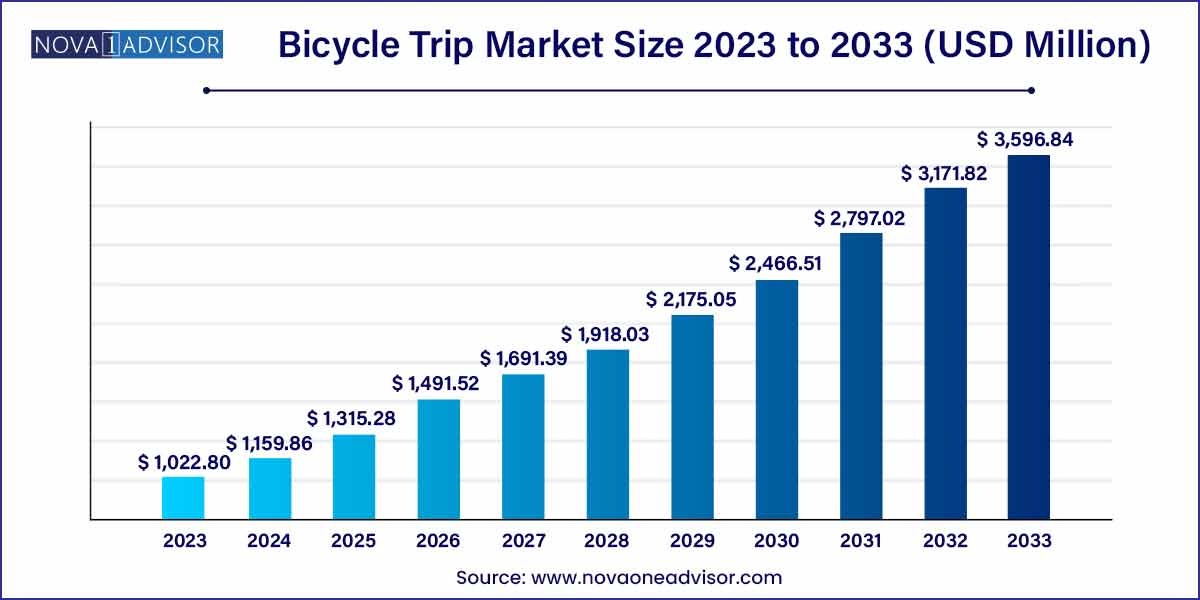

The global bicycle trip market size was exhibited at USD 1,022.80 million in 2023 and is projected to hit around USD 3,596.84 million by 2033, growing at a CAGR of 13.4% during the forecast period of 2024 to 2033.

Key Takeaways:

