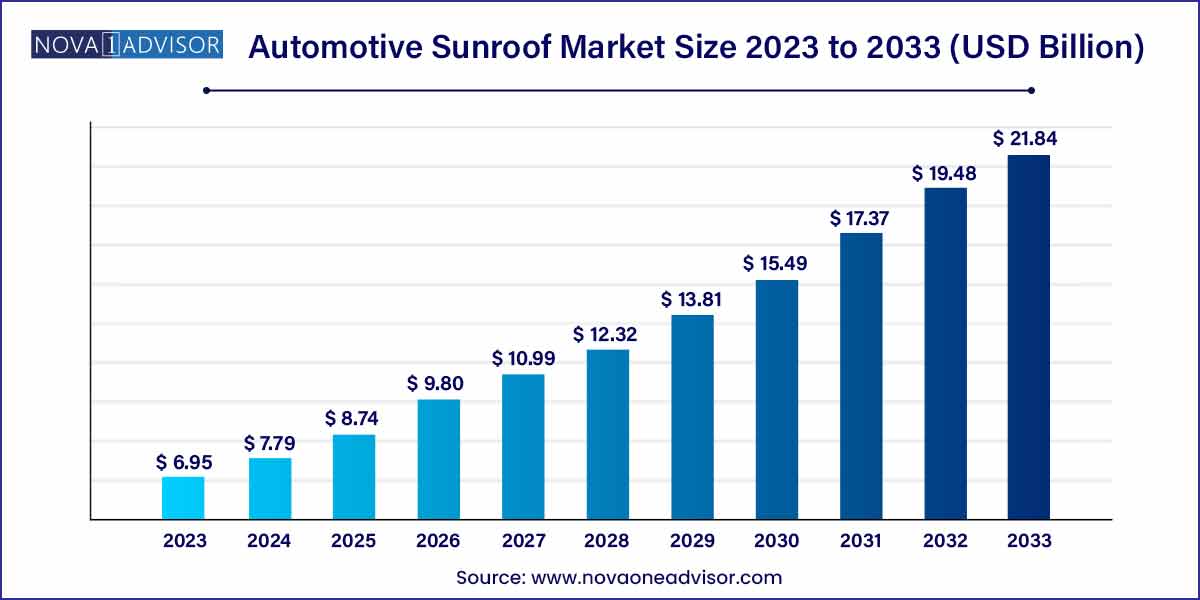

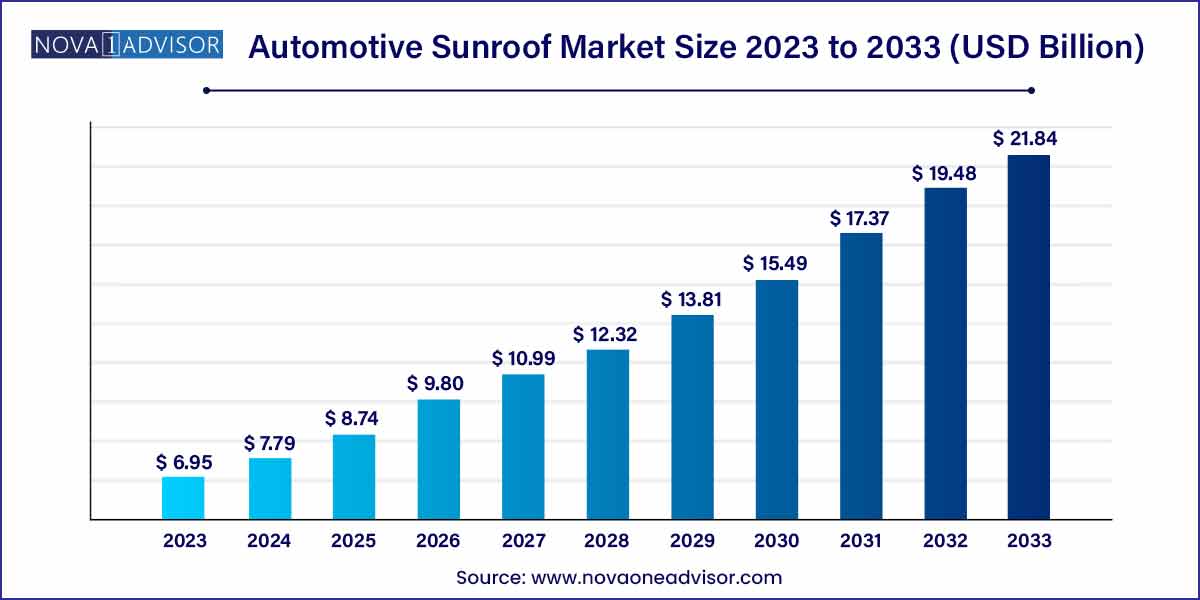

The global automotive sunroof market size was estimated at USD 6.95 billion in 2023, and it is expected to hit around USD 21.84 billion by 2033, growing at a CAGR of 12.13% from 2023 to 2033.

