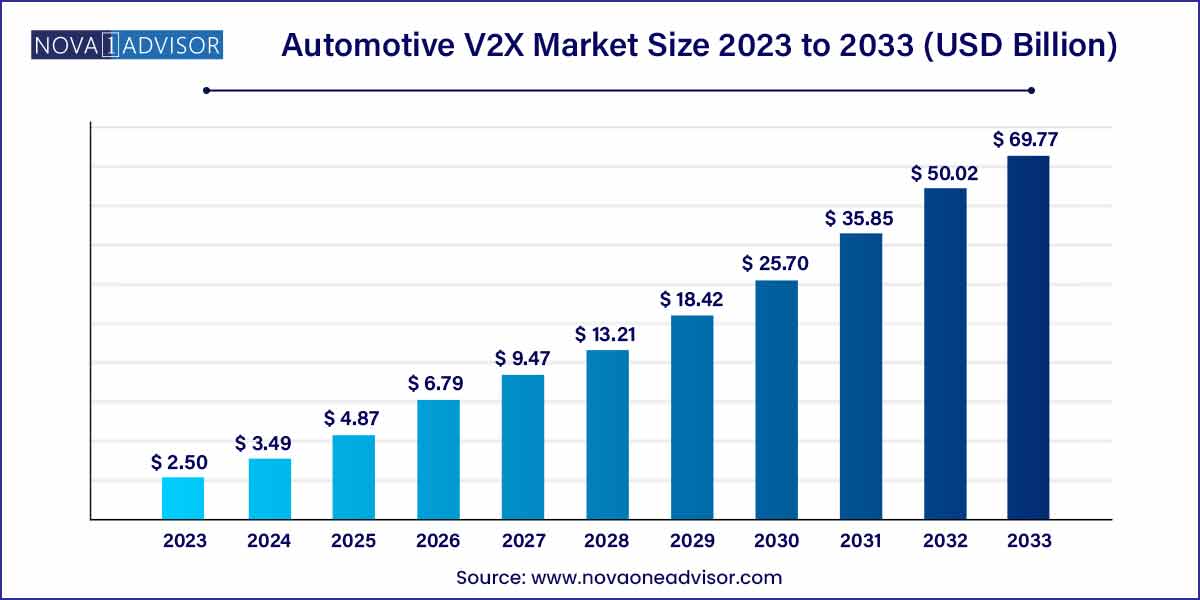

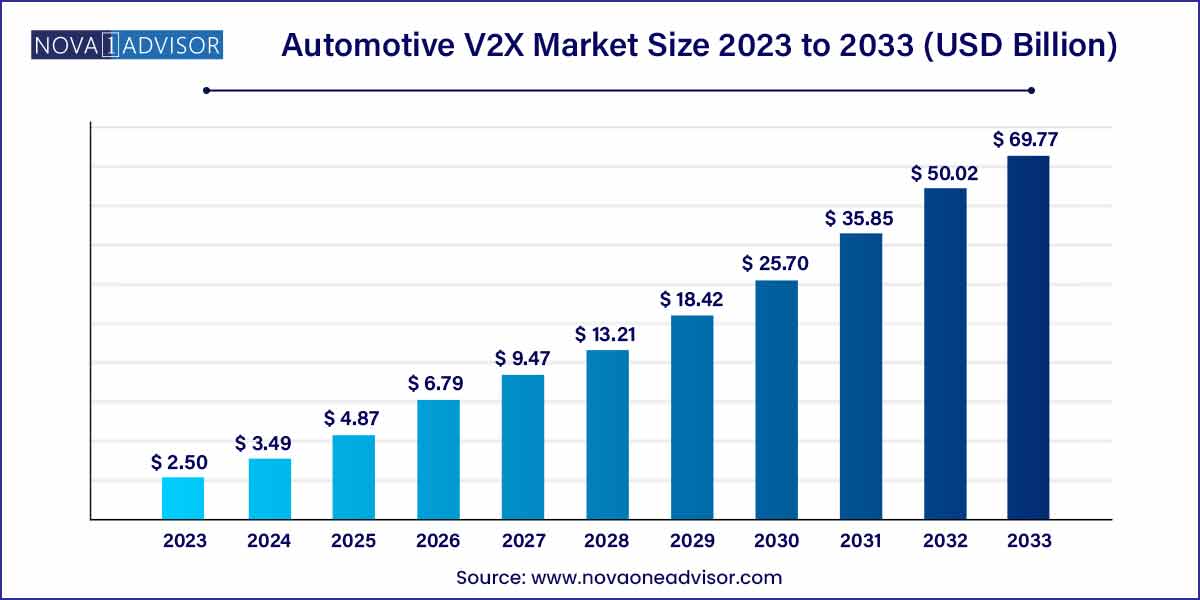

The global automotive V2X market size was exhibited at USD 2.50 billion in 2023 and is projected to hit around USD 69.77 billion by 2033, growing at a CAGR of 39.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America led the global market with the highest market share in 2023.

- By communication type, the vehicle-to-Vehicle (V2V) segment registered the maximum market share in 2023.

