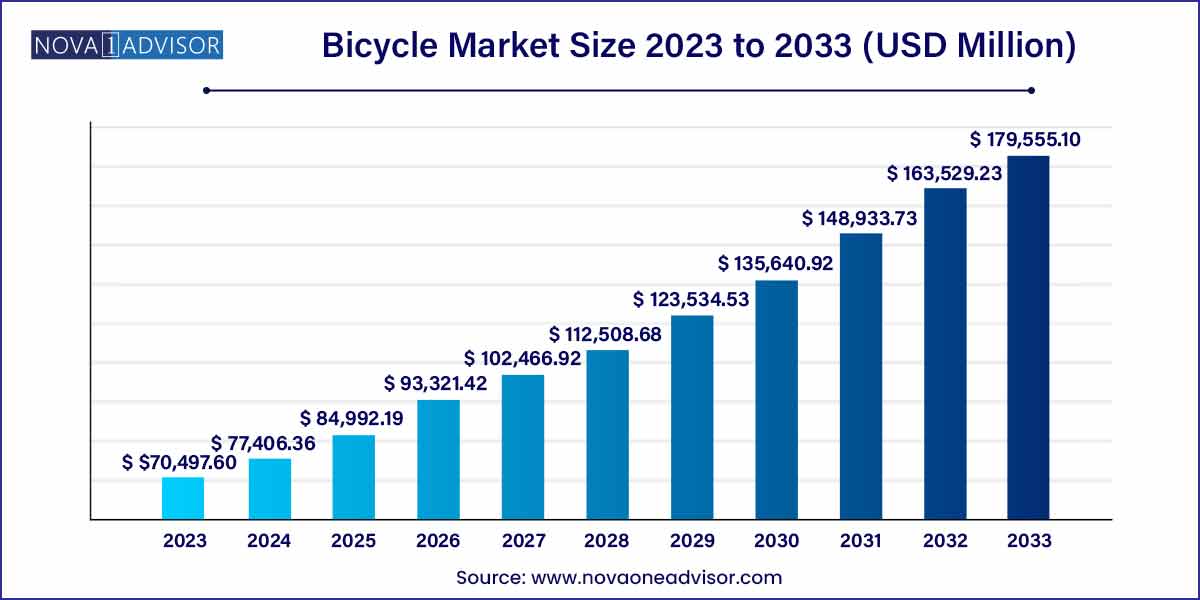

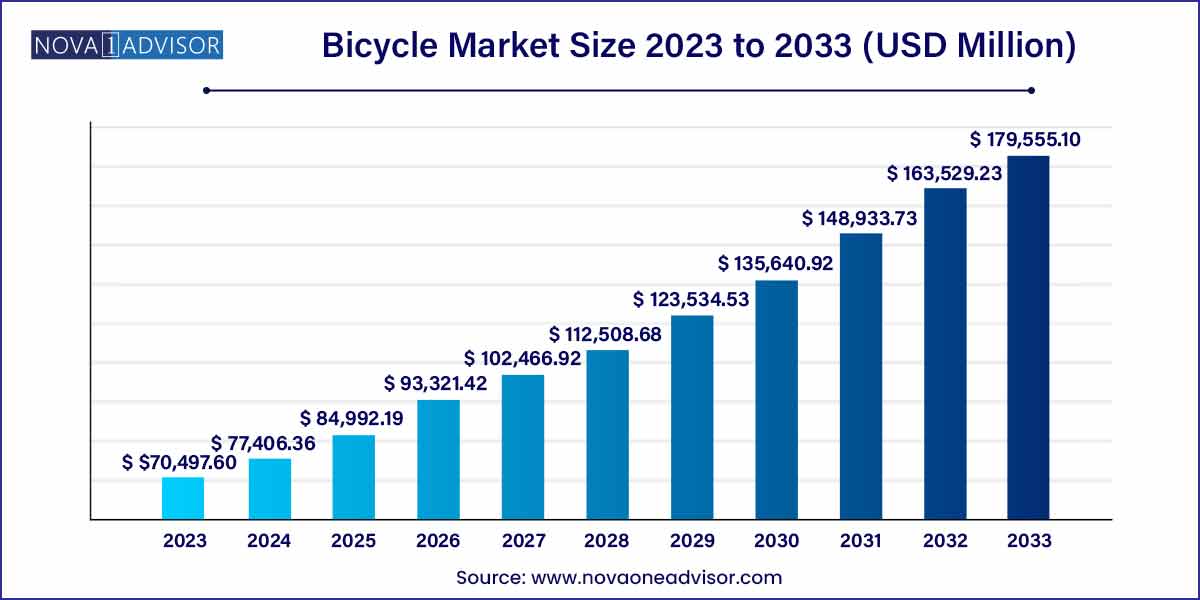

The global bicycle market size was exhibited at USD 70,497.6 million in 2023 and is projected to hit around USD 179,555.1 million by 2033, growing at a CAGR of 9.8% during the forecast period of 2024 to 2033.