Key Insights:

- By geography, the Asia-Pacific market is expected to report a sizable portion in the global market.

- By geography, Europe is the second-largest market and will continue to grow rapidly from 2023 to 2033.

- By sunroof type, the panoramic segment captured a sizable market share in 2023.

- By operation, the automatic segment is expected to grow drastically in the market from 2023 to 2033.

- By material type, the glass sunroof segment held the most significant market share of over 81% in 2023.

- By distribution channels, the OEM segment dominates the market.

- By vehicle type, the passenger car segment is predicted to grow significantly in the market.

Automotive Sunroof Market: Overview

The automotive sunroof market has witnessed significant growth in recent years, driven by evolving consumer preferences, advancements in technology, and increasing demand for enhanced driving experiences. This overview aims to provide insights into the current landscape of the automotive sunroof market, highlighting key trends, growth drivers, and future prospects.

Automotive Sunroof Market Growth

The automotive sunroof market is experiencing robust growth, propelled by several key factors. One significant driver is the increasing consumer preference for open-air driving experiences, particularly in regions with favorable climates. Additionally, rising disposable incomes, particularly in emerging economies, are fueling demand for vehicles equipped with premium features like sunroofs. Moreover, continuous technological advancements, including the integration of advanced features such as panoramic sunroofs and smart control systems, are attracting consumers and driving market expansion. As a result, the automotive sunroof market is expected to continue growing steadily in the coming years, driven by a combination of evolving consumer preferences, improving economic conditions, and ongoing innovation within the automotive industry.

Automotive Sunroof Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.95 Billion |

| Market Size by 2033 |

USD 21.84 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.13% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Sunroof Type, By Operation, By Material Type, By Distribution Channels and By Vehicle Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Webasto SE, Inalfa Roof Systems B.V., Inteva Products LLC, Aisin Seiki Co., Ltd., Magna International, Inc., CIE Automotive, Wuxi Ming Fang AutoMobile Parts, Wuhu Mosentek Automobile Technology, Yachiyo Industry Co. Ltd, Zhejiang Wanchao Electric Co. Ltd, Johnan Manufacturing Inc. and Others. |

Automotive Sunroof Market Dynamics

- Consumer Preference for Enhanced Driving Experiences:

Increasingly, consumers are seeking vehicles that offer not only comfort and convenience but also an enhanced driving experience. Sunroofs provide an opportunity for drivers and passengers to enjoy open-air driving, creating a sense of spaciousness and connection with the outdoors. This preference for a more enjoyable driving environment is fueling the demand for vehicles equipped with sunroofs, particularly in regions with favorable climates. As automakers continue to prioritize customer satisfaction and cater to evolving consumer preferences, the adoption of sunroof systems is expected to rise steadily.

- Technological Advancements and Innovation:

Continuous advancements in sunroof technology are reshaping the automotive industry, driving market growth and enhancing the functionality of sunroof systems. Manufacturers are integrating advanced features such as panoramic sunroofs, power-operated sunshades, and anti-pinch technology to improve comfort, safety, and convenience for passengers. Furthermore, the emergence of transparent solar panels and smart control systems is adding new dimensions to sunroof functionality, enabling energy generation and enhanced user control. As technology continues to evolve, the automotive sunroof market is poised for further expansion, with manufacturers competing to deliver innovative and cutting-edge solutions to meet consumer demands.

Automotive Sunroof Market Restraint

Despite the increasing demand for vehicles equipped with sunroofs, the additional cost associated with installing and maintaining sunroof systems can act as a significant restraint. Sunroofs, especially those with advanced features like panoramic designs or integrated technology, can substantially increase the overall cost of the vehicle. This cost factor may deter some consumers, particularly those with budget constraints, from opting for vehicles with sunroof options. Moreover, the ongoing maintenance and repair costs of sunroof systems can also add to the overall ownership expenses, further limiting market penetration, particularly in price-sensitive segments.

- Structural and Safety Concerns:

The integration of sunroofs into vehicle designs presents structural and safety challenges for automakers. Sunroof installations require modifications to the vehicle's roof structure, potentially compromising its integrity and safety in the event of a collision or rollover accident. Additionally, improper installation or maintenance of sunroof systems can lead to water leaks, air leaks, and other structural issues, affecting the vehicle's overall performance and durability. Concerns related to structural integrity and safety may deter some consumers from opting for vehicles with sunroof options, particularly if they perceive potential risks outweighing the benefits. Addressing these structural and safety concerns through rigorous testing, certification, and adherence to regulatory standards is essential to mitigating this restraint and fostering consumer confidence in sunroof-equipped vehicles.