- By Vehicle Type, the passenger cars segment recorded more than 76% of revenue share in 2023.

Automotive V2X Market: Overview

The automotive Vehicle-to-Everything (V2X) market is revolutionizing the automotive and transportation industry by enabling seamless communication between vehicles, infrastructure, pedestrians, and networks. V2X technology involves various communication protocols and systems that enhance the safety, efficiency, and convenience of transportation. Through V2X, vehicles can communicate with each other (V2V), with infrastructure (V2I), with pedestrians (V2P), and with other connected entities, creating an intelligent, interconnected system that enhances mobility and reduces accidents.

The development of V2X is driven by advancements in 5G technology, growing demand for autonomous vehicles, and the need for safer roads. The system allows for real-time data exchange between vehicles and surrounding infrastructure, improving traffic flow, reducing collisions, and enabling features such as collision avoidance, adaptive traffic management, and autonomous driving capabilities.

V2X communications are poised to play a crucial role in the adoption of intelligent transportation systems (ITS), as well as the transition toward fully autonomous vehicles. With an increasing number of governments and automakers investing in V2X technology, the automotive V2X market is expected to experience significant growth over the next decade. The market’s expansion is being fueled by the rising demand for enhanced safety features, efficiency in traffic management, and the growing adoption of electric vehicles (EVs) and connected technologies.

Automotive V2X Market Growth

The Automotive V2X market is experiencing exponential growth, propelled by several key factors. Regulatory mandates advocating for enhanced road safety and intelligent transportation systems are driving widespread adoption. With rising concerns regarding road accidents, there is a growing recognition of V2X technology's potential to prevent collisions and reduce fatalities. The increasing integration of sophisticated communication capabilities in connected vehicles is further fueling market expansion. Additionally, advancements in dedicated short-range communication and cellular-V2X technologies are enhancing the performance and scalability of V2X systems. As automakers and technology providers invest in research and development, the Automotive V2X market is poised for sustained growth, promising safer, more efficient, and smarter transportation solutions.

Automotive V2X Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.50 Billion |

| Market Size by 2033 |

USD 69.77 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 39.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Communication Type, Vehicle Type, Connectivity Type, Regional Outlook |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Nolato AB, Freudenberg Medical LLC, Rochling Group, GW Plastics Inc., MedPlast Inc., Phillips Medisisze Corporation, C&J Industries Inc., Tekni-Plex, Inc., Pexco LLC, and Medical Plastic Devices Inc. |

Automotive V2X Market Dynamics

Government regulations mandating the integration of V2X technology in vehicles to enhance road safety and traffic efficiency are a significant driving force in the market. Various regions worldwide are enacting stringent safety standards and initiatives promoting intelligent transportation systems (ITS). These regulations create a compelling incentive for automakers to incorporate V2X communication capabilities into their vehicles, thereby fostering market growth.

- Increasing Concerns Regarding Road Safety:

Despite advancements in automotive technology, road accidents remain a pressing global issue, prompting heightened concerns for road safety. V2X technology offers a promising solution by enabling vehicles to communicate with each other, infrastructure, and pedestrians in real-time, thereby enhancing situational awareness and facilitating proactive collision avoidance. As the automotive industry and consumers alike prioritize safety features, the demand for V2X solutions continues to rise, driving market expansion.

Automotive V2X Market Restraint

- Infrastructure Development Challenges:

One major restraint in the adoption of V2X technology is the need for robust infrastructure to support seamless communication between vehicles and the surrounding environment. Establishing an extensive network of roadside units and infrastructure components such as traffic lights and sensors requires substantial investment and coordination among various stakeholders. Delays or limitations in infrastructure development can hinder the widespread deployment of V2X systems, slowing market growth.

- Interoperability and Standardization Issues:

Another key restraint facing the Automotive V2X market is the lack of uniform standards and interoperability among different communication technologies and protocols. As various regions and stakeholders develop and deploy V2X solutions independently, compatibility issues may arise, inhibiting seamless communication between vehicles from different manufacturers or operating in different geographical areas. The absence of standardized protocols can also complicate regulatory compliance and create uncertainties for market participants, thereby impeding market expansion.

Automotive V2X Market Opportunity

- The Evolution of Smart Cities:

The rise of smart city initiatives presents a significant opportunity for the automotive V2X market. As urban centers increasingly embrace digital transformation, there is growing interest in leveraging V2X technology to create interconnected transportation ecosystems. By integrating V2X communication with intelligent traffic management systems, smart city planners can optimize traffic flow, reduce congestion, and improve overall transportation efficiency. Additionally, V2X-enabled infrastructure can support innovative mobility services such as autonomous shuttles, dynamic routing, and on-demand transportation, enhancing urban mobility and quality of life for residents.

- Emergence of Autonomous Vehicles:

The proliferation of autonomous vehicle technology represents a transformative opportunity for the Automotive V2X market. As self-driving cars become more prevalent, the demand for V2X communication systems is expected to soar. V2X technology plays a critical role in enabling autonomous vehicles to navigate complex traffic scenarios, interact with other road users, and make real-time decisions based on environmental data. By leveraging V2X capabilities, autonomous vehicles can enhance safety, efficiency, and reliability, accelerating the adoption of self-driving technology and opening up new revenue streams for V2X solution providers.