Key Takeaways:

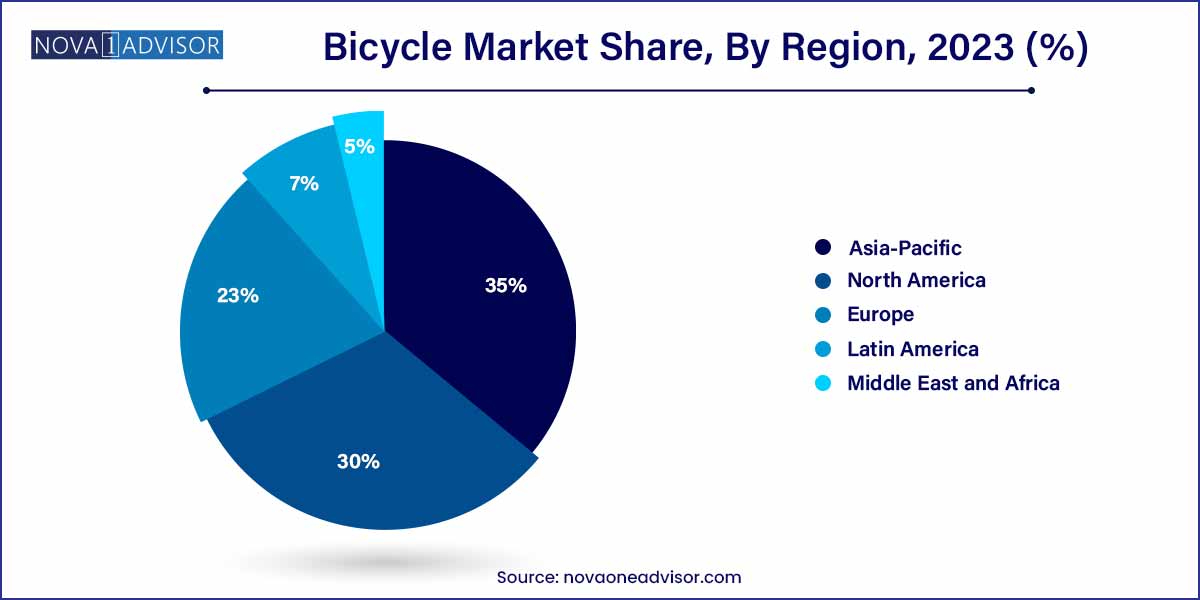

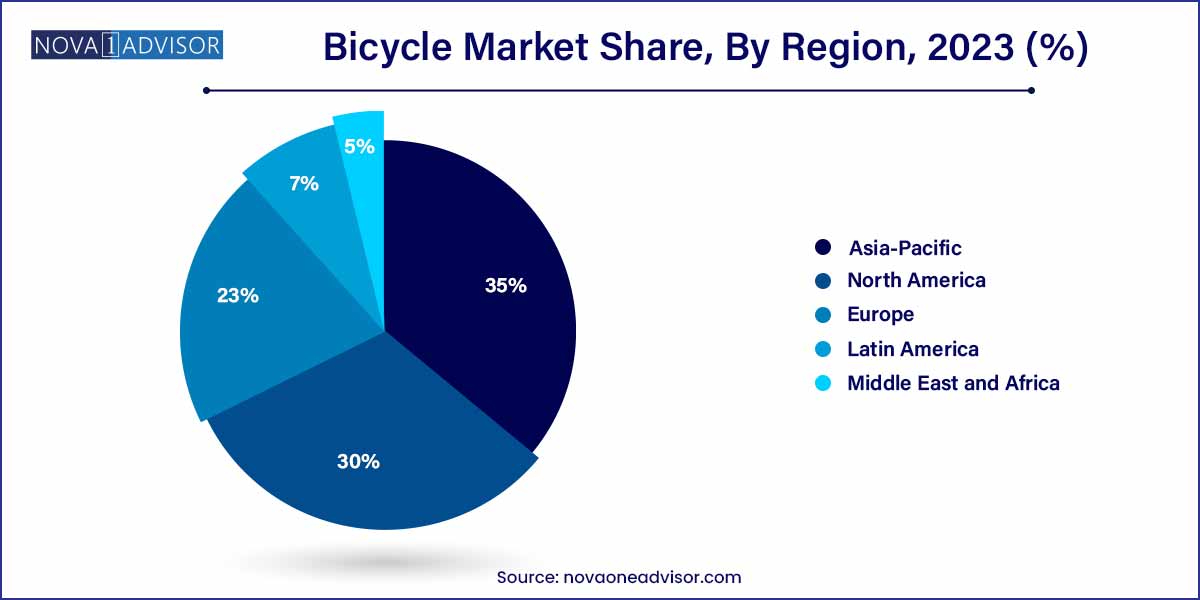

- Asia Pacific emerged as the dominant regional market in 2023 with a revenue share of 35.0%.

- The road bicycle segment accounted for the largest revenue share of over 40.1% in 2023 and is expected to remain dominant over the forecast period.

- The conventional segment accounted for the largest revenue share of 83.4% in 2023 and is expected to remain dominant over the forecast period.

- The offline distribution channel segment accounted for the largest revenue share of over 51.5% in 2023.

- The men's segment accounted for the largest market share of over 46.0% in 2023.

Bicycle Market: Overview

The global Bicycle Market has been experiencing substantial growth, fueled by increasing environmental awareness, the push for healthier lifestyles, rising urbanization, and the integration of smart technologies into bicycles. Once viewed primarily as a mode of leisure, bicycles have now evolved into a vital solution for urban mobility, fitness, cargo transport, and even luxury recreation. Governments worldwide are encouraging bicycle use by investing in bike-sharing programs, dedicated cycle lanes, and awareness campaigns to reduce traffic congestion and carbon emissions.

Moreover, the COVID-19 pandemic played a pivotal role in accelerating demand for bicycles as consumers sought socially distanced and sustainable transportation alternatives. Innovations in electric bicycles (e-bikes), folding designs, and durable lightweight materials have further broadened the consumer base across different demographics and use cases. Companies are increasingly focusing on producing specialized bikes, such as mountain bikes and cargo bikes, to meet diverse user needs.

Leading players, including Giant Manufacturing, Trek Bicycle Corporation, and Accell Group, are investing heavily in research and development to introduce technologically advanced, aesthetically appealing, and durable bicycles that cater to the modern consumer's expectations.

Bicycle Market Growth

The growth of the bicycle market is underpinned by several key factors. Firstly, heightened awareness of environmental sustainability has propelled the demand for eco-friendly transportation options, with bicycles emerging as a prominent choice due to their zero-emission nature. Additionally, a cultural shift towards healthier lifestyles has fueled interest in cycling as a form of exercise, driving demand for bicycles as fitness tools. Urbanization trends, marked by increasing congestion and a need for efficient