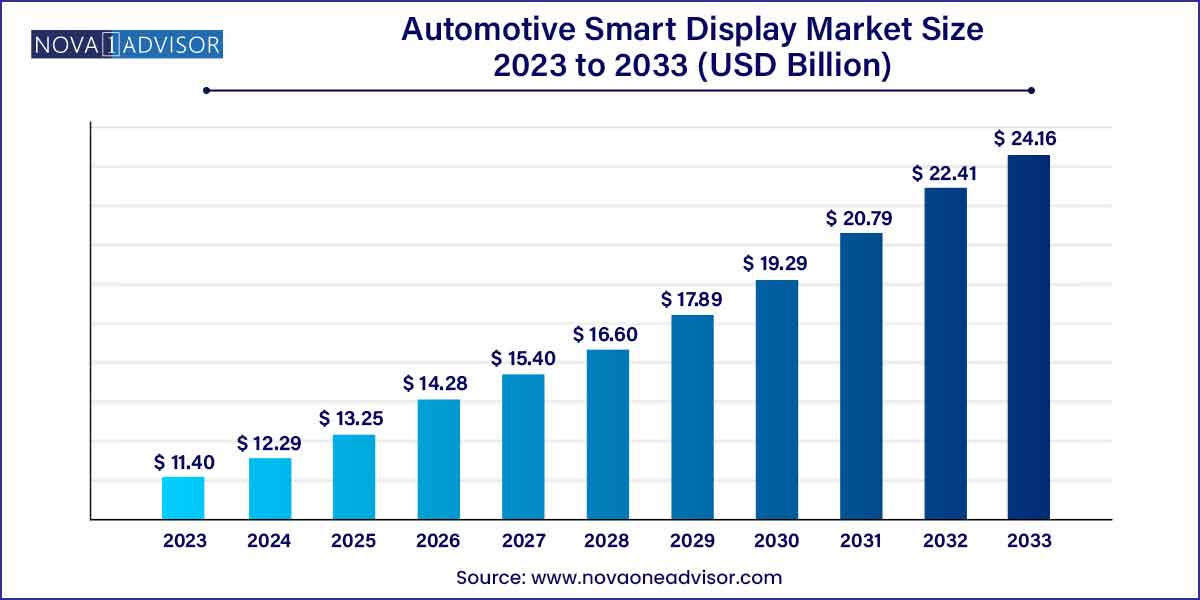

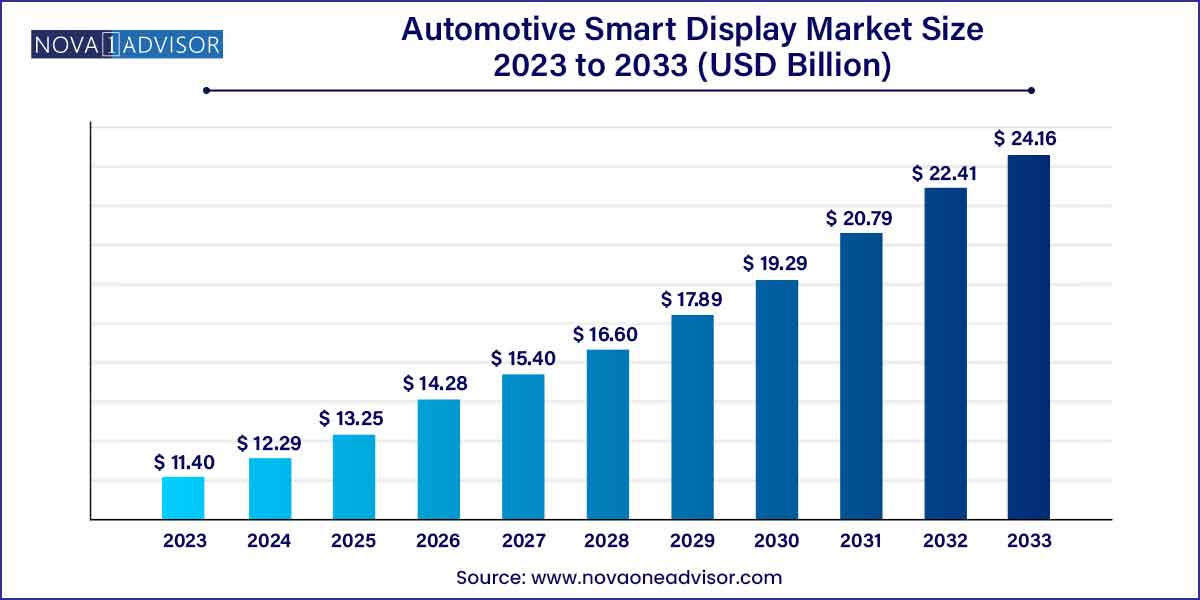

The global automotive smart display market size was exhibited at USD 11.40 billion in 2023 and is projected to hit around USD 24.16 billion by 2033, growing at a CAGR of 7.8% during the forecast period of 2024 to 2033.

