Bifurcation Lesions Market Size and Trends

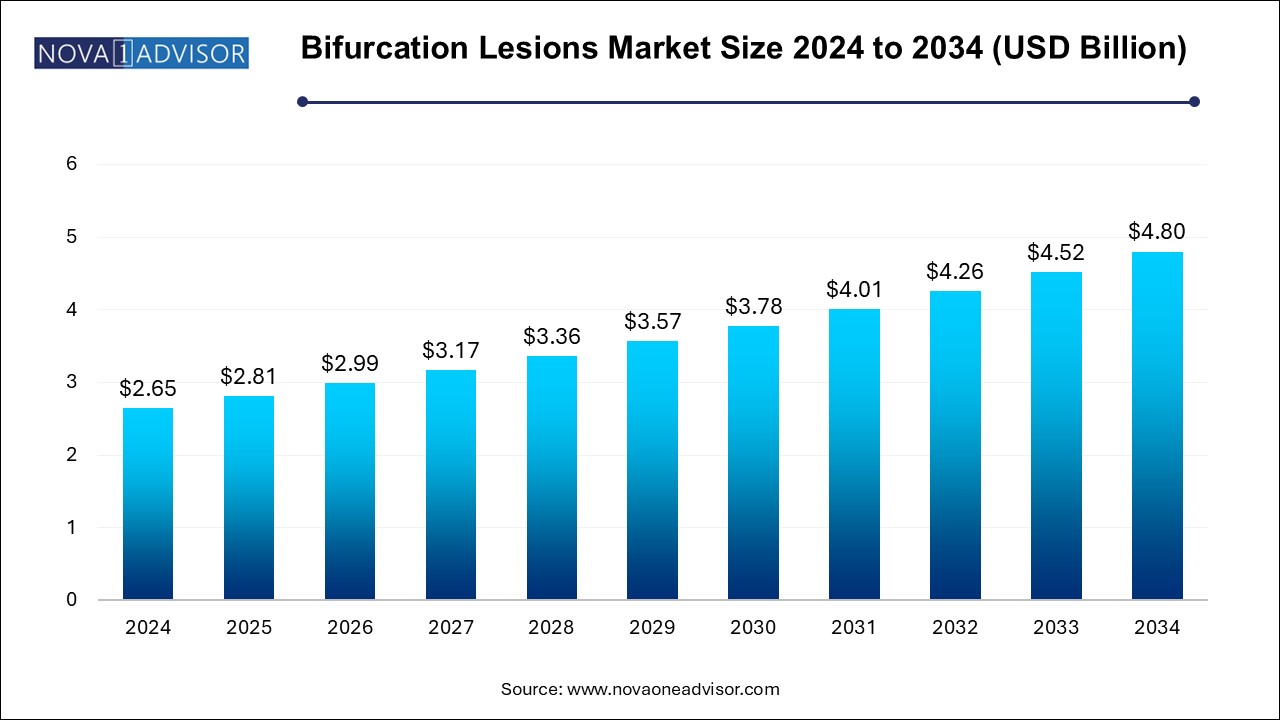

The bifurcation lesions market size was exhibited at USD 2.65 billion in 2024 and is projected to hit around USD 4.8 billion by 2034, growing at a CAGR of 6.1% during the forecast period 2025 to 2034.