Automotive Sunroof Market Opportunity

- Market Expansion in Emerging Economies:

Emerging economies present significant growth opportunities for the automotive sunroof market. Rapid urbanization, increasing disposable incomes, and improving infrastructure in countries such as China, India, Brazil, and Mexico are driving a surge in vehicle ownership rates. As consumers in these regions seek vehicles with enhanced comfort and aesthetic appeal, the demand for sunroof-equipped vehicles is expected to rise. Moreover, automakers are increasingly focusing on expanding their presence in emerging markets, offering a wide range of sunroof options tailored to local preferences and affordability levels. By tapping into these burgeoning markets, manufacturers can capitalize on the growing demand for automotive sunroof systems and drive market growth in the coming years.

- Shift Towards Electric Sunroofs:

The growing emphasis on sustainability and energy efficiency presents an opportunity for the adoption of electric sunroof systems. Electric sunroofs, powered by electricity instead of traditional mechanical mechanisms, offer enhanced functionality, reliability, and energy efficiency. Additionally, transparent solar panels integrated into sunroof designs enable solar energy harvesting, providing a renewable power source for vehicle accessories and systems. With increasing concerns about greenhouse gas emissions and environmental sustainability, electric sunroofs offer a compelling solution for reducing the carbon footprint of vehicles while enhancing their functionality and appeal.

Automotive Sunroof Market Challenges

- Regulatory Compliance and Safety Standards:

Meeting stringent regulatory requirements and safety standards poses a significant challenge for manufacturers operating in the automotive sunroof market. Sunroof systems must comply with various regulations related to structural integrity, crashworthiness, and occupant protection to ensure the safety of vehicle occupants in the event of accidents or collisions. Additionally, regulatory frameworks may vary across different regions and markets, requiring manufacturers to navigate complex certification processes and adhere to diverse compliance requirements. Failure to meet regulatory standards can result in costly recalls, fines, and damage to brand reputation.

- Structural Integration and Vehicle Design Constraints:

Integrating sunroof systems into vehicle designs while maintaining structural integrity and aesthetic appeal presents a significant challenge for automakers. Sunroof installations require modifications to the vehicle's roof structure, which may impact overall vehicle dynamics, weight distribution, and aerodynamics. Moreover, accommodating sunroof components within limited space constraints poses challenges in terms of design optimization, interior packaging, and vehicle styling. Balancing structural integrity, safety, and design aesthetics without compromising vehicle performance and functionality requires extensive engineering expertise and innovative design solutions.

Segments Insights:

Material Type Insights:

Glass sunroofs dominated the material segment.

Glass remains the preferred material for automotive sunroofs due to its durability, aesthetic appeal, and ability to incorporate modern technologies like UV protection, tinting, and smart glass capabilities. Laminated and tempered glass ensures passenger safety while offering an unobstructed view. Prominent models like the BMW X5 and Tesla Model Y boast advanced panoramic glass roofs that blend seamlessly with the vehicle’s design language, driving the dominance of glass sunroofs.

Fabric sunroofs are seeing a niche resurgence.

Fabric sunroofs, often associated with convertible or retro-themed vehicles like the Fiat 500C, are experiencing renewed interest. Modern weather-resistant, UV-protected, and lightweight fabrics are making fabric sunroofs a viable, stylish alternative, particularly in European markets where classic car designs remain popular. This niche segment is steadily carving out a loyal consumer base seeking distinctive aesthetics.

Sunroof Type Insights:

Panoramic sunroofs dominated the sunroof type segment.

Panoramic sunroofs, characterized by large glass panels that often cover both front and rear seats, have gained immense popularity among consumers seeking a more open and luxurious cabin environment. Vehicles like Tesla's Model S and Audi's Q5 have set industry standards by offering expansive panoramic sunroofs, appealing particularly to younger consumers and families. Automakers are marketing panoramic sunroofs not only for luxury but also for enhancing passengers' connection with the external environment, promoting well-being during travel.

Meanwhile, spoiler sunroofs are growing at the fastest rate.

Spoiler sunroofs combine tilt and slide features, providing flexibility, ease of operation, and sporty aesthetics. They are becoming increasingly popular, especially in compact and mid-sized vehicles like Honda Civic and Toyota Corolla. Their aerodynamic design and relative affordability compared to full panoramic options make them attractive to cost-conscious yet style-driven buyers. As more automakers offer spoiler sunroofs as optional upgrades, the segment's growth trajectory is accelerating rapidly.

Operation Insights:

Automatic sunroofs dominated the operation segment.

Automatic sunroofs, operated through one-touch buttons, remote keys, or smartphone apps, dominate the automotive sunroof market. Technological enhancements, such as rain sensors, obstacle detection, and programmable settings, have made automatic sunroofs synonymous with convenience and luxury. Vehicles across segments, including the Volkswagen Tiguan and Hyundai Tucson, come equipped with advanced automatic sunroof systems, catering to modern consumer expectations of ease and sophistication.