Key Takeaways:

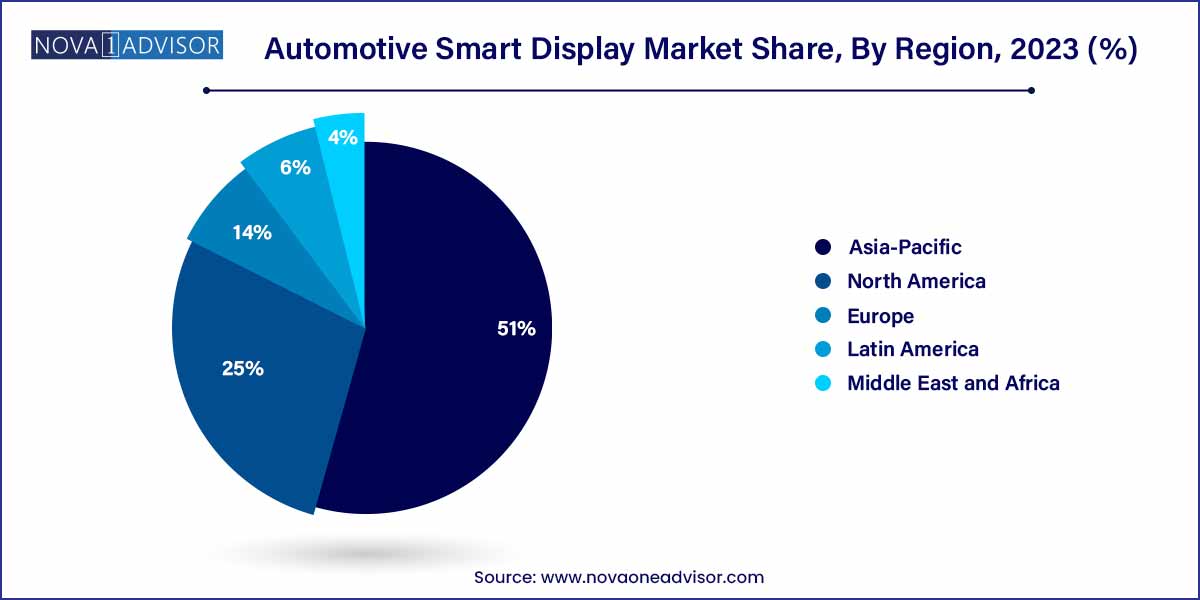

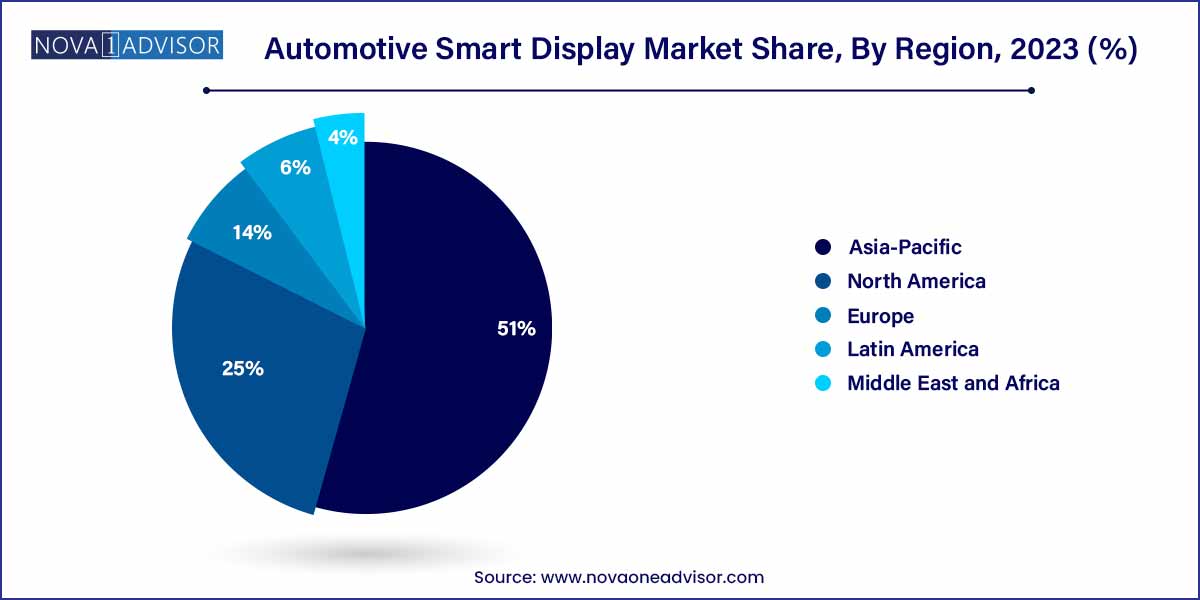

- Asia Pacific accounted for the largest revenue share of over 51% in the overall market in 2023

- The less than 5” display size segment accounted for the largest revenue share of over 45% in 2023.

- The TFT-LCD display segment accounted for the largest share of over 51% of the overall market in 2023.

- The center stack display segment accounted for the largest share of around 40.0% of the market in 2023.

Automotive Smart Display Market: Overview

The global automotive smart display market has witnessed significant transformation, propelled by the increasing integration of advanced driver assistance systems (ADAS), infotainment, and digital connectivity in vehicles. Smart displays, which include digital instrument clusters, center stacks, head-up displays (HUDs), and rear-seat entertainment systems, serve as critical interfaces between the driver, passengers, and vehicle electronics. They enhance the driving experience by providing real-time information in a visually appealing and intuitive manner.

Factors such as the rising demand for connected vehicles, the popularity of electric vehicles (EVs), and growing consumer expectations for sophisticated in-car experiences have fueled the market expansion. Automakers are actively collaborating with technology firms to develop next-generation displays featuring OLED, augmented reality (AR), and AI-driven capabilities. Furthermore, stringent government regulations for vehicle safety and emissions are encouraging the adoption of advanced smart display technologies to support driver assistance and efficient energy management.

Automotive Smart Display Market Growth

The automotive smart display market is experiencing robust growth driven by several key factors. The rise of electric vehicles (EVs) has spurred demand for smart displays that provide real-time information on battery status, range, and charging infrastructure. Additionally, advancements in autonomous driving technology have created a need for intuitive displays that facilitate human-machine interaction and convey critical information to passengers. Moreover, the integration of 5G connectivity and IoT capabilities has transformed smart displays into hubs for accessing multimedia content, navigation services, and vehicle diagnostics. Furthermore, the shift towards user-centric design and personalized experiences has prompted automakers to prioritize the development of sophisticated displays that seamlessly integrate with consumers' digital lifestyles. These factors, combined with ongoing technological innovations and regulatory mandates, are driving the expansion of the automotive smart display market, positioning it for continued growth in the foreseeable future.