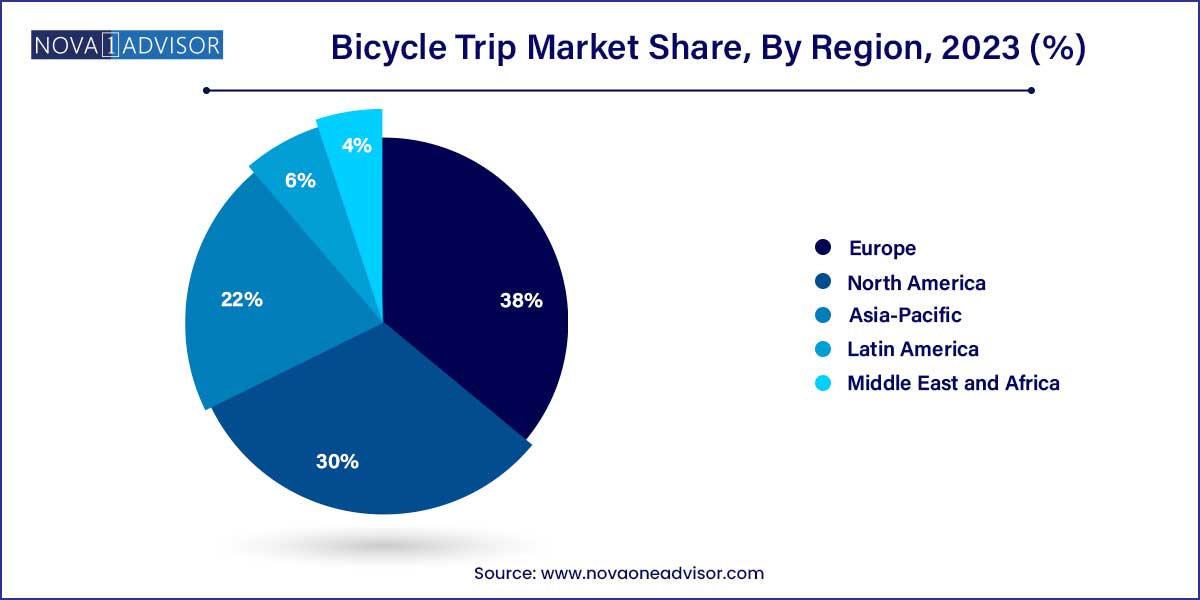

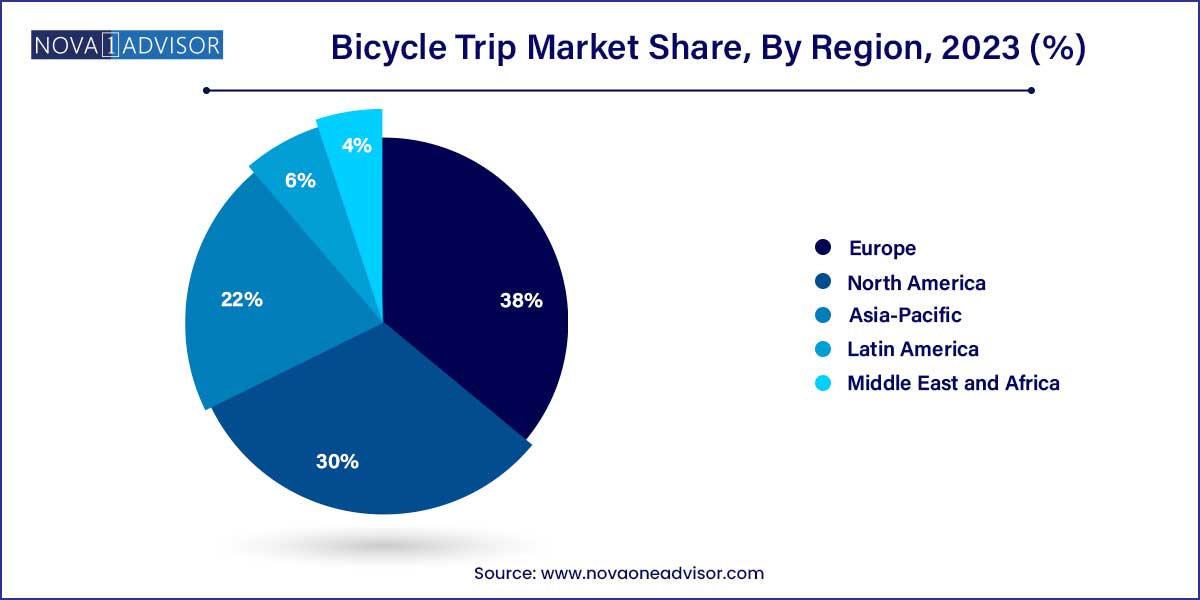

- Europe dominated the bicycle trip market and accounted for over 38% of the global revenue share in 2023

- The couple type segment held the largest revenue share of 47.3% in 2023 and is expected to grow significantly during the forecast period.

- The multi-day segment accounted for the largest revenue share of around 69.7% in 2023.