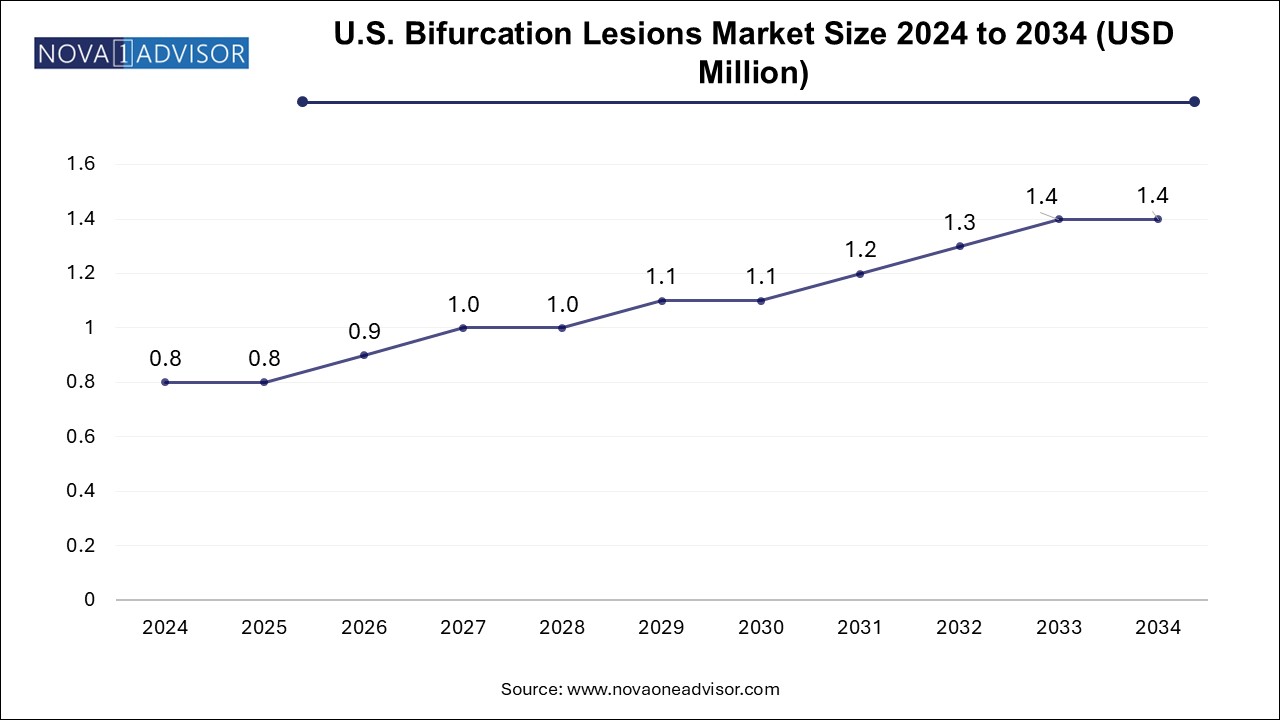

U.S. Bifurcation Lesions Market Size and Growth 2025 to 2034

The U.S. bifurcation lesions market size is evaluated at USD 0.80 million in 2024 and is projected to be worth around USD 1.4 million by 2034, growing at a CAGR of 5.21% from 2025 to 2034.

North America emerged as the dominant region in the bifurcation lesions market in 2024, driven by a highly structured healthcare system, high procedural volumes, and early adoption of advanced interventional technologies. The United States, in particular, boasts a large network of specialized cardiac centers equipped with state-of-the-art catheterization labs, access to the latest drug-eluting stents, and reimbursement support for complex PCI procedures. Leading cardiovascular societies like the American College of Cardiology (ACC) and Society for Cardiovascular Angiography and Interventions (SCAI) play a critical role in driving evidence-based adoption of bifurcation PCI strategies.

Asia Pacific is projected to witness the fastest growth in the bifurcation lesions market due to increasing cardiovascular disease burden, expanding healthcare access, and strategic investments in interventional cardiology training and infrastructure. Countries such as China, India, South Korea, and Japan are seeing a marked increase in PCI volumes, supported by rising middle-class populations, government subsidies, and the proliferation of private cardiac centers.

China, in particular, is undergoing a PCI transformation, with national health policies emphasizing local innovation and indigenous production of coronary devices. The Chinese FDA has streamlined approval processes, encouraging both domestic and international players to introduce cost-effective, bifurcation-specific devices in the market. Simultaneously, India’s National Health Mission is facilitating the deployment of cath labs in tier 2 and tier 3 cities, enabling greater access to advanced interventions.

The Asia Pacific region also benefits from a large pool of young interventional cardiologists, many of whom are trained overseas or through regional fellowships sponsored by global medtech companies. This youthful and dynamic workforce is more likely to adopt novel bifurcation PCI techniques and participate in international best practice initiatives, fueling innovation and long-term growth.

Market Overview

The bifurcation lesions market represents a specialized and growing segment within the broader interventional cardiology space. Bifurcation lesions refer to the narrowing of blood vessels at or near a point where a large artery branches into two smaller ones, commonly seen in coronary and peripheral arteries. These lesions present unique anatomical and procedural challenges due to their complex morphology and the necessity to maintain adequate blood flow in both the main and side branches.

