Barbados Healthcare & Medical Tourism Market Size and Growth

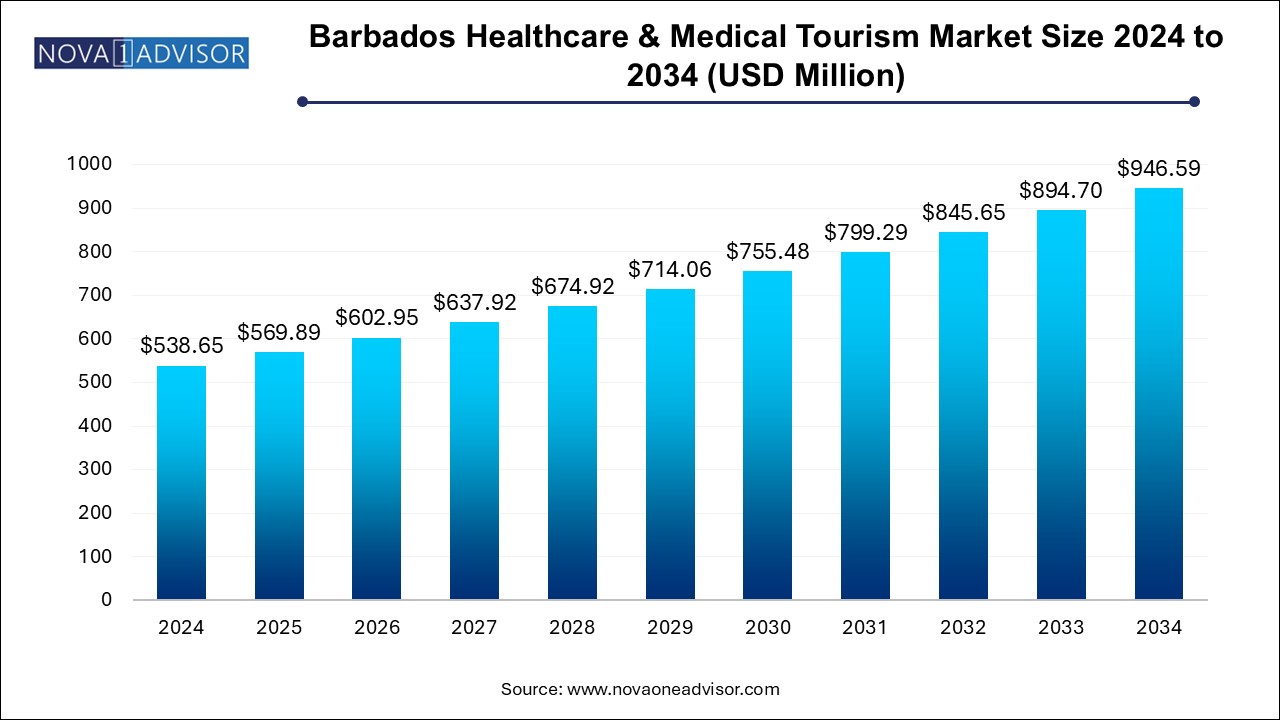

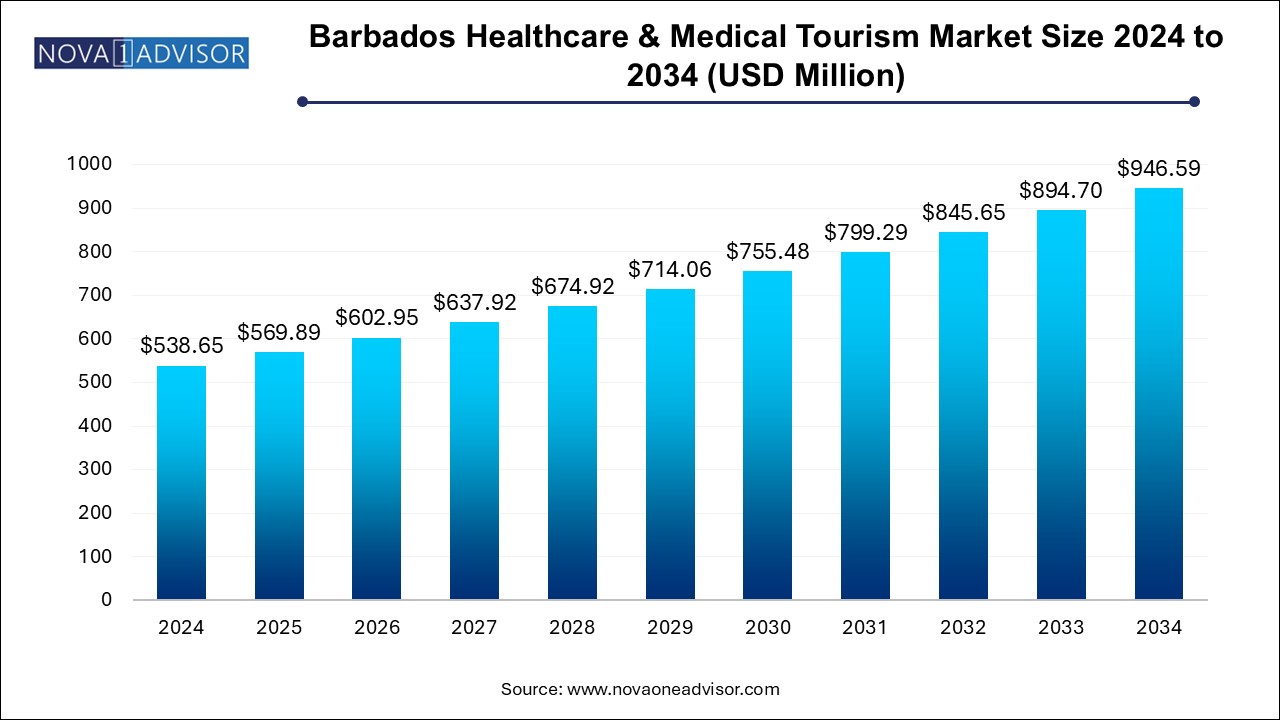

The Barbados healthcare & medical tourism market size was exhibited at USD 538.65 million in 2024 and is projected to hit around USD 946.59 million by 2034, growing at a CAGR of 5.8% during the forecast period 2024 to 2034. The global Barbados healthcare & medical tourism market growth is attributed to the increasing government spending.

Barbados Healthcare & Medical Tourism Market Key Takeaways:

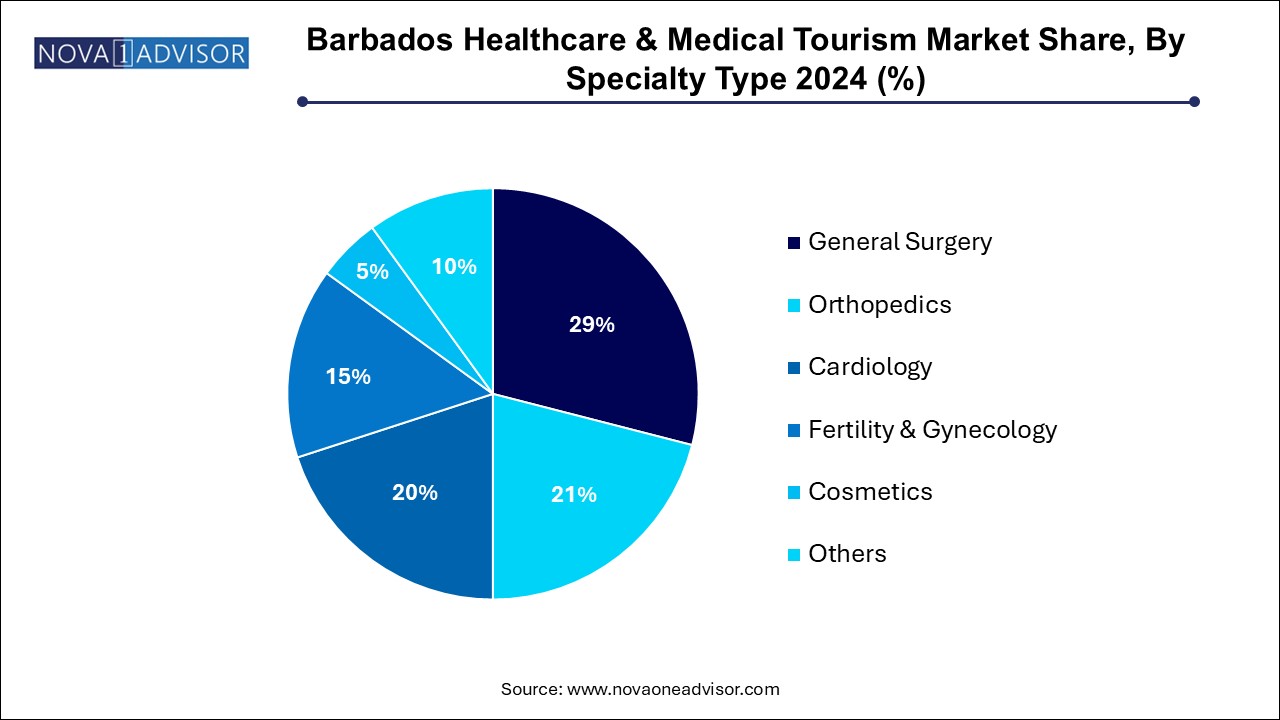

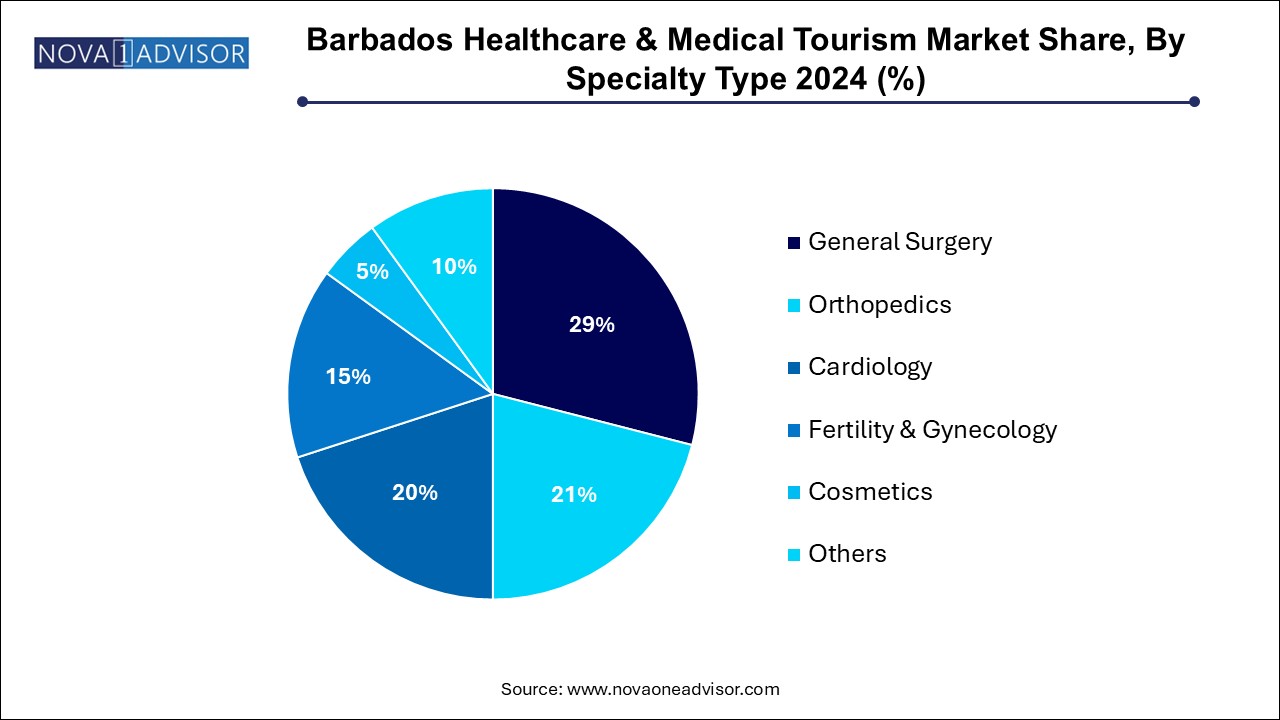

- Based on specialty, general surgery segment held the largest revenue share of over 29% in 2024.

- Barbados medical tourism held a significant market share in 2024.

Market Overview

The Barbados Healthcare & Medical Tourism Market is a rapidly growing sector driven by the country's strategic location, high-quality medical services, and affordable healthcare offerings compared to more developed nations. Barbados has positioned itself as a prime destination for international medical travelers seeking specialized healthcare services, particularly in fields like orthopedics, cosmetic surgery, fertility treatments, and cardiology. The island benefits from its well-established healthcare infrastructure, which includes state-of-the-art hospitals, skilled medical professionals, and a well-developed tourism industry. This combination makes Barbados a competitive player in the Caribbean medical tourism market.

Major Trends in the Market

- Increase in Medical Tourism: The influx of medical tourists, particularly from North America, the UK, and Latin America, seeking affordable treatments and cosmetic procedures.

- Cosmetic and Aesthetic Surgery Popularity: A rise in demand for non-invasive procedures such as Botox, liposuction, and facelifts.

- Specialized Fertility Treatments: Growth in fertility and gynecology treatments, attracting patients looking for advanced reproductive technologies.