Automotive V2X Market Challenges

- Security and Privacy Concerns:

One of the foremost challenges facing the automotive V2X market is ensuring robust security and safeguarding user privacy. As vehicles become increasingly connected and reliant on V2X communication, they become potential targets for cyber attacks and unauthorized access. Ensuring the integrity, confidentiality, and authenticity of V2X data transmissions is paramount to prevent incidents such as hacking, spoofing, or tampering, which could compromise road safety and undermine consumer trust. Additionally, addressing privacy concerns related to the collection and sharing of sensitive vehicle data is essential to maintain user confidence and regulatory compliance.

- Spectrum Allocation and Interference:

Spectrum allocation and interference issues pose significant challenges to the widespread deployment of V2X technology. With various wireless communication standards competing for limited frequency bands, including Dedicated Short-Range Communication (DSRC) and Cellular-V2X (C-V2X), there is a risk of spectrum congestion and interference, which could degrade communication performance and reliability. Moreover, regulatory uncertainties regarding spectrum licensing and allocation policies may hinder investment and deployment efforts by industry stakeholders, delaying the realization of the full potential of V2X technology in enhancing road safety and mobility.

Segments Insights:

Communication Type Insights

The Vehicle-to-Infrastructure (V2I) communication segment dominates the automotive V2X market. This type of communication enables vehicles to exchange information with surrounding infrastructure, such as traffic lights, road signs, and sensors, to optimize traffic flow and enhance safety. V2I is particularly important in urban environments, where traffic congestion and accidents are more frequent. For example, V2I systems can allow traffic lights to change in real-time based on vehicle volume, reducing waiting times and preventing congestion.

Moreover, V2I communication plays a critical role in enhancing the safety of both autonomous and human-driven vehicles. By allowing vehicles to communicate with traffic signals and road sensors, V2I ensures that vehicles can adjust their speed or route based on real-time road conditions, such as accidents, construction, or weather-related hazards. As cities increasingly adopt smart infrastructure, V2I will continue to be the largest and most important communication type in the automotive V2X market.

The Vehicle-to-Pedestrian (V2P) communication segment is growing rapidly as a key safety feature in modern vehicles. With pedestrian safety becoming a top priority for both automakers and regulators, V2P technology aims to reduce pedestrian-related accidents by allowing vehicles to communicate with pedestrians and alert them of potential hazards. For example, if a pedestrian is detected crossing the road near a vehicle, the V2P system can send warnings to both the pedestrian and the driver, preventing potential collisions.

V2P systems are particularly important in urban areas, where pedestrian traffic is dense and the risk of accidents is high. With the increasing adoption of advanced safety features, such as pedestrian detection systems, V2P is expected to see significant growth in the coming years.

Regional Insights

North America, particularly the United States, dominates the automotive V2X market due to its advanced automotive infrastructure, high levels of vehicle automation, and extensive government support for smart transportation systems. The U.S. government has been actively investing in V2X technologies as part of its efforts to reduce traffic accidents and improve road safety. Additionally, major automotive manufacturers, including General Motors, Ford, and Tesla, are leading the charge in integrating V2X communication into their vehicles, particularly with the advent of autonomous driving.

The U.S. also benefits from a highly connected infrastructure, with many cities implementing smart traffic management systems and investing in vehicle-to-infrastructure (V2I) communication technologies. This infrastructure, combined with strong regulatory support, has created an environment where V2X technologies can thrive.

The Asia-Pacific region is witnessing the fastest growth in the automotive V2X market, driven by rapid urbanization, the growing adoption of autonomous vehicles, and increasing government investments in smart city infrastructure. Countries like China, Japan, and South Korea are leading the charge in V2X deployment, with strong government initiatives aimed at reducing traffic congestion, enhancing road safety, and improving the efficiency of public transportation systems.

China, in particular, is investing heavily in intelligent transportation systems (ITS) as part of its "Made in China 2025" initiative, which includes plans to develop autonomous vehicles and connected infrastructure. The rapid growth of electric vehicles (EVs) in the region is also driving the adoption of V2G (Vehicle-to-Grid) communication systems, further fueling market growth.

Some of the prominent players in the automotive V2X market include:

- Continental AG

- Delphi Automotive LLP

- NXP Semiconductors

- TomTom International B.V.

- Qualcomm, Inc.

- Robert Bosch GmbH

- HARMAN International

- Cisco Systems, Inc.

- Mobileye

- Infineon Technologies AG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive V2X market.

By Communication Type

- Vehicle-To-Infrastructure (V2I)

- Vehicle-To-Grid (V2G)

- Vehicle-To-Vehicle (V2V)

- Vehicle-To-Home (V2H)

- Vehicle-To-Pedestrian (V2P)

- Vehicle-To-Network (V2N)

By Vehicle Type

- Commercial Vehicles (CV)

- Passenger Cars

By Connectivity Type

- Cellular Connectivity

- DSRC

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)