mobility solutions, have further boosted the market, as bicycles offer a practical and agile means of navigating city landscapes. Moreover, technological advancements, particularly in electric bicycles and smart accessories, have expanded the market by catering to diverse consumer preferences and enhancing the overall riding experience. Collectively, these growth factors underscore the resilience and potential for expansion within the bicycle market, positioning it as a pivotal player in the global transportation landscape.

Bicycle Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 70,497.6 Million |

| Market Size by 2033 |

USD 179,555.1 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 9.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Design, Technology, End-user, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Accell Group; Atlas Cycles (Haryana) Ltd.; Avon Cycles Ltd.; Cervelo; Dorel Industries Inc.; Giant Bicycles; Merida Industry Co., Ltd; Specialized Bicycle Components, Inc.; SCOTT Sports SA; Trek Bicycle Corporation. |

Bicycle Market Dynamics

- Sustainability Imperative:

The bicycle market is strongly influenced by the global imperative for sustainability. With increasing concerns about climate change and environmental degradation, consumers are gravitating towards eco-friendly transportation options. Bicycles, being emission-free and requiring minimal resources to operate, are positioned as a sustainable alternative to traditional vehicles. This emphasis on sustainability is driving demand across various demographics, from environmentally conscious individuals to city planners seeking to reduce carbon emissions and alleviate traffic congestion.

- Urbanization and Mobility Needs:

Urbanization trends and evolving mobility needs are reshaping the dynamics of the bicycle market. As urban populations swell and traffic congestion worsens, bicycles are increasingly recognized as a practical and efficient mode of urban transportation. Cities worldwide are investing in cycling infrastructure, such as bike lanes and shared bike programs, to promote cycling as a viable alternative to cars and public transit. This urban focus is driving innovation in bicycle design, with manufacturers developing models tailored to the needs of urban commuters, such as lightweight, foldable bikes with integrated technology features. Moreover, the rise of micromobility solutions, including shared bike and scooter services, is further catalyzing the adoption of bicycles as a first-mile/last-mile transportation option in densely populated urban areas.