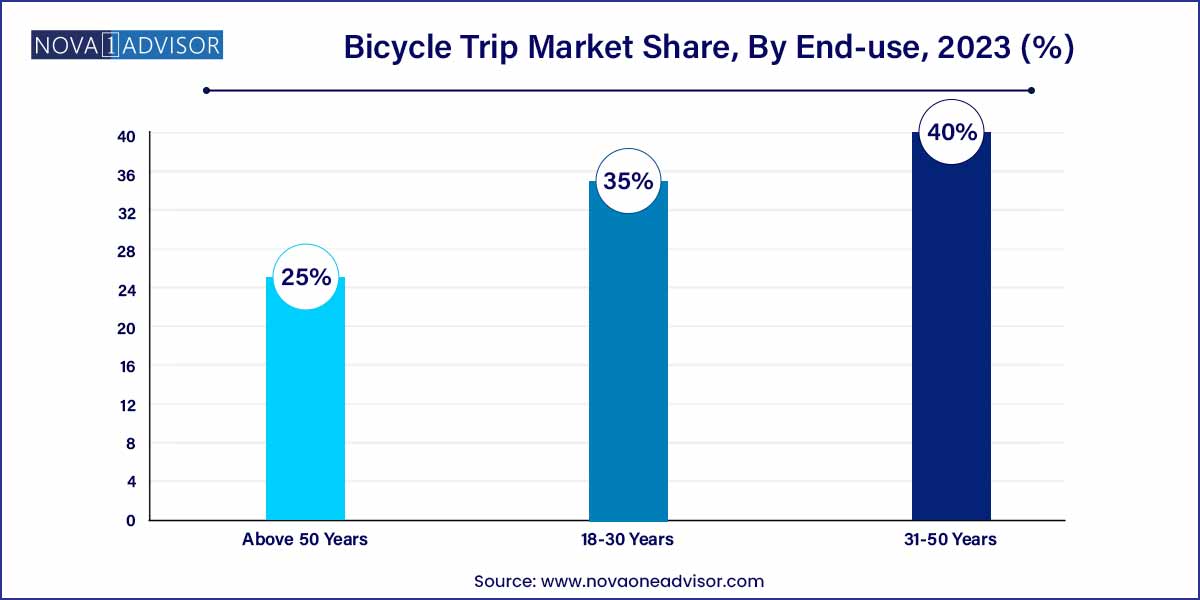

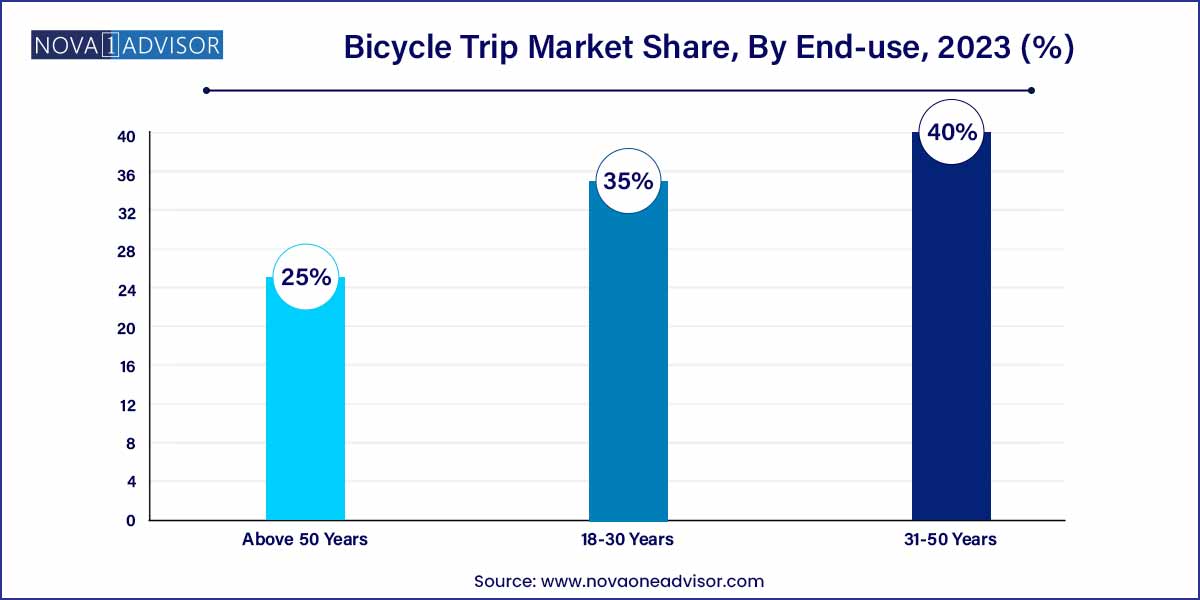

- The 31-50 years segment held the largest revenue share of 40% in 2023.

Bicycle Trip Market: Overview

In recent years, the bicycle trip market has witnessed remarkable growth, fueled by a surge in interest in sustainable travel, adventure tourism, and outdoor recreation. As individuals seek alternatives to traditional modes of transportation and embrace a healthier lifestyle, bicycle trips have emerged as a popular choice for leisure travel, eco-friendly commuting, and immersive cultural experiences. This comprehensive overview delves into the dynamics, trends, and opportunities shaping the bicycle trip market globally.

Bicycle Trip Market Growth

The growth of the bicycle trip market can be attributed to several key factors driving its expansion. Firstly, increasing awareness and concern for environmental sustainability have led to a rise in eco-tourism, with travelers opting for bicycle trips as a low-impact way to explore destinations. Secondly, the growing focus on health and wellness has propelled the popularity of bicycle trips, appealing to travelers seeking active vacations that combine physical activity with scenic beauty. Additionally, the allure of adventure and exploration has contributed to the market's growth, as bicycle trips offer opportunities for off-the-beaten-path experiences and immersive cultural encounters. Moreover, the rise of urban cycling culture has spurred demand for city bike tours and bike-sharing programs, catering to urban dwellers and tourists alike. These factors, coupled with technological advancements and a shift towards sustainable travel, are expected to fuel continued growth in the bicycle trip market.