- Post-Surgery Recovery Tourism: Surge in patients choosing Barbados as a destination for post-surgical recovery, especially after cosmetic or orthopedic procedures.

- Government Initiatives: Expansion of the healthcare infrastructure with government support for medical tourism, creating better facilities and services for international patients.

Report Scope of Barbados Healthcare & Medical Tourism Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 569.89 Million |

| Market Size by 2034 |

USD 946.59 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 5.8% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Specialty Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

The Sparman Clinic; FMH Emergency Medical; Sandy Crest Medical Centre; Barbados Fertility Centre; Premiere Surgical Centre; The Queen Elizabeth Hospital BARBADOS; Bayview Hospital. |

Market Drivers

One of the primary drivers of the Barbados Healthcare & Medical Tourism Market is the affordability of medical procedures compared to North America and Europe. For instance, patients from the U.S. and Canada often face long waiting times and high costs for treatments such as joint replacements, cosmetic surgeries, or fertility treatments. Barbados offers these procedures at a fraction of the cost, making it an attractive destination for those seeking quality healthcare at a lower price. In addition, the country has earned a reputation for high-quality medical services, with internationally trained doctors and state-of-the-art hospitals offering world-class healthcare solutions. This value-for-money proposition, combined with a favorable climate and tourism options, positions Barbados as an ideal destination for medical tourists.

Market Restraints

However, one of the significant restraints faced by the Barbados Healthcare & Medical Tourism Market is limited international marketing and visibility. Despite the country's well-established healthcare infrastructure, it faces challenges in increasing awareness about its medical tourism offerings in international markets. While the Caribbean region, in general, attracts tourists for leisure, Barbados needs more targeted marketing to promote its specialized healthcare services to potential medical tourists, particularly in high-demand sectors like orthopedics, cosmetic surgery, and cardiology. Limited promotion of medical tourism at global trade events or health expos has hindered Barbados from expanding its share in the global medical tourism market.

Market Opportunity

A key opportunity in the Barbados Healthcare & Medical Tourism Market lies in wellness and recovery tourism. Increasingly, patients from abroad are not only seeking medical procedures but are also interested in combining treatment with relaxation and recovery in a serene, vacation-like environment. Barbados, with its beautiful beaches, luxury resorts, and tropical climate, is an ideal destination for this type of tourism. After undergoing surgeries, especially cosmetic or orthopedic treatments, many patients seek environments that promote relaxation and healing. By capitalizing on this trend, Barbados could expand its medical tourism offerings by introducing packages that combine medical procedures with wellness activities such as spa treatments, yoga, and holistic therapies, making it an attractive destination for a broader patient base.

Barbados Healthcare & Medical Tourism Market By Specialty Type Insights

The General Surgery segment is one of the most established and dominating segments of the Barbados Healthcare & Medical Tourism Market. General surgical procedures, including appendectomies, gallbladder removals, and hernia repairs, are commonly sought after by medical tourists. Barbados' hospitals offer cutting-edge equipment, highly skilled surgeons, and competitive pricing, attracting patients from neighboring Caribbean islands and the U.S. who require routine or emergency surgeries. The reliable and cost-effective surgical care in Barbados allows it to capture a large share of the medical tourism market in the region.

Cardiology has emerged as one of the fastest-growing segments within the market. Barbados has positioned itself as a prime destination for joint replacements, spinal surgeries, and sports injury treatments. Patients, particularly from North America, are increasingly traveling to Barbados for affordable orthopedic treatments performed by world-class surgeons. The high success rates and advanced techniques used in orthopedic surgeries in Barbados further enhance the country’s attractiveness for medical tourists.

Some of the prominent players in the Barbados healthcare & medical tourism market include:

- The Sparman Clinic

- FMH Emergency Medical

- Sandy Crest Medical Centre

- Barbados Fertility Centre

- Premiere Surgical Centre

- The Queen Elizabeth Hospital BARBADOS

- Bayview Hospital

Barbados Healthcare & Medical Tourism Market Recent Developments

-

April 2023: Surgical Solutions Barbados, a leading private healthcare provider in the country, announced a partnership with international insurance companies to offer medical tourism packages, catering to patients from North America and Latin America.

-

January 2023: The government of Barbados introduced a new initiative to enhance medical tourism infrastructure by offering incentives for private hospitals to expand their international patient services and increase the number of healthcare professionals trained in global medical standards.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Barbados healthcare & medical tourism market

Specialty Type

- General Surgery

- Orthopedics

- Cardiology

- Fertility & Gynecology

- Cosmetics

- Others