Management of bifurcation lesions often requires advanced stenting techniques, such as provisional stenting, double stenting (including culotte, crush, and T-stenting), and drug-coated balloon (DCB) interventions. As cardiovascular diseases (CVDs) continue to dominate global mortality statistics, the burden of bifurcation lesions has also increased significantly. Interventional cardiologists increasingly prefer drug-eluting stents (DES) and specialized guidewires, balloons, and bifurcation-specific stents to navigate the complexities of these lesions and optimize outcomes.

Technological innovation is central to this market's momentum. From next-generation DES with enhanced radial strength and conformability to novel imaging technologies such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), the therapeutic landscape has rapidly evolved. Increasing clinical awareness, updated treatment guidelines, and favorable reimbursement policies in developed economies further propel market adoption. Additionally, the emergence of bioresorbable scaffolds (BRS), although currently limited, points toward a future where long-term vascular healing may be achieved without permanent implants.

The market's growth is also buoyed by increased percutaneous coronary intervention (PCI) volumes, the rising prevalence of diabetes and hypertension, and aging populations—particularly in Europe, North America, and parts of Asia. As new device platforms and minimally invasive approaches continue to emerge, the bifurcation lesions market is poised for robust growth over the next decade.

Major Trends in the Market

-

Growing Adoption of Dedicated Bifurcation Stents: Devices specifically engineered for bifurcation anatomy are gaining traction over conventional stenting strategies.

-

Increasing Use of Imaging-Guided PCI: Technologies like OCT and IVUS are becoming standard for lesion assessment and post-stent optimization.

-

Proliferation of Drug-Coated Balloons (DCBs): Especially in side branch treatment, DCBs offer a non-stent alternative to minimize restenosis risk.

-

Expansion of Complex PCI Training Programs: Medical societies are investing in bifurcation-specific training for interventional cardiologists.

-

Surge in Clinical Trials and Evidence Generation: Studies such as EBC MAIN and DEFINITION II are influencing clinical practice patterns.

-

Bioresorbable Scaffold Development: While still in early stages, BRS are being evaluated as long-term solutions for bifurcation lesions.

-

Rising Demand for Hybrid Revascularization: Combining surgical and percutaneous approaches for complex lesions is becoming more common.

-

Regional Medical Device Partnerships: Companies are partnering with local distributors in Asia and Latin America to expand reach and affordability.

Report Scope of Bifurcation Lesions Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.81 Billion |

| Market Size by 2034 |

USD 4.8 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Boston Scientific Corp.; Abbott; Cardinal Health; Medtronic; C. R. Bard, Inc.; Johnson & Johnson Services, Inc.; Spectranetics; Terumo Medical Corp.; Tryton Medical Inc. |

Market Driver: Increasing Burden of Coronary Artery Disease (CAD)

The most prominent driver of the bifurcation lesions market is the escalating prevalence of coronary artery disease, which often involves complex lesion subsets like bifurcations. CAD remains the leading cause of mortality worldwide, particularly in aging populations. Bifurcation lesions are present in approximately 15-20% of all percutaneous coronary interventions (PCI), making them a critical subset of the cardiovascular intervention domain.

Lifestyle-related risk factors—such as poor dietary habits, physical inactivity, obesity, diabetes, and smoking—are contributing to early-onset CAD across the globe. This epidemiological trend has led to an increased demand for precise and effective PCI techniques, specifically for anatomically complex lesions like those found at bifurcations. Innovations in stent design, guidewire control, and procedural strategies have improved the success rate of these interventions, thereby further reinforcing demand. Hospitals and cardiac centers are also investing in specialized PCI tools and operator training to improve outcomes in bifurcation lesion management.

Market Restraint: Procedural Complexity and Operator Dependency

One of the primary restraints in the bifurcation lesions market is the procedural complexity associated with treating these lesions, often requiring highly skilled interventionalists and advanced tools. The success of bifurcation PCI largely depends on operator experience and familiarity with various bifurcation strategies. Inadequate lesion preparation, suboptimal stenting technique, or poor understanding of side branch preservation can lead to adverse outcomes, including restenosis, thrombosis, or side branch occlusion.