Passenger-operated manual sunroofs are still relevant in certain regions.

Despite the dominance of automatic systems, manually operated sunroofs remain popular in entry-level vehicles in price-sensitive markets like Southeast Asia and Latin America. Brands like Suzuki and Renault continue to offer manually operated pop-up and sliding sunroofs in specific models to cater to budget-conscious consumers who prioritize affordability over automation.

Distribution Channels Insights:

OEMs dominated the distribution channel segment.

Original Equipment Manufacturers (OEMs) are the primary suppliers of sunroofs, integrating them seamlessly during the vehicle design and production process. Factory-fitted sunroofs offer better structural integrity, superior finish, and alignment with safety standards. Major automakers like Hyundai, BMW, and Toyota are incorporating sunroofs across diverse model ranges, bolstering the OEM segment's leadership.

The aftermarket segment is growing rapidly.

The aftermarket segment, offering sunroof retrofitting services, is gaining traction, particularly in regions where consumers seek to upgrade their existing vehicles. Companies like Webasto and Signature Automotive Products provide high-quality aftermarket solutions, including custom panoramic roof installations. As vehicle ownership cycles extend, the demand for aftermarket sunroof installations is poised to rise steadily.

Vehicle Type Insights:

Passenger cars dominated the vehicle type segment.

Passenger cars, spanning sedans, hatchbacks, and SUVs, account for the lion's share of sunroof installations. The widespread consumer preference for passenger cars, combined with their growing luxury feature adoption rates, has established this dominance. Models like the Hyundai Venue and Ford EcoSport now offer sunroofs as standard or optional features, enhancing passenger appeal across budget ranges.

Electric-powered vehicles are the fastest-growing vehicle type.

Electric vehicles (EVs) and hybrids are rapidly integrating sunroofs, especially panoramic and solar-powered versions. Brands like Lucid Motors and Rivian are emphasizing large, continuous glass roofs to distinguish their models and enhance sustainability credentials. As global EV adoption accelerates, the associated sunroof market in this segment is expected to witness exponential growth.

Regional Insights

Asia-Pacific dominated the automotive sunroof market.

Asia-Pacific, led by China, Japan, and India, holds the dominant share in the global automotive sunroof market. The region's robust vehicle production, increasing middle-class population, and rising demand for feature-rich vehicles are critical factors behind this dominance. China, in particular, showcases strong consumer preference for panoramic sunroofs, with local brands like BYD and global automakers offering sunroofs in mid-range SUVs and sedans to meet expectations. Moreover, government initiatives supporting EVs and technological innovations further bolster sunroof market growth in Asia-Pacific.

Europe is the fastest-growing region for automotive sunroofs.

Europe’s strong automotive heritage, stringent emission regulations, and emphasis on premium vehicles contribute to rapid growth in the sunroof segment. German manufacturers like Mercedes-Benz and Audi are at the forefront, integrating panoramic roofs and solar innovations into their vehicles. Moreover, the surge in electric vehicle sales in Europe is driving further adoption of lightweight, energy-efficient sunroof designs, making Europe the fastest-growing regional market for automotive sunroofs.

Recent Developments:

-

January 2025: Webasto announced the launch of its "Next-Gen Solar Roof System," designed for electric vehicles, featuring enhanced photovoltaic cell efficiency.

-

February 2025: Inalfa Roof Systems inaugurated a new R&D center in Germany focused on developing lightweight and smart glass sunroof technologies.

-

March 2025: Yachiyo Industry Co. (Honda subsidiary) revealed its innovative fabric panoramic sunroof concept tailored for compact urban EVs.

-

April 2025: CIE Automotive introduced a new modular sunroof platform with smart glass integration capable of autonomous tint adjustments.

Some of the prominent players in the automotive sunroof market include:

- Webasto SE

- Inalfa Roof Systems B.V.

- Inteva Products LLC

- Aisin Seiki Co., Ltd.

- Magna International, Inc.

- CIE Automotive

- Wuxi Ming Fang AutoMobile Parts

- Wuhu Mosentek Automobile Technology

- Yachiyo Industry Co. Ltd

- Zhejiang Wanchao Electric Co. Ltd

- Johnan Manufacturing Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive sunroof market.

By Sunroof Type

- Inbuilt Sunroof

- Panoramic Sunroof

- Spoiler Sunroof

- Pop-Up Sunroof

By Operation

- Passenger Cars

- Light Commercial Vehicles

- Automatic

By Material Type

By Distribution Channels

By Vehicle Type

- Passenger Cars

- Light weigh vehicles

- Electric Powered Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)