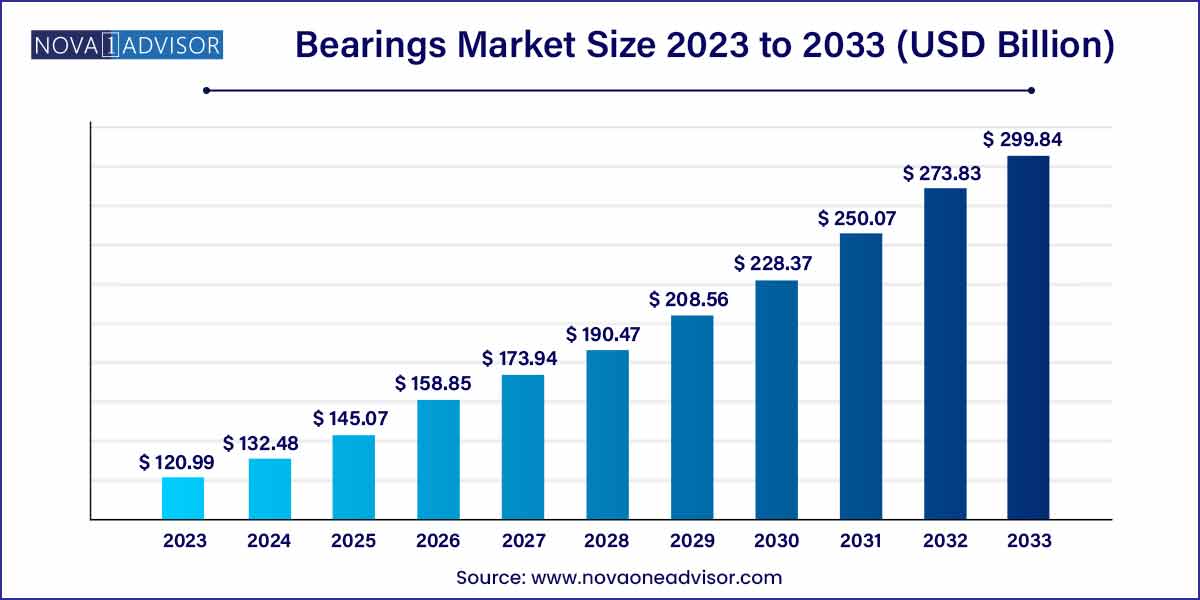

The global bearing market size was exhibited at USD 120.99 billion in 2023 and is projected to hit around USD 299.84 billion by 2033, growing at a CAGR of 9.5% during the forecast period of 2024 to 2033.

Key Takeaways:

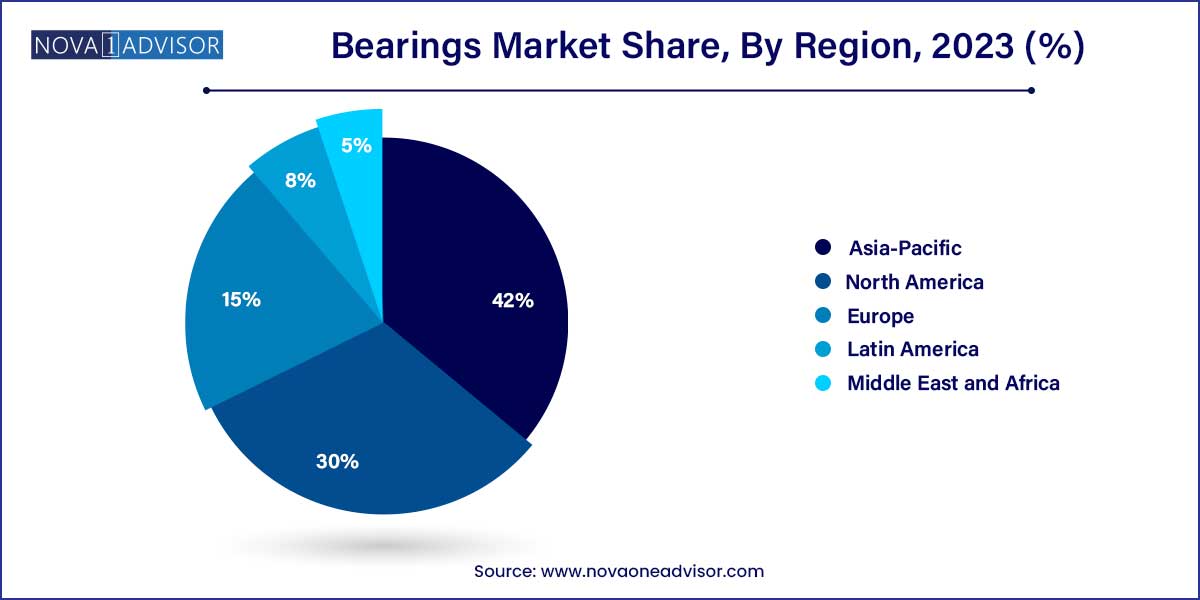

- Asia Pacific dominated the market and accounted for a revenue share of 42% in 2023.