Bicycle Trip Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1,022.80 Million |

| Market Size by 2033 |

USD 3,596.84 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 13.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Tour Type, Age Group, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Spice Roads; Life Time Fitness, Inc. (Unbound Gravel); Epic Road Rides; Explore Worldwide Limited; Intrepid; Exodus Travels Limited; G Adventures. |

Bicycle Trip Market Dynamics

The bicycle trip market is witnessing a significant boost due to the increasing popularity of eco-tourism. With growing concerns about environmental sustainability, travelers are seeking more eco-friendly modes of transportation and leisure activities. Bicycle trips offer a sustainable and low-impact way to explore destinations, aligning with the preferences of environmentally conscious travelers. As a result, tour operators and travel agencies are expanding their offerings to include eco-friendly bicycle tours, catering to the growing demand for responsible travel experiences.

- Health and Wellness Focus:

Another key dynamic shaping the bicycle trip market is the growing emphasis on health and wellness among travelers. In an era where individuals are prioritizing physical and mental well-being, bicycle trips have emerged as an attractive option for those seeking active vacations. Cycling not only provides an opportunity for cardiovascular exercise but also allows travelers to immerse themselves in nature and scenic landscapes, promoting relaxation and stress relief. Consequently, tour operators are developing specialized wellness-focused bicycle tours that combine cycling with activities such as yoga, meditation, and healthy dining options, tapping into the burgeoning wellness tourism market.

Bicycle Trip Market Restraint

- Infrastructure Limitations:

One of the primary restraints impacting the bicycle trip market is infrastructure limitations in certain destinations. While bicycle-friendly infrastructure, such as dedicated bike lanes and cycling paths, has improved in many urban areas, there are still regions where inadequate infrastructure hinders the growth of bicycle tourism. Limited or poorly maintained cycling routes, lack of bike rental facilities, and safety concerns on roads pose significant challenges for cyclists and discourage travelers from choosing bicycle trips as their preferred mode of exploration.

Safety Concerns:

Another restraint affecting the bicycle trip market is safety concerns associated with cycling, particularly in destinations with high traffic volumes or challenging terrain. Cyclists face risks such as accidents, collisions with vehicles, and injuries from falls, which can deter travelers from embarking on bicycle trips, especially families and novice cyclists. Safety measures, such as helmet laws, traffic regulations, and educational campaigns, are essential for mitigating these risks and instilling confidence among cyclists.

Bicycle Trip Market Opportunity

- Expansion into Emerging Markets:

One significant opportunity within the bicycle trip market lies in expanding operations into emerging markets. As bicycle tourism continues to gain traction globally, there is a growing demand for unique and off-the-beaten-path cycling experiences in lesser-known destinations. Tour operators and travel agencies can capitalize on this opportunity by diversifying their offerings and tapping into emerging markets with untapped potential for bicycle tourism. By developing innovative tour packages, forging partnerships with local stakeholders, and leveraging digital marketing channels to reach new audiences, businesses can position themselves as pioneers in emerging bicycle tourism destinations and capture a share of the growing market.

- Integration of Technology for Enhanced Experiences:

Another key opportunity in the bicycle trip market is the integration of technology to enhance the overall customer experience. With the proliferation of smartphones, GPS navigation systems, and wearable devices, cyclists have access to a wide range of technological tools that can enhance route planning, navigation, and trip customization. Tour operators can leverage technology to provide interactive route maps, real-time weather updates, and personalized recommendations for attractions and amenities along the route. Additionally, the use of virtual reality (VR) and augmented reality (AR) technologies can offer immersive previews of cycling routes and destinations, allowing travelers to visualize their journey and make informed decisions.

Bicycle Trip Market Challenges

- Infrastructure Limitations:

One of the primary challenges facing the bicycle trip market is infrastructure limitations, particularly in regions where cycling infrastructure is underdeveloped or poorly maintained. Inadequate bike lanes, lack of signage, and unsafe road conditions can hinder the growth of bicycle tourism and deter travelers from choosing cycling as their preferred mode of exploration. Addressing these infrastructure challenges requires collaboration between government agencies, urban planners, and advocacy groups to invest in the development of bicycle-friendly infrastructure, including dedicated bike lanes, cycling paths, and bike rental facilities.

Another significant challenge in the bicycle trip market is safety concerns associated with cycling, particularly in urban areas with heavy traffic and congested roadways. Cyclists face risks such as accidents, collisions with vehicles, and injuries from falls, which can undermine the appeal of bicycle tourism and deter travelers from participating in cycling activities. Addressing safety concerns requires implementing measures to improve road safety for cyclists, such as implementing traffic calming measures, creating separated bike lanes, and educating motorists and cyclists about sharing the road responsibly. Additionally, promoting helmet use, providing safety equipment, and offering cycling training programs can help mitigate risks and enhance the safety of bicycle tourism experiences.