Bicycle Market Restraint

- Infrastructure Limitations:

Despite growing interest in cycling as a mode of transportation, inadequate cycling infrastructure remains a significant restraint on the bicycle market's growth. Many cities lack sufficient bike lanes, secure parking facilities, and other essential infrastructure to support safe and convenient cycling. This deficiency discourages potential cyclists, particularly those concerned about safety, from adopting bicycles as a primary means of transportation. Moreover, the absence of well-connected cycling networks limits the feasibility of cycling for longer distances or across different urban areas.

Safety concerns pose another significant restraint on the bicycle market's growth, particularly in regions where cycling infrastructure is underdeveloped or inadequate. Cyclists face various safety hazards, including interactions with motor vehicles, poor road conditions, and limited visibility, which can deter individuals from cycling, especially for commuting purposes. Additionally, perceptions of cycling as a dangerous activity may deter potential cyclists, particularly among families with children or older individuals. Addressing safety concerns requires comprehensive measures, including infrastructure improvements, traffic calming initiatives, public education campaigns, and enforcement of traffic laws to promote safer cycling environments.

Bicycle Market Opportunity

- Health and Wellness Trends:

The burgeoning emphasis on health and wellness presents a significant opportunity for the bicycle market. With increasing awareness of the importance of physical activity and outdoor recreation, cycling is experiencing a resurgence as a preferred form of exercise and leisure activity. Health-conscious consumers are turning to cycling to improve cardiovascular fitness, boost mental well-being, and maintain an active lifestyle. This trend is driving demand for bicycles across various segments, from road bikes for fitness enthusiasts to electric bicycles for individuals seeking accessible and low-impact exercise options. Moreover, the integration of technology, such as fitness tracking apps and wearable devices, is enhancing the cycling experience by providing users with real-time feedback on performance metrics and health outcomes.

- Urban Mobility Solutions:

The rapid urbanization of global populations presents a significant opportunity for the bicycle market to address urban mobility challenges. As cities become more congested and pollution levels rise, there is a growing need for sustainable and efficient transportation solutions. Bicycles offer a practical and eco-friendly alternative to cars and public transit for short-distance commuting and urban mobility. With the proliferation of cycling infrastructure, such as bike lanes, bike-sharing programs, and bike-friendly urban planning initiatives, cities are increasingly conducive to cycling as a viable mode of transportation. Additionally, technological advancements, such as electric bicycles and smart mobility apps, are enhancing the accessibility and convenience of cycling for urban commuters.

Bicycle Market Challenges

- Competition from Alternative Transportation Modes:

One of the primary challenges confronting the bicycle market is stiff competition from alternative transportation modes, such as electric scooters, ridesharing services, and emerging micro-mobility solutions. These alternatives offer convenience, flexibility, and often faster travel times, posing a threat to the traditional bicycle market. Additionally, the proliferation of electric vehicles (EVs) and advancements in autonomous vehicle technology may further disrupt the transportation landscape, potentially reducing the appeal of bicycles as a primary mode of transportation.

- Perception and Cultural Barriers:

Another significant challenge facing the bicycle market is overcoming perception and cultural barriers that hinder broader adoption of cycling, particularly in regions where car culture predominates or cycling is perceived as a recreational activity rather than a practical mode of transportation. Negative perceptions of cycling, such as concerns about safety, lack of infrastructure, and social stigma, can deter individuals from embracing bicycles as a viable transportation option. Moreover, ingrained cultural norms and preferences for car ownership may pose challenges to promoting cycling as a primary mode of transportation. Addressing these perception and cultural barriers requires concerted efforts from stakeholders, including government agencies, advocacy groups, and bicycle manufacturers, to promote cycling as a safe, accessible, and socially acceptable mode of transportation through public awareness campaigns, infrastructure investments, and policy initiatives.

Segments Insights:

Product Insights

Road Bikes dominated the bicycle product segment in 2024. Road bikes are favored by both professional cyclists and recreational riders due to their lightweight frames, aerodynamic designs, and efficiency on paved surfaces. Their dominance is attributed to the growing trend of fitness-oriented cycling events, marathons, and amateur racing leagues, particularly in Europe and North America. High-end road bikes equipped with carbon fiber frames, advanced gearing systems, and aerodynamic features are witnessing high demand among enthusiasts.