- The roller bearings segment accounted for the largest revenue share of more than 47% in 2023.

- In 2023, the automotive segment dominated the market and accounted for 49% of the market share.

Bearings Market Overview

The bearings market forms an integral backbone of the industrial and automotive sectors, ensuring smooth rotational and linear movements while reducing friction between moving parts. Bearings are vital in enhancing equipment efficiency, extending machinery lifespan, and minimizing energy consumption. From massive industrial equipment to precision instruments, bearings find application across a myriad of industries such as automotive, aerospace, electrical, mining, construction, and agriculture.

Recent years have witnessed the bearings market experiencing significant expansion driven by industrial automation, rising vehicle production, growing demand for high-performance machinery, and the continuous evolution of advanced bearing materials and designs. Innovations like ceramic bearings, smart bearings with IoT-enabled monitoring, and sustainable lubrication methods are reshaping the landscape. Furthermore, the growing emphasis on energy efficiency and predictive maintenance is making technologically advanced bearings a preferred choice across industries worldwide.

Bearings Market Growth

The growth of the bearings market is propelled by several key factors. Technological advancements in bearing design, lubrication techniques, and manufacturing processes have led to products characterized by reduced friction, enhanced load-bearing capabilities, and extended service life. Additionally, the increasing adoption of electric vehicles is driving demand for high-performance bearings, while the rise of Industry 4.0 and the Internet of Things (IoT) is fostering the development of smart bearings and predictive maintenance solutions. Furthermore, the expansion of emerging economies, infrastructural development initiatives, and the revival of the manufacturing sector post-pandemic are expected to fuel market growth. These factors, coupled with a growing emphasis on sustainability and energy efficiency, create a conducive environment for the continued expansion of the bearings market globally.

Bearings Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 120.99 Billion |

| Market Size by 2033 |

USD 299.84 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Brammer PLC, Harbin Bearing Manufacturing Co., Ltd., HKT Bearings Ltd., JTEKT Corporation, NBI Bearings Europe, and NSK Global., NTN Corporation, RBC Bearings Inc., Rexnord, Corporation, RHP Bearings, Schaeffler Group, SKF, and The Timken Company. |

Bearings Market Dynamics

- Technological Advancements:

The bearings market is characterized by dynamic technological advancements, driving innovation in bearing design, materials, and manufacturing processes. These advancements lead to the development of bearings with reduced friction, increased load-bearing capacities, and extended service life. Additionally, the integration of smart technologies such as sensors and condition monitoring systems enables real-time performance monitoring and predictive maintenance, enhancing operational efficiency and reducing downtime.

- End-User Industry Trends:

The bearings market dynamics are significantly influenced by trends in end-user industries such as automotive, aerospace, manufacturing, and energy. The demand for bearings is closely tied to industrial activities, infrastructure development projects, and the overall economic landscape. Emerging trends, such as the increasing adoption of electric vehicles, expansion of renewable energy infrastructure, and growth in industrial automation, drive demand for specialized bearings tailored to specific applications, creating opportunities for market growth and diversification.

Bearings Market Restraint

- Price Volatility of Raw Materials:

One of the significant restraints facing the bearings market is the price volatility of raw materials, such as steel and alloys, used in bearing production. Fluctuations in raw material prices can impact manufacturing costs, profit margins, and overall market competitiveness. Manufacturers often face challenges in managing cost fluctuations, leading to potential disruptions in supply chains and pricing strategies.

- Intensifying Competition:

The bearings market is characterized by intense competition among key players, both domestic and international. This competition stems from factors such as technological advancements, product innovation, and pricing strategies. As a result, manufacturers often face pressure to differentiate their offerings, maintain competitive pricing, and invest in research and development to stay ahead in the market. Intensifying competition can lead to margin pressures and challenges in market penetration, particularly for smaller players in the industry.

Bearings Market Opportunity

- Rise of Electric Vehicles (EVs):

The increasing adoption of electric vehicles presents a significant opportunity for the bearings market. EVs require specialized bearings that can withstand high speeds, heavy loads, and extreme operating conditions. As the automotive industry shifts towards electric propulsion systems, there is a growing demand for bearings with enhanced performance characteristics, such as reduced friction and increased durability. This trend creates opportunities for bearing manufacturers to develop innovative solutions tailored to the unique requirements of electric vehicle applications, thereby expanding their market presence and revenue potential.

- Expansion of Industrial Automation:

The expansion of industrial automation, driven by Industry 4.0 and the Internet of Things (IoT), presents another lucrative opportunity for the bearings market. Automation technologies, such as robotics, conveyor systems, and CNC machines, rely heavily on precision bearings for smooth operation and accurate positioning. As industries increasingly adopt automation to improve efficiency, productivity, and quality control, the demand for high-performance bearings is expected to rise. Bearing manufacturers can capitalize on this trend by developing advanced bearing solutions optimized for automation applications, thereby tapping into a growing market segment and driving revenue growth.