Segments Insights:

Type Insights

Group trips dominated the bicycle trip market by type in 2024, owing to the rising trend of adventure group tours and team-building excursions among corporates and friends.

Group bicycle trips cater to the social and communal aspect of travel. Many corporate companies sponsor group cycling excursions as team-building activities, blending leisure with professional networking. Furthermore, group cycling clubs and organizations such as "Cycle Europe" organize group rides, attracting a wide demographic range. The camaraderie of traveling together, shared experiences, and reduced individual costs have made group tours immensely popular, especially in Europe and North America.

Meanwhile, solo trips are projected to be the fastest-growing segment, driven by the increasing number of solo travelers seeking personal enrichment and self-exploration. Solo cycling trips offer unparalleled freedom, the ability to set one’s own pace, and the opportunity for deep introspection, aspects highly valued by millennials and Gen Z tourists.

Tour Type Insights

Multi-day bicycle trips allow travelers to deeply explore regions, cultures, and landscapes that single-day trips cannot match. Famous routes like "La Route Verte" in Quebec and "Danube Cycle Path" across Europe are designed for multi-day exploration, enabling tourists to engage with local communities, savor regional cuisines, and absorb scenic beauty at a leisurely pace.

Single-day tours, however, are the fastest-growing segment, particularly among tourists with limited vacation time or those seeking to include cycling as a part of broader travel itineraries. Urban bike tours in cities like Amsterdam, Barcelona, and New York offer cultural, architectural, and culinary experiences compacted into a few hours.

Age Group Insights

The 31-50 years age group was the leading demographic in 2023, due to their higher disposable incomes, greater health consciousness, and ability to balance adventure with comfort.

This demographic segment often seeks structured yet adventurous travel options, making them ideal customers for mid-range to luxury bicycle trips. They prioritize experiences that combine physical activity with cultural and gastronomical exploration, like cycling tours through vineyards in France or coastal routes in Australia.

The 18-30 years segment is the fastest-growing, attributed to the "experience economy" mindset prevalent among millennials and Gen Z. Budget-friendly cycle tours, hostel accommodations, and backpacker-friendly routes are highly attractive to this group. They are also more willing to experiment with alternative travel modes and are drawn to social cycling events and adventure challenges.

Regional Insights

Europe dominated the global bicycle trip market in 2023, with countries like France, Germany, Netherlands, and Italy leading the charge.

Europe’s dominance stems from its well-established cycling culture, comprehensive bike infrastructure, and governmental support. Routes like EuroVelo, Rhine Cycle Route, and Loire Valley trails offer scenic, well-maintained paths with ample amenities for cyclists. The "bike-friendly city" initiatives in Copenhagen and Amsterdam have turned urban cycling into a major tourist attraction, while rural and coastal cycling tours are popular in Spain, Portugal, and Ireland.

Asia-Pacific is expected to witness the fastest growth during the forecast period, especially propelled by countries like Japan, Vietnam, and Thailand.

As disposable incomes rise and domestic tourism expands in emerging economies, bicycle tourism is being recognized as an affordable, adventurous, and eco-friendly way to travel. Japan’s Shimanami Kaido trail and Vietnam's Mekong Delta cycling tours are gaining international fame. Governments are also investing in developing cycling infrastructure, and cycling festivals are increasingly common, adding further impetus to the market.

Some of the prominent players in the bicycle trip market include:

- Spice Roads

- Life Time Fitness, Inc. (Unbound Gravel)

- Epic Road Rides

- Explore!Worldwide Limited

- Intrepid

- Exodus Travels Limited

- G Adventures

- Backroads

- Bicycle Adventures

- DuVine Adventures

Recent Developments

-

March 2025: TDA Global Cycling announced the launch of "Trans-European Odyssey," a 90-day cycling adventure connecting major European capitals.

-

January 2025: Backroads, a leading active travel company, expanded its e-bike offerings across Europe, citing a 35% increase in demand for assisted bicycle trips.

-

February 2025: Butterfield & Robinson partnered with local communities in Tuscany, Italy to curate "local immersion" experiences during their cycling tours, blending gastronomy, heritage, and biking.

-

April 2025: SpiceRoads Cycling, a major Asia-Pacific bicycle tour operator, introduced "Heritage Rides" focusing on historical and UNESCO sites across Southeast Asia.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global bicycle trip market.

Type

Tour Type

Age Group

- 18-30 Years

- 31-50 Years

- Above 50 Years

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)