Electric Cargo Bikes are expected to be the fastest-growing segment. The rise of e-commerce and last-mile delivery services has propelled the adoption of cargo bikes, particularly in urban centers where vehicle access is limited. E-cargo bikes offer a sustainable and cost-effective alternative for transporting goods. In 2024, DHL expanded its cargo e-bike fleet in multiple European cities, highlighting the surging demand for this versatile bicycle segment.

Technology Insights

Conventional bicycles held the major share of the bicycle technology segment. Traditional bicycles remain popular due to their affordability, mechanical simplicity, and low environmental impact. They continue to dominate in markets like India, Africa, and parts of Southeast Asia, where bicycles are essential for daily commuting.

Electric bicycles are the fastest-growing technology segment. Technological innovations in battery efficiency, motor performance, and lightweight materials are making e-bikes increasingly attractive to a wider consumer base. Countries like Germany, China, and the Netherlands are witnessing a surge in e-bike sales, supported by government subsidies and evolving consumer preferences for faster, effortless commuting options.

Distribution Channel Insight

Offline channels dominated the distribution segment. Brick-and-mortar stores, specialty bicycle shops, and sporting goods retailers remain the primary purchasing platforms, especially for customers seeking test rides, in-person fittings, and professional consultations. Physical stores also offer servicing and maintenance, enhancing customer loyalty.

Online channels are experiencing explosive growth. The convenience of home delivery, broader product availability, and attractive online discounts are driving a surge in online bicycle purchases. Companies are optimizing their e-commerce platforms, and pure-play online retailers like Rad Power Bikes are expanding their digital presence, making online sales a dominant future trend.

End-User Insight

Men dominated the bicycle end-user segment. Historically, the male demographic has shown higher participation in cycling, both for commuting and recreational purposes. The dominance continues due to strong engagement in road biking, mountain biking, and competitive cycling events, with brands often designing performance-specific models targeting male riders.

The women's segment is growing rapidly. Recognizing the potential, brands are increasingly designing women-specific bicycles with ergonomically optimized frames, saddles, and handlebars. Women's cycling communities, advocacy campaigns, and sports events like "The Women's Tour" in the UK are further encouraging female participation, making this a high-growth area for the market.

Regional Insight

Asia-Pacific dominated the global bicycle market in 2024. Countries like China, India, and Japan have large cycling populations, both for commuting and recreational purposes. China, the world's largest bicycle producer and consumer, remains at the forefront, supported by strong manufacturing capabilities and government initiatives promoting green transportation. Additionally, bike-sharing programs are thriving in cities like Beijing and Shanghai, further driving market expansion.

Europe is the fastest-growing region. The continent’s deep-rooted cycling culture, government investments in cycling infrastructure, and incentives for e-bike purchases are fueling unprecedented market growth. In cities like Amsterdam, Copenhagen, and Paris, cycling is now a mainstream mode of daily transportation. In March 2024, the European Commission announced a new "Cycling Strategy for Europe" aimed at doubling cycling levels by 2030, underscoring the region's commitment to promoting bicycle use.

Recent Developments

-

March 2024: Giant Bicycles announced a strategic collaboration with Yamaha Motor to develop next-generation electric bicycle drive systems.

-

February 2024: Trek Bicycle Corporation launched its new "Trek Connect" smart e-bike series with integrated GPS, fitness tracking, and anti-theft features.

-

April 2024: Decathlon opened Europe's largest bicycle innovation center in France, focusing on developing sustainable and affordable cycling solutions.

-

January 2024: Specialized Bicycle Components unveiled a lightweight urban e-bike targeted at first-time commuters and city dwellers.

-

March 2024: Rad Power Bikes secured $150 million in funding to expand its direct-to-consumer electric bike operations globally.

Some of the prominent players in the bicycle market include:

- Accell Group

- Atlas Cycles (Haryana) Ltd.

- Avon Cycles Ltd.

- Cervelo

- Dorel Industries Inc.

- Giant Bicycles

- Merida Industry Co., Ltd

- Specialized Bicycle Components, Inc.

- SCOTT Sports SA

- Trek Bicycle Corporation

- Orbea

- BH Bikes

- Axalko Bikes

- Hagen Bikes

- Mammoth bikes

- Egurra Bikes

- Garri Bike

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global bicycle market.

Bicycle Product

- Mountain Bikes

- Hybrid Bikes

- Road Bikes

- Cargo Bikes

- Others

Bicycle Design

Bicycle Technology

Bicycle End-user

Bicycle Distribution Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)