Automotive Smart Display Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 11.40 Billion |

| Market Size by 2033 |

USD 24.16 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Display Size, Display Technology, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Alps Alpine Co., Ltd.; Continental AG; Denso Corporation; Hyundai Mobis; Nippon Seiki Co., Ltd.; Panasonic Corporation; Pioneer Corporation; Robert Bosch GmbH; SAMSUNG (HARMAN International); Visteon Corporation. |

Automotive Smart Display Market Dynamics

- Technological Advancements:

The automotive smart display market is propelled by continuous technological innovations aimed at enhancing user experiences and functionality. Advancements in display technologies, such as OLED (Organic Light-Emitting Diode) and MicroLED, are enabling automakers to deliver high-resolution and immersive displays that provide crisp visuals and vibrant colors. Furthermore, the integration of augmented reality (AR) capabilities is revolutionizing the driving experience by overlaying contextual information, such as navigation cues and hazard warnings, directly onto the windshield. Additionally, the convergence of artificial intelligence (AI) and machine learning algorithms is enabling smart displays to anticipate user preferences, provide proactive recommendations, and adapt the user interface based on individual driving habits and environmental conditions.

- Regulatory Mandates and Safety Concerns:

The automotive smart display market is influenced by regulatory mandates aimed at improving vehicle safety and reducing driver distraction. Governments worldwide are imposing stringent regulations regarding the integration of driver assistance systems and human-machine interfaces to mitigate the risks associated with distracted driving. As a result, automakers are investing in advanced smart display technologies that prioritize safety features such as heads-up displays (HUDs), voice recognition, and gesture control to minimize driver distraction and enhance situational awareness. Additionally, industry initiatives such as the Automotive Safety Integrity Level (ASIL) certification are driving the adoption of functional safety standards for smart displays, ensuring compliance with regulatory requirements and bolstering consumer confidence.

