among potential buyers and hinder the widespread adoption of electric powertrains. Moreover, the expansion of charging infrastructure requires significant investment in terms of both capital expenditure and regulatory approvals, posing challenges for governments, utility companies, and private investors. Furthermore, the availability of renewable energy sources to power electric vehicles adds another layer of complexity to the infrastructure challenge.

Automotive Powertrain Market Opportunity

- Expansion of Electric Vehicle Market:

One of the significant opportunities within the automotive powertrain market lies in the expansion of the electric vehicle (EV) market. With increasing environmental concerns and government initiatives aimed at reducing emissions, there is a growing demand for electric vehicles powered by advanced electric powertrains. This presents a significant opportunity for automotive manufacturers to invest in the development and production of electric powertrain components, including batteries, electric motors, and power electronics. Moreover, the shift towards electrification opens up new revenue streams and business models, such as battery leasing and energy storage solutions, further enhancing the market opportunity.

- Technological Innovation and Integration:

Another key opportunity in the automotive powertrain market lies in technological innovation and integration. As the automotive industry undergoes a digital transformation, there is a growing demand for advanced powertrain technologies that offer improved efficiency, performance, and connectivity. This presents an opportunity for automotive manufacturers, suppliers, and technology providers to collaborate and develop innovative powertrain solutions that meet the evolving needs of consumers and regulatory requirements. Additionally, the integration of emerging technologies such as artificial intelligence (AI), machine learning, and predictive analytics offers new opportunities to optimize powertrain performance, enhance diagnostics, and enable predictive maintenance.

Automotive Powertrain Market Challenges

A significant challenge facing the automotive powertrain market is regulatory uncertainty, particularly concerning emissions regulations and government policies. Rapidly evolving emissions standards, varying regulations across regions, and uncertainty about future policy direction create challenges for automotive manufacturers in terms of compliance and strategic planning. Meeting stringent emissions targets requires significant investment in research and development to develop cleaner and more efficient powertrain technologies. Moreover, differing regulations in various markets add complexity to product development and manufacturing processes, leading to increased costs and logistical challenges for automotive stakeholders.

- Shift towards Electrification:

Another significant challenge facing the automotive powertrain market is the ongoing shift towards electrification. While electric powertrains offer environmental benefits and long-term cost savings on fuel, the transition from traditional internal combustion engines poses challenges for automotive manufacturers in terms of investment, infrastructure, and consumer acceptance. Electric vehicles require significant upfront investment in battery technology and electric drivetrains, leading to higher manufacturing costs and price premiums compared to conventional vehicles. Additionally, the availability of charging infrastructure and concerns about range anxiety present barriers to consumer adoption of electric vehicles, particularly in emerging markets. Moreover, the electrification trend disrupts existing supply chains and manufacturing processes, requiring automotive stakeholders to adapt to new technologies and business models.

Segments Insights:

Propulsion Type Insights

Internal Combustion Engine (ICE) vehicles dominated the propulsion type segment in 2024. Despite growing electrification trends, ICE vehicles, including gasoline, diesel, and natural gas variants, still account for a majority of global vehicle sales, especially in emerging economies. Gasoline-powered vehicles dominate due to their affordability and widespread refueling infrastructure. Diesel remains significant in commercial applications, offering better torque and fuel economy for heavy-duty vehicles.

Electric vehicles are the fastest-growing propulsion type. Within the electric vehicle category, Battery Electric Vehicles (BEVs) lead the surge owing to their zero tailpipe emissions, lower operating costs, and favorable government incentives. PHEVs are also gaining traction as transitional technologies, offering the benefits of electrification while mitigating range anxiety. In 2024, BYD and Tesla expanded their BEV portfolios significantly, showcasing the accelerating momentum in this segment.

Vehicle Type Insights

Passenger vehicles dominated the vehicle type segment in 2024. The high production volume of passenger cars, combined with growing consumer demand for fuel-efficient, low-emission vehicles, drives innovation and investment in passenger vehicle powertrains. Powertrain optimization for sedans, hatchbacks, and SUVs is a major focus for OEMs.

Commercial vehicles represent the fastest-growing vehicle type. Electrification efforts are increasingly targeting buses, delivery vans, and heavy-duty trucks. In April 2024, Daimler Truck launched its new heavy-duty electric truck with a modular electric powertrain, highlighting the surging momentum in commercial vehicle electrification to meet corporate sustainability goals.

Regional Insights

Asia-Pacific dominated the global automotive powertrain market in 2024. With China leading EV adoption, Japan's technological innovation, and India's emerging automotive sector, Asia-Pacific holds the largest market share. Government initiatives like China's New Energy Vehicle (NEV) mandate and India's FAME II scheme are further stimulating growth. Major automakers like Toyota, BYD, and Hyundai are heavily invested in developing diverse powertrain solutions across ICE, hybrid, and electric platforms in this region.

Europe is the fastest-growing region. The European automotive industry is at the forefront of electrification, spurred by aggressive CO2 emission reduction targets and massive investments in EV infrastructure. Germany, France, and the Nordic countries are witnessing rapid growth in EV sales, compelling automakers to develop cutting-edge electric and hybrid powertrains. In February 2024, Stellantis announced its commitment to electrify 100% of its European vehicle sales by 2030, emphasizing Europe's role in driving the future of powertrain innovation.

Recent Developments

-

March 2024: Tesla introduced a next-gen drivetrain architecture designed to reduce production costs and enhance energy efficiency in upcoming models.

-

April 2024: Volkswagen Group announced its investment of $5 billion in solid-state battery startup QuantumScape to accelerate next-gen EV powertrains.

-

February 2024: Hyundai Motor Group revealed its new eM Platform designed for next-generation electric vehicles with optimized modular powertrains.

-

January 2024: Stellantis unveiled its STLA Large electric platform, capable of supporting vehicles with up to 500 miles of range.

-

March 2024: General Motors commenced production of its Ultium-based all-electric trucks featuring modular battery and drive motor systems.

Some of the prominent players in the automotive powertrain market include:

- BorgWarner Inc.

- Continental AG

- Magna International Inc.

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- NIDEC CORPORATION

- Robert Bosch GmbH

- Schaeffler AG

- ZF Friedrichshafen AG

- VALEO

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive powertrain market.

Propulsion Type

-

- Gasoline

- Diesel

- Natural Gas Vehicle

Vehicle type

- Passenger Vehicle

- Commercial Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)