Bearings Market Challenges

- Stringent Regulatory Standards:

One of the primary challenges facing the bearings market is the presence of stringent regulatory standards pertaining to environmental sustainability and product safety. Bearing manufacturers must comply with a myriad of regulations and certifications, which often involve rigorous testing procedures and compliance requirements. Ensuring adherence to these standards adds complexity to the manufacturing process, increases operational costs, and may pose barriers to market entry for smaller players. Moreover, evolving regulatory frameworks and changing compliance requirements necessitate ongoing investment in research and development to develop environmentally friendly and compliant bearing solutions.

- Global Economic Uncertainty:

The bearings market is susceptible to fluctuations in the global economy, geopolitical tensions, and trade uncertainties, which can impact demand dynamics and market stability. Economic downturns, currency fluctuations, and trade disputes between key market players can disrupt supply chains, dampen consumer confidence, and hinder investment in industrial infrastructure projects. Moreover, the COVID-19 pandemic has highlighted the vulnerability of global supply chains to external shocks, underscoring the importance of resilience and adaptability in navigating economic uncertainties. Bearing manufacturers must closely monitor macroeconomic trends, diversify their customer base, and implement robust risk management strategies to mitigate the impact of economic volatility on business operations.

Segments Insights:

Product Insights

Ball bearings dominated the market in 2024, largely due to their versatile applications across automotive, electrical, and industrial machinery sectors. Deep groove ball bearings, known for handling radial and axial loads with minimal friction, are the most widely used type. They are essential in applications requiring high speed and low noise, such as electric motors and home appliances. Companies like NSK Ltd and NTN Corporation are continuously innovating to enhance ball bearing efficiency, durability, and load-handling capacity.

Conversely, roller bearings are the fastest-growing product segment, propelled by the increasing demand for heavy-duty applications requiring higher load capacities. Tapered roller bearings, in particular, are crucial for automotive hubs, gearboxes, and heavy machinery. Split roller bearings, offering easy installation and maintenance, are gaining popularity in industries like mining and pulp & paper. Growth in mining activities and construction projects globally supports the surging demand for robust roller bearings.

Application Insights

Automotive applications dominated the bearings market, reflecting the sector's massive consumption volume for bearings in engines, transmissions, wheels, and chassis systems. As OEMs innovate toward lightweight and energy-efficient vehicle designs, the demand for specialized automotive bearings continues to rise. Automotive aftermarket also plays a vital role, with bearings being among the most frequently replaced components due to wear and tear.

Meanwhile, railway and aerospace applications are the fastest-growing segments. Railway sector modernization, high-speed rail projects, and the expansion of aerospace manufacturing, including commercial aviation and defense, are driving this surge. Bearings used in aircraft must withstand extreme temperatures, vibrations, and loads, necessitating premium-grade materials and precision engineering. Companies like Timken and NTN-SNR are pioneering aerospace-grade bearing innovations to capture this burgeoning market.

Regional Insights

Asia-Pacific dominated the bearings market in 2024, driven by its robust manufacturing base, burgeoning automotive industry, and rapid industrialization. China, Japan, and India are key contributors to regional dominance. China, being the world’s largest automotive market and a global manufacturing hub, has immense bearings consumption across various sectors. Major regional players are investing heavily in expanding production capacities and R&D facilities to cater to both domestic and international markets.

North America is the fastest-growing region, fueled by strong investments in electric vehicles, renewable energy projects, aerospace advancements, and industrial automation. The United States’ focus on reshoring manufacturing capabilities and enhancing infrastructure is creating a conducive environment for bearings manufacturers. Companies are collaborating with technology firms to innovate smart and high-performance bearings suited for next-generation industrial applications.

Recent Developments

-

March 2025: SKF announced the launch of a new range of eco-friendly bearings with patented self-lubricating technology, designed to reduce maintenance needs across industrial applications.

-

February 2025: Schaeffler AG inaugurated its new aerospace bearings manufacturing facility in South Carolina, USA, aimed at serving the growing North American aviation market.

-

January 2025: Timken Company acquired Aurora Bearing Company to strengthen its portfolio in precision bearing solutions for aerospace and defense sectors.

-

December 2024: NSK Ltd introduced a next-generation series of high-speed ceramic ball bearings for electric vehicle applications, enhancing speed and energy efficiency.

-

November 2024: NTN Corporation announced a strategic partnership with Hitachi Construction Machinery to supply customized split roller bearings for mining equipment.

Some of the prominent players in the Bearing Market include:

- Brammer PLC

- Harbin Bearing Manufacturing Co., Ltd.

- HKT Bearings Ltd.

- JTEKT Corporation

- NBI Bearings Europe

- NSK Global

- NTN Corporation

- RBC Bearings Inc.

- Rexnord Corporation

- RHP Bearings

- Schaeffler Group

- SKF

- The Timken Company

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global bearing Market.

Bearings Product

-

- Deep Groove Bearings

- Others

-

- Journal Plain Bearings

- Linear Plain Bearings

- Thrust Plain Bearings

- Others

Bearings Application

- Automotive

- Agriculture

- Electrical

- Mining & Construction

- Railway & Aerospace

- Automotive Aftermarket

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)