Additionally, the learning curve for mastering complex two-stent strategies such as DK crush or culotte is steep and time-intensive. This creates variability in clinical outcomes across centers and regions, especially in low- and middle-income countries where access to continuous medical education and advanced imaging tools may be limited. Furthermore, the cost of premium bifurcation-specific devices may deter adoption in budget-constrained healthcare systems.

Market Opportunity: Expansion in Emerging Markets with Growing Interventional Infrastructure

A substantial opportunity lies in expanding the bifurcation lesion treatment portfolio in emerging markets, where access to PCI is improving due to government investments in cardiac care infrastructure. Countries in Asia Pacific and Latin America are witnessing a rise in cardiovascular procedures supported by better insurance penetration, increasing specialist availability, and public-private partnerships to upgrade cath lab facilities.

These regions offer a fertile ground for manufacturers to introduce cost-effective, simplified bifurcation systems that do not compromise on outcomes. For instance, India and Brazil have initiated large-scale non-communicable disease programs that include free or subsidized cardiac interventions. Moreover, regional manufacturers and distributors are beginning to localize stent production, making advanced devices more affordable. This paves the way for increased penetration of bifurcation-specific tools and tailored PCI training programs for regional interventionalists.

Bifurcation Lesions Market By Application Insights

Based on Coronary applications dominated the bifurcation lesions market in 2024, accounting for the majority share of global interventions. This dominance is attributed to the high clinical incidence of coronary bifurcation lesions, which occur at critical anatomical sites like the left main coronary artery, the left anterior descending (LAD) artery, and diagonal branches. Given the importance of preserving myocardial perfusion in these arteries, precision in stenting and side-branch protection is paramount. Techniques such as the provisional stent strategy are widely accepted as the first-line approach, with increasing use of imaging tools like IVUS to enhance procedural success.

Advancements in device technologies—such as stents with ultra-thin struts, enhanced side-branch access, and drug-eluting coatings—have significantly improved patient outcomes in coronary bifurcation PCI. The availability of randomized clinical data, including results from studies like DEFINITION II, has provided greater procedural clarity and standardization across hospitals. Coronary bifurcation PCI is now considered a sub-specialization, with dedicated workshops and simulation labs training physicians worldwide, further fueling market expansion.

Peripheral applications are expected to grow at the fastest rate, particularly in managing bifurcation lesions in lower limb arteries, including femoral-popliteal and tibial bifurcations. Peripheral artery disease (PAD) is becoming increasingly common in diabetic and elderly populations, particularly in Asia and Latin America. These lesions often require a hybrid approach involving balloons, stents, and atherectomy tools tailored to peripheral vasculature. Drug-coated balloons and self-expanding stents are gaining traction for their ability to maintain vessel patency without the risks associated with excessive metal implantation in dynamic peripheral vessels.

As peripheral interventions gain recognition for limb salvage and mobility restoration, demand for bifurcation-specific tools is projected to rise. Companies are investing in flexible delivery systems and longer-length stents to navigate peripheral anatomies. Moreover, as awareness grows about the overlap between PAD and CAD, comprehensive vascular screening and treatment programs are expected to further fuel this segment's growth.

Some of the prominent players in the bifurcation lesions market include:

Bifurcation Lesions Market Recent Developments

-

In March 2025, Abbott announced positive 12-month outcomes from its latest clinical trial involving the Xience Skypoint™ stent for complex bifurcation lesions, demonstrating superior side-branch patency and low restenosis rates.

-

In January 2025, Biosensors International received CE mark approval for a new dedicated bifurcation DES platform, tailored for left main bifurcation PCI, signaling its planned expansion into European and Asian markets.

-

In December 2024, Medtronic partnered with the Chinese Society of Cardiology to launch a nationwide training initiative on complex bifurcation PCI, covering over 150 hospitals across the country.

-

In November 2024, Boston Scientific unveiled its SYNERGY™ XD stent platform upgrade, incorporating enhanced deliverability features for bifurcation lesions, now rolled out across Europe and Latin America.

-

In September 2024, the European Bifurcation Club (EBC) released updated consensus guidelines for bifurcation PCI, recommending routine imaging use and tailored two-stent techniques in specific anatomies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the bifurcation lesions market

By Application

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)