Automotive Smart Display Market Restraint

One of the primary restraints hindering the automotive smart display market is the significant cost associated with integrating advanced display technologies into vehicles. High-resolution displays, touchscreens, and augmented reality (AR) capabilities require substantial investments in research and development, manufacturing, and component sourcing. As a result, automakers face challenges in balancing the need for cutting-edge display technologies with cost considerations, particularly in price-sensitive market segments. Additionally, the complexity of integrating smart displays into vehicle architectures adds to the overall cost, as it necessitates collaboration among multiple stakeholders, including automakers, suppliers, and technology providers.

- Compatibility and Integration Challenges:

Another significant restraint impacting the automotive smart display market is the complexity of integrating smart display technologies into existing vehicle architectures. Automakers must ensure compatibility and seamless integration of smart displays with other onboard systems, including infotainment systems, instrument clusters, and driver assistance systems. However, achieving interoperability among disparate systems and components poses technical challenges, such as software compatibility issues, interface standardization, and hardware limitations. Furthermore, the rapid pace of technological advancements often leads to obsolescence concerns, as newer display technologies may outpace the capabilities of existing vehicle platforms.

Automotive Smart Display Market Opportunity

- Augmented Reality (AR) Displays:

Augmented reality (AR) technology presents a significant opportunity for innovation within the automotive smart display market. AR-enabled smart displays have the potential to revolutionize the driving experience by overlaying contextual information directly onto the windshield, providing drivers with real-time navigation cues, hazard warnings, and points of interest. By integrating AR capabilities into smart displays, automakers can enhance situational awareness, improve driver safety, and deliver immersive driving experiences. Furthermore, AR displays offer opportunities for personalized content delivery, such as adaptive route guidance and enhanced vehicle diagnostics, tailored to individual driver preferences.

- Integration of Artificial Intelligence (AI):

The integration of artificial intelligence (AI) presents another promising opportunity within the automotive smart display market. AI-powered smart displays can enhance user interactions, anticipate driver preferences, and deliver personalized experiences tailored to individual driving habits and environmental conditions. By leveraging AI algorithms, smart displays can analyze vast amounts of data from onboard sensors, navigation systems, and external sources to provide proactive recommendations, optimize route planning, and adapt the user interface in real-time. Additionally, AI-driven voice recognition and natural language processing capabilities enable seamless hands-free operation, reducing driver distraction and improving overall safety.

Automotive Smart Display Market Challenges

One of the primary challenges confronting the automotive smart display market is ensuring safety amidst increasing digitalization and connectivity within vehicles. While smart displays offer enhanced functionality and convenience, they also introduce potential distractions for drivers, posing safety risks on the road. The proliferation of touchscreen interfaces, complex menu systems, and multimedia content can divert drivers' attention from the task of driving, leading to an increased likelihood of accidents and injuries. Additionally, displays with bright and dynamic visuals may cause visual clutter and cognitive overload, further exacerbating distraction. Addressing safety concerns requires a delicate balance between innovation and risk mitigation. Automakers must prioritize the development of intuitive user interfaces, ergonomic designs, and driver assistance systems that minimize distraction and promote safe driving behaviors.

- Complexity of Integration:

Another significant challenge facing the automotive smart display market is the complexity of integrating advanced display technologies into vehicle architectures. Modern vehicles consist of numerous onboard systems, including infotainment systems, instrument clusters, driver assistance systems, and telematics platforms, each with unique requirements and interfaces. Integrating smart displays into existing vehicle architectures requires coordination among multiple stakeholders, including automakers, suppliers, and technology providers, to ensure compatibility, interoperability, and seamless functionality. However, achieving integration is often complicated by disparate hardware and software platforms, varying communication protocols, and evolving industry standards. Moreover, the rapid pace of technological advancements introduces additional complexity, as newer display technologies may outpace the capabilities of existing vehicle platforms, leading to compatibility issues and obsolescence concerns.

Segments Insights:

Display Size Insights

The 5''-10'' segment dominated the automotive smart display market.

The 5''-10'' segment remains dominant due to its extensive application across mid-range vehicles and mainstream models. These displays offer an optimal balance between size, functionality, and cost. They are commonly used in center stacks for infotainment, digital instrument clusters, and smaller HUDs. Manufacturers favor this segment for its affordability and versatility, catering to a broad consumer base. For example, models like Toyota Corolla and Honda Civic feature displays within this size range, striking a balance between functionality and affordability for a mass audience.

Conversely, displays greater than 10'' are experiencing the fastest growth, driven by luxury vehicle demand.

Larger displays are increasingly becoming a hallmark of luxury and technologically advanced vehicles. Automakers like Tesla, Mercedes-Benz, and BMW are installing 12'' and even larger displays as central control units, offering immersive entertainment, navigation, and vehicle control systems. The Mercedes-Benz MBUX Hyperscreen, spanning over 56 inches across the dashboard, is a prime example of this trend. As consumers demand more intuitive, visually rich interfaces, the "greater than 10''" segment is poised for exponential growth, especially in electric and autonomous vehicle categories.

Display Technology Insights

LCD technology dominated the automotive smart display market in 2024.

Liquid crystal display (LCD) technology has historically dominated the automotive smart display market due to its cost-effectiveness, reliability, and decent visual performance. LCD panels are extensively used in instrument clusters, center stacks, and entertainment screens across a wide range of vehicle classes. Their proven durability and resistance to environmental factors like heat and vibration make them a safe choice for automakers catering to large-volume production.

Meanwhile, OLED technology is the fastest growing, driven by superior aesthetics and performance.

Organic Light Emitting Diode (OLED) displays offer significant advantages over traditional LCDs, including superior contrast ratios, vibrant colors, thinner designs, and better flexibility. Luxury automakers are pioneering the adoption of OLED displays to provide their customers with cutting-edge experiences. For instance, Cadillac's 38-inch curved OLED display in the Escalade 2021 model garnered widespread acclaim. As production costs decline and durability concerns are addressed, OLED displays are expected to experience rapid market adoption across various vehicle segments.

Application Insights

Center stack displays dominated the automotive smart display market, offering central control hubs.

Center stack displays serve as the primary interface for infotainment, navigation, vehicle settings, and connectivity functions. Positioned within easy reach of the driver and front passenger, they have become an essential feature in modern vehicles. The increasing complexity of in-vehicle systems necessitates intuitive, touchscreen-based center stack displays. Brands like Tesla revolutionized the market with their large center-mounted touchscreens, a trend now echoed by Ford, Hyundai, and others.

At the same time, head-up displays (HUDs) are the fastest growing application segment.

HUDs project vital driving information directly onto the windshield, allowing drivers to stay informed without taking their eyes off the road. The demand for HUDs is growing rapidly, spurred by increasing safety regulations, rising consumer awareness, and technological advancements like augmented reality integration. Companies such as Continental AG and Panasonic Automotive are heavily investing in HUD innovations, while mainstream vehicles like Hyundai's Palisade now offer HUDs as optional or standard features.

Regional Insights

Asia-Pacific dominated the automotive smart display market, driven by robust automotive production and technological advancements.

Asia-Pacific, particularly countries like China, Japan, and South Korea, holds the lion's share of the global automotive smart display market. The region benefits from the presence of leading automotive OEMs and display manufacturers, such as Toyota, Hyundai, Honda, Samsung, LG Display, and Panasonic. Rapid urbanization, rising disposable incomes, and growing demand for connected vehicles in China and India further amplify the market growth. Additionally, government policies supporting electric vehicles indirectly boost the demand for smart displays that manage EV-specific data like battery levels and range.

Meanwhile, Europe is the fastest-growing region in the automotive smart display market.

Europe's strong emphasis on vehicle safety, environmental sustainability, and advanced driver assistance systems is propelling the growth of the smart display market. Automakers in Germany, France, and the UK are at the forefront of integrating large, high-resolution displays and AR HUDs into their models. Initiatives like the European New Car Assessment Programme (Euro NCAP) ratings have accelerated the adoption of smart displays that enhance driver safety and vehicle communication. As the electric and autonomous vehicle markets expand across Europe, demand for sophisticated automotive smart displays is set to soar.

Some of the prominent players in the automotive smart display market include:

- Alps Alpine Co., Ltd.

- Continental AG

- Denso Corporation

- Hyundai Mobis

- Nippon Seiki Co., Ltd.

- Panasonic Corporation

- Pioneer Corporation

- Robert Bosch GmbH

- SAMSUNG (HARMAN International)

- Visteon Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive smart display market.

Display Size

- Less than 5''

- 5''-10''

- Greater than 10''

Display Technology

Application Type

- Digital Instrument Cluster

- Center Stack

- Head-Up Display (HUD)

- Rear Seat Entertainment

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)